Unlocking Profit Potential: A Deep Dive into Crypto Arbitrage Scanners

Want to capitalize on crypto price differences across exchanges? A crypto arbitrage scanner automates this process, finding profitable discrepancies for you. This list of the top 6 crypto arbitrage scanners in 2025 – including Arbitrage Scanner, CryptoArbitrage, Coinrule, Coinigy, ArbiSmart, and 3Commas – will help you find the right tool to boost your crypto earnings. We'll cover the pros, cons, and pricing of each, so you can make an informed decision and start maximizing your arbitrage strategy today.

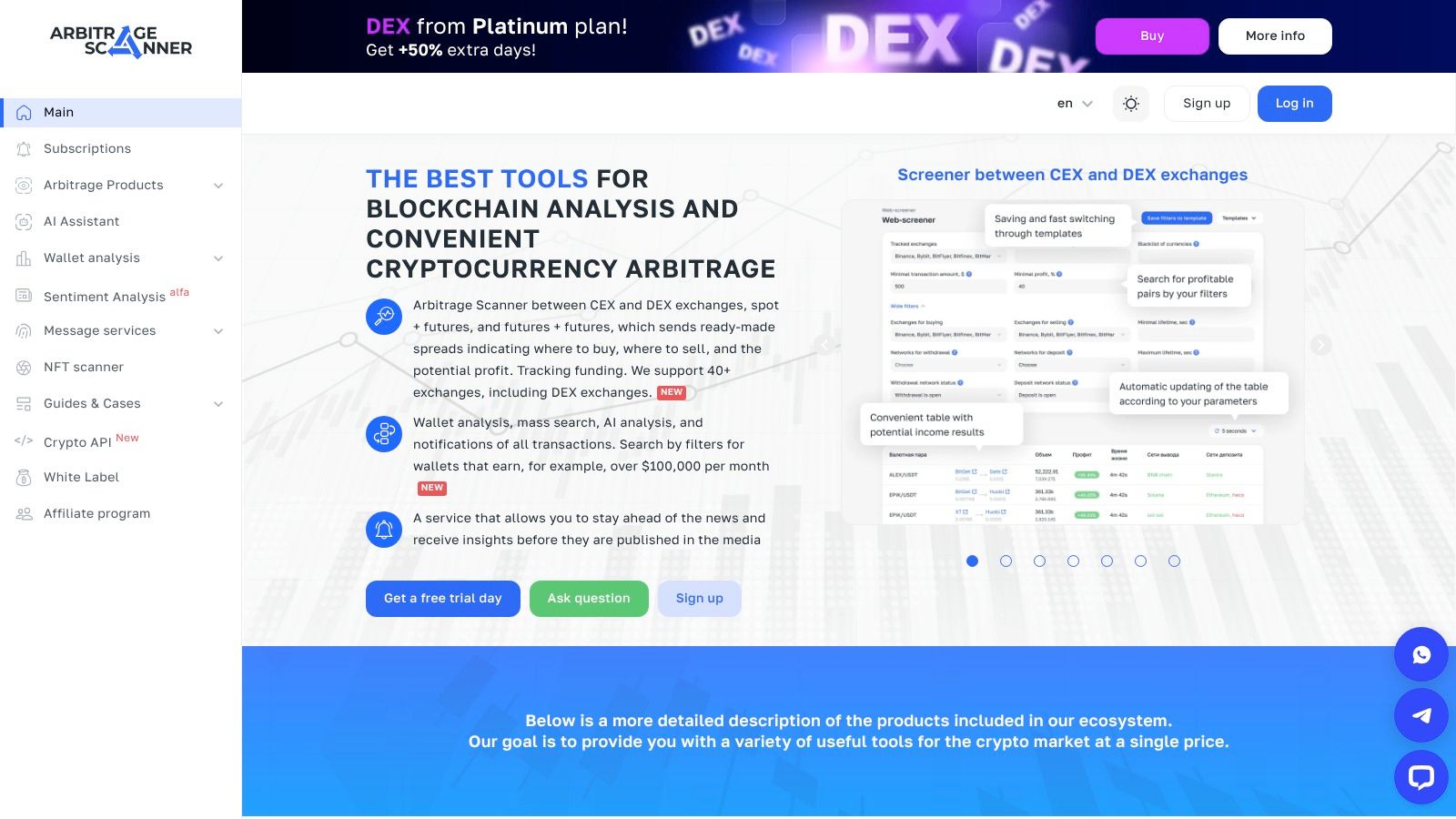

1. Arbitrage Scanner

For those looking to capitalize on the often volatile nature of the cryptocurrency market, arbitrage opportunities can offer significant profit potential. A crypto arbitrage scanner helps automate the process of identifying these price discrepancies across different exchanges, saving traders valuable time and effort. Arbitrage Scanner (https://arbitragescanner.io) stands out as a powerful web-based platform designed for both beginners and seasoned professionals, providing comprehensive market analysis and real-time tracking of arbitrage opportunities across a vast network of over 100 cryptocurrency exchanges. Its focus on detailed profit calculations, incorporating fees and spread analysis, makes it a valuable tool for anyone serious about crypto arbitrage.

One of the key strengths of Arbitrage Scanner is its extensive coverage. Monitoring over 100 exchanges allows for a comprehensive view of the market, increasing the likelihood of discovering profitable arbitrage opportunities. This broad reach is particularly beneficial for seasoned traders looking for diverse opportunities across a variety of cryptocurrencies. Real-time updates, delivered with minimal latency, ensure that traders are equipped with the most current price information, crucial in the fast-paced world of cryptocurrency trading. This feature caters to both novice and experienced traders who require up-to-the-minute data to execute timely trades.

The platform boasts a user-friendly interface, making it accessible even to those new to arbitrage trading. Clear and concise presentation of data simplifies the process of identifying and analyzing potential arbitrage opportunities. While the platform caters to beginners, its advanced features, like detailed fee calculations and spread analysis, also appeal to professional traders. By factoring in exchange fees and the difference between buying and selling prices (spread), Arbitrage Scanner offers a more accurate profit estimation, allowing traders to make informed decisions. This focus on precise profit calculation sets it apart from some competitors that offer less detailed analysis.

