Why Crypto Portfolio Allocation Makes Or Breaks Your Success

Let's be real: the key to winning in crypto isn't about picking the next moon shot. It's about building a solid crypto portfolio allocation strategy. I've talked to tons of investors who've navigated the crypto rollercoaster, and the common thread is this: chasing hype leads to heartbreak. Strategic allocation? That's your ticket to lasting growth.

Think about the pros. Fund managers don't gamble, they allocate. They know that even a small crypto allocation, like 1-3%, can seriously boost overall returns. In fact, studies show that strategically adding digital assets to a diversified portfolio can improve returns and lower risk. [^1] This isn't about mindlessly holding onto everything; it's about a structured approach to rebalancing and managing risk.

This move towards strategic crypto allocation is happening with the big players too. Large funds are increasingly incorporating crypto not as a speculative bet, but as a core piece of their investment strategy. By 2025, digital assets are expected to be a regular part of institutional portfolios, showing how crypto is gaining legitimacy as an asset class. [^1]

Why Traditional "HODL" Strategies Often Fail

The old "buy and hold" approach just doesn't work in crypto's wild west. It's like building a house on sand – you might get lucky for a bit, but the market will shift, and your gains can vanish in a flash.

The Power of Diversification and Rebalancing

Strategic crypto portfolio allocation? That's building your house on solid ground. It's about spreading your holdings across different crypto assets, similar to how you'd diversify across stocks and bonds in a regular portfolio. It's also about regularly rebalancing – selling some winners and buying some losers – to stick to your target allocation and manage risk. Check this out for more info: How To Start Trading Cryptocurrency.

Let's say you're split between Bitcoin and Ethereum. Bitcoin takes off, suddenly becoming 80% of your portfolio. Rebalancing means selling some Bitcoin and buying more Ethereum to get back to your original target, maybe 50/50. This locks in profits and prevents you from being too exposed to one asset.

Before we dive deeper, let's look at a comparison of different approaches to crypto allocation. The table below highlights the key differences between traditional "HODL" strategies and more strategic approaches.

| Approach | Typical Allocation | Risk Level | Expected Returns | Rebalancing Frequency |

|---|---|---|---|---|

| Traditional "HODL" | Concentrated in a few assets | High | Potentially high, but also high potential for loss | Rarely or never |

| Strategic Allocation | Diversified across multiple assets | Moderate | More stable, potentially lower but more consistent | Regularly (e.g., quarterly, annually) |

As you can see, a strategic approach offers a more balanced risk-reward profile compared to the traditional "HODL" strategy.

This disciplined approach separates the pros from the amateurs. It’s the foundation of a portfolio that can handle the inevitable ups and downs of crypto and achieve long-term growth.

[^1]: Want to learn more about strategic crypto allocation? Dive in here: Strategic Crypto Allocation Research

Understanding Your Real Risk Tolerance (Not What You Think It Is)

Let's face it, figuring out your true risk tolerance in crypto usually happens during a market crash. When prices are pumping, everyone feels invincible. But experienced investors understand the difference between risk capacity (what you can lose) and risk tolerance (what you can stomach losing) before they jump in.

I’ve watched friends convince themselves they have a high risk tolerance only to panic sell at the bottom of a dip. One guy, convinced he was a high roller, went all-in on a meme coin. Predictably, he lost big when the market corrected. It’s a classic case of mistaken risk tolerance.

This image from Wikipedia illustrates the different parts of risk tolerance:

It really highlights how risk tolerance isn’t just about your bank account; it's about your psychology and how you react to potential losses.

Why Crypto Risk Tolerance Differs From Traditional Investing

Crypto volatility is a whole different animal. A 20% daily swing is normal in crypto, but it would cause chaos in traditional markets. Your comfort level with these swings is vital for smart crypto portfolio building. Seriously, ask yourself: can you sleep knowing your holdings might drop 30%, 50%, or even more?

Practical Tips For Assessing Your True Crypto Risk Tolerance

-

The Sleep Test: Picture a 50% drop in your portfolio. Would you toss and turn all night? If so, lower your risk.

-

The "Oh No" Moment: Think about how you reacted to past losses. Did you panic sell? Learning from those emotional responses is key.

