Making Sense of DeFi Before You Risk Your Money

This snapshot from CoinMarketCap gives you a feel for the current DeFi landscape. You can see the top DeFi protocols, ranked by market cap, along with key metrics like Total Value Locked (TVL) and trading volume. It's a great starting point for anyone beginning their DeFi journey.

Notice how a handful of protocols really dominate. Still, there's a ton of smaller projects out there, each with its own unique approach. This highlights just how important it is to do your research before investing.

So, what exactly is DeFi? Decentralized finance aims to rebuild traditional financial tools like lending, borrowing, and trading, but without the banks or governments. It's all about cutting out the middleman.

This can mean lower fees and more transparency. But it also means more responsibility. You're the one in charge of your security. Think of it like lead generation – you need a solid strategy to manage and convert leads effectively. The same goes for DeFi investments. Check out this article on automating lead generation for some helpful insights on strategy. You'll need a similar level of planning in DeFi.

DeFi is growing rapidly, fueled by increasing cryptocurrency adoption and exciting new tools like liquidity mining and yield farming. The market hit about $30.07 billion in 2024 and is projected to reach $42.76 billion by 2025 – that's a 42.2% CAGR! Find more detailed information here. While these numbers are impressive, they also show how quickly things can change in this market.

Understanding the Core Principles of DeFi

Why does DeFi exist in the first place? It's all about addressing the shortcomings of traditional finance. Traditional banks hold a lot of power – they control your money, set interest rates, and even dictate how you use your funds. DeFi flips this script and puts you in control.

This shift in power comes from smart contracts, self-executing agreements on the blockchain. They automatically enforce the rules, removing the need to trust a third party. This makes transactions more secure and transparent. But remember, even with smart contracts, there are risks. Bugs can be exploited, and the lack of regulation means limited recourse if something goes wrong.

Here’s a good resource: Exploring the Benefits of Digital Asset Investments in 2025. Understanding the potential downsides is crucial as you learn how to invest in DeFi. Next up, we’ll cover setting up your DeFi wallet—your first real step into the decentralized world.

Setting Up Your DeFi Wallet the Right Way

Your DeFi wallet is essentially your passport to the decentralized finance world. Setting it up properly, though, is absolutely critical. A misstep here, and you could lose your funds before you even begin investing. Let's skip the overly simplistic tutorials and walk through the process seasoned DeFi investors use.