Beyond identifying arbitrage opportunities, Arbitrage Scanner offers multi-exchange portfolio tracking and management. This feature enables users to monitor their holdings across various exchanges from a centralized dashboard, simplifying portfolio management and providing a holistic view of their overall trading performance. Advanced filtering options allow users to refine their search by exchange, coin, and profit threshold, streamlining the process of finding opportunities that align with their specific trading strategies. Historical arbitrage data and trend analysis tools further enhance the platform's analytical capabilities, providing valuable insights into past market behavior and assisting in predicting future trends.

While Arbitrage Scanner offers a comprehensive suite of tools, it does have some limitations. Currently, its mobile app functionality is somewhat limited, which might be a drawback for mobile-first users who prefer to manage their trades on the go. While core functionality is typically available in a free tier, access to premium features, such as advanced charting or increased API request limits, often requires a subscription. Finally, while the platform strives for real-time data across all exchanges, data feeds from smaller, less established exchanges may occasionally experience delays.

For novice crypto investors exploring arbitrage, Arbitrage Scanner provides an accessible entry point with its user-friendly interface and detailed profit calculations. Seasoned traders will appreciate the extensive exchange coverage, real-time updates, and advanced filtering options. While the limited mobile functionality and subscription requirement for premium features might be considerations, the platform’s strengths in real-time scanning, comprehensive market analysis, and user-friendly design make it a strong contender in the crypto arbitrage scanner landscape. If you're looking for a robust tool to help you identify and capitalize on cryptocurrency price differences, Arbitrage Scanner is definitely worth exploring.

2. CryptoArbitrage

CryptoArbitrage stands out as a comprehensive crypto arbitrage scanner designed for both novice and seasoned cryptocurrency traders looking to capitalize on price discrepancies across multiple exchanges. This platform distinguishes itself by providing in-depth analysis of arbitrage opportunities, fueled by real-time data feeds, and enhanced by automated alert systems. Crucially, CryptoArbitrage prioritizes accurate profit calculations, meticulously factoring in trading fees and transfer costs, a feature often overlooked by other platforms. This focus on precise profitability makes it a valuable tool for anyone serious about arbitrage trading.

One of the core strengths of CryptoArbitrage lies in its broad exchange coverage. Monitoring price differences across more than 50 platforms, it provides a wide net for capturing potential arbitrage opportunities. This extensive reach is particularly beneficial for traders looking to diversify their arbitrage strategies and maximize their profit potential. The platform’s automated alert system plays a crucial role in timely execution, notifying users of profitable discrepancies as they arise. This real-time information is essential in the fast-paced world of cryptocurrency trading, where opportunities can appear and disappear within minutes.

