Unlocking Passive Income: A Deep Dive into Crypto Staking

In the world of digital assets, staking has solidified its place as a primary method for generating passive income. This strategy allows you to put your cryptocurrency to work, earning rewards simply for holding and supporting a network. But what does staking actually involve? In essence, it’s the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. By ‘locking up’ a specific amount of your crypto assets, you contribute directly to the network's security and operations. In exchange for this service, you receive rewards, typically in the form of newly created coins or transaction fees.

This guide moves beyond simple, surface-level recommendations to provide a comprehensive roundup of the best crypto to stake. We will dissect the leading contenders, evaluating each one based on a core set of critical criteria. These include potential annual percentage yield (APY), the underlying strength and security of the network, ecosystem maturity, specific lock-up periods, and the inherent risks involved with each asset. Our objective is to arm you with detailed, actionable insights, helping you select the ideal cryptocurrency for your staking strategy and risk tolerance, whether you are a seasoned investor or just starting your journey into decentralized finance.

1. Ethereum 2.0 (ETH)

Following its historic transition from Proof-of-Work to Proof-of-Stake in an event known as "The Merge," Ethereum cemented its position as a cornerstone of the staking world. By staking ETH, you actively participate in securing the network, processing transactions, and storing data, all while earning rewards. This makes it a compelling candidate for anyone searching for the best crypto to stake, combining robust security with a vibrant ecosystem.

How to Stake Ethereum

There are two primary pathways for staking ETH. The first is solo staking, which requires you to run your own validator node. This path offers full control and rewards but comes with a steep minimum requirement of 32 ETH and significant technical responsibility. For those who don't meet the capital or technical threshold, staking pools and liquid staking platforms provide an accessible alternative. Services like Lido Finance, Rocket Pool, and centralized exchanges like Coinbase and Kraken allow you to stake any amount of ETH and receive a liquid token (like stETH from Lido) in return, which can be used in other DeFi applications.

