At its core, a crypto liquidity pool is a big pot of cryptocurrency tokens locked away in a smart contract. You can almost picture it as a community-owned vending machine for crypto—anyone can put tokens in or swap them out instantly, without having to go through a traditional broker or exchange. This simple idea is one of the cornerstones of decentralized finance (DeFi).

Demystifying Crypto Liquidity Pools

Before liquidity pools came along, trading on decentralized platforms was often clunky and slow. These early systems relied on an order book, much like the New York Stock Exchange. In that world, you need a buyer for every seller. If you wanted to sell one Ethereum (ETH) for $3,500, you had to just sit and wait until someone, somewhere, decided to place a matching buy order. This created huge bottlenecks, especially for newer or less popular tokens.

Crypto liquidity pools completely flip this model on its head. Instead of waiting to be matched with another person, traders can swap their tokens directly with the pool itself. This whole process is managed by an Automated Market Maker (AMM)—essentially, the smart contract code that acts as the brain of the pool.

The core idea is simple yet powerful: by pooling assets together, a constant source of liquidity is available for anyone to use, enabling trades to happen instantly and automatically, 24/7. This removes the dependency on finding a direct counterparty for every transaction.

How AMMs Differ from Order Books

These pools have fundamentally changed how trading works on decentralized exchanges (DEXs), allowing users to trade directly against reserves held in a smart contract and slashing much of the friction. It’s no surprise that platforms built on this model have seen explosive growth. Uniswap, for example, stands as the most popular liquidity pool on Ethereum, with billions of dollars in locked value. For a deeper dive into the market impact of other top-tier pools, you can explore the analysis over at 101blockchains.com.

The contrast between an AMM-powered liquidity pool and a traditional order book is stark. The AMM uses a math formula to set prices based on the ratio of tokens in the pool, whereas an order book depends on matching the highest bid with the lowest ask. This makes liquidity pools far more accessible for new projects and everyday users alike.

To really nail down the differences, let's put them side-by-side.

Liquidity Pools vs Traditional Order Books

The two systems approach trading from completely different angles. One relies on algorithms and pooled funds, while the other is a legacy model based on matching individual orders.

| Feature | Crypto Liquidity Pool (AMM) | Traditional Order Book |

|---|---|---|

| Trading Mechanism | Users trade against a pool of tokens locked in a smart contract. | Buyers and sellers are matched based on compatible orders. |

| Price Discovery | An algorithm automatically sets the price based on token ratios. | Determined by the highest price a buyer will pay and the lowest a seller will accept. |

| Liquidity Source | Sourced from any user who deposits assets into the pool. | Provided by professional market makers and individual traders. |

| Accessibility | Open and permissionless; anyone can create a market or provide liquidity. | Often restricted and requires approval from a central exchange. |

Ultimately, the AMM model has democratized market-making, allowing anyone to contribute to a pool and earn fees, a role once reserved for large financial institutions.

How Crypto Liquidity Pools Actually Work

To really get your head around a crypto liquidity pool, it helps to think of it as a stage with two main actors: the Liquidity Providers (LPs) who supply the tokens, and the traders who use those tokens to swap assets. These two groups don’t interact directly—instead, a smart contract acts as the director, creating a self-sufficient ecosystem for decentralized trading.

It all starts with the Liquidity Providers. These are folks who agree to lock up their crypto assets in a shared pool, making them available for others to trade against. The key rule here is that they must deposit an equal monetary value of two different tokens. For example, if you wanted to add to an ETH/USDC pool and 1 ETH was trading at $3,500, you’d need to deposit your 1 ETH plus $3,500 worth of USDC.

Once you’ve made the deposit, the smart contract automatically issues you special LP tokens. Think of these like a digital claim check or a receipt; they represent your specific share of the entire pool. These tokens are absolutely vital—they're used to calculate your cut of the trading fees and are the only way you can get your original deposit back.

