Level Up Your Trading Game: The Best Mobile Trading Apps Revealed

Finding the best mobile trading app is crucial for managing your investments effectively. This listicle explores the top 12 mobile trading apps of 2025, offering insights beyond simple feature lists. We'll delve into practical usage, highlighting real-world scenarios and limitations. Whether you’re a novice crypto investor seeking fee-free options or a seasoned trader demanding advanced analytics, this guide helps you find the perfect app. We'll cover standout platforms like vTrader, known for its fee-free structure and robust tools, along with industry giants like Fidelity and Interactive Brokers. Are you ready to elevate your mobile trading experience? Let's dive in.

1. vTrader

vTrader stands out among the best mobile trading apps for its commission-free cryptocurrency trading. This feature maximizes profitability on Bitcoin, Ethereum, and 30+ altcoins, appealing to both novice and experienced traders. The platform offers advanced analytical tools, real-time market data, and seamless integration across desktop and mobile devices. Learn more about vTrader's innovative features and European launch in their official news release: Learn more about vTrader's European launch.

Security is a priority, with robust measures and FinCEN registration ensuring compliant asset management. Beyond trading, the VTrader Academy offers educational resources on topics like gas fees and staking, allowing users to earn USDT rewards.

Pros and Cons of vTrader

Pros:

- Zero Commission Trading: Maximize profits with no trading fees.

- Advanced Tools: Real-time data and analytical tools empower informed decisions.

- Multi-Device Access: Seamless trading experience on desktop and mobile.

- Robust Security: FinCEN registration ensures secure asset management.

- Educational Ecosystem: VTrader Academy offers learning and earning opportunities.

Cons:

- Limited Information on Supported Countries: Accessibility may be restricted.

- Fiat Currency Pair Details Lacking: Trading options might be limited beyond Bitcoin.

vTrader: Getting Started

vTrader offers a $10 sign-up bonus and a lucrative referral program. 24/7 customer support and instant Bitcoin purchases further enhance the user experience. While specific technical requirements aren't explicitly listed, the app is designed for both iOS and Android devices. While vTrader shines as a robust platform, researching country availability and supported fiat pairs is recommended before committing.

2. Charles Schwab

Charles Schwab's mobile app offers a comprehensive trading experience, ideal for both beginners and seasoned investors. It provides commission-free trading on stocks and ETFs, granting access to a diverse range of investment options. The platform seamlessly integrates real-time data, robust research tools, and educational resources, empowering informed decision-making. This makes it a solid choice for those building a diversified portfolio.

Schwab's commitment to investor education shines through its in-app resources, catering to various experience levels. From beginner guides to advanced trading strategies, users can enhance their investment knowledge directly within the platform. Furthermore, the integration with other Schwab financial services simplifies overall portfolio management.

Pros and Cons of Charles Schwab

Pros:

- Comprehensive Research & Education: In-depth tools and resources empower informed decisions.

- User-Friendly Interface: Easy navigation caters to both beginners and experienced investors.

- Commission-Free Trading: Maximize profits with zero commissions on stocks and ETFs.

Cons:

- Limited Cryptocurrency Options: Restricts access to the growing crypto market.

- Learning Curve for Advanced Features: Beginners might require time to master all functionalities.

Charles Schwab: Getting Started

Getting started with Charles Schwab is straightforward. The app is available on both iOS and Android devices. While the specific technical requirements aren't readily available, the user-friendly design ensures accessibility for most mobile users. While Schwab excels in traditional investments, the limited cryptocurrency support may deter crypto-focused traders. Consider your investment priorities before choosing this platform. It’s a strong choice for traditional markets, but other apps might be more suitable for crypto enthusiasts.

3. Fidelity Investments

Fidelity Investments' mobile app shines as a robust platform for long-term investors, particularly those focused on U.S. markets. It delivers commission-free trades on U.S. stocks and ETFs, combined with comprehensive research tools and educational resources. Real-time market updates and customizable alerts keep users informed. This makes Fidelity a solid choice for building and managing a diversified portfolio.

Beyond stocks and ETFs, Fidelity provides access to mutual funds and options trading. The user-friendly interface offers personalized news feeds tailored to individual investment interests. This personalized approach enhances the user experience and makes portfolio management intuitive.

Pros and Cons of Fidelity Investments

Pros:

- Extensive Educational Materials: A wealth of resources empowers informed investment decisions.

- Strong Customer Service Support: Reliable assistance is readily available.

- No Minimum Account Balance: Accessibility for investors of all levels.

Cons:

- Limited Cryptocurrency Trading Options: Not ideal for crypto-focused investors.

- Some Advanced Features May Be Overwhelming for Beginners: A learning curve may exist for new users.

Fidelity Investments: Getting Started

Fidelity Investments offers a user-friendly mobile app experience. While specific technical requirements aren't readily available, the app is designed for both iOS and Android devices. The platform is particularly well-suited for long-term investors focused on traditional asset classes. However, those primarily interested in cryptocurrency trading might find its limited crypto offerings a drawback.

