Table of Contents

AI XRP Price Prediction (How AI Forecasts Work)

Can AI predict XRP price?

AI can estimate probabilistic XRP scenario ranges from historical patterns and market signals, but it can’t reliably predict unexpected catalysts like regulatory shocks. Use AI as a support tool within a transparent method, not a single-number promise.

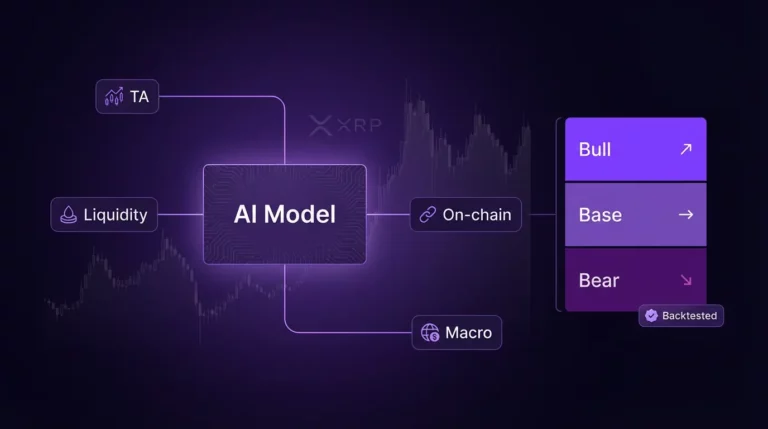

How VTrader Uses AI:

AI supports scenario modeling by processing multiple data inputs and generating probability estimates. It does not replace methodology, feasibility constraints, or human judgment. AI outputs are converted into base/bull/bear scenario ranges with clear confirmation and invalidation rules.

AI-Informed Scenario Framework:

- Base scenario: AI-weighted most likely range based on current regime

- Bull scenario: Upper probability band if positive drivers confirm

- Bear scenario: Lower probability band if negative drivers trigger

For the complete forecasting framework, see the XRP price prediction methodology.

Disclaimer: AI forecasts are informational only and subject to significant uncertainty. Model outputs change as new data arrives. Past performance does not guarantee future results. Always verify forecasts against updated methodology pages.

Can AI Predict XRP Price Accurately? (Short Answer + Why)

AI can be useful for generating probabilistic estimates and detecting pattern-based signals, but accuracy varies significantly by horizon and market regime. The key is understanding what AI does well and where it fails.

What AI Is Good At (Pattern Extraction, Probabilistic Ranges)

- Extracting patterns from large datasets (price, volume, volatility)

- Generating probability distributions instead of single points

- Identifying regime characteristics (trending vs ranging)

- Processing multiple input streams simultaneously

What AI Is Bad At (Exogenous Shocks, Regime Breaks)

- Predicting regulatory decisions, legal outcomes, or policy changes

- Anticipating black swan events (exchange failures, hacks, geopolitical shocks)

- Handling sudden regime shifts where past patterns don’t apply

- Forecasting events outside its training data distribution

What Data AI Uses for XRP Forecasting (Entity–Attribute–Value Inputs)

| Entity | Attribute | Example Values | Why It Matters | Horizon Helped |

| Price Structure | Trend, volatility | ATR, MA slope | Direction and range | Day/Week |

| Volume | Average, change | 24h vol, vol ratio | Participation strength | Day/Week |

| Liquidity | Depth, spreads | Bid-ask spread, OB depth | Execution friction | Day/Week |

| Derivatives | OI, funding | Funding rate %, OI change | Positioning and leverage | Day/Week |

| On-Chain | Activity, flows | Active addresses, txns | Network usage trends | Month/Year |

| Macro Context | BTC regime, rates | BTC trend, Fed stance | Risk environment | Week/Month/Year |

Price/Volume Structure Features (Trend, Ranges, Volatility)

Price and volume data provide the foundation for most AI forecasting. Models extract trend direction, range boundaries, and volatility metrics to estimate probable price paths. For detailed technical inputs, see the XRP technical analysis hub.

Market Microstructure Features (Liquidity, Spreads, Depth)

Order book depth, bid-ask spreads, and execution quality metrics help AI models assess how easily price can move. Thin liquidity can widen forecast ranges. For liquidity interpretation, see the XRP sentiment and liquidity hub.

Derivatives Features (Open Interest, Funding, Liquidation Data)

Open interest and funding rates reveal positioning and leverage. Elevated OI with extreme funding can signal squeeze risk. Liquidation data shows where forced orders may cascade. These features help AI estimate volatility expansion probability.

