The cryptocurrency market is no longer just about buying low and selling high. A sophisticated ecosystem has emerged, offering savvy investors numerous ways to generate consistent returns without actively trading. This guide explores the most effective strategies for building crypto currency passive income, transforming your digital assets from static holdings into dynamic, yield-generating engines. We move beyond the basics, providing a detailed roundup of practical methods, from the simplicity of exchange-based staking to the complexities of decentralized yield farming.

Whether you're a newcomer looking for a secure starting point or an experienced investor aiming to optimize returns, this comprehensive list will equip you with the knowledge to make your crypto work for you. We will delve into a curated selection of the best platforms and protocols designed to solve a critical problem: unlocking the earning potential of idle assets. Inside, you'll find a direct path to leveraging platforms like vTrader, Coinbase, Lido, and Aave to achieve your financial goals.

This listicle is designed for action. Each entry provides a clear breakdown of the strategy, its risk profile, and typical returns you can expect. To help you get started immediately, we've included:

- Actionable 'how-to' guides for each method.

- Direct links to the recommended platforms and tools.

- Step-by-step screenshots to guide you through complex processes.

Our goal is to eliminate the guesswork and provide a clear, practical roadmap. You will learn not just what your options are for generating crypto currency passive income, but precisely how to implement them using trusted websites and applications, ensuring you can confidently navigate the landscape of passive crypto earnings in 2025 and beyond.

1. vTrader

Website: https://www.vtrader.io

vTrader presents a compelling and innovative model for traders looking to maximize profits while simultaneously generating crypto currency passive income. It operates as a US-focused, commission-free cryptocurrency exchange, but with a unique mechanism: zero-fee trading is unlocked by staking specific assets. This structure positions vTrader not just as a trading venue, but as a comprehensive ecosystem designed for active traders, long-term holders, and learners alike. Its core value proposition is the fusion of active trading benefits with passive earning potential, a combination rarely found in the exchange market.

The platform’s standout feature is its staking-backed, zero-commission model. By staking a minimum of $1,000 worth of approved proof-of-stake (PoS) assets like Ethereum (ETH), Solana (SOL), Avalanche (AVAX), or Polkadot (DOT), users eliminate trading fees entirely across more than 130 supported cryptocurrencies. This is a powerful advantage for high-frequency traders, as it allows them to keep 100% of their gains without commissions eroding their profits.

While the staked assets are used to secure their respective networks, they also generate a competitive 6–8% APY for the user. In essence, vTrader shares the validator rewards it earns with its users, using that revenue to subsidize the platform's operational costs. This creates a symbiotic relationship: you earn passive income on your staked holdings while gaining unlimited, commission-free access to a robust trading environment.

Key Features and Ecosystem

vTrader is more than just a fee-free exchange; it offers a full suite of tools that cater to both novice and advanced users.

- Advanced Trading Suite: The platform integrates TradingView charts, multiple order types (market, limit, stop-limit), and real-time market data. For sophisticated traders, API access enables the development and deployment of automated strategies. To delve deeper into this, you can learn more about algorithmic trading for cryptocurrency on vTrader.

- Security and Compliance: Security is a cornerstone of the vTrader experience. It boasts 95% cold storage for digital assets, mandatory two-factor authentication (2FA), and FDIC insurance on USD deposits up to the standard maximum. The platform is also registered with FinCEN as a Money Services Business (VTrader LLC MSB #: 31000279172817), underscoring its commitment to regulatory compliance.

- Educational Resources: vTrader Academy is an integrated learning hub where users can complete educational modules about crypto and earn USDT rewards. This "Learn-to-Earn" model, combined with tutorials and a news hub, provides a supportive environment for those new to the space.

- User Experience: With a clean interface available on both desktop and mobile, vTrader focuses on accessibility. Users often praise its intuitive design, fast transaction processing, and reliable order execution. A $10 sign-up bonus and 24/7 live chat support further enhance the onboarding process.

How to Get Started

- Sign Up: Create an account on the vTrader platform and complete the necessary identity verification.

- Deposit Funds: Fund your account via bank integration (for USD) or by transferring crypto.

- Stake Assets: Navigate to the staking section and stake at least $1,000 in ETH, SOL, AVAX, or DOT.

- Activate Zero-Fee Trading: Once the stake is confirmed (typically within 24 hours), zero-commission trading is automatically activated on your account.

- Trade and Earn: You can now trade any of the 130+ coins fee-free while your staked assets generate passive income.

Pros and Cons

| Strengths | Weaknesses |

|---|---|

| True Zero-Commission Trading: Keep 100% of your trading profits on over 130 cryptocurrencies once the staking requirement is met. | $1,000 Staking Minimum: This initial requirement may be a barrier for investors with smaller portfolios or those just starting out. |

| Integrated Passive Income: Earn a competitive 6–8% APY on staked assets, combining active trading with a steady return. | Staking Risks: Staked funds are subject to network-specific risks (like slashing) and market volatility. |

| Robust Security & Compliance: Features bank-grade security protocols, including 95% cold storage, FDIC-insured USD, and FinCEN registration. | Delayed Liquidity: Unstaking assets is not instant and typically takes around 48 hours, making funds less liquid than cash. |

| Comprehensive Ecosystem: Includes advanced trading tools, an educational academy with rewards, mobile apps, and 24/7 support for a holistic experience. | Limited Staking Options: The zero-fee model is currently tied to staking only ETH, SOL, AVAX, or DOT. |

vTrader's innovative model makes it a top-tier choice for those serious about integrating passive income streams with their active trading strategies.

