Crypto Exchange Regulations a Global Guide

Navigating the world of crypto exchange regulations can feel like trying to solve a puzzle with pieces from a dozen different boxes. Simply put, these are the rules and legal frameworks that governments across the globe use to keep an eye on digital asset platforms. The real challenge is that every country seems to have its own rulebook, creating a complex web of compliance that exchanges must untangle to operate.

The Global Puzzle of Crypto Regulation

Picture yourself on a road trip across the world. In one country, you drive on the left. In the next, there are no speed limits. In another, your car needs a special permit just to enter. That’s pretty much what crypto exchanges face today. It's a fragmented and often confusing landscape where the rules of the road change dramatically from one border to the next.

This regulatory patchwork isn't random; it stems from the fact that different nations see digital assets in entirely different ways. The fundamental question is the same everywhere: how do you foster financial innovation without opening the door to crime or leaving consumers vulnerable? The answers, however, are all over the map, shaped by each country's unique economic goals, political climate, and appetite for risk. To really get a handle on this, it helps to see where crypto fits in the bigger picture, for instance, by looking at how Bitcoin stacks up against traditional assets like gold.

Diverse Philosophies and Approaches

As of 2025, the global approach to crypto is a spectrum, ranging from full-throated acceptance to outright bans. At one end, you have countries like El Salvador, which has made Bitcoin legal tender in a bold economic experiment. On the other, nations like China have stuck with strict prohibitions on nearly all crypto-related activities.

In the middle, you’ll find major financial hubs like Hong Kong and Singapore trying to thread the needle. They’re rolling out sophisticated licensing systems designed to attract crypto businesses while keeping a tight rein on the risks. This ever-shifting environment makes it incredibly tough for exchanges and investors, as being compliant in one place offers no guarantees in another. The first step to navigating this maze is understanding these core differences. For anyone looking to go deeper, our vTrader Academy is packed with guides and learning modules on a wide range of crypto topics at https://www.vtrader.io/en-us/academy.

The ultimate goal of crypto exchange regulations is not to stifle growth, but to build a sustainable and trustworthy market where innovation can flourish safely within established financial guardrails.

A Snapshot of Global Stances

To bring some clarity to this complex picture, we can sort the different regulatory approaches into a few main categories. Each one reflects a distinct philosophy on how to deal with the promise and peril of digital currencies.

Here’s a look at the major global stances on crypto regulation, which helps illustrate just how varied the oversight is from one region to another.

Global Approaches to Crypto Regulation

| Regulatory Stance | Key Characteristics | Example Regions/Countries |

|---|---|---|

| Permissive | Actively encourages crypto adoption with minimal rules, often using it as a tool for economic growth. | El Salvador, Central African Republic |

| Structured | Implements comprehensive frameworks with clear licensing, AML/KYC, and investor protection rules. | European Union (MiCA), Singapore |

| Fragmented | Multiple agencies compete for jurisdiction, leading to unclear rules and "regulation by enforcement." | United States |

| Restrictive | Imposes outright bans on certain crypto activities like trading, payments, or mining. | China |

Understanding these high-level approaches is the key to making sense of the specific compliance rules we'll dive into next. This table gives you a bird's-eye view before we get into the nitty-gritty details.

Understanding AML and KYC Compliance

If you think of crypto regulations as the official rulebook for the digital economy, then Anti-Money Laundering (AML) and Know Your Customer (KYC) are two of its most critical chapters. These aren't just tedious administrative tasks. Think of them as the digital equivalent of a bouncer checking IDs at an exclusive venue—together, they make sure everyone inside is who they say they are and isn't there to cause trouble.

The two concepts are deeply connected. KYC is all about verifying a user's identity, while AML is the bigger picture—the set of rules and technologies used to spot and stop financial crime. You can’t have one without the other. After all, how can you detect suspicious behavior if you have no idea who your customers are?

The Role of Know Your Customer (KYC)

KYC is the first line of defense for any reputable crypto exchange. It’s the "who are you?" moment when you first sign up. When a regulated platform asks for your name, address, birthdate, and a government-issued ID, you're going through a standard KYC process.

This formal procedure is known as a Customer Identification Program (CIP). Its goal is simple: to confirm, with a high degree of confidence, that you are who you claim to be. This single step makes it incredibly difficult for criminals to open anonymous accounts for money laundering, terrorist financing, or other illegal schemes.