-

Separate "Play Money" from Essentials: Only invest what you can genuinely afford to lose. This protects you from making emotional decisions. Want to go deeper on the technical side? Check out our guide on Crypto Technical Analysis for Beginners.

Position Sizing as Your Safety Net

Position sizing – how much you invest in each asset – is your best protection against your own emotions. Smaller positions limit potential losses and prevent panic selling during market downturns. It's directly linked to building a solid crypto portfolio.

Remember, understanding your risk tolerance isn’t a one-time thing. It shifts with the market and your own finances. Regular self-assessment is crucial for navigating crypto's ups and downs. It’s the bedrock of any successful long-term strategy.

Building Your Foundation With Assets That Actually Last

Forget the hype. Seriously. When it comes to building a crypto portfolio that lasts, you've got to think long-term. Ditch the get-rich-quick schemes and focus on established assets. It’s like building a house – you wouldn't start with the paint job before the foundation, right? Same goes for crypto. Start with a solid base of proven assets before venturing into the more speculative plays.

But hold on, building a strong foundation doesn't mean blindly piling into the biggest names. It’s about understanding why certain assets have performed well historically. How do they fit into your overall strategy? Look at portfolios that have weathered the storms – the bull runs and the bear markets. Learning from the past helps you build a portfolio that can handle the dips while still capturing crypto’s potential for growth.

Diversification: Your Crypto Portfolio's Safety Net

Diversification is crucial, and not just in the traditional sense of spreading your investments across stocks and bonds. It’s vital within crypto itself. Holding only Bitcoin, for example, exposes you to the ups and downs of a single asset, regardless of its history.

Think about a mix. Blue-chip cryptocurrencies like Bitcoin and Ethereum offer stability. Think of them as the anchors of your portfolio. Then, allocate smaller amounts to promising up-and-coming projects. These offer the potential for bigger gains, sure, but they come with more risk. Finding that balance is key. Crypto is growing – projections point to 861 million users globally by 2025, with nearly 100 million in the US. This makes strategic portfolio allocation even more critical. Discover more insights

Understanding Correlation: Why It Matters During Market Stress

Here’s something many overlook: correlation. When the market is calm, correlations between different cryptocurrencies might be low. This gives a false sense of diversification. But when the market crashes, everything tends to move together. Suddenly, your "diversified" portfolio isn't so diverse anymore. Consider this when building your foundation. Look for assets that have historically shown some independence during market downturns. For example, during the 2022 crypto winter, some decentralized finance (DeFi) tokens held up better than Bitcoin, providing some downside protection.

Learning From the Experienced: Real Portfolio Examples

Want to learn the ropes? Look at what successful investors are doing. Study their portfolios. You can pick up invaluable insights into their strategies. Check out resources like this: Crypto Market Outlook 2025. Seeing how others balanced blue-chip holdings with emerging opportunities, and how their core allocations provided stability during turbulent times, is incredibly helpful. This practical knowledge empowers you to make smarter decisions and build a portfolio ready to weather any storm. Remember, a solid foundation is everything in crypto.

Mastering Rebalancing When Markets Go Crazy

Rebalancing your crypto portfolio sounds simple enough, right? Just maintain your target percentages. But when Bitcoin takes a 50% nosedive or moonshots 200%, sticking to the plan becomes a real emotional rollercoaster. The investors who consistently succeed aren't magically predicting the market. They’re maintaining their strategic asset allocation when everyone else is panicking.

I've witnessed this firsthand. A friend of mine built a beautifully balanced portfolio. Then Ethereum went 3x. His allocation was completely out of whack, but instead of rebalancing, he rode the wave, convinced the gains would keep coming. The inevitable correction wiped out his profits faster than you can say "HODL." He learned a tough lesson about discipline.