2. Coinbase

Coinbase stands as a cornerstone for newcomers venturing into the world of cryptocurrency, particularly those in the United States. Its primary strength lies in simplifying the entire process, from converting U.S. dollars into crypto to generating passive income from those assets, all within a single, regulated platform. This integrated approach makes it an ideal starting point for anyone looking to earn crypto currency passive income without the complexities of self-custody and on-chain interactions.

The platform’s user-friendly interface is its defining feature. Buying crypto is as straightforward as a typical e-commerce transaction, and activating staking rewards often requires just a few clicks. This seamless user experience removes significant barriers to entry, making passive earning strategies accessible to a broad audience that might otherwise be intimidated by the technical demands of decentralized finance.

Key Features and Offerings

Coinbase's main passive income offering is its in-app staking service. It supports a curated selection of popular Proof-of-Stake (PoS) assets, allowing users to earn rewards directly from their accounts.

- Ease of Use: Staking can be enabled with a simple toggle for eligible assets. Coinbase handles all the technical backend processes, such as running validator nodes.

- Automated Payouts: Rewards are automatically calculated and distributed to your account at regular intervals, which vary depending on the specific asset's network protocol.

- Clear Reporting: As a U.S.-based company, Coinbase provides clear tax documentation, such as Form 1099-MISC for users who meet the income threshold, simplifying tax season.

Staking Commission and Availability

The convenience of Coinbase's staking service comes at a cost. The platform charges a commission on the staking rewards earned, which is a percentage of the gross yield. This fee is transparently disclosed, but it means your net APY will be lower than if you were to stake directly on-chain.

Additionally, access to staking for certain assets can be restricted based on your geographical location, particularly within different U.S. states, due to evolving regulatory landscapes. It's crucial to check the eligibility of specific assets in your jurisdiction directly on the platform.

Pros and Cons

| Pros | Cons |

|---|---|

| Beginner-Friendly: The easiest on-ramp from fiat to staking. | Commission Fees: Reduces the total rewards you receive. |

| High Security: A publicly-traded, regulated U.S. company. | Limited Asset Selection: Only supports a selection of major PoS coins. |

| Integrated Tax Reporting: Simplifies U.S. tax compliance. | Geographic Restrictions: Staking availability varies by location. |

Who is it Best For?

Coinbase is the perfect platform for beginners who prioritize simplicity, security, and a direct USD-to-staking pathway. If you are comfortable sacrificing a portion of your yield for the convenience and peace of mind that comes with using a heavily regulated and user-friendly platform, Coinbase is an excellent choice for starting your crypto currency passive income journey.