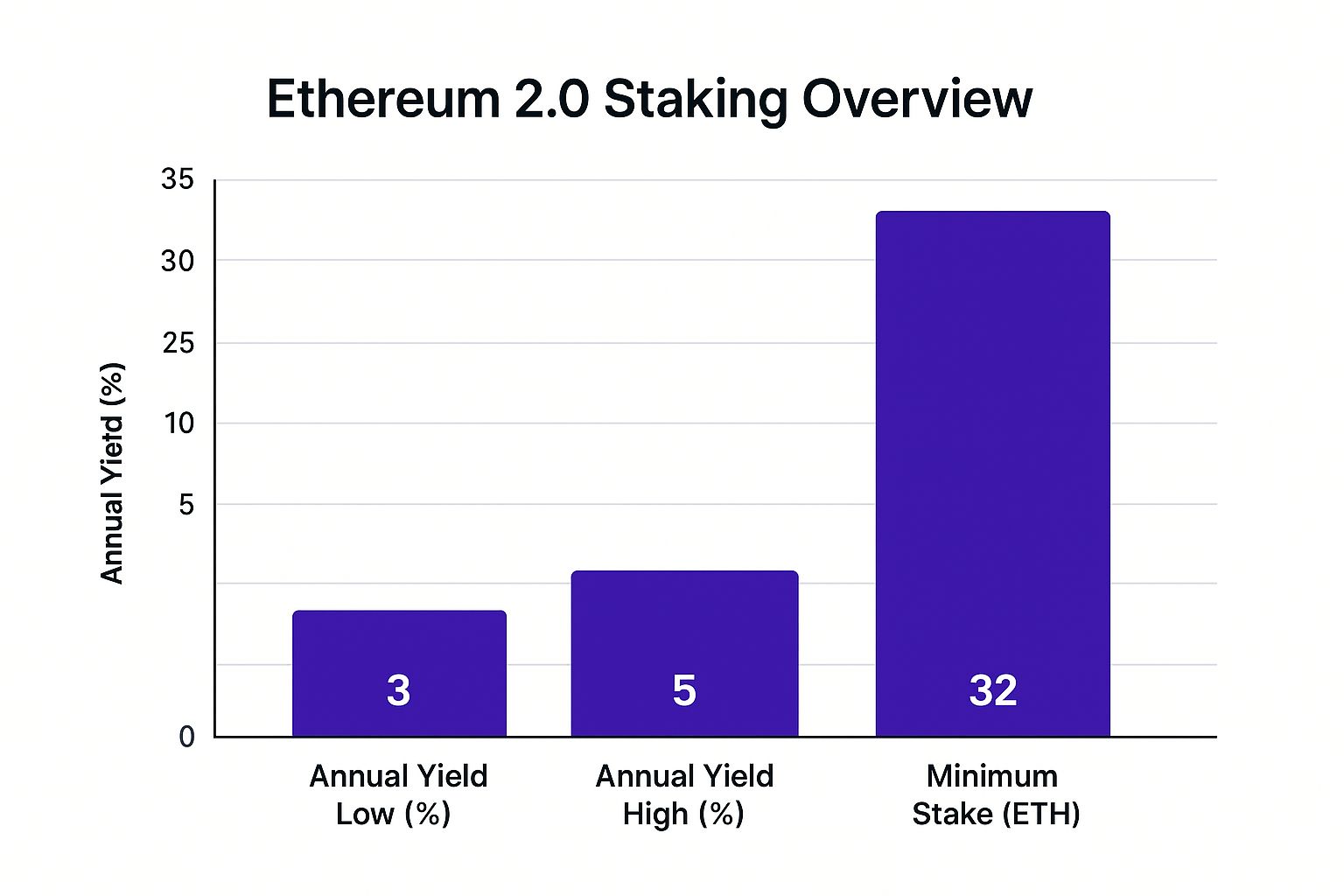

The following bar chart outlines key data points for Ethereum staking, including typical yield percentages and the minimum stake for solo validators.

As the data shows, while the annual yield typically ranges from 3-5%, the direct path to becoming a validator requires a substantial 32 ETH investment.

Staking Tips and Risks

Before committing your funds, consider these factors:

- Weigh Your Options: For smaller amounts, liquid staking platforms offer flexibility and lower barriers to entry compared to solo staking.

- Understand the Risks: Be aware of "slashing," a penalty where a validator loses a portion of its staked ETH for malicious behavior or prolonged downtime.

- Monitor Your Investment: As you evaluate potential returns, it's crucial to see how these investments fit into your overall financial picture. For comprehensive tracking, you might want to learn how to choose the best net worth tracker app to monitor your assets effectively.

- Stay Informed: The Ethereum network is constantly evolving. Keep an eye on network upgrades and changes to staking parameters that could impact your returns. The popularity of staking continues to grow, and you can read more about Ethereum's staking milestones to grasp its scale.

2. Cardano (ADA)

Cardano stands out in the staking landscape with its unique Ouroboros Proof-of-Stake protocol, a system built on peer-reviewed academic research. Staking ADA involves delegating your holdings to a stake pool, allowing you to participate in network security and earn rewards without ever locking up your funds. This combination of scientific rigor, user-friendly delegation, and energy efficiency makes Cardano a top-tier choice for those seeking the best crypto to stake.

How to Stake Cardano

Staking on the Cardano network is designed to be accessible. Instead of running a complex validator node, you simply delegate your ADA to one of the hundreds of community-run stake pools. This process can be done directly from official native wallets like Daedalus (a full-node wallet) or Yoroi (a light wallet), which give you complete control over your keys. For those who prefer a more streamlined experience, major centralized exchanges like Binance and Kraken also offer ADA staking services, though this typically means relinquishing custody of your assets to the exchange.

