Table of Contents

XRP Price Prediction February

Will XRP go up in February?

XRP can rise in February if the market stays risk-on and price holds key support zones. Use scenario ranges (base/bull/bear) and confirmation triggers—breakouts above resistance or breaks below support—to update the outlook through the month.

Last Updated: January 2026 (Evergreen February framework established)

February Outlook: February is the second month of the calendar year and typically builds on January’s direction or provides a counter-move. XRP’s February performance depends on the prevailing market regime, liquidity conditions, and catalyst resolution. Rather than predicting a single price, use scenario ranges with clear confirmation and invalidation rules to adapt as conditions evolve throughout the month.

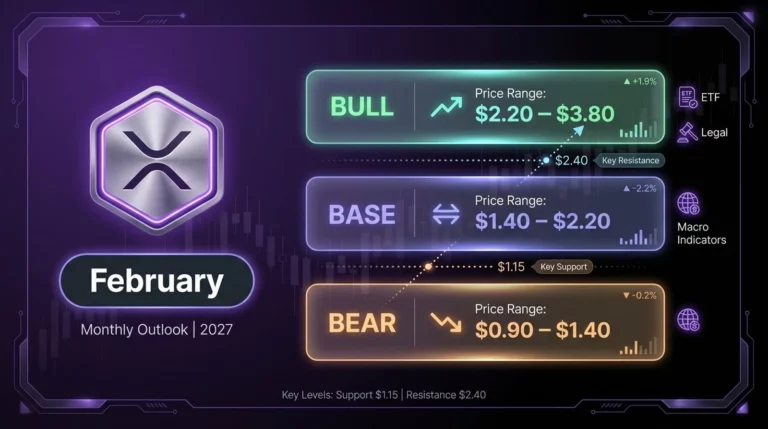

February Scenario Snapshot:

- Base Scenario: Continuation or consolidation within established ranges; January trend extends or stabilizes

- Bull Scenario: Breakout above resistance; momentum continuation from strong Q1 start; positive catalyst resolution

- Bear Scenario: Support breakdown; risk-off rotation; macro deterioration or crypto-specific headwinds

February Key Levels (Current Regime):

- Primary Support: January’s established floor; structural significance for Q1

- Secondary Support: Prior breakout retest zone; backup if primary fails

- Primary Resistance: Range high / breakout trigger zone for bull scenario

- Extension Resistance: Bull target if breakout confirms with follow-through

- Monthly Invalidation: Weekly close below primary support (base case fails)

February Catalyst Checklist:

- FOMC meeting (if scheduled) — rate guidance and policy tone

- CPI/inflation data release — price stability signals

- Earnings season spillover — risk appetite from equity markets

- BTC regime and volatility — risk-on/risk-off signal for altcoins

- ETF flow dynamics — institutional demand signals

- XRP-specific headlines — legal, Ripple updates, ecosystem milestones

Navigate: XRP price prediction → XRP prediction by month → February | How we build scenarios | How key levels are selected

February XRP Forecast Summary (Base, Bull, Bear Scenarios)

| Scenario | Range Logic | Assumptions | Triggers | Confirmation | Invalidation |

| Base | Continuation | Risk-on regime; January trend continues; normal volatility | Hold support | Range trading | Break S/R |

| Bull | Breakout | Strong Q1 momentum; ETF flows; BTC strength | Break resistance | Weekly close >R | Rejection fail |

| Bear | Breakdown | Risk-off; macro shock; BTC weakness | Break support | Weekly close <S | Reclaim levels |

Base Scenario (Most Likely February Path)

The base scenario assumes February continues or consolidates January’s direction. This path requires: risk-on market regime maintained (BTC stable or trending), primary support holding on retests, normal volatility (no extreme catalyst surprises), and balanced positioning (funding/OI not at extremes). February often builds on the tone set in January—either extending momentum or providing healthy consolidation before the next move.

Bull Scenario (Conditions for Upside Expansion)

The bull scenario activates on confirmed breakout above February’s primary resistance zone. Drivers include: strong Q1 momentum continuation, BTC strength supporting broad risk-on sentiment, positive ETF flow data, or constructive regulatory/ecosystem signals. Confirmation requires a weekly close above resistance with volume expansion. February bull scenarios often emerge when January strength carries over and catalysts resolve constructively.

Bear Scenario (Conditions for Downside Expansion)

The bear scenario activates on confirmed breakdown below February’s primary support zone. Drivers include: risk-off macro rotation (equity weakness, hawkish Fed surprise, inflation concerns), BTC rejection and broader crypto weakness, or XRP-specific disappointment. Confirmation requires a weekly close below support with volume. February bear scenarios can emerge from failed January breakouts or new macro concerns materializing.