On-Chain/Network Features (Activity, Flows, Ecosystem Growth)

Active addresses, transaction counts, and network activity metrics provide adoption signals. These features matter more for longer-horizon forecasts (months/years) than short-term predictions. For fundamental drivers, see the XRP fundamentals hub.

Macro/Context Features (BTC Regime, Rates, Risk Sentiment)

Bitcoin’s trend often sets the market’s risk regime. Macro factors like interest rates and risk sentiment affect capital allocation to crypto. AI models use these context features to condition forecasts on the broader environment.

AI Model Types Used for Crypto Forecasting (Explain Without Hype)

Time-Series Models (ARIMA, Prophet) – Where They Break

- Strengths: Simple, interpretable, work well for stable patterns

- Weaknesses: Assume stationarity; break during regime changes and volatility spikes

ML Regressors (XGBoost, Random Forest) – Feature Dependency

- Strengths: Handle nonlinear relationships, feature importance visible

- Weaknesses: Require good feature engineering; can overfit without proper validation

Deep Learning (LSTM/Transformers) – Data Hunger and Overfitting Risk

- Strengths: Capture complex temporal patterns and long-range dependencies

- Weaknesses: Require large datasets; high overfitting risk; less interpretable

LLMs (ChatGPT-Style) – Good at Reasoning, Weak at True Prediction

- Strengths: Explain scenarios, summarize patterns, reason about market dynamics

- Weaknesses: No inherent live data; can’t truly forecast without current inputs; text generation ≠ price prediction

How We Convert AI Outputs Into Scenarios (Base/Bull/Bear)

Probability Bands Instead of Single Targets

AI outputs are expressed as probability distributions, not single numbers. We convert these into scenario ranges: base (most likely), bull (upper band if positive catalysts confirm), and bear (lower band if negative triggers activate). This approach acknowledges uncertainty rather than hiding it.

AI Output Interpretation: If AI probability bands widen, the volatility regime is likely changing. If bands narrow, the model sees a stable regime. Watch for band changes as early warning signals.

Confirmation and Invalidation Rules

AI scenarios require confirmation before acting. Price must close beyond key levels, and other signals (volume, liquidity response) must align. Invalidation rules define when a scenario is no longer valid. These rules are detailed in the XRP price prediction methodology hub.

When We Update AI-Informed Scenarios

- New data shifts probability estimates significantly

- Market regime changes (volatility, liquidity, trend)

- Major catalyst occurs (but note: AI can’t predict catalysts)

Backtesting and Evaluation (How to Judge Model Quality)

Metrics: MAE/RMSE vs Directional Accuracy

- MAE/RMSE: Measure average error magnitude; useful but can hide directional misses

- Directional accuracy: Measures how often the model predicts the right direction; crucial for scenario-based forecasting

Walk-Forward Validation (Avoid Look-Ahead Bias)

Walk-forward validation trains on past windows and tests on subsequent windows repeatedly. This prevents look-ahead bias where future data leaks into training. Results should be evaluated across multiple time periods, not just a single favorable stretch.

Regime Segmentation (Bull/Bear/Sideways)

Average metrics can be misleading. A model might perform well in bull markets but fail in bear markets. Evaluate performance separately across regimes (bull, bear, sideways) to understand where the model adds value and where it struggles.

Common AI XRP Prediction Mistakes (Debunking Patterns)

Model Risk Checklist: Overfitting (model memorizes past instead of learning patterns), regime shift (past patterns don’t apply to new conditions), data leakage (future information contaminates training), non-stationarity (statistical properties change over time), exogenous shocks (events outside training distribution).

Overconfidence in Single Numbers

AI models that output single price targets (“XRP will be $5.27”) ignore uncertainty. Markets are probabilistic systems. Forecasts should express ranges and scenarios, not false precision.

Ignoring Market Cap Constraints and Supply Assumptions

AI can generate any number, but high targets must pass feasibility checks. $100 XRP implies a multi-trillion dollar market cap—is that plausible given adoption and liquidity constraints? Use the XRP price targets hub for constraint-based feasibility analysis.

Feasibility Guardrail: Before accepting any AI price target, check: What market cap does this imply? What adoption level is required? Is the liquidity depth sufficient? If constraints aren’t met, the target is aspirational, not realistic.