A big part of understanding KYC also involves how exchanges manage your sensitive data. This is typically outlined in their privacy policies, which are shaped by data protection laws. For a real-world example of how this is laid out, you can review YieldSeeker's Privacy Policy to see how these disclosures work in practice.

Expanding Beyond Identity to AML

While KYC is about identity, AML is about behavior. Once a customer is on board, the exchange’s AML duties begin, which means keeping an eye on their activity. It’s like a security team that doesn't just check IDs at the door but also patrols the venue to ensure everyone is playing by the rules.

An exchange’s responsibility doesn’t end after verifying a user’s identity. Continuous monitoring is the backbone of any effective AML program, helping to protect the integrity of the entire financial system.

This isn't done by hand. Sophisticated systems, often powered by AI, analyze transaction patterns to spot red flags. These systems are fine-tuned to catch unusual activities that might point to criminal intent.

Examples of Red Flags Monitored by AML Systems:

- Structuring: A user making lots of small deposits that fall just under the reporting threshold to fly under the radar.

- Rapid Movement of Funds: A large deposit is made, then immediately withdrawn and scattered across multiple external wallets.

- Transactions with High-Risk Jurisdictions: Funds flowing to or from countries known for lax AML enforcement.

- Use of Mixers or Tumblers: Services specifically designed to muddy the trail of cryptocurrency transactions.

From Detection to Reporting

When an exchange's AML system flags a transaction as suspicious, it kicks off an internal investigation. If the activity can't be easily explained, the exchange is legally bound to file a Suspicious Activity Report (SAR) with the appropriate financial intelligence unit, like FinCEN in the U.S.

Filing a SAR helps law enforcement connect the dots between different platforms, sometimes uncovering massive criminal operations. Exchanges that fail to run a proper AML program and file SARs can face staggering fines and even criminal charges. For users, this means regulated platforms are far safer, as they actively weed out bad actors and protect everyone’s assets.

How Licensing Turns Exchanges into Legitimate Businesses

What really separates a trustworthy crypto exchange from some risky, fly-by-night operation? While a lot of factors come into play, one of the biggest is a license.

Think of a license as more than just a piece of paper. It’s a government's official seal of approval, signaling that the exchange has been put through its paces and meets tough standards for security, financial stability, and consumer protection.

Getting that seal of approval is an exhausting and expensive journey, and that’s by design. It's meant to weed out anyone who isn't serious or has bad intentions. It’s basically a financial stress test, proving an exchange is built to last and can operate responsibly.

The Grueling Gauntlet of Licensing

Imagine trying to get a traditional banking license. You wouldn't just fill out a quick form and open your doors. You’d face intense scrutiny over your business plan, your leadership's background, and, most critically, your capital. Crypto exchange licensing is on a similar, demanding path.

Regulators put every applicant under a microscope to make sure they can actually protect user funds and keep the platform stable. The goal is simple: to ensure that when you deposit money, there's a legitimate, well-funded business on the other side of the screen. Exploring the foundational legal requirements for legitimate operations helps put into context just how much effort this involves.

Key hurdles applicants must clear often include:

- Sufficient Capital Reserves: Proving the exchange has enough cash on hand to cover all its costs and potential losses without ever touching customer assets.

- Robust Cybersecurity Protocols: Showing they have state-of-the-art defenses against hacks, backed by penetration tests and solid incident response plans.

- Qualified Leadership: Making sure the executive team has a clean record and real-world experience in finance and tech.

- Comprehensive AML/KYC Programs: Implementing and proving the effectiveness of systems designed to stop financial crime in its tracks.

A Wallet Full of Licenses

The world of crypto exchange regulations isn't a one-size-fits-all game. A single license rarely gives an exchange a golden ticket to operate globally. Instead, different countries have their own unique licensing frameworks that platforms must navigate to serve customers in those areas.

This complicated reality forces major international exchanges to collect licenses like a traveler collects passport stamps. Each one represents compliance with a different set of local rules, from investor protection laws in Europe to specific reporting demands in Asia. This is why you’ll often see an exchange’s legal pages reference multiple regulatory bodies. For a real-world example, you can review the vTrader terms and conditions to see how a platform outlines its legal obligations.

A license transforms an exchange from a mere tech platform into a recognized financial institution. It signals a commitment to transparency and accountability, providing users with a crucial layer of confidence that their assets are being handled by a supervised entity.

The most common types of licenses fall into a few key categories, each with a specific job.