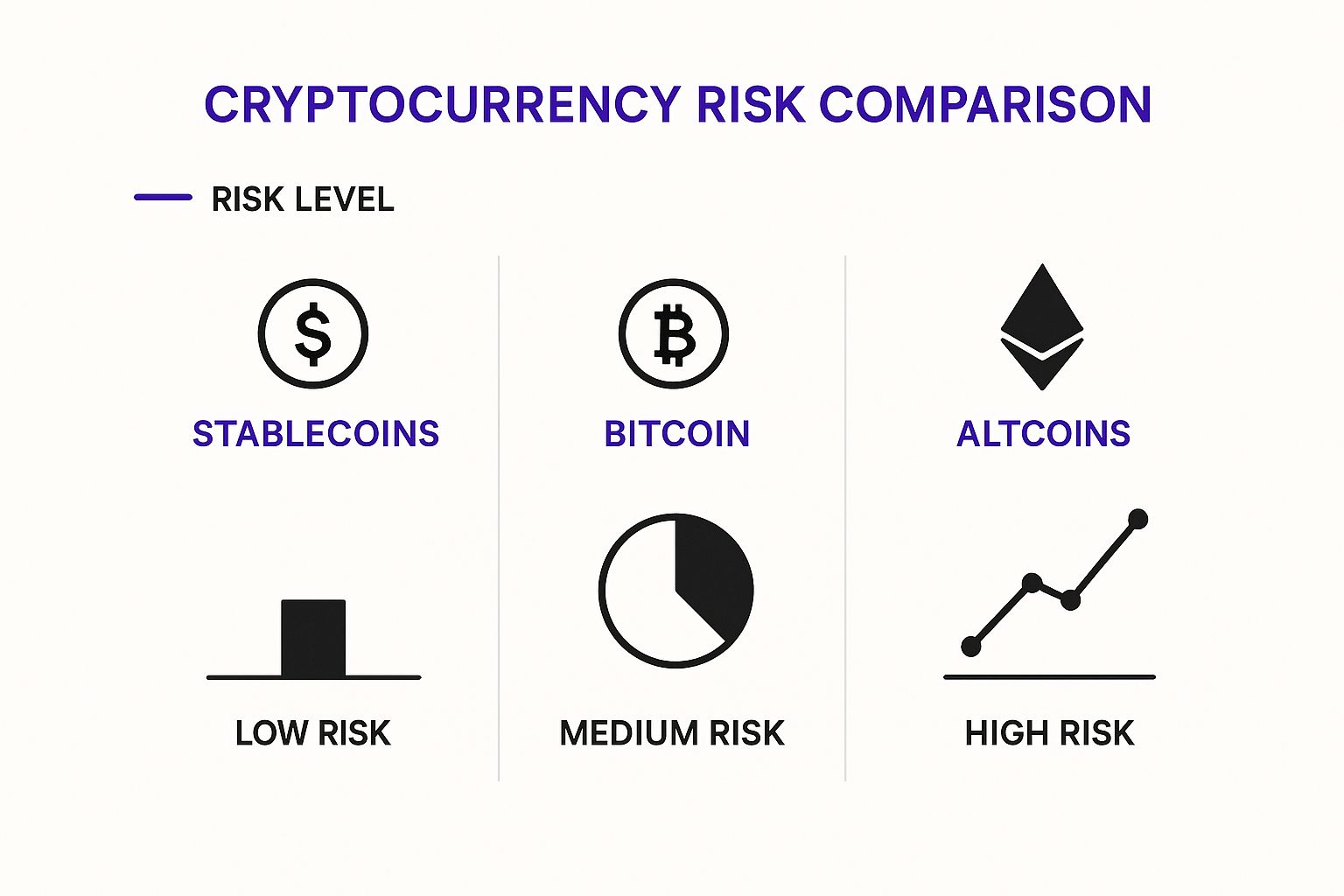

Let's dive into practical rebalancing approaches that actually work in crypto's wild west, using real-world examples from investors who’ve weathered the storms and come out on top. This infographic illustrates the risk levels associated with different asset classes in a typical crypto portfolio:

As the infographic shows, stablecoins offer the lowest risk, while altcoins can swing wildly in both directions. This highlights the importance of understanding your own risk tolerance. When building your crypto foundation, it’s also wise to consider the tax implications. For more information on this topic, especially for Australian investors, check out this helpful resource: Tax Implications of Cryptocurrency.

Why Traditional Rebalancing Schedules Might Not Work for Crypto

Traditional rebalancing, like quarterly or annually, can feel sluggish in the face of crypto's rapid price movements. It's like trying to steer a speedboat with a cruise ship rudder – you need something much more responsive.

