Table of Contents

XRP SEC/Legal Watch Q2 2026: Timeline and Price Implications

How does XRP’s legal status affect price?

XRP’s legal and regulatory status affects price by changing investor access, perceived risk, and liquidity. Clearer outcomes can reduce the risk premium and improve participation; setbacks can raise volatility. This page maps milestones to scenarios and triggers.

Coverage Period: Q2 2026 (April 1 – June 30, 2026)

Published: April 2026

Last Updated: April 2026 (Initial Q2 Legal Watch)

Q2 2026 STATUS SNAPSHOT — WHAT CHANGED:

- Settlement Status: SEC v. Ripple settlement finalized in Q1 2025; post-settlement compliance period continues

- Regulatory Clarity: XRP classified as non-security for programmatic sales; institutional clarity continues improving

- Exchange Access: Major US exchanges maintain XRP listings; liquidity normalized post-settlement

- ETF Progress: Multiple XRP ETF applications under review; legal clarity supports approval pathway

- Risk Premium: Legal risk premium compressed significantly vs 2023-2024; now priced similar to major altcoins

- Q2 Watch Items: ETF decision windows, potential policy developments, international regulatory harmonization

Q2 2026 KEY MILESTONES TO WATCH:

- April-May: SEC ETF review window; potential comment period responses

- May-June: Potential ETF preliminary decisions; international regulatory updates

- Ongoing: Congressional crypto legislation progress; stablecoin framework developments

SCENARIO IMPLICATIONS (BASE/BULL/BEAR):

- Base (~55%): Status quo continues; no major surprises; gradual ETF progress; risk premium stable

- Bull (~30%): ETF approval; positive policy developments; access expands; risk premium compresses further

- Bear (~15%): ETF rejection; adverse regulatory signals; access restriction; risk premium expands

Navigate: Legal hub | ETF Watch Q2 2026 | Catalysts hub | 2026 year hub

What Changed in XRP Legal/Regulatory Watch for Q2 2026? (Delta Summary)

WHAT CHANGED VS Q1 2026:

- ETF applications advanced to SEC review phase (Q1: initial filing; Q2: formal review)

- Congressional crypto legislation progressed through committee (ongoing watch item)

- International regulatory coordination improved (EU MiCA implementation, Asia harmonization)

- Risk premium compression continues (legal overhang diminished vs Q1)

New Filings / Rulings / Deadlines

Q2 2026 brings several notable regulatory developments. Multiple XRP ETF applications have entered the formal SEC review phase, with preliminary decision windows expected in late Q2 or early Q3. No new adverse legal filings have emerged against Ripple or XRP. The post-settlement compliance framework from the 2025 resolution continues operating as expected. Congressional hearings on digital asset classification have referenced the Ripple decision as precedent for programmatic sales clarity.

Regulatory Communications / Policy Signals

SEC communications have remained neutral-to-constructive regarding XRP specifically, with no indications of renewed enforcement interest post-settlement. Commissioner statements suggest the agency is focused on stablecoin regulation and exchange oversight rather than reopening settled matters. Policy signals from Treasury and the Federal Reserve indicate continued support for innovation within appropriate guardrails. International regulators (particularly EU and UK) have cited US legal clarity as a factor in their own XRP treatment.

Access/Market-Structure Implications

XRP access has normalized across major US exchanges. Coinbase, Kraken, and other platforms maintain full XRP trading without restrictions. Institutional access has improved with custody solutions now widely available. The ETF pathway, if approved, would significantly expand retail and institutional access through traditional brokerage accounts. Market structure has stabilized with XRP liquidity comparable to other top-10 cryptocurrencies. For liquidity analysis, see the sentiment and liquidity hub.

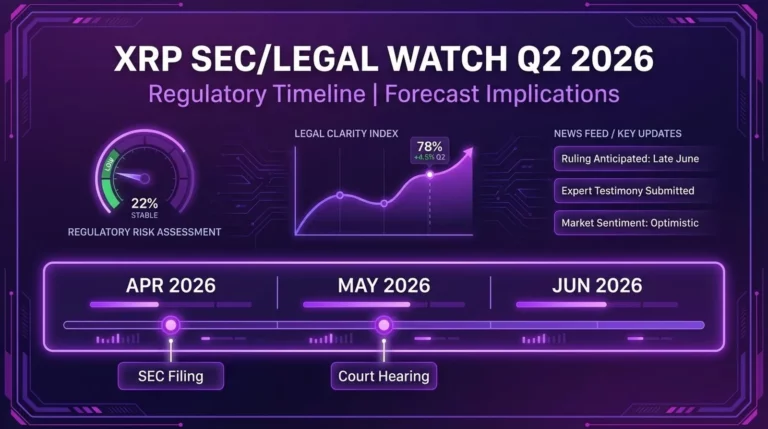

Q2 2026 Regulatory Timeline (What to Watch Next)

| Event/Milestone | Date/Window | Status | Stakeholders | Why It Matters |

| XRP ETF Review Phase | Apr-May 2026 | In Progress | SEC, Applicants | Approval = major access expansion |

| ETF Comment Period Close | Late Apr 2026 | Pending | SEC, Public | Volume/tone signals approval likelihood |

| Preliminary ETF Decision | May-Jun 2026 | Expected | SEC, Issuers | Key catalyst for risk repricing |

| Crypto Legislation Progress | Ongoing Q2 | Committee | Congress | Framework clarity affects entire market |

| International Coordination | Ongoing Q2 | Active | Global regulators | Harmonization improves global access |