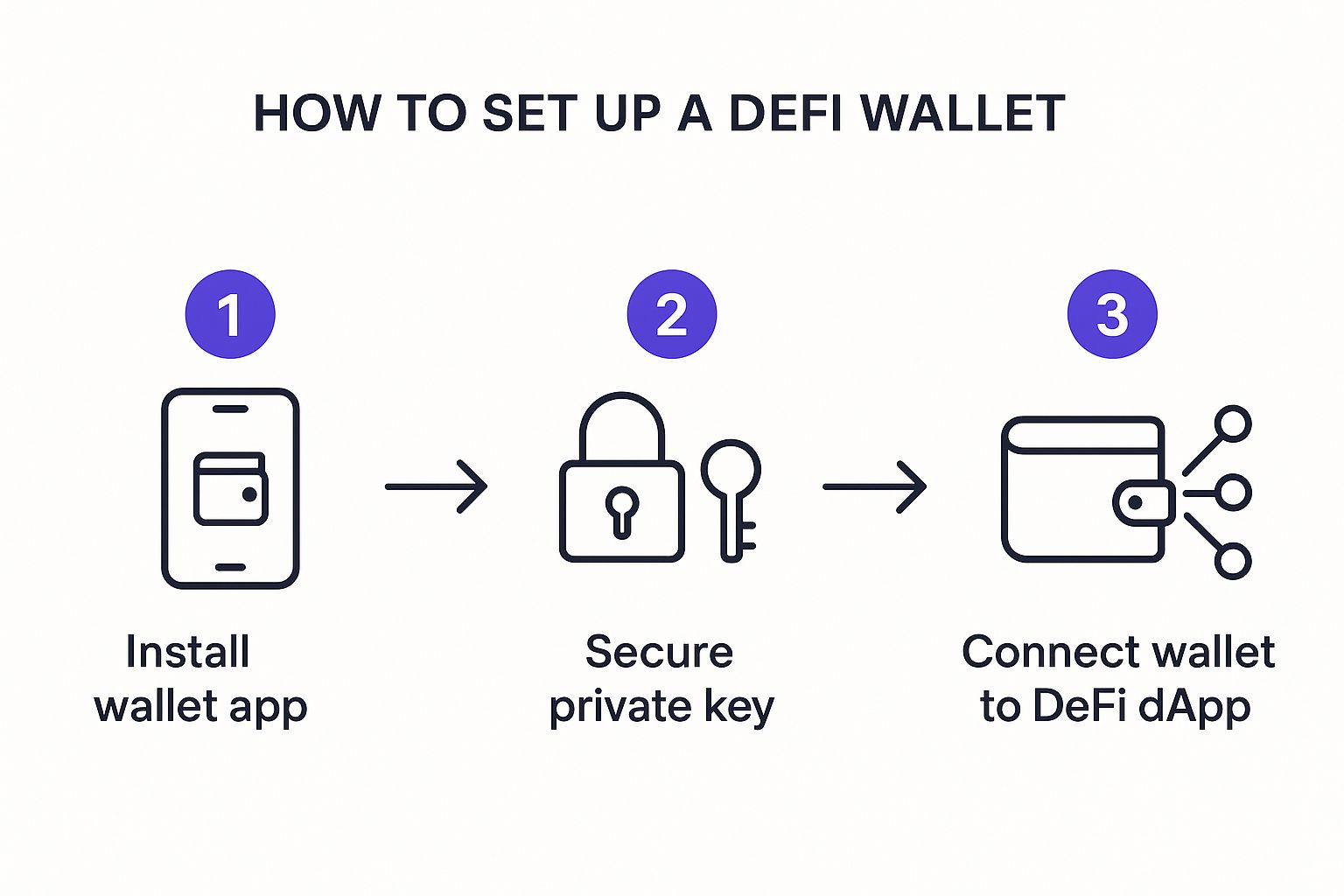

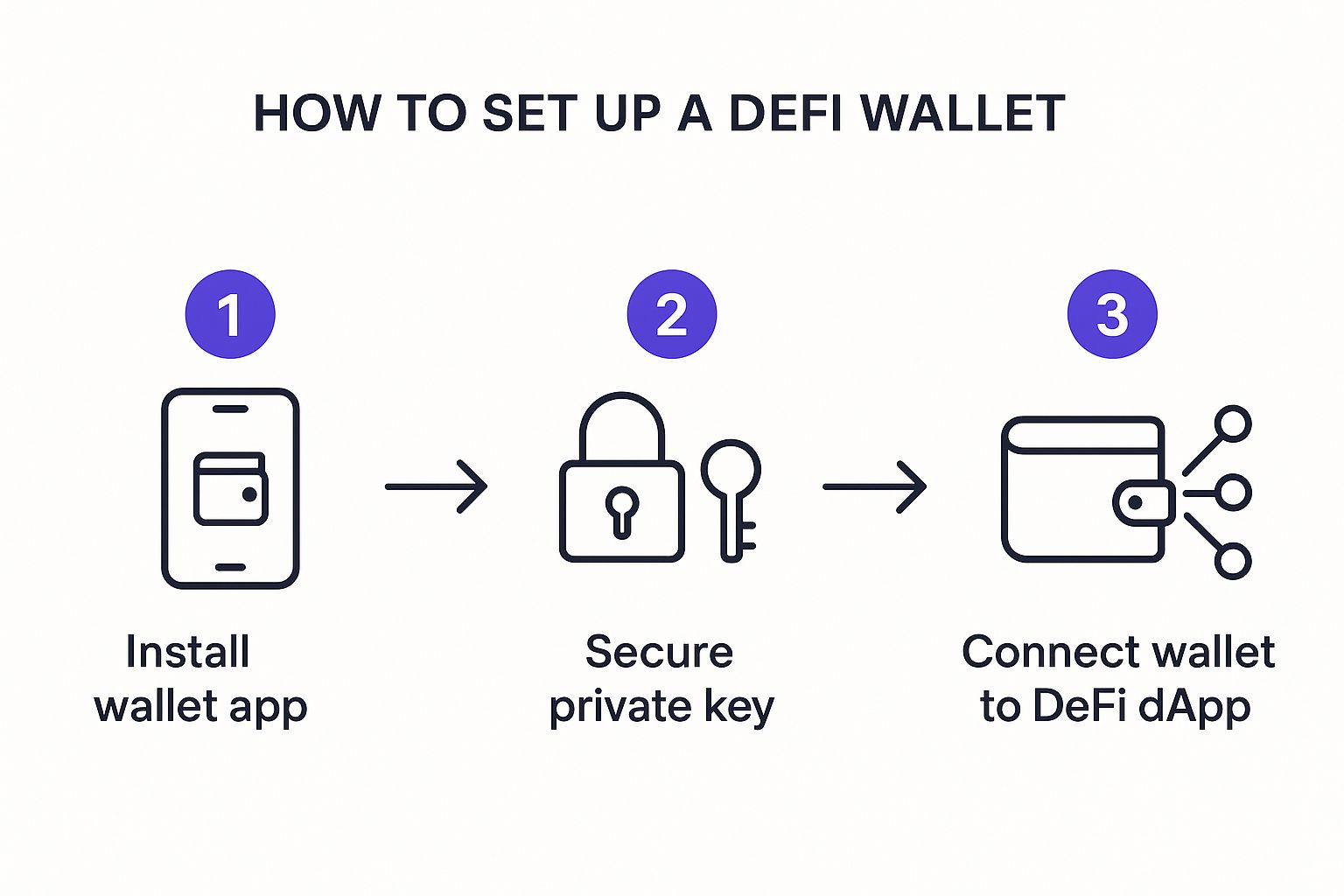

This infographic gives you a bird’s-eye view of setting up a wallet: install a wallet app, protect your private key, and link your wallet to a DeFi dApp.

It looks straightforward, right? But each step has its nuances and security considerations we’ll explore.

Hardware vs. Software Wallets: A Real-World Perspective

First, you need to choose between a hardware wallet (a physical device) and a software wallet (an app or browser extension). Hardware wallets, such as Ledger or Trezor, offer top-notch security. This is because your private keys (essentially your passwords) are kept offline. I've heard some truly unsettling stories of investors losing their savings because their software wallets were compromised. A hardware wallet could prevent this.

However, hardware wallets can be a bit clunky, especially if you trade often. Software wallets, like MetaMask, are much more accessible. Take a peek at MetaMask’s interface:

MetaMask's simple design makes connecting to dApps a breeze, hence its popularity in the DeFi world. Just remember, convenience does come with added risk.

Securing Your Seed Phrase: Your Backup Plan

Regardless of your wallet choice, you'll get a seed phrase, usually a list of 12-24 words. This phrase is your lifeline. If you lose or damage your wallet, this phrase restores access to your funds.

Write your seed phrase down on paper and keep it somewhere safe offline. Never, ever store it digitally. Personally, I have several copies in different secure locations. Overkill? Maybe. But it's a small price to pay for peace of mind.

