Unlocking the Secrets to Low-Cost Crypto Acquisition

Want to buy crypto without breaking the bank? This guide reveals eight proven strategies for acquiring cryptocurrency at the cheapest prices, maximizing your investment potential. Discover how to use dollar-cost averaging, optimize exchange fees, explore peer-to-peer (P2P) trading, utilize decentralized exchanges (DEXs), and more. Whether you're a beginner or an expert, learning the cheapest way to buy crypto is crucial for long-term success. These methods will empower you to make informed decisions and minimize costs.

1. Dollar-Cost Averaging (DCA)

One of the cheapest ways to buy crypto, particularly for long-term investors, is through a strategy called Dollar-Cost Averaging (DCA). This method involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency's price. Instead of trying to time the market and invest a lump sum at the "perfect" moment, DCA spreads your purchases over time, mitigating the impact of price volatility. This means you buy more cryptocurrency when the price is low and less when the price is high, ultimately lowering your average cost per unit. DCA isn't about maximizing returns; it's about minimizing risk and building a position gradually. This makes it an excellent strategy for those new to cryptocurrency investing.

DCA simplifies the investment process by removing the emotional element of trying to predict market movements. It eliminates the need for complex technical analysis or market timing, which can be challenging for novice investors. By sticking to a predetermined schedule, you avoid impulsive decisions driven by fear or greed, common pitfalls that can lead to significant losses. This disciplined approach is particularly valuable in the volatile cryptocurrency market.

How DCA Works in Practice:

Let's say you want to invest $500 in Bitcoin. Instead of buying $500 worth of Bitcoin all at once, you could divide this amount into $50 weekly purchases over ten weeks. Some weeks, when the price is low, your $50 will buy more Bitcoin. Other weeks, when the price is high, it will buy less. Over time, this strategy averages out the purchase price, potentially reducing your overall cost basis.

Features of DCA:

- Automated Recurring Purchases: Many exchanges allow you to set up automatic recurring buys, making DCA effortless.

- Fixed Time Intervals: You choose the frequency of your purchases, whether daily, weekly, bi-weekly, or monthly.

- Same Dollar Amount Each Purchase: You invest the same amount of money each time, regardless of price fluctuations.

- Price-Agnostic Buying Approach: DCA removes the stress of trying to predict market movements.

- Long-Term Accumulation Strategy: DCA is ideal for building a position in a cryptocurrency over an extended period.

Pros and Cons of DCA:

Pros:

- Reduces Impact of Market Volatility: Smoothing out price fluctuations leads to a more stable investment experience.

- Eliminates Need for Market Timing: No need to predict market highs and lows.

- Builds Discipline in Investing: Encourages regular and consistent investment habits.

- Lower Average Cost Over Time: Potentially reducing your overall cost basis.

- Reduces Emotional Decision-Making: Removes fear and greed from the equation.

- Can Be Automated: Set it and forget it with automated recurring purchases.

Cons:

- May Miss Opportunities During Extended Downtrends: If the market consistently declines, lump-sum investing might have yielded better results.

- Requires Consistent Cash Flow: You need to ensure you have the funds available for each purchase.

- Not Optimal for Short-Term Trading: DCA is a long-term strategy, not suitable for quick profits.

- May Result in Higher Costs During Bull Markets: If the market consistently rises, lump-sum investing at the beginning might have been more profitable.

Examples of DCA:

- Weekly $50 Bitcoin purchases on Coinbase Pro

- Monthly $200 Ethereum buys through Kraken

- Daily $10 crypto purchases via Swan Bitcoin

- Bi-weekly portfolio rebalancing on Gemini

Tips for Effective DCA:

- Start with Small Amounts: Test the strategy and become comfortable with the process.

- Choose Exchanges with Low Recurring Purchase Fees: Minimize costs to maximize returns.

- Set Up Automatic Transfers from Your Bank Account: Automate the process for convenience and consistency.

- Track Your Average Cost Basis for Tax Purposes: Keep accurate records for tax reporting.

- Consider Increasing Amounts During Market Downtrends: Capitalize on lower prices to accumulate more cryptocurrency.

Influential Figures in DCA:

The concept of DCA is rooted in traditional value investing principles popularized by Benjamin Graham. In the crypto space, platforms like Swan Bitcoin have championed Bitcoin-specific DCA strategies, and figures like Michael Saylor, CEO of MicroStrategy, have publicly advocated for DCA as a corporate treasury strategy for Bitcoin.

DCA is a powerful tool for anyone seeking the cheapest way to buy crypto in the long term. By consistently investing small amounts over time, you can minimize risk, avoid emotional decision-making, and potentially lower your average cost per unit. While it may not yield the highest possible returns, DCA offers a reliable and accessible path to building a strong cryptocurrency portfolio.

