Understanding Cryptocurrency Arbitrage Fundamentals

Cryptocurrency arbitrage trading is a strategy focused on exploiting price differences for the same asset on different exchanges. Essentially, it involves buying a cryptocurrency on one exchange where the price is low and simultaneously selling it on another where it's higher. This allows traders to profit from these market inefficiencies. For instance, imagine Bitcoin trading at $45,000 on Exchange A and $45,200 on Exchange B. This price difference represents a potential arbitrage opportunity.

How Arbitrage Works In Practice

The key to successful arbitrage lies in quickly identifying and acting upon these price discrepancies. In this rapidly changing market, timing is critical as these windows of opportunity can vanish in mere seconds. While tools and automation can assist in this process, understanding the fundamental mechanics is paramount.

-

Identify the Price Difference: Start by carefully monitoring cryptocurrency prices across various exchanges. Using specialized tools or software can help streamline this tracking process.

-

Calculate Potential Profit: It's crucial to account for transaction fees and other associated costs. This will determine your true profit potential after all expenses are deducted.

-

Execute the Trades: Once you've identified a profitable opportunity, you need to execute your trades swiftly. Buy low on one exchange and sell high on another. This requires having accounts funded on both platforms. You might be interested in: How to day trade Bitcoin.

-

Withdraw Profits: After successfully completing your trades, transfer your earnings to your preferred wallet.

Why Do These Opportunities Exist?

Several factors contribute to the price variations that create arbitrage opportunities across cryptocurrency exchanges.

-

Market Fragmentation: The cryptocurrency market is relatively new and less regulated than traditional financial markets. This lack of uniform regulation can lead to pricing discrepancies between different platforms.

-

Varying Liquidity: Exchanges with lower trading volumes may experience slower price adjustments. This creates potential arbitrage opportunities for traders monitoring higher-volume exchanges.

-

Regional Differences: Local regulations, demand fluctuations, and even specific events can impact cryptocurrency prices in certain geographical regions.

-

Exchange-Specific Factors: Exchange-related issues such as withdrawal fees, deposit methods, and even temporary server downtime can create momentary price discrepancies.

These inefficiencies are the engine that drives arbitrage trading. This fast-paced market rewards quick thinking and efficient execution. Employing automated tools can significantly enhance your success. A strong understanding of these fundamental concepts provides a solid base for exploring more sophisticated arbitrage strategies.

Why Market Fragmentation Creates Your Best Opportunities

Unlike traditional stock markets, the cryptocurrency market isn't a unified entity. This fragmentation creates lucrative arbitrage trading opportunities. Instead of one central exchange, cryptocurrencies are traded on numerous independent exchanges worldwide. This leads to price differences, sometimes quite large, for the same asset.

For example, Bitcoin might be slightly more expensive on a US-based exchange than an Asian one. This is due to variations in demand and specific local market conditions.

Understanding the Factors Behind Fragmentation

Several factors contribute to this fragmented landscape. Varying regulatory environments play a major role. One country might readily accept cryptocurrencies, while another imposes strict regulations. These different regulatory approaches influence local demand, and therefore, prices.

Regional preferences for specific cryptocurrencies or trading pairs also play a part. A coin popular in one area might see higher demand and a higher price, compared to a region where it’s less popular. Cryptocurrency arbitrage opportunities have historically been more prevalent across exchanges rather than within them.

This is partly due to varying market conditions and regulations in different regions. Research shows that price deviations across countries are more significant and tend to increase when Bitcoin gains value. This is especially true in countries with higher Bitcoin prices compared to the US Bitcoin price. Learn more about this phenomenon: Trading and Arbitrage in Cryptocurrency Markets.

Exploiting Timezone Differences and Geopolitical Events

Even small factors like timezone differences can create predictable arbitrage opportunities. When a large Asian exchange opens, it might react differently to overnight news than a US exchange that's been trading all night.

This delay in information and market reaction can create short-lived but profitable price gaps. However, these aren't the only factors that traders exploit. Geopolitical events, regulatory announcements, and even technological advancements can create price volatility and arbitrage opportunities.

A sudden regulatory change in one country might lower local prices. Meanwhile, markets elsewhere stay unaffected, creating opportunities for traders.

Identifying Sustainable Profit Segments

Not all arbitrage opportunities are equal. Some market segments offer more consistent profits. These segments often involve less-traded altcoins or exchanges with lower trading volumes. Price inefficiencies tend to last longer in these areas.

