The fast-paced world of crypto day trading demands more than just luck; it requires precision, speed, and the right assets. But what truly defines the best cryptocurrency for day trading? It’s a crucial combination of high volatility for profit opportunities, deep liquidity to ensure your orders execute at desired prices, and low transaction fees that don’t eat into your gains. This guide moves beyond generic advice to provide a strategic breakdown of the top digital assets that meet these demanding criteria.

We'll dive into a ranked list of cryptocurrencies ideal for intraday strategies, complete with key metrics, pros, cons, and actionable trading tips for each. For novice and seasoned traders alike, we will also explore the platforms like Coinbase Advanced and Kraken Pro where you can trade these assets effectively. Given the prevalence of speculative claims in the crypto space, mastering how to evaluate information sources is paramount for making informed decisions and gaining a true edge.

This article cuts straight to the point, helping you identify which cryptocurrencies align with your trading style and which platforms provide the necessary tools. Prepare to uncover the resources that will sharpen your trading edge and help you navigate the intraday market with confidence.

1. vTrader: An All-In-One Platform for Day Traders

For traders searching for the best cryptocurrency for day trading, the platform you use is as crucial as the assets you choose. vTrader emerges as a premier choice, offering a comprehensive and cost-effective ecosystem designed to maximize trading efficiency and profitability. Its combination of zero-fee trades, advanced tools, and robust educational resources makes it an exceptional all-in-one solution.

Why vTrader Stands Out

vTrader distinguishes itself by completely eliminating commission fees across more than 30 cryptocurrencies, including majors like Bitcoin and Ethereum. This zero-fee structure is a significant advantage for day traders, where frequent transactions can quickly accumulate costs on other platforms. By removing this financial friction, traders can execute strategies with greater flexibility and retain more of their profits.

The platform is engineered for performance, providing real-time market data and powerful analytical tools accessible on both desktop and mobile. This ensures traders can make informed, split-second decisions whether at their desk or on the go.

Key Features for Day Traders

- Commission-Free Trading: Execute unlimited trades across a diverse range of assets without incurring any commission fees, a critical feature for high-volume day trading.

- Advanced Charting and Data: Access sophisticated, real-time tools to analyze market movements, identify patterns, and execute trades based on precise data.

- Seamless User Experience: Benefit from an intuitive interface that simplifies complex trading activities. Features like instant Bitcoin purchases and easy bank integration streamline the entire process from deposit to trade execution.

- Robust Security: vTrader is registered with FinCEN, adhering to strict regulatory standards. This commitment to compliance and security provides peace of mind that your assets are protected.

Getting the Most Out of vTrader

To maximize your success, integrate the platform's educational resources into your strategy. vTrader’s integrated learning ecosystem offers tutorials, guides, and market insights that can sharpen your trading acumen. Before you start trading, you can explore in-depth guides and enhance your knowledge through the vTrader Academy. New users can also capitalize on the $10 sign-up bonus to start their portfolio.

Website: https://www.vtrader.io/en-us/explore-crypto

| Feature Evaluation | Rating |

|---|---|

| Cost-Effectiveness | ★★★★★ |

| Trading Tools | ★★★★☆ |

| User Experience | ★★★★★ |

| Security | ★★★★★ |

2. Coinbase Advanced

For U.S.-based day traders who prioritize regulatory compliance and security without sacrificing advanced tools, Coinbase Advanced is a premier destination. It replaces the former Coinbase Pro, integrating a powerful trading interface directly into the main Coinbase platform, offering a seamless experience for those looking to actively trade some of the best cryptocurrency for day trading. Its core strength lies in its position as a publicly traded, U.S.-regulated company, providing a level of trust and transparency that many offshore competitors lack.

Traders gain access to a comprehensive suite of tools, including TradingView-powered charts packed with popular indicators like EMAs, MACD, and RSI. The platform supports over 500 trading pairs, ensuring deep liquidity, especially for major assets paired with USD and USDC.

