If you've ever found a popular video game for $40 at one store and seen it selling for $60 across town, you’ve spotted an arbitrage opportunity. The $20 difference is your potential profit. Crypto arbitrage operates on the exact same principle: buying a digital asset on one exchange for a lower price and, at the same moment, selling it on another where it’s trading higher.

This strategy isn't about betting on whether a coin's price will go up or down. It’s about cashing in on price differences that exist right now.

What Is Arbitrage Trading in Cryptocurrency

At its heart, crypto arbitrage is a classic “buy low, sell high” game, but with a twist. Instead of holding an asset and waiting for its value to grow over weeks or months, you’re exploiting price gaps for the same exact asset that exist across different exchanges simultaneously.

These price gaps are a natural consequence of the crypto market's fragmented nature. Unlike the stock market, which often revolves around a central exchange, crypto is traded on hundreds of separate platforms. Each one has its own set of buyers, sellers, and order books, which inevitably leads to temporary price imbalances.

Why Do Price Gaps Even Occur?

So, what causes these momentary profit windows? A sudden spike in demand for a coin on one exchange can push its price up before other markets have a chance to react. Another key factor is liquidity—how easily you can buy or sell without moving the price. A high-volume exchange might have a slightly different price than a smaller one.

But here’s the catch: these opportunities are incredibly fleeting. They often vanish in seconds or minutes as automated trading bots and other sharp-eyed traders jump in to close the gap. Speed and precision are everything.

Key Takeaway: Crypto arbitrage is a market-neutral strategy. It doesn't matter if Bitcoin is surging or crashing. Your profit depends solely on the existence of a price difference between two or more markets.

The Main Types of Arbitrage

As the crypto market has exploded to over 10,000 different assets, the opportunities for these strategies have multiplied. The most common approach is spatial arbitrage, which is simply buying on one exchange and selling on another. More advanced methods include triangular arbitrage, which involves trading three different assets on a single exchange, and statistical arbitrage, a high-frequency strategy driven by complex algorithms.

These methods offer a path to potential returns even when the market is choppy, but success comes down to managing fees and having enough capital ready to deploy.

If you want to build a solid foundation in these core crypto concepts, our vTrader Academy provides a wealth of learning resources.

To give you a clearer picture, here’s a quick breakdown of the core arbitrage strategies we’ll be diving into.

Core Crypto Arbitrage Strategies at a Glance

This table provides a simple overview of the main arbitrage types, how they work, and what they require.

| Strategy Type | Mechanism | Primary Requirement |

|---|---|---|

| Spatial Arbitrage | Buying an asset on Exchange A and selling it for a higher price on Exchange B. | Accounts and funds on multiple exchanges. |

| Triangular Arbitrage | Exploiting price discrepancies between three different assets on a single exchange. | Speed and a robust trading algorithm. |

| Statistical Arbitrage | Using quantitative models and bots to find and exploit temporary price patterns. | Advanced software and data analysis skills. |

We’ll explore each of these in much greater detail later in this guide, breaking down exactly how you can put them into practice.

Exploring Key Crypto Arbitrage Strategies

Alright, you've got the basic idea behind arbitrage. Now, let's get into the nitty-gritty of how traders actually pull it off. The world of crypto arbitrage is buzzing with different methods, from the surprisingly simple to the mind-bendingly complex. Each one is designed to hunt down a specific type of market hiccup.

