What Bitcoin Actually Is (And Why It Matters to You)

Forget the confusing headlines for a moment. At its heart, Bitcoin is a form of digital money that lets you send value to anyone, anywhere in the world, without needing a bank to give the okay. A great way to think about it is like email, but for money. Just as email lets you send a message directly to someone else without a post office, Bitcoin allows for direct, person-to-person financial transfers. It was first described in 2008 by a mysterious figure known only as Satoshi Nakamoto, who imagined a new kind of financial network.

This network runs on a technology called a blockchain, which is essentially a global, public receipt book. Every single Bitcoin transaction is recorded on this digital ledger, which is then copied and distributed across thousands of computers. This structure makes the system remarkably transparent and secure because no single person or company can change the records without everyone else knowing. It’s a system that relies on shared agreement rather than the authority of a central institution.

You can learn more by visiting the official homepage for Bitcoin, which offers a simple starting point for its core ideas.

As the screenshot shows, Bitcoin's key features—fast peer-to-peer payments, low fees, and worldwide reach—all support the goal of a financial network that works for everyone.

Why Is This a Big Deal?

This idea is significant because it offers solutions to real-world problems in traditional finance. Unlike government-issued currencies such as the U.S. Dollar or the Euro, Bitcoin has a hard cap—there will only ever be 21 million bitcoins in existence. This built-in scarcity is a primary reason many people consider it "digital gold," a possible shield against the inflation that can erode the value of standard money over time.

This isn't just a fascination for tech geeks anymore. Bitcoin's use has grown quickly around the world. As of early 2025, it's estimated that more than 500 million people globally own some cryptocurrency, with Bitcoin leading the pack. This growth is driven by people looking for alternatives to high international transfer fees, protection from economic uncertainty, and more direct control over their assets.

Bitcoin in the Real World

So, what does this mean in practical terms? Picture sending money to a relative in another country. A standard bank wire can take days to process and comes with a significant fee. With Bitcoin, that same transaction can be done in minutes for a much lower cost, at any time, on any day of the week. Here are a few key benefits:

- Financial Control: You are the true owner of your Bitcoin. No bank can freeze your account or stop a transaction you want to make.

- Lower Fees: For many transfers, especially international ones, Bitcoin is far cheaper than old-school banking services.

- Accessibility: Anyone with an internet connection can use Bitcoin, bringing financial tools to billions who are excluded from the traditional banking system.

As you continue through this guide, you will likely have more questions about how everything works. This technology presents a powerful new way to think about and handle money.

How Bitcoin Works (Explained Like You're Five)

If you've ever wondered how digital money can work without a bank or government in charge, you've stumbled upon the most fascinating part of Bitcoin. The secret is a clever technology that operates behind the scenes. This guide will break down the core ideas of how Bitcoin functions into simple, easy-to-grasp concepts. At its heart, Bitcoin runs on a system that is transparent, secure, and needs no central authority.