2. Exchange Fee Comparison and Optimization

One of the smartest ways to maximize your crypto returns is by minimizing the fees you pay when buying and selling. This involves a strategy called "Exchange Fee Comparison and Optimization," which focuses on finding the cheapest way to buy crypto by strategically selecting the trading platforms you use. By understanding how fees are structured and leveraging certain features, you can significantly reduce your trading costs and boost your overall profitability. This approach is essential for anyone looking for the cheapest way to buy crypto, from novice investors to seasoned traders.

This method involves diligently researching and comparing the fee schedules of various cryptocurrency exchanges. Don't assume all platforms are created equal! Fees can vary significantly, impacting your bottom line. Key aspects to consider include maker vs. taker fees, volume-based fee tiers, and whether the platform caters to your specific trading patterns. For example, high-frequency traders will benefit from exchanges offering volume discounts, while occasional traders might prioritize platforms with low base fees. Even seemingly small differences in fees can add up significantly over time, especially for active traders.

Understanding the intricacies of fee structures is crucial. Maker orders, which provide liquidity to the order book, generally incur lower fees (or even zero fees on some platforms) compared to taker orders, which remove liquidity. Many exchanges also offer tiered fee structures based on your trading volume; the more you trade, the lower your fees become. There are even opportunities for geographic arbitrage, where you can exploit price differences and fee discrepancies between exchanges in different regions. In the broader financial world, regulations like capital requirements for banks play a significant role in the financial health of banks and influence their operational costs, which can indirectly affect the fees they charge customers. A similar awareness of the crypto landscape can help you navigate the complexities of exchange fees.

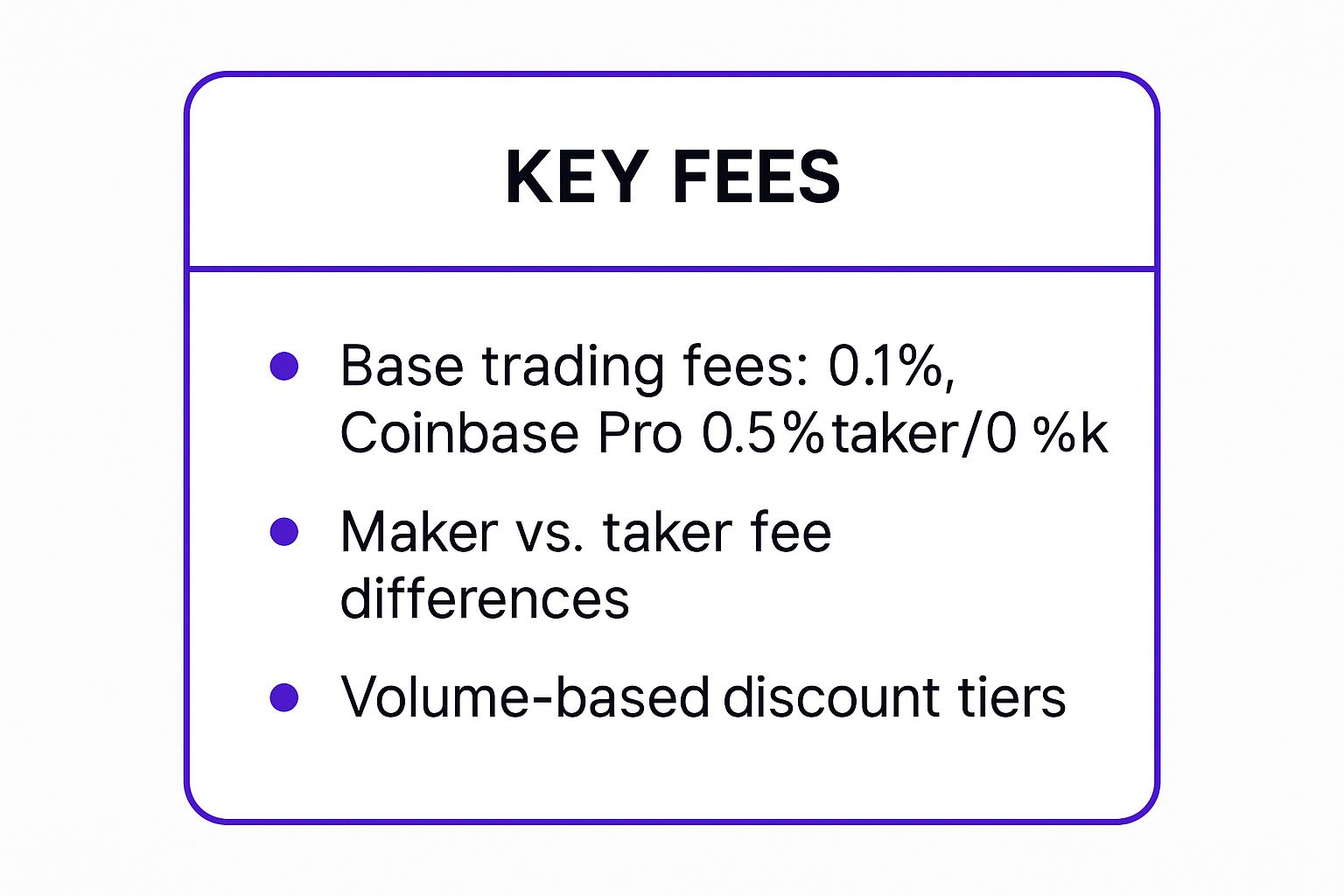

Several popular exchanges illustrate how fee structures can differ. Binance, for example, offers a 0.1% base fee, which can be further reduced by using their native token, BNB. Coinbase Pro employs a tiered system, with fees as high as 0.5% for low-volume traders, but offers 0% maker fees for high-volume users. KuCoin advertises 0.1% trading fees with additional discounts available, while FTX utilizes a volume-based fee structure starting at 0.1%. These variations highlight the importance of careful comparison shopping.