Navigating Gas Fees: Avoiding Hidden Costs

Gas fees, the transaction costs on the blockchain, can really take a bite out of your profits if you’re not careful. These fees go up and down depending on how congested the network is. Strategically timing your transactions can save you a decent chunk of change. Plus, there are tools out there that can help you estimate and optimize gas fees.

Before we wrap up, let's look at some popular wallet choices. The following table compares a few key features and security aspects to consider:

DeFi Wallet Comparison: Features and Security

A comprehensive comparison of popular DeFi wallets including security features, supported networks, and fees

| Wallet Name | Security Level | Supported Networks | Average Gas Fees | Best For |

|---|---|---|---|---|

| MetaMask | Medium | Ethereum, Polygon, Binance Smart Chain, Avalanche | Varies depending on network | Beginners, frequent traders |

| Ledger | High | Bitcoin, Ethereum, and many more | Set by the user | Security-conscious users, large holdings |

| Trezor | High | Bitcoin, Ethereum, and many more | Set by the user | Security-conscious users, diverse portfolio |

| Trust Wallet | Medium | Ethereum, Binance Smart Chain, and many more | Varies depending on network | Mobile users, Binance Smart Chain ecosystem |

As you can see, the "best" wallet really depends on your individual needs and priorities. If security is paramount, a hardware wallet is the way to go. But if you value convenience and accessibility, then a software option like MetaMask might be a better fit.

