Ever found a collector's item for $50 at one shop, only to see it selling for $55 at another just down the street? That simple 'buy low, sell high' idea is the very heart of arbitrage trading crypto. It’s a strategy that hinges on exploiting temporary price differences for the same digital asset across different exchanges.

Unlocking Profits From Market Inefficiencies

At its core, arbitrage in the crypto world is all about capitalizing on market inefficiencies. Unlike the stock market, crypto is decentralized and runs 24/7 across hundreds of independent exchanges. This fragmented setup means the price of a single coin, like Bitcoin or Ethereum, can be slightly different from one platform to the next at any given moment.

These price gaps, no matter how small, create an opportunity. An arbitrage trader spots these discrepancies, buys the asset on the exchange where it's cheaper, and simultaneously sells it on the exchange where it's more expensive. The difference, after subtracting any fees, is their profit.

To give you a clearer picture, here's a quick rundown of what crypto arbitrage involves.

Crypto Arbitrage At a Glance

| Element | Description |

|---|---|

| Concept | Buying a crypto asset on one exchange and selling it for a higher price on another. |

| Typical Profit | Often small, ranging from 0.05% to 0.15% per trade after fees. |

| Key Requirement | Speed. Price gaps close in seconds, so execution must be lightning-fast. |

| Capital Needed | Often substantial ($100,000+) to make small percentage gains worthwhile. |

| Primary Risk | Slippage and execution delays can erase profits or even cause losses. |

| Tools Used | Automated trading bots are essential for identifying and executing trades quickly. |

As you can see, while the idea is straightforward, the execution requires precision and the right tools.

Why Do These Price Gaps Even Exist?

Several factors create these temporary price differences, making arbitrage trading crypto a viable strategy. If you can understand them, you're one step closer to spotting potential trades.

- Varying Liquidity: Exchanges with massive trading volumes usually have more stable prices. In contrast, those with lower liquidity can experience more dramatic price swings, creating gaps.

- Geographic Demand: A sudden surge in demand from a specific region can drive up prices on local exchanges. For instance, a wave of buyers in Asia might temporarily inflate a coin's price on an Asian platform compared to a US-based one.

- Listing Delays: When a new coin gets listed on various exchanges at different times, the initial price discovery phase can open up significant arbitrage windows for sharp-eyed traders.

The essence of arbitrage is pure speed. The whole game is about locking in a profit from a known price difference before the rest of the market catches on and corrects the inefficiency, which often happens in mere seconds.

The Modern Reality of Crypto Arbitrage

While the concept is simple, pulling it off in today's market requires a serious, strategic approach. Cross-exchange arbitrage is still a go-to method, but the landscape has changed. Research shows that while opportunities for major assets like Bitcoin are less frequent—now averaging just 2-8 per day—they do still pop up. The catch? The profit margins are razor-thin, typically hovering between 0.05% and 0.15% after you account for all the fees.

To succeed, you often need significant capital (think upwards of $100,000 spread across multiple exchanges) and an investment in automated trading systems to execute trades fast enough to matter. You can build a stronger foundation in these concepts by exploring the learning resources at the vTrader Academy. For anyone serious about this path, the costs for infrastructure and compliance can be steep, which really underscores the need for meticulous planning.

Key Strategies for Crypto Arbitrage

Knowing what crypto arbitrage is and actually making money from it are two different ballgames. Success in arbitrage trading crypto boils down to picking the right strategy for the market's mood. Let’s get past the basic definitions and dive into the main methods you can use—each with its own quirks, complexities, and demands.

H3: Spatial or Cross-Exchange Arbitrage

This is the most straightforward and common type of arbitrage, and it’s pretty easy to get your head around. Think of it as a digital treasure hunt. Spatial arbitrage is all about buying a cryptocurrency on one exchange where it’s cheaper and, at the exact same time, selling it on another where the price is higher. The "space" between the two exchange prices is where you find your profit.