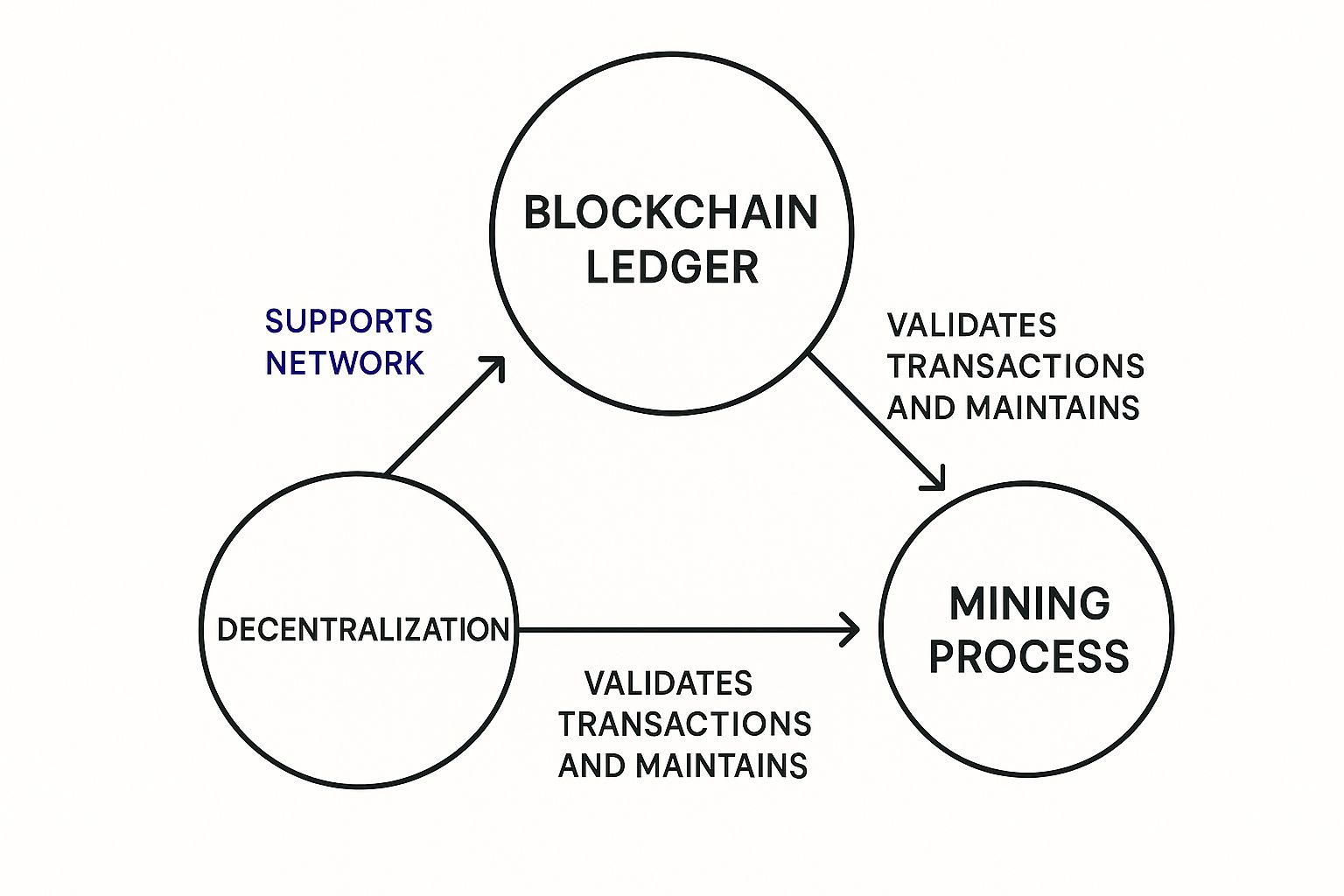

This system is built on three key pillars that work together: a public ledger called the blockchain, a global competition known as mining, and a decentralized network. The following infographic shows how these elements are connected.

The graphic illustrates how mining validates transactions, which are then permanently recorded on the blockchain ledger, all of which reinforces the decentralized structure of the network.

The Blockchain: A Global Public Notebook

Imagine a special kind of notebook where every time someone sends or receives Bitcoin, the details are written on a new page. Now, picture that notebook being instantly photocopied and sent to thousands of computers worldwide. This is the core idea behind the blockchain—a digital record book shared publicly across the entire Bitcoin network.

Because everyone on the network has a copy, the system is incredibly transparent and secure. No one can secretly alter a past transaction because their version of the notebook would no longer match everyone else's. This prevents fraud and makes every entry permanent. If you'd like to learn more about the mechanics, you can discover more about the underlying blockchain technology and its unique design.

