Making Sense of Crypto Futures Without the Confusion

At its heart, crypto futures trading is like placing a bet on the future price of a digital asset without having to own it right now. Let's say you're convinced the price of Bitcoin will shoot up in the next three months. Instead of buying actual Bitcoin (what's called spot trading), you can buy a futures contract. This contract is a formal agreement to buy or sell a set amount of Bitcoin at a fixed price on a specific date in the future.

Think of it like booking a beach house for a summer vacation six months ahead of time. You lock in today's rental rate, shielding yourself from price surges as your vacation dates get closer. If rental prices go through the roof, you've snagged a bargain. In the same way, if you buy a Bitcoin futures contract and its price climbs, your contract's value increases. You can then sell that contract for a profit before it expires, earning the difference without ever handling the actual Bitcoin.

Going Long vs. Going Short

This leads us to two basic strategies in futures trading: going long and going short.

- Going Long: This is your move when you expect an asset's price to rise. You buy a futures contract, planning to sell it later for a higher price. For many new traders, this feels like the most natural approach.

- Going Short: This is the exact opposite. You go short when you believe an asset's price is headed for a downturn. You sell a futures contract, committing to buy it back later. If the price falls as you predicted, you buy it back for less, and the difference is your profit. It's a key strategy for finding opportunities even when the market is falling.

As the image above shows, a futures contract simply locks in a price for a buyer and seller for a transaction down the road. This flexibility to speculate on price movements in either direction is a major draw for people interested in crypto futures trading in the US.

