Breaking Into The Crypto Trading World Without Overwhelm

The cryptocurrency world can feel intimidating for newcomers. Between the unfamiliar jargon, rapidly shifting markets, and constant flow of new information, it's easy to feel lost. This guide provides a clear picture of crypto trading, setting realistic expectations and debunking some common myths. It's the foundation you need to navigate this exciting market with greater confidence.

Understanding Crypto Trading Vs. Traditional Investing

Crypto trading differs significantly from traditional investing. Traditional investing typically focuses on long-term growth and dividends. Crypto trading, on the other hand, can involve much shorter timeframes.

For example, day trading involves buying and selling assets within the same day to profit from small price changes. This requires a more active approach than traditional investing, with traders continuously monitoring market movements.

Additionally, the volatility in the crypto market is much higher than in traditional markets. This creates opportunities for significant profits, but also increases the risk of rapid losses. Understanding and managing this volatility is a cornerstone of successful crypto trading.

Navigating The Crypto Market Landscape

The crypto market is a mix of various participants, from individual retail traders to large institutional investors. Understanding the roles these players have is essential for grasping market dynamics.

Large institutional investments, for instance, can significantly sway prices, presenting both opportunities and challenges for individual traders. This interplay between different market participants shapes the trading environment.

Furthermore, the crypto market is affected by a range of influences, including technological advancements, regulatory changes, and overall market sentiment. The global cryptocurrency market is experiencing rapid growth, attracting increasing numbers of new traders. Projections show the market expanding from USD 2.87 billion in 2025 to USD 5.43 billion by 2029, a compound annual growth rate (CAGR) of 17.3%. This expansion is driven by institutional adoption, growing global acceptance, and advancements in blockchain technology. You can find more detailed statistics from Research and Markets. These factors all contribute to the dynamism and volatility that characterize the crypto space.

Setting Realistic Expectations & Avoiding Common Pitfalls

One of the biggest mistakes new traders make is entering the market with unrealistic expectations. “Getting rich quick” is a fantasy, and aiming for consistent, manageable gains is a much more sustainable strategy.

Falling for hype and making emotional trading decisions can lead to substantial losses. Developing a disciplined trading strategy based on careful analysis and risk management is crucial. This measured approach, combined with realistic goals, is the key to long-term success in crypto trading.

Choosing Your Trading Platform And Getting Set Up Right

Picking the right cryptocurrency exchange is a big deal. It's not just about profits; it's about security too. Evaluating key features, understanding fees, and prioritizing security measures are all crucial steps. Smart decisions now will pay off later with a smoother, more profitable trading experience.

Essential Features For Beginners

New to crypto trading? Some platform features matter more than others. A user-friendly interface simplifies buying and selling. Educational resources empower you with market knowledge. And a transparent fee structure helps you avoid unexpected costs that can eat into your profits.

- User-Friendly Interface: Easy navigation is essential, especially when starting out.

- Educational Resources: Look for platforms with tutorials and guides.

- Transparent Fee Structure: Know all fees beforehand.

Evaluating Platforms Like A Pro

Don't just jump into the first platform you see. Do your research. Comparing platforms like Blockfolio Vs Delta Vs Coinbase can help you evaluate features, security, and supported cryptocurrencies. This ensures the platform aligns with your needs and risk tolerance. Focus on the practical aspects, not just the marketing hype.

Centralized vs. Decentralized Exchanges: Key Differences

Centralized exchanges (CEXs) act as intermediaries, facilitating trades and often offering features like KYC/AML compliance and customer support. Decentralized exchanges (DEXs) connect buyers and sellers directly through smart contracts. DEXs prioritize privacy and control but can be less user-friendly.

Red Flags To Watch Out For

Beware of platforms with hidden fees, negative reviews, and unclear security practices. Unrealistic promises and aggressive marketing are also red flags. Due diligence now can save you from trouble later.

Setting Up Your Account: A Step-by-Step Guide

After choosing a platform, set up your account correctly. This involves identity verification (KYC), creating a strong password, and enabling two-factor authentication (2FA). Funding your account is usually easy, with options like bank transfers and card purchases. How to buy Bitcoin and crypto in Europe offers helpful guidance. Remember, security is paramount in the crypto world.

