Unlocking the Power of Staking: Your Guide to Top Platforms

Finding the best crypto staking platforms can feel like navigating a maze. This listicle cuts through the complexity, presenting 10 leading platforms for 2025, each carefully analyzed to help you maximize your crypto earnings. Whether you're a seasoned trader or just starting, this guide offers actionable insights to choose the platform that aligns with your individual needs. We'll delve into critical aspects like fees, security, user experience, and potential yields.

This detailed comparison covers a diverse range of platforms, from established giants like Coinbase and Binance to innovative decentralized options like Lido Finance and Rocket Pool. We'll also explore platforms like Marinade Finance, Staked, Chorus One, Figment, and Everstake, offering a broad spectrum of staking solutions. Understanding these nuances is crucial for optimizing your staking strategy and achieving your financial objectives within the crypto market.

What You'll Learn

This listicle delivers practical guidance, enabling you to:

- Identify secure and reliable staking platforms: We'll examine the security measures each platform employs, helping you protect your assets.

- Maximize your staking rewards: Discover platforms offering competitive yields and understand how to leverage their features to boost returns.

- Choose a platform tailored to your experience level: Find beginner-friendly options or platforms with advanced tools for seasoned investors.

- Navigate the diverse features of each platform: Learn about unique offerings, from flexible staking options to integrated educational resources.

If you're interested in maximizing your reach and sharing valuable information about these platforms, consider automating your content creation. To automate video creation, consider exploring the capabilities of AI video generators. (Source: Top 10 Best AI Video Generators of 2025 for Stunning Content from ClipCreator.ai)

This in-depth analysis of the best crypto staking platforms provides the knowledge you need to confidently navigate this evolving space. This curated list offers a comprehensive overview, empowering you to choose the perfect platform for your crypto staking journey.

1. Coinbase

Coinbase is one of the largest and most user-friendly cryptocurrency exchanges, offering staking services for a variety of cryptocurrencies. It provides a streamlined, automated staking experience directly within your Coinbase account, eliminating technical hurdles and minimum balance requirements. This makes it an excellent entry point for beginners looking to delve into the world of crypto staking and passive income. For seasoned investors, Coinbase offers a familiar and trusted platform to diversify their portfolio and earn rewards on existing holdings.

Ease of Use and Accessibility

Coinbase's intuitive interface simplifies the staking process, making it accessible even to those new to crypto. Users can stake their assets with just a few clicks, without needing to manage private keys or understand complex technical setups. This ease of use is a significant advantage for novice investors. Beyond staking, Coinbase functions as a comprehensive trading platform, offering buying, selling, and trading services for a multitude of cryptocurrencies.

Supported Cryptocurrencies and Rewards

Coinbase supports staking for a growing number of cryptocurrencies, including Ethereum (ETH), Cardano (ADA), Algorand (ALGO), Cosmos (ATOM), and several others. This breadth of options allows users to diversify their staking portfolio and potentially maximize returns. When exploring different investment avenues, it's worthwhile to consider the evolving landscape of influencer marketing, particularly on platforms like TikTok. Check out this article: Top TikTok Influencers to Follow in 2025. The platform boasts over 100 million users globally, providing substantial reach and engagement opportunities. As a publicly traded company (COIN), Coinbase operates with a degree of transparency not always present in the crypto space.