Website: https://www.coinbase.com

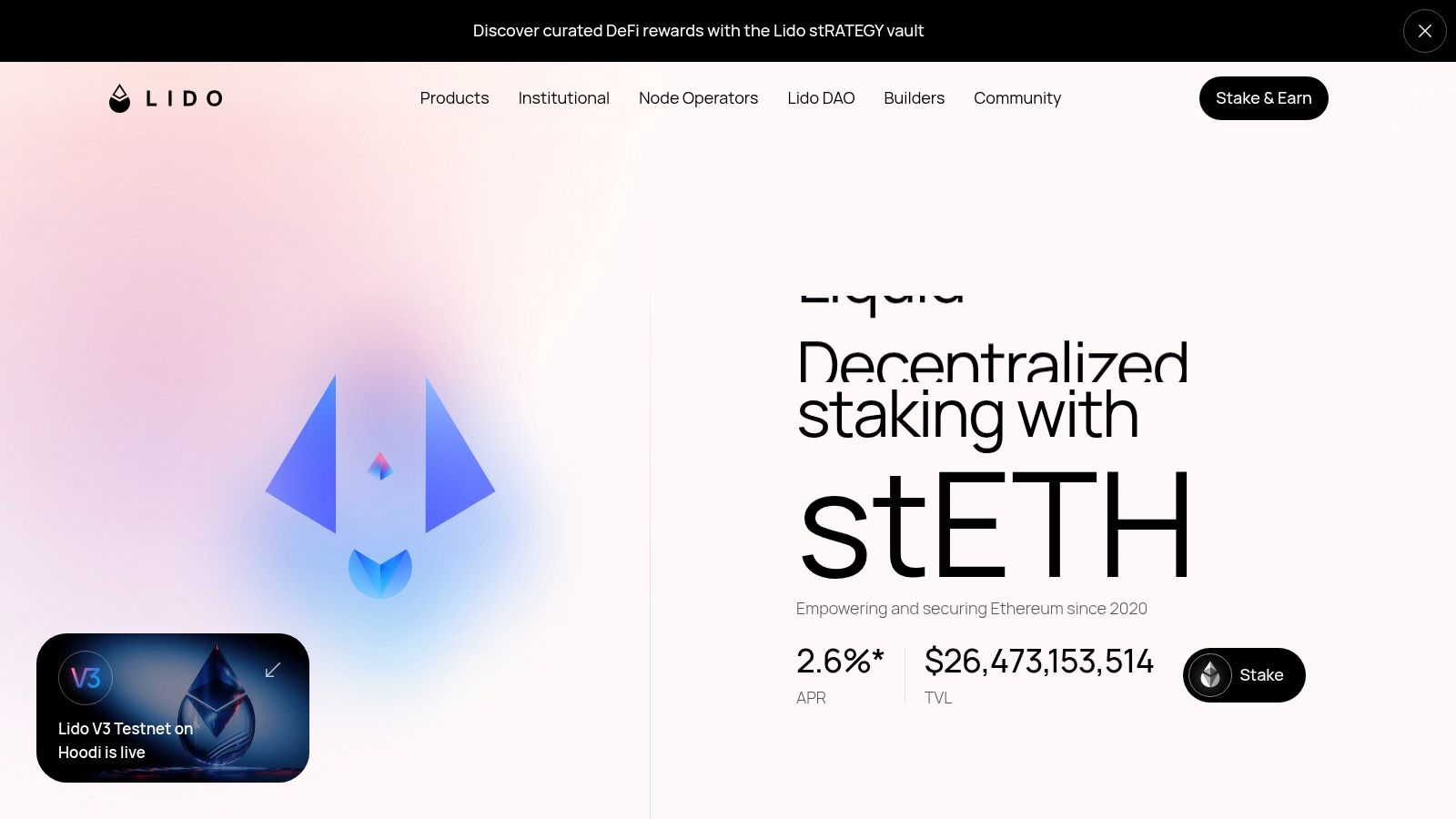

3. Lido

Lido has established itself as the leading liquid staking protocol, particularly for Ethereum, offering a powerful way to generate crypto currency passive income while maintaining asset flexibility. Its core innovation is providing a non-custodial solution that allows users to stake their assets and receive a tokenized version in return, such as stETH for staked ETH. This "liquid" token accrues staking rewards automatically and can be used across the decentralized finance (DeFi) ecosystem, solving the traditional staking problem of locked capital.

This model is ideal for users who want to participate in network security and earn rewards without sacrificing liquidity. Instead of having their assets locked in a staking contract, they can deploy their liquid staking tokens as collateral for loans, provide them to liquidity pools, or use them in other yield-generating strategies. This "composability" unlocks multiple layers of potential earnings on a single underlying asset, making it a cornerstone of modern DeFi.

Key Features and Offerings

Lido’s primary service is its decentralized liquid staking protocol, which abstracts away the complexity of running validator nodes. Users simply connect their wallets and deposit assets to start earning.

- Liquid Staking Tokens: Upon staking, users receive a token (e.g., stETH) that represents their staked principal plus accruing rewards. The balance of this token increases daily to reflect earned yield.

- No Minimum Deposit: Unlike solo staking Ethereum which requires 32 ETH, Lido allows users to stake any amount, making it accessible to everyone.

- Broad DeFi Integration: Lido's stETH is the most widely accepted liquid staking token in DeFi, usable on platforms like Aave, Maker, and Curve.

- Transparent Reporting: The Lido website provides a real-time dashboard showing the current Annual Percentage Rate (APR) and Total Value Locked (TVL).

Staking Commission and Availability

Lido operates as a Decentralized Autonomous Organization (DAO) and charges a fee on the staking rewards generated. This fee, typically 10%, is split between the node operators who run the validator infrastructure and the Lido DAO treasury. This is how the protocol sustains itself and incentivizes professional, reliable node operation.

The protocol itself is globally accessible, but interacting with it requires a non-custodial crypto wallet like MetaMask. The main risks are technical, including smart contract vulnerabilities and the potential for the liquid staking token (stETH) to trade at a discount to its underlying asset (ETH) during periods of high market stress.

Pros and Cons

| Pros | Cons |

|---|---|

| High Liquidity: stETH is widely used and accepted as collateral in DeFi. | Protocol Fee: A 10% fee is taken from gross staking rewards, reducing net APR. |

| Set-and-Forget Staking: No need to manage validator hardware or software. | Smart Contract Risk: As with any DeFi protocol, there is risk of bugs or exploits. |

| Full DeFi Composability: Earn staking rewards and use the liquid token simultaneously. | De-Peg Risk: stETH can deviate from a 1:1 value with ETH in stressed markets. |

Who is it Best For?

Lido is best for intermediate to advanced crypto users who are comfortable with non-custodial wallets and want to maximize their capital efficiency. If you aim to earn a staking yield while keeping your assets productive within the broader DeFi ecosystem, Lido's liquid staking solution is the industry standard. It offers a perfect blend of passive income generation and active capital deployment. You can learn more by reading a crypto staking explained guide.

Website: https://lido.fi

4. Rocket Pool

Rocket Pool offers a decentralized approach to Ethereum staking, standing out for its commitment to community-run infrastructure and network health. It provides a platform for users to generate passive income from ETH through liquid staking, but its core distinction is its permissionless network of node operators. This focus on decentralization appeals to users who prioritize a more grassroots, resilient method for securing the Ethereum network while earning rewards.

Unlike centralized exchanges, Rocket Pool is a protocol that allows anyone to participate in two primary ways: as a staker receiving a liquid token (rETH), or as a node operator. This structure gives users more control and direct participation in the staking process, making it a compelling option for those looking to move beyond custodial services and engage more deeply with the crypto currency passive income ecosystem.

Key Features and Offerings

Rocket Pool’s design is centered on its liquid staking token, rETH, and its decentralized network of node operators. This dual-sided system provides flexibility for different types of users.

- Liquid Staking with rETH: Users can stake any amount of ETH and receive rETH in return. This token represents their staked ETH plus accrued rewards and can be freely traded or used in DeFi.

- Permissionless Node Operation: For more advanced users, Rocket Pool allows you to run a "minipool" validator with only 16 ETH (plus some RPL collateral), which is half the amount required for solo staking. Operators earn a commission on the 16 ETH pooled from other stakers. To understand more about the underlying mechanics, you can read about what is a liquidity pool.