By focusing on these niche markets, traders can potentially avoid intense competition found in more popular cryptocurrency trading pairs. This allows for a more strategic approach. Traders can focus on finding and using opportunities where others aren't looking. Understanding market fragmentation empowers traders to locate the most profitable segments and take advantage of the cryptocurrency market's inherent inefficiencies.

Traditional Vs. Modern Approaches: DEX and Layer 2

The cryptocurrency arbitrage landscape is constantly shifting. Staying ahead of the curve means understanding the core differences between centralized exchange (CEX) arbitrage and the emerging opportunities on decentralized exchanges (DEXs) and Layer 2 solutions.

Traditionally, arbitrage focused on exploiting price discrepancies across CEXs like Binance. However, these platforms often come with higher fees and slower transaction speeds, impacting potential profits. This is where DEXs and Layer 2 solutions enter the picture. They provide faster transactions with lower fees and often experience less price slippage, making DEX-based arbitrage increasingly attractive. Explore this topic further.

The Rise of Decentralized Arbitrage

DEXs operate without intermediaries, facilitating direct peer-to-peer trading. This translates to lower fees and often faster execution speeds compared to CEXs. The increased transparency and security inherent in blockchain technology add to the appeal of DEXs. However, challenges remain, including lower liquidity and the risk of smart contract vulnerabilities. Careful risk assessment is crucial.

Layer 2 Solutions: Unlocking New Possibilities

Layer 2 solutions are protocols built atop existing blockchains (like Ethereum) designed to enhance scalability and reduce transaction costs. They significantly improve the efficiency of cryptocurrency arbitrage, enabling near-instantaneous trades at minimal expense. A trader might move assets to a Layer 2 network, execute a trade, and then swiftly withdraw profits back to the main blockchain at low cost. This unlocks new possibilities for high-frequency arbitrage that were previously unattainable.