To help visualize the fee differences between popular exchanges, consider the infographic below. It summarizes key fee data points to give you a quick reference for comparison.

As the infographic highlights, choosing the right exchange based on your trading style and volume can lead to significant savings. High-volume traders can capitalize on maker rebates and volume discounts, while those trading smaller amounts should prioritize platforms with competitive base fees.

Here are some practical tips for optimizing your exchange fees:

- Calculate total costs: Don’t just focus on trading fees. Factor in deposit and withdrawal fees, as these can significantly impact your overall costs.

- Use limit orders: Whenever possible, use limit orders. This allows you to act as a maker, often qualifying for lower fees or even rebates.

- Consider exchange tokens: Many exchanges offer their own tokens that can be used to reduce trading fees.

- Monitor fee changes and promotions: Exchanges frequently adjust their fee schedules and run promotions. Stay informed to take advantage of these opportunities.

- Factor in deposit and withdrawal methods: Different deposit and withdrawal methods can incur varying fees. Choose the most cost-effective option for your needs.

By adopting this strategy, you not only save money but also gain a deeper understanding of the true cost of trading. This empowers you to make more informed decisions, improve your profit margins, and potentially unlock access to professional trading features like volume discounts and advanced order types. While it requires some initial research and ongoing monitoring, and you may need to manage multiple exchange accounts to optimize for different trading scenarios, the potential cost savings and increased profitability make it well worth the effort. Remember to consider the differing security levels and liquidity variations between platforms when making your choices. This approach is popular among professional crypto traders, institutional trading firms, and is often highlighted by crypto comparison websites like CoinGecko.

3. Peer-to-Peer (P2P) Trading

When exploring the cheapest way to buy crypto, Peer-to-Peer (P2P) trading often emerges as a compelling option. This method bypasses traditional cryptocurrency exchanges, allowing you to buy and sell digital currencies directly with other individuals. This direct interaction often translates to better exchange rates and lower fees, making it a potentially cost-effective approach, particularly appealing to those seeking the cheapest way to buy crypto. The decentralized nature of P2P trading also offers greater privacy and control over your transactions.

P2P platforms act as facilitators, connecting buyers and sellers. They typically offer features like escrow services to secure transactions and mitigate counterparty risk. The process usually involves a buyer selecting a seller based on their offered price, payment method, and reputation. Once an agreement is reached, the platform holds the seller's cryptocurrency in escrow. Upon the buyer completing the payment through the chosen method (e.g., bank transfer, PayPal, gift cards), the platform releases the cryptocurrency to the buyer. This direct interaction cuts out the intermediary fees typically charged by centralized exchanges, making P2P a strong contender for the cheapest way to buy crypto.

The flexibility of payment methods is another key advantage of P2P trading. Unlike traditional exchanges that may have limited options, P2P platforms often support a wide range of payment methods, including bank transfers, online payment systems, and even cash in some cases. This allows users to transact using methods most convenient to them, particularly beneficial for those in regions with limited access to traditional banking. This accessibility contributes to P2P trading being a viable solution for finding the cheapest way to buy crypto.

Furthermore, P2P trading empowers users with price negotiation capabilities. Buyers can often engage in direct discussions with sellers to agree on a mutually acceptable price, potentially securing even better deals than those listed publicly. This aspect of bargaining is absent in traditional exchanges and can significantly contribute to finding the cheapest way to buy crypto.

Examples of P2P Platforms:

- LocalBitcoins: A long-standing platform known for its local currency support and diverse payment options.

- Paxful: A popular platform emphasizing security and a wide range of payment methods.

- Binance P2P: Leverages the security and liquidity of Binance, offering a reliable P2P trading experience.

- Bisq: A decentralized P2P exchange focused on privacy and security.

- LocalCryptos: Supports a variety of cryptocurrencies and offers secure escrow services.

Pros:

- Often better exchange rates than traditional exchanges.

- Lower fees, contributing to the cheapest way to buy crypto.

- More payment method flexibility.

- Enhanced privacy options.

- Direct price negotiation.

- Access to local markets.

Cons:

- Higher counterparty risk compared to established exchanges.

- Longer transaction times due to direct interactions.

- Requires more active management and research.

- Potential for disputes, requiring careful due diligence.

