Table of Contents

XRP Price Prediction January

Will XRP go up in January?

XRP can rise in January if the market stays risk-on and price holds key support zones. Use scenario ranges (base/bull/bear) and confirmation triggers—breakouts above resistance or breaks below support—to update the outlook.

Last Updated: January 2026 (Updated for current market conditions)

January Outlook: January is the first month of the calendar year and often sets the tone for crypto market sentiment. XRP’s January performance depends on the prevailing market regime, liquidity conditions, and catalysts. Rather than predicting a single price, use scenario ranges with clear confirmation and invalidation rules to adapt as conditions change throughout the month.

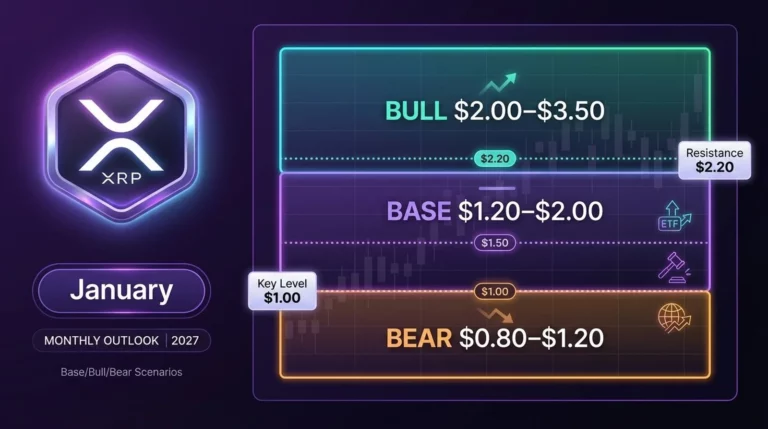

January Scenario Snapshot:

- Base Scenario: Consolidation within established ranges; risk-on regime with moderate volatility

- Bull Scenario: Breakout above resistance; new year momentum; strong ETF/institutional flows

- Bear Scenario: Support breakdown; risk-off rotation; macro deterioration or crypto-specific headwinds

January Key Levels (Current Regime):

- Primary Support: Prior month’s accumulation zone (structural floor)

- Secondary Support: December low / year-end retest zone

- Primary Resistance: Range high / breakout trigger zone

- Extension Resistance: Bull scenario target if breakout confirms

- Monthly Invalidation: Weekly close below primary support (base case fails)

January Catalyst Checklist:

- New year institutional rebalancing and allocation cycles

- First FOMC meeting of the year (policy tone for Q1)

- January NFP/jobs report (labor market health)

- BTC volatility and risk regime coming out of holidays

- ETF flow dynamics (fresh allocation cycle signals)

- Any XRP-specific headlines (legal/regulatory, Ripple updates)

Navigate: XRP price prediction → XRP prediction by month → January | How we build scenarios | How key levels are selected

January XRP Forecast Summary (Base, Bull, Bear Scenarios)

| Scenario | Range Logic | Assumptions | Triggers | Confirmation | Invalidation |

| Base | Consolidation | Risk-on regime; stable macro; normal volatility | Hold support | Range trading | Break S/R |

| Bull | Breakout | New year momentum; ETF flows; BTC strength | Break resistance | Weekly close >R | Rejection fail |

| Bear | Breakdown | Risk-off; macro shock; BTC weakness | Break support | Weekly close <S | Reclaim levels |

Base Scenario (Most Likely January Path)

The base scenario assumes January maintains the prevailing market regime—typically a continuation of late-year conditions with adjustments for new year positioning. XRP consolidates within established ranges, with support holding and resistance capping upside. This path features normal volatility, balanced positioning, and no major catalyst surprises. The base scenario probability is highest when holiday compression gives way to measured volume recovery.

Bull Scenario (Conditions for Upside Expansion)

The bull scenario activates on confirmed breakout above January’s primary resistance zone. Drivers include: strong new year momentum from institutional rebalancing, BTC continuation higher, positive ETF flow data, or constructive regulatory signals. Confirmation requires a weekly close above resistance with volume expansion. January bull scenarios often emerge when risk appetite carries over from positive Q4 momentum.

Bear Scenario (Conditions for Downside Expansion)

The bear scenario activates on confirmed breakdown below January’s primary support zone. Drivers include: risk-off macro rotation (equity weakness, hawkish Fed surprise), BTC rejection and broader crypto weakness, or XRP-specific disappointment. Confirmation requires a weekly close below support with volume. January bear scenarios can emerge from ‘new year reset’ positioning or macro concerns overriding holiday optimism.

