Your First Step into Crypto: How to Choose the Right Exchange

Choosing where to buy your first cryptocurrency can feel more intimidating than deciding what to buy. With hundreds of platforms available, each with its own fees, features, and user interface, finding the best crypto exchange for beginners is a critical first move. Your choice will directly impact how easily you can navigate the market, how much you pay in transaction costs, and how secure your digital assets are. A platform designed for professional day traders, for instance, might overwhelm a newcomer with complex charts and order types, leading to costly mistakes.

This guide cuts through the noise. We will provide a comprehensive roundup of the top beginner-friendly exchanges, breaking down exactly what makes each one a strong contender. Instead of offering vague advice, we will dive into the specific details that matter most to someone just starting out. You will learn about:

- User Interface (UI) and Ease of Use: How intuitive is the platform for making your first trade?

- Fee Structures: A clear explanation of maker-taker fees, deposit/withdrawal costs, and credit card charges.

- Security Features: What measures like two-factor authentication (2FA) and cold storage are in place to protect your funds?

- Available Cryptocurrencies: Does the exchange offer major coins like Bitcoin and Ethereum, or a wider variety of altcoins?

- Educational Resources: How well does the platform support your learning journey with tutorials and guides?

Making informed decisions extends beyond the platform itself. For example, understanding the financial implications of your trades is essential. Beyond choosing an exchange, understanding your tax obligations is crucial. For detailed information, consider exploring the ultimate guide to Australian crypto tax to ensure you are prepared from day one. By the end of this article, you will have the clarity needed to select an exchange that aligns with your goals and helps you confidently take your first step into the world of crypto.

1. Coinbase

Coinbase has established itself as one of the most recognizable names in the cryptocurrency space, often serving as the primary on-ramp for newcomers. Founded in 2012 and now a publicly traded company (NASDAQ: COIN), its reputation is built on providing an exceptionally user-friendly experience. For someone just starting their crypto journey, Coinbase removes much of the initial intimidation factor, making the process of buying, selling, and storing digital assets feel as straightforward as using a modern banking app. This simplicity is a core reason it consistently ranks as a top choice for the best crypto exchange for beginners.

The platform is designed with a clear, intuitive interface that guides users through their first transactions with ease. Beyond its basic buy-and-sell functionality, Coinbase offers a suite of features that support a user's growth. Its security measures are robust, incorporating industry-best practices that give new investors peace of mind.