Setting Trigger Points That Make Sense for Crypto

Instead of rigid schedules, consider setting trigger points. For example, if your Bitcoin allocation grows 20% beyond your target, that triggers a rebalance. This lets you proactively manage risk and lock in gains without needing to constantly watch the market. For more on handling volatility, see: Navigating Volatility: A Guide for Crypto Investors

Managing Tax Implications While Maintaining Your Desired Allocation

Remember, rebalancing can have tax implications. Every time you sell, you might realize a capital gain or loss. Factor this into your strategy to avoid any tax-time surprises. Consider strategies like tax-loss harvesting – selling losing assets to offset gains from winners.

Rebalancing in Action: Real-World Examples

During the 2021 bull run, savvy investors rebalanced by taking profits from Bitcoin and Ethereum as they skyrocketed, reinvesting into stablecoins or less volatile altcoins. This locked in gains and reduced their exposure before the market cooled off. Conversely, during the 2022 downturn, disciplined rebalancers bought more Bitcoin and Ethereum as they dipped, taking advantage of lower prices to set themselves up for future growth. These examples show how consistent rebalancing, regardless of market direction, is key for long-term success.

Automating Rebalancing While Staying in Control

Some exchanges offer automated rebalancing tools. These can be helpful, but make sure you understand how they work and retain control over your key decisions. You don’t want to completely outsource your strategy to an algorithm. Treat these tools as helpful assistants, not replacements for your own judgment.

Remember, disciplined rebalancing is more than just a tactic – it’s a mindset. It's about sticking to your strategy even when emotions are running high. This is how you build a crypto portfolio that not only survives but thrives.

The following table summarizes different rebalancing strategies:

Rebalancing Strategies and Frequency Comparison: Analysis of different rebalancing approaches and their effectiveness in crypto markets

| Strategy | Frequency | Complexity | Tax Efficiency | Performance in Bull Markets | Performance in Bear Markets |

|---|---|---|---|---|---|

| Calendar-based | Quarterly/Annually | Low | Moderate | Can lag behind rapid price increases | Can miss buying opportunities during dips |

| Percentage-based (Trigger Points) | When asset deviates by a certain percentage from target | Moderate | Moderate | More responsive to market changes | More effective at capturing gains and buying dips |

| Constant Rebalancing | Frequent, often automated | High | Potentially low due to frequent trades | Potentially highest gains | Potentially highest losses |

As the table highlights, each strategy offers different trade-offs. Calendar-based rebalancing is simple but can be slow to react. Percentage-based strategies offer more responsiveness. Constant rebalancing, while potentially lucrative, requires close monitoring and can lead to higher tax burdens. Choosing the right approach depends on your individual circumstances and risk tolerance.

Advanced Strategies That Go Beyond Basic Percentages

So, you've nailed the crypto portfolio allocation basics. Risk, diversification, rebalancing—you've got it. But what if you're ready to step up your game? What secrets are the pros using? Let's dive into some advanced strategies that go beyond simply picking percentages.

Trust me, these strategies can seriously boost your portfolio's performance and help it weather those crypto storms. It's interesting to note that by 2025, a whopping 59% of professional investors planned to put more than 5% of their managed assets into crypto. Find out more about institutional crypto adoption. That shows growing faith in the sector, right? And this shift towards higher crypto allocations really highlights why these advanced strategies are so important.

Dynamic Allocation Models: Adapting to Market Volatility

Static allocations (setting fixed percentages and holding steady) are a decent starting point. But in fast-moving markets, they can sometimes lag behind. Dynamic allocation models, on the other hand, adjust your portfolio based on what the market is doing.

For example, when things get volatile, you might automatically shift more into stablecoins or less volatile assets. Think of it as a cushion for your portfolio. Then, when things calm down, you can increase your exposure to higher-growth assets again. It's a more responsive way to navigate the crypto waves.

Correlation-Based Approaches: Navigating Market Stress

Remember correlation? Well, in a downturn, even assets that seem unrelated can suddenly move together, wiping out your carefully planned diversification. Correlation-based approaches look at the historical relationships between different cryptocurrencies.

