So, can you actually day trade Bitcoin? The short answer is a resounding yes. In fact, its unique blend of high volatility and enormous trading volume makes it a playground for traders aiming to profit from short-term price action.

Answering The Big Question: Can You Day Trade Bitcoin?

Day trading Bitcoin isn't about long-term investing or believing in its world-changing potential. Forget the "HODL" mantra for a moment. This is a different game entirely, one that feels more like running a high-speed digital business. It's about executing multiple buy and sell orders within a single day to skim profits off small, predictable price swings.

To pull this off, you need to develop a very specific set of skills. Success hinges on your ability to read the market’s daily pulse—deciphering technical charts, staying glued to real-time market news, and executing trades with razor-sharp precision. It's not enough to know it's possible; you have to understand why it works in the fast-paced world of crypto. To keep a finger on that pulse, you can always check out the latest crypto news.

The market itself provides the perfect conditions for this kind of trading. Let's break down the key characteristics that make it all possible.

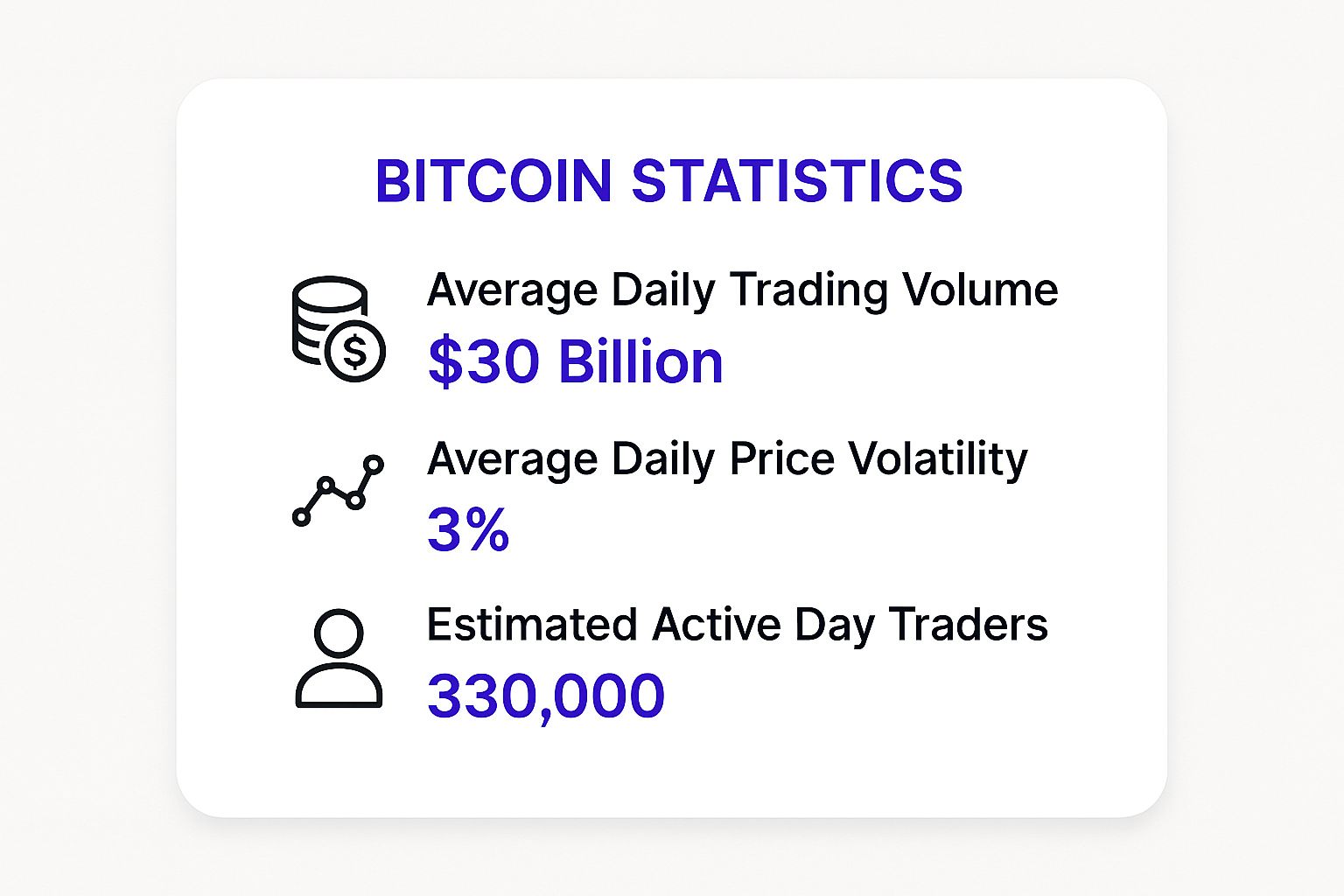

As you can see, these numbers paint a picture of a market that’s practically buzzing with opportunity. The constant price movement and deep liquidity are exactly what a day trader needs to get in and out of positions without a hitch.

Why Liquidity Is Everything

The most critical element here is market liquidity, which is just a fancy way of saying there's a ton of trading activity happening around the clock. Bitcoin's massive daily trading volume is the lifeblood for day traders. It ensures that when you're ready to buy or sell, you can do so almost instantly and at a fair price, without your own trade dramatically moving the market.

Think of it this way: high volume means there are always buyers and sellers at the ready. This allows for quick, clean trades—an absolute must-have for anyone trading on short timeframes.

Below is a table summarizing the core market factors that make day trading Bitcoin a viable strategy.

| Factor | Why It Matters for Day Trading | Example |

|---|---|---|

| High Volatility | Creates frequent and significant price swings, offering multiple profit opportunities within a single day. | Bitcoin's price might jump 3-5% in a few hours, allowing a trader to buy low and sell high quickly. |

| Massive Liquidity | Ensures traders can enter and exit large positions quickly without causing major price slippage. | A trader can sell $50,000 worth of Bitcoin instantly without crashing the price on a major exchange. |