Known Dates and Expected Windows

The SEC operates on statutory timelines for ETF applications, with key decision windows in late Q2 2026. Comment periods typically close 21-45 days after Federal Register publication. Preliminary decisions can come as approval, rejection, or extension. Congressional activity follows legislative calendars with recesses affecting timeline. International regulators operate on their own schedules but increasingly coordinate with US developments.

What Each Milestone Means for Risk Pricing

ETF approval would likely trigger significant risk premium compression and access expansion—historically, approved crypto ETFs have seen substantial inflows. ETF rejection would temporarily expand the risk premium but unlikely to reverse post-settlement clarity gains. Legislative progress provides long-term clarity but typically moves slowly. International harmonization improves global liquidity and institutional participation over time.

Outcome Scenarios and Probability Weights (Q2 2026)

| Scenario | Prob | What Would Increase | What Would Decrease | Watch Items |

| Base | ~55% | ETF delay; neutral signals | ETF decision; policy shift | SEC communications; timeline |

| Bull | ~30% | ETF approval; positive policy | ETF rejection; adverse signals | ETF decision; access expansion |

| Bear | ~15% | ETF rejection; negative policy | ETF approval; clarity improves | Adverse filings; restrictions |

Base Case (Status Quo / Slow Process)

The base case (~55% probability) assumes the regulatory environment continues largely unchanged through Q2. ETF decisions may be delayed or extended rather than definitively approved or rejected. Congressional legislation progresses slowly without major breakthroughs. XRP maintains current access and liquidity levels. The risk premium remains stable at post-settlement levels. This scenario supports range-bound trading with existing support and resistance levels remaining relevant.

Bull Case (Clarity Improves / Access Expands)

The bull case (~30% probability) assumes positive regulatory catalysts materialize. ETF approval would be the primary trigger—historically, crypto ETF approvals have driven significant price appreciation and inflows. Positive legislative developments or additional exchange listings would compound the effect. The risk premium would compress further, potentially aligning XRP’s valuation multiples with other major altcoins. This scenario supports breakout above key resistance levels.

Bear Case (Setback / Restriction / Adverse Signals)

The bear case (~15% probability) assumes regulatory setbacks occur. ETF rejection would be disappointing but unlikely to reverse post-settlement gains. More severe would be new adverse regulatory actions, exchange restrictions, or policy signals suggesting renewed enforcement interest. The risk premium would expand, and access could temporarily contract. This scenario supports breakdown below key support levels. Note: post-settlement, the bear case probability is lower than during the active litigation period.

How Legal/Regulatory Outcomes Affect XRP Price (Mechanisms)

| Mechanism | Expected Effect | Time Horizon | Evidence / Prior Analogs |

| Risk Premium | Clarity compresses premium; uncertainty expands it | Immediate | XRP 2023-2025 settlement impact |

| Investor Access | ETF approval expands retail/institutional access | Weeks-Months | BTC/ETH ETF approval effects |

| Liquidity | Access improves depth; restrictions reduce it | Days-Weeks | XRP delisting/relisting patterns |

| Headline Reflexivity | News drives positioning; positioning drives vol | Immediate | All major legal headlines |

Risk Premium and Investor Access

The ‘legal risk premium’ refers to the additional return investors require for holding an asset with regulatory uncertainty. During the SEC lawsuit, XRP traded at a discount to comparable altcoins due to this premium. Post-settlement, the premium has compressed significantly. ETF approval would likely compress it further by legitimizing XRP for traditional investors and expanding the accessible investor base through brokerage accounts.

Liquidity and Market Participation Effects

Legal clarity directly affects market participation. When major exchanges delisted XRP in 2021, liquidity suffered and spreads widened. Post-settlement, liquidity has normalized with tight spreads and deep order books. ETF approval would add a significant new liquidity venue through authorized participant arbitrage. Adverse regulatory actions could temporarily reduce participation, though the structural improvement from settlement provides a floor.

Reflexivity (Headline → Positioning → Volatility)

Legal headlines trigger reflexive price action: news drives initial positioning, which creates momentum, which attracts more attention and positioning. This reflexive loop can amplify moves beyond fundamental justification in both directions. The effect is typically strongest immediately after headlines, then normalizes as the market digests implications. Traders should expect volatility spikes around major regulatory announcements.