How Margin and Leverage Work

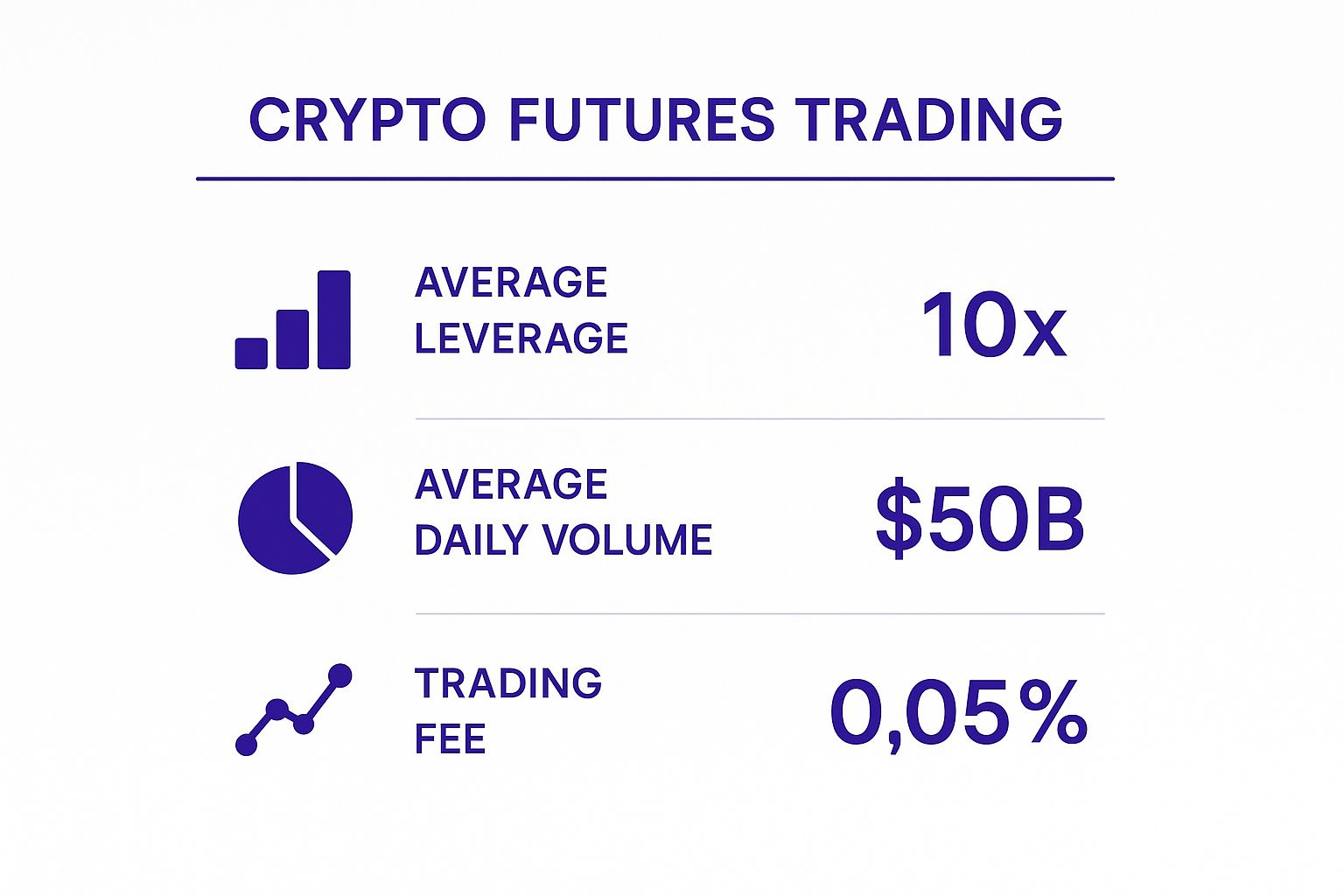

Another crucial part of the puzzle is leverage. Futures trading lets you control a large amount of crypto with a much smaller amount of your own money, which is called margin. For example, with 10x leverage, a $1,000 deposit (your margin) could let you trade a $10,000 position in Bitcoin futures. This can dramatically increase your profits if the market goes your way. But be careful—leverage is a double-edged sword that amplifies losses just as quickly.

This power has attracted significant attention. The U.S. crypto futures market has seen major growth, with more large-scale investors getting involved. Data shows that Bitcoin futures trading has hit impressive numbers, with daily volumes often topping 20,000 contracts. This translates to thousands of bitcoins being traded every day. To see more detailed figures, you can check out the market data insights from CME Group. This growth points to a more established market where both individual and institutional traders are active.

Understanding US Regulations That Actually Protect You

While the rules for crypto futures trading in the US can seem like extra hurdles, they're actually there to protect you. The regulatory framework, led by the Commodity Futures Trading Commission (CFTC), acts as a critical safety barrier, shielding serious traders from the chaotic "wild west" of unregulated offshore markets. When your own money is at stake, these protections are less a bureaucratic bother and more of a vital safety net.

This oversight creates a more stable and predictable trading environment. For example, platforms under CFTC rules must segregate customer funds. This means your deposited cash can't be used for the exchange's own operating costs—a key protection that has saved customers from huge losses when offshore exchanges have failed. These rules are built to establish trust and market integrity, which are crucial for any long-term trading strategy.

The Role of the CFTC

In the US, the CFTC is the primary federal agency regulating derivatives markets, which include crypto futures. Its mission is to encourage open, transparent, and financially stable markets while protecting traders and the public from fraud, manipulation, and unfair practices. By establishing clear standards, the CFTC helps legitimize the market for crypto futures trading in the US.

Here's a look at the CFTC's official site, a central resource for regulatory information, enforcement updates, and consumer alerts.

The site’s clear focus on consumer protection and market oversight highlights the agency's commitment to creating a safer trading space for everyone.

Key Protections for US Traders

Trading on a regulated US platform gives you several clear advantages that directly affect your security and success. While offshore platforms might dangle the carrot of higher leverage, they often don't provide these essential safeguards. Knowing the difference is key to making a smart decision.

To give you a clearer picture, here's a breakdown of how US regulations stack up against international alternatives.