Before we dive deeper, let's compare how this new system stacks up against the traditional banking you're already familiar with. The table below highlights the key differences.

| Feature | Traditional Banking | Bitcoin |

|---|---|---|

| Control | Centralized (controlled by banks and governments). | Decentralized (no single entity is in charge). |

| Transaction Fees | Often high, especially for international transfers. | Generally lower, determined by network demand. |

| Transaction Speed | Can take several business days, especially for cross-border payments. | Transactions are confirmed in minutes, 24/7. |

| Accessibility | Requires a bank account and can be exclusive. | Open to anyone with an internet connection, no permission needed. |

| Transparency | Private; only the bank and parties involved see the transaction. | Public; all transactions are visible on the blockchain (though identities are pseudonymous). |

This table clearly shows that Bitcoin offers a fundamentally different approach to managing money, prioritizing user control and global access over institutional oversight.

How a Transaction Happens

Sending Bitcoin feels a bit like sending a special kind of email that can't be copied, faked, or taken back once it's sent. Here is a simple breakdown of the steps involved:

- You Start the Transaction: Using your digital wallet (think of it as your Bitcoin account), you decide how much Bitcoin to send and specify the recipient's address.

- You Sign It Digitally: To prove the Bitcoin is truly yours, you use a private key—a secret password only you should ever know—to digitally "sign" the transaction. This signature is unique every single time.

- It's Broadcast to the Network: Your signed transaction is sent out to the global network of computers running the Bitcoin software.

- Miners Get to Work: Specialized computers, known as "miners," pick up your transaction and check that you have enough Bitcoin to send it.

This process brings us to the final piece of the puzzle: how transactions are confirmed and officially added to the blockchain.

Mining: A Global Puzzle Competition

Bitcoin mining is the process that keeps the entire network honest and secure. You can think of it as a massive, worldwide puzzle competition that runs nonstop, every single day. Computers all over the globe race against each other to solve an incredibly difficult math problem.

The first computer to solve the puzzle earns the right to do two important things:

- They get to verify the latest batch of transactions (including yours) and add them as a new "block" to the blockchain.

- As a reward for their work and the electricity they used, they receive a certain amount of brand-new Bitcoin plus the transaction fees from that block.

This competitive race is designed so that a new block is added to the chain roughly every 10 minutes. It is this constant cycle of transactions, verification, and puzzle-solving that keeps the Bitcoin network running smoothly and securely, all without any single person or company in control.

Real Benefits That Actually Matter to Regular People

It’s easy to get lost in the technical jargon, but the true power of Bitcoin lies in how it addresses everyday problems that traditional finance often overlooks. Let's cut through the noise and look at the practical advantages making a real difference in people's lives. These aren't just abstract ideas; they are concrete benefits that show why a bitcoin for dummies guide is so valuable for newcomers.

Financial Freedom and Lower Costs

One of the most powerful benefits is sending money across borders cheaply and quickly. Imagine you need to transfer funds to family living abroad. A standard wire transfer comes with high fees, poor exchange rates, and can take days to clear. With Bitcoin, you can send value directly to anyone, anywhere in the world, 24/7, including holidays. Transactions often settle in minutes, with fees that can be much lower than what banks typically charge.

This system gives you full control. Your Bitcoin is yours and yours alone, secured by your private key. Unlike a bank account, it can't be frozen or seized by a third party without your approval. This financial sovereignty is a core principle of Bitcoin, offering you complete authority over your assets. You don't need anyone's permission to use your money—you just use it.

A Shield Against Economic Instability

In many places around the world, people struggle with high inflation, where their local currency rapidly loses value. This constant erosion of wealth can erase a lifetime of savings. For them, Bitcoin can serve as a financial shield. Because there will only ever be 21 million bitcoins, its supply is fixed and cannot be changed by governments printing more money.

This key feature makes it a potential hedge against inflation, much like digital gold. People using Bitcoin for this reason have driven its adoption, especially in regions with economic turbulence. You can learn more about Bitcoin's global adoption on Cointelegraph to see how countries across Asia, Latin America, and Africa are seeing strong growth in grassroots usage as people seek to protect their financial future.

Empowering the Unbanked and Protecting Privacy

Another important benefit is Bitcoin's role in financial inclusion. Globally, more than a billion adults lack access to a bank account. However, many of them own a smartphone. Bitcoin bypasses the need for traditional banking systems, allowing anyone with an internet connection to send, receive, and store value. This opens up financial services to people who were previously left out.

