Table of Contents

In March, we’re going to be closing out Q1 2026, that puts us at month 23 in the Bitcoin halving cycle. For those new to crypto, halvings are pre-programmed events in Bitcoin’s code that cut the reward miners get for adding new blocks to the blockchain in half. This happens about every four years or so, in essence lowering the supply of new BTC and often sparking bullish price action. The latest halving event happened in April 2024, dropping the reward from 6.25 BTC to 3.125 BTC.

This supply cut drives the boom/bust cycles we as traders track obsessively. In past cycles, the big momentum tended to ramp up 12-18 months after a halving, with tops sometimes hitting late in the first year or carrying on into the second. About 23 months later, it puts us squarely in the mature phase, where things can heat up or cool off based on the broader market sentiment.

I often call this the “institutional phase,” where big money from companies holding BTC and more stable demand take the forefront. As a trader who’s been through multiple cycles since 2012, I can tell you this time, it feels pivotal to me.

If we focus on seasonal trends, historically, March lands in Bitcoin’s top three months performance-wise. I gathered data from all of Bitcoin’s cycles, and it averages to a solid upside month, helping ward off any Q1 sluggishness and get BTC into position for a spring rally.

March 2026 Bitcoin Price Forecast Summary

Looking at specific price ranges, analysts are forecasting a $98,000-$115,000 price range for March 2026. This consensus takes into account the recent January chop and 2025’s rollercoaster price action. There are also bets on economic factors like interest rates getting cut and a resolution to the Europe-US trade war. Some optimists even believe in breakouts leading to fresh highs early in the year, while their skeptics warn of dips if President Trump continues to destabilize the global economy.

The analysis we compiled today comes from multiple firms like Grayscale, Bitwise, Binance, Changelly, and MEXC, plus broader 2026 outlooks and predictions. What we will dissect is a realistic band given current trading ranges with no major economic shocks expected in Q1.

Sorting through all these breakdowns, about 40% of them are bullish, eyeing $110,000 or higher. Another 45% are moderate, forecasting a range between $100,000 – $110,000, pointing to steady on-chain activity. The bears are left with 15%, putting the price at $98,000-$100,000 dollars, this camp is wary of short-term liquidity squeezes. These percentages aren’t random, they come from real-time data like whale transactions and options positioning, which I’ve cross-checked via tools like CoinGecko and recent exchange data.

Key factors that influence price are our position in the cycle, 23 months post the April 2024 halving, where the reduced miner rewards continue tightening supply and historically push prices higher in this mature cycle phase. Think of halvings as Bitcoin’s built-in scarcity mechanism, cutting new coin issuance every four years to mimic gold’s limited stock.

Then there’s Q1 rebalancing, where big funds tweak their portfolios at quarter-end, often sparking flows into assets like Bitcoin for diversification. Tax season adds another layer, as US investors sell to cover gains from 2025, potentially creating temporary downward pressure but also creating “buy-the-dip” opportunities.

Fresh research highlights geopolitical tensions, such as sanctions pushing folks toward Bitcoin’s decentralized nature, and options market dynamics where dealer hedging has kept prices high over the past year.

No guarantees here, of course, but staying nimble with stop-losses and watching whale wallets has served me well through past cycles. If we break above the $98,000 resistance, things could heat up fast.

March Seasonal Patterns

March ranks as Bitcoin’s third-best performing month historically, with an average return of around +11% across all previous cycle data. This edge is still behind powerhouse months like October and November, but it consistently shows up positive more often than not. Digging into the 2017-2025 window specifically, March closes green in a majority of the years.

Post-halving Marches are even better, averaging closer to +15% growth in those windows. Why? The halving’s supply cut starts showing its effects a year or two later, creating scarcity while demand builds from fresh adopters and institutional inflows.

Think of it as the market waking up to tighter coin flow after the initial halving event consolidation. Spring rally characteristics kick in right about here too. It looks like lighter selling volume, renewed risk appetite as rates get lower, and often a pickup in new money flowing into crypto.

March Volatility Analysis

Volatility in March tends to spike around two big factors.

- First, quarter-end options expiry hit prices hard, especially with growing institutional derivatives at play. Big players roll or close positions by the last Friday of the month, which can amplify swings as their hedges unwind and gamma exposure lessens. This creates chop but often sets up directional moves once the dust settles.