US vs International Crypto Futures Regulations Comparison

Key differences between US regulated futures markets and international alternatives

| Aspect | US Regulated | International/Offshore | Impact on Traders |

|---|---|---|---|

| Regulatory Body | Commodity Futures Trading Commission (CFTC) | Varies by country; some are unregulated | US traders get strong, centralized oversight and a clear legal framework. |

| Customer Funds | Must be segregated from exchange's operational funds | Often commingled with company funds | Your money is protected from exchange insolvency in the US. |

| Leverage Limits | Typically lower (e.g., up to 10x) | Can be much higher (e.g., 100x or more) | Lower leverage in the US encourages responsible risk management and reduces the chance of liquidation. |

| Market Integrity | Strict rules against manipulation and front-running | Protections vary widely and may be non-existent | US markets offer a more level playing field for retail traders. |

| Dispute Resolution | Formal, mandated procedures for resolving customer issues | Limited or no formal recourse for disputes | You have a clear path to resolve issues if something goes wrong on a US platform. |

| Capital Requirements | Exchanges must hold significant capital reserves | Requirements are often lower or not enforced | US exchanges are better equipped to handle extreme market volatility without failing. |

This table shows that while US rules might seem restrictive, they provide a much safer environment for your capital. The trade-offs, like lower leverage, are designed to promote stability and long-term success over high-risk gambling.

Key benefits of trading within the US regulatory framework include:

- Segregated Customer Funds: Your capital is kept separate from the exchange’s corporate funds, protecting it if the company goes bankrupt.

- Fair Trading Practices: Regulations forbid manipulative activities like front-running, which ensures a more balanced environment for all traders.

- Dispute Resolution: Regulated platforms must have clear processes for settling customer disputes, giving you options if a problem arises.

- Capital Requirements: Exchanges are required to maintain a certain amount of capital, lowering the risk of platform failure during a market crash.

These measures might result in lower leverage compared to international exchanges, but this exchange offers crucial stability. For traders aiming to build a sustainable strategy, these protections are invaluable. Embracing regulation isn’t about limiting your options; it’s about making sure the opportunities you take are built on a solid and secure foundation. You can find more details on how platforms like vTrader follow these standards in our FAQ section.

Choosing the Right Platform for Your Trading Style

Picking the right platform for crypto futures trading in the US is a bit like choosing the right car. A sports car is great for speed but not for a family road trip. Similarly, the platform you choose needs to match your trading style, experience level, and how much you plan to invest. Some are built for big financial institutions, while others are designed with active retail traders in mind.

Making the wrong choice can make your trading journey more difficult and costly. It's crucial to find a platform that aligns with your specific needs to set yourself up for a better chance at success.

Key Factors in Platform Selection

It's easy to get swayed by flashy marketing, but what really matters are the features that directly affect your trading and your wallet. Things like hidden fees can slowly eat away at your profits, and poor customer support can be a nightmare when you run into an issue. A platform might look good on paper, but if it crashes during a busy market moment, it’s not reliable.

When you're comparing your options, here are the most important things to check:

- Fee Structure: Don't just look at the trading fees. Check for deposit, withdrawal, and overnight financing costs, because these can quickly add up.

- Margin and Leverage: Make sure you understand the maximum leverage offered and what the initial margin requirements are. A platform with flexible margin rules might be a better fit for your personal risk tolerance.

- User Interface (UI): A clean, easy-to-use interface helps reduce the risk of making costly mistakes, which is especially important when the market is moving fast.

- Order Types and Tools: The platform should have the specific order types you need, like stop-limit or trailing stop orders, along with good charting tools for your analysis.

- Security and Insurance: Always confirm the platform’s security measures. Look for features like cold storage for assets and any insurance that protects user funds.

Comparing Major US-Compliant Platforms

For a long time, the US market was dominated by platforms geared toward institutions, like the CME Group. They are known for top-tier infrastructure, but this focus often meant larger contract sizes that were out of reach for the average retail trader.

This is changing. The introduction of "micro" contracts has opened the door for smaller traders to access these dependable markets. As you can see from the data, the crypto futures market boasts significant daily volume, reasonable leverage, and competitive fees, making it an attractive space for traders.

The options available to US traders are growing. Crypto perpetual futures, for example, have become very popular globally, and major players are now working on CFTC-compliant versions for the American market. This is a big deal, signaling that regulators are becoming more open to these products. You can read more about the rise of perpetual futures in the US to get a sense of where the industry is heading.