For instance, say you spot Bitcoin (BTC) trading for $60,000 on Exchange A, but it’s going for $60,240 on Exchange B. A savvy trader would immediately jump on this.

- Buy 1 BTC on Exchange A for $60,000.

- Sell 1 BTC on Exchange B for $60,240.

Before you even think about fees, that’s a potential $240 profit. The real challenges here are speed and transfer times. If moving your BTC from one exchange to the other takes too long, that price gap could vanish. Pro traders get around this by keeping funds on both exchanges, so they can buy and sell instantly without waiting on the blockchain.

Key Insight: Spatial arbitrage is a flat-out race against the clock. The window of opportunity for these price gaps is often measured in seconds, not minutes. For consistent results, an automated trading bot isn't just helpful—it's practically a requirement.

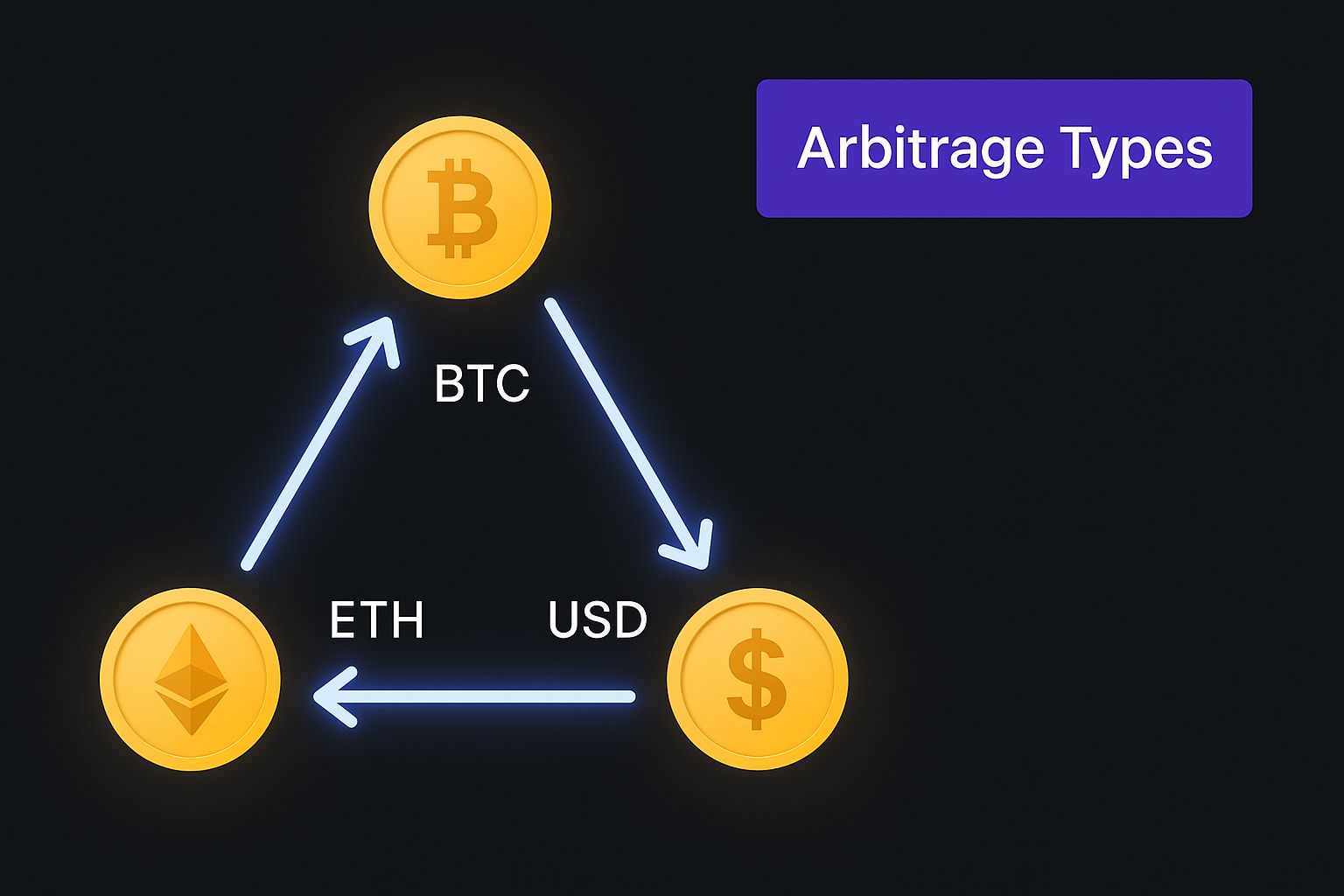

H3: Triangular Arbitrage

What if you could pocket a profit without ever having to move your funds off a single exchange? That’s the genius behind triangular arbitrage. This strategy sniffs out price mismatches between three different cryptocurrencies that are all trading on the same platform. It’s like a currency exchange magic trick where you end up with more than you started with, just by making a few quick trades in a specific order.

The whole thing works in a three-step loop. For example, a trader might do this:

- Start with USD and buy Bitcoin (BTC).

- Instantly swap that BTC for Ethereum (ETH).

- Finally, sell the ETH right back into USD.

If the exchange rates between the USD/BTC, BTC/ETH, and ETH/USD pairs aren't perfectly aligned, the final pile of USD could be bigger than the initial one. These opportunities are incredibly rare and disappear in a flash, demanding sophisticated software to spot the gap and fire off all three trades in a heartbeat.

This image really drives home how arbitrage, whether it’s across different exchanges or all on one, is about pouncing on those fleeting moments when the market is out of sync.

H3: Statistical Arbitrage

This is where things get seriously complex and data-heavy. Statistical arbitrage, or "stat arb," leaves simple price gaps behind and ventures into the world of high-level quantitative analysis. Traders using this strategy create mathematical models to find assets that historically move up and down together.