Securing Your Wallet: Desktop, Mobile, and Hardware Options

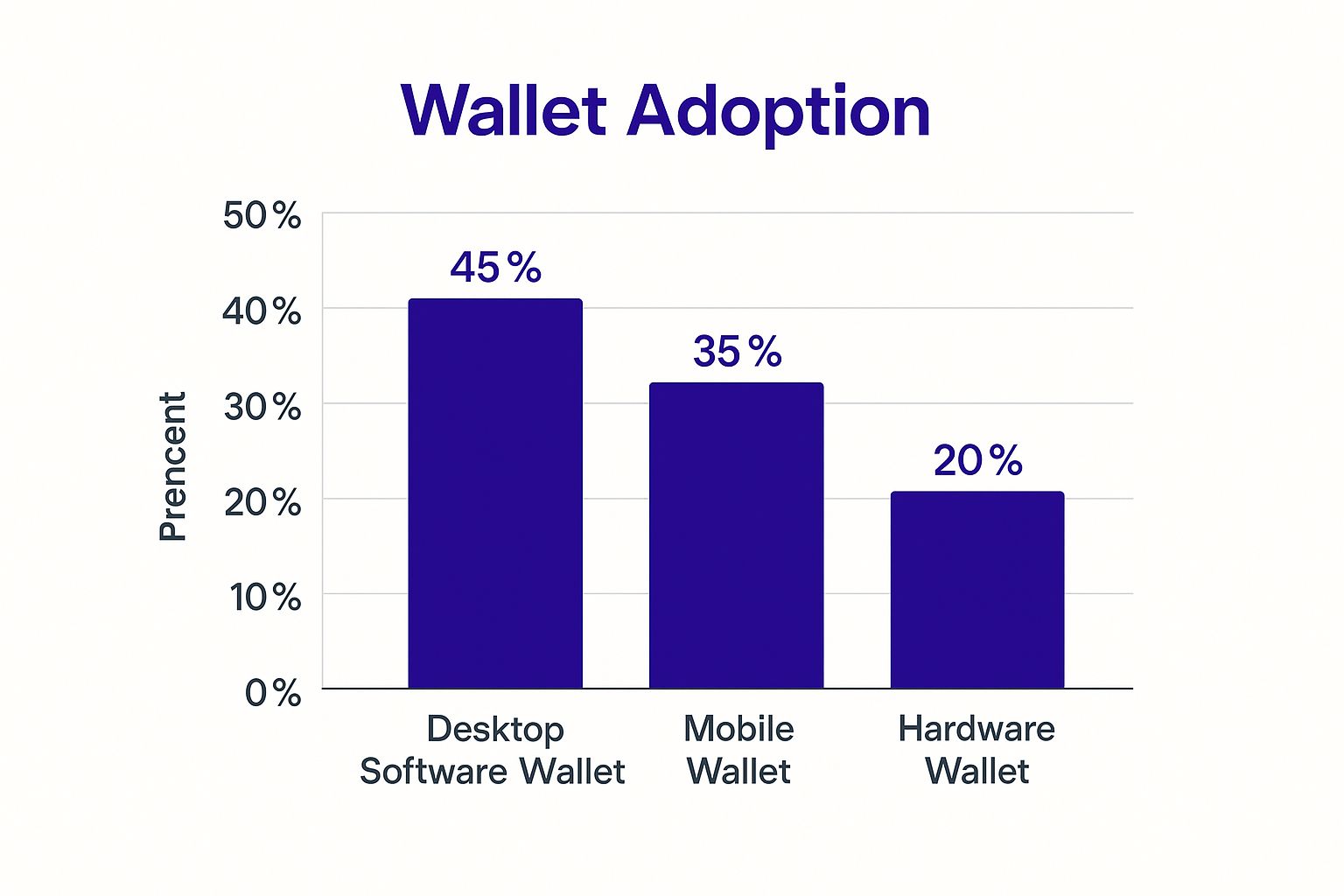

Your wallet choice affects your crypto's safety.

This chart illustrates the current wallet adoption breakdown. 45% of users favor desktop software wallets, while 35% prefer mobile wallets for accessibility. Hardware wallets account for 20%, prized for their enhanced security, especially for storing larger amounts of cryptocurrency. Choose a wallet type that balances security and convenience based on your trading style. With the right platform and secure wallet, you're ready to begin your crypto journey.