Common Crypto License Types

1. Virtual Asset Service Provider (VASP) License: This is a broad category, first laid out by the Financial Action Task Force (FATF) and now adopted by many countries. It covers a huge range of crypto activities, from exchange services to wallet hosting.

2. Money Transmitter License (MTL): This is a big one in the U.S. It’s for any business that moves money from one person or place to another. Most crypto exchanges that deal with traditional currencies like the US dollar fall into this bucket.

3. Specialized Crypto Licenses: Some places, like New York with its famous BitLicense, have built their own specific regulatory frameworks just for digital asset businesses.

Successfully getting these licenses is what takes an exchange to the next level. It turns a promising idea into a legitimate and durable business that users can actually trust. It’s a tough but absolutely essential step in building a mature and stable crypto market.

Navigating Regulations in the Americas

The Americas offer a fascinating, and at times chaotic, look at crypto exchange regulations. The entire region is a mashup of pioneering countries, cautious latecomers, and outright battlegrounds where powerful government agencies are still clashing over control. From the high-stakes regulatory drama playing out in the United States to the bold experiments in Central America, this continent provides a full spectrum of the challenges and opportunities that exchanges face every day.

For any exchange with global ambitions, getting a handle on this regional diversity is non-negotiable. The rules that govern your operations in one country can be completely different just across the border, which makes a one-size-fits-all compliance strategy a recipe for disaster. This is a region defined by its sharp contrasts.

The United States Regulatory Tug-of-War

The U.S. is, without a doubt, the most complex and influential regulatory environment on the planet. For years, the story here has been one of "regulation by enforcement." Instead of getting clear rules from lawmakers, exchanges have been forced to learn the hard way through high-profile, precedent-setting lawsuits. It’s created a tense atmosphere for any platform just trying to operate on the right side of the law.

At the center of all this confusion is a fundamental disagreement between two of the country’s most powerful financial agencies:

- The Securities and Exchange Commission (SEC): This agency has taken the stance that many digital assets are securities—in other words, investment contracts. If a token is classified as a security, any exchange that lists it must follow the same strict laws that govern Wall Street.

- The Commodity Futures Trading Commission (CFTC): This agency sees major cryptocurrencies like Bitcoin differently, treating them as commodities much like gold or oil. This designation triggers a completely different set of rules, primarily focused on preventing market manipulation and regulating derivatives trading.

This "security vs. commodity" debate isn't just a matter of semantics; it has enormous real-world consequences for every exchange operating in the U.S. How an asset is classified determines everything from registration and reporting requirements to how it can be marketed. For platforms to operate with confidence, they need a crystal-clear understanding of their legal obligations and how they manage user information, details often outlined in a privacy policy.

A Shift Towards Clarity

Thankfully, it looks like the tide is finally turning. In a major shift for 2025, the U.S. seems to be moving away from its notoriously ambiguous enforcement-first strategy and toward creating clear, rule-based oversight. New legislative efforts are aimed at finally settling the jurisdictional turf war between the SEC and CFTC that has been a source of so much uncertainty.

At the same time, core compliance rules for Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) remain non-negotiable. Under the Bank Secrecy Act (BSA), crypto businesses are treated as financial institutions and fall under the watchful eye of the Financial Crimes Enforcement Network (FinCEN). This multi-layered approach means every exchange must have a rock-solid compliance program to fight illicit finance. You can dive deeper into this evolution in this detailed 2025 global crypto regulation report.

The real goal in the U.S. is to transform the crypto space from a field of legal landmines into a market with clear guardrails. This shift is absolutely essential for bringing in more institutional money and building lasting consumer trust.

Diverse Approaches Across the Continent

Once you step outside the U.S., the regulatory picture across the Americas gets even more interesting. Each nation is carving its own path, driven by its unique economic ambitions and appetite for risk.

Canada's Unified Approach

Canada stands in stark contrast to its southern neighbor. The country has adopted a much more coordinated national strategy, with provincial securities regulators all working in concert under the Canadian Securities Administrators (CSA). This collaboration has produced a clearer, more unified framework where crypto trading platforms are generally required to register as restricted dealers. For exchanges, this centralized model brings a welcome level of predictability.