Imagine two altcoins that are usually joined at the hip. If one suddenly tanks while the other stays put, the model flags it as a break from the norm. An arbitrage bot would then swoop in to:

- Buy the coin that dropped, betting it will bounce back.

- Short-sell the other coin, betting it will dip to meet its partner.

Once the price relationship between the two snaps back to its historical average, the trader closes both trades and collects the profit. This strategy is almost entirely in the hands of quant funds and top-tier technical traders, as it relies on powerful algorithms and massive datasets to predict price movements based on probability.

Comparing Crypto Arbitrage Strategies

To help you see how these strategies stack up, here’s a quick comparison. Each has its place, but they demand very different levels of skill, capital, and risk tolerance.

| Strategy Type | Complexity | Capital Needed | Primary Risk |

|---|---|---|---|

| Spatial | Low | High (to hold on multiple exchanges) | Execution speed & transfer delays |

| Triangular | Medium | Moderate (contained to one exchange) | Slippage & execution speed |

| Statistical | High | Varies (often high) | Model failure & market shifts |

Ultimately, the right strategy depends on your resources and technical expertise. While spatial arbitrage offers a clearer entry point, statistical arbitrage represents the peak of automated, data-driven trading.

Understanding the Real Risks of Crypto Arbitrage

It’s easy to get drawn in by the promise of arbitrage trading crypto—the idea of scooping up nearly instant, low-risk profits sounds like a trader’s dream. But the reality on the ground is far more complicated. That allure of easy money has a way of hiding the very real dangers that can flip a surefire win into a painful loss in less time than it takes to blink.

Success in this game isn't just about spotting a price difference. It’s about skillfully navigating a minefield of pitfalls that can blow up in your face without warning. Think of it like being a professional race car driver. The car is incredibly fast and the track ahead looks clear, but one tiny miscalculation or a moment of hesitation can send you spinning off the course. The same principle applies here; the dangers are swift and don't offer second chances.