Key Features and Security

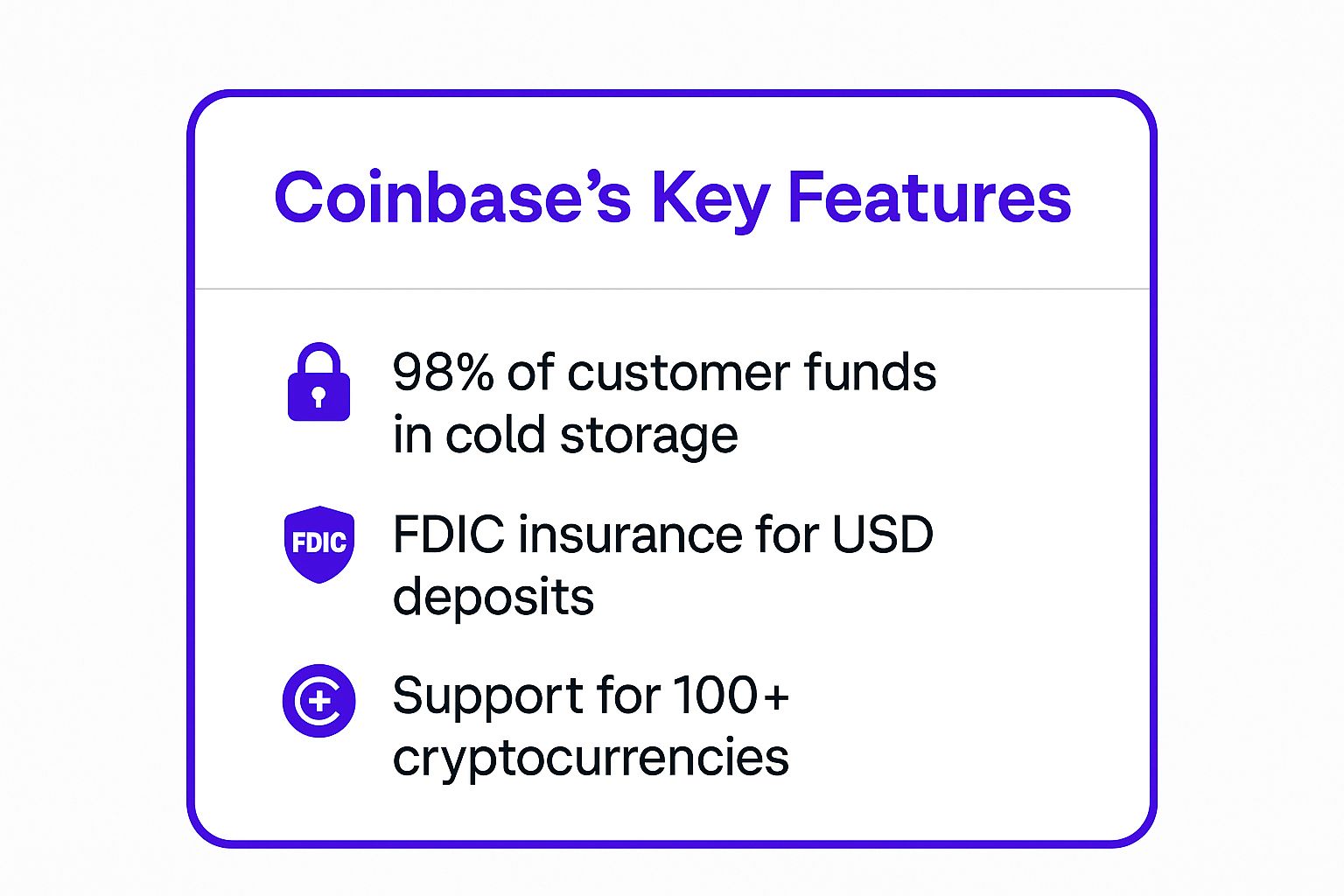

Coinbase prioritizes security, implementing multiple layers of protection to safeguard user assets. These measures include two-factor authentication (2FA), biometric logins on its mobile app, and holding the vast majority of customer funds in secure offline "cold storage." This segregation of funds protects them from potential online threats. Furthermore, USD balances held in Coinbase accounts are covered by FDIC insurance up to $250,000, offering a level of security comparable to traditional financial institutions.

The following infographic highlights some of Coinbase's core security and feature commitments.

As the visualization shows, the combination of extensive cold storage, FDIC insurance for cash, and a wide selection of assets makes for a secure and versatile starting point.

Actionable Tips for New Users

To make the most of your Coinbase experience, consider these practical steps:

- Start with Coinbase Earn: This feature allows you to learn about various cryptocurrencies through short video lessons and quizzes. In return, you receive small amounts of that crypto for free. It’s an excellent, risk-free way to both educate yourself and diversify your portfolio from day one.

- Implement Dollar-Cost Averaging (DCA): Use the "recurring buy" feature to invest a fixed amount of money at regular intervals (e.g., $25 every week). This strategy helps mitigate the impact of price volatility and builds your position over time without needing to time the market.

- Graduate to the Advanced Platform: Once you feel comfortable with basic trading, explore Coinbase's advanced trading platform (formerly Coinbase Pro). The fees here are significantly lower than on the simple "Buy/Sell" interface, making it more cost-effective for frequent or larger trades.

- Secure Your Account Immediately: Before funding your account, enable two-factor authentication (2FA) using an authenticator app like Google Authenticator or Authy. This provides a critical layer of security against unauthorized access. If you're looking for more in-depth tutorials on setting up these features, you can find valuable resources at the vTrader Academy.

2. Binance

Binance stands as the world's largest cryptocurrency exchange by trading volume, offering a vast ecosystem that caters to nearly every type of crypto enthusiast. Founded in 2017 by Changpeng Zhao (CZ), it quickly grew into a global behemoth, known for its massive selection of cryptocurrencies and a comprehensive suite of financial services. While its sheer scale can seem daunting, Binance has made significant strides to welcome newcomers, making it a powerful, if more complex, contender for the best crypto exchange for beginners.