El Salvador's Bitcoin Experiment

On the complete opposite end of the spectrum is El Salvador, which made history in 2021 by adopting Bitcoin as legal tender. It was a bold move aimed at driving financial inclusion and attracting foreign investment. For exchanges operating there, it means navigating an ecosystem where crypto isn't just an asset class—it's an official currency. While the experiment has drawn both praise and heavy criticism, it remains a powerful real-world example of how a government can embrace crypto as a strategic economic tool.

Decoding Regulations in Europe and Asia

When you look at the global map of crypto exchange regulations, two continents stand out with starkly different philosophies: Europe and Asia. While both are massive, critical markets, they’re tackling oversight from opposite ends of the field. Europe is building a single, harmonized fortress, while Asia is more like a collection of nimble, competing city-states, each carving out its own unique regulatory haven.

For any exchange with global ambitions, getting a handle on these differences isn't just important—it's everything. The compliance strategy that works in one region is almost guaranteed to fail in the other. It's a tale of two very different worlds, one focused on unity and the other on dynamic, bespoke competition.

Europe's Unified Rulebook with MiCA

The European Union is making a game-changing move with its Markets in Crypto-Assets (MiCA) framework. Think of it as a single, comprehensive rulebook for the entire 27-member bloc. Instead of forcing an exchange to navigate the bureaucratic maze of securing 27 different licenses, MiCA introduces a "passporting" system. Once you're licensed in one EU country, you can offer your services across all member states. Simple as that.

This is a deliberate strategy to turn the EU into a predictable, unified market. The goal is to wipe out the regulatory fragmentation that has historically made operating across Europe a headache-inducing and expensive ordeal.

MiCA's main job is to bring legal certainty to crypto-assets, spark innovation, protect consumers and investors, and lock down financial stability. It's easily one of the most thorough pieces of crypto regulation we've seen anywhere in the world.

Under MiCA, what are known as Crypto-Asset Service Providers (CASPs)—which includes exchanges—have to meet some pretty strict requirements. We’re talking about everything from capital reserves and custody policies to transparent pricing and managing conflicts of interest. The idea is to elevate the crypto industry to the same operational standards as traditional finance, which in turn boosts trust and makes the market safer for everyone involved.

Asia's Hub-and-Spoke Strategy

In sharp contrast to Europe's unified playbook, Asia presents a vibrant but fragmented mosaic of regulatory strategies. The continent’s approach is best described as a "hub" model, where ambitious jurisdictions are all fiercely competing to become the region's go-to crypto destination.

Powerhouse financial centers like Hong Kong, Singapore, and Dubai are leading the charge here. They're rolling out their own bespoke licensing regimes, each one carefully designed to attract top-tier crypto talent and investment. These frameworks are undeniably strict, but they're also clear, offering a legitimate path forward for well-funded and serious exchanges.