- Decentralized Governance: The protocol is governed by a DAO, giving the community a voice in its future development and parameter changes.

Staking Commission and Availability

For standard stakers who simply swap ETH for rETH, there are no direct fees. The rewards are built into the increasing value of rETH relative to ETH. For node operators, the commission structure is transparent. Operators earn a flat commission (currently 14%) on the rewards generated by the ETH provided by the staking pool.

As a decentralized protocol, Rocket Pool is globally accessible to anyone with an Ethereum wallet. However, running a node requires technical knowledge and dedicated hardware, which represents a barrier to entry compared to one-click staking on centralized platforms.

Pros and Cons

| Pros | Cons |

|---|---|

| Emphasis on Decentralization: Supports Ethereum's network health by using a diverse set of operators. | Higher Technical Barrier: Running a node requires setup and ongoing maintenance. |

| Lower Capital for Validators: Allows running a node with just 16 ETH instead of 32 ETH. | Lower Liquidity: rETH is less integrated in DeFi compared to larger liquid staking tokens. |

| Permissionless and Open: Anyone can participate as a staker or node operator without approval. | Smart Contract Risk: As a DeFi protocol, it carries inherent smart contract vulnerabilities. |

Who is it Best For?

Rocket Pool is ideal for Ethereum enthusiasts who prioritize decentralization and wish to contribute directly to the network's security. It's a great fit for users who want to run their own validator but lack the full 32 ETH, or for stakers seeking a liquid, non-custodial passive income solution that aligns with the core ethos of crypto.

Website: https://rocketpool.net

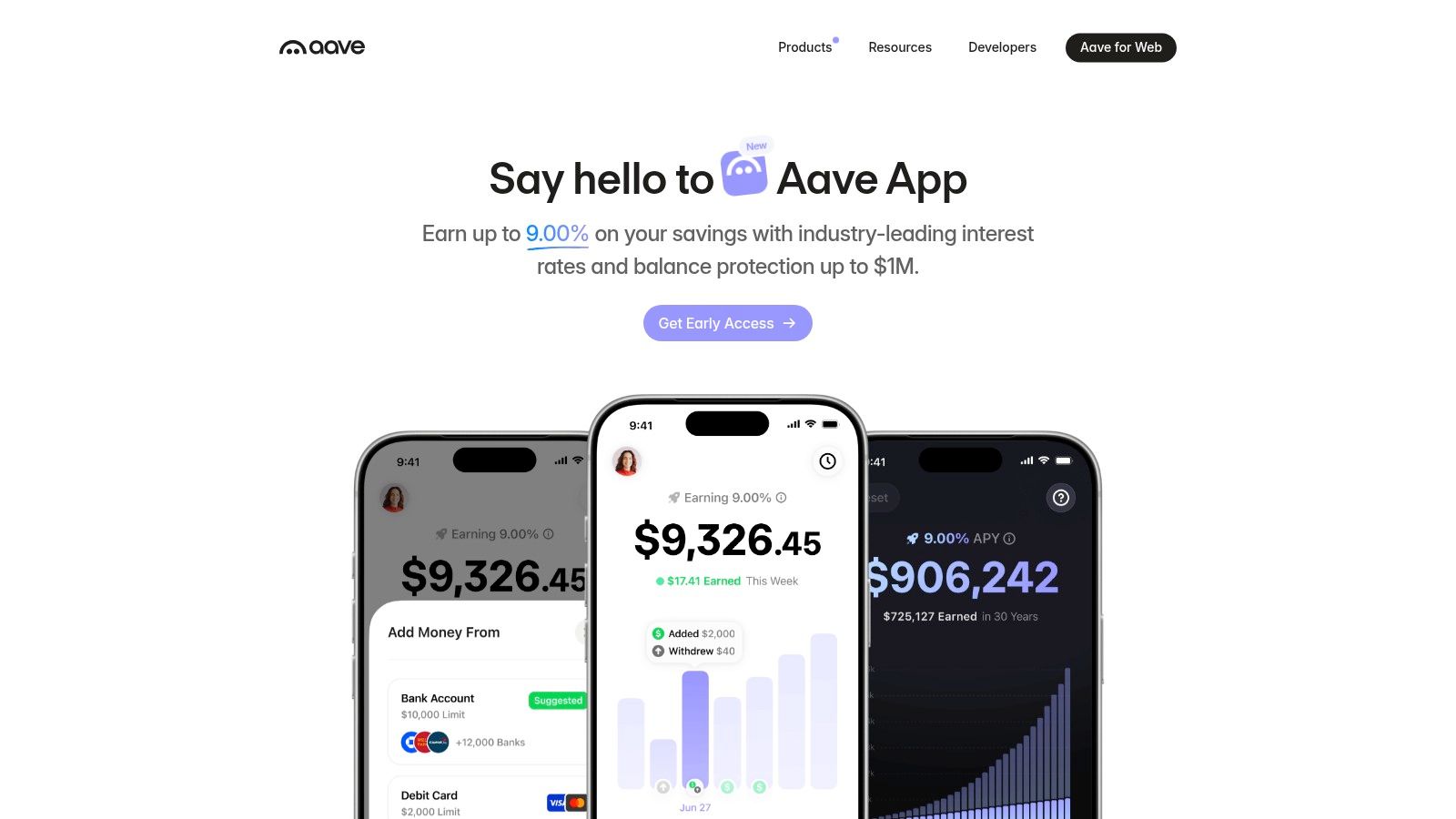

5. Aave

Aave is a foundational pillar of decentralized finance (DeFi), operating as a non-custodial, on-chain money market. It allows users to supply their crypto assets to liquidity pools and earn variable interest, providing a powerful method for generating crypto currency passive income directly from a self-custody wallet. Unlike centralized platforms, Aave’s protocol is governed by smart contracts, and interest rates are determined algorithmically based on the real-time supply and demand within each asset pool.

