When it comes to buying your first crypto, or even just adding to your stack, your bank account is hands-down the most direct, secure, and wallet-friendly way to get it done. It cuts out the middlemen and their hefty fees, especially the ones that credit card companies love to charge. Best of all, platforms like vTrader let you make zero-fee purchases this way, so every dollar you invest goes straight into your portfolio.

Why Your Bank Account Is Your Best Bet for Buying Crypto

Let’s cut right to the chase. You could use a credit card or a digital wallet, sure. But those options almost always come with nasty transaction fees that take a bite out of your investment before you even start.

Using your bank account, typically through an Automated Clearing House (ACH) transfer, is the industry standard for a reason. It’s a clean, direct bridge from your traditional bank to the crypto market. This method is built on decades of established financial security protocols, and it’s the one that regulated exchanges prefer. Why? It helps them meet strict anti-money laundering (AML) and Know Your Customer (KYC) rules, which ultimately makes the entire ecosystem safer for everyone. You can dig into vTrader’s dedication to building a secure platform over in our about us section.

The Financial Edge

The number one reason to use your bank account is simple: you save money.

Credit card companies often treat crypto purchases as "cash advances." This sneaky classification means you get hit with fees of 3-5% right off the bat, and that’s before the exchange adds its own charges. In stark contrast, ACH transfers on platforms like vTrader are completely free. Put $1,000 in, and the full $1,000 goes toward buying crypto. No slicing and dicing from fees.

This isn’t some niche trick; it’s how most people are entering the market now. The numbers are staggering. In a single year, between July 2024 and June 2025, bank account-funded purchases on major exchanges exploded, with the United States alone racking up over $4.2 trillion in crypto buys. For more on this global trend, the full Chainalysis report has some fascinating insights.

Crypto Payment Method Showdown

Here’s a quick comparison of common payment methods, highlighting why a bank account is often the superior choice for buying crypto.

| Payment Method | Typical Fee Range | Transaction Speed | Security & Reliability |

|---|---|---|---|

| Bank Account (ACH) | 0% – 1% | 1-5 Business Days | High – established banking rails, less likely to fail. |

| Credit Card | 3% – 5%+ | Instant | Medium – often flagged by fraud systems, high fees. |

| Debit Card | 2% – 4% | Instant | Medium – higher fees than ACH, fewer fraud flags than credit. |

| Wire Transfer | $20 – $30 Flat Fee | Same Day | High – reliable but expensive for smaller purchases. |

As you can see, for routine buys, nothing beats the cost-effectiveness and reliability of a direct bank link.

Reliability and Higher Limits

Another big win for bank transfers is reliability. Credit card transactions can be a roll of the dice; they’re often flagged as suspicious by aggressive fraud detection systems, leading to frustrating declines. Bank transfers? They just work.

On top of that, exchanges reward you for this more secure connection by offering much higher purchasing limits for verified bank accounts compared to other methods.

By linking your bank account, you're not just picking a payment option; you’re building a secure and sustainable on-ramp for your entire crypto journey. It's the most efficient way to turn your cash into digital assets.

Ultimately, funding your crypto buys from your bank account is the move for any serious investor. It’s a clear signal that you’re focused on building your portfolio the smart way—without letting unnecessary fees chip away at your progress.

Getting Your Accounts Ready for a Secure Connection

Before you can buy crypto with your bank account, a little bit of prep work will make everything go much smoother. Think of it less like a chore and more like laying down a solid, secure foundation for your investments.

First things first, you need to pick the right platform. The most critical move is choosing a reputable and regulated exchange like vTrader that actually takes compliance and user protection seriously. This isn't just about hunting for the lowest fees; it's about trusting a platform that plays by the rules with your hard-earned money.

Regulated exchanges are held to strict security and identity verification protocols. This brings us to a term you'll see a lot: KYC, or "Know Your Customer." It might sound like a bit of technical jargon, but it's a crucial security layer designed to protect both you and the platform from any fraudulent activity. It’s really just the digital version of a bank asking for your ID to open an account—a standard, necessary step for financial security these days.

Setting Up Your Secure Profile

Jumping through the KYC hoops is usually pretty straightforward. You'll typically need to have a government-issued photo ID handy, like a driver's license or passport. My advice? Get clear digital copies of these documents ready to go before you even start. It will make the sign-up process fly by.

Platforms use this info to confirm you are who you say you are, which is a cornerstone of preventing financial crime. If you're curious about the specifics of how your data is handled, you can always check out the vTrader privacy policy.

The next step is an absolute non-negotiable in my book: enabling two-factor authentication (2FA). This single action adds an incredibly powerful layer of defense to your account. It requires a second verification code, usually from an app on your phone, on top of your password. It’s worth noting that in 2024 alone, account takeover attempts in the financial world shot up by over 60%, which makes 2FA more essential than ever.