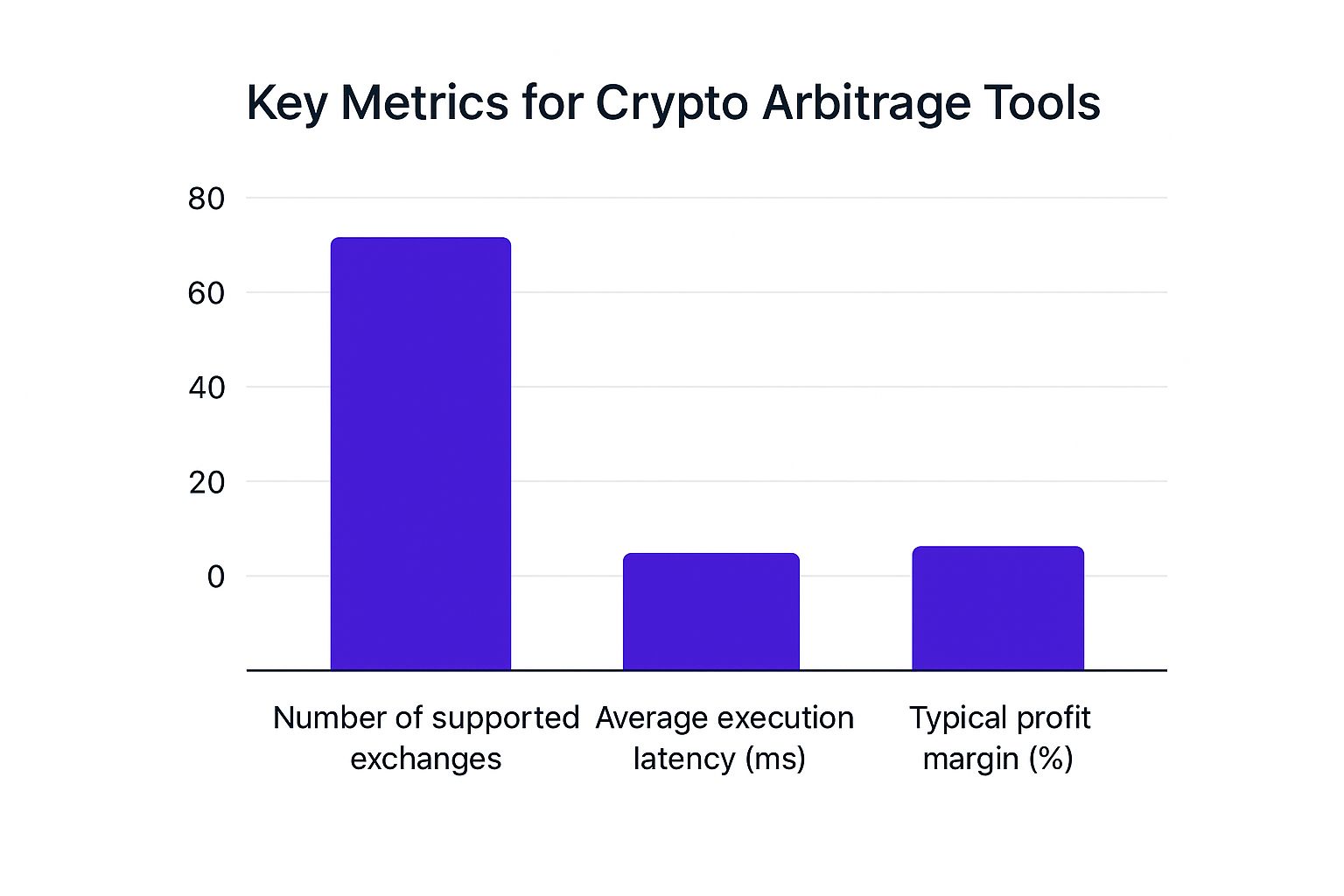

To illustrate the key differences between these approaches, let's look at a comparison table:

The following table summarizes the key differences between traditional CEXs, DEXs, and Layer 2 solutions regarding the number of supported exchanges, average execution latency, and typical profit margins.

Centralized vs. Decentralized Exchange Arbitrage Comparison: A detailed comparison of key factors between traditional CEX arbitrage and modern DEX arbitrage approaches.

| Factor | Centralized Exchanges | Decentralized Exchanges | Layer 2 Solutions |

|---|---|---|---|

| Number of Supported Exchanges | High (Hundreds) | Medium (Dozens) | Growing (Tens) |

| Average Execution Latency | Medium (Seconds to Minutes) | Low (Sub-second to Seconds) | Very Low (Sub-second) |

| Typical Profit Margins | Lower (Due to fees and slippage) | Higher (Lower fees, less slippage) | Highest (Minimal fees, near-instant execution) |

| Liquidity | High | Medium to Low | Growing |

| Security | Centralized (Exchange dependent) | Decentralized (Smart contract risk) | Decentralized (Inherited from Layer 1, plus Layer 2 specific risks) |

As this table illustrates, while centralized exchanges might offer a wider range of listed assets, DEXs and especially Layer 2 solutions boast faster execution speeds and the potential for higher profit margins thanks to reduced fees.

The infographic above visually reinforces these key differences, highlighting the speed and potential profit advantages of DEXs and Layer 2 solutions.

Choosing The Right Approach

The best approach – CEX, DEX, or Layer 2 – depends on individual circumstances and the specific arbitrage opportunity. CEXs might be suitable for larger trades requiring deep liquidity. DEXs and Layer 2 solutions excel with smaller, faster trades where minimizing fees is paramount. Understanding the strengths and weaknesses of each is vital for success in the dynamic world of cryptocurrency arbitrage.

AI and Automation: Staying Competitive in Modern Markets

Manual cryptocurrency arbitrage trading is becoming increasingly difficult. However, automation and AI are changing the game. They provide individual traders with tools previously only available to large institutions. These technologies are democratizing profitable arbitrage opportunities, leveling the playing field for everyone.

How AI Is Transforming Arbitrage

AI empowers traders to identify and exploit arbitrage opportunities with unmatched speed and efficiency. Imagine manually monitoring prices across dozens of exchanges. It's practically impossible. However, an AI-powered bot effortlessly tracks real-time data from multiple platforms, executing trades in milliseconds.

AI and automation have become essential for identifying and executing arbitrage opportunities quickly in increasingly efficient and competitive markets. Integrating AI into arbitrage systems has also improved the detection and execution of opportunities, bolstering this strategy's viability. Learn more: Trading and Arbitrage in Cryptocurrency Markets.

Types of AI Systems for Arbitrage

A wide range of AI tools are available to traders. Simple price monitoring bots alert you to potential opportunities. More sophisticated algorithms can adapt to changing market conditions, automatically adjusting trading strategies in real-time. This dynamic response maximizes profitability during market fluctuations. Some advanced AI systems even identify hidden arbitrage opportunities that human traders might miss.

Automation Strategies for Different Budgets

AI-powered arbitrage trading doesn't require a huge budget or a computer science degree. Various automation strategies cater to different needs and skill levels. Beginners can start with user-friendly bots. These often focus on basic price monitoring and execution. ChatGPT: Your Guide to Decoding Crypto Market Trends in 2025. As your skills and budget grow, explore more advanced, customizable solutions offering greater control and sophistication.