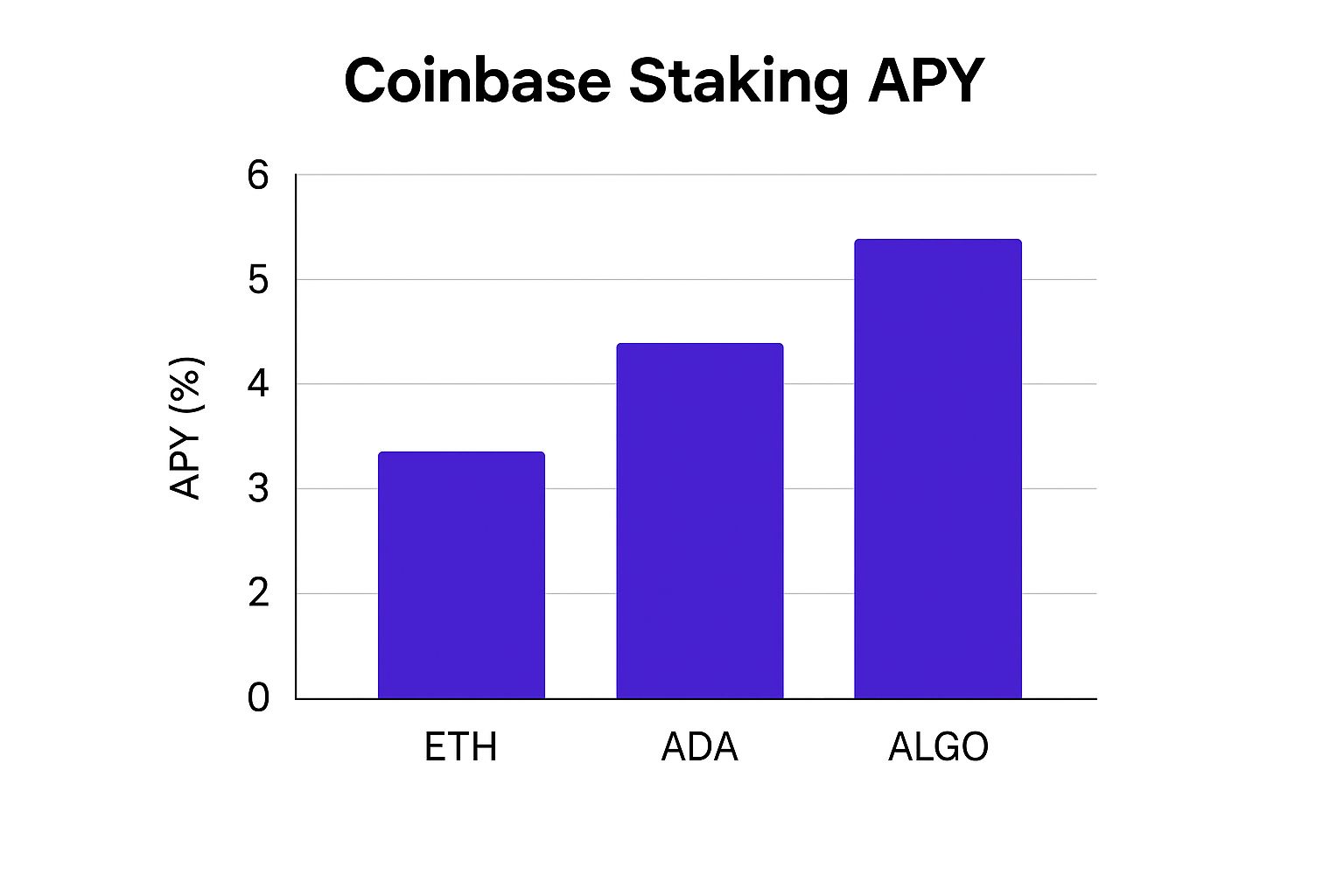

The bar chart above visualizes the average Annual Percentage Yield (APY) offered by Coinbase for three prominent stakeable assets. As the chart indicates, estimated returns can vary depending on the specific cryptocurrency. While these rates can fluctuate, the visualization provides a snapshot of the potential passive income achievable through Coinbase's staking program.

Tips for Staking on Coinbase

- Compare Rewards: Research staking rewards across various platforms to ensure you're getting a competitive rate. Don't settle for the first offer you see.

- Understand Lock-Up Periods: Be aware of any lock-up periods or unstaking restrictions associated with each cryptocurrency before committing your funds.

- Prioritize Security: Enable two-factor authentication (2FA) to add an extra layer of security to your Coinbase account.

- Consider Dollar-Cost Averaging: Gradually build your staking positions over time using dollar-cost averaging to mitigate the impact of market volatility.

2. Binance

Binance is the world's largest cryptocurrency exchange by trading volume, offering comprehensive staking services. These services are available through multiple products, including Binance Earn, DeFi Staking, and Locked Staking. It provides both flexible and fixed-term staking options with competitive rewards, catering to a diverse range of investors. Binance is an attractive platform for both beginners and experienced users due to its wide array of features and extensive cryptocurrency support.