This decentralized approach offers transparency and user control, as you retain ownership of your assets at all times. By supplying assets like stablecoins (USDC, DAI) or volatile crypto (ETH, WBTC), you receive corresponding aTokens, which are interest-bearing tokens that represent your share in the pool and accrue yield continuously. This mechanism makes Aave a top choice for those comfortable with on-chain interactions who want to earn yield without relying on intermediaries.

Key Features and Offerings

Aave's core function is its decentralized lending and borrowing protocol, where users can earn by supplying liquidity. The platform's transparent and audited nature has made it a DeFi blue-chip.

- Flexible Deposits: Users can supply assets to liquidity pools and start earning interest immediately, with the ability to withdraw their funds at any time, provided there is sufficient liquidity.

- Interest-Bearing aTokens: When you deposit an asset, you receive a corresponding aToken (e.g., supplying USDC gets you aUSDC). These tokens accrue interest in real-time directly in your wallet.

- Algorithmic Interest Rates: APYs are variable and adjust automatically based on pool utilization. High demand for borrowing an asset leads to higher interest rates for suppliers.

- Transparent Protocol: As a leading DeFi protocol, Aave's smart contracts are heavily audited and its market dynamics are publicly verifiable on the blockchain. The recent DeFi fee revenue surge shows Aave's market strength.

Interest Rates and Associated Risks

Aave operates without commissions, as it is a decentralized protocol. However, users must pay network transaction fees (gas fees) to interact with the smart contracts for depositing or withdrawing funds. The interest rates (APYs) are entirely variable and can fluctuate significantly.

The primary risks involve smart-contract vulnerabilities, although Aave is among the most battle-tested protocols in DeFi. Additionally, if you use your supplied assets as collateral to borrow, you face liquidation risk should the value of your collateral fall below a certain threshold. For purely passive income generation via supplying, this is not a direct risk.

Pros and Cons

| Pros | Cons |

|---|---|

| Non-Custodial: You maintain full control over your private keys. | Variable APYs: Yields can decrease significantly if market demand drops. |

| Deep Liquidity: A blue-chip protocol with substantial assets under management. | Smart-Contract Risk: All DeFi protocols carry inherent technical risks. |

| Flexible Terms: No lock-up periods for supplied assets. | Requires On-Chain Knowledge: Users must manage their own wallet and gas fees. |

Who is it Best For?

Aave is best suited for crypto users who are comfortable with self-custody and interacting with DeFi protocols. It is an excellent choice for those looking to earn a variable yield on their assets, particularly stablecoins, in a transparent and decentralized manner. If you prioritize control over your funds and understand the dynamics of on-chain transactions, Aave offers a robust pathway to crypto currency passive income.