| 24/7 Market Access | Unlike traditional stock markets, crypto markets never close, providing trading opportunities across all time zones. | A trader in Europe can react to market news from Asia overnight. |

These three pillars—volatility, liquidity, and constant access—create the dynamic environment where day traders can truly thrive.

Since 2020, Bitcoin's 24-hour trading volume has regularly sat in the tens of billions of U.S. dollars. During periods of intense market interest, it has even rocketed past the $100 billion mark. For instance, the frenzy in February 2021 saw record-breaking trading activity, proving the market can handle colossal transaction flows. This steady river of capital provides the stability and opportunity that day traders count on to successfully execute their game plan.

What Bitcoin Day Trading Actually Involves

First things first: if you're wondering whether you can day trade bitcoin, you need to understand how different it is from long-term investing. An investor might buy Bitcoin hoping it will soar in value years from now. A day trader, on the other hand, is in the trenches of a bustling digital market, aiming to profit from price swings that happen today.

This isn't about "HODLing" and waiting. It’s a total mindset shift toward active trading. You’re not betting on Bitcoin's grand future; you're capitalizing on its daily volatility. Your entire focus shrinks from a multi-year horizon down to hours, minutes, or even seconds.

The daily grind for a Bitcoin day trader is all about opening and closing multiple positions within a single session. The objective isn't to hit one massive home run. Instead, it's about stacking up small, consistent gains that accumulate over time. This is a game of high discipline and sharp strategy, not blind luck.

A day trader doesn’t ask, “Will Bitcoin succeed in the long run?” They ask, “Based on the data right now, where is the price headed in the next few hours?” That question is the very heart of day trading.

The Trader's Core Toolkit

To navigate these fast-paced market shifts, traders depend on a very specific set of tools and analytical techniques. While a long-term investor might dig into fundamental factors, a day trader lives and breathes technical analysis.

Technical analysis is simply the art of forecasting future price action by studying past price movements and trading volume. Traders use charting software to hunt for patterns and signals that give them an edge on where the price might be going next.

A typical session for a day trader involves a flurry of activity:

- Chart Analysis: Scouring candlestick charts for tell-tale patterns like a "head and shoulders" or a "double top," which often signal a potential trend reversal.

- Indicator Monitoring: Using tools like the Relative Strength Index (RSI) to see if Bitcoin is overbought or oversold, or tracking Moving Averages to confirm the direction of a trend.