To help you sort through the options, here's a comparison of some of the top US-compliant platforms available today.

| Platform | Available Contracts | Min Investment | Leverage Limits | Key Features |

|---|---|---|---|---|

| vTrader | BTC, ETH, SOL, XRP Futures | No Minimum | Up to 100x | 0% trading fees, educational academy, advanced charting tools |

| CME Group | Bitcoin, Micro Bitcoin, Ether Futures | Varies (larger contracts) | Up to 5x (regulated) | Institutional-grade liquidity, high reliability, physically settled options |

| Coinbase Derivatives | Nano Bitcoin & Ether Futures | Low (Nano contracts) | Up to 10x | Regulated by CFTC, accessible contract sizes for retail, integrated with spot exchange |

| Kraken Futures | BTC, ETH, LTC, XRP, BCH Perpetual Futures | Low | Up to 50x | Wide range of perpetuals, tight spreads, advanced order types |

This table shows a clear trend: platforms are increasingly catering to retail traders with smaller contract sizes and user-friendly features. While established exchanges like CME offer unmatched reliability, newer platforms like vTrader are focused on accessibility with zero fees and robust educational support.

Ultimately, choosing the right platform means balancing these factors. Platforms such as vTrader aim to support both new and seasoned traders by offering zero-fee trading alongside powerful tools. If you're looking to build your knowledge, resources like the vTrader Academy can be invaluable. A good platform doesn't just give you the tools to trade; it helps you grow as a trader.

Your First Trade: Getting Started Without Expensive Mistakes

Taking your first step into crypto futures trading in the US can feel like a big leap, but a step-by-step approach helps you avoid the common mistakes that trip up new traders. Before you place an order, laying the groundwork with a properly set up account and a clear plan is essential.

Account Verification and Funding

The first thing you'll do on any US-compliant platform is verify your account through a process called Know Your Customer (KYC). This isn't just a box-ticking exercise; it's a legal requirement to prevent fraud and maintain a secure trading environment. You'll typically be asked for a government-issued ID, your Social Security number, and proof of your address. This process is a key feature that distinguishes regulated platforms from their riskier offshore alternatives.

Once your account gets the green light, it's time to add funds. A smart move is to start with a small amount of money you are completely prepared to lose. A frequent error is depositing too much capital right away. You don’t need a huge sum to get going; many platforms let you begin with as little as $50 or $100. This first deposit sits in your margin account, serving as the collateral for your trades. To make your money go further, look for funding options with low fees, such as ACH bank transfers.

Planning Your Trade

A solid plan is your most important tool in the often-unpredictable crypto markets. Trading without one is like sailing into a storm without a compass. Your initial plan can be simple, but it must be clear and cover three key areas:

- Risk Assessment: Define the absolute maximum you're willing to lose on any single trade. A good rule for beginners is to risk no more than 1-2% of your total trading capital per position.

- Goal Setting: Your objective needs to be more specific than just "make money." A better goal is, "I'm aiming for a 5% profit on this trade, and I will exit if it drops by 2.5%."

- Entry and Exit Points: Based on your own market analysis, pinpoint the exact price where you will enter a contract (buy or sell). Just as important, decide on the prices where you will take your profit or cut your losses with a stop-loss.

Here is an example of a simple trading interface on Binance.US, which shows the order book, price chart, and order entry fields.

This type of interface gives you all the essential information to execute a trade, including the current market price, active buy/sell orders, and charts to help find potential entry points.

Executing and Managing Your First Position

With your plan ready, you can now execute your trade. Let’s walk through a hypothetical example. Say Bitcoin is trading at $60,000, and you believe its price will increase. You decide to open a long position.

- Place the Order: You can use a market order to buy immediately at the current price. Alternatively, you could use a limit order to buy only if the price reaches a specific level you've set, like $59,950.

- Set Your Stop-Loss: This is your safety net. Immediately after opening your position, you place a stop-loss order at your predetermined exit price (for example, $59,000). This automatically closes your position if the market moves against you, limiting your potential loss.

- Monitor the Position: Once your trade is active, fight the urge to meddle with it based on fear or excitement. Stick to your plan and your exit points unless significant new market information justifies a change.