The platform is famous for its dual-interface approach. Beginners can start with a simplified version, while experienced traders have access to one of the most sophisticated trading dashboards in the industry. This scalability allows a user to grow their skills without ever needing to leave the platform. With daily trading volumes often exceeding $20 billion and a user base spanning over 180 countries, its liquidity and market depth are unparalleled.

Key Features and Security

Binance offers a staggering array of features that extend far beyond simple trading, including staking, savings accounts, a launchpad for new tokens, and even an NFT marketplace. Its native token, Binance Coin (BNB), is a top-five cryptocurrency and powers the Binance Smart Chain (BSC), a major blockchain network that hosts thousands of decentralized applications. Understanding the broader ecosystem is key, and for those engaging with BSC or Ethereum-based tokens, tools like an ETH Gas Tracker can be essential for managing transaction costs.

Security is a major focus for Binance, which established the Secure Asset Fund for Users (SAFU). This is an emergency insurance fund financed by taking 10% of all trading fees, offering a layer of protection for users' assets in the event of a security breach. The exchange also employs universal 2FA, advanced data encryption, and real-time monitoring to secure its platform against threats.

Actionable Tips for New Users

To navigate Binance effectively and avoid feeling overwhelmed, follow these targeted steps:

- Start with Binance Lite: The mobile app offers a "Lite" mode that strips away the complex charts and order types. It presents a clean, simple interface for basic buying, selling, and converting crypto, making it ideal for your first few transactions.

- Use BNB to Reduce Trading Fees: Purchase and hold a small amount of Binance Coin (BNB) in your wallet. By enabling the option in your dashboard to pay trading fees with BNB, you receive an automatic 25% discount on all spot trading fees, a significant saving over time.

- Complete Identity Verification (KYC): To unlock higher withdrawal limits and access all platform features, complete the "Know Your Customer" (KYC) identity verification process as soon as you sign up. This is a standard regulatory requirement and a crucial step for securing your account.

- Educate Yourself with Binance Academy: Before investing, spend time on Binance Academy. It is a massive, free resource filled with articles and videos explaining everything from basic blockchain concepts to advanced trading strategies.

- Stick to Spot Trading First: Binance offers complex products like futures and margin trading, which carry high risk. As a beginner, focus exclusively on the "Spot" market to buy and sell assets directly. Avoid leveraged products until you have significant experience and a deep understanding of the risks involved.

3. Kraken

Kraken stands out as one of the oldest and most trusted names in the cryptocurrency industry. Founded in 2011, its longevity is a testament to its commitment to security, regulatory compliance, and user trust. For beginners, Kraken offers a clear pathway into the market, balancing ease of use with the powerful tools needed to grow as an investor. Its reputation for never having been hacked in over a decade of operation provides a significant layer of confidence for those new to the space, solidifying its position as a strong contender for the best crypto exchange for beginners.

The platform is uniquely positioned to cater to both novices and experts. It provides a simple, instant buy interface for your first few transactions, while also offering a professional-grade trading platform, Kraken Pro, under the same account. This dual-platform approach allows users to start simple and transition to more advanced features without needing to switch exchanges. This scalability is a key advantage for anyone serious about their crypto journey.

As shown in the image, Kraken’s branding reflects its professional and secure approach. This reputation is backed by its historic achievement of becoming the first cryptocurrency exchange to receive a U.S. state-chartered banking license, further highlighting its dedication to regulatory excellence.

Key Features and Security

Kraken’s security-first philosophy is its defining characteristic. The exchange maintains full reserves and conducts regular, independent proof-of-reserves audits to verify that customer funds are fully backed and accounted for. This transparency is a cornerstone of its operations. Security measures include universal 2FA, configurable account permissions, and PGP-signed email communications to protect against phishing.

The platform also offers a robust selection of cryptocurrencies and is a leader in providing secure staking services. Staking allows users to earn passive rewards on their holdings directly through the exchange, offering a straightforward way to grow their assets. Its comprehensive security framework is why it is trusted by institutions and government agencies alike. You can explore more about Kraken's industry position and how it compares to innovative newcomers like vTrader by checking out the vTrader 'About Us' page.