Ease of Use and Accessibility

Binance offers a user-friendly interface, especially within the Binance Earn section, simplifying the staking process. Users can easily navigate through different staking products and select their preferred options. While the platform offers advanced trading tools, the staking process itself remains straightforward. This accessibility makes it suitable for users with varying levels of experience in the crypto space. The platform is available on both web and mobile, enhancing convenience for users who prefer trading on the go.

Supported Cryptocurrencies and Rewards

Binance supports staking for a large selection of cryptocurrencies, exceeding 50 different assets. This extensive list provides users with ample opportunities to diversify their staking portfolio and potentially optimize returns. The platform offers various staking durations and reward rates, allowing users to choose options that align with their investment goals and risk tolerance. Binance also offers educational resources through Binance Academy, empowering users to make informed staking decisions.

Tips for Staking on Binance

- Start with Flexible Staking: Begin with flexible staking products to understand the process and explore different options before committing to fixed-term lock-up periods.

- Monitor APY Rates: Promotional APY rates on Binance can change frequently. Regularly monitor these rates to ensure you're receiving optimal returns.

- Utilize Binance Academy: Take advantage of the educational resources available on Binance Academy to learn more about staking and different cryptocurrencies.

- Consider BNB Token: Using Binance's native BNB token can offer fee discounts and other benefits within the ecosystem.

- Research Security Best Practices: Implement strong security measures like 2FA to protect your Binance account.

3. Kraken

Kraken is a well-established cryptocurrency exchange known for its robust security, regulatory compliance, and professional-grade staking services. It offers on-chain staking, allowing users to directly participate in network consensus and earn rewards. Kraken's focus on security and its strong reputation in the institutional crypto space make it a compelling option for both seasoned investors and those new to staking. For over 12 years, Kraken has operated without being hacked, building trust among its 9 million+ users. Learn more about their institutional-grade services: Kraken Launches Exclusive Prime Brokerage Service.

Ease of Use and Accessibility

While Kraken offers a professional trading platform (Kraken Pro) with advanced charting and order types, its standard interface is also user-friendly. Users can easily navigate the platform to access staking services. Kraken provides clear instructions and educational resources to guide users through the staking process. This commitment to user education is beneficial for those starting their staking journey. The platform's accessibility extends to both desktop and mobile devices.

Supported Cryptocurrencies and Rewards

Kraken supports a diverse range of cryptocurrencies for staking, including prominent assets like Ethereum (ETH), Polkadot (DOT), Solana (SOL), and Cardano (ADA). This variety enables users to diversify their staking portfolio and optimize their reward potential. Kraken's competitive reward rates, combined with its robust security infrastructure, position it as a strong contender in the staking landscape. The exchange was the first to obtain a U.S. banking charter, furthering its position as a trusted platform.

Tips for Staking on Kraken

- Explore Kraken Pro: If you're a more experienced trader, consider using Kraken Pro for lower fees and advanced trading features.

- Maximize Rewards: Compare staking rewards across different cryptocurrencies on Kraken to identify the most lucrative opportunities.

- Security First: Enable two-factor authentication (2FA) and utilize Kraken's security features to protect your account.

- Funding Options: Explore Kraken's funding options, including wire transfer, for potentially better limits compared to other methods.

- Large Transactions: For substantial cryptocurrency transactions, consider using Kraken's over-the-counter (OTC) desk.

4. Lido Finance

Lido Finance is a leading liquid staking protocol that allows users to stake their cryptocurrencies while maintaining liquidity. This is achieved through derivative tokens. It's particularly popular for Ethereum staking, providing stETH tokens that represent staked ETH. These stETH tokens can then be used in various decentralized finance (DeFi) protocols, opening up additional earning opportunities. This makes Lido a powerful tool for those looking to maximize returns on their crypto holdings. Lido Finance stands out as one of the best crypto staking platforms due to its innovative approach to liquid staking and its broad DeFi integration.

Ease of Use and Accessibility

Lido offers a user-friendly interface for staking, simplifying the process significantly. Users can easily stake their ETH and receive stETH in return. This streamlined process eliminates the technical complexities often associated with staking and makes it accessible to a wider audience. The platform's integration with major DeFi protocols further enhances its usability, allowing seamless interaction with other platforms.