- Limited customer support compared to centralized exchanges.

Tips for Successful P2P Trading:

- Check trader reputation and feedback scores: Prioritize sellers with positive feedback and a history of reliable transactions.

- Use platforms with built-in escrow services: This protects your funds during the transaction process.

- Verify payment methods before trading: Ensure the chosen payment method is secure and aligns with your preferences.

- Start with smaller amounts to test reliability: Gain experience and confidence before committing larger sums.

- Keep detailed records for tax purposes: Maintain accurate records of all transactions for tax compliance.

P2P trading, championed by platforms like LocalBitcoins and aligned with Satoshi Nakamoto’s original vision of decentralized finance, has emerged as a viable option for those seeking the cheapest way to buy crypto. While it requires more active participation and carries some inherent risks, the potential for better rates, lower fees, and greater flexibility makes it a worthwhile consideration for both novice and experienced cryptocurrency traders. Whether you're a seasoned trader, a mobile-first user, or just starting your crypto journey, understanding the nuances of P2P trading can empower you to navigate the market effectively and potentially unlock more cost-effective ways to acquire your desired cryptocurrencies.

4. Decentralized Exchange (DEX) Usage

Decentralized exchanges (DEXs) represent a revolutionary approach to buying and selling cryptocurrencies, offering a potentially cheaper alternative to centralized exchanges (CEXs) and playing a crucial role in the decentralized finance (DeFi) ecosystem. If you're looking for the cheapest way to buy crypto, DEXs deserve serious consideration. They cut out the intermediary, allowing for direct peer-to-peer transactions facilitated by smart contracts and automated market makers (AMMs). This translates to lower fees, greater privacy, and more control over your funds, making it an attractive option for cost-conscious and privacy-focused crypto investors.

Instead of relying on a central authority like a CEX, DEXs operate on a distributed network, typically a blockchain like Ethereum or Binance Smart Chain. This decentralized nature brings several key advantages. First, it eliminates the need for Know Your Customer (KYC) procedures, meaning you can trade without revealing your identity. Second, it enhances security and privacy as your funds are held directly in your own wallet, minimizing the risk of exchange hacks or data breaches. Third, it typically results in lower platform fees as there’s no intermediary taking a cut. Finally, DEXs often provide earlier access to newly launched tokens, offering exciting opportunities for early adopters.

Here's how it works: Users connect their cryptocurrency wallets directly to the DEX platform. When someone wants to trade, they interact with a smart contract, which automatically executes the trade based on pre-defined rules. AMMs, a key component of many DEXs, provide liquidity by using algorithms and liquidity pools to determine asset prices and facilitate trades. This eliminates the need for traditional order books and allows for 24/7 trading even with lower trading volumes.

Several popular DEXs have emerged as leaders in the space. Uniswap, operating on the Ethereum network, is a prominent platform for trading ERC-20 tokens. PancakeSwap, built on Binance Smart Chain, offers similar functionality with generally lower gas fees. SushiSwap is another example of a cross-chain DEX. For users seeking the best prices across multiple DEXs, aggregators like 1inch provide a convenient solution. Curve Finance specializes in efficient trading of stablecoins.

While DEXs offer numerous advantages, they also come with their own set of challenges. One major consideration is network gas fees. These fees, paid to miners for processing transactions on the blockchain, can be substantial, especially during periods of high network congestion. Another hurdle is the higher technical complexity compared to CEXs. Users need to understand how to interact with smart contracts, manage their wallets, and navigate the intricacies of blockchain technology. Additionally, there's always the potential for smart contract vulnerabilities, which can be exploited by hackers. Liquidity for certain trading pairs can also be lower on DEXs compared to CEXs. Finally, customer support is often limited due to the decentralized nature of the platforms.

To make the most of your DEX experience and truly leverage the cheapest way to buy crypto, consider these tips:

- Use DEX aggregators: Platforms like 1inch can help you find the best prices across multiple DEXs, ensuring you get the most for your money.

- Consider Layer 2 solutions: Layer 2 scaling solutions, like Arbitrum and Optimism, offer significantly lower gas fees compared to the main Ethereum network.

- Check slippage tolerance settings: Slippage refers to the difference between the expected price of a trade and the actual price executed. Adjusting your slippage tolerance can help you avoid unexpected price fluctuations.

- Verify token contracts: Always double-check the contract address of the token you're trading to avoid scams involving fake tokens.

- Time your transactions: Try to execute transactions during periods of low network congestion to minimize gas fees.

DEXs have been instrumental in the growth of DeFi and offer a compelling alternative for users seeking the cheapest way to buy crypto. Pioneered by platforms like Uniswap and fueled by the DeFi summer movement in 2020, DEXs are continuously evolving, offering more features, better liquidity, and improved user experiences. By understanding the pros and cons and following the tips outlined above, you can effectively leverage the power of DEXs to minimize trading costs and take control of your crypto trading journey.