Actionable Tips for New Users

To get the most out of your Kraken account, follow these practical steps:

- Complete Full Verification: While you can start with basic verification, completing the "Intermediate" or "Pro" verification levels unlocks higher funding limits, access to more features like futures trading, and faster withdrawal times. Do this early to avoid limitations later.

- Start with the 'Buy Crypto' Interface: Use the simple "Buy Crypto" widget for your first purchase. It streamlines the process by abstracting away order books and complex charts, making it less intimidating for beginners.

- Graduate to Kraken Pro: Once you are comfortable, switch to using the Kraken Pro interface. It offers significantly lower trading fees, advanced charting tools, and more sophisticated order types. This is the most cost-effective way to trade on the platform.

- Explore Staking Services: Instead of letting your assets sit idle, explore Kraken's staking options. You can earn rewards on supported cryptocurrencies like Ethereum (ETH) and Cardano (ADA), providing a source of passive income with minimal effort.

- Utilize the Kraken Learn Center: Kraken provides an extensive library of articles, videos, and tutorials covering everything from basic blockchain concepts to advanced trading strategies. Use these free resources to build your knowledge.

4. Crypto.com

Crypto.com has aggressively positioned itself as an all-in-one cryptocurrency hub, expanding far beyond a simple exchange. Launched in 2016, its strategy focuses on integrating crypto into everyday life through a powerful mobile app, a popular crypto-backed debit card, and an expansive ecosystem that includes DeFi and NFTs. Its high-profile marketing, including partnerships with Formula 1 and the renaming of the Staples Center to the Crypto.com Arena, has rapidly grown its user base to over 50 million. For beginners, this platform offers a streamlined entry point with a vast array of features that encourage exploration and engagement with the broader crypto economy, making it a strong contender for the best crypto exchange for beginners.

The platform's main appeal for newcomers is its mobile-first design, which simplifies buying, selling, and earning interest on digital assets. Crypto.com bundles its services into a single, cohesive application, allowing users to move seamlessly between trading, spending with the Visa card, and generating passive income. This integrated approach demystifies complex crypto concepts by making them accessible and functional.

Key Features and Security

Crypto.com employs a robust, multi-layered security framework, emphasizing proactive threat detection and defense-in-depth principles. It holds 100% of user cryptocurrencies in offline cold storage in partnership with Ledger Vault and has secured a $750 million insurance policy to cover potential losses. The platform adheres to strict compliance standards, having achieved top-tier security certifications like ISO/IEC 27001:2013, ISO/IEC 27701:2019, and PCI:DSS v3.2.1 Level 1 compliance.

For users, security is enhanced through mandatory multi-factor authentication (MFA), which includes password, biometric, and authenticator-based verification. These measures ensure that user accounts and assets are protected against unauthorized access, providing a secure environment for those new to the space.

Actionable Tips for New Users

To get the most out of the Crypto.com ecosystem, follow these practical strategies:

- Start with the Mobile App: The main Crypto.com app is designed for simplicity. Use it for your initial purchases and to get a feel for the platform's layout. The interface is intuitive and makes buying your first crypto straightforward.

- Consider the Crypto.com Visa Card: This prepaid debit card allows you to spend your crypto balance and earn CRO token rewards on purchases. It’s an excellent way to see the real-world utility of digital assets. Start with the free tier to test it out.

- Use Crypto Earn for Passive Income: The "Earn" feature lets you deposit your crypto for a fixed term to generate interest, paid out weekly. This is a simple form of staking that puts your assets to work. For a more detailed breakdown of how staking works, you can explore the fundamentals of crypto staking at vTrader.

- Upgrade to the Exchange App for Lower Fees: Similar to Coinbase, Crypto.com has a separate Exchange platform (available via web or a different mobile app) with significantly lower trading fees and more advanced tools. Once you are comfortable, transition your trading activity there to save on costs.

5. Gemini

Gemini, founded in 2014 by the Winklevoss twins, has built its reputation on a "security-first" and compliance-driven approach. Operating as a New York trust company, it is subject to strict regulatory oversight by the New York State Department of Financial Services (NYSDFS). This commitment to regulation makes it a compelling choice for newcomers who prioritize safety and trust above all else. For those wary of the "wild west" reputation of crypto, Gemini offers a highly regulated and transparent environment, making it a strong contender for the best crypto exchange for beginners.