Supported Cryptocurrencies and Rewards

While primarily known for Ethereum staking, Lido is expanding its support to other cryptocurrencies. Currently, it supports Ethereum 2.0, Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM). This growing list of supported assets provides users with more options for diversifying their staking portfolio. Learn more about Lido Finance and related staking options in the context of recent Solana ETF filings: Learn more about…. Expanding into these diverse blockchain ecosystems further strengthens Lido's position as a versatile staking platform.

Tips for Staking on Lido Finance

- Understand Smart Contract Risks: Lido operates using smart contracts, which are inherently susceptible to vulnerabilities. Thoroughly research and understand these risks before staking your assets.

- Monitor stETH/ETH Price Ratio: The price ratio between stETH and ETH can fluctuate. Regularly monitor this ratio to manage your risk effectively.

- Consider Gas Fees: Ethereum gas fees can impact the profitability of staking, particularly for smaller amounts. Factor in these fees when making staking decisions.

- Explore DeFi Opportunities: Leverage stETH in various DeFi protocols for yield farming and other income-generating strategies.

5. Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol offering a unique approach to earning rewards. It operates as a trustless and permissionless network, allowing users to stake any amount of ETH, even fractions. In return, they receive rETH, a liquid token representing their staked ETH plus accrued rewards. Rocket Pool also empowers node operators to run validators with less than the usual 32 ETH requirement, lowering the barrier to entry for participation in securing the Ethereum network.

Ease of Use and Accessibility

Rocket Pool simplifies ETH staking, particularly for those with less than 32 ETH. Users can stake any amount and receive rETH, which can be traded or used in other DeFi protocols. This flexibility makes Rocket Pool accessible to a wider range of investors. For those interested in running a node, Rocket Pool reduces the capital requirement by pooling resources. This allows more individuals to participate in validating the Ethereum network and earn rewards.

Supported Cryptocurrencies and Rewards

Currently, Rocket Pool exclusively supports Ethereum (ETH) staking. Users receive rETH, a token pegged to ETH that continuously accrues staking rewards. The value of rETH relative to ETH represents the accumulated staking returns over time. This single-asset focus allows Rocket Pool to specialize and optimize its services for Ethereum staking.

Tips for Staking on Rocket Pool

- Research Smart Contract Audits: Prioritize security by reviewing the audits of Rocket Pool's smart contracts to ensure the platform's reliability and safety.

- Understand rETH Premium/Discount: The value of rETH can fluctuate relative to ETH. Be aware of this dynamic and understand the potential for a premium or discount before staking.

- Join the Community Discord: Engage with the Rocket Pool community on Discord for support, updates, and to stay informed about the project's development.

- Consider DeFi Opportunities with rETH: Explore the various decentralized finance (DeFi) protocols that integrate rETH, opening up opportunities for lending, borrowing, and yield farming.

Rocket Pool is a compelling option for anyone looking to participate in ETH staking, especially those with smaller amounts of ETH or interested in running a node. Its decentralized and permissionless nature aligns with the ethos of Ethereum, offering a robust and accessible platform for earning staking rewards.

6. Marinade Finance

Marinade Finance is the leading liquid staking protocol on the Solana blockchain. It allows users to stake their SOL tokens and receive mSOL in return. mSOL is a liquid staking token that represents your staked SOL and can be used in various decentralized finance (DeFi) applications within the Solana ecosystem. This approach offers the benefits of staking rewards while maintaining access to your capital. Marinade contributes to the decentralization of the Solana network by distributing stake across a diverse set of validators.

Ease of Use and Accessibility

Marinade Finance simplifies the staking process on Solana. Users can easily stake their SOL and receive mSOL through a user-friendly interface. Unlike traditional staking, mSOL provides liquidity, allowing users to participate in other DeFi activities without unstaking their SOL. This flexibility is a key advantage for those looking to maximize their returns within the Solana ecosystem. To learn more about Solana's growth and investments, you can check out recent news like this article: Learn more about Marinade Finance and Solana's investment landscape.

Supported Cryptocurrencies and Rewards

Marinade Finance focuses specifically on Solana (SOL) staking. By staking SOL, users receive mSOL, which accrues staking rewards. These rewards are automatically compounded, increasing the value of mSOL over time. The platform's specialization in Solana allows it to optimize the staking process and offer competitive reward rates for SOL holders.