XRP Levels & Triggers to Watch Around Legal Headlines

| Trigger | Observation | Threshold | Likely Scenario Change |

| ETF Approval | SEC decision announcement | Formal approval | Bull probability +20%; resistance break |

| ETF Rejection | SEC decision announcement | Formal rejection | Bear probability +10%; support test |

| Positive Policy Signal | Congressional/regulatory statement | Explicit clarity improvement | Bull probability +5-10% |

| Adverse Regulatory Action | New filing/restriction/sanction | Direct XRP impact | Bear probability +15%; support break risk |

| Exchange Restriction | Major exchange policy change | Reduced XRP access | Bear probability +10%; liquidity impact |

Levels That Confirm ‘Risk-Off’ vs ‘Risk-On’ Repricing

Legal headlines often push price toward key technical levels. A positive catalyst that breaks resistance confirms ‘risk-on’ repricing—the market is assigning lower risk premium. A negative catalyst that breaks support confirms ‘risk-off’ repricing—the market is demanding higher risk premium. Current key levels: resistance around the $5.00-$5.50 zone represents risk-on confirmation; support around the $4.00-$4.50 zone represents the floor where post-settlement clarity should provide buying interest. For current level analysis, see the XRP forecasts linked in the routing section below.

Invalidation Rules (What Proves the Legal-Driven Scenario Wrong)

A legal-driven scenario is invalidated when: (1) The expected catalyst resolves differently than expected; (2) Price action contradicts the scenario (e.g., positive catalyst but price breaks support); (3) New information emerges that changes the timeline or probability distribution. When invalidation occurs, reassess scenario weights and adjust level expectations accordingly.

How This Updates the 2026 Forecast (Internal Routing)

Link to 2026 Year Hub + Impacted Month Hubs

Q2 2026 legal/regulatory developments affect the broader forecast framework. ETF decision windows in April-June directly impact monthly forecasts during that period. For year-level context and scenario weights: XRP price prediction 2026. For next-month planning: next month XRP prediction. For the pillar overview: XRP price prediction.

Link to Legal Hub + Catalysts Hub + ETF Watch Q2

This Legal Watch Q2 2026 page is part of a paired catalyst framework. For evergreen legal context: XRP SEC lawsuit and legal hub. For the companion ETF-specific analysis: XRP ETF Watch Q2 2026. For comprehensive catalyst mapping: XRP price drivers and catalysts. For ETF fundamentals: XRP ETF hub.

Frequently Asked Questions

What is the latest XRP legal and regulatory news in Q2 2026?

Q2 2026 focuses on ETF review progress, congressional legislation developments, and international regulatory coordination. The SEC v. Ripple settlement from Q1 2025 continues providing the foundation for improved clarity. No new adverse legal actions have emerged.

How does XRP’s legal status affect price?

Legal clarity affects price through three mechanisms: risk premium (uncertainty = higher required returns), investor access (restrictions = fewer buyers), and liquidity (clarity = deeper markets). Post-settlement, XRP’s risk premium has compressed significantly and access has normalized.

What is the key regulatory timeline for XRP in Q2 2026?

Key Q2 2026 milestones: ETF comment period close (late April), preliminary ETF decision window (May-June), ongoing congressional legislation progress, and international regulatory coordination. The ETF decision is the highest-impact catalyst this quarter.

What are the possible legal outcome scenarios and their price implications?

Base (~55%): Status quo continues; ETF delayed; gradual progress. Bull (~30%): ETF approved; access expands; risk premium compresses. Bear (~15%): ETF rejected; adverse signals; risk premium expands. The bull case supports breakout; bear case supports retest of support.

How can legal milestones change XRP support and resistance levels?

Positive catalysts often push price through resistance (confirming risk-on repricing); negative catalysts often push price through support (confirming risk-off repricing). The market reassesses risk premium around headlines, and technical levels reflect this repricing.

How does Legal Watch relate to ETF Watch for XRP?

Legal Watch covers broader regulatory clarity and access; ETF Watch focuses specifically on ETF approval milestones. ETF approval depends on regulatory clarity, so the two are deeply connected. Read them together for complete catalyst analysis.

What would increase or decrease the probability of a positive legal outcome?

Increases: ETF approval, positive legislative progress, favorable regulatory statements, international harmonization. Decreases: ETF rejection, new adverse filings, exchange restrictions, policy reversals. Monitor SEC communications, congressional hearings, and exchange policies for signals.

Where can I find the next quarterly update (Q3 2026)?

The Q3 2026 Legal Watch will be published and linked in the ‘Next Quarter Preview’ section below and from the Legal Hub. The quarterly series (Q1→Q4) provides a temporal chain of regulatory developments throughout 2026.

Update Log

| Date | Update Notes |

| April 2026 | Initial Q2 2026 Legal Watch published. ETF review phase underway. Base 55%, Bull 30%, Bear 15%. |

Next Quarter Preview (Q3 2026)

Q3 2026 Legal Watch will cover:

- ETF decision outcomes and market impact (if Q2 decisions occur)

- Congressional legislation progress (summer session developments)

- International regulatory coordination updates

- Updated scenario probabilities based on Q2 outcomes

- Revised trigger maps for H2 2026

Q3 2026 Legal Watch Status: Will be published in July 2026 and linked here.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.