The platform is meticulously designed with a clean, intuitive interface that simplifies the process of buying and selling digital assets. While its simple interface is perfect for first-time buyers, Gemini also provides a clear growth path for users as they become more experienced. Its strong institutional backing and partnerships, such as being the first licensed Ether exchange and integrating with Samsung, underscore its credibility in the digital asset space.

Key Features and Security

Gemini’s core philosophy revolves around robust security and regulatory adherence. The exchange was one of the first major exchanges to become SOC 2 Type 2 certified, a rigorous audit that demonstrates its commitment to securing customer data and funds. The majority of digital assets are held in a proprietary, geographically distributed cold storage system, which is among the most secure solutions in the industry.

In addition to offline storage, Gemini offers insurance coverage for digital assets held in its online "hot wallet" and provides FDIC insurance for U.S. dollar deposits up to $250,000. This dual-pronged approach to asset protection provides a significant level of reassurance for users just entering the market.

Actionable Tips for New Users

To get the most out of your Gemini account, consider these practical strategies:

- Switch to ActiveTrader for Lower Fees: The standard Gemini interface is simple but has higher fees. Once you are comfortable with the platform, switch to the ActiveTrader interface. It offers advanced charting, more order types, and a significantly lower, volume-based fee structure, saving you money on every trade.

- Utilize Gemini Earn: This feature allows you to lend your cryptocurrency holdings and earn interest on them. It’s a powerful way to generate passive income on your assets while they are sitting in your account, putting your investments to work for you.

- Educate Yourself with Cryptopedia: Gemini offers a comprehensive learning portal called Cryptopedia, which provides in-depth articles on everything from basic blockchain concepts to complex DeFi protocols. Use this free resource to deepen your understanding of the crypto ecosystem.

- Consider the Gemini Credit Card: For users in eligible regions, the Gemini Credit Card offers rewards paid directly in cryptocurrency. It's a seamless way to accumulate crypto on everyday purchases without having to make direct investments.

6. eToro

eToro distinguishes itself by blending social media dynamics with investment, creating a unique social trading platform. Founded in 2007, long before most crypto exchanges, it initially focused on traditional assets like stocks and forex before embracing cryptocurrencies. Its core innovation is its social trading feature, which allows users to view, follow, and even automatically copy the trades of other successful investors on the platform. This approach makes it a compelling choice as one of the best crypto exchange for beginners, especially for those who want to learn by observing and engaging with a community.

The platform is designed to be highly accessible, with a clean interface that integrates social feeds, portfolios, and trading functions seamlessly. While it functions more like a brokerage than a traditional exchange for some assets, it provides a familiar and less intimidating environment for newcomers. This social learning ecosystem, combined with a wide range of tradable assets, positions eToro as an excellent entry point for those interested in more than just crypto.

Key Features and Security

eToro's standout feature is CopyTrader, which allows you to allocate funds to automatically replicate the trading activity of experienced investors, known as "Popular Investors." This provides a hands-on way to learn strategies and participate in the market without needing deep expertise from day one. In terms of security, eToro is regulated by multiple authorities globally, including the FCA in the UK and ASIC in Australia, providing a strong compliance framework.

User accounts are protected with two-factor authentication (2FA), and funds are held in segregated, tier-1 bank accounts. While the platform offers trading of crypto CFDs (Contracts for Difference) in some regions, it also allows for the purchase and transfer of actual cryptocurrencies to the separate eToro Money crypto wallet, giving users true ownership of their assets. This flexibility caters to different risk appetites and strategic goals.

Actionable Tips for New Users

To get the most out of the eToro platform as a beginner, follow these practical steps:

- Start with the Virtual Portfolio: Before committing real money, use eToro's virtual account, which comes pre-loaded with $100,000 in practice funds. This is a risk-free way to familiarize yourself with the platform's features, test trading strategies, and practice using the CopyTrader system.

- Use CopyTrader Wisely: When copying another trader, don't just pick the one with the highest returns. Analyze their risk score, historical performance, and investment strategy. Start by copying with a small amount of your capital and diversify by following a few different traders with varied approaches.