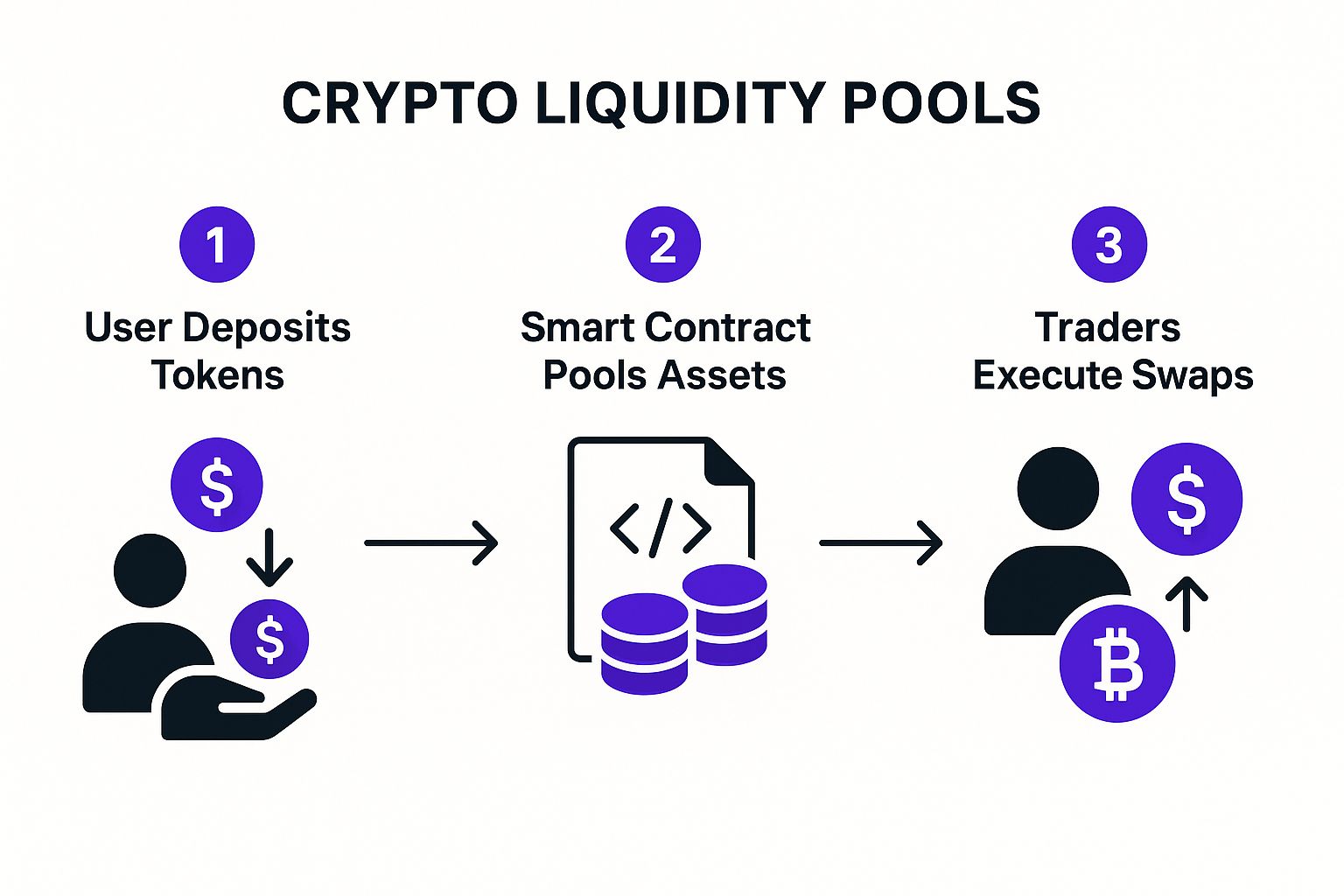

This flow is mapped out below, showing how assets move from providers into the pool, which then becomes the trading ground for everyone else.