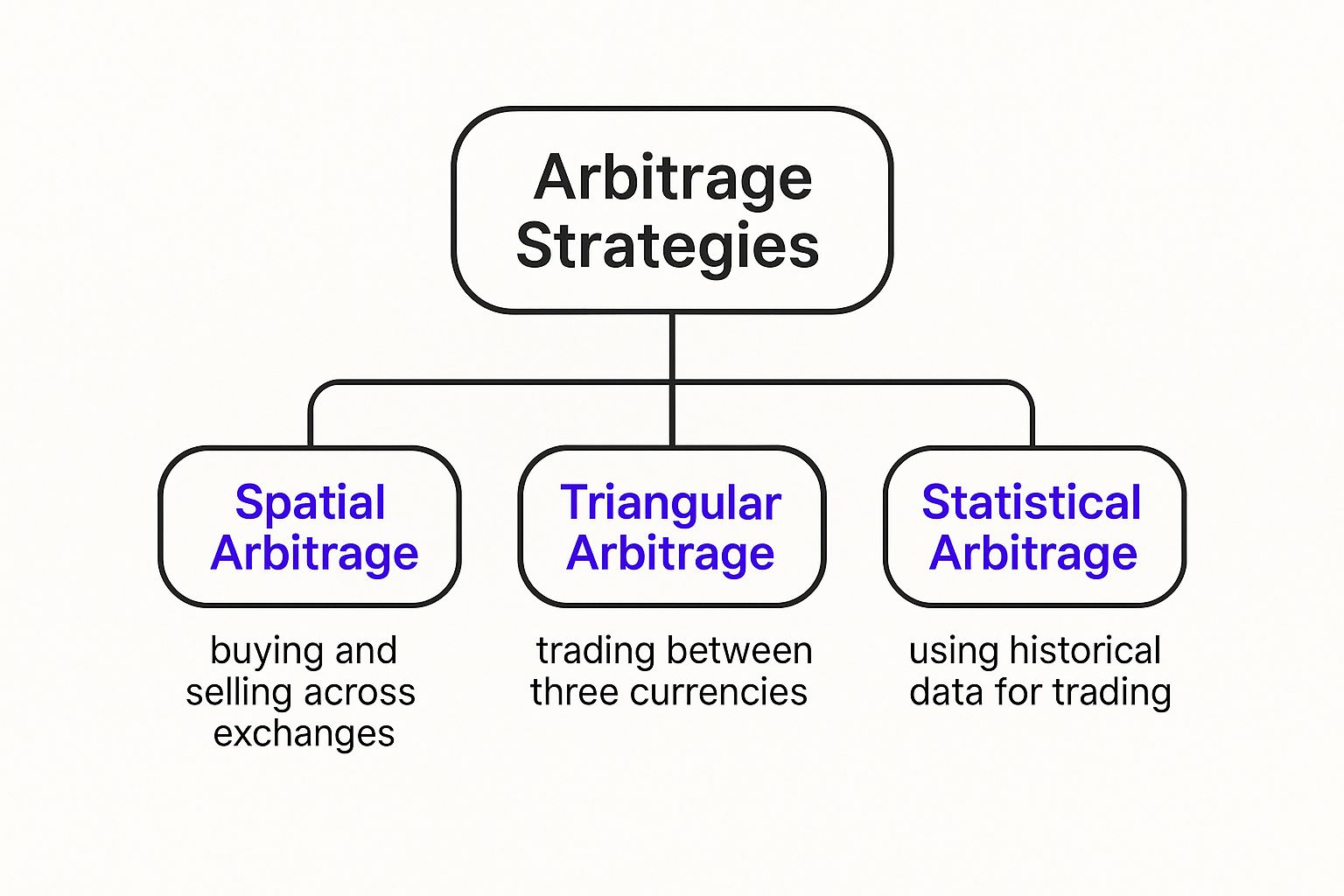

The infographic below gives you a bird's-eye view of the three core strategies we're about to unpack. Think of it as a roadmap for turning market noise into profit.

As you can see, we've got strategies that jump between exchanges (Spatial), ones that work their magic inside a single platform (Triangular), and others that run on pure data science (Statistical). Let's break them down.

Spatial Arbitrage: The Classic Approach

Spatial arbitrage is the one most people think of first. It's intuitive and the easiest to wrap your head around. Imagine buying a rare comic book in a small town for a bargain and immediately selling it online to a collector in a big city for a higher price. That’s spatial arbitrage, but with crypto exchanges as the "cities."

This whole play hinges on a simple fact: Bitcoin might be trading for $60,000 on one exchange while simultaneously hitting $60,150 on another. A sharp trader can buy on the first and sell on the second to pocket that $150 spread.

But there's a catch, of course. To make it work, you need two things:

- Funded Accounts: You can't wait for a bank transfer. You need cash ready to buy on Exchange A and the crypto asset already sitting on Exchange B, ready to sell.

- Speed: These price gaps are fleeting, often vanishing in seconds. The whole strategy falls apart if you're too slow, which is why having those pre-funded accounts is non-negotiable.

Real-World Example:

Let's say you have $10,000 sitting on Kraken and 0.166 BTC on Binance. You notice BTC is at $60,000 on Kraken but $60,250 on Binance. You'd hit "go" on two trades almost at the same time:

- Buy: Your $10,000 on Kraken snags you roughly 0.166 BTC.