- Understand What You Are Buying: Be aware of the distinction between buying the actual cryptocurrency and trading a crypto CFD. If your goal is long-term holding and self-custody, ensure you are purchasing the underlying asset and know how to transfer it to the eToro Money wallet.

- Engage with the Community: Actively use the social feed to follow successful crypto traders. Read their analyses, ask questions, and participate in discussions. This is an invaluable, free resource for learning about market sentiment and specific digital assets. For more information, you might want to check out the frequently asked questions about eToro.

7. KuCoin

KuCoin positions itself as “The People’s Exchange,” attracting a massive global user base by offering an extensive and diverse selection of digital assets. Founded in 2017, it has earned a reputation for being one of the first platforms to list new and emerging cryptocurrencies, particularly in the DeFi and GameFi sectors. This makes it an exciting destination for those looking to explore beyond mainstream coins like Bitcoin and Ethereum. For newcomers with a bit of an adventurous spirit, KuCoin provides a gateway to the broader crypto ecosystem.

While its vast array of over 700 tradable assets might seem overwhelming, the platform balances this with a user-friendly interface that simplifies navigation. Its blend of basic trading features and more advanced options, such as futures trading and margin accounts, allows users to grow their skills without needing to switch exchanges. This scalability and its reputation for discovering hidden gems make it a compelling choice for those looking for more than just a simple on-ramp, while still qualifying as one of the best crypto exchange for beginners who want room to grow.

Key Features and Security

KuCoin employs a hybrid security architecture that combines multi-cluster and multi-layer systems with robust offline cold storage for the majority of its assets. The exchange features a dedicated risk-control department that continuously monitors for unusual activity. For users, security is enhanced with mandatory two-factor authentication (2FA), a separate trading password distinct from the login password, and anti-phishing safety phrases for emails.

A unique feature is the KuCoin Shares (KCS) token, the platform's native cryptocurrency. Holding and using KCS provides tangible benefits, including significant trading fee discounts and a daily bonus distributed from the exchange's trading fee revenue. This incentive structure encourages user loyalty and participation within the KuCoin ecosystem.

Actionable Tips for New Users

To effectively navigate KuCoin and its vast offerings, beginners should follow a structured approach:

- Start with Major Cryptocurrencies: Before diving into speculative altcoins, build a foundational understanding by trading established assets like Bitcoin (BTC) or Ethereum (ETH). This helps you get comfortable with the platform’s interface and order types in a less volatile environment.

- Utilize the KCS Token for Discounts: Purchase a small amount of KuCoin's native token, KCS, and enable the "Pay Fees with KCS" option in your settings. This simple step can reduce your trading fees by 20%, significantly lowering costs over time.

- Explore KuCoin Earn for Passive Income: Instead of letting your assets sit idle, explore the KuCoin Earn section. You can participate in staking, lending, or flexible savings promotions to generate passive income on your holdings. This is an excellent way to grow your portfolio with minimal effort.

- Use Stop-Loss Orders: Given KuCoin’s wide array of volatile altcoins, risk management is crucial. Always use stop-loss orders when placing trades. This automatically sells an asset if it drops to a predetermined price, protecting you from significant losses.

Top 7 Crypto Exchanges for Beginners: Key Feature Comparison

| Exchange | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Coinbase | Low 🔄 Beginner-friendly interface | Moderate ⚡ User-friendly apps | Secure crypto storage, strong regulatory trust | Beginners seeking secure, easy crypto access | Ease of use, FDIC insurance, Coinbase Earn |

| Binance | Medium 🔄 Multiple interfaces | High ⚡ Extensive features | High liquidity, wide crypto selection | Experienced traders, extensive crypto access | Lowest fees, massive volume, diverse services |

| Kraken | Medium-High 🔄 Advanced features | Moderate ⚡ Strong security | Secure trading, institutional trust | Security-conscious traders | Excellent security, competitive fees, pro tools |

| Crypto.com | Low-Medium 🔄 Mobile-focused | Moderate ⚡ Integrated ecosystem | Crypto rewards, versatile usage | Mobile users wanting rewards and easy access | Crypto debit card, rewards, comprehensive apps |

| Gemini | Low Medium 🔄 Regulated & simple | Moderate ⚡ Robust security | Safe, regulated trading | Security-focused beginners & institutions | Strong compliance, insurance, educational tools |

| eToro | Low 🔄 Social trading platform | Low-Mod ⚡ Multi-asset exposure | Social learning, copy trading | Beginners wanting social & multi-asset trading | Social features, demo account, regulation |

| KuCoin | Medium-High 🔄 Feature-rich | Moderate-High ⚡ Wide altcoin | Early access to new tokens, passive income | Altcoin traders, DeFi enthusiasts | Wide altcoin selection, no basic KYC, earning ops |

