Thinking about trading altcoins? It's more than just hitting "buy" and "sell." A solid strategy involves five key phases: digging into promising projects, getting your trading account locked down, reading the market, making your move, and—most importantly—managing your risk. This isn't just about gambling; it's a strategic approach to navigating one of the most volatile and opportunity-rich markets out there.

Diving Into the World of Altcoin Trading

So, you've heard about Bitcoin. But the real action for many traders is in the thousands of other cryptocurrencies known collectively as altcoins. The term "altcoin" is just a simple way of saying any crypto that isn't Bitcoin, from giants like Ethereum (ETH) down to brand-new projects you’ve never heard of.

What makes them so interesting to trade? While Bitcoin is often pitched as digital gold, altcoins represent a whole universe of different ideas—new technologies, decentralized applications, and vibrant communities. This incredible diversity creates trading dynamics that are often completely disconnected from whatever Bitcoin is doing.

Sure, this means higher volatility, which can be risky. But for traders looking for dynamic price action, that volatility is exactly where the opportunity for high returns lives.

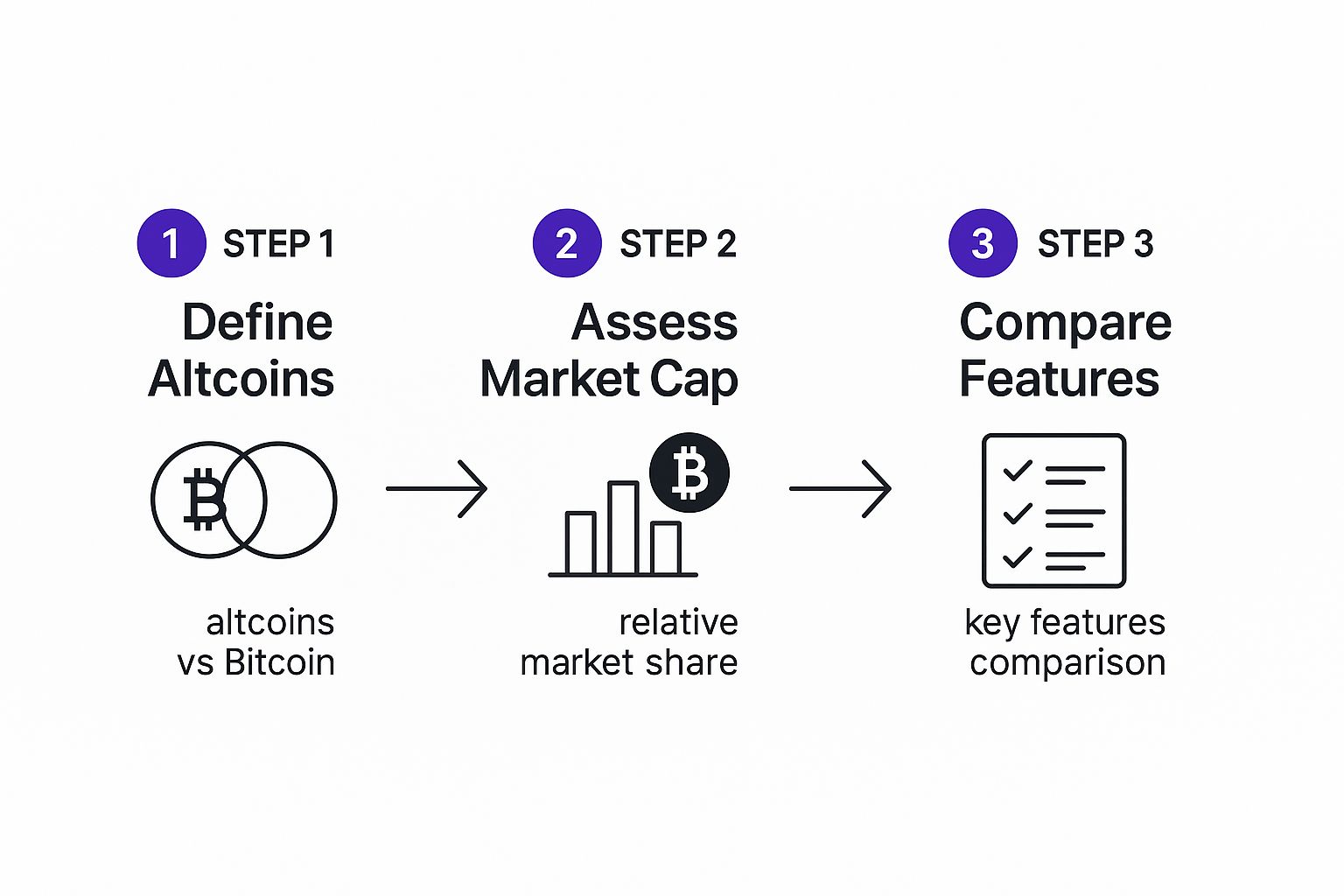

This visual breaks down the very first steps you should take when sizing up any new altcoin. It’s about understanding what it does, how big its potential market is, and how it stacks up against the competition.

As the infographic shows, a trader’s first job is always to look past the price chart and get a handle on the project's real-world value.

Understanding the Altcoin Market Landscape

The sheer scale of this market is staggering and shows just how much capital is fueling the action. As of early 2025, the total crypto market cap was hovering around $3.4 trillion, after touching a high of nearly $3.8 trillion in late 2024. That's a massive amount of money flowing through the system, and a huge chunk of it is churning through the altcoin sector.

To trade altcoins successfully on a platform like vTrader, you need a repeatable process. It’s not about getting lucky on a hyped-up coin; it’s about building a system you can rely on trade after trade.

The real secret to successful altcoin trading isn't having a crystal ball. It's about developing a system that gives you a long-term edge. That system is built on solid research, disciplined execution, and iron-clad risk management.