Website: https://aave.com

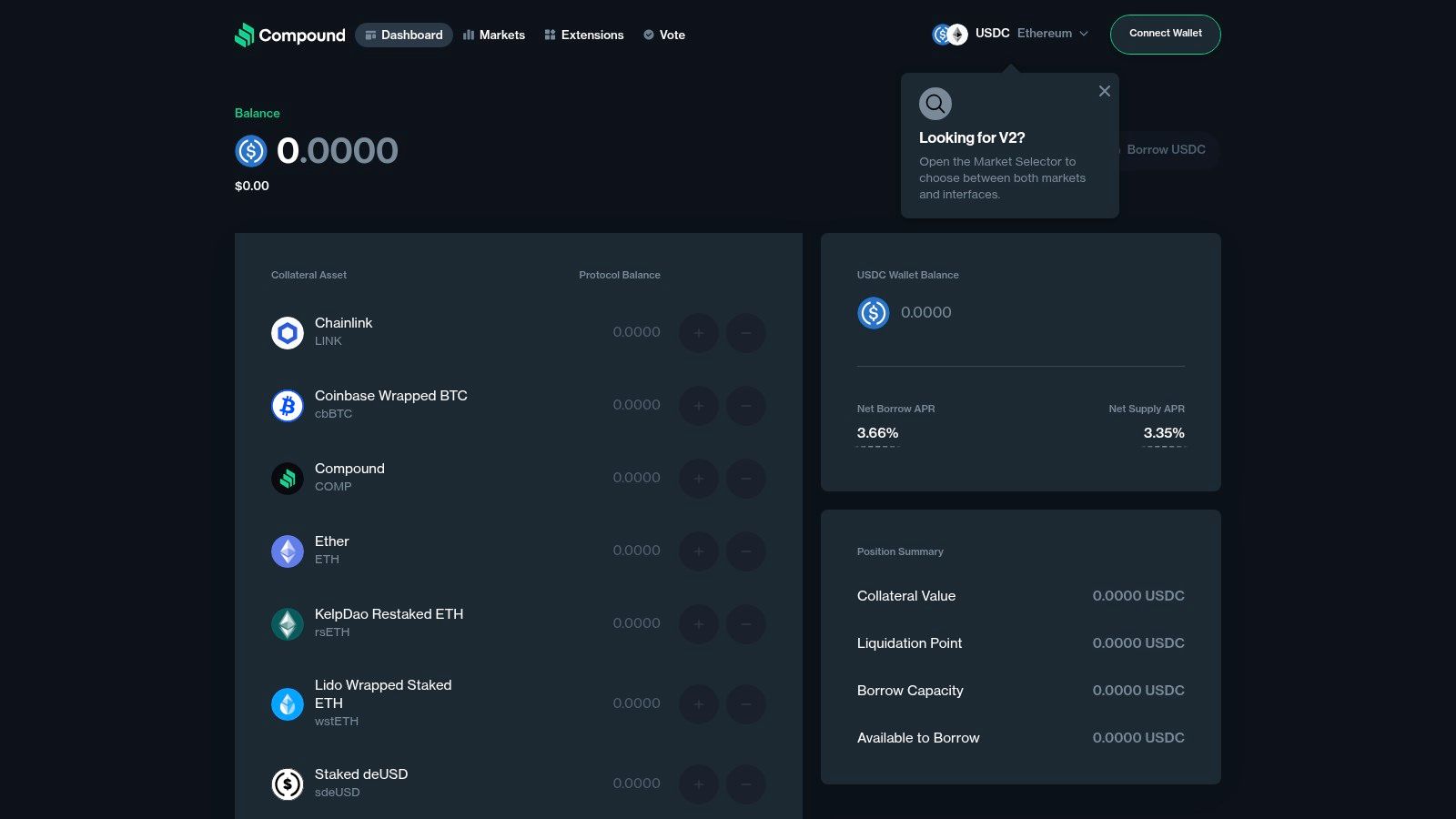

6. Compound

Compound is a pioneering decentralized lending protocol that allows users to earn interest on their crypto assets by supplying them to a liquidity pool. As one of the foundational projects in Decentralized Finance (DeFi), it provides a transparent, on-chain method for generating crypto currency passive income, particularly with stablecoins. Its model is built on algorithmic interest rates that adjust based on supply and demand, offering a dynamic way to earn without intermediaries.

The protocol's strength lies in its battle-tested smart contracts and transparent on-chain accounting. Users interact directly with the protocol through a web dashboard, which clearly displays key metrics like the current Supply APY and market utilization rates. This on-chain transparency ensures that all operations are verifiable, making it a trusted cornerstone for many DeFi participants looking to put their stablecoins to work.

Key Features and Offerings

Compound’s core function is its supply-and-earn lending market. Users deposit assets into the protocol and immediately begin earning variable interest, which is paid out in the same asset they supplied.

- Algorithmic Interest Rates: The annual percentage yield (APY) is determined by the supply and demand within each specific market. Higher borrowing demand leads to higher yields for suppliers.

- Flexible Deposits: Unlike fixed-term products, users can supply and withdraw their assets at any time, providing complete liquidity and control over their funds.

- Transparent On-Chain Data: The web app dashboard provides real-time data on Supply APY, total supply, and utilization for each asset market, allowing for informed decision-making.

Variable Rates and Gas Costs

The primary characteristic of Compound is its variable interest rate. The APY you earn is not fixed and can fluctuate significantly based on market dynamics. This means your passive income stream can change from day to day.

As a DeFi protocol, every interaction with Compound (supplying, withdrawing) requires a transaction on the blockchain, which incurs a network fee, also known as a gas fee. These costs can impact your net returns, especially for smaller-sized deposits or frequent transactions. It is crucial to factor in gas costs when calculating potential profits.

Pros and Cons

| Pros | Cons |

|---|---|

| Transparent On-Chain Accounting: A long-running, battle-tested lending market. | Variable Rates: APY is not guaranteed and can fluctuate significantly. |

| High Flexibility: No lock-up periods; deposit and withdraw anytime. | DeFi Complexity: Requires a non-custodial wallet and understanding of gas fees. |

| Decentralized and Non-Custodial: You retain control over your private keys. | Smart Contract Risk: As with any DeFi protocol, there is inherent smart contract risk. |

Who is it Best For?

Compound is best suited for crypto users who are comfortable with self-custody and want to generate a variable yield on their assets, especially stablecoins, in a transparent DeFi environment. It’s an excellent option for those who prioritize on-chain transparency and flexibility over the fixed rates and custodial nature of centralized platforms. If you understand the mechanics of gas fees and are willing to manage your own wallet, Compound offers a foundational way to participate in decentralized passive income.