4. E*TRADE

ETRADE offers a versatile mobile platform catering to both casual investors and active traders. Its commission-free trading for stocks and ETFs, combined with advanced charting tools, makes it a strong contender among the best mobile trading apps. The platform also provides access to a wider range of investment options, including futures and options, appealing to more experienced investors. Bloomberg has reported on Morgan Stanley's potential plans to integrate crypto trading into ETRADE, which could further expand its offerings. Learn more about E*TRADE's potential crypto integration.

E*TRADE prioritizes user education, providing comprehensive resources and market analysis tools. Customizable dashboards allow for personalized tracking and management of investments. While there's no minimum account balance requirement, which is a plus for beginners, it's worth noting that broker-assisted trades incur higher fees.

Pros and Cons of E*TRADE

Pros:

- Comprehensive Educational Resources: Extensive learning materials cater to all experience levels.

- Advanced Tools for Active Traders: Charting and analysis features empower informed decisions.

- No Minimum Account Balance: Accessibility for investors starting with smaller capital.

Cons:

- Higher Fees for Broker-Assisted Trades: Added costs for personalized support.

- Limited Cryptocurrency Trading Options: Currently, crypto access is not directly available.

E*TRADE: Getting Started

E*TRADE's mobile app is available on both iOS and Android devices. While specific technical requirements are not readily available, the app is generally well-optimized for modern mobile devices. New users can benefit from the educational resources to quickly familiarize themselves with the platform. However, potential users interested in cryptocurrency trading should be aware of its current limitations in that area.