Tips for Staking on Marinade Finance

- Monitor Solana Network Health: Stay informed about the Solana network's performance and any potential downtime, as this can impact staking rewards.

- Understand mSOL/SOL Exchange Rates: Be aware of the exchange rate between mSOL and SOL, as this can fluctuate based on market conditions.

- Explore Solana DeFi Opportunities: Leverage mSOL to participate in various DeFi protocols within the Solana ecosystem, such as lending, borrowing, and yield farming.

- Keep Some SOL for Transaction Fees: Ensure you retain a small amount of SOL in your wallet to cover transaction fees on the Solana network.

7. Staked

Staked, acquired by Coinbase in 2021, is an institutional-grade staking platform designed for both individuals and institutions. It prioritizes security, reliability, and maximizing staking rewards. Staked achieves this through advanced infrastructure and sophisticated risk management practices, making it a robust choice for serious investors. This focus on institutional-grade features positions Staked as a premium option within the broader crypto staking landscape.

Ease of Use and Accessibility

While Staked offers a streamlined experience, its focus on institutional clients means it may not be as intuitive as platforms designed for retail investors. Navigating the platform and understanding its advanced features might require a steeper learning curve. However, for users comfortable with more complex financial tools, Staked offers a powerful suite of staking management options. Its interface is tailored for efficient management of larger staking amounts.

Supported Cryptocurrencies and Rewards

Staked supports staking for a diverse selection of prominent blockchain networks, including Ethereum 2.0, Polkadot, Solana, Tezos, and Cosmos. This variety caters to investors seeking diversification across multiple Proof-of-Stake protocols. Staked emphasizes maximizing returns through its robust infrastructure, ensuring validators maintain high uptime and optimal performance. This focus on performance is a key differentiator for investors looking to optimize their staking yields.

Tips for Staking on Staked

- Suitable for Larger Amounts: Staked is generally better suited for individuals and institutions staking significant amounts due to its institutional focus.

- Review Insurance Coverage: Carefully examine Staked’s insurance policies and security measures to understand the protections in place for your staked assets.

- Understand Fee Structure: Thoroughly review Staked's fee structure to accurately assess the impact on potential returns. Transparency in fees is crucial for informed investment decisions.

- Consider for Institutional Needs: If you have institutional-level staking requirements, Staked's focus on security, compliance, and advanced features makes it a strong contender.

8. Chorus One

Chorus One is a leading institutional blockchain infrastructure provider offering professional staking services across multiple Proof-of-Stake networks. They focus on secure, reliable, and high-performance validator operations with a strong emphasis on governance participation. This makes them an excellent choice for serious long-term stakers interested in actively contributing to the networks they invest in. Chorus One manages over $1 billion in delegated stake, demonstrating their significant presence in the staking ecosystem.

Ease of Use and Accessibility

While Chorus One primarily caters to institutional clients, their services are also accessible to individual stakers. They provide clear documentation and resources to guide users through the delegation process. However, compared to platforms like Coinbase, Chorus One assumes a higher level of technical understanding from its users. This focus on institutional-grade infrastructure and security makes them a robust choice for experienced investors seeking a reliable staking partner.

Supported Cryptocurrencies and Rewards

Chorus One validates on more than 25 networks, offering staking support for a diverse range of cryptocurrencies. This broad coverage allows users to diversify their staking portfolio across various promising projects. They actively participate in governance across the protocols they support, giving delegators a voice in the future direction of these networks. For serious stakers, this commitment to governance adds a valuable layer of engagement beyond simply earning rewards.

Tips for Staking on Chorus One

- Research Their Validations: Explore the networks Chorus One validates on to align your staking strategy with their expertise.

- Understand Delegation: Familiarize yourself with the concept of delegation and how it differs from direct staking. Chorus One handles the technical complexities of running validator nodes, allowing users to participate without managing their own infrastructure.

- Review Governance Record: Investigate Chorus One's governance voting record to understand their approach to network participation. This provides insight into their values and long-term vision.

- Consider Long-Term Strategy: Chorus One's focus on security and governance makes them particularly suitable for long-term stakers committed to the growth and development of Proof-of-Stake networks. Their commitment to these core principles benefits both the individual staker and the broader ecosystem.