Finally, in an age where our online activities are constantly monitored, Bitcoin provides a degree of financial privacy. While all transactions are recorded on the public blockchain, they aren't directly linked to your real-world identity unless you choose to connect them. This allows for more discreet transactions without sharing your personal spending habits with corporations and data brokers. Exploring ways to manage your crypto assets, including passive income, can extend these benefits. You might find it useful to learn about staking opportunities to see how your holdings can work for you.

The Honest Truth About Bitcoin Risks

While Bitcoin presents exciting opportunities, it's essential to walk in with your eyes wide open to the risks. Think of it like learning to drive; you wouldn't just focus on the accelerator without knowing where the brakes are. A key part of understanding Bitcoin is accepting that where there's potential for high reward, there's also risk. The most talked-about risk is price volatility.

Bitcoin's value can shift dramatically over short periods. It's not unusual for its price to jump or fall by 10-20% in a single day—a level of movement rarely seen in traditional stock markets. This means your investment could grow rapidly, but it could also shrink just as quickly. For instance, in 2021, Bitcoin soared to a peak of over $68,000, only to drop by more than 50% in the months that followed. This isn't meant to frighten you, but to set a realistic tone: Bitcoin is not a get-rich-quick scheme. You should only invest an amount you are truly prepared to lose.

Security and Regulatory Challenges

In the world of traditional banking, if you lose your password, you can call for help. If your credit card gets stolen, your bank can often reverse the charges. With Bitcoin, you are your own bank, which means you are completely responsible for your own security. Your access to Bitcoin is guarded by a private key—a very long, secret password. If you lose this key, your Bitcoin is gone for good. There's no customer service line to call for a reset.

This level of personal responsibility can make newcomers a target for scams. You need to be aware of:

- Phishing Attacks: Deceptive emails or fake websites that mimic legitimate exchanges or wallets to trick you into giving away your private keys or login details.

- Fake Exchanges: Unregulated platforms that promise outrageous returns, only to vanish with everyone's money.

- "Giveaway" Scams: Social media posts, often from fake celebrity accounts, promising to double any Bitcoin you send them. Remember, a legitimate giveaway will never ask you to send cryptocurrency first.

Finally, the rules and regulations for cryptocurrencies are still a work in progress. Governments worldwide are deciding how to handle digital assets, and new laws can have a sudden and strong effect on Bitcoin's price and availability. If a major country were to ban Bitcoin trading, for example, it could create market-wide uncertainty and cause the price to fall.

To help you manage these factors, the table below breaks down the primary risks and provides practical steps to protect yourself.

Bitcoin Risk Assessment and Mitigation Strategies

A comprehensive overview of Bitcoin risks ranked by likelihood and impact, with corresponding protection strategies

| Risk Type | Likelihood | Impact Level | Protection Strategy |

|---|---|---|---|

| Price Volatility | High | High | Invest only what you can afford to lose. Avoid making emotional decisions based on short-term price swings. |

| Loss of Private Key | Medium | Critical | Use a reputable wallet. Create multiple, secure backups of your private key and store them offline in different locations. |

| Scams & Hacking | High | High | Use strong, unique passwords and enable two-factor authentication (2FA). Never share your private key. Only use trusted platforms like vTrader. |

| Regulatory Changes | Medium | Medium | Stay informed about crypto news from reliable sources. Understand the regulations in your country. |

Successfully handling these risks comes down to being educated and prepared. Your first and most important line of defense is choosing a secure, regulated platform. Good exchanges make user safety a priority by using strong security measures and following financial rules. To see how a trusted platform works, you can learn more about the mission and security commitments of vTrader, which builds a solid foundation for safe trading.

Why Big Companies Are Betting on Bitcoin

Bitcoin is no longer just a playground for individual tech enthusiasts and early adopters. A major shift is underway as large corporations, investment funds, and even governments begin to treat it seriously. This growing trend of institutional adoption is a strong signal that Bitcoin is maturing into a legitimate financial asset, changing the entire market dynamic. This evolution from a niche interest to a mainstream consideration is a key part of the modern bitcoin for dummies narrative.