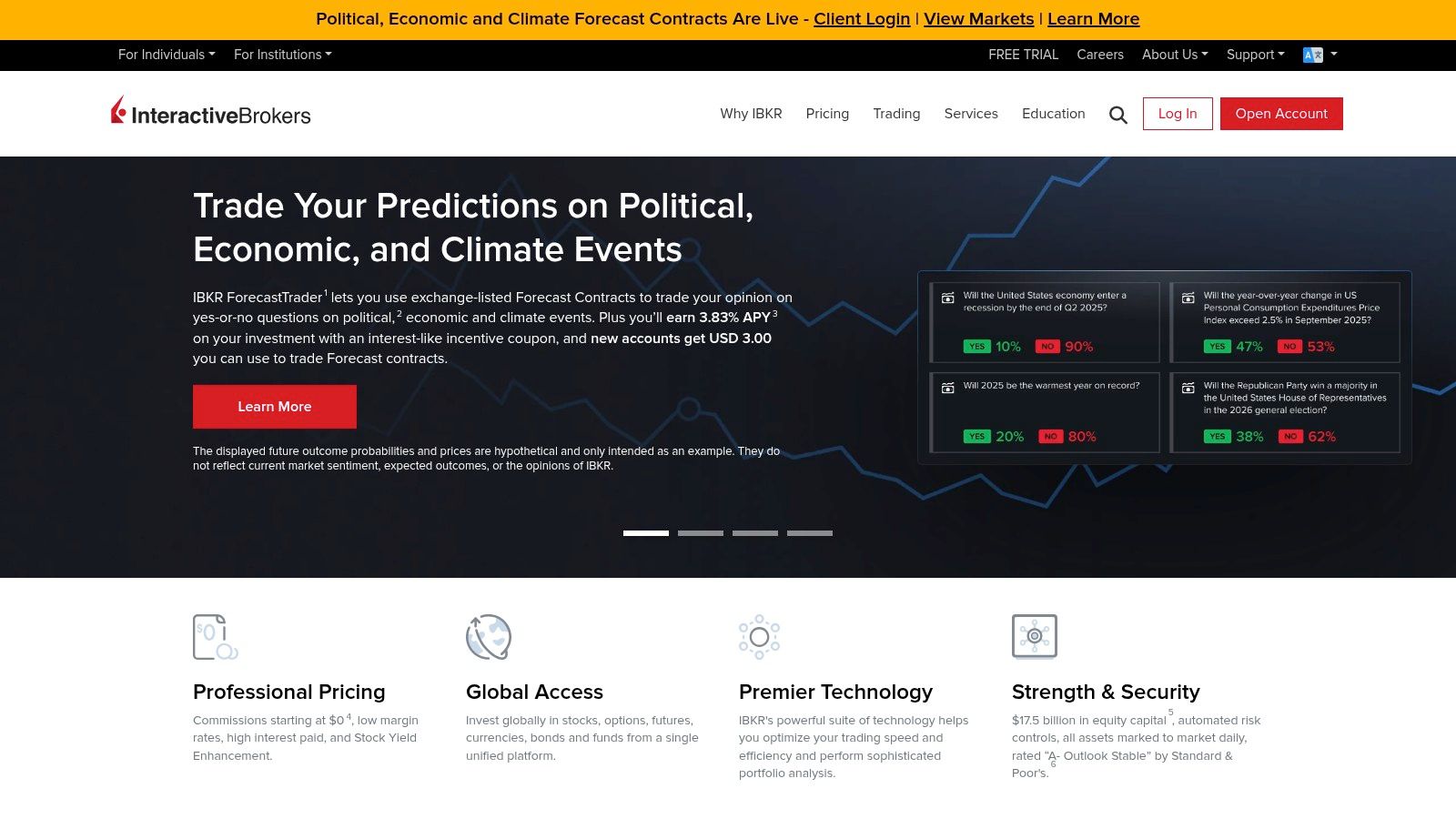

5. Interactive Brokers

Interactive Brokers is favored by advanced traders for its extensive investment options and competitive pricing. The platform provides access to global markets, advanced tools, and low-cost trading for stocks, options, and futures. Serious investors will appreciate the depth of market data and analytical resources available.

The customizable interface allows traders to tailor their workspace to their specific needs. Comprehensive research and risk management features further enhance the trading experience. However, this robust functionality comes at a cost; the interface can feel overwhelming for beginners.

Pros and Cons of Interactive Brokers

Pros:

- Extensive Investment Options: Access diverse asset classes across global markets.

- Competitive Pricing: Benefit from low fees and competitive margin rates.

- Advanced Tools: Utilize professional-grade tools for technical analysis and charting.

Cons:

- Complex Interface: The platform's complexity can be daunting for new traders.

- Inactivity Fees: Users with low account activity may incur fees.

Interactive Brokers: Getting Started

Interactive Brokers offers a tiered commission structure, with pricing varying based on trading volume and account type. While specific technical requirements aren't explicitly listed on the mobile app download page, the app is available for both iOS and Android devices. While Interactive Brokers offers a powerful suite of tools, new traders may find the learning curve steep. Starting with a demo account is recommended to familiarize yourself with the platform's intricacies.