9. Figment

Figment is a comprehensive blockchain infrastructure platform offering staking, governance, and data services across numerous Proof-of-Stake networks. Catering to both institutional and retail clients, Figment prioritizes education, security, and maximizing staking rewards. They manage billions in staked assets and support over 50 blockchain protocols, making them a significant player in the staking ecosystem. For those interested in recent developments, vTrader reported on Figment's ambitious acquisition strategy: Learn more about Figment's recent activity.

Ease of Use and Accessibility

Figment provides a user-friendly interface for managing staking activities across various networks. Their platform simplifies the often complex process of staking, offering a streamlined experience for both beginners and experienced users. While their focus extends to institutional clients, their tools remain accessible and intuitive for individual investors. This dual approach makes Figment a versatile platform for a wide range of staking needs.

Supported Cryptocurrencies and Rewards

Figment boasts support for a diverse range of 50+ blockchain protocols. This extensive list offers users ample opportunities to diversify their staking portfolio and potentially enhance returns. Their support for numerous networks positions them as a one-stop shop for users seeking exposure to various Proof-of-Stake cryptocurrencies. Figment's commitment to supporting a broad spectrum of assets underscores their dedication to the evolving staking landscape.

Tips for Staking on Figment

- Utilize Educational Resources: Figment offers a wealth of educational materials, including over 100 guides. Leverage these resources to deepen your understanding of staking and the specific networks they support.

- Compare Fees: Staking fees can vary across different networks. Thoroughly compare these fees on Figment to ensure you're optimizing your potential returns.

- Consider Governance Policies: Figment actively participates in governance across the networks they support. Review their voting policies to understand how they represent their users' interests.

- Explore API Integration: For institutional clients, Figment provides a robust API. Exploring this option can enhance large-scale staking operations and portfolio management.

10. Everstake

Everstake is a professional staking platform and validator service operating across 70+ blockchain networks. They cater to a broad spectrum of users, from individuals seeking passive income through staking to institutions requiring robust validation infrastructure. Everstake offers both direct staking services for individuals and white-label solutions for businesses, emphasizing high performance, security, and community engagement within the Proof-of-Stake ecosystem. Their extensive reach and involvement in numerous blockchain projects make them a prominent player in the staking landscape. You can learn more about Everstake's stance on regulatory matters and their commitment to non-custodial staking in this article: Learn more about Everstake's advocacy for non-custodial staking.

Ease of Use and Accessibility

While Everstake supports numerous blockchains, navigating their platform and selecting a suitable network for staking can initially seem overwhelming. However, their website provides detailed guides and resources to help users understand the process. They prioritize transparency and community engagement, offering support through various channels. This makes the platform accessible to both beginners and experienced users seeking to diversify their staking portfolios.

Supported Cryptocurrencies and Rewards

Everstake's key strength lies in its extensive support for various cryptocurrencies across a wide range of blockchain networks. They are a top 10 validator on many networks, demonstrating their commitment to performance and reliability. This broad reach allows users to explore diverse staking opportunities and potentially optimize their returns based on individual risk tolerance and investment strategies. Their active participation in protocol governance contributes to the overall health and development of the networks they support.

Tips for Staking on Everstake

- Research Network Performance: Before staking, thoroughly research the specific network you're interested in. Consider factors such as network stability, transaction fees, and overall community sentiment.

- Join the Community: Engage with the Everstake community through their various channels. This provides valuable insights into validator performance, upcoming network upgrades, and other important updates.

- Understand Unbonding Periods: Be mindful of the unbonding periods associated with each network. This refers to the time required to withdraw your staked assets.

- Monitor Validator Performance: Regularly monitor the performance of Everstake's validators on the chosen network. Look for consistent uptime and active participation in network governance.