By following these structured steps—verifying your account, planning with clear risk limits, and using stop-losses—you build a disciplined trading habit. This framework helps protect you from emotional decisions and the costly errors many beginners make.

Strategies That Work in Real Market Conditions

Classroom theories are one thing, but putting them to work in the fast-paced world of crypto futures is a completely different challenge. A solid approach to crypto futures trading in the US needs more than just basic knowledge; it requires proven methods that can withstand real market pressure. Experienced traders don't just guess where the market is headed; they use specific, repeatable strategies to manage their risk and find opportunities.

A common strategy for those who already own cryptocurrencies is hedging. Picture this: you hold a good amount of Bitcoin and believe in its long-term potential, but you're worried about a short-term price dip. Instead of selling your coins, which could trigger a tax bill, you can sell (or "short") Bitcoin futures contracts. If Bitcoin's price does fall, the profit from your short futures position can help balance out the loss on your actual Bitcoin holdings. It's a smart way to shield your portfolio from market volatility.

Momentum and Spread Trading

Another popular method is momentum trading. This strategy works on the idea that an asset with a strong price trend will probably keep moving in that direction. Crypto is famous for its wild price swings, which create powerful trends that momentum traders look to ride. They use technical indicators, like the Relative Strength Index (RSI) or moving averages, to spot when an asset is gaining steam and then open a futures position to catch a piece of that move.

This chart from TradingView shows Bitcoin's price action with moving average indicators, which traders often use to identify trends.

The chart shows how prices crossing above or below key moving averages can signal good times to enter or exit a momentum-based trade.

For traders with more experience, spread trading offers a way to trade without betting on the market's overall direction. Instead, you trade the price difference between two related futures contracts. For instance, a trader might buy a Bitcoin futures contract that expires in one month and, at the same time, sell one that expires in three months. They make a profit if the price gap—or spread—between these two contracts moves in their favor, no matter if Bitcoin's price itself goes up or down.

Adapting to the US Market

The massive interest in crypto has turned North America into the world's largest crypto economy by trading volume. An estimated 65.7 million Americans, or about 20% of the adult population, now own some form of cryptocurrency, which drives huge demand for products like futures. You can discover more about these cryptocurrency statistics to understand their market impact. This wide participation means that trading strategies must also consider events that affect the US economy, like Federal Reserve announcements, which can trigger major market shifts.

In the end, successful trading boils down to having a system and sticking with it. Whether you're hedging, chasing momentum, or trading spreads, consistency is your best friend. This also means paying attention to how your trades are settled. Many platforms settle futures contracts in stablecoins, so knowing how assets like USDC work is essential for managing your money well. By combining a proven strategy with disciplined action, traders can build a more durable approach for the US crypto futures market.

Protecting Your Capital When Markets Go Crazy

In the fast-paced arena of crypto futures trading in the US, where leverage can amplify both wins and losses, managing risk isn't just a good idea—it's the single most important skill for survival. Think of it this way: winning traders don't just hunt for big profits; they are obsessed with protecting their capital, especially when the market gets chaotic. This discipline is what separates those who trade for the long haul from those whose accounts are quickly wiped out.

A fundamental rule of thumb is position sizing. Imagine your trading capital is the oxygen in a scuba tank for a deep-sea dive. You wouldn't burn through half your air exploring a small, shallow cave. Likewise, you should never risk so much on a single trade that a loss could take you out of the game. A widely accepted guideline is to risk no more than 1-2% of your total capital on any one position. So, if you have a $5,000 account, your maximum loss on a trade should be between $50 and $100. This strategy ensures that even a string of bad trades won't sink your entire portfolio.

The Art of the Stop-Loss

A stop-loss order is your essential safety net. It’s an instruction you set in advance to automatically close your trade if the price hits a certain level, capping your potential losses. In a market where Bitcoin can plunge 10% in a matter of minutes, simply planning to exit isn't enough. You need to have a firm stop-loss order placed on the exchange as soon as you open a position.

- Static Stop-Loss: This is a fixed price point you set. If the market turns against you and hits this price, your trade closes. It's your line in the sand.

- Trailing Stop-Loss: This type is more dynamic. It moves up as a trade goes in your favor, effectively locking in profits while still protecting you from a reversal.