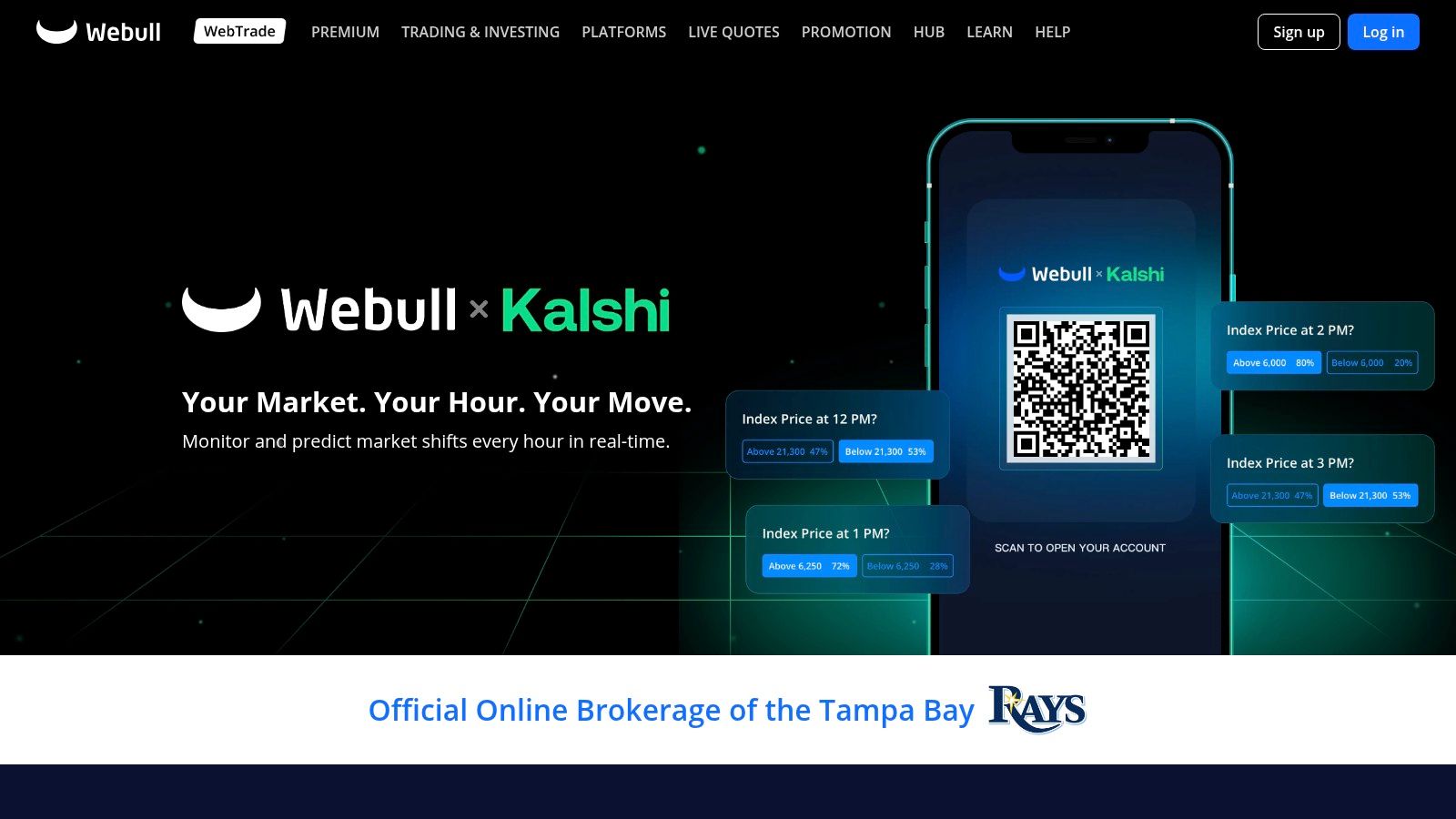

6. Webull

Webull positions itself as a feature-rich mobile trading app ideal for intermediate traders seeking more advanced tools. Its commission-free trading model for stocks, ETFs, and options, combined with advanced charting and extended trading hours, makes it a compelling choice. The platform also offers a valuable paper trading feature for practicing strategies risk-free.

Webull's community features enable users to share market ideas and discuss trading strategies. This creates a collaborative environment that can be particularly beneficial for those looking to learn from more experienced traders. While Webull excels in its offerings for stocks, ETFs, and options, it currently lacks support for mutual funds and bonds, which might limit some investors.

Pros and Cons of Webull

Pros:

- User-Friendly Interface: Advanced tools are presented in an accessible way.

- No Minimum Balance: Start trading without a large initial investment.

- Extended Trading Hours: Flexibility for reacting to market events.

- Paper Trading: Practice strategies without risking real capital.

Cons:

- Limited Educational Resources: Fewer learning opportunities compared to other platforms.

- No Mutual Funds/Bonds: Investment options are restricted to stocks, ETFs, and options.

Webull: Getting Started

Webull's user-friendly interface makes it relatively easy to get started. The app is available on both iOS and Android devices. While no specific technical requirements are prominently listed, a stable internet connection is essential for real-time data access. While Webull offers a robust platform for intermediate traders focusing on stocks, ETFs, and options, researching the limitations regarding educational resources and asset availability is recommended before committing.