- News Watching: Keeping one eye glued to real-time news feeds. A regulatory announcement or a shift in macroeconomic data can send prices swinging wildly in an instant.

- Trade Execution: Placing buy and sell orders with surgical precision, often using stop-loss and take-profit orders to manage risk automatically.

Getting a handle on these skills doesn't happen overnight; it takes serious screen time and practice. If you're looking to build a strong foundation, diving into educational resources is a smart move. For a structured path, the comprehensive guides at the vTrader Academy cover these core concepts in great detail. At the end of the day, successful trading is a skill built on a deep, practical understanding of how markets behave.

How to Use Bitcoin's Volatility to Your Advantage

In most investment circles, volatility is the boogeyman—a chaotic force everyone tries to avoid. But for a day trader, that very chaos is where the magic happens. It's the constant price movement, the daily ebb and flow, that carves out the small windows of opportunity for profit. You can't even begin to answer "can you day trade bitcoin" without first learning to harness this volatility.

Think of it like this: a surfer can’t do much on a glassy, flat ocean. But an ocean with steady, rolling waves? That's a playground. The Bitcoin market is that ocean, and its price swings are the waves a sharp day trader learns to ride. These movements, sparked by anything from a government announcement to a shift in the global economy, create the daily chances to buy low and sell high.

Unlike the sleepy, predictable tides of the stock market, the crypto world is a dynamic, high-energy environment. The real skill is learning to read the currents, not getting pulled under by them.

Reading the Market's Pulse

To turn that chaos into a calculated strategy, you have to know what makes Bitcoin’s price tick. Its notorious volatility isn't random; it's almost always a reaction to specific events. A smart trader keeps a close eye on these triggers, knowing they often signal a big move is just around the corner.

These catalysts typically fall into a few key buckets:

- Macroeconomic News: Big announcements on inflation, interest rates, or jobs data don't just shake up Wall Street—they send ripples straight through the crypto markets.

- Regulatory Updates: Any whisper of new government rules or crackdowns can trigger an immediate, sharp reaction in Bitcoin's price.

- Institutional Adoption: When a major corporation announces it's buying Bitcoin or will start accepting it for payments, it often kicks off a bullish rally.

- Technological Developments: Major upgrades to the Bitcoin network itself or breakthroughs in blockchain tech can sway trader sentiment and move the market.

For a day trader, volatility isn't a bug; it's a feature. The goal is not to predict the unpredictable but to react swiftly to the price action that volatility creates. This proactive mindset separates successful traders from those who are merely gambling.

Understanding Correlations and Market Behavior

Bitcoin doesn’t trade in a bubble. Its price often moves in step with other major financial assets, and spotting these relationships can give you a serious leg up. Historically, Bitcoin has shown clear correlations that traders use to fine-tune their strategies, and its price action has always been a perfect fit for the high-frequency nature of day trading.

While Bitcoin’s volatility has certainly settled down, dropping by about 60% from its 2021 highs, its average daily price swings of around 2.1% still dwarf traditional assets. This leaves plenty of room to make a profit within a single day.

Better yet, its statistical ties to other markets—like a +0.52 correlation with tech stocks and a -0.29 correlation with the U.S. dollar—give savvy traders clues for making macro plays or hedging their bets. You can dive deeper into Bitcoin's historical volatility and what drives it in this detailed OANDA analysis.

Navigating Crypto Regulations and Tax Rules

Let's get one thing straight: trading legally isn't optional. While the whole decentralized appeal of crypto is powerful, staying on the right side of the law is what protects your capital and keeps you in the game long-term. No one wants an unexpected headache from regulators down the line. It all starts with where you choose to trade.

Any exchange worth its salt operates under strict rules. They’re required to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, which means they’ll need to verify your identity. Yes, it can feel like a bit of a hurdle, but it’s there to stop shady activities and ultimately protects everyone on the platform.

Picking a regulated exchange is your first and best line of defense. It's a clear signal that the platform takes security and compliance seriously—something you absolutely want when your own money is involved.

The Impact of Evolving Regulations

For a long time, the crypto market felt like the Wild West. That era is quickly fading. Governments around the globe are finally setting clear rules, and frankly, it’s a huge positive for serious traders. Why? Because regulatory clarity builds stability and trust, which in turn attracts the big institutional players. That adds much-needed depth and liquidity to the market.