The Five Phases of an Altcoin Trade

To get a handle on trading, it helps to break the entire process down into manageable phases. Each one builds on the last, giving you a complete framework for making smarter, more confident decisions. If you want to go deeper on any of these, the vTrader Academy has a ton of resources to help you master each step.

Here’s a quick look at the five phases we’ll be covering. Think of this as your roadmap from start to finish for any trade.

The Five Phases of an Altcoin Trade on vTrader

| Phase | Key Action | Primary Goal |

|---|---|---|

| Research | Dig into the whitepaper, team, and community. | Find altcoins with a legitimate reason to exist. |

| Setup | Create and secure your vTrader account. | Build a safe and funded launchpad for trading. |

| Analysis | Use charts and news to find your shot. | Pinpoint the best prices to get in and out. |

| Execution | Place your market, limit, or stop-limit orders. | Enter or exit a position at the price you want. |

| Risk Management | Set stop-losses and decide your position size. | Protect your capital so you can trade another day. |

This table lays out the fundamental workflow for every single trade. It's a loop: research, set up, analyze, execute, and manage. Get this rhythm down, and you’re already ahead of the game.

This guide will walk you through each of these phases in detail, using vTrader to show you how it all works in the real world. By the end, you’ll have a clear plan to go from simply watching the market to actively participating in it.

Setting Up Your vTrader Trading Headquarters

Before you can even think about trading altcoins, you need a solid base of operations. This is your trading headquarters, and setting up your vTrader account the right way is the first, most critical step in protecting your capital. It’s not just about picking a password—it’s about building a fortress around your funds.

Think of it like this: you wouldn't build a bank vault and then leave the door unlocked. The very first thing you should do after creating your account is enable Two-Factor Authentication (2FA). Honestly, this is non-negotiable. It adds a second layer of security, usually a code from your phone, that someone needs to access your account.

Crypto-related hacks are always on the rise, and accounts without 2FA are just low-hanging fruit for bad actors. Setting it up on vTrader takes less than five minutes, and it's the single best thing you can do to secure your trading future.