To help you choose the right platform, here is a comparison of popular options:

Popular Cryptocurrency Trading Platforms Comparison

Comparison of major crypto exchanges showing fees, security features, supported cryptocurrencies, and beginner-friendliness.

| Exchange | Trading Fees | Security Features | Beginner Friendly | Supported Coins |

|---|---|---|---|---|

| Binance | 0.1% | 2FA, Device Management, Address Whitelisting | Yes | BTC, ETH, BNB, and many more |

| Coinbase | Variable, typically 1-4% | 2FA, FDIC Insurance for USD balances | Yes | BTC, ETH, LTC, and select others |

| Kraken | 0.16% – 0.26% | 2FA, Global Settings Lock | Intermediate | BTC, ETH, DOT, and a wide variety |

| Gemini | Variable, based on trading volume | 2FA, Cold Storage | Intermediate | BTC, ETH, BCH, and a growing selection |

| KuCoin | 0.1% | 2FA, Trading Password | Intermediate | BTC, ETH, KCS, and a wide range of altcoins |

This table provides a general overview and fees may vary. Always check the latest fee schedules on each platform's official website.

Key takeaways from this comparison include the importance of balancing security features with user-friendliness, especially for beginners. Trading fees can significantly impact profitability, so understanding the fee structure is crucial. The variety of supported coins also plays a role depending on your investment strategy.

Securing Your Crypto Like A Pro From Day One

Security is paramount in the world of cryptocurrency. Unlike traditional finance with its banks and customer service, crypto security is your own responsibility. Understanding and implementing strong security measures is crucial from the very beginning. One misstep can be costly, and there are no safety nets.

Understanding Hot and Cold Wallets

The first step to securing your crypto is understanding hot and cold wallets. A hot wallet is connected to the internet. This provides convenient access for frequent trading. However, it also increases vulnerability to hacks. Think of it like cash in your pocket – easy to access but also easier to steal.

A cold wallet, on the other hand, stores your crypto offline. This maximizes security, but makes accessing your funds for trading less convenient. It's similar to a safe deposit box – very secure, but not easily accessible.

Choosing between hot and cold storage depends on your crypto usage. Active day traders may need a hot wallet. However, for long-term holding (also known as HODLing), a cold wallet offers the best security.

Multi-Layered Security: A Must-Have

Protecting your crypto investment requires a multi-layered approach. Begin with strong, unique passwords. A password manager can generate and securely store these passwords. Enable two-factor authentication (2FA) on all accounts for added security.

Be wary of phishing scams. These scams often use emails or messages that impersonate legitimate platforms or people. They're designed to trick you into revealing your login details. Always double-check URLs and never share your private keys. For more detailed information, check out our guide on How to secure your crypto wallet.

Private Key Management and Backup Strategies

Your private key is like the master key to your cryptocurrency. Losing it means losing your funds, permanently. Never share it with anyone. Store it securely offline, ideally in multiple separate locations.

Back up your wallet. This could involve writing down your seed phrase (a list of words that can restore your wallet). Alternatively, use a hardware wallet with backup functionality. Store these backups safely, protected from damage and unauthorized access.

Hardware Wallets: Your Fort Knox

For the highest level of security, consider a hardware wallet. These devices store your private keys offline, away from internet threats. While there's a cost involved, they offer significant peace of mind, especially for large crypto holdings. Choose a reputable brand with a proven track record of security and reliability. For a deeper look into wallet security, you might be interested in: How to master…. This guide can help you effectively implement these security strategies. By following these practices, you can create a solid security foundation for your crypto trading journey, protecting your investments and minimizing risks.

Making Your First Trade With Confidence

Ready to dive into the world of cryptocurrency trading? This guide will help you take your first steps, moving from theory to your initial crypto purchase. We'll cover essential topics like funding your account, understanding order types, navigating trading interfaces, and managing risk effectively.

Funding Your Account: Exploring Your Options

Funding your trading account is the first step in your crypto journey. Bank transfers and debit/credit cards are common methods, but exploring other options can often lead to lower fees and faster processing times.

Peer-to-peer (P2P) transfers, supported by some exchanges, can be a cost-effective alternative. However, always be aware of payment methods that might involve high fees or extended processing periods. This is especially important with international transfers, where costs can quickly accumulate.

Choosing the right funding method saves you time and money, crucial for reacting to dynamic market conditions.

Understanding Order Types: Market, Limit, and Stop-Loss

Understanding different order types is essential for successful trading. A market order executes immediately at the current market price. This is useful for quick trades, but you might not get the exact price you anticipated.

A limit order lets you set a specific buy or sell price. This provides more control, allowing you to take advantage of price fluctuations and potentially secure a better deal. Stop-loss orders are critical for managing risk. They automatically sell your crypto when the price falls to a predetermined level, protecting you from substantial losses in a downturn.

Navigating the Trading Interface and Charts

Trading interfaces can seem complex at first, but understanding the key components is crucial for executing trades smoothly. The order book displays current buy and sell orders, providing valuable insight into market sentiment. Price charts visually represent price movements over time. For additional guidance on avoiding common beginner mistakes, check out this resource: How to master….