As you can see, it's a circular system. User deposits form the foundation that allows traders to seamlessly execute their swaps.

The Automated Market Maker Engine

So how does a pool manage all this trading without a classic order book full of buy and sell orders? This is where the magic of the Automated Market Maker (AMM) comes in. The AMM is the algorithm at the very core of the pool's smart contract, and its sole job is to set asset prices automatically.

Most of the early and still popular AMMs run on a surprisingly simple mathematical rule known as the constant product formula. You'll often see it written like this:

x * y = k

In this formula, x represents the amount of Token A, y is the amount of Token B, and k is a fixed constant. The formula’s one command is that k, the total liquidity, must always stay the same after any trade. It's this simple principle that guarantees the pool can always quote a price for an asset, no matter how big or small the trade. The price is just a function of the ratio between the two tokens in the pool.

The constant product formula is the secret sauce that makes permissionless trading a reality. By ensuring the product of the two token amounts remains constant, the AMM can automatically rebalance the pool after every swap, instantly setting a new market price without any human getting involved.

A Practical Trading Example

Let's make this real and go back to our ETH/USDC pool.

Imagine the pool currently holds 10 ETH and 35,000 USDC.

x(ETH) = 10y(USDC) = 35,000- This means our constant

kis10 * 35,000 = 350,000.

Right now, the price of 1 ETH is $3,500 (35,000 divided by 10). Simple enough.

Now, a trader shows up wanting to buy 1 ETH. To do this, they will put USDC into the pool and take ETH out. The AMM's job is to figure out exactly how much USDC they need to add to keep our constant k at 350,000. After the trade, the pool will only have 9 ETH left.

To find the new USDC amount (y), the formula does its thing:

9 * y = 350,000

y = 350,000 / 9 = 38,888.89

The trader had to add $3,888.89 in USDC ($38,888.89 – $35,000) to get that 1 ETH, making their effective price $3,888.89. The moment this trade is complete, the new market price for ETH in the pool is $4,320.98 (38,888.89 / 9). This instant price shift caused by a single trade is called slippage, and it's a fundamental part of how every crypto liquidity pool operates.

The Critical Role of Stablecoins

In the wild west of crypto, a liquidity pool needs an anchor to keep from getting thrashed by violent market swings. This is where stablecoins come in to save the day. Pairing a volatile asset like Ethereum (ETH) with a price-pegged stablecoin like USD Coin isn't just a popular move; it's a foundational strategy for building a more stable and predictable trading environment.

Think of a stablecoin as a financial shock absorber. By tying one half of the pool to a steady value (usually the US dollar), it dramatically dampens the overall volatility. This helps shield liquidity providers from the nasty effects of impermanent loss, making the whole venture a lot less nerve-wracking.

Anchoring DeFi with Stable Assets

The sheer reliability of major stablecoins makes them the go-to base currency for thousands of trading pairs across the decentralized finance (DeFi) world. When traders know they can swap in and out of a stable asset with confidence, they're far more likely to jump into a pool. This pushes trading volume higher, which in turn means more fee revenue for the folks providing the liquidity.

It’s a symbiotic relationship that shows just how tied the health of the stablecoin market is to the efficiency and growth of DeFi. The deeper a stablecoin's liquidity, the more solid the trading pairs built on top of it become. In essence, stablecoins are the bedrock on which much of DeFi's liquidity is built, creating a more mature and dependable ecosystem for everyone involved.

Stablecoins are the unsung heroes of countless liquidity pools. They provide a reliable store of value that dials down risk, encourages trading, and creates a more predictable way to earn passive income.

Their importance has only exploded as the market has matured. By 2025, stablecoins became a non-negotiable part of the entire crypto trading machine. The global stablecoin market now sits at an estimated $252 billion, acting as the foundational liquidity layer for both centralized and decentralized finance. This market is growing at a steady clip, fueled almost entirely by trading volumes and participation in DeFi liquidity pools.