Key Features and User Experience

The interface is clean and intuitive, providing a clear fee preview before you submit an order, which eliminates surprises. Its volume-based maker/taker fee structure is competitive, rewarding higher-volume traders with lower costs. You can view a detailed breakdown of the Coinbase Advanced fee schedule to understand how your 30-day trading volume impacts your rates.

- Robust API Access: Coinbase Advanced offers a powerful API with high rate limits, ideal for connecting automated trading bots from services like 3Commas or Coinrule.

- Security First: It provides strong security measures, including FDIC pass-through insurance on USD cash balances up to $250,000.

- Integrated Platform: Easily switch between simple buying, staking, and advanced trading without leaving the Coinbase ecosystem.

Trading Tip: Leverage the Advanced Trade API to automate your strategies. For example, you can set up a bot to execute a scalping strategy on the BTC/USD pair, automatically placing buy and sell orders based on RSI indicators crossing specific thresholds (e.g., buy at RSI 30, sell at RSI 70). This hands-off approach maximizes efficiency and removes emotion from your trading.

While its fees can be higher for low-volume traders and it may lack some of the more obscure altcoins found on other exchanges, its blend of compliance, robust tools, and deep liquidity makes it a top-tier choice for serious U.S. traders.

Platform Link: https://www.coinbase.com/advanced-trade

3. Kraken Pro

For traders seeking a battle-tested platform that combines competitive fees with high liquidity and advanced trading options, Kraken Pro is an industry staple. As one of the longest-running U.S.-friendly exchanges, it has built a reputation for reliability, security, and deep order books, particularly on major trading pairs. It's an ideal environment for active traders looking to execute strategies on the best cryptocurrency for day trading with precision.

Kraken Pro’s strength lies in its professional-grade tools and transparent fee structure, which actively rewards high-volume traders and market makers. The platform also offers U.S. traders access to regulated margin and futures trading through affiliated entities, expanding the range of available strategies beyond simple spot trading. This makes it a comprehensive hub for serious day traders.

Key Features and User Experience

The Kraken Pro web terminal and mobile apps provide a sophisticated yet user-friendly interface with advanced charting, order-type flexibility, and a clear overview of your 30-day trading volume and current fee tier. Its maker/taker fee schedule is highly competitive, and the platform frequently runs promotions, such as temporary 0% maker fees on certain pairs, to incentivize liquidity. This focus on active traders, combined with tight spreads on major pairs, makes it a cost-effective choice.

- Active Liquidity Incentives: The fee structure, with volume-based discounts and potential maker rebates, is designed to benefit active day traders who contribute to market liquidity.

- Transparent Fee Tools: The platform provides clear documentation and tools to help you confirm your orders will be treated as "maker" orders, ensuring you get the lowest possible fees.

- Regulated Derivatives: Kraken is continually expanding its regulated U.S. derivatives offerings, providing more sophisticated trading instruments for advanced users.

Trading Tip: Keep a close watch on Kraken Pro’s promotions page for markets with 0% maker fees. When active, you can run a high-frequency market-making or scalping strategy on these pairs without incurring any fees on your limit orders, significantly boosting your potential profitability by eliminating a major trading cost.

While the lowest fee tiers require significant trading volume and some smaller altcoins may have thinner liquidity than on offshore exchanges, Kraken Pro’s blend of security, low costs for active traders, and expanding feature set cements its position as a top-tier platform.

Platform Link: https://pro.kraken.com

4. Robinhood Crypto

For traders who prioritize simplicity and a zero-commission fee structure, Robinhood Crypto offers an incredibly accessible entry point into the market. Its mobile-first design and streamlined user experience make it a popular choice for retail traders who want to quickly execute trades on some of the best cryptocurrency for day trading without navigating a complex interface. Robinhood’s core appeal is its "commission-free" model, where trading costs are embedded within the spread, making it straightforward for beginners to understand their potential entry and exit prices.