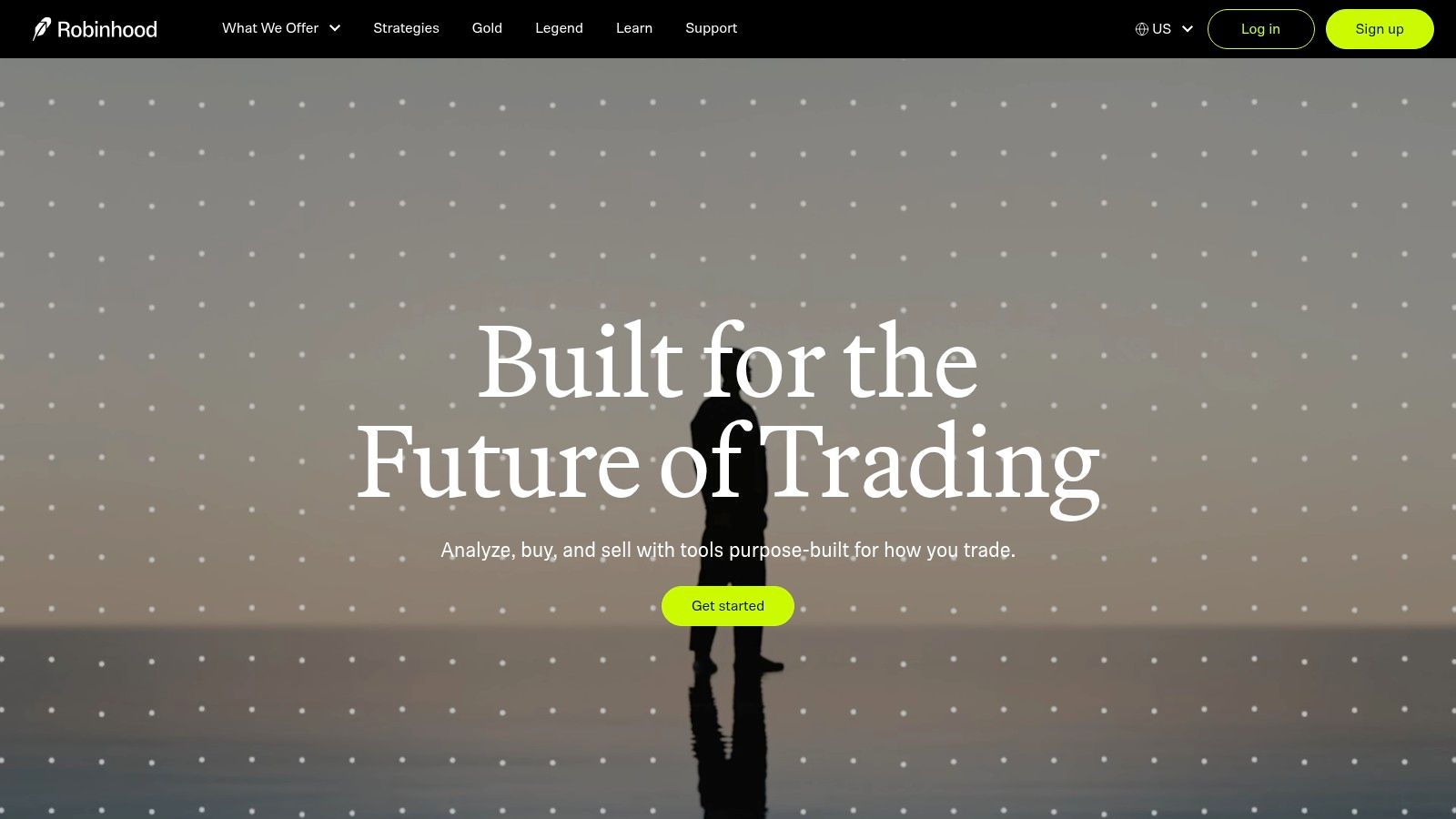

7. Robinhood

Robinhood is renowned for its commission-free trading and beginner-friendly interface, making it a popular choice among new investors. The platform offers trading in stocks, ETFs, options, and cryptocurrencies, providing a diverse range of investment opportunities. Its fractional shares feature allows users to invest with as little as $1, lowering the barrier to entry for smaller investors. vTrader recently reported on Robinhood’s acquisition of a crypto platform: Learn more about Robinhood's acquisition.

Real-time market data and news updates keep users informed, while cash management features with competitive interest rates offer additional value. Robinhood aims to simplify investing and provide a seamless mobile trading experience.

Pros and Cons of Robinhood

Pros:

- No Commission Fees: Trade stocks, ETFs, options, and crypto without commissions.

- Beginner-Friendly: Easy-to-use interface simplifies the investing process.

- Fractional Shares: Invest in smaller increments with as little as $1.

- Cash Management: Earn interest on uninvested cash.

Cons:

- Limited Research: Educational resources and research tools are basic.

- Customer Support: Response times can be slow, especially during peak hours.

Robinhood: Getting Started

Robinhood offers a straightforward account setup process and requires no minimum balance. The app is available on both iOS and Android devices, catering to mobile-first users. While Robinhood's simplicity is attractive, its limitations regarding research and customer support are important factors to consider. New investors may find its ease of use beneficial, while experienced traders might require more advanced platforms like vTrader for in-depth analysis and faster support.