This helps you identify assets that tend to move independently during stressful times. For example, including assets like privacy coins or decentralized storage tokens that don't perfectly mirror Bitcoin or Ethereum can make your portfolio more resilient during market crashes.

Incorporating New Opportunities: Maintaining Your Core Strategy

The crypto world is always changing, with new projects and exciting opportunities popping up constantly. But chasing every new thing can derail your core strategy and increase risk. You might be interested in: Cryptocurrency Investing Strategies.

A smarter approach is to set aside a small percentage of your portfolio specifically for exploring these new opportunities. This lets you participate in the potential upside while safeguarding your core holdings. It's like having a mini venture capital fund within your crypto portfolio.

Risk Parity: Adapting to Crypto

Risk parity is a popular strategy in traditional finance. It focuses on balancing the risk contributions of different assets, rather than just the dollar amounts. Adapting this to crypto means carefully assessing the volatility of each asset. You then adjust your allocation to make sure no single holding dominates your overall risk. This is especially useful in crypto because volatility can vary so much between coins and tokens.

Momentum-Based Tactical Adjustments: Capturing Short-Term Trends

Momentum investing is all about allocating more to assets that have seen strong recent price increases. While it's riskier, incorporating some momentum-based tactical adjustments into your broader strategy can help you capture short-term gains.

For instance, setting aside a small part of your portfolio for momentum plays can boost your overall returns. But be careful! Momentum can shift quickly, so manage your risk wisely.

Evaluating Complexity: Is It Worth It?

These advanced strategies offer real benefits, but they also need more effort and monitoring. Before jumping in, honestly assess your time, skills, and comfort level with complexity. If you’re just starting out, focus on the fundamentals.

As you gain experience, gradually add more sophisticated approaches that fit your goals and resources. Remember, the best strategy is the one you can consistently execute and manage well.

Avoiding The Costly Mistakes That Destroy Portfolios

Let's talk about portfolio pitfalls. I've seen firsthand how quickly things can go south, and it’s usually not some complicated technicality that does the damage. It's the mental game, the psychological traps that can snare even seasoned investors. After talking with lots of investors, I've noticed some recurring themes – allocation mistakes that keep popping up. Let’s explore them so you can steer clear.

The Danger of Over-Diversification in Crypto

Diversification is important, of course. Don't put all your eggs in one basket and all that. But in the crypto world, spreading yourself too thin across countless coins can actually hurt your returns. Managing a massive portfolio becomes a nightmare, and your potential gains get watered down. It's better to focus on a select group of assets that you really understand.

Chasing Performance: The Ultimate Portfolio Killer

We’ve all been tempted by the siren song of the latest hot coin. It’s tough to resist the FOMO. But constantly chasing performance is a recipe for long-term disappointment. It's a reactive approach, not a strategic one. Develop a solid crypto portfolio allocation strategy, and try to stick with it. Stay informed about potential opportunities, like Paymate India's IPO Plans, but don't let the hype derail your plan.

Emotional Decision-Making: Your Worst Enemy

Fear and greed: two emotions that can wreak havoc on your portfolio. They'll have you buying high and selling low every time. Even the best allocation strategy can be undermined by emotional decision-making. This screenshot from Wikipedia shows how behavioral economics comes into play:

It really highlights how easily our emotions can lead us astray, especially when it comes to investing. Understanding these biases is crucial for smart portfolio allocation.

Recognizing Emotional Decisions and Maintaining Discipline

So how do you keep your emotions in check? First, you have to recognize when they're taking over. Are you making decisions based on panic or FOMO? If so, pause. Breathe. Remind yourself of your long-term goals. A written plan is like an anchor in a storm, keeping you grounded and preventing impulsive moves. It's especially vital during those wild market swings.

Warning Signs That Your Allocation Needs Adjustment

Your allocation strategy isn't a "set it and forget it" kind of deal. It needs regular tweaking. Here are a few signs that it might be time for a change:

- Your portfolio is significantly deviating from your target allocations. Maybe your initial strategy needs an update.

- Your risk tolerance has changed. Life happens. Major events can shift your comfort level with risk.

- Your investment goals have evolved. A down payment on a house? Retirement planning? Your goals drive your allocation.