For traders focused on precise profitability, CryptoArbitrage’s built-in fee calculation engine is a game-changer. By automatically incorporating trading fees and transfer costs from various exchanges, the platform ensures that profit estimations are realistic and actionable. This feature eliminates the need for manual calculations, saving traders time and reducing the risk of miscalculations that can impact overall returns. Portfolio tracking with profit and loss (P&L) analysis provides further insights into trading performance, allowing users to monitor their arbitrage activities and adjust their strategies as needed.

Furthermore, CryptoArbitrage offers robust API integration, catering to advanced users who want to automate their trading systems. This functionality allows for seamless integration with existing trading bots and algorithms, enabling sophisticated arbitrage strategies and maximizing efficiency. This is particularly appealing to seasoned traders who require advanced tools and real-time data to execute complex trading strategies. While specific pricing details aren't readily available, it's anticipated that the platform operates on a subscription model, with premium features likely commanding higher fees. Technical requirements are likely minimal, primarily involving a stable internet connection and a compatible web browser.

While CryptoArbitrage offers a powerful suite of tools, it’s important to be aware of its potential drawbacks. One key consideration is the potential for higher subscription costs for accessing premium features, which may be a barrier for some users. The platform's advanced features might also present a steep learning curve for beginners. Additionally, some users have reported limited customer support response times, which can be frustrating when facing technical issues or requiring assistance. Learn more about CryptoArbitrage and its connection to the wider fintech landscape.

Despite these challenges, CryptoArbitrage's highly accurate profit calculations, comprehensive exchange coverage, and robust API support position it as a valuable tool for crypto arbitrage. Whether you're a seasoned trader or a novice investor seeking to explore arbitrage opportunities, CryptoArbitrage offers a platform to identify and capitalize on price discrepancies in the cryptocurrency market. Implementing CryptoArbitrage effectively involves familiarizing oneself with the platform's features, setting up personalized alert thresholds based on risk tolerance and profit targets, and diligently monitoring market conditions. For advanced users, leveraging the API integration for automated trading can significantly enhance efficiency and profitability. Understanding the fee structures of the exchanges being utilized is also crucial for optimizing arbitrage strategies. By carefully considering the platform’s features and limitations, traders can effectively integrate CryptoArbitrage into their toolkit and potentially enhance their crypto trading returns.

3. Coinrule

Coinrule stands out as a powerful tool for those looking to capitalize on cryptocurrency arbitrage opportunities. While primarily known as an automated trading platform, Coinrule offers sophisticated crypto arbitrage scanning capabilities that allow users to identify and exploit price discrepancies across different exchanges. This unique combination of automated trading and arbitrage detection makes it a versatile tool for both manual arbitrage scanning and the automated execution of arbitrage strategies. This means you can either actively scan for opportunities and execute trades manually or set up automated rules to do the heavy lifting for you. This makes Coinrule a flexible option for users with varying levels of trading experience. Whether you’re a seasoned trader or just starting out, Coinrule can adapt to your specific needs.

One of Coinrule's key strengths lies in its ability to let users create custom arbitrage strategies. Instead of relying on pre-defined templates, you can tailor your approach based on your risk tolerance, preferred exchanges, and specific coin pairs. This level of customization is particularly appealing to experienced traders who often have well-defined strategies in mind. The platform's drag-and-drop rule builder makes it easy to define complex trading rules without requiring any coding knowledge. This user-friendly interface allows even novice users to quickly grasp the basics and start creating their own arbitrage strategies. Coinrule integrates with over 15 major cryptocurrency exchanges, providing a broad reach for identifying arbitrage opportunities. It’s worth noting that while this broad integration is a significant advantage, Coinrule's arbitrage capabilities are, of course, limited to the exchanges it supports.

For those who want to test their strategies before deploying them in live markets, Coinrule offers backtesting capabilities. This allows you to simulate your arbitrage strategies against historical market data to gauge their potential effectiveness and identify any weaknesses. This is a crucial feature for mitigating risk and optimizing your strategy for maximum profit. The inclusion of a mobile app with push notifications further enhances the platform's usability, allowing you to stay informed about arbitrage opportunities and manage your trades on the go. This mobile accessibility caters to the increasingly mobile-first nature of the crypto trading landscape.

Coinrule's security measures are also robust, utilizing API keys for exchange integration rather than requiring direct access to your exchange accounts. This minimizes the risk of unauthorized access and protects your funds. Furthermore, Coinrule boasts an active community and provides extensive educational resources, making it a supportive environment for both new and experienced traders. Learn more about Coinrule and their recent growth.