Navigating Verification and Funding

With your account locked down, the next step is usually the Know Your Customer (KYC) process. This is a standard identity check required by regulated platforms like vTrader. Have your government-issued ID and proof of address handy, and you'll sail right through it. It’s a necessary hurdle that keeps the platform clean and prevents fraud.

Once you're verified, it's time to get some funds in your account. You've got a couple of choices here, and the best one really just depends on your starting point.

- Bank Transfers (ACH/Wire): This is the most straightforward route if you're starting with fiat currency like USD. It’s a familiar process, so it's great for beginners, but just be aware it can take a few business days for the money to land.

- Crypto Deposits: Already hold some crypto in another wallet or on a different exchange? You can send it directly to your vTrader wallet. This is almost always the faster option, with deposits often showing up in just a few minutes.

If you go the crypto route, just head to your vTrader wallet, pick the coin you want to deposit—say, Ethereum—and copy your unique deposit address. A word of caution from experience: always double-check, then triple-check, that the address is perfect. Sending crypto to the wrong address is a one-way street, and the funds are gone for good.

Your Dashboard and Funding Options

Get comfortable with the vTrader dashboard. This is your command center—you’ll use it to watch your portfolio, find your wallet addresses, and place trades. Spend some time just clicking around to see where everything is before you deposit any serious capital.

Your trading dashboard is your cockpit. You need to know where every dial and switch is located before you attempt to fly. Spend time exploring the interface until navigating it becomes second nature.

To make the choice easier, here’s a quick rundown on funding your account for the first time.

| Funding Method | Best For | Typical Speed | Key Consideration |

|---|---|---|---|

| Bank Transfer | New traders starting with fiat currency | 1-3 business days | Simple and familiar, but slower processing time. |

| Crypto Deposit | Traders moving existing assets | Minutes to hours | Faster settlement, but requires careful handling of wallet addresses. |

Once your funds arrive, you're officially ready to start analyzing the market. And don't forget, the assets you hold don't have to just sit there. If you're looking to earn passive rewards, you can put your crypto to work by exploring the options for staking on vTrader.

Learning to Read the Altcoin Market

Forget chasing fleeting social media hype. Real trading isn't about getting lucky on a random coin; it's a skill built on a bedrock of solid market analysis. To actually know how to trade altcoins, you have to learn the market's language.

That language has two distinct dialects: fundamental analysis and technical analysis. One asks why a project has value, while the other asks when its price might move. Get a handle on both, and you turn speculative guesses into strategic decisions. This is how you spot genuine opportunities before they hit the mainstream.

Decoding an Altcoin's Fundamental Value

Before you even glance at a price chart on vTrader, you need to get your hands dirty and investigate the project itself. This is where you dig past the ticker symbol and find out if there's any real substance. A project with a strong foundation has a much better shot at weathering market storms.

Your first stop should always be the whitepaper. This is the project's blueprint. Don't just skim it—look for a clear explanation of the problem it solves and what makes its solution different. A solid whitepaper is detailed and professional, not filled with vague marketing fluff.

Next, put the development team under a microscope. Are they public figures with verifiable track records? Anonymous teams are a massive red flag. You want to see developers with real experience in blockchain or related fields, because they're the ones who have to turn the whitepaper's vision into reality.

Finally, take the community's temperature. A lively, engaged community on platforms like X (formerly Twitter), Discord, and Telegram is a great sign. It signals genuine interest and adoption, which are vital for any project’s long-term health.

Using Technical Analysis on vTrader

Once you've vetted a project's fundamentals, it's time to switch gears to technical analysis. This is where the charting tools on vTrader come into play, helping you analyze price action to pinpoint potential entry and exit points. Think of it less as fortune-telling and more as identifying probabilities based on what the market has done before.

First up is learning how to read a candlestick chart. Each candle tells you a story of the tug-of-war between buyers and sellers over a set period. Green candles mean the price closed higher than it opened; red means it closed lower.