5. Stablecoin Arbitrage and Timing

One of the cheapest ways to buy crypto, especially during periods of market volatility, is through a strategy called stablecoin arbitrage and timing. This method involves holding reserves of stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, and strategically deploying them to purchase other cryptocurrencies when their prices dip. This combines the stability of dollar-pegged assets with opportunistic market timing to maximize your purchasing power and potentially acquire more cryptocurrency for the same amount of fiat currency. This approach can be particularly effective when trying to find the cheapest way to buy crypto as it allows you to bypass exchange fees often associated with direct fiat-to-crypto purchases and capitalize on price fluctuations.

Here's how it works: You purchase stablecoins like USDC, Tether (USDT), or DAI and hold them in your exchange account or a compatible wallet. You then monitor the market for dips in the price of your target cryptocurrency (e.g., Bitcoin, Ethereum). When the price drops to your predetermined target level, you use your stablecoin reserves to buy the cryptocurrency at the lower price. This effectively allows you to “buy the dip” and potentially profit from the subsequent price recovery.

The power of this strategy lies in the speed and flexibility it offers. Stablecoins are readily available on most exchanges and can be traded instantly, unlike bank transfers which can take several days. This rapid deployment capability is crucial for capitalizing on sudden price drops, commonly referred to as “flash crashes,” where prices can plummet and recover within minutes. Furthermore, by eliminating the need for currency conversion, you avoid potential delays and fees associated with exchanging fiat currency for cryptocurrency.

Several features make stablecoin arbitrage and timing a viable option for those seeking the cheapest way to buy crypto:

- Stablecoin reserves for opportunities: Holding a reserve of stablecoins provides readily available buying power.

- Market volatility monitoring: Actively tracking market trends and price movements is crucial for identifying buying opportunities.

- Rapid deployment capability: The near-instantaneous nature of stablecoin transactions allows you to capitalize on fleeting price dips.

- Price alert systems: Setting price alerts for target buy levels helps automate the buying process and ensures you don't miss opportunities.

- Multi-exchange positioning: Holding stablecoins on multiple exchanges can allow for arbitrage opportunities if price discrepancies exist between platforms.

Pros:

- Capitalize on market volatility: Buy low, sell high – the core principle of this strategy.

- Faster execution than bank transfers: No waiting for bank clearances, allowing for swift action.

- No currency conversion delays: Streamlined transactions without the hassle of currency exchange.

- Ability to act on sudden dips: React quickly to flash crashes and other unexpected price drops.

- Reduced emotional trading decisions: A pre-determined strategy can help minimize impulsive buying and selling.

Cons:

- Requires capital to sit idle: Holding stablecoin reserves means that capital isn't earning interest or being used elsewhere.

- Market timing risks: Incorrectly predicting market movements can lead to losses.

- Stablecoin regulatory risks: Regulatory changes affecting stablecoins could impact their value and usability.

- Opportunity cost of holding cash: The potential returns missed by not investing the capital elsewhere.

- Need for constant market monitoring: Requires active monitoring of market trends and price fluctuations.

Examples:

- Buying Bitcoin with USDC reserves during a 20% market correction.

- Taking advantage of a flash crash to purchase Ethereum using Tether on multiple exchanges, leveraging small price differences between platforms.

- Setting automated buy orders for a specific altcoin using DAI, triggered when the price reaches a pre-defined support level.

- Exploiting cross-exchange arbitrage opportunities by buying a stablecoin on one exchange at a discount and selling it on another at a premium.

Tips for Success:

- Set up price alerts: Use exchange features or third-party tools to receive alerts when your target cryptocurrency reaches your desired buy price.

- Keep stablecoins on multiple exchanges: This can give you an edge in exploiting arbitrage opportunities and reacting quickly to market movements on different platforms.

- Use limit orders: Ensure you buy at your target price by using limit orders, rather than market orders which execute at the current market price.

- Monitor stablecoin premium/discount rates: Be aware of fluctuations in stablecoin prices, especially during periods of high volatility, as they can impact your overall returns.

- Have a predetermined buying strategy: Define your entry and exit points, risk tolerance, and target cryptocurrencies before deploying this strategy.

This strategy is popular amongst professional crypto traders, quantitative trading firms, and DeFi yield farmers who often use sophisticated algorithms and tools. However, with careful planning and execution, it can be a powerful tool for anyone looking for the cheapest way to buy crypto and maximize their returns in the volatile cryptocurrency market.

6. Reward Credit Cards and Cashback Programs

Looking for the cheapest way to buy crypto? One increasingly popular method involves leveraging reward credit cards and cashback programs. This strategy allows you to essentially earn cryptocurrency passively through your everyday spending habits. By using a credit card that offers rewards in cryptocurrency or cashback that can be converted to crypto, you can integrate crypto accumulation seamlessly into your life without needing to make separate investments. This approach can be particularly appealing for those seeking a low-cost entry point into the crypto market.