- Sell: Your 0.166 BTC on Binance sells for about $10,021.50.

That small difference, minus any trading fees, is your profit. Simple as that.

Triangular Arbitrage: The Single-Exchange Loop

Triangular arbitrage is where things get a bit more sophisticated. The beauty of this strategy is that it all happens on a single exchange. This immediately sidesteps the headaches and delays of moving funds between platforms.

This method works by sniffing out tiny price imbalances between three different cryptocurrencies. It’s like a currency exchange game. You might notice that swapping your Dollars for Euros, then those Euros for Yen, and finally the Yen back to Dollars leaves you with more cash than you started with.

In crypto, the loop looks something like this:

- Trade 1: Use a stablecoin like USDT to buy Bitcoin (BTC).

- Trade 2: Instantly flip that BTC for Ethereum (ETH).

- Trade 3: Sell the ETH right back into USDT.

If the exchange rates between USDT/BTC, BTC/ETH, and ETH/USDT are momentarily out of sync, you’ll end up with more USDT than you began with. These opportunities are razor-thin and disappear in a flash, making them a job for automated trading bots.

Statistical Arbitrage: The Algorithmic Frontier

Welcome to the deep end of the pool. Statistical arbitrage, or "stat arb," leaves simple price hunting behind and wades into the world of high-level math and algorithms. It’s less about one coin's price and more about the complex dance between many assets.

Traders using this method build sophisticated models to find crypto assets that historically move in tandem. When one of those assets breaks from its typical price relationship, the algorithm sees an opening.

Key Concept: Statistical arbitrage is a purely data-driven hunt for temporary pricing oddities. It operates on the belief that correlated assets will, sooner or later, snap back to their historical price relationship.

For instance, a model might spot a strong correlation between two altcoins. If one suddenly tanks while the other holds steady, a bot might buy the cheap one and short the other, betting that the price gap will close. This is high-frequency trading territory, usually dominated by institutional firms with serious computing power. As the market gets smarter, you can keep track of these advanced plays over at the vTrader news hub.

Navigating the Real-World Challenges of Arbitrage

While the concept of crypto arbitrage sounds simple enough on paper, pulling it off profitably in the real world is a different beast entirely. That romantic notion of finding massive, obvious price gaps just sitting there for the taking? That’s largely a relic of crypto’s wild west days.

Today, the market is a far more competitive arena. The biggest hurdle is simply market maturity. As more sophisticated traders and big-money institutions jumped in, the market became incredibly efficient. Powerful automated bots now scan exchanges around the clock, pouncing on and closing price gaps in milliseconds. This intense competition has squeezed profit margins down to a razor's edge, often less than 1% per trade.

The Invisible Costs That Eat Your Profits

Beyond the stiff competition, a whole host of hidden costs can flip a promising trade into a frustrating loss. Think of them as the friction that slows your profit engine down. If you aren't accounting for every single one, you're essentially trading blind.

These fees aren't just minor annoyances; they are critical variables in your profit equation. A 0.5% arbitrage opportunity can vanish in the blink of an eye when you factor in a 0.2% trading fee on both sides of the deal, plus withdrawal costs.

Here are the main culprits you need to have on your radar:

- Trading Fees: Every exchange hits you with a fee to buy or sell. These "maker" and "taker" fees might seem small, but since you’re executing two trades for every arbitrage, their impact on your bottom line is doubled.

- Withdrawal Fees: When you’re doing spatial arbitrage, you have to move funds between exchanges to rebalance your capital. Exchanges charge a fixed fee for this, and it can take a serious bite out of your profits, especially on smaller trades.

- Network Fees (Gas): Moving assets on a blockchain, especially a busy one like Ethereum, costs money. These "gas" fees can swing wildly, sometimes costing more than the entire profit you were hoping to make.

Key Takeaway: Profitable arbitrage isn't about the raw price difference. It's all about the net profit that’s left after you’ve meticulously subtracted every trading, withdrawal, and network fee from the equation.

Getting a handle on these costs is non-negotiable. It’s why savvy traders lean toward platforms with transparent and low-cost structures. For example, you can explore the vTrader fee schedule to see firsthand how a clear fee model can make or break your profitability.