Staking Tips and Risks

Before delegating your ADA, consider these key strategies and potential risks:

- Choose Unsaturated Pools: The Cardano protocol is designed to discourage centralization by reducing rewards for pools that become "saturated." Opt for pools with high performance but well below the saturation point for optimal returns.

- Evaluate Pool Operators: Research a pool's operator. Look for a strong reputation, consistent uptime, and reasonable fees (both a fixed fee per epoch and a variable margin). Many operators are active in the community and even support charitable missions.

- Diversify Your Delegation: Mitigate risk by splitting your stake across several different pools. This protects your reward stream if one pool underperforms or goes offline.

- Participate in Project Catalyst: As a staker, you can register to vote on community-funded proposals through Project Catalyst. Participating not only gives you a say in the ecosystem's future but also provides additional ADA rewards.

- Monitor Network Health: The value of your stake and rewards is tied to the network's overall progress. Staying informed about Cardano's market performance and enterprise launches can provide valuable context for your investment strategy.

3. Solana (SOL)

Solana stands out as a high-performance blockchain designed for speed and scalability, utilizing a unique combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus. By staking SOL, you delegate your tokens to validators who process transactions and secure the network, contributing to its lightning-fast operations. This combination of strong annual yields and a rapidly growing ecosystem makes Solana a top-tier choice for those seeking the best crypto to stake.

How to Stake Solana

Staking SOL is primarily done through delegation. You choose a validator to entrust your tokens to without ever giving up custody of your assets. The most common method is through native Solana wallets like Phantom or Solflare, which have built-in staking interfaces. For those seeking more flexibility, liquid staking platforms such as Marinade Finance or Jito allow you to stake SOL and receive a liquid token in return (like mSOL or JitoSOL). These tokens can then be used across Solana's DeFi ecosystem to earn additional yield. Centralized exchanges also offer simplified staking services for SOL holders.

Staking Tips and Risks

Before delegating your SOL, review these essential factors to maximize returns and minimize risks:

- Validator Research is Key: Carefully evaluate potential validators based on their performance, uptime history, and commission fees. A high-performing validator with low commission ensures you receive a larger share of the rewards.

- Consider Liquid Staking: If you want to maintain liquidity, liquid staking protocols offer an excellent alternative to traditional staking, allowing your capital to remain productive elsewhere in DeFi.

- Understand Epoch Timelines: Staking and unstaking on Solana are not instantaneous. Be aware of the network's "epoch" schedule, as stakes take time to warm up (become active) and cool down (become liquid).

- Diversify Your Delegation: Avoid placing all your SOL with a single validator. Spreading your stake across several reputable validators mitigates the risk of a single point of failure or poor performance impacting your entire investment. To get started, you can follow a detailed Solana (SOL) staking guide for 2025 to navigate the process.

4. Polkadot (DOT)

Polkadot stands out in the crypto space with its unique mission to enable a multi-chain, interoperable web. It uses a Nominated Proof-of-Stake (NPoS) consensus mechanism, where DOT holders, known as nominators, back validators they trust to secure the network. This system not only supports the network’s security and governance but also offers a dynamic way to earn rewards, making it a top choice for those looking for the best crypto to stake with a focus on cross-chain innovation.

How to Stake Polkadot

Staking DOT involves actively participating in the network by selecting validators. The most direct method is through a native wallet like Polkadot-JS, where you can bond your DOT and nominate up to 16 validators. This approach gives you full control over your nominations and allows you to participate directly in on-chain governance.

For a simpler, more hands-off experience, many centralized exchanges like Kraken offer Polkadot staking services. These platforms handle the technical complexities of nomination for you, although they may take a small fee from your rewards. Another unique way to utilize your DOT is by participating in parachain crowdloans, where you lock your tokens to help a new project secure a slot on the Polkadot network, often receiving that project’s native token as a reward.