Real Performance Data and Implementation

Real-world data highlights the power of automated arbitrage systems. These systems can process large datasets from multiple exchanges, executing trades with remarkable speed. Some platforms boast execution times of less than 10 milliseconds, far exceeding human capabilities. This speed is crucial for capturing fleeting arbitrage opportunities.

Implementing automation into your trading strategy can be surprisingly easy. Many platforms offer step-by-step guidance, making it accessible even for those with limited technical expertise. Numerous online resources and communities offer support and insights to navigate automated arbitrage trading. By using these tools and strategies, individual traders can compete effectively in the fast-paced world of cryptocurrency arbitrage.

Navigating Modern Challenges: Staying Profitable Despite Competition

The cryptocurrency market is maturing, and with that comes more competition in arbitrage trading. Institutional players and high-frequency trading (HFT) firms, armed with powerful algorithms and incredibly fast infrastructure, are now major players. This has undeniably reshaped the market, but profitable opportunities still remain for resourceful traders.

Adapting to the Evolving Landscape

The increased presence of institutional investors and HFT firms has squeezed arbitrage margins. Opportunities that were once large and readily available are now smaller and disappear much faster. This doesn't mean arbitrage is gone; it simply means adapting is crucial. Traders who have successfully navigated this change emphasize the vital roles of speed and sophisticated tools.

Investing in robust trading platforms with low latency is essential. Using algorithms that can identify and execute trades in milliseconds gives individual traders a chance against the larger firms. This allows them to react quickly to market fluctuations and seize fleeting opportunities.

Finding Your Niche: Where Big Players Aren’t Competing

While HFT firms often dominate highly liquid, mainstream cryptocurrency pairs on platforms like Binance, opportunities exist in other market segments. These often involve less-traded altcoins or exchanges with lower trading volumes. These are often overlooked by larger players, creating niches for those willing to explore them.

Emerging markets and newly listed cryptocurrencies can also present unique arbitrage opportunities. By staying ahead of the curve and identifying these emerging trends, traders can potentially capture significant profits before the market becomes saturated. These niche areas often have less competition and wider price discrepancies. Early adoption and careful research can be very rewarding.

Leveraging Market Fragmentation

Even with increasing market efficiency, cryptocurrency markets remain fragmented. This continued fragmentation offers ongoing profit potential for astute traders. Different regulatory landscapes, varying regional demand, and exchange-specific factors all contribute to persistent price differences across various platforms.

Traders who are knowledgeable and can act decisively can capitalize on these discrepancies. It's important to remember that the landscape is always changing, so adaptability is key. Despite the evolution of cryptocurrency markets, especially with the rise of HFT firms, arbitrage remains a viable strategy for generating profit. Learn more: Crypto Arbitrage: Learn More. However, shrinking margins demand faster infrastructure and more sophisticated algorithms.

Staying Ahead of the Game

Staying profitable in the constantly changing world of cryptocurrency arbitrage requires continuous learning and adaptation. Embrace new technologies, explore emerging markets, and continually refine your strategies to maintain a competitive edge. By staying informed and proactive, traders can still find success in this exciting and dynamic market.

Essential Tools That Actually Make a Difference

Cryptocurrency arbitrage trading can be profitable, but success depends on using the right tools. This section explores the essential arbitrage scanners, trading bots, and analytical platforms that can truly make a difference. We'll examine how to choose platforms that match your trading style, budget, and technical skills, offering a balance of speed, accuracy, and value whether you're a beginner or a seasoned pro.

Must-Have Features For Profitable Tools

Choosing the right tools can distinguish between consistent profits and significant losses. Here's what to look for:

-

Real-Time Monitoring: This is essential for spotting price differences quickly. Faster updates mean more opportunities.

-

Execution Speed: In arbitrage, milliseconds count. Your platform needs to execute trades rapidly to secure profits before the window closes.

-

Reliability Under Market Stress: Your tools must remain stable, even during volatile market conditions. System failures can erase potential gains.

Building Your Trading Infrastructure

Setting up an effective trading system doesn't require a fortune. Focus on essential tools and avoid unnecessary extras. You might be interested in: Crypto Arbitrage Scanner.

Consider these core components:

-

Arbitrage Scanner: A quality scanner automatically finds price discrepancies between exchanges, automating what used to take hours of manual searching.

-

Trading Bot: Automating trades with a trading bot allows you to capitalize on opportunities around the clock.

-

Analytical Platform: Sophisticated market analysis tools give you the information you need to make smart decisions, adjust your strategy, and find new opportunities.