The Most Common Stablecoin Pairings

A few key stablecoins have risen to the top of the pack thanks to their reliability, regulatory footing, and deep liquidity. They are the first choice for anyone looking to create a stable, high-volume pool.

Here are some of the heavy hitters you’ll see most often:

- USD Coin (USDC): Known for its strong compliance and transparency, USDC is frequently paired with giants like ETH and WBTC. This creates some of the most trusted and liquid pools in all of DeFi.

- Tether (USDT): As the largest stablecoin by market cap, USDT has unmatched liquidity. It’s a dominant force in trading pairs across nearly every exchange and blockchain out there.

- Dai (DAI): As a decentralized stablecoin backed by a basket of other crypto assets, DAI is a huge favorite within the core DeFi community for its resilience and censorship resistance.

Weighing the Rewards and Risks of Providing Liquidity

Becoming a liquidity provider (LP) can feel like a golden opportunity to make your crypto assets work for you. But before you jump in, it's critical to understand that this path is paved with both incredible opportunities and some serious pitfalls.

The main draw for most people is the chance to earn passive income. Every time a trader makes a swap using the pool, they pay a small fee. On a popular platform like Uniswap, this fee is often around 0.3%. These fees are then split among all the LPs based on how much they've contributed to the pool. The more trades a pool facilitates, the more fee revenue everyone earns.

The Lure of Yield Farming

On top of the standard trading fees, many DeFi platforms sweeten the deal with an extra layer of rewards called yield farming. It works like this: when you deposit your funds, you get LP tokens back as a "receipt." You can then take these LP tokens and "stake" them in a separate smart contract.

For doing this, the platform rewards you with its own native tokens. This powerful strategy can seriously amplify your returns, as you're effectively earning two separate rewards from a single investment. It’s a smart way for platforms to attract the deep liquidity they need to grow.

Yield farming creates a compelling feedback loop: LPs provide the liquidity that makes a platform useful, and the platform rewards them with governance tokens, giving them a stake in its future success.

However, the promise of sky-high yields shouldn't blind you to the very real dangers lurking in the world of decentralized finance. LPs face a few key risks that can turn a profitable venture into a painful loss in the blink of an eye.

The Inescapable Risk of Impermanent Loss

The most unique—and often most confusing—risk for LPs is impermanent loss. This isn’t a loss in the typical sense of your balance going down; it's more of an opportunity cost. It happens when the price of the tokens you've deposited into the pool changes dramatically from when you first put them in.

Let’s say you deposit into an ETH/USDC pool. If ETH's price shoots up, the AMM protocol automatically rebalances your position by selling your appreciating ETH for USDC to keep the pool's 50/50 value ratio intact. If you decide to withdraw your funds at that moment, you'll get back less ETH and more USDC than you started with.

While the total dollar value of your assets might have increased, it would likely be less than what you would have had if you’d simply held onto your original ETH and USDC. The "loss" is the potential profit you missed out on by providing liquidity instead of just holding. It's the fundamental trade-off you make for earning those trading fees. To see how transaction costs can affect your overall strategy, you can find a full breakdown of the vTrader fee structure on our platform.

Other Critical Dangers to Consider

While impermanent loss is an ever-present risk, a couple of other dangers can be far more catastrophic.

- Smart Contract Bugs: Every liquidity pool runs on a smart contract. If there's a hidden vulnerability in the code, a hacker could exploit it and drain the entire pool. This isn't just theoretical—it has happened many times, leading to millions of dollars in stolen funds.

- Rug Pulls: This is flat-out theft by shady developers. They'll create a new token, generate a ton of hype to attract investors, and then once the pool is full of valuable assets like ETH, they pull everything out, leaving LPs holding worthless tokens. These scams can happen in a flash, as seen in the infamous $60 million AnubisDAO incident.