Key Levels to Watch in January (Support, Resistance, Invalidation)

| Zone | Type | Evidence/Rationale | Confirmation | Failure Signal |

| Primary Support | Support | December accumulation zone; year-end structure floor | Bounce + volume | Weekly close below |

| Secondary Support | Support | Prior breakout retest; structural significance | Defense on retest | Break = bear confirm |

| Primary Resistance | Resistance | Range high; breakout trigger zone | Weekly close above | Rejection = range |

| Extension Target | Resistance | Bull scenario target if breakout confirms | Follow-through | Fail = retest range |

| Invalidation Level | Critical | Base scenario fails; structure flip | N/A | Weekly close below |

Macro Support Zones (Why They Matter)

January support zones derive from December’s year-end trading structure. The primary support represents the accumulation floor where institutional buyers stepped in during holiday-thin liquidity. The secondary support is often a prior breakout level being retested. These zones matter because they represent structural integrity—holding them confirms the base scenario; breaking them shifts to the bear scenario. For level methodology, see the technical analysis hub.

Macro Resistance Zones (Breakout Confirmation)

January resistance zones are the breakout triggers. Primary resistance is the range high from prior structure—a confirmed break above triggers the bull scenario. Extension targets represent where price could travel if the breakout succeeds. Confirmation requires a weekly close above the zone with volume expansion. Watch for rejection candles at resistance as an early signal that the base (consolidation) scenario remains in play.

Invalidation Rules (What Proves the Base Case Wrong)

The base scenario invalidates when XRP breaks decisively below the primary support zone with a weekly close. This signals the January structure has failed and the bear scenario becomes the operating framework. Conversely, a confirmed break above primary resistance invalidates the consolidation thesis and shifts to the bull scenario. Use these invalidation rules to adapt positioning as conditions change.

January Catalysts & Drivers (Entity Map)

| Catalyst | Metric to Watch | Threshold Idea | Why It Matters for January |

| Institutional Flows | ETF daily/weekly net flows | Sustained inflows bullish | New year allocation cycles begin |

| FOMC/Fed Policy | Rate decision; forward guidance | Dovish = supportive | Sets Q1 policy expectations |

| NFP Jobs Report | Employment data; wage growth | In-line = neutral | Labor market health signal |

| BTC Regime | BTC price; volatility; dominance | BTC strength supports XRP | Post-holiday momentum direction |

| Leverage/Positioning | OI; funding rates; liquidations | Extremes = volatility risk | Fresh positioning after year-end reset |

| XRP Headlines | Legal; Ripple; ecosystem news | Positive = bullish bias | Can override broader market |

Macro + Risk Appetite (Rates, Equities Correlation)

January macro events set the tone for Q1. The first FOMC meeting establishes rate expectations. NFP/jobs data signals economic health. Equity market direction affects risk appetite broadly. XRP tends to correlate with risk assets—a constructive macro environment supports base/bull scenarios; deteriorating conditions support bear scenarios. For catalyst tracking, see the catalysts hub.

Crypto Liquidity & Leverage (OI, Funding, Liquidations)

January often sees fresh positioning as year-end deleveraging completes. Watch for: OI rebuilding (new leverage entering), funding rate extremes (crowded positioning), and liquidation clusters (cascade risk zones). Clean positioning (neutral funding, moderate OI) supports the base scenario; crowded positioning creates squeeze risk that can trigger volatility expansion. For positioning analysis, see the sentiment and liquidity analysis.

XRP-Specific Catalysts (Legal, ETF/Access, Ripple/XRPL Milestones)

XRP-specific catalysts can override broader market direction. Legal/regulatory developments affect risk premium. ETF flow data signals institutional demand. Ripple ecosystem updates (ODL volume, partnerships, XRPL metrics) affect fundamental narrative. January can feature earnings-style Ripple updates or regulatory timeline milestones. For fundamental analysis, see the fundamentals hub.

How to Monitor the January Forecast (Checklist)

Weekly Checkpoints

Each week during January, review:

- Price vs key levels: Where does XRP sit relative to support/resistance zones?

- BTC regime: Is Bitcoin supportive (trending up) or pressuring (trending down)?

- Positioning: Has funding/OI reached extremes that signal squeeze risk?

- Catalyst resolution: Have major events (FOMC, NFP) resolved? What was the market reaction?

- Volatility: Is volatility expanding or compressing? What does it imply for ranges?