A price chart is just a visual record of market psychology. Every peak and valley, every surge and dip, represents the collective fear and greed of thousands of traders. Learning to read it gives you a window into that collective mind.

With this basic knowledge, you can start to identify two of the most powerful concepts in all of trading:

- Support: A price level where a downtrend tends to stall out because of a cluster of buying interest. Think of it as a floor the price struggles to break.

- Resistance: The flip side of support. This is a price level where an uptrend tends to run out of steam due to selling pressure. It acts like a ceiling.

Spotting these levels on vTrader’s charts helps you frame your trades. For example, you might look to buy near a strong support zone or start taking profits as the price nears a major resistance level. If you're looking at a chart for Uniswap (UNI), for instance, you can map out these key levels to plan your trade. You can see this in action and learn how to analyze the UNI token on vTrader right now.

Key Indicators and The Bitcoin Effect

To sharpen your analysis, you’ll want to layer a few key indicators onto your vTrader charts. Two of the most common and effective for new traders are Moving Averages (MAs) and the Relative Strength Index (RSI). MAs smooth out price action to help you see the underlying trend, while the RSI helps you spot potentially overbought or oversold conditions.

But here’s a crucial piece of the puzzle: no altcoin trades in a bubble. You must always keep one eye glued to Bitcoin. As of 2024 and heading into 2025, Bitcoin and Ethereum commanded over 50% of the entire crypto market cap, according to research on crypto market share at Statista.com.

This dominance means Bitcoin's gravity pulls on the entire altcoin market. When Bitcoin is in a strong uptrend, it tends to lift all boats. But when it tumbles, it can drag even the most solid altcoins down with it. Experienced traders know this all too well—a perfect altcoin setup is far more likely to succeed if Bitcoin’s trend is pointing in the same direction.

Executing Your First Altcoin Trade on vTrader

All the late-night research and chart analysis have brought you to this point. You’ve found a promising altcoin, you have a solid trading plan, and now it's time to step into the ring and make your first move on vTrader. This is where your strategy truly comes to life—and knowing your tools is what separates a calculated decision from a hopeful gamble.

While some seasoned pros use a dedicated trading terminal to plug into multiple exchanges, we’ll stick to the clean, intuitive layout right here on vTrader. The heart of the action is the order panel. This is your command center, where you tell the platform exactly how you want to buy or sell.

Choosing the Right Order Type

Trading altcoins effectively means using the right tool for the job. vTrader offers a few different order types, but the main three you'll find yourself using are market, limit, and stop-limit orders. Each one has a specific job, and picking the right one is absolutely key to controlling your trades.

- Market Order: This is the fast and simple option. A market order buys or sells an altcoin at the best available price right now. It guarantees your trade gets filled, but it doesn't guarantee a specific price. Use this when speed is everything and you're fine with the current market rate.

- Limit Order: This order puts you in complete control of the price. You set the exact price you’re willing to buy or sell at, and the trade will only go through if the market hits that price or a better one for you. It's the perfect way to buy a dip at a support level you've identified or to lock in profits at a specific target.

- Stop-Limit Order: Think of this as your two-part safety net. It combines a stop price (the trigger) with a limit price (the execution price). Once the market touches your stop price, a limit order is automatically placed on the books. It's an indispensable tool for setting stop-losses to protect your capital from a sudden downturn.

A Practical Walkthrough: Trading SOL/USDT

Let's walk through a real-world scenario. Say your analysis suggests Solana (SOL) is looking undervalued and you want to buy $100 worth. You’ve picked out $165 as your ideal entry point, just above a key support level.

First, you'll head over to the SOL/USDT trading pair on vTrader. USDT (Tether) is a stablecoin pegged to the US dollar, which is why you see it paired with so many other cryptocurrencies.

Instead of just hitting "buy" with a market order, you’re going to be more precise and use a limit order.

- Select Order Type: Find the order panel and choose "Limit."

- Set Your Price: In the "Price" field, you’ll type in 165 USDT. This is you telling vTrader, "I won't pay a penny more than $165 per SOL."