While Coinrule offers a compelling suite of tools for crypto arbitrage, it's important to consider its potential drawbacks. Compared to dedicated crypto arbitrage scanners, Coinrule is arguably more complex. Its focus on automated trading adds a layer of complexity that might be overwhelming for users solely interested in simple arbitrage scanning. Understanding the intricacies of trading automation is crucial for maximizing the platform’s potential. Pricing information for Coinrule varies depending on the chosen subscription plan. Different tiers unlock different features and trading allowances, so users can select the plan that best aligns with their needs and budget. Technical requirements are minimal, primarily revolving around a stable internet connection and a compatible device (desktop or mobile).

For users looking for a platform that combines arbitrage scanning with automated execution, Coinrule offers a compelling solution. Its customizability, broad exchange integration, and backtesting capabilities make it a powerful tool for both manual and automated arbitrage. However, its complexity compared to dedicated scanners and the learning curve associated with trading automation should be considered before committing to the platform. If you’re comfortable with the technical aspects and are looking for a comprehensive platform that can handle both arbitrage scanning and automated trading, Coinrule deserves its place on your list of potential tools.

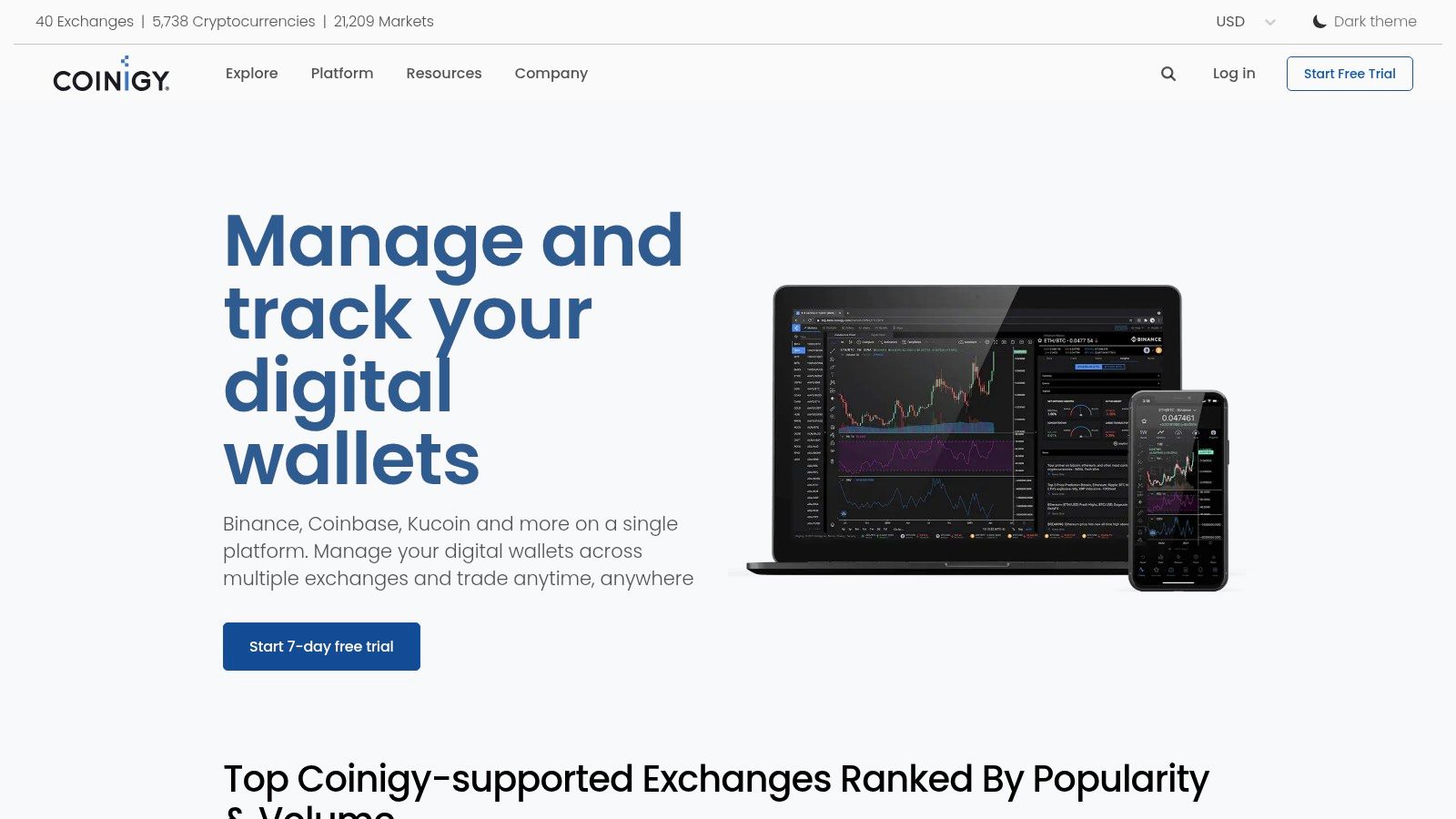

4. Coinigy

Coinigy stands out as a professional-grade cryptocurrency trading platform equipped with advanced arbitrage scanning tools, making it a compelling option for seasoned traders. While not solely dedicated to arbitrage, Coinigy's robust suite of features offers a comprehensive solution for identifying and capitalizing on price discrepancies across multiple exchanges. This platform caters to those who require in-depth market analysis combined with the ability to execute trades swiftly and efficiently. If you're looking for a crypto arbitrage scanner integrated within a larger trading ecosystem, Coinigy deserves consideration. It empowers users to monitor real-time market data from over 45 exchanges, providing a holistic view of the cryptocurrency landscape.

One of Coinigy's core strengths lies in its extensive exchange integrations. By connecting to over 45 exchanges through a unified API, users gain access to a vast pool of liquidity and trading opportunities. This broad reach is especially beneficial for arbitrage traders, who rely on identifying price differences between exchanges. Coinigy streamlines this process by presenting real-time market data and arbitrage opportunities within a single interface. Imagine being able to compare Bitcoin's price on Binance, Kraken, Coinbase Pro, and dozens of other exchanges simultaneously – that's the power Coinigy brings to the table. This consolidated approach simplifies the often complex task of managing multiple exchange accounts and executing arbitrage trades effectively.