How does it work? These specialized credit cards function similarly to traditional rewards cards. Instead of earning points or miles, you accrue cryptocurrency or cashback redeemable for crypto with every purchase. Many of these cards offer enhanced rewards for spending within specific categories, like dining or travel, further amplifying your crypto earnings. Furthermore, many providers offer attractive sign-up bonuses, providing a lump sum of crypto or cashback upon meeting certain spending thresholds.

Several platforms have embraced this innovative approach to crypto acquisition. For example, the Coinbase Card offers 4% back in crypto on eligible purchases, allowing users to choose from a selection of supported cryptocurrencies. The BlockFi Credit Card provides 1.5% back in Bitcoin on all purchases, a straightforward option for Bitcoin enthusiasts. Crypto.com’s Visa Card boasts cashback rates of up to 8%, depending on the card tier and the amount of CRO, their native token, staked. The Fold Card offers a unique spin-to-win feature alongside Bitcoin rewards on purchases, adding a gamified element to the experience. Finally, the Gemini Credit Card offers up to 3% crypto rewards on dining, 2% on groceries, and 1% on other purchases. These examples showcase the diverse range of reward structures available, catering to different spending habits and crypto preferences.

Why choose this method? Reward credit cards and cashback programs offer a distinct advantage for those seeking the cheapest way to buy crypto: you're effectively earning crypto without dedicating additional funds. This makes it a compelling option for individuals hesitant to make direct crypto purchases or those who prefer a more passive investment strategy. The potential for significant sign-up bonuses can also provide a substantial initial boost to your crypto holdings. Moreover, responsible credit card usage can help you build credit while simultaneously accumulating crypto.

However, it’s crucial to be aware of the potential drawbacks. Like any credit product, these cards come with credit approval requirements. The allure of earning rewards can also lead to increased spending if not managed carefully. Premium cards often carry annual fees, which can offset the value of the rewards earned if not used strategically. Most importantly, failing to pay off your balance in full each month will incur interest charges, negating any cost-saving benefits and potentially leading to debt. The crypto earning rates are also generally lower compared to direct purchases, so this approach is best suited for gradual accumulation rather than substantial investments.

To maximize the benefits and minimize the risks, consider these tips:

- Pay off your balance in full every month: This is the most critical aspect of using reward credit cards responsibly. Avoid interest charges at all costs to ensure you're genuinely earning free crypto.

- Maximize category bonuses: Plan your spending strategically to capitalize on categories offering higher reward multipliers.

- Take advantage of sign-up bonuses: These one-time bonuses can provide a significant jumpstart to your crypto earnings.

- Use the card for regular expenses you’d make anyway: Don't spend more than you normally would just to earn rewards. Integrate the card into your existing spending patterns.

- Compare annual fees vs. reward earning potential: For premium cards with annual fees, ensure the potential rewards outweigh the cost.

Reward credit cards and cashback programs represent an innovative and accessible pathway into the crypto market, particularly for those looking for the cheapest way to buy crypto. By leveraging your everyday spending habits and employing responsible credit card practices, you can gradually accumulate crypto without any additional out-of-pocket expenses. However, remember to carefully weigh the pros and cons, choose a card that aligns with your spending patterns and crypto preferences, and always prioritize responsible financial management.

7. OTC (Over-The-Counter) Trading for Large Purchases

When exploring the cheapest way to buy crypto, especially for substantial investments, Over-The-Counter (OTC) trading emerges as a powerful, albeit exclusive, option. While not accessible to everyone, OTC trading offers significant advantages for high-volume cryptocurrency purchases, making it a vital consideration for certain investor profiles. This method involves conducting large cryptocurrency transactions directly between two parties, or through specialized desks, bypassing the public order books of traditional exchanges. This direct approach allows for negotiated pricing and often results in a cheaper way to buy crypto than engaging with standard exchange platforms, particularly for large trades.

OTC trading operates outside the conventional exchange ecosystem. Instead of placing orders on a public order book visible to all, buyers and sellers connect directly, often facilitated by an OTC desk. These desks act as intermediaries, connecting buyers and sellers and helping to negotiate pricing and settlement terms. The process typically involves submitting a request for a specific cryptocurrency amount, receiving a quote from the desk, and, if accepted, settling the transaction privately. This personalized service is a key differentiator from standard exchange platforms.

Several well-established OTC desks facilitate these large-volume transactions. Genesis Trading, a pioneer in the OTC crypto space, provides institutional-grade trading services. Cumberland DRW caters to institutional investors with its robust trading infrastructure. Circle Trade offers professional trading services with a focus on stablecoins and other digital assets. Even major exchanges like Coinbase offer dedicated OTC desks like Coinbase Prime for institutional clients. BitGo also provides OTC trading services alongside its custody solutions. These examples illustrate the growing sophistication and accessibility of the OTC market.

Why Choose OTC Trading?

OTC trading deserves its place on the list of cheapest ways to buy crypto due to its potential for significant cost savings on large transactions. The key benefit lies in avoiding market impact. Large buy orders on public exchanges can drive up the price of the asset, effectively increasing the acquisition cost. OTC trading circumvents this by negotiating a fixed price for the entire purchase, shielding buyers from price slippage. This can translate into considerable savings when dealing with substantial sums.