The platform is available across all 50 U.S. states and territories, providing broad accessibility. While its coin selection is more curated than larger exchanges, it includes major assets like Bitcoin and Ethereum, alongside a growing list of trending altcoins, allowing traders to capitalize on retail-driven momentum.

Key Features and User Experience

Robinhood excels at removing friction from the trading process. New users can get started quickly with instant ACH deposits for smaller amounts, allowing them to trade almost immediately. The interface is clean and uncluttered, focusing on the essential actions of buying and selling, which is ideal for day traders who need to make rapid decisions. While it relies on payment for order flow, Robinhood is transparent about its relationships with market makers.

- Commission-Free Trading: No direct maker or taker fees are charged, though costs are built into the bid-ask spread.

- Universal U.S. Access: One of the few platforms available to residents in every U.S. state and territory.

- Simplified Interface: The UX is designed for speed and ease of use, perfect for traders who value simplicity over advanced charting tools.

Trading Tip: Use Robinhood’s trending lists and social feeds as a momentum indicator. Since the platform is popular with retail investors, assets that are gaining traction in-app often signal a short-term volatility spike. A day trader can monitor these trends to enter a position on a trending coin like DOGE or SHIB just as retail interest is peaking, aiming to capture quick gains from the subsequent price movement.

While power users may miss the granular control of an explicit maker/taker fee structure and advanced order types, Robinhood’s low barrier to entry and expanding coin support make it a compelling option for traders focused on simplicity and speed.

Platform Link: https://robinhood.com/crypto

5. Crypto.com Exchange

For traders seeking an all-in-one ecosystem that combines a powerful trading exchange with extensive DeFi and staking features, the Crypto.com Exchange is a compelling option. Distinct from its more widely known consumer app, the Exchange platform offers a traditional order-book interface with competitive maker/taker fees, making it a far better choice for active day traders. It provides a professional-grade environment where users can trade the best cryptocurrency for day trading with lower costs and deeper liquidity, especially on major pairs.

The platform is designed for serious trading, featuring robust charting tools, multiple order types, and strong liquidity on high-volume assets like Bitcoin and Ethereum. U.S. traders in particular benefit from the Exchange's fee structure, which is significantly more cost-effective than the instant buy/sell feature on the main Crypto.com App, where spreads are wider.

Key Features and User Experience

The Crypto.com Exchange offers clean web and mobile terminals, allowing for seamless trading on the go. Its fee schedule is designed to be accessible, with low entry tiers and periodic fee promotions that can further reduce trading costs. The integration with the broader Crypto.com ecosystem is a major advantage, allowing users to move assets between trading, staking, and earning products without friction. For details on how to maximize returns, you can explore the Crypto.com Exchange staking options.

- Competitive Fee Structure: The maker/taker model rewards market makers and offers progressively lower fees for high-volume traders.

- Integrated Ecosystem: Effortlessly move funds to utilize Crypto.com's other services, including its popular Visa card, Earn, and DeFi Wallet.

- Strong Major Pair Liquidity: Provides reliable execution for day trading strategies focused on top-tier cryptocurrencies paired against USD.

Trading Tip: Day traders should exclusively use the Exchange platform, not the main App, for executing trades. To capitalize on volatility, focus on the BTC/USD or ETH/USD pairs where liquidity is highest. Set limit orders to act as a market maker and benefit from lower (or even zero, during promotions) maker fees, which can significantly boost your net profitability over hundreds of trades.

While the consumer App is not ideal for day trading due to its spreads, the Exchange itself is a robust platform. However, U.S. users should always verify product eligibility and promotional terms, as these can change.