Coinigy's sophisticated charting tools and technical analysis features further enhance its appeal to serious traders. While arbitrage scanning is a key component, Coinigy goes beyond basic price comparisons by providing the tools necessary to analyze market trends and make informed trading decisions. Users can access a wide range of technical indicators, customizable charts, and drawing tools to delve deeper into market dynamics. This depth of analysis empowers traders to not only identify arbitrage opportunities but also assess the overall market context and potential risks. The platform’s portfolio management tools allow users to track their holdings across multiple exchanges, providing a consolidated overview of their investment performance.

For those interested in staying abreast of market movements and potential arbitrage opportunities, Coinigy offers real-time price alerts and arbitrage notifications. These alerts can be customized based on specific price thresholds or percentage changes, allowing traders to react quickly to market fluctuations. This proactive approach is crucial in the fast-paced world of cryptocurrency arbitrage, where opportunities can appear and disappear within minutes. The ability to receive instant notifications ensures that traders don't miss out on potentially profitable trades.

While Coinigy offers a powerful set of tools, it’s important to consider the associated costs. A monthly subscription is required to unlock the full suite of features, including arbitrage scanning. This subscription model might deter casual users or those primarily focused on free crypto arbitrage scanners. Furthermore, Coinigy's extensive feature set can be overwhelming for beginners. The platform is designed for experienced traders and requires a certain level of familiarity with cryptocurrency trading concepts and terminology. Though Learn more about Coinigy and explore related market trends, the platform's complexity might necessitate a learning curve for new users.

In summary, Coinigy offers a robust and professional trading environment with integrated crypto arbitrage scanning capabilities. Its strengths lie in its broad exchange integrations, advanced charting tools, and real-time market data. While the subscription fee and complex interface may present barriers for some users, the platform's comprehensive features make it a valuable tool for seasoned cryptocurrency traders seeking to identify and exploit arbitrage opportunities. Its strong reputation within the crypto trading community further solidifies its position as a leading platform for those seeking a professional-grade trading experience.

5. ArbiSmart

For investors seeking a fully automated and regulated approach to crypto arbitrage, ArbiSmart stands out as a compelling option. This platform not only scans for crypto arbitrage opportunities but also executes the trades automatically, making it a particularly attractive solution for passive income seekers. ArbiSmart distinguishes itself by operating as a licensed financial service provider, offering a level of regulatory compliance not commonly found in the crypto arbitrage space. This focus on regulation provides an added layer of security and trust, particularly for those wary of the volatile and often unregulated nature of the cryptocurrency market. If you're looking for a hands-off "crypto arbitrage scanner" that handles the entire process, ArbiSmart warrants a closer look.