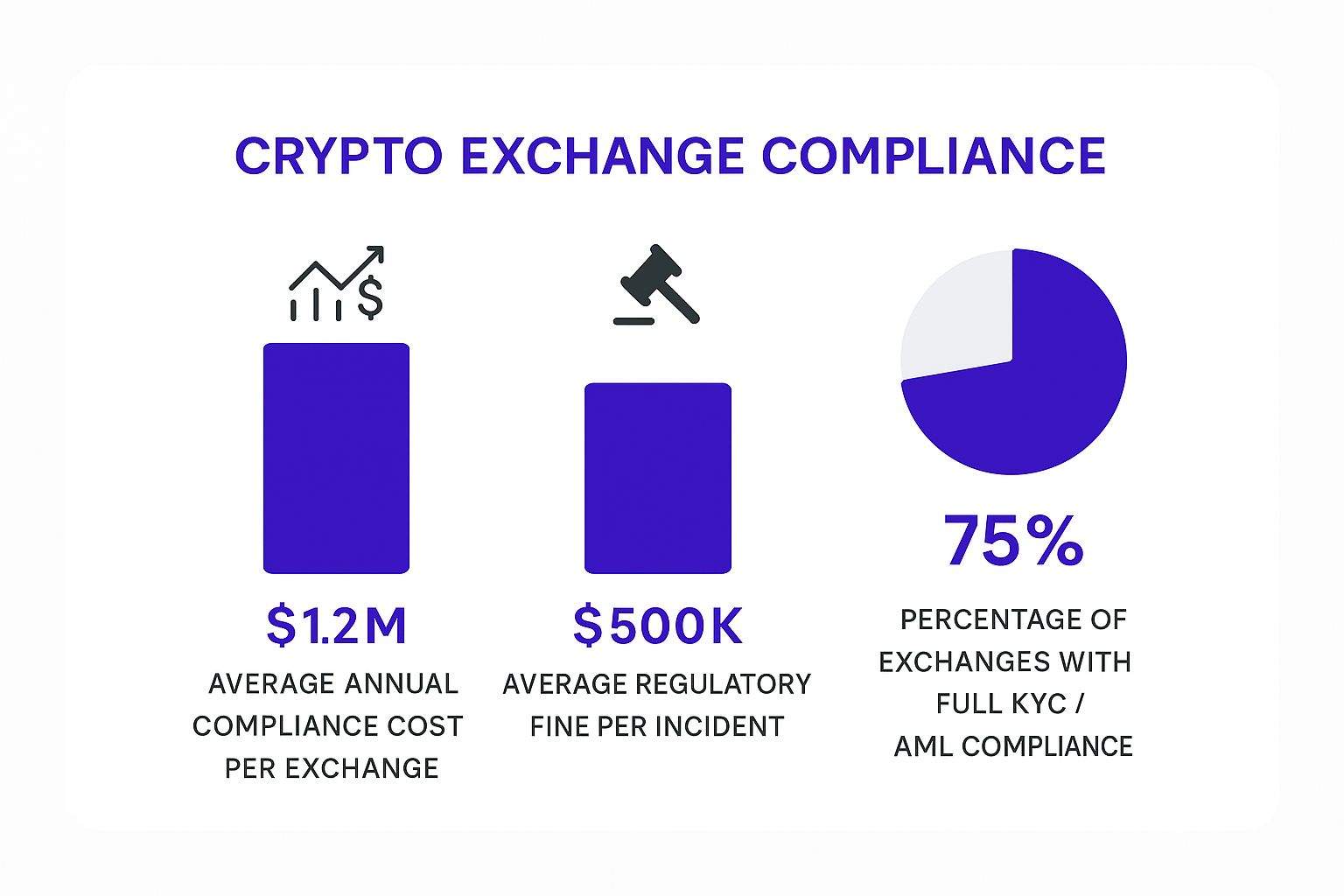

This is where the rubber meets the road, showing the high-level costs and compliance realities that exchanges face in this newly regulated world.

The data tells a clear story: operating as a regulated crypto exchange demands a significant financial commitment, both for ongoing compliance and for the hefty penalties you'll face if you drop the ball.

Comparing Two Major Frameworks

To really grasp these competing philosophies, it helps to put Europe's MiCA side-by-side with one of Asia's leading frameworks—Hong Kong's VASP (Virtual Asset Service Provider) regime. Both are trying to legitimize the industry, but their scope and focus couldn't be more different.

This table breaks down how two major regulatory frameworks are shaping the crypto landscape in very different ways.

Comparing MiCA (EU) and VASP (Hong Kong) Frameworks

| Regulatory Aspect | MiCA (EU) | VASP Regime (Hong Kong) |

|---|---|---|

| Geographic Scope | Covers all 27 EU member states with a single "passportable" license. | Applies only within Hong Kong, with a focus on its local market. |

| Asset Coverage | Broadly defines and regulates various crypto-assets, including stablecoins. | Initially focused on "security tokens" but has expanded to cover major non-security tokens like Bitcoin. |

| Licensing Body | National competent authorities in each member state, supervised by European bodies. | The Securities and Futures Commission (SFC). |

| Key Focus | Creating a harmonized, single market with strong consumer protection rules. | Attracting institutional investment and ensuring market integrity within a major financial hub. |

This comparison really highlights the fundamental strategic divide. The EU is building a massive, unified playing field, while Hong Kong is creating a highly specialized and competitive arena. This is all made even more complicated by restrictive nations like China, which maintains a strict ban on most crypto activities, making Asia a continent of extreme regulatory contrasts. For exchanges, this means navigating a region of immense opportunity, but one that demands a deeply localized and adaptable compliance game plan.

Future Trends in Crypto Regulation

The world of crypto exchange regulations is anything but static. It's a living, breathing landscape that moves at the speed of a market that never sleeps. Just when regulators roll out a new framework, technology throws another curveball, testing the very limits of traditional oversight.

Looking ahead, a few key trends are already shaping the next chapter for exchanges and investors. One of the biggest puzzles on the horizon is Decentralized Finance (DeFi).