From Speculation to Corporate Strategy

One of the clearest signs of this change is seeing large public companies add Bitcoin to their corporate treasuries. Firms like MicroStrategy have famously invested billions, viewing Bitcoin not as a short-term gamble but as a primary reserve asset. They see it as "digital gold," a way to store value long-term and shield the company's wealth from the inflation of traditional currencies.

This corporate buying introduces a stabilizing force. When major institutions hold large amounts of Bitcoin for the long haul, it can help smooth out the extreme price swings that once made mainstream users wary. This institutional confidence acts as a form of validation, proving that sophisticated financial players see lasting potential in Bitcoin’s fixed supply and decentralized design.

Wall Street Joins the Party

For years, traditional investors wanting to get into Bitcoin had to deal with the unfamiliar world of crypto exchanges and digital wallets. That barrier recently came down with the launch of Bitcoin Exchange-Traded Funds (ETFs). An ETF is an investment product you can buy and sell on regular stock exchanges, just like a share of Apple or Amazon.

Bitcoin ETFs let investors gain exposure to Bitcoin's price changes through their existing brokerage accounts, without needing to directly own and secure the cryptocurrency. This has opened the door for a massive wave of capital from Wall Street to enter the Bitcoin ecosystem, making it more accessible and connected with the traditional financial system. If you're interested in other digital assets, feel free to check out our guide on the UMA token.

Building a Safer and More Regulated Ecosystem

The influx of big money has also fueled the growth of a critical piece of infrastructure: regulated custody solutions. These are specialized, highly secure services that manage and store large quantities of cryptocurrency for institutional clients. This tackles one of the biggest security concerns, making it safer for large funds and corporations to hold Bitcoin.

This move toward professional management is a vital step in Bitcoin's journey. Its growing institutional acceptance is a key driver of its global adoption. Today, over 60 non-crypto firms hold Bitcoin on their balance sheets, solidifying its place in the financial sector. The rise of strong custody solutions and even nation-state adoption are powerful indicators of this trend, which you can read more about in the 2025 global crypto adoption report. This embrace isn't just about chasing profits; it’s about acknowledging Bitcoin's role as a durable asset in a modern economy.

Your Complete Step-by-Step Getting Started Guide

Ready to dive into the world of Bitcoin? This section will guide you through the whole process, from setting up your first digital wallet to making your initial purchase with confidence. We’ll explain each step clearly, helping you shift from a curious observer to an active participant. Your first stop is getting the most essential tool: a Bitcoin wallet.

Step 1: Choose Your Bitcoin Wallet

Think of a Bitcoin wallet as the digital equivalent of your bank account. It’s where you store, send, and receive Bitcoin. But not all wallets are created equal; they strike different balances between convenience and security. For newcomers, it’s important to understand the two main categories.

- Software Wallets (Hot Wallets): These are apps you can install on your phone or computer. They are very easy to use and make your Bitcoin accessible for daily transactions. Since they are always connected to the internet, they are called "hot wallets." They are perfect for holding small amounts you intend to use, much like the cash in your physical wallet.

- Hardware Wallets (Cold Wallets): These are physical devices, much like a USB stick, that keep your Bitcoin completely offline. This "cold storage" approach is the best in class for security and is suited for holding larger amounts of Bitcoin that you don’t plan to trade often. Consider it your personal vault.

For anyone starting out, a reliable software wallet from a well-known exchange is usually the most sensible first step. You can always move to a hardware wallet as your holdings grow.

Step 2: Select a Reputable Cryptocurrency Exchange

A cryptocurrency exchange is an online market where you can buy and sell Bitcoin with traditional money, like U.S. dollars or Euros. Picking the right one is vital for your security and the quality of your experience. When choosing an exchange, search for platforms that put user safety first, have a solid reputation, and are open about their fees.

Here is a screenshot from Coinbase, a popular exchange, showing a clean interface for buying and selling.