Final Thoughts

Navigating the world of cryptocurrency for the first time can feel like learning a new language. The sheer number of platforms, coins, and concepts is enough to overwhelm anyone. Our deep dive into the industry's leading exchanges, from Coinbase and Binance to Kraken and Gemini, was designed to demystify this process. We've shown that the best crypto exchange for beginners isn't a one-size-fits-all answer; it's the one that best aligns with your personal learning style, security needs, and financial goals.

We explored how Coinbase excels with its unparalleled user-friendliness, making it a default starting point for many. We also saw how Binance offers a vast universe of cryptocurrencies and advanced features, ideal for those who anticipate growing quickly beyond simple buying and selling. Kraken stands out for its robust security reputation and institutional-grade features, while Gemini provides a regulated and insurance-backed environment for the most risk-averse newcomers. Each platform presents a unique value proposition, and understanding these nuances is the first critical step toward making an informed decision.

Key Takeaways for Your Crypto Journey

As you move forward, keep these core principles in mind. They are the foundational pillars that will support you as you transition from a curious observer to a confident market participant.

- Prioritize Simplicity and Education: Your initial focus should not be on maximizing profit but on minimizing mistakes. Choose a platform with a clean user interface and abundant learning resources. An exchange that invests in educating its users, like Coinbase or Kraken, is investing in your long-term success.

- Understand the Fee Structure: Fees can significantly impact your portfolio over time. A 0.5% fee might seem small, but it adds up with every transaction. Compare the maker-taker fees, deposit and withdrawal charges, and credit card purchase premiums across platforms to find a model that fits your intended trading frequency.

- Security is Non-Negotiable: The "not your keys, not your coins" mantra is a cornerstone of crypto security. As a beginner, you will likely be entrusting your assets to a centralized exchange. Therefore, scrutinize its security measures. Look for platforms that offer two-factor authentication (2FA), cold storage for the majority of assets, and transparent security audits.

- Start Small and Diversify Slowly: The allure of volatile altcoins is strong, but it's wise to begin with established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Use your first few months to understand market dynamics with a small amount of capital you are prepared to lose. This practical, low-risk experience is more valuable than any tutorial.

Your Actionable Next Steps

Armed with this information, your path forward is clear. Don't fall into "analysis paralysis" by trying to find the single perfect exchange. Instead, take measured, concrete steps to get started.

- Create Accounts on Two Platforms: Select two exchanges from our list that appeal most to you. For example, you might choose Coinbase for its simplicity and Binance for its coin selection. This allows you to compare their interfaces and fee structures firsthand.

- Complete the KYC Process: Go through the "Know Your Customer" verification on both platforms. This is a mandatory step for regulated exchanges and a good sign of their commitment to compliance.

- Make a Small Test Deposit: Link a bank account and make a small deposit, perhaps $50 or $100, into each account. This will help you experience the funding process and see how long it takes for funds to become available.

- Execute Your First Trade: Use your test funds to buy a small amount of a major cryptocurrency like Bitcoin. Pay close attention to the entire process, from placing the order to seeing the asset appear in your wallet.

Embarking on your crypto journey is an investment in your financial literacy. By choosing the right platform, you are not just buying digital assets; you are gaining access to a new financial ecosystem. The skills you develop, from understanding market orders to securing your digital wallet, are transferable and will serve you well into the future. The most important step is the first one.

If you are looking for a platform that consolidates the best features for beginners, including an intuitive interface, robust educational modules, and competitive fees, consider exploring a next-generation solution. vTrader is designed to simplify the entry into crypto without sacrificing the powerful tools you'll need as you grow. Start your journey with a platform built for the modern investor at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.