Platform Link: https://crypto.com/exchange

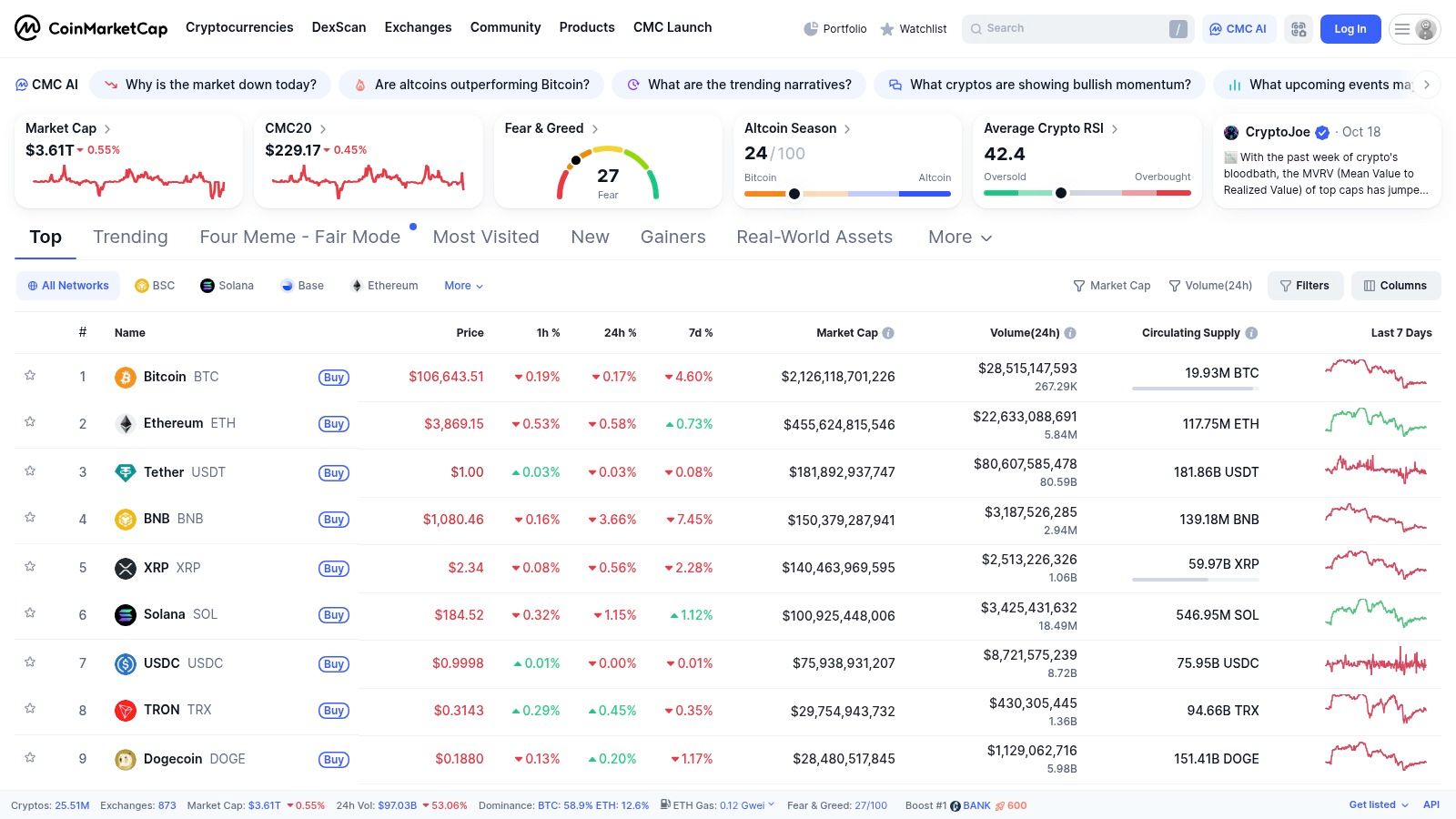

6. CoinMarketCap

For traders whose strategy relies on identifying market momentum and liquidity before placing a single trade, CoinMarketCap is an indispensable research and discovery hub. While it’s not a trading platform itself, its role as the leading market data aggregator makes it a critical first stop for finding the best cryptocurrency for day trading. It offers a bird's-eye view of the entire market, allowing traders to quickly spot assets with unusual volume, volatility, and price action.