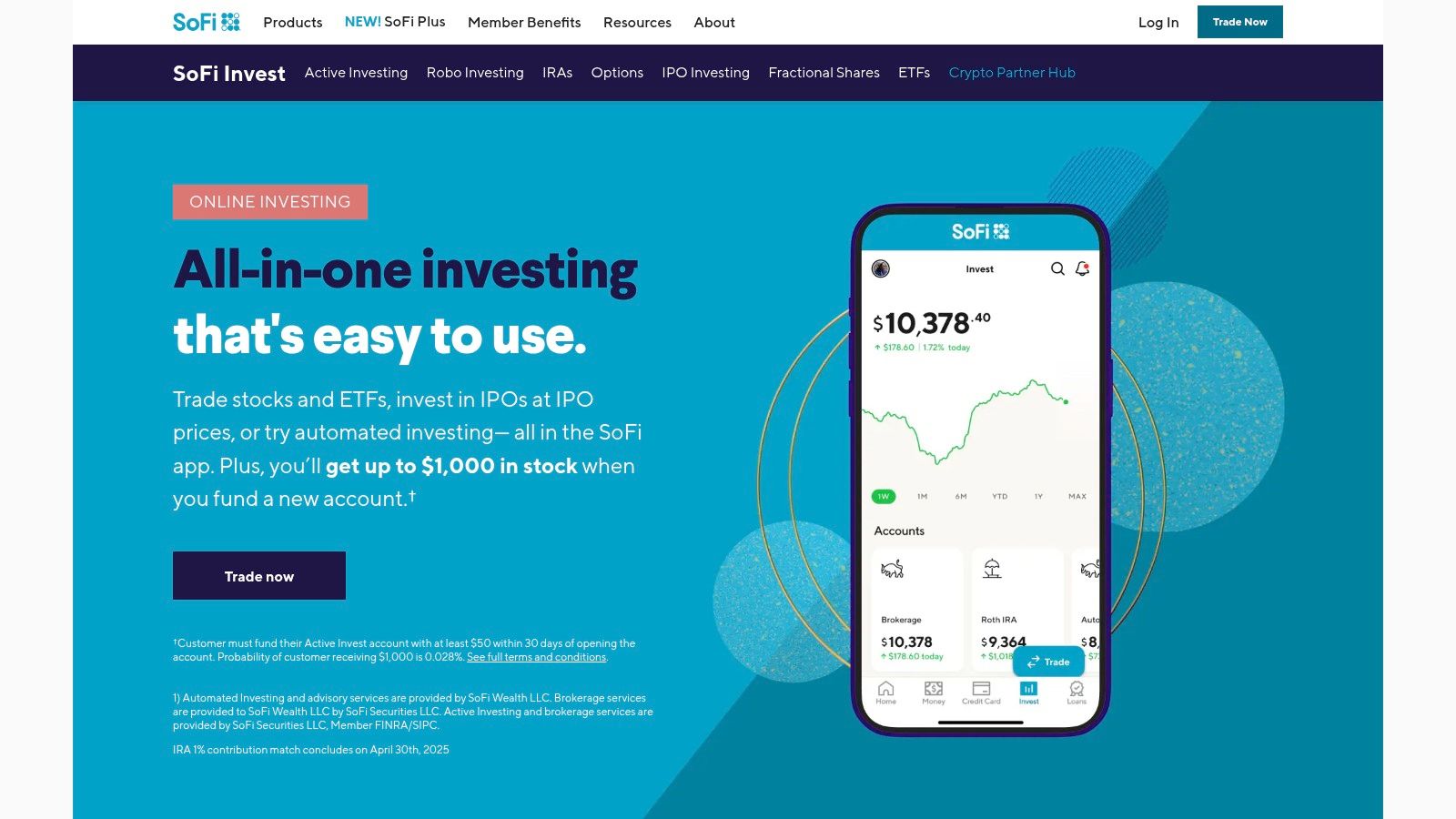

8. SoFi Invest

SoFi Invest shines among the best mobile trading apps for its user-friendly approach, blending active trading with automated investing. This platform particularly appeals to beginners seeking an accessible entry point into the market. Its commission-free trading on stocks and ETFs, combined with fractional share purchases, makes it easy to start building a diversified portfolio. Integration with SoFi's broader financial ecosystem, including loans and banking, offers a centralized financial management hub.

SoFi's automated investing feature simplifies portfolio management by creating diversified portfolios based on risk tolerance and financial goals. Educational resources and community features further empower users to take control of their finances. The platform requires no minimum account balance, lowering the barrier to entry for new investors.

Pros and Cons of SoFi Invest

Pros:

- User-Friendly Interface: Intuitive design caters to beginners.

- Integrated Financial Services: Connects seamlessly with SoFi loans and banking.

- No Minimum Balance: Start investing with any amount.

- Automated Investing: Simplifies portfolio diversification.

- Fractional Shares: Invest in expensive stocks with smaller amounts.

Cons:

- Limited Advanced Tools: May not satisfy experienced traders.

- Fewer Investment Options: Provides access to fewer assets than some competitors.

SoFi Invest: Getting Started

Getting started with SoFi Invest is straightforward. The app is available on both iOS and Android devices. While SoFi promotes its user-friendly nature, specific technical requirements aren't readily available. While the platform is ideal for beginners, experienced traders seeking advanced charting and analytical tools might find its offerings limited. Consider SoFi Invest if you value ease of use, integrated financial services, and automated investing. Visit their website to explore their offerings: https://www.sofi.com/invest/

9. Ally Invest

Ally Invest distinguishes itself among the best mobile trading apps with its user-friendly interface and seamless integration with Ally Bank. This integration simplifies fund transfers, making it particularly convenient for existing Ally Bank customers. The platform offers commission-free trading on stocks and ETFs, broadening its appeal to cost-conscious investors. Beyond stocks and ETFs, Ally Invest provides access to mutual funds, options, and forex, catering to diverse investment strategies.

Ally Invest empowers informed decision-making through its advanced charting and research tools. Furthermore, educational resources are available for users seeking to expand their investment knowledge. The platform's mobile app provides a smooth and intuitive trading experience, allowing users to manage their portfolios on the go.

Pros and Cons of Ally Invest

Pros:

- Integration with Ally Bank: Streamlined fund transfers for existing Ally Bank customers.

- No Minimum Account Balance: Accessible to investors of all sizes.

- Commission-Free Trading: Cost-effective trading of stocks and ETFs.

- Competitive Options Pricing: Attractive for options traders.

Cons:

- Limited Advanced Tools: May not fully satisfy active traders' needs.

- No Cryptocurrency Trading: Excludes investors interested in digital assets.

Ally Invest: Getting Started

Ally Invest requires no minimum account balance, removing a common barrier to entry for new investors. The platform's intuitive interface makes it easy to navigate and execute trades. While Ally Invest caters to a broad range of investors, its limited advanced tools might not satisfy experienced active traders seeking highly specialized features. Before committing, consider your individual trading style and whether Ally Invest’s features align with your specific needs. Visiting their website (https://www.ally.com/invest/) is recommended for the latest information.