- Enter the Amount: In the "Amount" field, you'll enter 0.606 SOL (which is just $100 divided by your $165 price). Or, even easier, vTrader has a handy slider that lets you just enter the total USDT you want to spend, and it does the math for you.

- Confirm the Order: A quick double-check—buy 0.606 SOL at a limit of 165 USDT—and then you hit "Buy SOL."

Done. Your order is now live and will appear in the "Open Orders" section of your dashboard. It will sit patiently, waiting for the market price of SOL to drop to $165 or lower. As soon as it does, your order gets filled.

An open limit order is your patient agent in the market. It waits tirelessly for your price, executing on your behalf so you don't have to be glued to the screen 24/7. This discipline is a hallmark of strategic trading.

Monitoring Your Trades and History

Once your order is filled, it disappears from "Open Orders" and moves into your "Trade History." This is your personal trading ledger. It keeps a perfect record of every buy and sell, including the price, amount, and any fees (which, by the way, are zero on vTrader). Reviewing your history is non-negotiable for improving; it’s where you see what worked, what didn’t, and how you can sharpen your strategy for the next trade.

This same process works for any asset. If you were looking at Aave, for instance, the principles of placing an order are identical. You can learn more about its unique market dynamics and trade AAVE on vTrader here. Master these orders, and you’ve mastered the foundation of trading any altcoin.

Putting Smart Risk Management into Practice

Catching a perfect trade feels great, but what really separates the pros from the gamblers is an obsession with playing defense. In the wild west of altcoins, protecting your capital isn't just a good idea—it’s the only way you’ll stay in the game long enough to actually win it.

The most promising setup in the world means nothing if one bad trade sends your account to zero.

This is where risk management becomes your most critical skill. It’s the framework that keeps your emotions from taking over and ensures no single market swing can knock you out. It all starts with making the old advice, "never risk more than you can afford to lose," a concrete, mathematical reality.

The 1% Rule and Your Secret Weapon: The Stop-Loss

The simplest yet most powerful rule in any trader's playbook is the 1% rule. The principle is dead simple: you never risk more than 1% of your total trading capital on any single trade. If you’re working with a $5,000 account on vTrader, your maximum acceptable loss on one position is just $50.

This rule is a psychological lifeline. It detaches you from the emotional rollercoaster of any single trade, letting you think clearly and systematically. Even if you hit a brutal losing streak of ten trades in a row, you've only drawn down your capital by 10%—a hit you can absolutely recover from.

To enforce this rule, you need to master the stop-loss order. A stop-loss is an order you place on vTrader to automatically sell your position if the price falls to a predetermined level. It’s your exit plan, set in stone before the chaos begins.

A stop-loss is your parachute. You set it up before you jump, not while you're already in freefall. It’s the most disciplined decision you can make because it’s made with a clear head, not in a moment of panic.

Let’s say you buy an altcoin at $10. Your analysis shows a strong support level at $9, so you might set your stop-loss just below it at $8.90. If that support breaks and the price tumbles, your losses are automatically capped. No second-guessing, no "hoping" it will bounce back.

How to Calculate Your Position Size

Once you know your risk per trade (your 1%), you can figure out your position size—the exact number of coins to buy. This is where so many new traders get it wrong. They just throw a random dollar amount at a coin without thinking about its volatility or where their stop-loss needs to be.

Here’s how the pros do it:

- Know Your Risk Amount: For a $5,000 account, this is $50.

- Define Your Entry and Stop: You want to buy an altcoin at $2.00, and your stop-loss will be at $1.80. The risk per coin is the difference: $0.20.

- Calculate Position Size: Now, divide your total risk amount by your per-coin risk.

- $50 / $0.20 = 250 coins

This simple math tells you to buy exactly 250 coins. If the trade hits your stop, you will lose precisely $50 (250 coins x $0.20), which is exactly 1% of your account. This method keeps your risk consistent across every single trade, no matter the coin's price.

