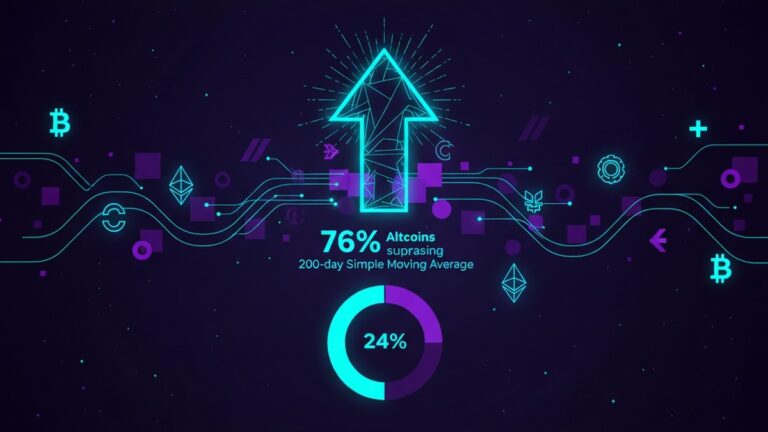

In the dynamic world of cryptocurrencies, there’s always a buzz around which coin will be the next big thing. As of today, October 1, 2025, only 24% of altcoins are trading above their 200-day Simple Moving Average (SMA). This statistic raises an intriguing question: Could this be a massive buying opportunity for savvy investors looking to capitalize on undervalued altcoins before the next crypto boom?

Altcoin Market: A Snapshot

The cryptocurrency market is notoriously volatile, with altcoins often experiencing wild price swings. The 200-day SMA is a crucial technical indicator used by traders to assess an asset’s long-term trend. When prices are above this average, the trend is generally considered bullish, while prices below it suggest a bearish outlook. With only a quarter of altcoins currently trading above this key level, it signals a potential undervaluation of many digital assets.

Potential for a Bullish Reversal?

Market analysts suggest that this low SMA penetration might present a golden opportunity for investors. Historically, the cryptocurrency market has shown cyclical patterns, with bear markets often paving the way for significant bull runs. For instance, following the 2018 crypto winter, Bitcoin and various altcoins rallied in the subsequent years, rewarding those who bought during the downturn.

Currently, altcoins like Cardano (ADA) and Polkadot (DOT) are trading below their 200-day SMA, despite ongoing development and adoption. Cardano, for example, has been making strides with its smart contract functionality and partnerships in Africa, yet its price doesn’t reflect these advancements fully. Similarly, Polkadot’s ecosystem is expanding with new parachain auctions, potentially setting the stage for future growth.

Risks and Rewards

While the potential rewards are enticing, it’s crucial to consider the risks. The crypto market’s volatility means that prices can drop further before any significant rebound, leading to potential losses for those who enter too early. Furthermore, regulatory challenges, technological hurdles, and market sentiment can all affect altcoin prices.

Investors should also be aware of the “altcoin graveyard,” where many projects fail to deliver on their promises, leading to price crashes. Conducting thorough research and diversifying one’s portfolio across several promising projects can mitigate some of these risks.

Expert Insights

Industry experts offer varying opinions on the current market scenario. Some believe that the low SMA penetration is a clear signal of an impending bull market, citing historical patterns and the increasing institutional interest in cryptocurrencies. They argue that as blockchain technology continues to mature, more altcoins will gain real-world utility, driving demand and prices.

On the other hand, skeptics caution against relying solely on technical indicators like the SMA. They point out that macroeconomic factors, such as interest rates and inflation, can significantly impact the crypto market. Additionally, geopolitical tensions and regulatory developments could either bolster or hinder market growth.

Strategies for Investors

For those considering entering the altcoin market, a balanced approach is key. Utilizing a combination of technical analysis, fundamental research, and market sentiment can provide a more comprehensive view. Investors might consider dollar-cost averaging (DCA), a strategy that involves buying a fixed amount of an asset at regular intervals, regardless of its price. This approach can reduce the impact of volatility and help build a position over time.

Furthermore, keeping an eye on emerging trends and technologies can offer insights into which altcoins could outperform. For instance, projects focusing on decentralized finance (DeFi), non-fungible tokens (NFTs), and interoperability are gaining traction and could see substantial growth in the coming years.

The Road Ahead

As the cryptocurrency market continues to evolve, the landscape for altcoins is likely to change. While the current low SMA penetration might present a buying opportunity, it’s essential for investors to remain informed and adaptable. By understanding the risks and rewards, conducting thorough research, and employing strategic investment methods, they can position themselves to potentially capitalize on the next crypto boom.

In conclusion, with only 24% of altcoins trading above their 200-day SMA, the market presents a mixed bag of opportunities and challenges. For those willing to navigate the complexities, this could be a moment to seize. However, as with any investment, caution and diligence are paramount.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.