Key Takeaway: In crypto arbitrage, the biggest threats often aren't about which way the market is heading. They're about operational failures, bad timing, and hidden costs that can completely derail a trade you thought was a lock.

The Ever-Present Threat of Execution Risk

Execution risk is the most immediate and common hazard you’ll face. In simple terms, it's the risk that by the time your order actually goes through, the price has already moved against you. This usually happens in one of two ways:

- Delays: The crypto market moves at the speed of thought. A lag of just one or two seconds between when you place your buy order and your sell order can be all it takes for that profitable gap to shrink or vanish entirely.

- Price Slippage: This is what happens when you try to execute a large order, but there aren't enough buyers or sellers at your target price. The exchange starts filling your order at the next best prices available, which get progressively worse and eat away at your expected profit margin.

Let’s say you find a juicy $100 arbitrage opportunity on an altcoin. You hit "buy" on the first exchange and "sell" on the second. But thanks to network lag, your sell order takes an extra three seconds to execute. In that tiny window, the price on the second exchange drops by $120. Just like that, your $100 potential profit has turned into a $20 loss.

Navigating Transfer Risk and Network Congestion

For any arbitrage that involves moving crypto between exchanges—known as spatial arbitrage—transfer risk is a huge obstacle. This is the danger of your funds getting stuck, delayed, or lost in transit while moving from one wallet to another.

A classic nightmare scenario involves a clogged blockchain network. You buy a coin on Exchange A and immediately send it to Exchange B to sell for a higher price. But the network is congested, and what should have been a five-minute confirmation turns into a 30-minute ordeal. By the time your crypto finally arrives, the arbitrage opportunity is ancient history, and you might even have to sell at a loss.

A smart way to counter this is to pre-fund your accounts on multiple exchanges. By keeping both your trading pair (like BTC) and a stablecoin (like USDT) on each platform, you can buy and sell at the exact same time without ever having to wait on a slow blockchain transfer. For any serious arbitrage trader, this isn't just a tactic—it's a necessity.

The Hidden Dangers You Cannot Ignore

Beyond the more obvious risks, a whole host of hidden challenges can pop up and throw a wrench in your plans. These are the "unknown unknowns" that can freeze your capital and completely wreck your strategy.

- Sudden Exchange Maintenance: Exchanges can go offline for updates or repairs with very little warning, trapping your funds and leaving you unable to close out a critical position.

- Withdrawal or Wallet Freezes: An exchange might suddenly halt withdrawals for a specific coin because of a technical bug or a security scare. When that happens, your assets are stuck.

- Hidden Fees: While most exchanges are upfront, some fees are easy to miss. To avoid nasty surprises, you have to dig into the complete fee schedule, from trading costs to deposit and withdrawal charges. You can get a clear breakdown by checking out the official vTrader fees page.

- Evolving Regulations: The rules governing crypto are always in flux. A new regulation in a certain country could abruptly stop trading or add new compliance hurdles, introducing a whole new layer of uncertainty.

Ultimately, getting ahead of these risks boils down to solid preparation and having the right tools for the job. High-speed trading bots, pre-funded accounts across multiple platforms, and a deep understanding of each exchange's rules aren't just nice-to-haves—they are fundamental requirements for surviving and thriving in the competitive world of arbitrage trading crypto.

Your First Crypto Arbitrage Trade Walkthrough

Theory is great, but putting your money on the line is where things get real. To really get a feel for arbitrage trading crypto, let's walk through a live trade example from start to finish. This is the blueprint that turns abstract ideas into a concrete, money-making process.

Think of it like a pilot's pre-flight checklist. Every step is critical. Skipping just one can turn a sure thing into a costly mistake. For this to work, you need speed, precision, and a sharp pencil.

Step 1: Spotting the Opportunity

Your first move is always hunting for a price difference. Manually refreshing pages across different exchanges is a fool's errand—the opportunity will vanish before you can even log in. This is where arbitrage scanners and bots are absolutely essential.