Website: https://app.compound.finance

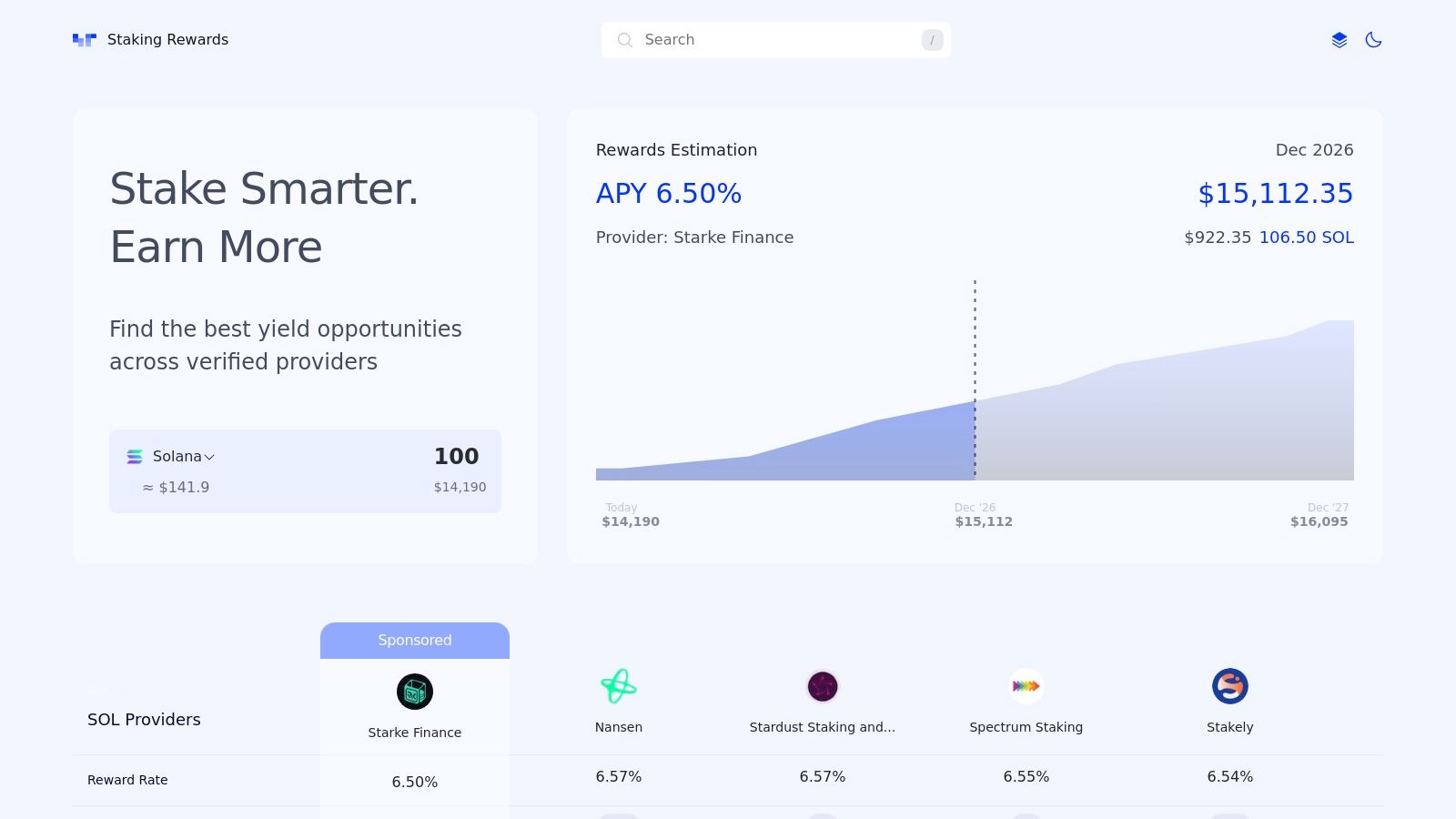

7. Staking Rewards

While most platforms on this list are direct venues for earning, Staking Rewards serves a different but equally crucial role: it's a comprehensive data aggregator and discovery engine for all things staking. Instead of offering staking services itself, it empowers users to research, compare, and vet thousands of opportunities across the crypto ecosystem. This makes it an indispensable tool for anyone serious about optimizing their crypto currency passive income strategy through due diligence.

The platform excels at organizing vast amounts of information into a digestible format, allowing users to find the best staking yields, evaluate validator reputations, and understand the technical details of different networks. It acts as a central hub for market intelligence, saving you countless hours of fragmented research and helping you make more informed decisions before you commit your capital to a specific asset or provider.

Key Features and Offerings

Staking Rewards is fundamentally a research tool. Its core value lies in its extensive, searchable database and verification programs that bring transparency to the staking industry.

- Comprehensive Asset Listings: Search and filter hundreds of stakeable assets by reward rate, market cap, and total value locked (TVL).

- Provider Rankings: Evaluate staking providers (validators and custodians) based on reputation, fees, network performance, and user reviews. The "Verified Staking Provider" program helps identify trusted operators.

- Live Market Data: Access real-time data on network inflation, staking ratios, and projected yields, which is critical for accurate calculations.

- Educational Resources: The platform offers guides and in-depth articles that explain the mechanics of different staking protocols. To further deepen your knowledge beyond specific staking platforms, consider exploring the general principles of understanding crypto rewards.

Staking Commission and Availability

Staking Rewards is a free-to-use informational platform and does not charge any fees or commissions itself, as it does not custody your assets or facilitate staking directly. Any fees you encounter will be from the third-party providers you choose based on your research on the site.

The platform is globally accessible for research purposes. However, the availability of the staking opportunities listed on the site will depend on the specific provider's geographic restrictions and your local regulations. For a closer look at what high APY options might be available, you can learn more about high APY crypto staking options.

Pros and Cons

| Pros | Cons |

|---|---|

| One-Stop Research Hub: The most comprehensive tool for comparing staking options. | Informational Only: You cannot stake directly on the platform. |

| Transparent Data: Provides live, unbiased data and key network metrics. | Potential for Bias: Sponsored placements may appear, requiring users to look for verification badges. |

| Provider Verification: Helps identify trusted and reputable staking providers. | Overwhelming for Beginners: The sheer amount of data can be a lot for newcomers. |

Who is it Best For?

Staking Rewards is best for intermediate to advanced crypto investors who want to perform thorough due diligence before selecting a staking asset or provider. If you prefer to move beyond the simple, high-commission options on centralized exchanges and want to find the most profitable and secure opportunities, this platform is an essential first step in your research process.