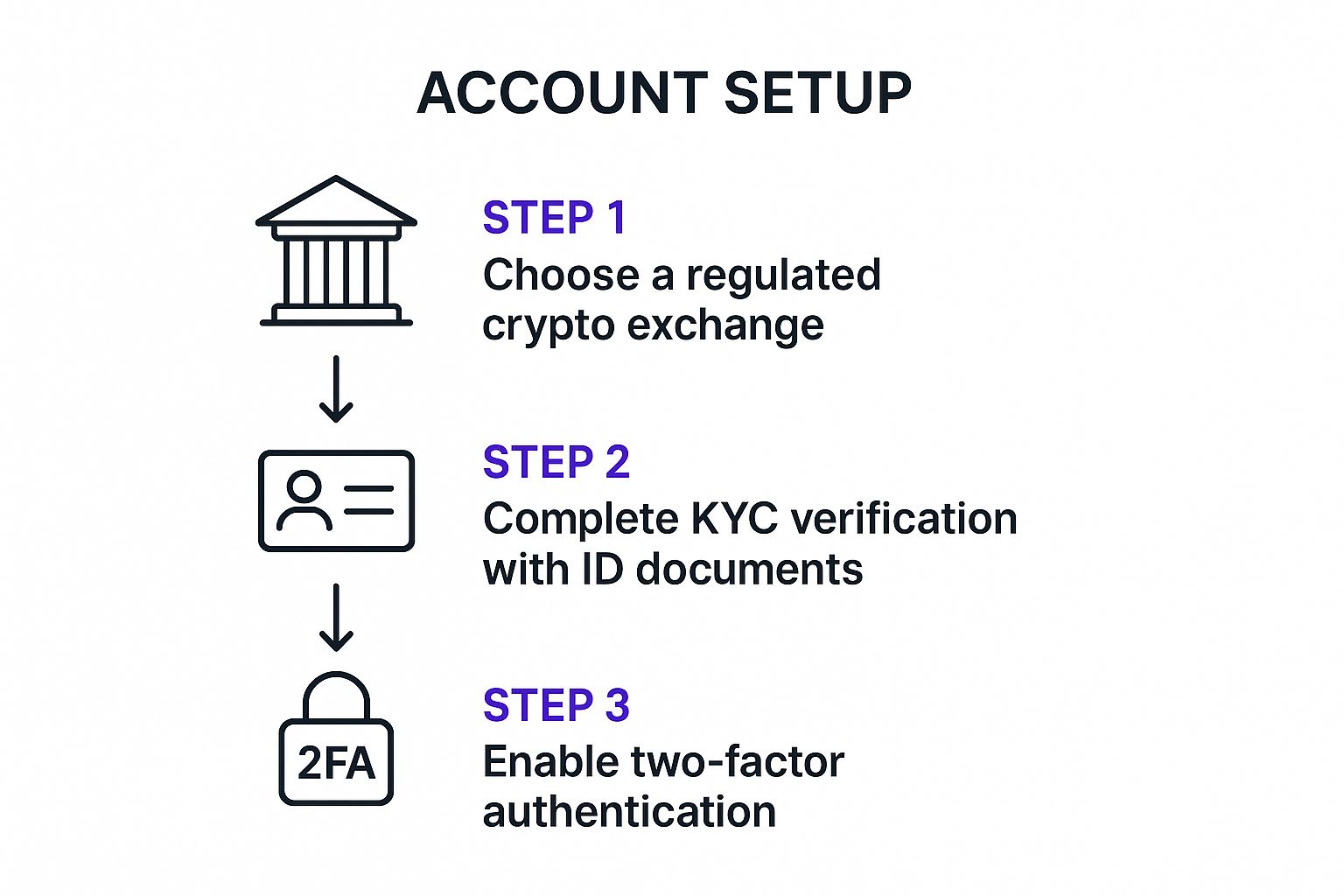

This infographic breaks down just how simple this whole setup process really is.

As you can see, securing your account is a clear, direct path that puts you in the driver's seat from the very beginning.

Taking these few preparatory steps—choosing a regulated platform, completing KYC, and activating 2FA—ensures your entry into the crypto market is not just easy, but fundamentally secure from day one.

Getting this prep work done upfront transforms what could be a confusing process into a simple one. It means that when you're ready to link your bank and make that first purchase, you can do it with total confidence, knowing your account is properly fortified. You're not just opening an account; you're building a secure financial hub for your digital assets.

Linking Your Bank Account Step by Step

Alright, with your crypto exchange account set up and secured, it's time for the main event: connecting your bank account. This is the bridge that turns your account from a crypto watchlist into a full-fledged trading hub. We'll walk through the process on vTrader to show you just how simple it is.