- Second, tax season selling pressure rears its head in the US, where folks liquidate portions of holdings to cover capital gains taxes from the prior year. Historical analysis shows that this can drag down prices in March some years, particularly if unrealized gains from late prior rallies trigger big bills.

But here’s the interesting part, that selling often gets absorbed fast, turning into a spring rally. Buyers step in on weakness, viewing dips as discounted entries during a bullish trend. So what is the effect? March volatility feels high on the surface, but it usually resolves bullish more times than not in similar cycles.

These historical patterns give us confidence heading forward. Strong average monthly gains, post-halving effects still in play, and economic calendar news that can be turned into opportunity. Patterns aren’t guaranteed, but they sure tilt the odds in your favor.

Bullish Forecasts

On the aggressive side, bullish analysts see a Q1 finale as a breakout as Bitcoin shakes out sellers and pushes higher. One prominent Wall Street forecast points to around $115,000, driven by the idea that March ends Q1 with renewed momentum from a spectacular earnings season.

So far, the earnings in the US are off to a strong start. We have high earnings beat rates where 79% of companies in the S&P 500 are doing better than expected, but revenue growth is slowing for everyone except banks, and the market is mostly focused on AI, tech, and geopolitical factors. Wall Street’s six largest banks achieved a record of $593 billion in revenue in Q4 of last year, with profits increasing 8% to $157 billion.

Watch for increased buying demand in crypto as supply tightens further. Another bullish forecast sits at $112,000, emphasizing acceleration in this late-cycle phase where historical post-halving patterns could fuel a quick leg up if investment volume picks up. The trade war headlines would need to be resolved and markets need to be optimistic in order to make risk based trades lucrative for this scenario to play out.

Moderate Forecasts

The biggest cluster of possibilities falls here, with analysts viewing March as sustained consolidation above psychological support levels. One targets $108,000, arguing for steady HODLing in the $100k zone as markets balance demand with any lingering uncertainty.

Another possible outcome is we land at $105,000, factoring in balanced Q1 momentum, average earnings from US companies and seasonal spring strength coming from quarter-end financial flows. This is counter balanced by tax season induced bearishness where profit-taking creates dips but doesn’t cancel the broader bullish uptrend.

Conservative Forecasts

The cautious analysts highlight downside risks. We can learn from them which risks are at the top of the list to balance a bullish thesis. The first scenario is $98,000 if tax season profit-taking hits harder than expected, and US investors liquidate to cover their bets after an average earnings season from tech and AI, leading to temporary pressure in the price of Bitcoin.

Overall, these breakdowns align with the $98k-115k consensus we discussed earlier, but the moderate majority (around that 100k-110k pocket) feels most grounded given current on-chain resilience and no immediate economic pitfalls.

Historical Month 23 Post-Halving Performance

Previous cycles offer us deep insights into the typical behavior during such extended post-halving windows. In the past, this period has been frequently plagued by corrections as the initial supply shock effects diminish:

- 2012 cycle: Month 23 delivered a -13% decline from Month 22, as Bitcoin moved from approximately $387 at the end of September 2014 to $338 by October 2014, after the initial 2013 bull run.

- 2016 cycle: Month 23 saw a -15% drop from Month 22, with prices falling from $7,494 in May 2018 to $6,404 by June 2018. This was during the crypto winter following the 2017 highs.

- 2020 cycle: Month 23 posted a -17% decrease from Month 22, declining from $45,539 in March 2022 to $37,715 by April 2022, as the market entered a prolonged bear phase after the November 2021 all-time high (ATH).

These trends show us what the late-cycle correction patterns look like. By this time, you can spot elevated selling pressure, reduced trading volumes, and broader market disinterest.

Often, it can be made worse by external factors like regulatory scrutiny or economic downturns. In March, month 23 typically signals a maturation of the cycle, with prices stabilizing or testing lower supports.

March 2026 Halving Cycle Implications

By March 2026, the market will endure 23 months of reduced issuance, with the supply shock largely absorbed and already priced in. By then, traders will be shifting their focus to demand factors like institutional holdings and global adoption. A relevant historical analog is April 2022, when Bitcoin dropped from about $45,500 to $37,700, representing a typical late-cycle pullback during rising interest rates and risk-off sentiment. Except now, the situation is a little different. Inflation is stabilizing and the Federal Reserve is lowering interest rates.