Beyond the Trade: Diversification and Discipline

Finally, while you're focusing on individual trades, don't lose sight of the bigger picture. Even in the altcoin market, diversification is crucial. Try to avoid piling all your capital into a single hot narrative, whether it's AI tokens or the latest meme coins. Spreading your bets across different crypto sectors can cushion the blow if one area suddenly falls out of favor.

But remember, all these rules and calculations are worthless without the mental discipline to stick to them. The market will test you. You’ll be tempted to move your stop-loss "just a little lower" or go all-in on that "sure thing." Resisting those impulses is what trading is all about.

Stick to your plan with conviction. Your future self will thank you for it.

Answering Your Lingering Altcoin Questions

Even the most solid trading plan runs into questions once the rubber meets the road. As you start putting theory into practice, you'll inevitably face new scenarios and have those "what if" moments. This is where we tackle the common queries that trip up traders, both new and seasoned, in the altcoin arena.

Let's clear the air on some of the practical concerns that almost always pop up once you get started.

What Exactly Is an "Altseason" and How Do I Catch It?

You’ll hear the term "altseason" thrown around a lot in crypto circles. It's that electrifying period in the market when altcoins, as a whole, start to dramatically outperform Bitcoin. During a true altseason, you see a massive rotation of capital out of Bitcoin and into smaller projects, causing their prices to explode in a short amount of time.

Spotting it early is the whole game. Sure, there are indexes that track it, but they're often lagging indicators. By the time they flash green, the easy money has been made. Instead, keep an eye out for these early signs on the ground:

- Bitcoin Dominance Dwindles: The classic signal is a steady, sustained drop in Bitcoin's share of the total crypto market cap.

- Altcoin Volume Spikes: You'll see trading volumes surge across a wide range of altcoins—not just one or two. This shows broad-based interest is shifting.

- Bitcoin Goes Sideways: An altseason often kicks off right after a big Bitcoin rally when BTC's price starts to consolidate and trade in a tight range.

How Do I Handle Taxes on My Altcoin Trades?

This is the big one that too many traders sleep on until it’s too late. In most places, including the United States, your crypto is treated as property for tax purposes. That means every single time you trade one crypto for another—like selling Solana for USDT—you've just triggered a taxable event.

On every trade, you realize either a capital gain or a capital loss, and you're required to report it. Keeping meticulous records is non-negotiable. You need dates, amounts, and prices in your local currency for every transaction. Luckily, vTrader makes this easier by giving you a detailed trade history you can export.

Thinking about taxes isn't just an annual headache; it's a core part of a profitable trading strategy. If you ignore the tax implications, a winning year can quickly turn into a losing one on paper.

For specific advice, your best bet is always to talk to a qualified tax professional who knows the rules in your area. Regulations are a moving target. For general questions about the platform itself, you can always check out our comprehensive vTrader FAQ page.

How Many Altcoins Should I Actually Own?

There's no magic number here, but the answer is definitely more than one and probably less than a hundred. Spreading yourself too thin across dozens of tiny positions—what some call "diworsification"—can be just as risky as going all-in on a single coin.

A smart starting point for most traders is to build a core portfolio of 5 to 10 solid altcoins. This is a manageable number, allowing you to actually keep up with news and developments for each project. It's also diversified enough to cushion the blow if one of your picks doesn't pan out. Make sure those picks are in different sectors, like DeFi, Layer 1s, or gaming, to spread your risk even further.

The crypto market's growth isn't slowing down, with more institutional money and real-world innovation pouring in. The Cryptocurrency Trends Business segment, valued at around $2.1 billion in 2024, is projected to hit $5 billion by 2030. These cryptocurrency trend projections highlight just how important it is to be in the game with a well-researched, balanced portfolio.

Ready to put your knowledge into action? With zero trading fees, advanced tools, and a secure platform, vTrader is the smartest place to start your altcoin trading journey. Sign up today and get a $10 bonus to kickstart your portfolio!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.