The Critical Role of Liquidity and Slippage

Perhaps the sneakiest—and most dangerous—challenge is liquidity. In simple terms, liquidity is just the availability of buyers and sellers on an exchange. High liquidity is your best friend; it means you can execute big orders without moving the price. Low liquidity, on the other hand, is an arbitrage killer.

When you try to place a sizable trade on an exchange with thin liquidity, you run headfirst into slippage. This is what happens when your order is so big it "slips" through the order book, getting filled at progressively worse prices than you were aiming for.

Picture this:

- You spot a juicy 1% price gap for a coin between two exchanges.

- You slam the buy button on the cheaper, low-liquidity exchange.

- But wait—there aren't enough sellers at that low price. Your order eats up all the available asks, and the average price you end up paying is 0.8% higher than you planned for.

- Just like that, your "profitable" trade is now a guaranteed loss before you’ve even sold on the other side.

This reality highlights just how much crypto arbitrage has evolved. It’s still a perfectly viable, market-neutral strategy, but success now hinges on speed, precision, and the right tools. Today’s game is about using automated systems to spot and act on those fleeting opportunities in an instant. Managing fees has become a primary focus, and checking liquidity is absolutely vital to make sure a price gap is real and not just a trap that will lead to disastrous slippage.

Essential Tools for Your Arbitrage Toolkit

Trying to trade crypto arbitrage manually is like showing up to a Grand Prix in a horse-drawn carriage. In today's market, the opportunities are just too fast, the margins too thin, and the competition too fierce. Success isn't about having a sharp eye anymore; it’s about having a powerful and lightning-fast tech stack.

The absolute centerpiece of this operation is the crypto arbitrage bot. These specialized programs are the engines of any serious strategy, built for one thing: to pounce on price differences faster than any human ever could. They work tirelessly, scanning dozens of exchanges at once and comparing prices in real time.

When a profitable gap opens up, a bot can fire off the buy and sell orders in milliseconds. This speed isn't just a perk—it's everything. A tiny 0.3% profit window can appear and slam shut in the time it takes you to move your mouse. Bots cut out human delay, grabbing those fleeting profits that would otherwise be gone forever.

The Power of Automation

The rise of automated crypto arbitrage bots has completely changed the game for traders in 2025. These are not generic trading bots; they're highly specialized programs designed to monitor multiple exchanges simultaneously and execute trades in a flash to capitalize on price discrepancies. There are different flavors for every strategy, from cross-exchange bots that jump between platforms to triangular arbitrage bots that run complex three-way trades on a single exchange.

These bots drastically cut down on human error and provide the raw speed needed in a market where opportunities can vanish in seconds. As of 2025, the top-tier bots can juggle multiple assets and exchanges, all while following your custom risk settings and analyzing data in real time. While they supercharge your profit potential, you still need to watch out for fees, exchange limits, and wild market swings. You can find a deeper dive into these systems and discover more insights about crypto arbitrage bots on crustlab.com.

Beyond the Bot: Your Supporting Toolkit

While the bot is the star player, it can't win the game alone. A complete arbitrage setup needs a strong supporting cast of tools that work together to streamline your workflow and keep your capital safe.

- Portfolio Trackers: When you have funds scattered across multiple exchanges, seeing the big picture is a nightmare. Portfolio trackers pull all your holdings into a single dashboard, helping you monitor your overall position and shift funds where they need to be.

- Price Alert Systems: If you prefer a more hands-on approach or just want to double-check the opportunities your bot finds, price alert systems are a must. Set up custom alerts for specific price spreads, and you'll get an instant ping when a potential trade is live.

- Secure Wallets: Moving assets around for arbitrage means security has to be your top priority. A solid crypto wallet is non-negotiable for storing funds that aren't in active trades or for securely rebalancing your capital between exchanges.

Key Insight: A winning arbitrage strategy is like a high-performance team. The bot is your star athlete, the portfolio tracker is the coach seeing the whole field, and your alert systems are the scouts finding the next big play.

How to Choose the Right Tools

Picking the right tools is a make-or-break decision that directly affects your security and your bottom line. With so many options out there, it's easy to get lost. Keep your focus on these key factors.

1. Security and Reputation

This is your number one priority. Period. Look for tools with a proven history, strong encryption, and essential features like two-factor authentication (2FA). Never, ever give API access to a platform you haven't thoroughly vetted.

2. Supported Exchanges and Pairs

The more exchanges and pairs your tools support, the more opportunities you'll find. Make sure your bot and tracker are compatible with the high-volume exchanges you plan to target.