Understanding gas fees, wallet security, and platform choice are fundamental to successful DeFi investing. You might also want to check out this article on the Crypto UX Revolution. Never underestimate the power of thorough research. Taking the time to grasp potential risks and opportunities will set you up for success in the DeFi space.

Choosing DeFi Platforms That Won't Disappear Overnight

This snapshot from DefiLlama gives you a real-time look at the Total Value Locked (TVL) across different DeFi protocols. It's a good starting point to see where the money's flowing. But remember, a high TVL isn't everything. Sometimes it's artificially inflated, so always do your homework.

Let's be real, the DeFi space can feel like the Wild West. Huge opportunities exist, but plenty of projects won't survive. Choosing the wrong platform can cost you everything. So, how do you find the real deal?

Looking Beyond the Hype: Evaluating DeFi Platforms

Ignore the flashy marketing and unrealistic promises. Focus on the basics. What problem does the platform solve? Is there a clear roadmap? Who's running the show? These are the key questions to ask.

TVL is a common metric, showing the total assets locked in a protocol. It gives you an idea of popularity, but it can be deceptive. A high TVL doesn't guarantee safety. You need to understand why the TVL is high. Is it real user interest or something more artificial?

When you're setting up your DeFi wallet, understanding decentralized digital identity is key. This article about .queensland dives into it: Decentralizing Digital Identity.

Audits and Community: Two Key Indicators

Audit reports from reputable firms can highlight potential code vulnerabilities. However, even audited platforms can be exploited. No audit guarantees complete safety.

The community surrounding a project can be the most telling sign. An active, engaged community often signals genuine interest and can be a fantastic source of information. Check out forums, social media, and Discord channels to get the inside scoop.

Stablecoins are a big part of the DeFi ecosystem. This article is a good read: Surge in Stablecoin Usage.

Diversification and Due Diligence: Your Protection Strategy

Diversification is key to managing risk. Don't put all your crypto in one place. Spread your investments across several platforms with different risk profiles. If one platform goes down, your whole portfolio won't go with it.

DeFi is merging with traditional finance. In 2024, tokenized assets hit over $16.7 billion. DeFi is increasingly used to tokenize traditional assets like stocks and bonds. Big players like BlackRock and JPMorgan are getting involved. Check out this report for more: DeFi Report 2024-2025. This merging of worlds could bring more stability to DeFi.

Finally, never skip due diligence. Thoroughly research any platform before investing. Read the whitepaper, understand the tokenomics, and look for red flags. If something sounds too good to be true, it probably is. You're responsible for your own security and funds. Take the time to understand the risks.

Building a Sustainable DeFi Portfolio: Long-Term Thinking

It's tempting to chase the next big thing, but a sustainable DeFi portfolio is about long-term growth. Look for platforms with a proven track record, strong community, and clear future plans. Remember, DeFi is constantly changing. Staying informed and adapting is crucial for success in this exciting but risky space.

Risk Management That Actually Protects Your Capital

This CoinGecko snapshot gives you a glimpse into the crypto market—market cap, prices, the whole nine yards. Notice how much things change in just 24 hours? That volatility is why a solid risk management plan is absolutely essential in DeFi.

Forget the hype around those "1000% APY" promises you see. The real pros in DeFi? They focus on keeping their money safe. I've chatted with tons of investors who've been through multiple market crashes, and they all agree: risk management is king.

Position Sizing: The Foundation of DeFi Safety

Let's talk position sizing. Honestly, it's way more important than trying to time the market perfectly. I learned this the hard way. I jumped headfirst into a project that looked amazing…and then it crashed. If I'd spread my investment out, the damage wouldn't have been nearly as bad. Now, I never put more than a small chunk of my portfolio into any single project.

For example, let's say you're okay with risking 1% of your portfolio on a riskier DeFi opportunity. Even if it goes to zero, you're not losing sleep. This lets you chase potential gains without risking your entire financial future. This change in thinking is crucial when you're learning the ropes of DeFi investing.

Diversification: Not Just Spreading Yourself Thin

Diversification in DeFi isn’t just about investing in a bunch of different projects. It's about spreading your risk across different types of risk. Think about the blockchain a project uses, the protocol itself, and the team behind it. Are all your eggs in one basket, ecosystem-wise? What happens if that ecosystem takes a hit? These are the questions you need to ask yourself.