Key Levels to Watch in February (Support, Resistance, Invalidation)

| Zone | Type | Evidence/Rationale | Confirmation | Failure Signal |

| Primary Support | Support | January floor; Q1 structural foundation | Bounce + volume | Weekly close below |

| Secondary Support | Support | Prior breakout level; structural backup | Defense on retest | Break = bear confirm |

| Primary Resistance | Resistance | Range high; bull scenario trigger | Weekly close above | Rejection = range |

| Extension Target | Resistance | Bull continuation target if breakout confirms | Follow-through | Fail = retest range |

| Invalidation Level | Critical | Base scenario fails; structure flip | N/A | Weekly close below |

Macro Support Zones (Why They Matter)

February support zones derive from January’s trading structure and the broader Q1 context. The primary support represents the established floor where buyers stepped in during January. The secondary support is often a prior breakout level being retested. These zones matter because they represent structural integrity for Q1—holding them confirms the base/bull scenarios; breaking them shifts to the bear scenario. For level methodology, see the technical analysis hub.

Macro Resistance Zones (Breakout Confirmation)

February resistance zones are the breakout triggers for Q1 continuation. Primary resistance is the range high from prior structure—a confirmed break above triggers the bull scenario. Extension targets represent where price could travel if the breakout succeeds. Confirmation requires a weekly close above the zone with volume expansion. Watch for rejection candles at resistance as early signals that the base (consolidation) scenario remains in play.

Invalidation Rules (What Proves the Base Case Wrong)

The base scenario invalidates when XRP breaks decisively below the primary support zone with a weekly close. This signals the February structure has failed and the bear scenario becomes the operating framework. Conversely, a confirmed break above primary resistance invalidates the consolidation thesis and shifts to the bull scenario. Use these invalidation rules to adapt positioning as conditions change.

February Catalysts & Drivers (Entity Map)

| Catalyst | Metric to Watch | Threshold Idea | Why It Matters for February |

| FOMC/Fed Policy | Rate decision; forward guidance | Dovish = supportive | Sets Q1 risk appetite continuation |

| CPI/Inflation | Inflation data; expectations | In-line = neutral | Affects rate path expectations |

| BTC Regime | BTC price; volatility; dominance | BTC strength supports XRP | Q1 momentum continuation signal |

| ETF Flows | Daily/weekly net flows | Sustained inflows bullish | Institutional allocation cycles |

| Leverage/Positioning | OI; funding rates; liquidations | Extremes = volatility risk | Clean positioning = healthier moves |

| XRP Headlines | Legal; Ripple; ecosystem news | Positive = bullish bias | Can override broader market |

Macro + Risk Appetite (Rates, USD, Equities Correlation)

February macro events can reinforce or reverse January’s direction. FOMC meetings (if scheduled) set rate expectations. CPI/inflation data affects policy outlook. Earnings season spillover influences risk appetite from equity markets. Dollar strength typically pressures risk assets; weakness supports them. XRP tends to follow the broad risk-on/risk-off regime—constructive macro supports base/bull scenarios; deteriorating conditions support the bear scenario. For catalyst tracking, see the catalysts hub.

Crypto Liquidity & Leverage (OI, Funding, Liquidations)

February positioning often reflects January’s trend. Watch for: OI continuation or reset (new leverage entering or old leverage exiting), funding rate extremes (crowded positioning), and liquidation clusters (cascade risk zones). Clean positioning after January supports the base scenario; crowded positioning from momentum creates squeeze risk. For positioning analysis, see the XRP next 30 days forecast for rolling horizon tracking.

XRP-Specific Catalysts (Legal, ETF/Access, Ripple/XRPL Milestones)

XRP-specific catalysts can override broader market direction. Legal/regulatory developments affect risk premium. ETF flow data signals institutional demand. Ripple ecosystem updates (ODL volume, partnerships, XRPL metrics) affect fundamental narrative. February can feature Q4 earnings-style Ripple updates or regulatory timeline milestones. For fundamental analysis, see the fundamentals hub.

How to Monitor the February Forecast (Checklist)

Weekly Checkpoints

Each week during February, review:

- Price vs key levels: Where does XRP sit relative to February support/resistance zones?

- BTC regime: Is Bitcoin supportive (trending up) or pressuring (trending down)?

- Positioning: Has funding/OI reached extremes that signal squeeze risk?

- Catalyst resolution: Have major events (FOMC, CPI) resolved? What was the market reaction?