For weekly updates, see: This week XRP outlook | Next week XRP scenarios

‘If/Then’ Scenario Switching Rules

Use these rules to adapt as conditions change:

- IF XRP holds support and respects resistance → THEN base scenario (consolidation) remains active

- IF XRP breaks above resistance with weekly close → THEN shift to bull scenario; target extension levels

- IF XRP breaks below support with weekly close → THEN shift to bear scenario; watch secondary support

- IF major catalyst surprises market → THEN widen expected ranges; volatility expansion possible

January by Year (Routing Module)

For year-specific January forecasts with precise levels, scenarios, and year-bounded catalysts, see the links below:

| Year | Status | Link |

| January 2026 | Published | XRP January 2026 Forecast |

| January 2027 | Coming Soon | XRP January 2027 Forecast (when published) |

| January 2028 | Future | XRP January 2028 Forecast (future) |

XRP January 2026 Forecast

The XRP January 2026 forecast provides specific scenario ranges, key levels, and catalysts for January 2026. It includes the mid-month breakout documentation, post-inauguration policy signals, and detailed delta tracking.

XRP January 2027 Forecast

The XRP January 2027 forecast will be published when January 2027 approaches. It will include year-specific scenario ranges, levels reflecting the 2027 context, and catalysts relevant to that period. For overall 2027 context, see the XRP price prediction by year hub.

Related Month Forecasts

February, March, April (Sibling Months)

XRP Price Prediction February | XRP Price Prediction March | XRP Price Prediction April | All months

For shorter time horizons: Next month forecast | Today’s outlook | Next 24 hours

Frequently Asked Questions

What is the XRP price prediction for January?

January forecasts are best expressed as scenario ranges rather than single prices. This page provides base/bull/bear paths, the assumptions behind each, and the key levels that confirm or invalidate the outlook as price and liquidity conditions change throughout the month.

Will XRP go up in January?

It depends on regime and levels. If XRP holds key support zones and the market maintains a risk-on posture, upside scenarios gain probability. Breaks below support or risk-off macro shocks increase downside scenario probability. Use the confirmation/invalidation triggers to update expectations.

Is January typically bullish or bearish for XRP?

Month-to-month direction isn’t guaranteed by calendar patterns. Rather than assuming seasonality, evaluate January’s specific conditions: current market regime, liquidity environment, and catalysts. Use this page to map those conditions into scenario probabilities.

What are the key support and resistance levels to watch in January?

Key levels are higher-timeframe zones where price historically reacted and liquidity clustered. This page provides primary support, secondary support, primary resistance, and extension targets for January. Each zone includes rationale, confirmation signals, and failure conditions.

What catalysts most often move XRP during January?

Common January catalysts: new year institutional rebalancing, first FOMC meeting of the year, NFP jobs data, BTC regime shifts coming out of holidays, ETF flow dynamics, and any XRP-specific headlines (legal, Ripple updates). Ecosystem updates can matter more when the broader market is stable.

How do Bitcoin and market risk sentiment affect XRP in January?

XRP often follows the broader crypto risk regime. BTC trend, volatility, and dominance influence liquidity and correlation. A risk-on regime (BTC strength, equity strength) supports XRP upside scenarios; risk-off (BTC weakness, macro concerns) raises downside probability.

How do liquidity and leverage conditions change a one-month forecast?

Thin liquidity and crowded leverage can expand ranges and increase squeeze/cascade risk. Healthier liquidity (deeper books, tighter spreads) can stabilize ranges. Track spot volume quality, bid-ask spreads, open interest, funding rates, and liquidation clusters to assess the volatility regime.

How should I use scenario ranges instead of a single price target?

Plan around ranges and triggers rather than betting on a single number. Start with the base scenario and define confirmation/invalidation rules. When a trigger occurs (e.g., breakout above resistance with volume), shift probability to the appropriate scenario. This approach adapts to changing conditions.

Where can I find XRP price predictions for January by year (e.g., January 2026)?

Use the ‘January by Year’ routing module on this page. It links to year-specific January forecasts (January 2026, January 2027, etc.) which include precise scenario logic, levels, and year-bounded catalysts. This page is the evergreen January hub; year-specific pages provide dated detail.

Update Log

| Date | Update Notes |

| January 2026 | Initial January month hub published. Evergreen framework with year-specific routing. |

This update log tracks material changes to the January framework—scenario weights, key level methodology, and catalyst additions. The page is evergreen; year-specific updates appear in the dedicated January 2026/2027/etc. posts.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.