It's like building a house. You wouldn't build the whole thing out of just wood, right? You'd use a mix of materials – concrete, wood, tiles – each with its own strengths. Diversifying your DeFi investments is the same idea. It makes your portfolio more resilient.

Managing Impermanent Loss: A Practical Approach

Impermanent loss is a DeFi-specific risk that can be a real headache. It happens when you provide liquidity to a decentralized exchange (DEX) and the prices of the two assets in your liquidity pool go in opposite directions. You can end up with less value than if you'd just held the assets. Strategies like using stablecoin pairs or choosing protocols that minimize impermanent loss can help. But remember, it’s part of the game. Don't let it scare you off completely.

Insurance and Exit Strategies: Your Safety Net

Think about getting some DeFi insurance. Some protocols offer protection against smart contract hacks or other unexpected events. It's not a silver bullet, but it can offer some peace of mind. Also, have clear exit strategies. Know your limits, and decide beforehand when you’ll sell. This takes the emotion out of your decisions when things get crazy.

At the end of the day, successful DeFi investing is about taking smart risks and planning carefully. It’s about balancing potential rewards with protecting your capital. Don't be afraid to jump in, but don’t be reckless either. Learn from others, and create a strategy that works for you.

Yield Farming Strategies That Actually Generate Profits

Yield farming. It’s the wild west of DeFi. Fortunes can be made, but just as easily lost. The difference between success and a rug pull? A solid strategy and a bit of timing. I’ve been there, seen the highs and lows, and trust me, understanding the nuances is key. Let's break down how to approach yield farming for consistent profit.

Deciphering APY and Tokenomics

Those tempting APY figures can be deceiving. Don’t fall for the hype. I learned this the hard way, chasing an 800% APY only to watch my investment evaporate as the token tanked. Tokenomics are everything. A sky-high APY often signals unsustainable emissions and impending collapse.

Dig beneath the surface. What’s driving the yield? Is the token’s value tied to real-world use cases or pure speculation? Understand the reward distribution and inflation rate. This due diligence is crucial for gauging the long-term viability of a yield.

Yearn.finance is a prime example of a more established yield aggregator. Its simplified interface, as seen in the screenshot, streamlines access to various DeFi strategies. But remember, even with established platforms, risk is inherent.

Calculating Real Returns: Beyond the Headlines

The advertised APY rarely reflects your actual earnings. Fees, taxes, and opportunity costs can significantly impact your bottom line. I once celebrated a 50% yield, only to realize gas fees and taxes slashed it to 30%. A good return, sure, but a stark reminder to factor in all expenses.

Always calculate your net return. And don't forget about opportunity cost. Could your capital be working harder elsewhere? Perhaps staking on a less volatile platform or exploring a promising new protocol? Sometimes, the best yield farming strategy is not farming at all.

Advanced Strategies and Exit Plans

Ready to take it up a notch? Consider auto-compounding protocols. These platforms automatically reinvest your earnings, boosting your returns through compounding. But keep an eye on those gas fees. They can add up.

Strategic rotation—moving between different farms as yields fluctuate—can also maximize gains. This requires active monitoring and a keen understanding of market trends. If this sounds like a job for automation, consider exploring AI-driven crypto trading bots. Our guide on mastering their setup can help you get started.

Finally, always have an exit strategy. DeFi markets are volatile. Know when to take profits and protect your capital. This could involve setting stop-loss orders or gradually reducing your exposure as a farm matures.

Yield farming can be a powerful tool for wealth generation, but it's not a magic bullet. It requires research, strategic thinking, and continuous learning. Treat it like a business, not a lottery ticket. With the right approach and a bit of timing, you can create a sustainable yield generation strategy that builds your wealth over time.

Handling DeFi Taxes Without Getting Burned

This screenshot from Koinly gives you a peek at their crypto tax software dashboard. Notice how it connects to different exchanges and wallets? That's key for accurately tracking your DeFi adventures. Koinly takes the pain out of calculating gains and losses across multiple platforms. Think of it as a preemptive strike against a tax-time meltdown.

DeFi taxes can be a real headache, right? The rules are still a bit of a moving target, but ignoring them isn't an option if you want to keep your profits. This isn't just about staying on the right side of the law; it's about maximizing your returns after taxes.