- Volatility: Is volatility expanding or compressing? What does it imply for ranges?

For weekly updates, see: XRP weekly hub | Next month forecast

‘If/Then’ Scenario Switching Rules

Use these rules to adapt as conditions change:

- IF XRP holds support and respects resistance → THEN base scenario (continuation/consolidation) remains active

- IF XRP breaks above resistance with weekly close → THEN shift to bull scenario; target extension levels

- IF XRP breaks below support with weekly close → THEN shift to bear scenario; watch secondary support

- IF major catalyst surprises market → THEN widen expected ranges; volatility expansion possible

February by Year (Routing Module)

For year-specific February forecasts with precise levels, scenarios, and year-bounded catalysts, see the links below:

| Year | Status | Link |

| February 2026 | Coming Soon | XRP February 2026 Forecast (when published) |

| February 2027 | Future | XRP February 2027 Forecast (future) |

| February 2028 | Future | XRP February 2028 Forecast (future) |

XRP February 2026 Forecast

The XRP February 2026 forecast will be published as February 2026 approaches. It will include specific scenario ranges, key levels reflecting the 2026 context, and catalysts relevant to that period. For overall 2026 context, see the XRP price prediction by year hub.

XRP February 2027 Forecast

The XRP February 2027 forecast will be published when February 2027 approaches. It will include year-specific scenario ranges, levels reflecting the 2027 context, and catalysts relevant to that period.

Related Month Forecasts

January, March (Sibling Months)

XRP Price Prediction January | XRP Price Prediction March | All months

For shorter time horizons: Next month forecast | XRP February Monthly Update

Frequently Asked Questions

What is the XRP price prediction for February?

February forecasts are best expressed as scenario ranges rather than single prices. This page provides base/bull/bear paths, the assumptions behind each, and the key levels that confirm or invalidate the outlook as price and liquidity conditions change throughout the month.

Will XRP go up in February?

It depends on regime and levels. If XRP holds key support zones and the market maintains a risk-on posture from January, upside scenarios gain probability. Breaks below support or risk-off macro shocks increase downside scenario probability. Use the confirmation/invalidation triggers to update expectations.

Is February typically bullish or bearish for XRP?

Month-to-month direction isn’t guaranteed by calendar patterns. Rather than assuming seasonality, evaluate February’s specific conditions: January’s outcome, current market regime, liquidity environment, and catalysts. Use this page to map those conditions into scenario probabilities.

What are the key support and resistance levels to watch in February?

Key levels are higher-timeframe zones where price historically reacted and liquidity clustered. This page provides primary support, secondary support, primary resistance, and extension targets for February. Each zone includes rationale, confirmation signals, and failure conditions.

What catalysts most often move XRP during February?

Common February catalysts: FOMC meetings (if scheduled), CPI/inflation data, earnings season spillover from equities, BTC regime continuation, ETF flow dynamics, and any XRP-specific headlines (legal, Ripple updates). Ecosystem updates can matter more when the broader market is stable.

How do Bitcoin and market risk sentiment affect XRP in February?

XRP often follows the broader crypto risk regime. BTC trend, volatility, and dominance influence liquidity and correlation. A risk-on regime (BTC strength, equity strength) supports XRP upside scenarios; risk-off (BTC weakness, macro concerns) raises downside probability.

How do liquidity and leverage conditions change a one-month forecast?

Thin liquidity and crowded leverage can expand ranges and increase squeeze/cascade risk. Healthier liquidity (deeper books, tighter spreads) can stabilize ranges. Track spot volume quality, bid-ask spreads, open interest, funding rates, and liquidation clusters to assess the volatility regime.

How should I use scenario ranges instead of a single price target?

Plan around ranges and triggers rather than betting on a single number. Start with the base scenario and define confirmation/invalidation rules. When a trigger occurs (e.g., breakout above resistance with volume), shift probability to the appropriate scenario. This approach adapts to changing conditions.

Where can I find XRP price predictions for February by year (e.g., February 2026)?

Use the ‘February by Year’ routing module on this page. It links to year-specific February forecasts (February 2026, February 2027, etc.) which include precise scenario logic, levels, and year-bounded catalysts. This page is the evergreen February hub; year-specific pages provide dated detail.

Update Log

| Date | Update Notes |

| January 2026 | Initial February month hub published. Evergreen framework with year-specific routing. |

This update log tracks material changes to the February framework—scenario weights, key level methodology, and catalyst additions. The page is evergreen; year-specific updates appear in the dedicated February 2026/2027/etc. posts.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.