Staking Tips and Risks

To maximize your staking returns and minimize risks with Polkadot, keep these factors in mind:

- Diversify Your Nominations: Always nominate multiple trusted validators. If one validator gets slashed (penalized) for misbehavior or goes offline, you won't lose all potential rewards.

- Do Your Homework: Before nominating, research a validator’s history, commission rate, and uptime. A reliable validator leads to more consistent rewards.

- Plan for Unbonding: Withdrawing staked DOT involves a 28-day unbonding period during which your funds are locked and do not earn rewards. Plan any withdrawals well in advance.

- Engage with Governance: As a DOT holder, you have a voice in the network's future. Participating in governance proposals can be both rewarding and empowering.

- Explore Crowdloans: Parachain crowdloans offer an alternative to traditional staking, providing a chance to support emerging projects and earn different types of rewards. As the ecosystem grows, keeping track of developments and market performance for Polkadot can help you spot new opportunities.

5. Tezos (XTZ)

Tezos stands out with its innovative Liquid Proof-of-Stake (LPoS) consensus mechanism and a strong focus on self-amendment through on-chain governance. This unique design allows the network to evolve and implement upgrades without contentious hard forks. By staking, or "baking," XTZ, participants help secure the network and validate transactions, earning rewards in the process. Its adaptability and active community governance make it a strong contender for the best crypto to stake for those who value protocol evolution and direct participation.

How to Stake Tezos

Staking on the Tezos network is exceptionally accessible. Instead of requiring a large minimum stake to run your own validator (a "baker"), most users opt for delegation. This process involves assigning your voting rights to a baker who then stakes on your behalf, sharing the earned rewards with you after taking a small fee. Crucially, you retain full custody of your XTZ at all times, as delegation is a non-custodial act.

Popular wallets like Temple Wallet or Kukai Wallet allow you to delegate directly to a baker of your choice from within the wallet's interface. For an even simpler approach, centralized exchanges like Coinbase and Kraken offer streamlined Tezos staking services, handling the entire delegation process automatically for their users. This flexibility allows anyone, regardless of technical expertise or the amount of XTZ they hold, to participate.

Staking Tips and Risks

To maximize your Tezos staking experience and returns, consider the following factors:

- Baker Selection is Key: Choose your baker carefully. Research their performance history, uptime, fee structure, and whether they are over-delegated, which can impact reward payouts. A reliable baker ensures consistent rewards.

- Diversify Your Delegation: To mitigate the risk of a single baker underperforming or shutting down unexpectedly, consider splitting your XTZ holdings and delegating to multiple bakers.

- Engage in Governance: Your staked XTZ gives you voting power on protocol amendments. Participating in governance proposals allows you to have a direct say in the future of the Tezos network.

- Understand the Risks: While you retain custody of your tokens, the primary risk is opportunity cost. If your chosen baker performs poorly, has significant downtime, or fails to pay out rewards, you will earn less than you could have with a more efficient validator. Always monitor your baker's performance.

6. Cosmos (ATOM)

Often called the "Internet of Blockchains," Cosmos is designed to solve the problem of blockchain interoperability. It uses a Delegated Proof-of-Stake (DPoS) consensus mechanism powered by Tendermint, allowing independent blockchains to communicate with each other seamlessly. By staking the native token, ATOM, you delegate your holdings to a validator, helping secure the network and process transactions. In return, you earn staking rewards and gain the right to vote on governance proposals, making it a powerful contender for the best crypto to stake.

How to Stake Cosmos

Staking ATOM is primarily done through delegation using a compatible wallet. The most popular choice within the ecosystem is the Keplr wallet, which provides a user-friendly interface for selecting validators and delegating your tokens. The process involves choosing one or more validators from an active list, considering their commission rates and uptime, and then committing your ATOM. In addition to native staking, the ecosystem offers liquid staking options through decentralized exchanges like Osmosis. This allows you to receive a liquid token representing your staked ATOM, which can then be used in other DeFi protocols across the Cosmos network.

