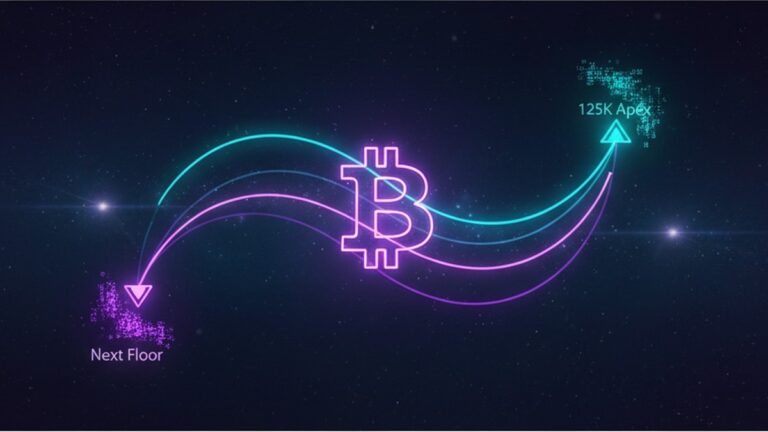

Bitcoin has once again captured the attention of investors and traders worldwide, reaching a staggering all-time high of $125,000 before experiencing a swift correction. In the volatile world of cryptocurrency, such fluctuations are not unusual, but they do prompt significant discussion and speculation about what could happen next. As the digital currency retraces, market participants are keenly analyzing where Bitcoin’s price might find its next support.

A Rollercoaster Ride for Bitcoin

Just days ago, Bitcoin soared to unprecedented heights, with traders and analysts celebrating its new all-time high. However, as quickly as it climbed, Bitcoin tumbled by more than $2,000, leaving many to question where this rollercoaster ride will bottom out. The correction, while sudden, is not entirely unexpected given Bitcoin’s historic volatility.

Bitcoin’s drop has reignited conversations about market corrections and the psychological barriers that often drive them. The $125,000 mark was a significant milestone, but it also represented a psychological ceiling for many investors. The subsequent correction could be viewed as a natural market response, allowing traders to consolidate gains and reassess their positions.

Market Speculation and Support Levels

In the wake of this correction, traders and analysts are busy mapping potential support zones where Bitcoin might stabilize. Some experts suggest that the $120,000 mark could serve as a strong psychological support, given its proximity to the recent peak. Others argue that a deeper retracement could test the $115,000 or even $110,000 levels, which have historically acted as solid support zones during previous corrections.

Traders are also keeping a close eye on technical indicators, such as moving averages and Relative Strength Index (RSI), to gauge the market’s health. A convergence of these indicators around key price levels could offer clues about where Bitcoin might find its footing.

The Broader Market Context

This correction comes amid a backdrop of broader economic factors that could influence Bitcoin’s next move. Global inflation concerns, fluctuating interest rates, and geopolitical tensions are all playing a role in shaping investor sentiment. Bitcoin’s appeal as a hedge against these uncertainties continues to attract both retail and institutional investors, but it also adds layers of complexity to price predictions.

Moreover, regulatory developments worldwide are impacting the crypto landscape. Recent discussions around potential regulations in the United States and Europe have injected a degree of caution among traders. How these regulations unfold could either bolster Bitcoin’s legitimacy or introduce new hurdles for the cryptocurrency market.

Investor Sentiment and Long-Term Outlook

Despite the recent price drop, the long-term outlook for Bitcoin remains optimistic for many in the crypto community. Enthusiasts argue that Bitcoin’s fundamentals—such as its finite supply and increasing adoption—support a bullish trajectory in the long run. Additionally, the ongoing interest from institutional investors, such as major hedge funds and publicly traded companies, underscores the growing acceptance of Bitcoin as a legitimate asset class.

However, there are also voices of caution. Skeptics warn that Bitcoin’s price volatility could deter potential investors and hinder its adoption as a mainstream currency. They argue that until Bitcoin can achieve greater stability, it will remain a speculative asset rather than a stable store of value.

Navigating the Path Ahead

As Bitcoin navigates this correction, traders and investors are left with the challenging task of distinguishing between short-term noise and long-term trends. The key may lie in a balanced approach, where investors remain informed about market developments while maintaining a clear perspective on their investment goals.

In the coming weeks, the cryptocurrency community will be watching closely to see how Bitcoin responds to this correction. Will it find support and resume its upward trajectory, or will further retracements be in store? Only time will tell, but one thing is certain: Bitcoin’s journey is far from over, and its next moves are likely to be as captivating as ever.

In conclusion, as Bitcoin corrects from its all-time high, the market is rife with speculation about its next steps. Whether this correction is a mere blip on the radar or a precursor to further volatility, Bitcoin’s status as a leading cryptocurrency remains unchallenged. For now, traders and investors alike will continue to monitor market dynamics, poised to seize opportunities in this ever-evolving digital landscape.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.