10. Merrill Edge

Merrill Edge provides a solid mobile trading experience for investors seeking a wide range of investment options tied to their banking. The platform excels with commission-free stock and ETF trading, making it cost-effective for frequent traders. Advanced research tools and seamless Bank of America account integration streamline portfolio management. This makes it particularly appealing to existing Bank of America customers.

Beyond stocks and ETFs, Merrill Edge provides access to mutual funds, options, and fixed income products. This breadth of offerings caters to diverse investment strategies. Educational resources and personalized guidance help novice investors navigate the complexities of the market. This makes it a great platform for beginners building their portfolios.

Pros and Cons of Merrill Edge

Pros:

- Bank of America Integration: Streamlined banking and investing experience.

- No Minimum Balance: Accessibility for investors of all sizes.

- Extensive Research & Education: Valuable resources for informed decisions.

Cons:

- Limited Advanced Trading Tools: May not suit active traders needing complex strategies.

- No Cryptocurrency Trading: Excludes investors interested in digital assets.

Merrill Edge: Getting Started

Merrill Edge doesn't require a minimum account balance, making it accessible to a broad range of investors. While specific technical requirements for the mobile app aren't readily available, it's offered on both iOS and Android devices. Users seeking advanced charting or options strategies may find the platform's tools somewhat limited. However, its strength lies in its ease of use and integration with Bank of America services, which is ideal for those already within the Bank of America ecosystem. It is recommended to thoroughly research specific investment options and platform capabilities to ensure it aligns with individual trading needs.

11. Moomoo

Moomoo shines as a compelling option among the best mobile trading apps, offering commission-free trading on stocks, ETFs, and options. This, coupled with advanced charting tools and real-time market data, caters to both novice and seasoned traders. The platform also provides a paper trading feature, allowing users to practice strategies risk-free, and fosters a community for sharing insights. While Moomoo's focus on stocks, ETFs, and options is a strong suit, it's worth noting the recent investment in Solana by DeFi Development Corp, highlighting the growing interest in the broader crypto market. For more context on these market shifts, learn more about Solana's investment landscape: Learn more about Solana's investment landscape.

The user-friendly interface combined with powerful tools makes Moomoo an attractive choice for active traders. The absence of a minimum account balance further lowers the barrier to entry. However, the limited educational resources and lack of access to mutual funds or bonds might be drawbacks for some investors.

Pros and Cons of Moomoo

Pros:

- Commission-Free Trading: Trade stocks, ETFs, and options without commissions.

- Advanced Charting: Utilize robust charting tools and technical indicators.

- Real-Time Data: Access real-time market data and news.

- Paper Trading: Practice strategies in a simulated environment.

- Community Forum: Connect and share strategies with other traders.

Cons:

- Limited Education: Fewer educational resources compared to some competitors.

- No Mutual Funds/Bonds: Investment options are restricted to stocks, ETFs, and options.

Moomoo: Getting Started

Moomoo's intuitive interface makes it easy to get started. While specific technical requirements aren't readily available, the app is accessible on both iOS and Android devices. The lack of a minimum balance makes it easy to begin trading with any amount. However, users seeking broader investment options or in-depth educational materials may want to consider other platforms.

12. Public

Public distinguishes itself among mobile trading apps by combining commission-free investing with a social networking platform. This unique approach allows users to invest in stocks and ETFs while connecting with a community of investors to share insights and strategies. The platform's focus on fractional shares, starting at just $1, makes it particularly appealing to beginners.

Public's social feed provides real-time discussion on market trends and individual stocks, offering a valuable learning opportunity for new investors. More experienced traders may find value in the collective intelligence of the community, though they might miss advanced charting tools found on other platforms. The educational resources and market insights further enhance the learning experience.

Pros and Cons of Public

Pros:

- Social Investing: Combines trading with a community for shared learning.

- No Minimum Balance: Accessible to investors of all levels.

- Fractional Shares: Invest in expensive stocks with small amounts.

- Beginner-Friendly: Simple interface and educational resources.

Cons:

- Limited Tools: Lacks advanced charting and technical analysis features.

- No Options or Crypto: Trading is restricted to stocks and ETFs.

Public: Getting Started

Public's simple interface makes it easy to get started. The app is available on both iOS and Android devices. While the social aspect can be a great learning tool, remember that investment decisions should be based on your own research and risk tolerance. The lack of options and cryptocurrency trading may limit its appeal for more experienced traders seeking diverse asset classes. If your focus is on stocks and ETFs, and you value a social learning environment, Public is worth considering.