In the current cycle, March 2026 could serve as a potential stabilization or entry point for long-term accumulation, with analysts estimating a 55-65% chance of a green yearly close despite some bearish pressures.

Also, overbearing institutional involvement may control the declines this time around, but risks will increase if macro conditions deteriorate.

Q1 Institutional Rebalancing

As March 2026 marks the final month of Q1, institutional portfolio rebalancing is expected to play a major role in shaping Bitcoin’s price action during this period.

With many large funds, asset managers, and Bitcoin ETF vehicles required to adjust positions at quarter-end, this window often generates meaningful price action.

Quarter-End Portfolio Rebalancing

Institutional rebalancing follows well-established mechanics or rules if you will. At the end of each quarter, portfolio managers typically:

- Take profits from outperforming assets in order to bring allocations back in line with their target weights

- They also reallocate capital toward underperforming or newly favored sectors

- And finally, adjust risk budgets in response to volatility, macro conditions, and performance relative to benchmarks (S&P 500).

In the case of Bitcoin, many institutions now maintain formal or informal allocation targets ranging from 1–5% of total AUM. When Bitcoin significantly outperforms equities or other risk assets during Q1 (as it has in several prior cycles), managers often trim positions to lock in gains and reduce concentration risk.

Conversely, if Bitcoin has lagged or corrected sharply, rebalancing can become a source of buying as funds increase exposure to meet their strategic targets.

Spot Bitcoin ETFs, which now manage tens of billions in assets, amplify this dynamic. Quarterly rebalancing flows from ETF providers and their authorized participants are estimated to range between $5,000,000,000 and $10,000,000,000 during a typical Q1, depending on net inflows/outflows and the need to rebalance their portfolio.

These flows tend to concentrate in the final days of March, which will often create short-term volatility around the end of the quarter.

Q1 Performance Impact on Q2 Positioning

The direction and magnitude of Q1 performance is heavily influenced by institutional behavior heading into Q2:

- If Q1 is strong, Bitcoin is significantly up year-to-date, momentum strategies get implemented. Many funds and institutions increase allocation to “winners,” allowing Bitcoin exposure to drift higher than target weights. This momentum-based behavior can extend rallies into April and May, especially when supported by positive macro factors.

- Risk management considerations often pull prices in the opposite direction. After strong gains, disciplined allocators take profits to de-risk, harvest gains for tax purposes, or simply reduce volatility exposure ahead of uncertain periods.

In March 2026, the institutional rebalancing window arrives at a historically delicate phase. Past cycles show that late-stage rebalancing can either cushion corrections (through forced buying) or accelerate them (through widespread profit-taking).

The effect this will have on Q1 prices will likely depend on whether Bitcoin enters March above or below key psychological and technical levels, as well as the tone set by global equities, interest rate expectations, and ETF flows.

Tax Season Impact on Price Action

March 2026 falls squarely in the heart of the U.S. tax season, with the April 15 deadline just weeks away. For many investors who realized significant Bitcoin gains in 2025, this period typically brings a combination of strategic positioning, tax-loss harvesting, and capital-gains payment planning.

April 15 Tax Deadline

As the deadline approaches, investors often adjust their portfolios to optimize for tax purposes. Common strategies that professional investors use are:

- Selling portions of winners to cover expected tax liabilities

- Delaying additional purchases until after April 15th to avoid realizing more short-term gains in the current tax year

- Rebalancing to lock in long-term capital gains treatment where possible

These actions can create mild but noticeable selling pressure, particularly in the first half of March.

Tax-Loss Harvesting Completion

The sophisticated investors complete tax-loss harvesting well before the end of Q1, often by mid-March, to ensure trades settle and losses can be applied to the prior tax year. By March 15–20th, this selling wave has typically run its course. Once harvesting is finished, the supply of “forced sellers” diminishes, frequently removing a key source of downward pressure.

Capital Gains Payment Strategies

High-net-worth individuals and funds facing large capital-gains bills sometimes liquidate small portions of Bitcoin holdings in March to prepare for quarterly payments or to build cash reserves ahead of April 15.