3. Customizability and Control

A good tool puts you in the driver's seat. You should be able to define your own rules, like setting minimum profit thresholds, establishing stop-loss limits, and hand-picking the trading pairs you want to watch.

4. Cost and Fee Structure

Tools can range from free to pricey monthly subscriptions. Weigh the cost against the features and make sure the fee structure is crystal clear. Don't forget to bake these costs into your profit calculations.

By carefully choosing your tools and understanding how they fit together, you’re building a system that not only spots opportunities but also actively manages risk. This balanced approach is critical, much like diversifying your broader crypto portfolio. While arbitrage is an active strategy, pairing it with passive income streams can make your portfolio more resilient. For example, you can learn more about generating returns through staking on vTrader to see how different crypto ventures can complement each other.

Executing Your First Crypto Arbitrage Trade

All the theory and tools in the world mean nothing until you put your knowledge to the test. This is where the rubber meets the road. We're going to walk through a complete, step-by-step spatial arbitrage trade, covering everything from initial setup to calculating your final take-home profit.

Think of this as your pre-flight checklist. Running through these steps methodically is your best bet for a smooth and potentially profitable experience trading crypto arbitrage.

Step 1: Prepare Your Trading Environment

In arbitrage, speed is the name of the game. You simply can't afford to be stuck waiting on a bank transfer or crypto deposit while a golden opportunity vanishes before your eyes. In fact, your preparation long before a trade is even spotted is the most critical part of the entire process.

Your main objective is to have funds ready to go, instantly, on at least two different exchanges. Let’s call them Exchange A (where you’ll buy) and Exchange B (where you’ll sell).

To be truly ready for a spatial arbitrage opportunity, you’ll need to:

- Load up Exchange A with Fiat or Stablecoins: Get your funds, like USD or a stablecoin such as USDT, onto the exchange where you plan to buy. This is your "dry powder," ready to deploy at a moment's notice.

- Pre-position Crypto on Exchange B: You need to already own the crypto you intend to sell. Send a chunk of it over to your wallet on Exchange B ahead of time so it's waiting for your sell order.

This two-pronged setup is what allows you to hit the "buy" and "sell" buttons almost simultaneously, which is the only reliable way to lock in a price difference before the market corrects it.

Step 2: Identify a Profitable Opportunity

With your accounts funded and ready for action, it’s time to go hunting. Manually refreshing browser pages won't cut it—it’s far too slow. This is where your chosen monitoring tools or arbitrage bots earn their keep.

Your tool will be scanning countless trading pairs across your selected exchanges, sniffing out a price difference big enough to still be profitable after you factor in all the fees.

Let’s imagine your scanner pings you with this opportunity:

- Exchange A (vTrader): Bitcoin (BTC) is trading at $60,000.

- Exchange B (Another Exchange): Bitcoin (BTC) is trading at $60,300.

On the surface, this $300 gross spread looks juicy. Now, you have to do a quick mental check to make sure it's still worth your while after fees.

Crucial Checkpoint: Never pull the trigger without running the numbers. The formula is simple: (Sell Price – Buy Price) – (Buy Fee + Sell Fee + Withdrawal/Network Fee). If that doesn't spit out a positive number that meets your personal profit target, it’s a no-go.

Step 3: Execute the Buy and Sell Orders

The price gap is real and the potential profit is there. It's go-time—and you need to move now. The buy and sell orders have to be placed as close together as humanly (or robotically) possible.

Using our running example:

- On Exchange A (vTrader): You smash the market buy button for 0.1 BTC, costing you $6,000.

- On Exchange B: At the exact same time, you hit the market sell button for the 0.1 BTC you already had sitting there, netting you $6,030.

You've done it. The price difference is locked in. You now have more cash on Exchange B and the new crypto you just bought is sitting on Exchange A.

Step 4: Calculate Your Net Profit

With the dust settled and the trades confirmed, it’s time for the final accounting. This is the moment of truth where you see if the careful planning paid off. Let's tally up the real profit, fees and all.