ArbiSmart’s core function is to identify and exploit price discrepancies across different cryptocurrency exchanges. The platform’s automated system constantly monitors a wide range of exchanges, leveraging its speed and efficiency to capitalize on these fleeting opportunities. This eliminates the need for manual intervention, saving users considerable time and effort. While some platforms simply identify arbitrage opportunities, leaving the execution to the user, ArbiSmart takes care of the entire process, from scanning to trade completion. This automated execution is a significant advantage, especially for those new to arbitrage or lacking the time to constantly monitor the market.

One of ArbiSmart’s key selling points is its guaranteed profit-sharing model. The platform offers users predetermined returns based on their investment amount, providing a level of predictability not often associated with cryptocurrency investments. This transparent fee structure allows investors to clearly understand their potential returns and assess the platform's profitability. While the platform boasts professional risk management, it’s crucial to remember that all investments carry inherent risks. For a deeper understanding of risk management in the volatile crypto landscape, you might find this article relevant: Learn more about ArbiSmart. While seemingly unrelated at first glance, the article highlights the importance of due diligence and understanding potential pitfalls, which applies to all crypto investments, including arbitrage.

ArbiSmart’s multi-currency support, including fiat, broadens its accessibility and appeal to a wider user base. Users can deposit and withdraw funds in various currencies, streamlining the investment process. Furthermore, the platform offers compound interest earning opportunities, allowing users to maximize their returns over time. This feature adds an additional layer of passive income potential, making ArbiSmart an attractive choice for long-term investors.

While ArbiSmart offers significant advantages, it also has some drawbacks. The platform's higher minimum investment requirements might be a barrier to entry for some users. Compared to other crypto arbitrage scanners that allow smaller initial investments, ArbiSmart's higher threshold may exclude some potential investors. Additionally, the fully automated nature of the platform means users have less control over individual trades. While this automation simplifies the process, it also limits the ability to customize trading strategies or react to specific market conditions. Finally, the limited transparency in the specific trading strategies employed by ArbiSmart might be a concern for some users who prefer a more detailed understanding of the platform’s inner workings. Geographic restrictions also apply to some users depending on their location and local regulations, which is worth investigating based on your individual circumstances.

Despite these limitations, ArbiSmart's combination of automated arbitrage execution, regulatory compliance, guaranteed returns, and multi-currency support makes it a strong contender in the crypto arbitrage scanner landscape. It caters specifically to those seeking a passive investment strategy with a degree of predictability in a notoriously volatile market. If you’re a novice crypto investor looking for an all-in-one platform, a seasoned trader seeking automated arbitrage solutions, or even an affiliate marketer looking for referral opportunities, ArbiSmart's features might align with your investment goals. Whether you prioritize ease of use, regulatory compliance, or passive income generation, ArbiSmart offers a unique approach to crypto arbitrage that’s worth exploring. For more details, visit the ArbiSmart website.