Historical March Tax Season Patterns

Looking at previous cycles, March often exhibits a familiar rhythm during U.S. bull and early-bear phases:

- Early March: Mild selling pressure from tax-related activity

- Mid-to-late March: Rebound as harvesting finishes, quarter-end rebalancing kicks in, and new inflows (including fresh post-tax-season capital) begin to dominate the narrative

This classic tax season pattern could provide a “buy the dip” opportunity, especially if broader market sentiment remains positive. Historically, the effect of tax season on Bitcoin in March has been neutral to slightly positive once the initial pressure subsides.

Technical Analysis For Bitcoin’s Price Targets

Technical structure remains constructive on the monthly and weekly timeframes, but short-term price action shows signs of testing lower supports before any meaningful Q2 trends start to appear.

Support Levels

- Primary support is positioned at $96,000-$98,000. This zone aligns closely with the expected February 2026 monthly close and represents the 50-week moving average. There is also a high-volume node here, formed during the late 2025 price discovery phase. A weekly close above this level would keep the broader uptrend intact and signal healthy digestion of the prior gains by the market.

- Critical support starting from $92,000-$94,000. This deeper support level corresponds to the February swing low. Also, the 61.8% Fibonacci retracement indicator drawn over the May-October 2025 rally, and a prior breakout structure. A sustained break below $92,000 would shift sentiment bearish and likely open the door toward $80,000–$85,000 in a more aggressive bear decline.

Resistance Levels

- First resistance – $105,000-$108,000. This is the current consolidation ceiling and a forecasted high for late January/early February 2026. Multiple failed attempts here have built a strong resistance level. A decisive close above $108,000 would neutralize any short-term bearish pressure.

- Major resistance at $113,000-$115,000. This is a quarter-end target zone that correlates with the 200-week moving average and the psychologically important $110,000 area. Clearing this level in March would strongly favor a bullish trend heading into Q2.

- Breakout level – $120,000–$125,000. Reclaiming this area would position Bitcoin for a serious Q2 bullish launch pad. Breaking this resistance level would set the target on prior all-time highs (ATHs) and even higher if macro statistics turn optimistic.

Key Technical Indicators

- RSI (20, weekly chart): Currently oscillating between 65 and 78. This is still in strong bullish territory but flirting with overbought readings on shorter timeframes. A correction towards 50-60 without breaking a key support would be the ideal situation for bullish continuation.

- MACD (weekly & monthly): Remains in a bullish territory with expanding histogram bars on the monthly chart, signaling sustained momentum despite recent sideways price action.

- Volume profile: Convergence of declining retail participation and steady increasing institutional buying suggests underlying demand remains healthy. You can monitor this statistic yourself in the ETF AUM growth and on-chain metrics.

Federal Reserve March FOMC Meeting Implications

The second FOMC meeting is scheduled to be on March 17–18 in 2026, with a press conference to follow. After interest rates were cut late in 2025 (down to 3.50%–3.75%), expectations lean toward a potential 25 bps cut (or at least dovish guidance) in Q2. This is only possible if inflation continues cooling and employment softens.

Markets price in modest easing for 2026 overall (50 bps total), but a hawkish hold or surprise pause could put pressure on risk assets like Bitcoin. A dovish hint would support risk-on plays and reinforce BTC as a macro hedge.

Global Regulatory Updates

We can already see a steady progress toward clearer rules. The U.S. is pushing forward on market structure bills, like the CLARITY Act amendments and stablecoin frameworks like the GENIUS Act implementation (expected mid-year).

Globally, the EU’s MiCA is fully live, while Singapore, Hong Kong, UAE, and Japan are expected to tighten stablecoin oversight.

This kind of increased coordination reduces uncertainty for institutions, potentially boosting long-term capital inflows. Be aware that any headlines around U.S. delays could spark bearish volatility for a short while.

Network Fundamentals And Hashrate

The hashrate isn’t at an all-time high right now. After peaking near 1.1 ZH/s in late 2025, it’s pulled back down 15% to around 993 EH/s-1.05 ZH/s in January 2026. It happened while Bitcoin miners were being forced to sell due to falling profitability after the halving, with energy and hardware costs squeezing their bottom line.