- The market has fundamentally shifted. Big tech advancements or regulatory changes might require adjustments.

By understanding these common pitfalls and managing your emotions, you can build a robust crypto portfolio that can handle market volatility. Remember, investing is a marathon, not a sprint. Discipline and a long-term perspective are key.

Your Implementation Roadmap For Real Results

Theory is good, but putting your crypto portfolio plan into action is where the rubber meets the road. Let's ditch the abstract and get down to brass tacks. How do you take all this portfolio allocation talk and turn it into something you can actually use? We'll cover how to look at what you already hold, find any holes in your strategy, and tweak things so they really line up with your goals and how much risk you're comfortable with.

I remember when I first started; my portfolio was all over the place. A little of this, a little of that – basically a hodgepodge of coins with no real strategy. Does that sound familiar? It wasn't until I actually took the time to map out a plan that things started making sense. It was like finding a treasure map after years of wandering in the dark.

Assessing Your Current Situation: Where Do You Stand?

Before changing anything, you need a snapshot of your current crypto holdings. What coins do you own? How much of each? What's the total value? This isn't about beating yourself up over past decisions. It's about getting the info you need to move forward. Think of it like taking inventory before you renovate a house.

Identifying Gaps: Aligning With Your Goals

Now, compare your current portfolio to your goals. Are you taking on more risk than you intended? Not enough? Do your holdings match your long-term plans? This is where you figure out the difference between where you are and where you want to be. It's like comparing a blueprint to the house you’re building – any differences?

Making Adjustments: Fine-Tuning Your Allocation

This is where the actual changes happen. You might need to rebalance what you already own, sell some assets, or buy new ones. The important thing is to make changes that close those gaps and build a portfolio that truly reflects your goals and risk tolerance. It's like making those final adjustments to get the house perfectly aligned with the blueprint.

Actionable Frameworks for Implementation

Here’s how to actually put your plan into motion:

- Set Clear Goals: Figure out what you want to achieve financially. Short-term gains? Long-term growth? Knowing your "why" will guide your decisions.

- Determine Your Risk Tolerance: How much volatility can you stomach? Be honest with yourself.

- Choose Your Assets: Do your research and pick assets that fit your goals and risk tolerance.

- Determine Your Allocation Percentages: How much do you want to put into each asset, based on your research and risk assessment?

- Implement Your Plan: Buy or sell assets to reach your desired allocation.

Tracking and Maintaining Your Allocation

Setting up your portfolio isn't a "set it and forget it" kind of thing. You need to actively track and maintain your desired percentages. Regularly reviewing your portfolio, maybe every quarter or twice a year, is key. This is when you check your progress, see if you’ve drifted from your targets, and make any needed tweaks. Think of it as regular maintenance to keep your investment house in good shape.

- Use Portfolio Tracking Tools: Many platforms and apps, like CoinGecko or CoinMarketCap, can automatically track your portfolio and alert you to changes. This saves time and keeps you in the loop.

- Set Rebalancing Reminders: Set calendar reminders or use automated tools to remind yourself to check and rebalance regularly.

Realistic Expectations and Measuring Success

Crypto investing is a marathon, not a sprint. Don't expect to get rich quick. Focus on steady progress, not short-term ups and downs. Remember those tax implications, especially with the IRS keeping a closer eye on things, as discussed in this article about the crypto tax crackdown. Measuring success isn't just about how many dollars you make. It’s also about how well you stick to your plan, manage risk, and reach your financial goals.

Checklists, Warning Signs, and Troubleshooting Tips

-

Regular Portfolio Review Checklist: Make a checklist of things to review during your check-ups, like how your assets are performing, your allocation percentages, and what the overall market is doing.

-

Warning Signs Your Strategy Needs Adjustment: Watch out for things like big swings away from your target allocations, changes in your own risk tolerance, or major shifts in the market. These are signs you might need to adjust your strategy.

-

Troubleshooting Tips: Have a plan for unexpected things, like a sudden market crash or a major life change. This will help you stay calm and make smart decisions under pressure.

Ready to dive into crypto with confidence? vTrader offers a commission-free platform with advanced tools and resources to help you build and manage your portfolio. Start trading on vTrader today!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.