These tools are your eyes and ears, constantly watching the prices of thousands of crypto pairs across dozens of exchanges. They're built to ping you the second an asset—we'll use Solana (SOL) for this walkthrough—has a price gap worth looking at.

Imagine your scanner flashes an alert:

- Exchange A: SOL is trading at $135.00

- Exchange B: SOL is trading at $135.81

You've just spotted a potential $0.81 gap for every SOL you can trade. On the surface, this looks like a green light.

Step 2: Calculating the True Profit

This is the step that trips up most new traders. A price gap isn't profit. You have to account for every single fee that will chip away at your margin. Ignoring them is the fastest way to lose money on what looked like a guaranteed win.

Let’s run the numbers for our SOL trade, assuming a volume of 100 SOL:

- Trading Fees: Most exchanges charge for buying and selling. A common fee is around 0.1%.

- Buy Fee on Exchange A: 0.1% of (100 SOL * $135.00) = $13.50

- Sell Fee on Exchange B: 0.1% of (100 SOL * $135.81) = $13.58

- Withdrawal & Network Fees: If you have to move the SOL from one exchange to the other, there are costs involved.

- Exchange A Withdrawal Fee: We'll assume a flat 0.01 SOL.

- Solana Network Gas Fee: This is typically tiny, but let's budget $0.01 to be safe.

Now, let's put it all together.

Crucial Calculation: Gross Profit – Total Fees = Net Profit. This is the simple math that decides whether you pull the trigger. Never, ever skip this.

| Calculation Element | Amount |

|---|---|

| Gross Profit (100 SOL * $0.81 gap) | +$81.00 |

| Buy Fee (Exchange A) | -$13.50 |

| Sell Fee (Exchange B) | -$13.58 |

| Withdrawal Fee (0.01 SOL * $135) | -$1.35 |

| Network Fee | -$0.01 |

| Net Profit | $52.56 |

The math checks out. With a net profit of over $50, it's a go. It’s also smart to know the rules of the playground you're in; for example, understanding the vTrader refund policy ensures you’re clear on all fund-related terms before you start trading.

Step 3: Executing the Trade

Here, speed is everything. The smartest way to play this is by having funds ready on both exchanges to avoid transfer delays and risk. That means having USD or a stablecoin on Exchange A for the buy, and your SOL ready to sell on Exchange B.

The execution needs to be as simultaneous as you can manage:

- Place the Buy Order: Instantly hit the market order to buy 100 SOL on Exchange A for $13,500.

- Place the Sell Order: At the same time, execute a market order to sell 100 SOL on Exchange B for $13,581.

A good trading bot makes this a single, automated action, firing off both trades in milliseconds—a speed no human can ever hope to match.

Step 4: Reviewing the Outcome

Once the dust has settled, circle back and check the numbers. Dive into your trade history on both exchanges to see the exact execution prices and fees. Did slippage eat into your profits? Did the price shift in the split second it took to fill your orders?

Analyzing what actually happened helps you fine-tune your approach for next time. Maybe you need to adjust your scanner's minimum profit threshold or stick to exchanges with faster execution. This feedback loop is what turns one-off wins into a sustainable arbitrage trading crypto strategy.

Essential Tools for Successful Crypto Arbitrage

When you're playing a game of speed and precision, your tools aren't just helpful—they're everything. Successful arbitrage trading crypto hinges on technology that can spot and act on tiny market blips faster than any human ever could. Without the right tech, you're just watching from the sidelines.

Building your arsenal means picking software designed for very specific, high-stakes jobs. From catching price differences in real-time to juggling funds across multiple exchanges, each tool is a crucial piece of the puzzle, turning fleeting chances into real profits.

Arbitrage Scanners and Bots

Automation is the heart of any modern arbitrage strategy. Arbitrage scanners and trading bots are the twin engines that drive your operation, working around the clock to give you a serious competitive edge.