Some miners responded by shutting down or repurposing their hardware for AI and data center workloads instead of mining. This reset eases competition and could set up stronger margins if price recovers, signaling healthy network security despite the dip.

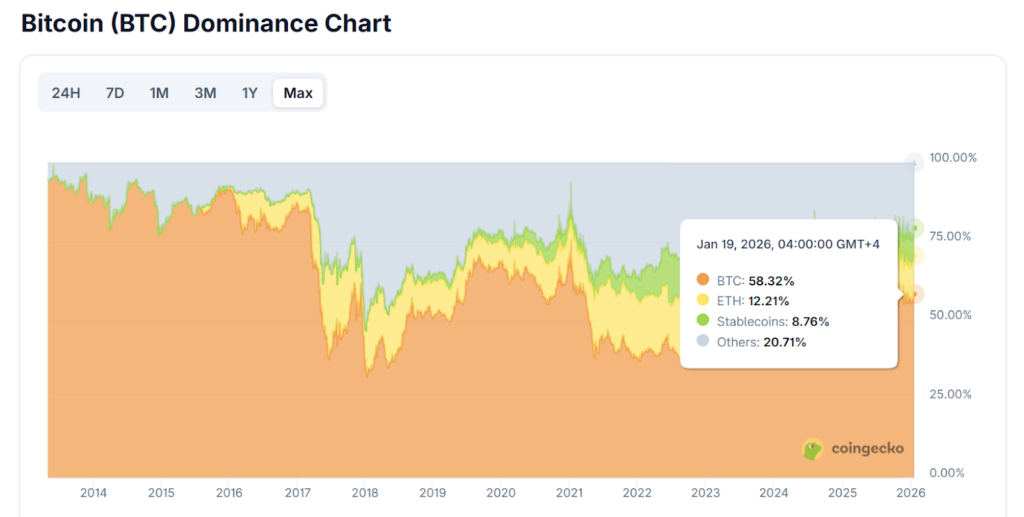

Bitcoin Dominance And Altcoin Season Timing

BTC dominance hovers near 59–60%, defending support levels and showing resilience. No clear altcoin season is visible quite yet, even though retail traders are desperate.

Fig. 1 – Coingecko Bitcoin Dominance Chart Comparing BTC, ETH, Stablecoins and Other Cryptos

Capital is staying concentrated in Bitcoin during macro caution. A break higher in dominance would delay broad alt rallies even more, while a drop below 50 could spark selective alt moves later in Q2.

Macro Environment Inflation Data, Employment Reports, Etc.

Key March releases that include CPI, PCE, and jobs data will continue to dictate sentiment going forward. Add these events to your calendar and monitor how they impact price action to make the most informed trading decisions. Sticky inflation or strong employment data might delay Fed easing, putting bearish pressure on Bitcoin.

Lower inflation readings would support a doveish narrative, which is generally favorable for Bitcoin. Longer term fundamentals remain intact, but price action in March could be choppy until macro data becomes clearly positive.

Trading Strategies for Bitcoin

March is a time when many investors and big funds decide whether to sell some Bitcoin to lock in profits or keep holding for potential gains later in the year. As Bitcoin is hovering around $93,000-$95,000 right now (mid-January 2026) and forecasts are pointing towards $100,000-$110,000 by March, here are some trading strategies that have been proven to work in the past.

Q1 Profit-Taking Strategies

After a solid run, some people will sell a portion (maybe even 20–50%) of their Bitcoin holdings near the end of March to cash in gains. Expect this, especially if they’ve made good money in early 2026. This strategy is called “fading”.

Others will prefer to hold through Q1, betting on stronger momentum in Q2 (April–June), when new money often flows in after tax season. The choice usually comes down to your risk comfort and overall strategy. Do you want to secure profits now or stay in for bigger gains?

Swing Trading

If Bitcoin stays in a broad range between $98,000 (support) and $115,000 (resistance) during March, swing traders will buy near the lower end and sell near the higher end over days or weeks. This works well in choppy, sideways markets. You can do this too, just set stop-losses to protect against sudden drops and make sure your risk to reward is better than 1/5.