Think of DeFi protocols as financial services running on autopilot, powered by code instead of a central company or a CEO. This creates a thorny question for regulators: who do you hold responsible when there’s no one officially in charge? It’s a challenge forcing a global rethink of how to apply old-school rules to a new world of autonomous organizations.

The Travel Rule and Greater Transparency

A massive shift already in motion is the worldwide adoption of the Financial Action Task Force (FATF) "Travel Rule." This has nothing to do with getting on a plane; it’s about making sure identifying information for both the sender and receiver "travels" with every crypto transaction between exchanges.

At its core, the rule is about closing a major loophole for illicit activity. It brings crypto transaction monitoring up to the same standard that’s been required in traditional banking for decades, pulling the industry further into the financial mainstream.

The big idea behind the Travel Rule is simple but powerful: give crypto assets the same anti-money laundering scrutiny as regular money. This eliminates a key blind spot that bad actors have exploited for years.

This mandate is a huge technical lift for exchanges, forcing them to build systems that can securely share data with one another. It's a critical step toward creating a truly transparent and accountable digital asset ecosystem. You can keep up with these and other market-moving stories on the vTrader news hub.

Spotlight on Stablecoins and ESG

Stablecoins—digital assets pegged to reserves like the U.S. dollar—have also landed squarely in the regulatory crosshairs. Because they have the potential to become a foundational part of the digital economy, governments are keen to ensure they are genuinely backed 1-to-1 by real-world assets. Expect to see much stricter rules for stablecoin issuers, demanding frequent audits and absolute proof of reserves to head off any potential crisis of confidence.

Finally, Environmental, Social, and Governance (ESG) issues are entering the conversation. The immense energy consumption tied to Proof-of-Work mining, which powers networks like Bitcoin, is drawing heavy fire. In the near future, crypto exchange regulations could start to include sustainability disclosures or even create incentives for assets that run on less power-hungry methods, like Proof-of-Stake.

Your Questions on Crypto Regulations Answered

Trying to get your head around crypto exchange regulations can feel like hitting a moving target. With rules changing all the time, it's totally normal to wonder how it all affects you as a trader. Here, we'll cut through the noise and give you clear, straightforward answers to the questions we hear most often.

Our aim is to ditch the jargon and give you the real-world takeaways. After all, understanding these rules isn’t just a task for exchanges—it’s essential for anyone active in the digital asset market.

Why Do We Even Need These Regulations?

At its heart, crypto regulation is all about creating a safe and legitimate space to trade. You can think of it like establishing a building code for the new world of digital finance. These rules are put in place for a few critical reasons:

- Protecting Consumers: They make sure your funds are held securely and that you aren't left vulnerable to scams or market manipulation.

- Preventing Financial Crime: Strong regulations help stop bad actors from using crypto for illegal activities like money laundering or financing terrorism.

- Ensuring Market Stability: They're designed to prevent a major exchange collapse from triggering a financial meltdown across the entire system.

Ultimately, these protections are what help crypto evolve from a "wild west" frontier into a trusted and mature asset class.

What Is the Difference Between a Regulated and Unregulated Exchange?

The difference is night and day, and it has a direct impact on the safety of your funds. A regulated exchange is one that has been officially licensed by a government authority. This means it has proven it meets strict standards for security, financial stability, and operational transparency.

An unregulated exchange, however, operates in a gray area without any government oversight. While this might sound appealing for anonymity, it comes with some serious risks.

Using an unregulated platform is like entrusting your money to a bank that has no insurance, no security guards, and no obligation to give you your money back if something goes wrong.

Regulated platforms are legally required to follow key rules like AML and KYC, keep customer funds separate from their own company cash, and hold enough capital to cover their obligations. It all adds up to a much safer environment for you and your assets.

How Do These Rules Affect Me as a User?

The most obvious way you'll see these rules in action is when you sign up for an exchange. When you’re asked to provide your ID and personal details, you're going through a required process called KYC, or "Know Your Customer." It might feel like an extra step, but it’s a crucial one for security.

This verification process confirms that everyone on the platform is a real person, which makes the entire ecosystem safer from fraud and manipulation. It also allows the exchange to monitor transactions for suspicious activity, protecting all users from potential scams. For more specific answers about how a platform works, a good place to start is often a comprehensive FAQ section.

Ready to trade on a platform that prioritizes security and compliance? vTrader is a FinCEN-registered exchange offering zero-fee trading in a secure environment. Sign up today and start your crypto journey with confidence.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.