Learning to interpret these charts is essential for informed decisions. Candlestick charts, for example, show the opening, closing, high, and low prices within a specific timeframe, offering valuable information about market trends and potential opportunities.

Managing Risk and Position Sizing

Position sizing involves determining how much capital you allocate to each trade. A common guideline is to risk no more than 1-2% of your total trading capital on any single trade. This protects your portfolio from significant losses due to a single unfavorable outcome.

Effective risk management involves setting clear stop-loss levels to limit potential losses, diversifying your portfolio across different cryptocurrencies, and avoiding emotional trading decisions. By following these principles, you can protect your capital and maximize your potential for long-term gains. This disciplined approach is key to successful crypto trading.

Reading Markets And Managing Risk Like A Professional

Successful cryptocurrency trading isn't about gazing into a crystal ball; it's about understanding and managing risk. This involves interpreting market trends, identifying key price levels, and employing strategies that mitigate potential losses while maximizing potential gains. Let's explore the essential skills that set successful traders apart.

Deciphering Market Trends: Price Action and Volume

Price action, the movement of an asset's price over time, is a cornerstone of market analysis. By studying price charts, traders can identify trends, support and resistance levels, and patterns that may signal trading opportunities. Volume, the amount of an asset traded within a specific timeframe, provides further insight. High volume often validates the strength of a trend or breakout, while low volume might indicate uncertainty in the market. Together, price action and volume provide a more comprehensive view of market dynamics.

Identifying Support and Resistance

Support refers to a price level where an asset tends to attract buying pressure, preventing further price drops. Conversely, resistance represents a price level where selling pressure typically stalls price increases. These levels are fluid, changing as market conditions evolve. Identifying these levels is vital for pinpointing entry and exit points, thereby optimizing trading strategies.

Recognizing Chart Patterns: Signals of Opportunity

Chart patterns, such as head and shoulders, double tops/bottoms, and triangles, offer valuable clues about potential future price movements. Recognizing these patterns can help traders anticipate potential breakouts or reversals, improving the timing of their trades. However, it's essential to remember that these patterns are not infallible. Combining them with other indicators often creates a more robust trading strategy.

Stablecoins and Institutional Influence

A significant trend influencing how individuals begin trading cryptocurrencies is the rise of stablecoins and the growth of DeFi platforms. Stablecoins, pegged to traditional currencies like the U.S. dollar, offer a stable store of value, reducing the volatility associated with other cryptocurrencies. This stability is particularly beneficial for newcomers, mitigating risks and allowing for more predictable trading approaches. Furthermore, the growing presence of institutional investors has significantly impacted the crypto market, introducing larger trading volumes and increased market depth.

Risk Management Techniques: Protecting Your Capital

Effective risk management is the bedrock of successful crypto trading. This involves using stop-loss orders to limit potential losses, diversifying your portfolio across various assets, and never risking more than you can afford to lose. Consider exploring resources like this guide on trading psychology to further enhance your risk management skills.

Mastering the Psychology of Trading: Staying Disciplined

Perhaps the most demanding aspect of trading is managing emotions. Fear and greed can trigger impulsive decisions that undermine even the most well-constructed strategies. Maintaining discipline, sticking to your trading plan, and avoiding emotional responses to market fluctuations are crucial skills for long-term success. This also includes taking breaks when necessary and objectively assessing your performance to continuously refine your trading strategy.

Building Your Personal Trading Strategy That Actually Works

Generic trading strategies often fall short in the ever-changing cryptocurrency market. A personalized approach, tailored to your financial goals, available time, and risk tolerance, is essential for success. This means understanding your trading style, establishing clear rules, and constantly adapting your strategy based on actual results. Building a personalized strategy is not a one-time task, but an ongoing process.

Identifying Your Trading Style

Do the rapid-fire trades of day trading, focusing on small, intraday price movements, appeal to you? Or are you more interested in long-term position plays, holding assets for extended periods to ride larger market trends? Maybe swing trading, aiming to capture medium-term price swings, better fits your personality and time commitment. Figuring out your natural trading style is the first step towards a strategy you can consistently implement. Explore our guide on different cryptocurrency investing strategies to determine the best approach for you.

Creating a Trading Plan With Clear Rules

A well-defined trading plan is your guide to navigating the market. This plan should outline specific entry and exit rules. For instance, you might use certain technical indicators from platforms like TradingView or predetermined price levels to trigger buy or sell orders. Set realistic profit targets and acceptable loss limits. These boundaries provide a structure for objective decision-making, minimizing the influence of emotions on your trades. Effective risk management is critical; consider exploring this article on various Risk Management Frameworks.