Breakout Plays Above $110,000

A clean move and close above $110,000 could spark real excitement and signal the start of Q2 momentum. Traders often buy the breakout with targets at $120,000. If you want to try this strategy, put tight stops below the breakout level to limit risk if it fails.

This late in the cycle, breakouts usually re-test the breakout level and if it holds, you can get in at a worse price but with higher conviction, which is often the better choice than taking a stop-loss on a false breakout.

Tax-Efficient Trading

If you are a tax resident of the U.S., tax rules are important because selling at a loss and buying back the same asset within 30 days can void the tax benefit of that loss under wash sale rules.

Choose specific tax lots (like the highest costing positions first) when selling to minimize capital-gains taxes. You can use tools and accountants to track this around tax deadlines. If you’re working with large amounts, I highly recommend consulting with a professional.

Quarter-End Options Strategies

Near March 31, some savvy investors use options (calls for upside bets, puts for protection) to hedge or make outsized gains without selling their actual Bitcoin positions. Covered calls (selling calls against your held BTC) can generate extra income if the price stays flat or rises slowly.

Frequently Asked Questions

Below are the most common questions, answered clearly to help you close the gaps in understanding and clarify what may need repeating.

What is the Bitcoin price prediction for March 2026?

Our analysts found that most forecasts point to a range of about $98,000–$115,000, with many clustering around $105,000–$110,000 as a realistic average range. Some experts see upside to $120,000 if multiple factors align, while others believe in a consolidation if macro conditions stay the same.

Is March a good month for Bitcoin?

Historically, yes. March ranks among the stronger months, often showing positive returns. It frequently benefits from reduced selling pressure at the start of the month and renewed buying towards the end.

Will Bitcoin reach $110,000 in March?

There is a reasonable chance it will do so. With roughly a 50–65% probability based on current forecasts and technical setups. It depends if we hold key support levels at $92,000–$98,000 and positive catalysts like Fed dovishness and more ETF inflows. Many economists see it as achievable if Q1 momentum stays bullish after January.

How does tax season affect the Bitcoin price action in March?

Early March can see mild selling as people cover their tax bills around deadlines. By mid to late March, that pressure usually fades, and often leads to a rebound as fresh capital enters and quarter end rebalancing takes over.

Should I sell Bitcoin in March?

It depends on your situation, if you have big gains from 2025 and need cash for taxes, selling a portion makes sense. But many hold through March betting on Q2 upside. Don’t let short-term pressure override your long-term plan.

What are some March 2026 Bitcoin trading strategies?

Bitcoin trading strategies tend to center on range control, risk aversion, and working with options. Many traders fade extremes by buying pullbacks into high-volume support and selling into resistance rather than chasing breakouts. This works because Q1 usually turns into consolidations after strong runs. I personally have not had much success trading breakouts during this period, instead I wait for a retest of the level and see how the price behaves afterwards. I only enter trades when the price clearly breaks above key resistance levels. You can take some profits before quarter-end, then buy back in after a market correction. Remember to always use tight stop-losses to avoid false breakouts. Focus on smart position sizing rather than overconfidence in the trade. Keeping losses small and rewards bigger while waiting for the market to show you a clear trend next quarter. In short, buy dips, sell rips.

How does post-halving affect March prices?

March 2026 is month 23 after the April 2024 halving. We’re now in a later, more mature phase where corrections or consolidation are more common before any new trend appears. Focus on range based trade setups for the best results.

Consolidation, Catalysts, and the Path Ahead

March comes up as a decisive month in this extended post-halving cycle. The most realistic forecasts place Bitcoin in a $98,000-$115,000 trading range for the month. That would be a solid Q1 finale from current levels near $93,000, reflecting healthy digestion of late-2025 highs while macro uncertainty keeps the prices humble.

The single biggest technical signal to watch is a decisive breakout and close above $110,000. Clearing that level with conviction would flip sentiment bullish and position Bitcoin for a potential bullish move in Q2. Even possibly reclaiming and exceeding prior all-time highs if institutional demand and liquidity conditions come together to make the perfect storm.

Towards the end of the month, post-tax season cash often flows back into risk assets, setting the stage for renewed momentum higher. Just stay patient, keep your risk under control, and let price action tell you what’s really happening.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.