Understanding Common DeFi Tax Scenarios

Even seemingly simple DeFi transactions can have tax implications. Swapping tokens? Taxable. Yield farming? Those rewards are taxable too. The more involved your strategies get, the more intricate your tax situation becomes. Looking to branch out and make some extra cash? Platforms like Telegram offer some interesting income opportunities. Check out this link for more info: make money on Telegram.

Record-Keeping Strategies That Save You Time and Money

Keeping accurate records is crucial. Track everything: dates, times, asset values, even those pesky gas fees. A spreadsheet works, but dedicated crypto tax software like Koinly, CryptoTrader.Tax, or Accointing can be a lifesaver. I use both – a spreadsheet for quick daily glances and software for generating tax reports. It might seem like overkill now, but you'll thank yourself later.

Navigating Different Tax Jurisdictions

Tax laws are like snowflakes – no two are exactly alike. What flies in one country might not in another. Do your homework and research the rules in your specific location, or talk to a crypto-savvy tax professional. This is especially important for complex DeFi plays like yield farming, where the tax implications can be significant.

Automation Tools for Tax Tracking

Thankfully, there are platforms that automate crypto tax tracking. These tools link to your wallets and exchanges, automatically logging transactions and calculating gains and losses. They save you hours and minimize errors. While there's usually a fee involved, the time and peace of mind are often worth the cost.

Staying Compliant in an Evolving Landscape

DeFi regulations are constantly shifting. Stay updated on tax law changes and reporting requirements in your area. Industry newsletters, government agency updates, and online communities can be great resources. This isn't just about dodging penalties; it's about strategically planning your DeFi activities to minimize your tax burden legally and ethically. After all, the more you keep, the better, right?

Your Personal DeFi Investment Action Plan

So, you're ready to dive into DeFi? Awesome! Let's map out a plan you can actually use. Think of this less as a rigid rulebook and more like a flexible framework that you can adapt to your own comfort level, risk tolerance, and the ever-shifting DeFi landscape.

Remember, there's no need to rush. Spend your first month exploring. Set up your MetaMask or other preferred wallet, browse different platforms like vTrader, and just get a feel for how things work. A good initial goal? Successfully making a few small transactions, maybe on a testnet first, or with tiny amounts on the mainnet. This helps you get comfortable with the process without any real risk.

Over the next few months, start building a diversified portfolio. Consider allocating a small percentage, say 1-2%, of your total investments to DeFi. Play around with different strategies, keep an eye on your progress, and adjust as you learn. Check out resources like this one on crypto portfolio allocation to get some ideas. Think of this phase as your DeFi apprenticeship.

Building Your DeFi Holdings Over Time

Once you feel comfortable with the basics, you can gradually increase your DeFi exposure. No need to jump in headfirst! Increase your allocation slowly, perhaps 2-5% each quarter, as you gain experience and confidence. This measured approach lets you capitalize on opportunities while keeping risk in check.

Staying Agile in a Changing Market

DeFi is a dynamic space. New platforms pop up, others fade away, and market conditions are constantly changing. Your strategy needs to be just as flexible. Regularly review your portfolio, reassess your risk tolerance, and adjust your allocation as needed. This might mean rebalancing your holdings, checking out new protocols, or even exiting positions that no longer fit your goals.

Tracking Progress and Spotting Red Flags

How do you know you're on the right track? Set some clear benchmarks for yourself. These could be specific APY targets, portfolio growth percentages, or even qualitative measures like your overall understanding of different DeFi concepts. Track your performance against these benchmarks regularly. It's also important to learn to spot warning signs early.

For example, a significant drop in a project’s Total Value Locked (TVL) or a sudden decline in community activity could be a red flag. Don't ignore these signals. Investigate and be ready to adjust your strategy. Remember, protecting your capital is the most important thing.

This plan isn’t about getting rich quick. It’s about building lasting wealth through careful planning, continuous learning, and adapting to the exciting world of DeFi. Ready to begin your DeFi adventure? vTrader is a great place to start. It's a secure, commission-free platform for buying, selling, and staking your crypto. Plus, its built-in learning resources and advanced trading tools can help both beginners and experienced investors navigate the DeFi space with confidence.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.