We'll assume this fee structure:

- Exchange A (vTrader) Fee: $0 (since vTrader is a zero-fee platform)

- Exchange B Taker Fee: 0.1%

- BTC Withdrawal Fee (for later): A flat fee of 0.0002 BTC (around $12)

Here’s how the math shakes out:

| Metric | Calculation | Amount |

|---|---|---|

| Gross Revenue (Sale) | 0.1 BTC * $60,300 | $6,030.00 |

| Cost of Purchase | 0.1 BTC * $60,000 | $6,000.00 |

| Gross Profit | $6,030 – $6,000 | $30.00 |

| Exchange B Fee | 0.1% of $6,030 | -$6.03 |

| Future Rebalancing Fee | Flat BTC Withdrawal | -$12.00 |

| Net Profit | $30.00 – $6.03 – $12.00 | $11.97 |

After all was said and done, you pocketed a net profit of $11.97. It might not sound like a life-changing amount, but remember, automated bots can find and execute dozens or even hundreds of these small-win trades every single day.

Step 5: Rebalance and Repeat

The trade is done, but your accounts are now out of whack. You've got more cash on Exchange B and more crypto on Exchange A. The final, crucial step is to rebalance your funds to get ready for the next opportunity.

This usually means withdrawing the BTC from Exchange A back to Exchange B, and maybe sending the cash from Exchange B back to Exchange A. This is precisely why we had to account for those withdrawal fees in our profit calculation. Once you're rebalanced, you’re armed and ready to repeat the entire cycle.

Common Questions About Crypto Arbitrage

As you dip your toes into crypto arbitrage, you're bound to have questions. It’s a field where the tiny details can make or break a strategy, and getting clear answers is the first step toward building confidence.

Let’s tackle some of the most frequent queries head-on, covering profitability, starting capital, and the very real risks you need to keep on your radar.

Is Arbitrage Trading Cryptocurrency Still Profitable?

Absolutely, but the game has changed. Gone are the days of finding huge, obvious price gaps just sitting there for the taking. Today, profitability is all about speed, volume, and razor-sharp efficiency.

The most successful traders now rely on automated bots to churn through a high volume of trades, with each one capturing a tiny profit margin—often under 1%. Those small wins, however, stack up over time. It all comes down to meticulously managing your transaction fees and having enough capital in play to make those thin percentages worth the effort.

The Enduring Advantage: The best part about arbitrage is that it's market-neutral. You can make money whether the crypto market is soaring, crashing, or just treading water. Your profit comes from price differences, not from predicting which way the market will go.

This reality check highlights just how critical a precise and disciplined approach is for modern arbitrage.

How Much Capital Do I Need to Start?

You can technically get a feel for the mechanics with just a few hundred dollars, but if you're looking to generate real income, you'll need a more substantial bankroll. The reason is simple math.

A 0.5% profit on a $100 trade is a measly 50 cents, which can easily get eaten up by a single transaction fee. But that same 0.5% on a $10,000 trade? That’s a much more interesting $50. Most serious traders deploy significant capital to make these paper-thin margins worthwhile.

For anyone just starting out, a two-step approach is the smartest path forward:

- Start Small: Begin with an amount you're genuinely comfortable losing. This is your "tuition" phase—use it to learn the workflow, test your tools, and get a feel for the process without any major financial stress.

- Scale Up Gradually: Once you’ve ironed out your process and feel confident in your strategy, you can think about increasing your capital to chase more substantial returns.

This measured approach lets you build real-world expertise while keeping your funds safe.

What Are the Biggest Risks in Crypto Arbitrage?

Arbitrage is often called "low-risk," but that’s only when you compare it to speculative day trading. Several critical risks can flip a profitable opportunity into a loss if you're not careful.

The big three you need to watch out for are:

- Execution Risk: You might know it as "slippage." This is when the price moves against you in the milliseconds between spotting a deal and your trade actually going through. It’s a huge problem on exchanges with low liquidity.

- Transfer Risk: This is the main headache for spatial arbitrage. If moving your crypto from one exchange to another gets delayed by a congested network, the price gap can disappear long before your funds land.

- Liquidity Risk: This happens when an exchange simply doesn’t have enough buyers or sellers to fill your order at the price you want. You might be forced to accept a worse price, killing your profit margin on the spot.

Beyond these, unexpected fees are a constant threat that can quietly bleed you dry. For a deeper dive into common trading issues and how to handle them, check out the vTrader FAQ section.

Ready to put your knowledge into practice on a platform designed for maximum profitability? With vTrader, you get commission-free trading on Bitcoin, Ethereum, and more, empowering you to keep more of your hard-earned arbitrage profits. Get started today and discover the zero-fee advantage at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.