Think of a scanner as your lookout. It’s constantly scanning prices across dozens of exchanges, hunting for those profitable gaps. Once it finds an opportunity that fits your rules—like a minimum profit target—a trading bot jumps into action. The bot is built to fire off the buy and sell orders automatically and almost instantly, slashing the risk of the price gap closing before you can make your move.

Key Insight: A typical arbitrage window lasts for just a few seconds. Trying to trade manually is a fool's errand. A solid bot is non-negotiable for executing fast enough to lock in a profit before it vanishes.

These tools are absolutely essential for any serious arbitrage trader.

- Pros: They bring incredible speed to the table, trade without emotion, and run 24/7, catching opportunities while you sleep.

- Cons: Good bots come with subscription fees, and setting them up correctly takes time and know-how. A poorly configured bot can drain your account fast.

- Cost: You could be looking at anything from a one-time fee of a few hundred dollars to monthly subscriptions between $50 to $500 for more advanced setups.

Portfolio Management Dashboards

When you're deep in arbitrage—especially across different exchanges—your money is scattered everywhere. Trying to track your total holdings, see how each asset is doing, and calculate your overall profit and loss can become a huge headache.

This is exactly what portfolio management dashboards are for. These platforms plug into your exchange accounts using APIs and pull all your data into one clean, simple view. You get a bird's-eye view of your entire portfolio, can review your trade history, and analyze your performance without jumping between a dozen different websites.

Exchange APIs for Programmatic Trading

The Application Programming Interface (API) is the digital handshake that lets your trading tools talk directly to an exchange. Instead of you physically clicking "buy" or "sell" on a webpage, an API key lets your bot send commands straight to the exchange's servers for near-instant execution.

Getting and protecting your API keys is a critical first step in setting up your trading rig.

| Key Feature | Why It Matters for Arbitrage |

|---|---|

| Speed | API commands are processed lightyears faster than manual clicks, which is vital for avoiding slippage. |

| Automation | This is what lets your bots pull off complex trades like triangular arbitrage without you lifting a finger. |

| Data Access | APIs provide a live firehose of market data that your scanners need to find opportunities in the first place. |

The API is what truly powers programmatic arbitrage trading crypto. While you're getting your strategy dialed in, it's also smart to explore other ways to put your crypto to work. For example, earning rewards through crypto staking can be a great way to complement your trading efforts. Building a solid tech stack means optimizing every part of your crypto journey.

Building a Sustainable Crypto Arbitrage Strategy

Venturing into arbitrage trading crypto isn't just about learning a new technique; it's about adopting a whole new mindset. You have to stop thinking about it as a fast track to overnight wealth and start treating it as a serious business—one that runs on skill, patience, and absolute precision. The traders who actually stick around and make a living from this aren't gamblers. They're meticulous planners.

Lasting profitability really boils down to four key pillars: deep market knowledge, strict risk management, adequate capital, and the right tech stack. If any one of these is missing, the whole thing falls apart. You can't spot real opportunities without understanding the market, and one bad trade can erase weeks of gains if you don't have tight risk controls.

Start Small and Refine Your Process

Diving in headfirst with a pile of cash is a classic rookie mistake and, frankly, a surefire way to lose it all. The smart approach is to start small. This lets you build confidence and iron out the kinks in your process without the crushing pressure of high-stakes trades. It gives you room to make mistakes while they're still cheap.

To get your footing, try easing in with these steps:

- Paper Trading: Before you risk a single real cent, fire up a trading simulator or even a basic spreadsheet to “paper trade.” Hunt for opportunities, crunch the numbers on fees, and see if your trades would have actually worked out. Think of it as your training ground.

- Focus on One Strategy: Don't try to be a jack-of-all-trades from day one. Pick a single strategy, like spatial arbitrage, and get to know every little detail about it.