Pros and Cons of OTC Trading:

Pros:

- Better Prices for Large Volumes: Negotiated pricing and avoidance of market impact often lead to more favorable prices compared to public exchanges.

- Reduced Market Impact: Large trades are executed discreetly, preventing price volatility and ensuring a stable acquisition cost.

- Personalized Service and Support: Dedicated account managers provide tailored guidance and support throughout the trading process.

- Enhanced Privacy for Large Trades: Transactions are conducted privately, offering greater anonymity compared to public exchanges.

- Access to Institutional Liquidity: OTC desks tap into deep liquidity pools, enabling the execution of very large orders.

- Flexible Settlement Terms: Buyers and sellers can negotiate customized settlement terms, including payment methods and timelines.

Cons:

- High Minimum Purchase Requirements: OTC trading typically caters to large investors, with minimum purchase amounts often exceeding hundreds of thousands or even millions of dollars.

- Limited to Institutional or High-Net-Worth Investors: Due to the high minimums, OTC trading is generally inaccessible to retail investors.

- Counterparty Risk Considerations: It's crucial to thoroughly vet the reputation and regulatory status of the OTC desk to mitigate counterparty risk.

- Less Regulatory Oversight: The OTC market operates with less regulatory oversight than traditional exchanges, requiring greater due diligence from participants.

- Longer Settlement Times: Settlement times can be longer compared to instant settlement on some exchanges, depending on the specific arrangements.

Tips for Navigating the OTC Market:

- Shop Multiple OTC Desks for Best Prices: Obtain quotes from several reputable desks to ensure you're getting the most competitive price.

- Verify Desk Reputation and Regulatory Status: Conduct thorough due diligence before engaging with any OTC desk.

- Understand Settlement and Custody Arrangements: Clearly define settlement procedures and custody arrangements before executing a trade.

- Negotiate Terms for Large or Repeat Transactions: Don't hesitate to negotiate terms, especially for large or recurring purchases.

- Consider Insurance and Counterparty Protections: Explore options for insurance and other counterparty protections to mitigate potential risks.

OTC trading, while not the cheapest way to buy crypto for everyone, provides a compelling solution for institutional investors and high-net-worth individuals seeking the best prices on large cryptocurrency purchases. By understanding the nuances of the OTC market and following the tips outlined above, large-volume buyers can leverage this method to acquire crypto assets efficiently and cost-effectively.

8. Mining and Staking as Acquisition Methods

Looking for the cheapest way to buy crypto? While it might seem counterintuitive, acquiring crypto without directly purchasing it is a viable and potentially cost-effective strategy. Mining and staking offer pathways to earn cryptocurrency by participating directly in the network's operation. While they require an initial investment and carry some inherent risks, these methods can provide crypto at below-market rates over time, making them a compelling option for long-term investors.

How Mining and Staking Work:

Mining, traditionally associated with Proof-of-Work (PoW) cryptocurrencies like Bitcoin, involves using specialized computer hardware (ASIC miners) to solve complex mathematical problems. The first miner to solve the problem adds the next block of transactions to the blockchain and is rewarded with newly minted cryptocurrency. This process secures the network and ensures the validity of transactions.

Staking, on the other hand, is associated with Proof-of-Stake (PoS) cryptocurrencies. Instead of computational power, staking uses a system where holders “lock up” a certain amount of their cryptocurrency to participate in validating transactions. Validators are chosen randomly based on the amount they stake and the duration of their stake. Successful validation earns them rewards in the form of newly minted coins. This method is generally more energy-efficient than mining.

Examples of Mining and Staking:

- Bitcoin Mining: While individual Bitcoin mining has become increasingly difficult due to the rising network hashrate, joining a mining pool allows smaller miners to combine their resources and share the rewards proportionally.

- Ethereum 2.0 Staking: Ethereum's transition to PoS allows users to stake 32 ETH to become a validator. While this is a significant investment, it offers the potential for consistent passive income.

- Cardano (ADA) Staking Pools: Cardano utilizes a delegated proof-of-stake system. Users can delegate their ADA to a staking pool without running a node themselves, making it a more accessible option for smaller investors.

- Polkadot (DOT) Nominated Proof-of-Stake: Polkadot employs a nominated proof-of-stake system where nominators back validators with their DOT, sharing in the rewards and risks.

- Cloud Mining Services: Cloud mining services like Genesis Mining offer an alternative to purchasing and maintaining your own hardware. Users rent computing power from a data center and receive a portion of the mined cryptocurrency.

Why Choose Mining or Staking?

These methods offer several advantages over directly purchasing crypto:

- Potentially Lower Cost Per Coin: Over time, the rewards earned through mining or staking can significantly lower the effective cost per coin compared to market purchases.

- Passive Income Generation: Both methods can generate a steady stream of passive income, which can be reinvested to further compound returns.