The interface is designed to be direct, letting users easily see prices and complete trades—exactly what a beginner needs. Trustworthy platforms like vTrader are registered with financial authorities (such as FinCEN in the U.S.), which adds another layer of compliance and security.

Step 3: Buy Your First Bitcoin

With your account set up and verified, you are ready to make a purchase. The most important rule is to start small and only invest what you can comfortably afford to lose. Bitcoin's price can be unpredictable, so it’s smart to get a feel for the market without taking on major risk. You don’t need to buy a whole Bitcoin; you can start by purchasing a small fraction, known as a satoshi.

The growing ease of access to crypto is clear from its expanding user base. In the latter half of 2024, the number of global crypto users increased by nearly 40 million, showing a strong and growing interest in digital assets. This growth is partly thanks to user-friendly platforms and AI-driven tools that make trading simpler. You can dive deeper into this trend by reading the full research about global crypto adoption.

Step 4: Secure Your Investment

Owning Bitcoin makes you your own bank, which means security is up to you. Here are three essential security practices you should follow:

- Enable Two-Factor Authentication (2FA): This adds a second security checkpoint to your exchange account, demanding a code from your phone along with your password.

- Create Secure Backups: When you create a wallet, you'll be given a "seed phrase" (a list of 12-24 words). Write it down and keep it in a secure, offline place. This is your master key; if you ever lose your device, this phrase is the only way to get your Bitcoin back.

- Practice Safe Storage: For small amounts, a wallet on a reputable exchange is adequate. For larger investments, it is best to move your Bitcoin to a personal hardware wallet that only you control.

By following these steps, you can start your journey safely and with confidence. The main goal is to begin with a strong educational base, which this bitcoin for dummies guide is designed to offer. If you want to look into other digital assets with different uses, you may find our guide on The Graph (GRT) interesting.

Your Bitcoin Journey Continues From Here

Congratulations on getting through the basics of Bitcoin.## Your Bitcoin Journey Continues From Here

Congratulations on getting through the basics of Bitcoin. The good news is that your path forward is now much clearer. Every expert in this field began exactly where you are, asking the same fundamental questions. The key now is to keep learning at your own speed and set achievable goals. This isn't a race; it's about building confidence one step at a time.

Charting Your Course: Next Steps

Your next moves can be adjusted to your personal comfort level. There isn't a single correct path, but here are a few practical steps you can take:

- Continue Learning: Spend some time "paper trading" or just watching how the market behaves without putting any money on the line. Follow reliable news outlets to see what makes Bitcoin's price tick.

- Start Small: If you're ready to make a purchase, stick to the golden rule: only invest what you can afford to lose. Beginning with a small amount, perhaps $20 or $50, lets you get a feel for the process without major financial risk.

- Join a Community: Look for beginner-friendly online forums or groups. Hearing from seasoned users can offer great perspective, but always proceed with caution and never give out personal details or your private keys.

This careful approach allows you to move from theory to real-world experience without unnecessary risk.

Setting Realistic Milestones

Getting comfortable with Bitcoin is a process that takes time. By setting small, manageable goals, you can make the journey feel less intimidating and more fulfilling. Here’s a potential timeline for a new user:

| Timeframe | Milestone |

|---|---|

| First Week | Open an account on a secure exchange, enable all security features (like 2FA), and get familiar with the platform's interface. |

| First Month | Make your first small purchase. Try sending a tiny amount of Bitcoin between two wallets to see how transactions work firsthand. |

| First 3-6 Months | Research the different types of wallets available. Keep learning about market trends and the factors that influence them. |

As you move forward, you also need to think about the financial side of things. Responsible ownership includes understanding cryptocurrency tax obligations, which can often be complex.

Remember, your curiosity is your greatest asset. By taking these deliberate steps, you're shifting from being just an observer to becoming an active participant in this new financial space.

Ready to take that first, secure step? vTrader offers a commission-free platform with solid security and a $10 sign-up bonus to help you start your portfolio. Open your vTrader account today and continue your Bitcoin journey with confidence.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.