The whole point here is to forge a secure, encrypted link between your bank and the exchange. Reputable platforms don't want the liability of storing your sensitive bank login details. Instead, they use trusted services like Plaid, which acts as a secure middleman. It's the same tech powering major fintech apps, so you know it's solid.

Navigating to Payment Settings

First things first, you need to find where to add a new payment method. On most platforms, vTrader included, this is usually tucked away in your account settings or profile section.

Be on the lookout for menu options like:

- Payment Methods

- Linked Accounts

- Funding Sources

- Add a Bank

Once you find the right spot and click through, you'll see a button to "Add a New Payment Method" or "Link Bank Account." That's your starting line.

Here’s a glimpse of what the initial screen on vTrader looks like when you're ready to get started.

As you can see, the interface is clean and gets straight to the point, asking you to pick your bank to kick off the secure linking process.

Choosing Your Verification Method

This is where you have a key decision to make. Exchanges typically give you two ways to verify your bank account, and each has its own trade-offs between speed and personal comfort.

The method you choose—instant or manual—is entirely up to you. Both are secure, but one gets you trading in minutes while the other takes a few days. Think about how quickly you want to jump in when making your choice.

Let's break down the two main options you'll almost always encounter.

Option 1: Instant Verification via Plaid

This is the fast lane, and it's by far the most common method. When you select your bank from the list, a secure Plaid window will pop up. You’ll simply enter the same username and password you use for your online banking.

Plaid uses these credentials to make a one-time, encrypted connection, confirm your account details, and prove you're the owner. It’s crucial to know that your login info is never shared with or stored by vTrader. The whole thing usually takes less than a minute. For a deeper dive into financial security topics, the vTrader Academy offers some fantastic resources.

Option 2: Manual Verification with Micro-Deposits

If you're not entirely comfortable typing in your bank login, there's always the manual route. This method is a bit old-school but just as effective. You'll start by providing your bank's routing number and your account number.

Over the next 1-3 business days, the exchange will send two tiny deposits (we're talking a few cents each) to your account. Once you see these "micro-deposits" pop up on your bank statement, you’ll log back into the exchange and enter the exact amounts to prove you own the account. It's definitely slower, but it’s a time-tested alternative.

| Verification Method | Speed | Process | Best For |

|---|---|---|---|

| Instant (Plaid) | Under 1 minute | Log in with online banking credentials in a secure pop-up. | Users who want to start trading immediately. |

| Manual (Micro-Deposits) | 1-3 Business Days | Enter routing/account numbers and verify two small deposits. | Users who prefer not to share login credentials. |

Once your bank is linked and verified, you're officially good to go. Your traditional financial world is now connected to the crypto ecosystem, allowing you to easily buy crypto with your bank account whenever you spot an opportunity. Now, let's get to the exciting part: making that first purchase.

Making Your First Crypto Purchase Like a Pro

Alright, your bank account is linked and ready to go. You're now officially at the threshold of the crypto market, and this is where the real action begins. Making that first purchase might feel like a big step, but the platform is built to make it simple.

Getting started is as easy as finding the "Buy/Sell" area, picking the crypto you've been eyeing, and deciding how much you want to invest. The most important part is just making sure your newly linked bank account is selected as the funding source.

A Real-World Purchase Scenario

Let's walk through it with a real example to see how it plays out. Say you’ve done your research and want to put $100 into Ethereum (ETH), a cornerstone of the digital asset world.

Here’s what that looks like on the vTrader purchase screen:

- You'd first select Ethereum (ETH) from the dropdown of available assets.

- Next, you'll enter "$100" into the purchase amount field.

- Finally, choose your linked bank account as the payment method.

Before you commit, the platform will show you a final confirmation screen. Think of this as your last-chance checkpoint. It’s crucial to give it a quick once-over. This screen is your best friend, laying out every detail of the transaction so there are no surprises.

Decoding the Confirmation Screen

This confirmation page is all about transparency. Take a second to scan it and make sure everything lines up with what you intended.

You'll see a clear breakdown of the trade:

- Asset: It will confirm you're buying Ethereum, not something else by mistake.

- Amount Paid: This shows the exact cash amount coming from your bank—in our case, $100.00.

- Price Per Coin: You'll see the market price for one ETH at that precise moment.

- Quantity: This shows the exact fraction of an ETH your $100 is buying.

- Fee: And here's the best part. When you buy crypto with a bank account on vTrader, this line should read $0.00.

Seeing that zero-dollar fee is a huge win. Other platforms and payment methods often skim a little off the top, but a direct bank transfer on vTrader means every single penny of your investment goes into your chosen crypto. You can see our full, straightforward pricing on the official vTrader fee schedule.