Top 10 Crypto Staking Platforms Comparison

| Platform | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Coinbase | Low – Automated, beginner-friendly interface | Minimal – No minimum staking required | Moderate rewards (2-12% APY) | Beginners, casual staking | User-friendly, FDIC insurance, strong compliance |

| Binance | Medium-High – Multiple products, complex interface | Moderate – Higher minimums for some | High potential rewards (1-20% APY) | Experienced users, variety seekers | Largest staking options, competitive APYs |

| Kraken | Medium – Professional interface | Moderate – Minimum staking on some | Competitive rewards (4-20% APY) | Security-focused, institutions | Strong security, transparent fees |

| Lido Finance | Medium-High – Liquid staking, DeFi integration | Low – No minimum staking | Moderate APY (3-7% ETH), liquidity | DeFi users, liquidity seekers | Liquid staking, DeFi compatibility |

| Rocket Pool | High – Decentralized, tech knowledge helpful | Low – No minimum ETH | Moderate rewards (3-5% APY), liquid | Ethereum users favoring decentralization | True decentralization, liquid staking |

| Marinade Finance | Medium – Solana focused, liquid staking | Low – No minimum SOL | Moderate-high APY (6-8%) | Solana ecosystem users | SOL liquidity, validator decentralization |

| Staked | High – Institutional-grade | High – Higher minimum staking | Reliable, moderate to high (4-15% APY) | Institutions, large stakers | Professional security, uptime, support |

| Chorus One | High – Institutional focus, multi-chain | High – Minimum staking requirements | High potential (5-20% APY) | Institutional, governance-focused | Institutional security, governance participation |

| Figment | Medium-High – Institutional platform | Moderate – Higher minimums for some | Moderate (4-18% APY) | Institutional & retail hybrid | Strong education, multi-protocol support |

| Everstake | High – Extensive network with complex navigation | Moderate – Minimum delegation amounts | High (5-25% APY) | Delegators on multiple networks | Wide network coverage, strong performance |

Staking Smarter: Choosing the Right Platform for Your Crypto Journey

This comprehensive guide has explored ten leading crypto staking platforms, each offering a unique blend of features and benefits. From established exchanges like Coinbase and Binance to decentralized platforms like Lido Finance and Rocket Pool, we've delved into the nuances of fees, potential yields, security measures, and user experience. Understanding these key aspects is crucial for making informed decisions and maximizing your staking rewards.

Key Takeaways for Successful Staking

Several critical factors consistently emerged as essential considerations when evaluating staking platforms. Security should always be a top priority. Look for platforms with robust security protocols, insurance coverage, and a proven track record. Yields, while enticing, should be viewed realistically. Higher yields often come with higher risks. Consider your risk tolerance and diversify your staking portfolio across different platforms and assets.

User experience plays a vital role in your overall staking journey. A platform with an intuitive interface, clear instructions, and readily available customer support can significantly simplify the process, especially for beginners. Finally, consider the range of supported assets. Some platforms specialize in specific cryptocurrencies, while others offer a wider selection. Choosing a platform aligned with your investment strategy is key.

Making Informed Decisions in a Dynamic Market

The crypto landscape is constantly evolving. New platforms emerge, existing platforms upgrade their features, and market conditions fluctuate. Staying informed about these changes is paramount to successful staking. Regularly review your chosen platform's performance, security updates, and fee structures. Don't be afraid to adjust your strategy based on market trends and emerging opportunities. When selecting a staking platform, it's important to also understand the pricing model. You can find more details about the pricing at Typewire Pricing.

Practical Steps for Getting Started

- Define your goals: What are you hoping to achieve through staking? Are you looking for long-term growth or short-term gains?

- Assess your risk tolerance: How much risk are you comfortable taking with your crypto investments?

- Research thoroughly: Use this guide as a starting point and conduct further research on platforms that pique your interest.

- Start small: Begin with a smaller investment to familiarize yourself with the platform and the staking process.

- Diversify your portfolio: Spread your investments across different platforms and assets to mitigate risk.

- Stay informed: Keep up-to-date on market trends, platform updates, and industry news.

Empowering Your Crypto Journey

Mastering these concepts and approaches is not just about maximizing returns; it's about taking control of your financial future in the exciting world of decentralized finance. By actively engaging in the staking process, you become an active participant in the growth and development of the crypto ecosystem. Research is your greatest ally. By utilizing the insights and resources provided in this guide, you can confidently embark on your staking journey, securing your financial future in the dynamic world of crypto.

Ready to simplify your crypto staking experience and access a diverse range of assets? Explore vTrader, an all-in-one platform designed for both novice and seasoned investors. vTrader offers a seamless staking experience with competitive yields, robust security, and an intuitive interface, making it an ideal choice for your crypto staking needs.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.