Its power lies in its ability to filter thousands of assets across hundreds of exchanges, presenting actionable data through intuitive leaderboards and category pages. By tracking real-time metrics, traders can generate fresh ideas and validate potential opportunities without being confined to a single exchange’s ecosystem.

Key Features and User Experience

The user interface is data-rich yet straightforward, designed for quick scanning and deep dives. The "Gainers & Losers" list is a go-to for momentum traders, instantly showing which cryptocurrencies are experiencing the most significant price swings. This data, combined with volume and liquidity scores, helps traders differentiate between a sustainable trend and a low-liquidity pump.

- Momentum Discovery: The Gainers & Losers leaderboards are perfect for identifying volatile assets with high 24-hour trading volume, a key ingredient for successful day trading.

- Sector Analysis: Category pages allow you to track the performance of entire crypto sectors (e.g., DeFi, Memes, AI) to pinpoint where capital is flowing.

- Comprehensive Data: Access to constantly updated market data is completely free, providing an essential resource for precursory research and trade idea generation. For instance, traders on the Ethereum network can use this data alongside tools like an ETH gas tracker to time their trades more effectively.

Trading Tip: Start your day by checking the "Top Crypto Gainers and Losers" page. Filter by assets with over $10 million in 24-hour volume to avoid illiquid traps. Once you identify a promising asset, click on its "Markets" tab to see which exchanges offer the most liquidity for that specific trading pair, ensuring you can execute your strategy with minimal slippage.

Although CoinMarketCap doesn't support direct trading and can experience minor data lags during extreme market volatility, its value as a free, comprehensive, and unbiased discovery tool is unmatched. It empowers traders to make informed decisions by providing the market-wide context needed to find and vet opportunities.

Platform Link: https://coinmarketcap.com

7. TradingView

For day traders who live and breathe technical analysis, TradingView is the undisputed gold standard. It's not an exchange but a powerful charting, screening, and social platform that provides the professional-grade tools needed to identify and analyze the best cryptocurrency for day trading. Its core strength is its unparalleled charting interface, packed with a massive library of indicators, drawing tools, and customization options that cater to every imaginable trading style.

The platform’s dedicated Crypto Coin Screener allows traders to filter thousands of assets across centralized and decentralized exchanges using technical, on-chain, and sentiment metrics. This makes it incredibly efficient to find coins that meet specific criteria, such as high volatility, recent breakouts, or oversold conditions.

Key Features and User Experience

The user experience is centered around its best-in-class charts, which are powered by real-time data from nearly every major crypto exchange. While a free plan is available, serious day traders will need a paid subscription to unlock essential features like multi-chart layouts, more indicators per chart, and faster data flow. You can learn more about how professionals use such tools at vtrader.io to enhance their strategies.

- Advanced Charting and Pine Script: Access hundreds of built-in indicators or create your own custom strategies using the proprietary Pine Script language.

- Powerful Screening Tools: The Crypto Screener is highly customizable, allowing you to scan for opportunities based on performance, oscillators, volume, and more.

- Broker Integration: Connect your exchange or broker account (e.g., Binance, Bybit) to execute trades directly from your TradingView charts, streamlining your workflow.

Trading Tip: Use the multi-chart layout feature (available on paid plans) to monitor a single cryptocurrency, like SOL/USDT, across multiple timeframes simultaneously (e.g., 1m, 5m, 15m, 1H). This allows you to spot short-term entry points on lower timeframes that align with the dominant trend on higher timeframes, significantly improving the probability of your trades.

While the necessity of a paid plan for full functionality is a drawback, no other platform offers this level of analytical depth and charting excellence. It is an indispensable tool for any trader serious about technical analysis.