- Supporting Network Decentralization: By participating in mining or staking, you contribute to the security and decentralization of the network.

- No Direct Market Purchase Required: You acquire cryptocurrency without needing to time the market or pay exchange fees.

Pros and Cons:

| Pros | Cons |

|---|---|

| Potentially lower cost per coin over time | High upfront costs for mining (hardware) |

| Passive income generation | Technical complexity and maintenance |

| Supporting network decentralization | Electricity and operational costs (mining) |

| No direct market purchase required | Market and technology risks |

| Compounding returns through reinvestment | Lock-up periods for staking (reduced liquidity) |

Tips for Success:

- Calculate Break-Even Points: Before investing in mining equipment, factor in all costs, including hardware, electricity, cooling, and maintenance, to determine your break-even point.

- Research Mining Difficulty and Profitability Trends: Mining difficulty fluctuates, impacting profitability. Stay informed about current and projected trends.

- Consider Staking Pools: For PoS cryptocurrencies, staking pools offer a lower barrier to entry than solo staking.

- Factor in Electricity Costs and Cooling Needs: Mining can consume significant amounts of electricity. Accurately estimate these costs and ensure adequate cooling for your hardware.

- Stay Updated on Network Changes and Upgrades: Network updates and upgrades can impact mining and staking profitability. Keep yourself informed to adapt to changes.

Who Popularized These Methods?

Mining was popularized by early Bitcoin miners and Satoshi Nakamoto, the pseudonymous creator of Bitcoin. The Ethereum Foundation has been instrumental in the transition to proof-of-stake. Mining pool operators like F2Pool and Antpool have made mining more accessible to individuals.

Mining and staking offer a unique approach to acquiring cryptocurrency that can be a cheaper way to buy crypto in the long run. By understanding the inherent risks and rewards, and by carefully researching and planning your strategy, you can leverage these methods to build your crypto holdings over time.

Cheapest Crypto Buying Methods Comparison

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Low – automated recurring purchases | Moderate – requires consistent funds | Steady accumulation, reduced volatility impact | Long-term investors avoiding market timing | Low average cost, disciplined investing |

| Exchange Fee Comparison & Optimization | Moderate – research and account management | Low to Moderate – multiple accounts possible | Reduced trading costs, improved profit margins | Active traders seeking cost efficiency | Significant fee savings, better cost understanding |

| Peer-to-Peer (P2P) Trading | Moderate – requires active management | Low – personal funds, time investment | Lower fees, better rates, payment flexibility | Users valuing privacy and flexible payments | Better rates, privacy, multiple payment options |

| Decentralized Exchange (DEX) Usage | High – technical knowledge required | Low to Moderate – gas fees apply | Privacy, control, access to new tokens | Tech-savvy users wanting non-custodial trading | Enhanced security, no KYC, full control |

| Stablecoin Arbitrage and Timing | High – continuous monitoring needed | Moderate – capital reserves must sit idle | Profit from dips, fast execution | Traders with stablecoin reserves ready for dips | Capitalize on volatility, quick market response |

| Reward Credit Cards & Cashback | Low – standard credit use | Low – requires credit approval | Earn crypto rewards passively | Everyday spenders wanting crypto back | Earn crypto with no extra cost, build credit |

| OTC Trading for Large Purchases | High – negotiation & large capital | Very High – large minimums | Better pricing, privacy, reduced market impact | Institutions, whales needing large orders | Better prices, privacy, personalized service |

| Mining and Staking | High – technical setup & maintenance | High – hardware, staking minimums | Passive income, below-market acquisition | Long-term holders supporting networks | Passive income, support decentralization |

Choosing the Right Path to Affordable Crypto

Finding the cheapest way to buy crypto isn't a one-size-fits-all endeavor. From dollar-cost averaging (DCA) and optimizing exchange fees to exploring peer-to-peer (P2P) trading and decentralized exchanges (DEXs), this article has explored various strategies to minimize costs when acquiring cryptocurrencies. We've also delved into more advanced techniques like stablecoin arbitrage, reward credit cards, over-the-counter (OTC) trading, and even mining and staking. The most suitable approach depends on factors such as your trading volume, investment timeframe, risk tolerance, and technical expertise.

Key takeaways include understanding the fee structures of different exchanges, recognizing the potential savings of P2P and DEX platforms, and appreciating the long-term benefits of DCA. Mastering these concepts empowers you to make informed decisions and optimize your crypto investment strategy. Whether you're a novice investor, a seasoned trader, or a mobile-first user, understanding how to minimize costs is crucial for maximizing returns and building a thriving crypto portfolio. This knowledge not only impacts your individual financial journey but also contributes to the broader adoption and growth of the crypto ecosystem.

The cheapest way to buy crypto ultimately involves a careful evaluation of your individual needs and the available options. For a seamless and cost-effective trading experience, explore vTrader, a commission-free exchange offering advanced tools, robust security, and zero-fee trading. Start maximizing your crypto investments today – visit vTrader to learn more and open your free account.

Article created using Outrank

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.