- Set Clear Loss Limits: Before you even place a trade, decide the absolute maximum you're willing to lose that day or on that single position. And then, you have to stick to it. No exceptions.

This deliberate start builds the muscle memory and the cool-headed discipline you'll need when you're trading live and the pressure is on.

Expert Advice: Look at your first few months of trading as an education. Any small losses you take are just the tuition fee for learning how to operate in a market that moves at the speed of light. Your main goal isn't profit—it's perfecting your process.

The Mindset of Continuous Adaptation

The crypto market never sleeps, and it certainly never stands still. A strategy that prints money today could be completely useless tomorrow as exchanges get faster and new protocols change the game. A truly sustainable arbitrage strategy isn't a fixed blueprint; it's a living framework you have to constantly tune and upgrade.

This means keeping your finger on the pulse of new exchanges, watching how network fees are changing, and always hunting for ways to execute faster and calculate with more accuracy. The traders who crush it in arbitrage are the ones who are perpetual students of the market. They never stop testing, learning, and tweaking their approach to stay ahead of the curve.

At the end of the day, your success in arbitrage trading crypto will be a direct result of how committed you are to mastering the craft. By blending strategic planning with a mindset of constant improvement, you can turn this complex game from a high-wire act into a calculated and sustainable business.

Frequently Asked Questions About Crypto Arbitrage

As you start exploring arbitrage trading crypto, it’s only natural for a few questions to come up. The strategy is simple on paper, but the real world has nuances every trader needs to get their head around. Let's dig into some of the most common questions to clear things up and set some realistic expectations.

Is Crypto Arbitrage Still Profitable?

Absolutely, but it’s not the wild west it used to be. As the crypto market has grown up, the price differences between exchanges have gotten much smaller and they disappear in a flash. Today, making a profit almost completely hinges on using sophisticated, high-speed trading bots.

These automated tools can spot and execute trades in milliseconds—a speed no human can match. The whole game has shifted from sharp eyes to sharp algorithms, meaning your success now really depends on your tech.

How Much Money Do I Need to Start?

There isn't a single magic number here, but you'll generally need more than just a few hundred bucks to make arbitrage worth your while. The profit on any single trade is often razor-thin, sometimes pulling in less than 0.5%. To make real money from such tiny margins, you have to be moving a decent amount of capital.

Realistic Capital: Most serious arbitrage traders don't even bother starting with less than $5,000 to $10,000. That's enough firepower to cover the trading and network fees and still walk away with a respectable profit. With anything less, you risk having your gains completely eaten up by fees.

Can I Perform Arbitrage Manually?

Technically, you could, but trying to do crypto arbitrage by hand in today’s market is a surefire way to get frustrated and lose money. The windows of opportunity for these trades are incredibly small, often lasting just a few seconds.

By the time you spot a price gap, log into two different exchanges, figure out your potential profit after fees, and place both trades, the opportunity is long gone. Automated bots aren't just a nice-to-have; they are essential for anyone serious about this because they deliver:

- Speed: Firing off near-instant trades in the blink of an eye.

- Accuracy: No fat-finger errors or miscalculations.

- Consistency: Working around the clock to catch opportunities while you sleep.

What Are the Tax Implications?

In most countries, every single profitable trade is a taxable event. Given the sheer volume of transactions in arbitrage trading, this can quickly turn into a massive headache come tax season. It is absolutely critical to keep meticulous records of every buy, sell, and transfer you make.

Failing to report your gains correctly can land you in hot water with some serious penalties. It’s a complex area, so talking to a tax professional who specializes in crypto is a very smart move to make sure you stay on the right side of the law. For more answers to common questions, you can also explore the detailed vTrader FAQ page.

Ready to put your knowledge into action on a platform designed for profitability? With vTrader, you get zero-fee trading on over 30 cryptocurrencies, advanced tools, and a secure environment to grow your portfolio. Start trading with zero commission on vTrader today

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.