Maintaining a Trading Journal and Tracking Metrics

A trading journal is much more than a simple log of your trades; it’s a valuable tool for self-improvement. Record your entry and exit points, the reasoning behind each trade, and even your emotional state at the time. This practice helps you recognize patterns in both your wins and losses, enabling more informed decisions in the future. Tracking key metrics, such as your win rate and average profit/loss per trade, offers quantifiable insights into your performance. For instance, monitor how often your trades reach your profit targets compared to your stop-loss levels. This data is crucial for refining your strategy over time. Accurate record-keeping is also essential for tax purposes, simplifying the reporting of your cryptocurrency gains and losses.

The cryptocurrency market has historically been known for its high volatility and speculative trading. However, recent developments point towards increased institutional and mainstream acceptance. The U.S. cryptocurrency market, for example, generated USD 1,350.8 million in 2024 and is projected to reach USD 2,723.0 million by 2030. This growth suggests that more investors are viewing cryptocurrencies as legitimate assets for diversification and potential high returns. Learn more about the U.S. cryptocurrency market. This growing institutional interest can present new opportunities for individual traders prepared to take advantage of them.

Your Path Forward: From Beginner To Confident Trader

Congratulations! You've executed your first cryptocurrency trades. This is just the beginning of your trading journey. Let's map out a course to help you become a consistently profitable trader.

Building a Solid Foundation: Expanding Your Knowledge

Starting with the basics is essential. Strengthen your understanding of core concepts like market capitalization, blockchain technology, and various cryptocurrency asset classes. From there, you can explore technical analysis.

Technical analysis involves studying price charts to identify trends and patterns using tools like moving averages and the relative strength index (RSI). TradingView is a popular platform for charting and technical analysis.

Additionally, investigate different trading strategies. Day trading, swing trading, and long-term investing each have unique approaches and risk profiles. Understanding these will help you define your personal trading style.

Don't feel overwhelmed. Focus on mastering one concept before moving on to the next. Consistent, focused learning is more effective than trying to learn everything at once.

Connecting With the Crypto Community

Engaging with other traders can accelerate your learning. Online forums, social media groups, and local meetups offer valuable opportunities to connect and learn. You can share experiences, ask questions, and learn from others' successes and mistakes.

These communities offer support and insights as you navigate the crypto market. However, be careful about the advice you follow. Not all online information is accurate. Critically evaluate the source before making trading decisions.

Leveling Up: Advanced Tools and Techniques

Once comfortable with the basics, consider exploring more advanced tools. Derivatives, like futures contracts and options, offer ways to profit from price movements without owning the underlying asset. However, approach these with caution due to increased risk and complexity.

Leverage, borrowing funds to amplify trading positions, can magnify both profits and losses. While tempting, understand the risks before using leverage. Over-leveraging can lead to significant losses, especially in a volatile market.

The Importance of Tax Implications and Record Keeping

As your trading activity increases, understanding tax implications becomes crucial. Maintain accurate records of all transactions, including purchase and sale dates and associated costs. This simplifies tax reporting.

Consult with a tax professional specializing in cryptocurrency for compliance. Staying organized from the start will prevent issues during tax season.

Realistic Timeline and Milestones

Developing expertise in crypto trading takes time. Don't expect overnight success. Focus on consistent progress and celebrate small wins. Signs of progress include following your trading plan, managing emotions, and understanding market dynamics.

Conversely, constantly chasing losses or deviating from your plan indicates you might be moving too fast. Take a step back, revisit the fundamentals, and refocus.

To guide you, consider the following learning path:

The table below, "Cryptocurrency Trading Learning Path," outlines progressive learning stages from beginner to advanced trader, with recommended resources and timeframes.

| Stage | Skills to Learn | Time Investment | Recommended Resources |

|---|---|---|---|

| Beginner | Basic terminology, market dynamics, order types, wallet setup | 1-3 Months | vTrader Academy, reputable online resources |

| Intermediate | Technical analysis, chart patterns, risk management, trading strategies | 3-6 Months | TradingView, advanced crypto communities |

| Advanced | Derivatives trading, leverage, portfolio management, tax optimization | 6+ Months | Specialized courses, professional mentors |

This table provides a structured approach to learning, helping you acquire skills progressively. Remember to adapt the timeframe based on your learning pace and available time.

Ready to begin with a platform for both beginners and advanced traders? vTrader offers a commission-free environment, advanced tools, and educational resources. Sign up today and claim your $10 bonus! Start Trading with vTrader

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.