Platform Link: https://www.tradingview.com/crypto-screener

Top 7 Crypto Day Trading Platforms Comparison

| Platform | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| En Us – Explore Crypto | Low | Moderate | Commission-free trading & crypto learning | Beginners to intermediate traders | Zero-fee trades, strong learning ecosystem, secure |

| Coinbase Advanced | Medium | High | Advanced trading with deep liquidity | Active U.S. day traders | TradingView charts, robust APIs, strong compliance |

| Kraken Pro | Medium | Medium to High | Competitive fees, liquidity incentives | Active traders, margin & futures users | Fee discounts, deep liquidity, regulated derivatives |

| Robinhood Crypto | Low | Low | Commission-free trading with spread costs | Casual/entry-level U.S. users | Easy onboarding, accessible across U.S., mobile UX |

| Crypto.com Exchange | Medium | Medium | Lower-cost trading with staking features | Cost-sensitive and staking-focused traders | Low taker fees, staking integration, strong liquidity |

| CoinMarketCap | Low | Low | Market data aggregation & trade opportunity ID | Research and trade idea generation | Free, comprehensive market data |

| TradingView | Medium | Medium to High | Advanced charting and screening for trading | Technical analysts and intraday traders | Premium charts, screening tools, broker integration |

Maximizing Your Profits: The Final Verdict

Navigating the volatile world of cryptocurrency day trading requires a potent combination of the right assets, powerful tools, and a robust trading platform. Throughout this guide, we've explored a range of top-tier platforms, from comprehensive exchanges like Coinbase Advanced and Kraken Pro to indispensable analytical tools such as TradingView and CoinMarketCap. Each offers unique strengths, whether it's advanced charting capabilities, deep liquidity, or access to a vast array of digital assets.

The central takeaway is that there is no single "best" platform for everyone. Your ideal choice hinges entirely on your individual trading style, experience level, and strategic goals. A novice trader might prioritize the educational resources and user-friendly interface of En Us, while a seasoned professional will demand the sophisticated order types and real-time data feeds of a pro-level exchange. The key is to align the platform's features with your personal trading workflow.

Key Considerations for Your Final Decision

As you finalize your choice, remember that the best cryptocurrency for day trading is often the one you can trade most efficiently and cost-effectively. Profitability isn't just about successful trades; it's about minimizing the costs that eat into your returns. Consider these critical factors:

- Trading Fees: Are you paying a commission on every single trade? Over hundreds or thousands of trades, these small percentages accumulate into significant amounts, directly reducing your net profit.

- Liquidity and Slippage: Does the platform have enough trading volume for your chosen assets? Low liquidity can lead to slippage, where your order executes at a less favorable price than intended, especially with large market orders.

- Analytical Tools: Can you perform detailed technical analysis directly on the platform, or will you need to rely on external tools like TradingView? An integrated, all-in-one solution saves time and streamlines your decision-making process.

- Tax Implications: Successful trading generates profits, which also creates tax obligations. Once you've identified the best cryptocurrencies and platforms, don't forget the importance of optimizing your tax strategy with crypto tax loss harvesting to keep more of your hard-earned profits.

Ultimately, your success as a day trader is a direct result of the ecosystem you build. By carefully selecting a cryptocurrency with high volatility and volume, pairing it with a low-fee exchange, and leveraging top-tier analytical tools, you create a powerful foundation for consistent profitability. The journey is continuous, so keep learning, adapting your strategy, and refining your toolkit to stay ahead in this fast-paced market.

Ready to stop sacrificing your profits to high commission fees? vTrader offers a powerful, all-in-one solution with zero-fee trading on over 30 of the most popular cryptocurrencies. Combine advanced analytical tools, robust security, and an integrated learning ecosystem to elevate your trading strategy without the extra cost. Explore vTrader today and discover how a commission-free platform can maximize your day trading results.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.