Website: https://www.stakingrewards.com

7-Platform Crypto Passive Income Comparison

| Product | 🔄 Implementation complexity | ⚡ Resource requirements | 📊 Expected outcomes | 💡 Ideal use cases | ⭐ Key advantages |

|---|---|---|---|---|---|

| vTrader | Low–Moderate — app onboarding + staking activation | Stake $1,000+ in ETH/SOL/AVAX/DOT; KYC and bank links | Commission-free trading after activation; 6–8% APY on staked assets; ~48h unstake | Active mobile-first traders who want fee-free trading + passive yield | True zero-commission trading post-stake; advanced trading tools; strong security/compliance |

| Coinbase | Low — custodial, in-app toggles | Minimal USD deposit; state-dependent availability; KYC | On-platform staking rewards (net of Coinbase fees); clear tax reporting | Beginners wanting simple fiat onramp and custodial staking | Regulated U.S. fiat onramp, easy UX, automated payouts and reporting |

| Lido | Low — single on‑chain tx for liquid staking | No minimum deposit; non-custodial wallet required (gas fees) | Receive stETH/wstETH that accrues rewards and remains liquid/composable | Users who want set‑and‑forget ETH staking with DeFi composability | Broad DeFi integrations; no min deposit; liquid-staked token utility |

| Rocket Pool | Moderate — choose rETH staking or run a node (more ops) | Deposit for rETH (no large min); optional node operator bond and maintenance | rETH accrues value; decentralization-focused rewards; operator commissions apply | Users valuing decentralization or wanting to operate validators with lower stake | Permissionless node network; decentralization and operator-focused design |

| Aave | Moderate–High — DeFi UX, variable rates and collateral options | Supply crypto (ETH, stablecoins); gas fees; onchain wallet | Variable interest via aTokens; can be used as collateral to borrow | Yield seekers and advanced DeFi users wanting flexible money-market use | Audited protocol, deep liquidity, continuous yield accrual and composability |

| Compound | Moderate — onchain lending UX with market metrics | Supply assets (commonly USDC); gas costs; wallet required | Variable supply APY; transparent on‑chain accounting | Onchain participants seeking passive stablecoin yields and transparency | Long-running, battle-tested lending market; transparent metrics and deployments |

| Staking Rewards | Very low — discovery and comparison platform | No capital to browse; time for research | Actionable comparisons, provider metrics and verified listings (no direct yield) | Research and due diligence before choosing staking provider | Comprehensive live data, provider rankings and verification program |

Building a Sustainable Passive Income Stream in Crypto

The journey to generating meaningful crypto currency passive income is one of strategic choices, diligent risk management, and continuous learning. Throughout this guide, we've navigated the diverse landscape of opportunities available, from the straightforward, all-in-one staking and reward systems offered by platforms like vTrader and Coinbase to the more complex, decentralized protocols of Lido, Aave, and Compound.

The core takeaway is that there is no universal 'best' method. The optimal strategy is deeply personal, hinging on your individual risk tolerance, technical comfort level, and long-term financial goals. A well-rounded, diversified approach often proves most resilient.

Synthesizing Your Strategy: From Theory to Action

Moving forward requires a shift from passive reading to active planning. The tools and platforms we've discussed, such as Staking Rewards for research and vTrader for implementation, are your building blocks. A novice investor might start by allocating a majority of their passive income portfolio to a secure, user-friendly platform, engaging in simple staking or utilizing an interest-bearing account.

As their confidence and knowledge grow, they might then allocate a smaller, more experimental portion of their capital to DeFi protocols like liquidity provision or yield farming. This balanced approach mitigates risk while allowing for exploration and potentially higher returns. The key is to start with a solid foundation of research, never invest more than you can afford to lose, and remain vigilant about market dynamics and regulatory shifts.

Key Factors for Success

As you select your tools and build your portfolio, keep these critical considerations at the forefront:

- Risk vs. Reward: Higher APYs almost always correlate with higher risk. This could be smart contract risk, impermanent loss, or the volatility of a newer, less established token. Always question why a return is high and understand the associated trade-offs.

- Security and Custody: Decide if you prefer the convenience of a custodial platform like an exchange or the full control of a non-custodial wallet for DeFi. Both have their merits, and your choice impacts your security responsibilities.

- Fees and Yield Calculation: Pay close attention to network fees (gas), platform fees, and withdrawal fees, as these can significantly erode your profits. It's also vital to understand how yields are calculated. When exploring various avenues for generating returns on your digital assets, understanding the potential yield is paramount. This article clarifies the nuances between different yield metrics: What Is APY in Crypto and How Does It Work?.

- Tax Implications: Passive income from crypto is generally a taxable event in most jurisdictions. Meticulous record-keeping is not optional; it is essential for accurate reporting and compliance.

Your Path Forward in Crypto Passive Income

Building a durable crypto currency passive income stream is not a set-it-and-forget-it endeavor; it's an active process of portfolio management and ongoing education. Platforms that integrate learning with earning, such as vTrader's Academy-Earn module, provide an invaluable advantage, helping you stay ahead of the curve.

By leveraging the diverse tools and structured strategies outlined in this article, you can successfully transition from a speculative mindset to one of a strategic, long-term investor. The goal is to make your digital assets work for you, creating a resilient portfolio that generates value regardless of daily market fluctuations. Your journey into the world of crypto passive income starts now, built on a foundation of informed, deliberate action.

Ready to put your knowledge into action? vTrader offers a powerful, all-in-one platform designed to simplify your crypto currency passive income journey with integrated staking, zero-fee trading, and educational resources. Start building your portfolio and earning rewards today by signing up at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.