This image from a leading risk analysis publication shows just how interconnected global financial systems are. Events happening far outside the crypto world can create ripple effects, making disciplined, personal risk management absolutely critical.

Managing Margin and Avoiding Liquidation

Leverage is a double-edged sword. While it can magnify your gains, it also dramatically shortens the distance to liquidation. This is the point where the exchange automatically closes your position to prevent further losses, wiping out your initial margin. Experienced traders use leverage with caution, basing the amount on their personal risk tolerance, not just the maximum amount a platform offers. If you want to dive deeper, understanding the risk/reward ratio is key, and this guide on Mastering Day Trading Risk Management offers valuable insights.

It's also wise to have an emergency plan for extreme market events, like flash crashes. This could mean reducing all your open positions or even stepping away from the market until things calm down. True portfolio management also involves understanding how your assets move together. Holding futures in both Bitcoin and an altcoin that closely follows its price isn't real diversification. For more advanced approaches, some traders explore ways to generate passive income to balance out trading ups and downs. For example, learning how staking can offer a complementary yield can provide a separate income stream. In the end, your success depends less on predicting every market move and more on having a solid defensive plan that always protects your capital.

Your Roadmap to Consistent Trading Success

Becoming a profitable crypto futures trader in the US isn’t about reaching a finish line; it's a continuous process of learning and adapting. Think of it less like finding a secret formula and more like building a sustainable business. The most critical factors are developing disciplined habits and setting grounded expectations, which are far more valuable than any single trading strategy. This roadmap breaks down the key principles into real, actionable steps to help you build a solid foundation for consistency.

The path from a new trader to a competent one is a marathon, not a sprint. By setting clear milestones, you can track your progress and steer clear of the common mistakes that trip up so many newcomers.

Timelines for Skill Development

Mastering the markets takes time, and believing you'll get rich overnight is a sure way to end up disappointed. Here’s a practical timeline to guide your expectations:

- Months 1-3 (The Foundation): Your only goal here is to survive, not to profit. Concentrate on learning the mechanics of the market, getting comfortable with your trading platform, and applying strict risk management with a small amount of capital. Your key milestone is simple: finish this period without blowing up your account while having executed a series of well-planned trades.

- Months 4-9 (Developing Consistency): Now, you should be fine-tuning your strategy. Start a detailed trading journal, recording every trade to spot patterns in both your wins and losses. Your milestone is to have a month where you break even or are slightly profitable. This shows your risk management is working.

- Months 10+ (Achieving Profitability): With a tested strategy and disciplined approach, you can begin to think about scaling. This involves gradually increasing your position sizes but keeping your risk rules exactly the same. The goal here is to achieve consistent monthly profitability.

The Mental Game and Continuous Improvement

The biggest obstacle in trading isn't reading charts; it's controlling your own emotions. Fear and greed are powerful forces that cause traders to abandon their plans, make impulsive moves, and suffer major losses. The secret to winning this mental game is to treat your trading like a business.

This requires a structured plan for constant learning. Instead of searching for a magical indicator, focus on resources that offer deep market knowledge.

This screenshot from a major financial education site like Investopedia shows the wide range of topics a serious trader needs to understand, from basic principles to complex analysis. It highlights that true knowledge comes from a broad commitment to learning, not just a narrow focus on one asset.

To stay on top of your game, build a routine for improvement:

- Daily Market Prep: Look at charts and read relevant news before you start your trading day.

- Weekly Review: Go through your trading journal to identify your strengths and weaknesses.

- Monthly Goal Setting: Create realistic, process-driven goals. For example, "I will honor my stop-loss on every single trade this month."

Ultimately, your trading journey will be your own. Using a platform that supports this growth is incredibly helpful. For instance, learning more about vTrader shows a company dedicated not just to providing tools but also to promoting trader education and secure, compliant asset management. This kind of supportive system is vital for anyone serious about crypto futures trading in the US.

Ready to apply what you've learned on a platform designed for your growth? Sign up with vTrader today to get zero-fee trading, advanced tools, and a supportive environment built to help you succeed.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.