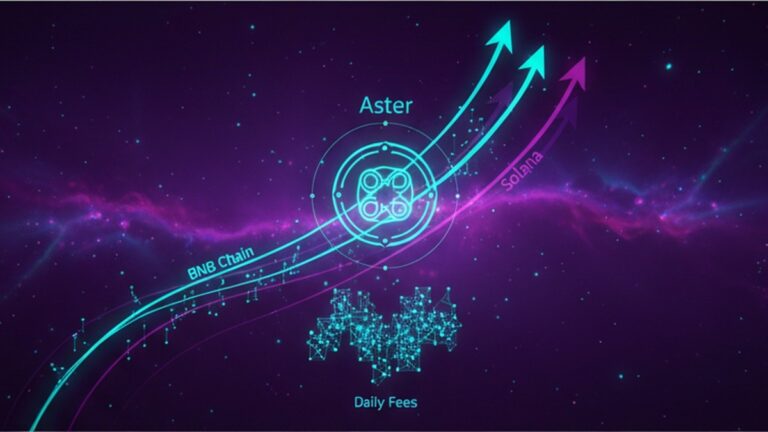

The cryptocurrency landscape witnessed a significant shift as BNB Chain surpassed Solana in daily transaction fees, reaching a remarkable $1.4 million. This surge was predominantly driven by the launch of Aster, a decentralized exchange (DEX) that has quickly gained traction among traders and investors. As the competition among blockchain networks intensifies, the implications of this development are both intriguing and multifaceted.

Behind the Surge: Aster’s Influence

The catalyst for BNB Chain’s recent success is none other than Aster, a new player in the DEX arena that has captivated the crypto community. With its user-friendly interface and innovative features, Aster has attracted a substantial number of users, leading to increased activity on the BNB Chain. This influx of transactions has resulted in higher fees, propelling BNB Chain to surpass Solana, which had long held a strong position in the market.

Aster’s appeal lies in its ability to offer fast, secure, and cost-effective trading. Users have reported seamless experiences, noting the platform’s robust infrastructure and commitment to security. This has not only enhanced user confidence but also drawn in traders who were previously hesitant to engage with decentralized exchanges due to concerns about security and user experience.

Solana’s Response: A Race to Innovate

While BNB Chain celebrates its victory, Solana isn’t resting on its laurels. Known for its high-speed transactions and low fees, Solana has been a favorite among developers and users alike. However, the recent developments have prompted Solana to accelerate its innovation efforts.

In response to BNB Chain’s surge, Solana is reportedly working on enhancements to its network to improve scalability and efficiency. The blockchain is also exploring partnerships and collaborations to expand its ecosystem and offer more diverse services to its users. Solana’s commitment to innovation signals its determination to regain its competitive edge and maintain its relevance in the rapidly evolving crypto space.

Market Reactions: Diverse Perspectives

The crypto community’s reaction to BNB Chain’s rise has been mixed. Supporters of BNB Chain have lauded the network’s ability to attract significant transaction volume, viewing it as a testament to its growing influence in the industry. They argue that the increased fees reflect a healthy and vibrant ecosystem, driven by genuine demand and user engagement.

On the other hand, critics have raised concerns about the sustainability of this growth. Some skeptics question whether the surge in fees is sustainable over the long term, cautioning that rapid increases might deter users if transaction costs become prohibitive. Additionally, there are concerns about network congestion, which could impact user experience if not addressed promptly.

Implications for the Future: A Shifting Landscape

The recent developments highlight the dynamic nature of the cryptocurrency industry, where innovation and competition drive progress. For BNB Chain, the challenge lies in maintaining its momentum and ensuring that its infrastructure can support the increased activity. This will require ongoing investments in technology and partnerships to bolster its position in the market.

For Solana, the focus will be on regaining its footing by enhancing its offerings and addressing any limitations that may have contributed to its recent slip. This might involve strategic collaborations, technological advancements, and a renewed focus on user engagement.

The Role of Decentralized Exchanges: A Growing Trend

The rise of Aster and its impact on BNB Chain underscores the growing importance of decentralized exchanges in the crypto ecosystem. As users seek more control over their assets and transactions, DEXs have emerged as a popular alternative to traditional exchanges. Their ability to offer greater transparency and security has resonated with a segment of the market that values these attributes.

The success of Aster could inspire other blockchain networks to invest in developing or supporting decentralized exchanges, further intensifying competition in this space. As the market continues to evolve, it’s likely that we will see more innovative solutions aimed at enhancing user experience and expanding the reach of blockchain technology.

Conclusion: Navigating a Competitive Landscape

As BNB Chain basks in the success of its recent surge, the broader cryptocurrency market is reminded of the relentless pace of innovation and competition. The ongoing battle for dominance among blockchain networks drives technological advancements and shapes the future of the industry. Both BNB Chain and Solana find themselves at pivotal moments, navigating challenges and opportunities in a landscape that is as unpredictable as it is exciting.

In this ever-changing environment, the ability to adapt and innovate will be key to sustaining success. Whether BNB Chain can maintain its lead or Solana can stage a comeback remains to be seen. What is certain, however, is that the crypto world will be watching closely, eager to see how this story unfolds.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.