Staking Tips and Risks

Before delegating your ATOM, keep these key considerations in mind:

- Choose Validators Wisely: Don't just pick the validator with the lowest commission. Research their performance history, uptime, and participation in governance. A reliable validator maximizes your rewards and protects your investment.

- Diversify Your Delegation: Avoid delegating all your ATOM to a single validator. Spreading your stake across several reputable validators minimizes your risk if one of them experiences downtime or gets slashed for misbehavior.

- Engage in Governance: Your staked ATOM gives you a voice. Stay informed about active governance proposals and participate in voting. This not only helps shape the future of the Cosmos Hub but is often a prerequisite for certain ecosystem rewards.

- Hunt for Airdrops: The Cosmos ecosystem is famous for its airdrops. New projects built within the network frequently reward ATOM stakers with free tokens. Staking ATOM, often outside of centralized exchanges, makes you eligible for these lucrative opportunities from projects like Osmosis, Juno, and Stargaze.

7. Avalanche (AVAX)

Avalanche stands out with its novel Snow consensus protocol, delivering high transaction throughput and near-instant finality. Its unique architecture, featuring customizable "subnets," allows projects to launch their own bespoke blockchains. By staking AVAX, you help secure the primary network and validate transactions, making it a powerful choice for those seeking the best crypto to stake while supporting a highly scalable and developer-friendly ecosystem.

How to Stake Avalanche

Staking on Avalanche offers two distinct roles: validator and delegator. Becoming a validator requires running a node and staking a minimum of 2,000 AVAX, granting you direct participation in the network's consensus. For those with a smaller amount, delegating is the perfect alternative. You can delegate as little as 25 AVAX to an existing validator and earn a share of their rewards. This can be done directly through the official Avalanche Wallet. For more flexibility, DeFi protocols like Trader Joe offer liquid staking solutions, providing a tokenized version of your staked AVAX that can be used elsewhere.

Staking Tips and Risks

To maximize your Avalanche staking experience, consider these key points:

- Choose Your Lock-up Period Wisely: Avalanche allows you to set a staking period from two weeks to one year. Longer periods may offer higher rewards but reduce your liquidity.

- Vet Your Validator: If delegating, research a validator’s uptime history and commission fees. A reliable validator with low fees ensures you receive the maximum possible rewards.

- Explore Liquid Staking: For those who don’t want their capital locked, liquid staking offers a way to earn rewards while keeping your assets usable in other DeFi applications.

- Monitor Subnet Growth: Keep an eye on the development of new subnets, especially in burgeoning sectors like gaming. The expansion of the ecosystem can create new staking opportunities, and you can read about new initiatives like the Avalanche gaming battle pass to stay informed.

- Factor in Opportunity Cost: Remember that while your AVAX is staked, you cannot sell it or use it for other investment opportunities. Weigh the staking rewards against potential gains from other activities.

Top 7 Crypto Staking Comparison

| Network | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Ethereum 2.0 (ETH) | High technical setup for solo validators; requires understanding slashing risk | High barrier solo: 32 ETH; pools allow smaller stakes | Moderate yield (3-5%); strong security and deflationary tokenomics | Long-term staking, DeFi integration, institutional investment | High decentralization and network security; multiple staking options |

| Cardano (ADA) | Low complexity; delegation without lock-up | No minimum stake; small transaction fees | Moderate yield (4.5-5.5%); no slashing risk | Easy entry staking; environmentally focused projects | No lock-up, sustainable consensus, active governance system |

| Solana (SOL) | Moderate complexity; validator delegation and warmup periods | Variable by validator; liquid staking available | High yield (6-8%); very fast transactions | High-speed apps, DeFi, NFT ecosystems | High staking rewards, fast low-cost network, liquid staking |

| Polkadot (DOT) | Complex nomination process; 28-day unbonding | High minimum for nomination: 120 DOT | High yield (10-14%); slashing risk on nominees | Interoperability projects; governance participation | Strong interoperability; active governance and parachains |