Before committing your funds, it's crucial to weigh these factors carefully. Here’s a simple breakdown to help you decide.

Pros and Cons of Being a Liquidity Provider

| Benefits (Pros) | Risks (Cons) |

|---|---|

| Earn Passive Income from trading fees. | Impermanent Loss can reduce your potential gains. |

| Yield Farming Rewards offer additional tokens. | Smart Contract Bugs could lead to a total loss of funds. |

| Support Favorite Projects by providing needed liquidity. | Rug Pulls are a constant threat from malicious developers. |

| Gain Governance Tokens and a say in the platform's future. | Market Volatility directly impacts the value of your assets. |

Ultimately, being an LP can be highly rewarding if you understand the mechanics and are willing to accept the associated risks. Always do your own research and never invest more than you can afford to lose.

How to Choose the Right Liquidity Pool

Jumping into a crypto liquidity pool without doing your homework is a bit like setting sail without a map. It’s a risky game. Not all pools are built the same, and picking the right one is absolutely essential to balancing those juicy potential rewards with your own personal risk tolerance.

This isn't about just chasing the highest advertised returns. It's a careful process, and it starts with a few key numbers.

The very first thing you should look at is a pool's Total Value Locked (TVL). Think of this as the total pile of cash everyone has deposited into the pool. A bigger TVL is a solid sign of trust and stability—it means plenty of other people have already put their money where their mouth is.

More importantly, a high TVL signals deep liquidity. For traders using the pool, this means less slippage, which is the annoying difference between the price they expect and the price they actually get. For you, the liquidity provider, less slippage brings in more traders, and more traders mean more fee revenue flowing straight into your wallet.

Evaluate Trading Volume and Fee Revenue

Once you've found a pool with a healthy TVL, the next step is to check its pulse—the trading volume. A pool can have billions locked up, but if nobody’s actually trading, you won't earn a dime in fees. You’re looking for pools with consistently high daily trading volumes, and you can usually find this data on any good DEX analytics site.

It's simple, really: your earnings are a slice of the fees from every trade. A pool with $10 million in TVL but $5 million in daily volume is almost certainly going to be more profitable than a massive pool with $50 million in TVL but a measly $500,000 in daily trades. High volume is the engine that drives your passive income.

A healthy pool has both depth (TVL) and activity (trading volume). You want to find that sweet spot where a big pile of capital is actually being put to work by traders. That's where you'll maximize your fee-earning potential.

While decentralized pools are changing the game, it’s worth remembering that a huge chunk of crypto liquidity still lives on centralized exchanges. For example, a recent CoinGecko report revealed that Binance alone controls about 32% of all centralized crypto liquidity. You can dig into the specifics in their full crypto liquidity report for 2025. This just goes to show how critical it is to pick platforms with deep, reliable liquidity, whether they’re centralized or not.

Assess Risk and Platform Security

Finally, you have to face the risks. The biggest financial gremlin for liquidity providers is impermanent loss. Pools that pair two highly volatile, speculative tokens are far more exposed to this than pools that pair a major player like ETH with a stablecoin like USDC. Always make sure the pair’s volatility matches what you’re willing to risk.

Beyond the market itself, platform security is an absolute deal-breaker. Only provide liquidity on platforms that have been through multiple, independent security audits. Any project worth its salt will make these audit reports public. A clean track record from well-known security firms is a huge green flag, signaling the smart contracts are likely free of critical bugs.

You might also want to look at related strategies to make your crypto work even harder for you. If you’re looking to earn rewards with a bit less exposure to trading ups and downs, it could be smart to learn about vTrader's crypto staking options, which can be a fantastic way to complement your liquidity providing.

By methodically checking these boxes—TVL, volume, volatility, and security—you can make a smart choice and find a crypto liquidity pool that fits your financial goals and helps you navigate the DeFi world with confidence.