A regulated market is a more predictable and stable market. For day traders, this means better price discovery, tighter spreads, and increased trust, creating a more professional trading environment.

A perfect example was the landmark GENIUS Act, which became law on July 18, 2025. This move created real guardrails for digital assets, forcing stablecoins to be fully collateralized and bringing oversight under one roof. The market’s reaction was immediate—a surge of institutional confidence that helped push Bitcoin past $123,000. It just goes to show how clear rules can strengthen the entire ecosystem.

Understanding Your Tax Obligations

Beyond the platform itself, you've got to get a handle on your taxes. In most places, profits from day trading Bitcoin are considered a taxable event. Every single time you close a trade for a gain, you could be looking at capital gains tax.

This is where being a meticulous record-keeper pays off big time. You absolutely need to track:

- Date and Time of Each Trade: When you opened and closed the position.

- Cost Basis: The price you paid for your Bitcoin.

- Sale Price: What you sold it for.

- Profit or Loss: The simple math between your cost and sale price.

- Fees Paid: Transaction fees can often be deducted, so don't forget them.

Ignoring your tax obligations can bring serious penalties. Tax authorities are getting much smarter about tracking crypto transactions. Stay ahead of the curve by keeping an eye on updates, like the ATO's new audit approach to cryptocurrency. Keeping clean records isn't just good form; it’s an essential part of being a responsible trader.

Essential Risk Management For Day Traders

Here’s a hard truth about day trading: your success isn’t measured by how many trades you win. It's defined by how you handle the ones you inevitably lose. Losing trades are a simple fact of life in the market. The real skill is making sure no single bad trade can knock you out of the game for good.

Think of it like being the driver of a high-performance race car. Your trading strategy is the powerful engine that propels you forward, but your risk management is the brakes and the seatbelt. You need the engine to win, but you absolutely need the safety features to survive a crash. For anyone seriously asking "can you day trade bitcoin," mastering these rules isn't optional—it's everything.

The Non-Negotiable Rules Of Capital Protection

The first, and arguably most important, rule you need to burn into your brain is the 1% rule. The concept is simple: you never, ever risk more than 1% of your total trading capital on any single trade. If you're working with a $5,000 account, that means your maximum loss on one position is just $50.

This rule acts as your primary shield against emotional blunders and catastrophic losses. It forces discipline and ensures that even a frustrating string of losses won’t drain your account to zero.

To make this rule a reality, you need to use two fundamental order types on every trade:

- Stop-Loss Orders: This is your automated safety net. You set an order to automatically sell your Bitcoin if the price drops to a specific level, preventing a small, manageable loss from spiraling out of control.

- Take-Profit Orders: On the flip side, this order automatically sells your position once it hits your profit target. It's the mechanism that locks in your gains and stops greed from turning a solid win into a disappointing loss.

These aren't just helpful tools; they are the bedrock of disciplined trading. Using a platform with reliable order types is essential, and it’s always a good idea to know their specific execution policies. You can get a feel for this by reviewing documents like the vTrader refund policy, which details how a platform handles different order scenarios.

A trader without a stop-loss is like a trapeze artist without a net. You might get away with it for a while, but one mistake can end your career. Sticking to your plan is everything.

Mastering Your Trading Psychology

Beyond the numbers and orders, you have to contend with your biggest adversary: your own mind. Fear and greed are the two emotions that wreck more trading accounts than anything else, leading to impulsive decisions that almost always end in regret.

One of the most destructive habits this leads to is revenge trading—the urge to jump right back into the market after a loss to "win your money back." This is a guaranteed recipe for disaster because you're trading from a place of anger and frustration, not cool-headed analysis.

The only way to sidestep this trap is by sticking to your predefined strategy, no matter what. To go deeper on this, it's worth exploring proven day trading risk management strategies. Lasting success in this game is built on discipline, not gut feelings.

Choosing the Right Platform for Fast-Paced Trading

When you're asking, “can you day trade bitcoin,” the platform you use is every bit as important as the strategy you follow. It's like a Formula 1 driver picking their car—speed, reliability, and cost are everything. Your trading platform is your core tool, and the right one can give you a serious edge in a market that doesn't wait for anyone.