Top 12 Mobile Trading Apps Comparison

| Platform | Core Features/Tools | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 vTrader | Zero commission crypto trading, advanced tools | ★★★★★ Secure, multi-device seamless UX | 💰 Free trading, $10 sign-up bonus | 👥 Beginners & experienced crypto traders | ✨ Learning academy with USDT rewards, instant BTC buy, FinCEN registered |

| Charles Schwab | Commission-free stocks & ETFs, research tools | ★★★★ User-friendly for all investors | 💰 No commissions on stocks/ETFs | 👥 New & seasoned stock investors | ✨ Wide investment variety, strong education |

| Fidelity Investments | Commission-free stocks/ETFs, real-time alerts | ★★★★ Robust research, good support | 💰 No minimum balance, free trades | 👥 Long-term stock investors | ✨ Personalized news feeds, extensive education |

| E*TRADE | Commission-free stocks/ETFs, futures/options | ★★★★ Advanced tools for active traders | 💰 No minimum, higher broker fees | 👥 Casual & active traders | ✨ Advanced charting, customizable dashboards |

| Interactive Brokers | Global markets, low-cost stocks/options/futures | ★★★★ Competitive pricing, complex UI | 💰 Low fees, inactivity charges | 👥 Professional & advanced traders | ✨ Extensive investment options, advanced tools |

| Webull | Stocks/ETFs/options commission-free trading | ★★★★ User-friendly, advanced charting | 💰 No minimum balance | 👥 Intermediate traders | ✨ Extended trading hours, paper trading |

| Robinhood | Commission-free stocks/crypto/options | ★★★ Beginner-friendly interface | 💰 No commissions, fractional shares | 👥 New investors | ✨ Crypto trading, easy cash management |

| SoFi Invest | Commission-free stocks/ETFs, automated investing | ★★★★ User-friendly, wide financial integration | 💰 No minimum balance | 👥 Beginners wanting automation | ✨ Integration with loans & banking |

| Ally Invest | Stocks/ETFs commission-free, options, forex | ★★★ User-friendly, good bank integration | 💰 Competitive options pricing | 👥 Retail investors | ✨ Integration with Ally Bank |

| Merrill Edge | Commission-free stocks/ETFs, research tools | ★★★★ Strong research, Bank of America integration | 💰 No minimum balance | 👥 Bank of America customers | ✨ Personalized guidance, robust education |

| Moomoo | Stocks/ETFs/options commission-free trading | ★★★★ User-friendly with advanced tools | 💰 No minimum balance | 👥 Intermediate traders | ✨ Real-time data, paper trading |

| Public | Commission-free stocks/ETFs + social features | ★★★ Beginner-friendly, social investing | 💰 No minimum balance | 👥 Social & casual investors | ✨ Investing + social networking |

Navigating the Future of Mobile Trading

Finding the best mobile trading app can feel overwhelming given the sheer number of choices available. This guide has explored twelve leading platforms, each offering a unique blend of features, fees, and user experiences. From established players like Charles Schwab and Fidelity to disruptive newcomers like Webull and Robinhood, the options cater to diverse needs and trading styles. This overview has aimed to provide the insights you need to navigate this dynamic landscape.

Key Takeaways for Today's Mobile Trader

A few crucial takeaways emerge from this in-depth analysis. First, fees significantly impact long-term returns. While many platforms have moved towards commission-free trading, it’s crucial to examine other potential costs, such as inactivity fees or premium subscription charges. Second, the depth of research tools varies significantly. Active traders will need platforms with real-time data, advanced charting, and robust analytical capabilities, while casual investors may prioritize ease of use and simplicity. Finally, mobile user experience is paramount. A clunky interface can lead to missed opportunities and frustration.

Choosing the Right App for Your Needs

Selecting the right app depends entirely on your individual requirements. Consider these factors:

- Trading Frequency: Are you a day trader, swing trader, or long-term investor?

- Investment Style: Do you prefer stocks, options, ETFs, or cryptocurrencies?

- Tech Savviness: Are you comfortable with complex platforms or do you prefer a streamlined interface?

- Budget: How much are you willing to pay in fees and commissions?

Implementation Considerations

Once you’ve chosen a platform, consider these implementation steps:

- Practice with a Demo Account: Familiarize yourself with the platform's features before risking real capital.

- Start Small: Begin with smaller investments and gradually increase your exposure as you gain experience.

- Stay Informed: Continuously educate yourself about market trends and investment strategies.

The Power of Fee-Free Trading with Advanced Tools

Throughout this guide, vTrader has emerged as a particularly compelling option for a broad range of investors. Its fee-free structure, coupled with advanced charting, real-time data, and educational resources, positions it as a strong contender in the crowded field of best mobile trading apps. For those seeking a robust, accessible, and cost-effective platform, vTrader merits serious consideration. Other platforms like Interactive Brokers cater to experienced traders with their sophisticated tools and global market access, while others like Robinhood prioritize simplicity and user-friendliness for beginners.

The mobile trading landscape is constantly evolving. New technologies and platforms continue to emerge, empowering investors with greater access and control over their finances. By staying informed, adapting to change, and choosing the right tools, you can position yourself for success in this exciting market.

Ready to experience the future of fee-free mobile trading with powerful tools? Explore vTrader today and unlock your investment potential. vTrader offers a comprehensive platform for both novice and seasoned traders looking to maximize their returns in today's dynamic markets.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.