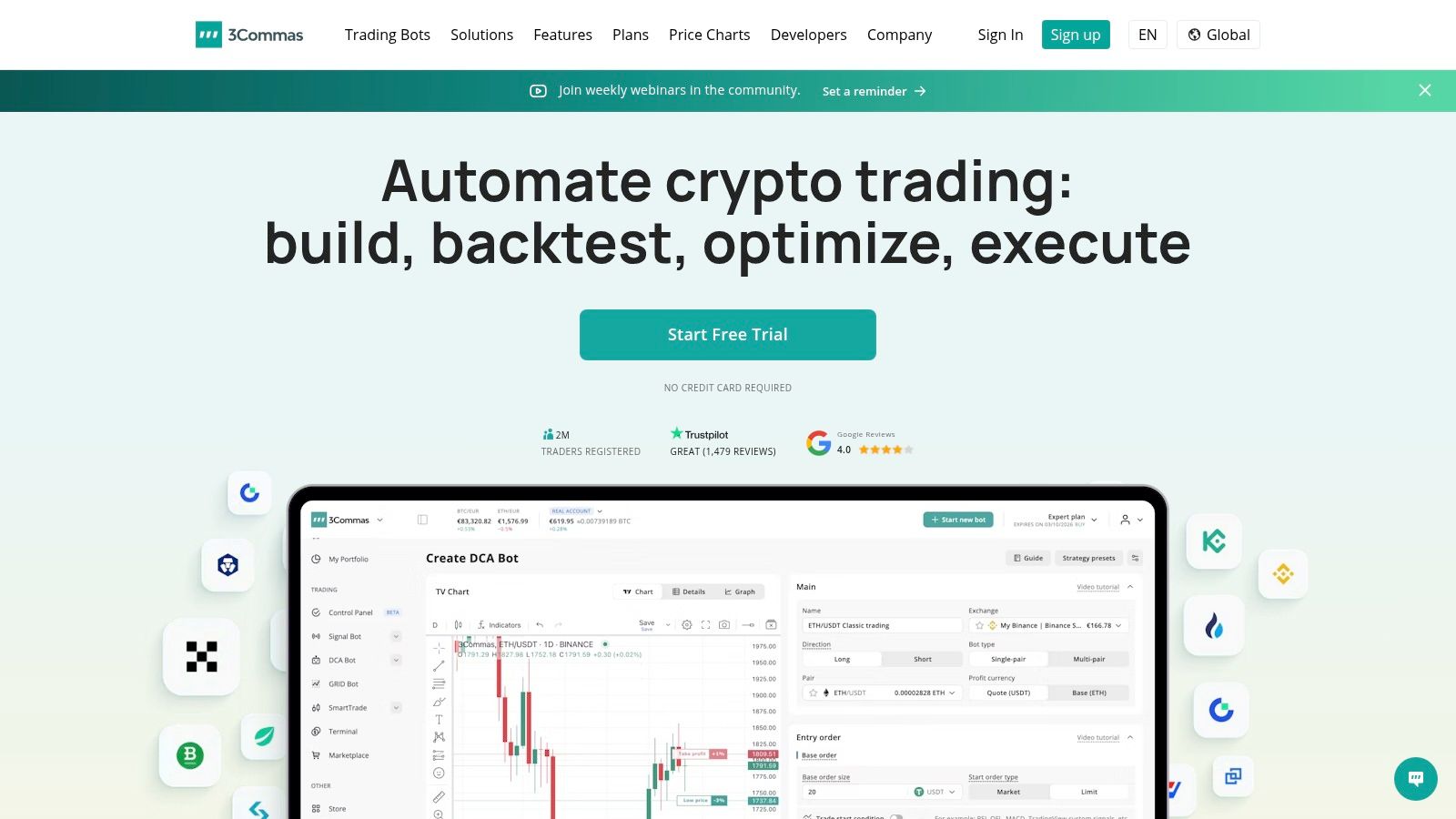

6. 3Commas

3Commas stands out as a comprehensive crypto trading platform offering a suite of tools, including a crypto arbitrage scanner, making it a valuable asset for traders seeking to capitalize on price discrepancies across exchanges. While not solely dedicated to arbitrage, its integration within a broader trading ecosystem provides users with a centralized platform to manage various strategies, including DCA bots, grid trading, and of course, arbitrage detection across multiple exchanges. The platform's user-friendly interface and extensive automation capabilities make arbitrage more accessible to both novice and experienced traders. This makes it an attractive option for those who desire an all-in-one solution rather than a dedicated arbitrage tool.

One of 3Commas's core strengths lies in its multi-exchange arbitrage scanning and execution. By integrating with over 20 major exchanges, including Binance, Coinbase Pro, and Kraken, it offers a wide range of arbitrage opportunities. The platform's automated bots can be configured to execute trades based on identified arbitrage opportunities, saving traders valuable time and potentially increasing profitability. For those seeking to understand the impact of these strategies, the built-in portfolio analytics and performance tracking tools offer a clear overview of trading activity and returns. This is particularly helpful for seasoned traders who require advanced analytical tools and real-time data to make informed decisions. Furthermore, the platform's smart trading terminal with advanced order types empowers users with greater control over their trades, allowing for sophisticated execution strategies.

For novice crypto investors, the user-friendly interface of 3Commas offers a relatively straightforward introduction to the complexities of arbitrage trading. The platform’s strong community and educational resources further aid the learning process, making it an attractive option for those new to crypto trading. 3Commas has also recognized the growing importance of AI in financial markets, as evidenced by their recent integration of AI-driven features to enhance their arbitrage capabilities. You can learn more about 3Commas and these advancements. These AI enhancements aim to provide more accurate predictions and faster execution speeds, further optimizing the arbitrage process.