Confusing Text Generation with Price Forecasting

LLMs like ChatGPT generate plausible-sounding text, but this doesn’t mean they can predict prices. An LLM can explain why XRP might rise or fall, but without live data and proper forecasting architecture, its “predictions” are scenarios or summaries, not true forecasts.

How to Use AI Predictions on VTrader (Navigation)

Today/Tomorrow/Next Week Pages (Short Horizon)

Short-horizon forecasts use AI for regime detection and range estimation. See XRP price prediction today, XRP price prediction tomorrow, and XRP price prediction next week for tactical applications.

Monthly 2026 Pages (Priority)

Monthly forecasts incorporate AI probability estimates conditioned on adoption, macro, and catalyst scenarios. See the XRP 2026 forecast hub for year-specific analysis.

2026 Year Hub and 2030 Hub (Planning)

Long-horizon forecasts rely more on scenario modeling and constraints than AI pattern recognition. AI supports probability weighting, but adoption, regulation, and macro cycles dominate. See the XRP 2030 forecast hub for extended planning horizons.

Targets Pages (Feasibility)

AI can generate targets, but feasibility requires constraint checks. The XRP price targets hub evaluates what market conditions must be true for various price levels. For catalyst analysis beyond AI capabilities, see the XRP catalysts hub.

Main hub: XRP price prediction

Frequently Asked Questions

Is AI accurate for XRP price prediction?

AI can be useful for probabilistic estimates and pattern-based signals, but accuracy varies by horizon and market regime. It performs best when outputs are expressed as ranges and scenarios and when you account for model risk, regime shifts, and unexpected catalysts.

What AI model is best for predicting crypto prices?

There isn’t one best model for all conditions. Simpler models can work in stable regimes, while ML/deep learning can capture nonlinear patterns but risk overfitting. The best approach is scenario forecasting with walk-forward testing and clear invalidation rules.

Can ChatGPT predict XRP price?

ChatGPT can explain scenarios and summarize historical patterns, but it doesn’t inherently have live market data. Without current inputs, it can’t reliably forecast price. It’s best used as a reasoning tool inside a transparent methodology, not as a standalone predictor.

Why do AI crypto predictions change so often?

Crypto regimes change quickly. When volatility, liquidity, or narrative drivers shift, model inputs change, and so do probability bands. Frequent changes are normal—what matters is whether updates are tied to evidence and stated rules.

What data does AI use to forecast XRP?

Common inputs include price/volume history, volatility, trend structure, order-book/liquidity signals, derivatives data (open interest/funding), on-chain activity, and macro context like Bitcoin’s trend and risk sentiment.

Can AI predict XRP price targets like $10 or $100?

AI can output probabilities, but targets require feasibility checks: supply assumptions, implied market cap, and liquidity constraints. Use target pages to evaluate feasibility and treat AI outputs as scenario inputs, not guarantees.

How do you backtest an AI model for XRP forecasting?

Use walk-forward validation: train on past windows and test on future windows repeatedly. Track error metrics (MAE/RMSE) and directional accuracy, and evaluate performance across regimes (bull/bear/sideways) to avoid misleading averages.

What is the biggest weakness of AI for crypto prediction?

The biggest weakness is handling exogenous shocks—regulatory decisions, sudden exchange events, and liquidity crises. Models trained on past data can’t ‘know’ future catalysts, so forecasts must include uncertainty and scenario switching rules.

How does AI handle sudden news like SEC or ETF headlines?

Most models only react after the market re-prices the news in price and liquidity data. That’s why forecast frameworks treat legal/ETF events as scenario switches and update rules, not something AI can consistently anticipate.

How should I use AI predictions with technical analysis?

Use TA for structure (levels, trend, invalidation) and AI for probabilistic context (range width, regime likelihood). When both align, confidence improves; when they diverge, use scenarios and wait for confirmation.

Do AI predictions work better for short-term or long-term XRP forecasts?

AI often performs better in the short-to-medium term where patterns and regimes persist briefly. Long-term forecasts depend more on adoption, regulation, and macro cycles, so long-horizon outputs should rely on scenario modeling and constraints.

How does VTrader combine AI with methodology and scenarios?

VTrader uses AI to support forecasting inputs and probability estimation, then converts outputs into base/bull/bear scenario ranges with confirmation and invalidation rules. Feasibility checks and catalyst analysis prevent overconfident single-number predictions.

Last Updated: January 14, 2026 | Model inputs and evaluation notes updated as methodology evolves.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.