To help you make an informed choice, we've compiled a comparison of some leading platforms:

To help you choose the right tools, here’s a comparison of some popular options:

Top Arbitrage Trading Tools and Features

Comparison of popular arbitrage trading platforms with their key features, pricing, and best use cases

| Platform | Key Features | Pricing | Best For | Pros | Cons |

|---|---|---|---|---|---|

| Arbitao | Real-time monitoring, automated trading, multi-exchange support | Starting at $99/month | Beginners and experienced traders | User-friendly interface, advanced charting tools | Limited free trial |

| Bitsgap | Arbitrage scanner, trading bot, portfolio management | Free and paid plans | Professional traders | Wide range of features, customizable settings | Can be complex for beginners |

| Coinigy | Multi-exchange trading terminal, charting tools, portfolio tracking | Starting at $18.66/month | Experienced traders | Advanced charting and analysis tools | Steep learning curve |

This table summarizes the key features, pricing, and ideal user profiles for each platform, helping you make an informed decision. Remember to research each platform further to determine the best fit for your specific needs.

Choosing The Right Tools For You

There’s no single perfect tool. The best choice depends on individual needs and preferences. Some prefer simple interfaces, while others value advanced features.

Consider these factors:

-

Your Trading Style: Are you a scalper seeking small, frequent profits, or a long-term strategist?

-

Budget Constraints: Free or inexpensive tools may be sufficient for beginners. More experienced traders often invest in premium platforms.

-

Technical Expertise: Choose tools that match your technical skills. Avoid overly complex software if you're starting out.

By carefully choosing and using the right tools, you can significantly improve your arbitrage trading performance and maximize your profit potential.

Starting Smart: Risk Management and Your First Steps

Before jumping into the world of cryptocurrency arbitrage trading, it's crucial to understand the potential risks. Developing a solid risk management strategy is key. While arbitrage can be profitable, various factors can influence your returns. These range from exchange liquidity issues and withdrawal delays to regulatory changes. Learning from seasoned traders and using practical risk management techniques can protect your capital as you build experience.

Understanding the Risks

Even the most carefully planned arbitrage trades can face challenges:

-

Exchange Liquidity Issues: Low liquidity on an exchange can make it difficult to sell at your target price. This can significantly impact your profit margin, potentially leading to a loss.

-

Withdrawal Delays: Some exchanges have extended processing times for withdrawals. This can tie up your funds, preventing you from capitalizing on new opportunities.

-

Regulatory Changes: Unexpected regulatory announcements can drastically affect cryptocurrency prices and disrupt arbitrage trades.

-

Technical Glitches: Issues with the exchange platform, internet connectivity problems, or errors in your automated tools can all negatively impact your trades.

Managing Risk Effectively

Here are some key strategies to help mitigate these risks:

-

Position Sizing: Never risk more than you can afford to lose on a single trade. Start with a small amount and gradually increase your position size as you become more experienced and confident.

-

Exchange Diversification: Distributing your capital across multiple reputable exchanges minimizes the impact of problems on any single platform.

-

Liquidity Buffers: Keeping sufficient funds in your exchange accounts ensures you can cover unexpected fees or margin requirements.

Realistic Expectations and Time Commitment

Cryptocurrency arbitrage trading isn't a quick path to riches. While profits are possible, achieving consistent results requires time, effort, and a learning curve. A 1-5% profit per trade is a realistic target for most arbitrage traders. However, this depends on the chosen strategy and market conditions.

The time commitment also varies. Casual traders might spend a few hours per week monitoring the market, while more active traders could dedicate significantly more time. Consider your available time before committing to this trading strategy. You might be interested in: Learn more about cheapest way to buy crypto.

Your First Steps in Arbitrage Trading

Follow these steps to get started:

-

Start Small: Begin with a small capital investment to gain experience without substantial risk.

-

Practice on Paper Trading Platforms: Many exchanges offer simulated trading environments. Use these platforms to test strategies and hone your skills before using real money.

-

Focus on One or Two Exchanges Initially: Mastering a few exchanges before expanding to others can prevent you from feeling overwhelmed.

-

Implement Automation Gradually: As you gain experience, consider incorporating automated tools like TradingView to improve speed and efficiency.

By understanding the risks, managing your capital wisely, and starting with a realistic plan, you can confidently embark on your arbitrage trading journey.

Ready to begin? vTrader offers a commission-free platform with advanced tools, real-time data, and a seamless multi-device experience to help maximize your profits. Sign up for vTrader today!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.