The first thing you need is low-latency execution. This simply means your trades get processed almost instantly. Without it, you’ll fall victim to slippage—that maddening gap between the price you clicked and the price you actually got. In a market as wild as crypto, a tiny delay can flip a winning trade on its head.

Just as critical is deep liquidity. A platform with high trading volume means there are always buyers and sellers waiting in the wings. This lets you jump in and out of positions smoothly, even with large orders, without your own trade sending prices haywire.

Evaluating Features and Fees

Beyond raw speed and liquidity, a platform’s tools and fee structure can make or break you. Professional charting tools packed with a full suite of technical indicators are completely non-negotiable for any serious trader. You have to be able to spot patterns and trends on the fly.

But even the most advanced tools won't help if high fees are constantly siphoning off your profits. For a day trader who might execute dozens of trades in a single session, these costs stack up alarmingly fast.

A day trading strategy is a game of inches, built on small, consistent gains. A platform with high fees is like a constant tax on your every move, making it incredibly difficult to stay ahead over the long haul.

This is exactly why finding a platform with a friendly fee model is a must. Some exchanges, for example, offer zero-fee or low-commission models specifically for active traders. It’s always smart to comb through a platform's entire fee schedule to uncover any hidden costs. You can learn more about how a competitive fee structure directly impacts your bottom line.

Finally, don't ever cut corners on security. Make sure the platform uses industry-standard protections like two-factor authentication (2FA) and keeps the bulk of user funds in cold storage (which is completely offline). Your trading environment needs to be both powerful and bulletproof to protect your capital.

Common Questions About Day Trading Bitcoin

Once you get the hang of the basics, a few practical questions almost always pop up. Answering "can you day trade bitcoin" is one thing, but figuring out the real-world logistics is where the rubber meets the road. Let's tackle some of the most common queries to give you a clearer picture of what this journey actually involves.

This isn’t about hypotheticals; it’s about the nitty-gritty details. Getting these points straight will help you set realistic expectations and start your trading career with a much clearer head.

How Much Money Do You Need to Start Day Trading Bitcoin?

There’s no official minimum capital requirement, but let's be practical. While some platforms might let you start with just $10, you can't do much with that. You need enough of a bankroll to place trades that matter and to handle transaction fees without them wiping out your position.

A good rule of thumb is to start with an amount you are completely okay with losing—many experienced traders suggest a float between $500 and $1,000. This amount is enough to let you practice proper risk management, like the 1% rule (risking only $5–$10 per trade), while still opening positions large enough to be worthwhile. The key is to start small, learn the ropes, and only inject more capital once you’ve found some consistency.

What Are the Best Times to Day Trade Bitcoin?

The Bitcoin market never closes, but that doesn't mean every hour is prime time for a day trader. The real action—the juice, the volatility, and the volume—tends to spike during the overlap of major global market sessions. The sweet spot is often when the London and New York sessions cross over, which is roughly from 8:00 AM to 12:00 PM EST.

During these peak hours, you have a massive influx of traders from two of the world's biggest financial hubs. This creates bigger price swings and, therefore, more opportunities. But remember, major news or economic data can ignite volatility at any time, day or night.

Is Day Trading Bitcoin Better Than Holding It?

That’s like asking if sprinting is better than running a marathon. Neither is "better"—they're just completely different games with different goals. Holding, or "HODLing," is a passive, long-term play. It's built on the belief that Bitcoin's fundamental value will climb significantly over months or years.

Day trading is the total opposite. It's an active, high-intensity strategy focused on profiting from the daily price static, regardless of where Bitcoin is headed in the long run. It requires your full attention, a sharp eye for technical analysis, and rock-solid risk management. While day trading can offer quicker returns, it also brings a whole lot more risk and stress to the table. For more answers to common questions, you can dive into the extensive vTrader FAQ section for detailed information on a wide range of topics.

Ready to put your knowledge into action on a platform designed for success? vTrader offers zero-fee trading on Bitcoin and over 30 other cryptocurrencies, empowering you with advanced tools and a secure environment. Start trading with vTrader today and keep more of your profits.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.