While 3Commas offers a powerful suite of tools, it's important to consider the platform's subscription model. While some basic features are available for free, access to the more advanced functionalities, including some crucial arbitrage features, requires a paid subscription. This tiered structure means that users solely interested in arbitrage may find themselves paying for features they don't need. Furthermore, while user-friendly for a comprehensive trading platform, 3Commas can be initially overwhelming for users solely interested in crypto arbitrage scanning. Navigating through the numerous features and settings may require a learning curve for those focused specifically on this trading strategy. Some advanced arbitrage features are locked behind higher-tier subscriptions, which could represent a significant cost for some users.

Setting up 3Commas for arbitrage trading involves connecting your chosen exchanges through API keys. Users can then configure bots to automatically monitor and execute arbitrage opportunities based on pre-defined parameters such as profit thresholds and trade volumes. It is crucial to thoroughly test any bot configuration in a simulated environment before deploying it with real funds. This allows users to familiarize themselves with the platform and refine their strategies without risking capital.

Compared to dedicated crypto arbitrage scanners, 3Commas provides a broader range of functionalities but at a subscription cost. If you're a high-volume trader looking to incorporate arbitrage as one component of a diversified trading strategy, 3Commas is a viable option. However, if your sole focus is crypto arbitrage and you’re on a tight budget, a dedicated arbitrage scanner might be a more cost-effective alternative. Finally, for mobile-first users, while 3Commas offers a mobile app, its full functionality and complexity are best experienced on a desktop platform. The mobile app is better suited for monitoring existing trades and portfolios rather than setting up complex arbitrage strategies. Visit the 3Commas website at https://3commas.io to explore their offerings and pricing plans.

Crypto Arbitrage Scanners Feature Comparison

| Platform | Core Features ✨ | User Experience ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| Arbitrage Scanner | Real-time scan 100+ exchanges, profit calc. demo | Beginner-friendly, minimal latency | Free tier, subscription for premium | Beginners & pros | Detailed fee calc., historic arbitrage data |

| CryptoArbitrage | 50+ exchanges, automated alerts, API integration | Accurate, reliable but steep learning curve | Higher subscription cost | Advanced traders & algo users | Strong API support, comprehensive fee calculation |

| Coinrule | Auto arbitrage exec., custom rules, backtesting | User-friendly drag-drop, mobile app | Subscription-based | Traders wanting automation | Combines rule-based trading & auto arbitrage |

| Coinigy | 45+ exchanges, pro charts, portfolio mgmt | Professional grade, complex for casuals | Monthly subscription | Serious traders | Unified API, advanced technical analysis |

| ArbiSmart | Fully automated trades, regulated, guaranteed ROI | Passive, regulated but limited control | Higher minimum investment | Passive investors | Licensed with profit-sharing & compound interest |

| 3Commas | Multi-exchange bots, arbitrage scanning | User-friendly, extensive automation | Subscription required | All level traders | Multi-strategy platform with smart terminal |

Choosing the Right Crypto Arbitrage Scanner: Final Thoughts

Finding the perfect crypto arbitrage scanner can significantly impact your trading success. Whether you're a novice investor, a seasoned trader, a mobile-first user, or even an affiliate marketer, the tools discussed in this article – from dedicated scanners like Arbitrage Scanner and CryptoArbitrage to integrated platforms like Coinrule and 3Commas – cater to a wide range of needs. Remember, the key is to select a crypto arbitrage scanner that aligns with your individual trading style and goals. Consider factors such as the breadth of exchange support, the accuracy and speed of real-time data, the precision of fee calculations, the availability of automation features, and the user-friendliness of the interface. For learners, integrated platforms with tutorials and guides can be invaluable, while advanced traders might prioritize analytical tools and customizable dashboards.

Some crypto arbitrage scanners provide highly specialized functionality, while others, like Coinigy and ArbiSmart, offer more comprehensive trading suites. Choosing the best tool depends on your preferred level of control and automation. If you're seeking a holistic trading platform alongside your arbitrage scanning capabilities, consider platforms that offer both. No matter your choice, keep in mind the importance of accurate fee calculations, as seemingly small discrepancies can significantly affect your profitability.

As you embark on your arbitrage journey, remember that choosing the right crypto arbitrage scanner is a crucial first step. By carefully evaluating your needs and leveraging the insights provided here, you can confidently navigate the market and maximize your arbitrage opportunities.

Ready to put your arbitrage strategies into action with minimal fees? Explore vTrader, a commission-free exchange, to potentially amplify your profits. Visit vTrader and discover how its competitive fee structure can complement your chosen crypto arbitrage scanner.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.