| Tezos (XTZ) | Low to moderate; baking or delegation; governance involved | Low minimum: 1 XTZ; no lock-up | Moderate yield (4.5-6%); no lock-up period | Formal verification projects; institutional adoption | Self-amending protocol; no lock-up; strong security focus |

| Cosmos (ATOM) | Moderate; delegated PoS with 21-day unbonding | Variable minimum by validator | High yield (15-20%); slashing risk present | Interoperability and multi-chain ecosystems | Strong interoperability; regular airdrops; active governance |

| Avalanche (AVAX) | Moderate; subnet setup adds complexity | 25 AVAX delegation; 2000 AVAX for validation; lock-up varies | High yield (8-11%) depending on stake duration | Enterprise blockchains; customizable subnet use cases | Flexible staking periods; high throughput; EVM-compatible |

Making Your Choice: A Strategic Guide to Staking Success

Navigating the world of staking can feel overwhelming, but as we have explored, the goal is not to find a single, universally "best" asset. Instead, the objective is to identify the best crypto to stake for your unique financial goals, risk appetite, and desired level of hands-on involvement. The path to generating passive income through staking is paved with strategic decisions, not speculative guesses. By understanding the core trade-offs between yield, security, and flexibility, you can build a resilient and profitable staking portfolio.

This guide has provided a deep dive into the top contenders, from the bedrock security of Ethereum to the high-performance ecosystems of Solana and Avalanche. Your choice ultimately hinges on what you value most as an investor.

Recapping Your Top Staking Candidates

To crystallize your decision, consider which investor profile best describes you:

-

The Blue-Chip Strategist: If maximum security and network decentralization are your top priorities, Ethereum (ETH) remains the undisputed leader. Its robust ecosystem and proven track record make it a cornerstone for any long-term, conservative staking strategy.

-

The High-Yield Seeker: For those comfortable with more complexity in exchange for higher potential returns, Polkadot (DOT) and Cosmos (ATOM) are compelling choices. Their impressive APYs are attractive, but remember to account for their longer unbonding periods and the intricacies of their respective ecosystems.

-

The Flexible Investor: If you need to keep your assets liquid and accessible, Cardano (ADA) and Tezos (XTZ) are ideal. Their native liquid staking models, which feature no mandatory lock-up periods, offer a perfect blend of reward generation and financial agility.

-

The Performance Enthusiast: For investors betting on the future of high-speed decentralized applications, Solana (SOL) and Avalanche (AVAX) stand out. Staking these assets means supporting rapidly growing DeFi and NFT landscapes, offering a stake in what could be the future of blockchain performance.

Your Actionable Pre-Staking Checklist

Before you commit your capital, a final round of due diligence is critical. This is not just a suggestion; it is a vital step in protecting your investment and maximizing your success.

- Thoroughly Vet Your Validator: Do not delegate your stake to the first validator you see. Investigate their uptime history, commission fees, and community reputation. A reliable validator is your partner in earning rewards, while a poor one can lead to missed income or even slashing penalties.

- Internalize the Risks: Re-familiarize yourself with the primary risks: market volatility (the token's price can fall), slashing (penalties for validator malpractice), and unbonding periods (the time your assets are locked before you can sell).

- Define Your Allocation: Never invest more than you are prepared to lose. Decide what percentage of your portfolio you will allocate to staking and stick to your plan. This disciplined approach prevents emotional decision-making during market fluctuations.

Mastering these concepts transforms you from a passive participant into an active, informed investor. It is the difference between simply holding crypto and strategically putting it to work to build lasting wealth.

Ready to put this knowledge into action and begin your journey? vTrader simplifies the entire process by offering secure, integrated, and zero-fee staking for many of the top assets discussed today. Sign up in minutes, claim your welcome bonus, and start building your passive income portfolio with confidence.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.