Always review the confirmation screen. It’s the final step that guarantees you know the price, the exact amount of crypto you're getting, and—most importantly—that you're not paying any hidden fees.

Once you’ve verified all the details and are happy with the numbers, go ahead and hit confirm. The trade executes immediately at that locked-in price. You’ll then get an estimate for when the ETH is fully settled in your wallet, which usually aligns with standard bank transfer times.

And just like that, you've made your first crypto purchase. Simple, fee-free, and smart.

Making Sense of the Modern Crypto World

Before you jump in, it helps to understand the bigger picture. Knowing the lay of the land will make you a smarter, more confident investor. When you buy crypto with a bank account today, you're not just dipping your toes into some obscure market anymore—you're connecting to a global financial system that's maturing at an incredible pace.

This isn't the Wild West of a few years ago. Things have changed. A lot. The rules and technology have caught up, making direct bank-to-exchange transfers safer and more common than ever. A big part of this shift comes from clearer regulations in places like the U.S. and the EU, which now have rules for everything from exchange licensing to anti-money laundering. You can actually dive deep into these trends in this insightful McKinsey report on global payments.

This growing regulatory framework acts as a much-needed safety net for investors like you, pushing platforms to be more transparent and secure.

How Stablecoins Connect the Old and New Money

A huge piece of the puzzle has been the rise of stablecoins like USDC and USDT. Think of them as the perfect bridge between traditional money and crypto. These digital assets are pegged to real-world currencies (usually the U.S. dollar), which keeps their value, well, stable.

Stablecoins are the grease in the gears of the digital economy. They provide the liquidity and stability that crypto markets need to run smoothly, letting traders move between volatile assets without having to cash out to dollars or euros every single time. It just makes the whole system more fluid.

The fact that we have a growing, regulated market for stablecoins is a massive signal. It shows the financial world is building permanent, reliable bridges to digital assets. This legitimizes the entire space and makes your linked bank account a direct on-ramp to a more stable crypto ecosystem.

Why This All Matters for Your Investment Plan

So, what does this all mean for you and your money? It means connecting your bank account to a regulated exchange like vTrader isn't some fringe gamble anymore. It's a strategic move, backed by a solid legal and tech foundation.

This new reality gives you a few key advantages:

- Better Security: Clear rules force exchanges to step up their game on security, which means better protection for your funds and personal data.

- More Confidence: It’s easier to invest with peace of mind when you know governments and major financial players are establishing rules for the road.

- Long-Term Potential: The tight integration with traditional finance is a clear sign that crypto is here for the long haul, making it a more credible part of a long-term investment strategy.

By getting a handle on these forces, you're not just another person buying crypto. You're an informed investor who sees that linking your bank account is part of a much bigger, positive shift toward a more connected and secure financial future.

Common Questions About Buying Crypto with Your Bank

Deciding to jump in and buy crypto with your bank account usually brings up a few last-minute questions. It’s smart to be curious—especially when your money and the timing of your trades are on the line. Let’s tackle some of the most common concerns head-on.

One of the biggest questions I hear is about speed. How long does it really take for a bank transfer to go through? While a standard ACH transfer can take a few business days to fully settle in the background, this waiting period often doesn't actually slow you down.

Platforms like vTrader give you instant trading access, meaning you can buy assets the moment you confirm the deposit. You just can’t withdraw the crypto to an external wallet until the bank transfer officially clears. It’s a great balance, letting you act on market moves without delay.

Is It Safe and What if Something Fails?

Another big one is security. You’re right to be cautious about entering your bank login details anywhere. The good news is that reputable exchanges never handle those credentials directly. Instead, they use trusted third-party services like Plaid, which creates a secure, encrypted link.

Plaid acts as a secure go-between, confirming you own the account without ever sharing your actual login information with the exchange. It's the industry standard for a reason. For more on this, our comprehensive FAQ page covers many common security questions.

But what if a transfer gets declined? This almost always comes down to a simple issue, like insufficient funds or a typo in your account details. When that happens, the transaction is just canceled. If you were allowed to trade instantly, the platform might reverse those trades or place a temporary hold on your account until the funds are successfully redeposited.

The speed of these transactions is constantly improving. While traditional international bank networks like SWIFT see 89% of payments reach the destination bank within an hour, the final settlement can still lag. This has led to a major push toward real-time payment systems to make on-ramping even faster. Learn more about how blockchain is changing cross-border payments.

Ultimately, the entire process is designed with safeguards to protect both you and the platform, ensuring that even minor hiccups are handled smoothly and transparently.

Ready to make your first move with confidence? Join vTrader today and experience zero-fee crypto purchases when you use your bank account. Get started in minutes at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.