The Future of Liquidity Pools in DeFi

The crypto liquidity pools we see today are a whole different beast compared to the simple models that first kickstarted the DeFi movement. As the space grows up, these core engines of decentralized trading are evolving at a breakneck pace. They're becoming smarter, more efficient, and more connected than ever.

This isn't just about minor tweaks, either. We're talking about a complete overhaul in how capital gets put to work in the world of crypto.

Concentrated Liquidity: Doing More with Less

One of the biggest game-changers has been the rise of concentrated liquidity, a concept made famous by Uniswap V3. If you remember the old pool models, a provider's capital was spread incredibly thin—across a price range from zero to infinity. That was a huge waste, since most assets only trade within a much smaller window.

Concentrated liquidity flips that script. It lets liquidity providers (LPs) act more like professional market makers. Now, they can focus their capital in tight, specific price ranges where they anticipate the most action. This simple change massively boosts capital efficiency, letting providers rake in far more in trading fees with the same amount of money.

Breaking Down Blockchain Barriers

Another exciting frontier is the push for cross-chain liquidity. For a long time, a liquidity pool was basically an island, stuck on its own blockchain like Ethereum or Solana. This created a fractured, siloed market that made it a pain to trade assets between different crypto ecosystems.

But that's changing fast. New protocols are now building bridges between these islands. They’re creating solutions that allow a single crypto liquidity pool to serve multiple blockchains at once. This enables traders to make seamless, low-cost swaps across networks that were once completely walled off from each other—a huge step toward a truly unified financial system.

The next generation of liquidity pools are not just passive pots of tokens. They are becoming sophisticated financial instruments designed for active management, capital efficiency, and interoperability, paving the way for a more integrated DeFi landscape.

Smarter Pools for Smarter Strategies

Beyond these major trends, the pools themselves are just getting more intelligent. Developers are hard at work building in features to automatically cushion the blow from impermanent loss, which has always been a major headache for providers.

We're also seeing the rise of complex, multi-layered strategies that used to be reserved for big-shot institutional traders. As innovation keeps accelerating, staying in the loop is key. For regular updates on these market shifts, you can check out the latest crypto news and analysis on vTrader.

The direction here is crystal clear. The humble crypto liquidity pool is evolving from a passive "set it and forget it" tool into an active, dynamic force in a sophisticated new financial world. They are the bedrock technology that will continue to unlock a more open and efficient future for everyone.

Frequently Asked Questions About Liquidity Pools

Diving into liquidity pools can bring up a lot of questions. Here are some straight answers to the ones we hear most often.

Is Providing Liquidity Profitable?

It certainly can be. When you provide liquidity, you’re earning a cut of the trading fees from that pool, and often you can snag extra token rewards through what’s called yield farming. But it's crucial to understand that profit is never a sure thing. You're always exposed to impermanent loss, a tricky situation where your assets could end up being worth less than if you had just held onto them in your wallet.

What Is the Safest Type of Liquidity Pool?

If safety is your top priority, pools that pair two different stablecoins—like a USDC/DAI pool—are generally your best bet. Because the prices of both assets barely move, your risk of impermanent loss drops dramatically. The trade-off? These safer pools typically come with lower returns.

Can You Lose All Your Money?

Yes, absolutely. While everyone talks about impermanent loss, the biggest threat is actually smart contract risk. If a hacker finds a bug in the pool's code or the whole project turns out to be a scam (a "rug pull"), you could lose every cent you put in, instantly. This is why you must always do your homework and check for security audits on any project you're considering.

If you have more questions about the crypto world, you can always find more in-depth answers on the vTrader FAQ page.

Ready to explore the world of crypto with zero trading fees? Join vTrader today to access advanced tools, real-time data, and a secure platform designed for both new and experienced traders. Sign up now and start your journey with a platform that puts your profitability first.

Start trading with vTrader for free

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.