Table of Contents

XRP SEC Lawsuit & Regulation (Impact on Price Prediction)

How does the SEC lawsuit affect XRP price?

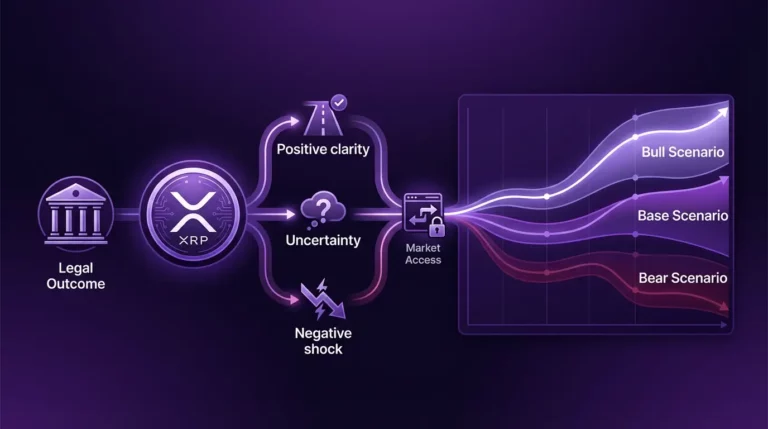

The SEC lawsuit affects XRP price mainly through market access and liquidity. Clearer outcomes can lower risk premiums and expand participation, while uncertainty or negative developments can restrict access and increase volatility—shifting bull/base/bear scenario probabilities.

Current Status (January 2026):

The SEC v. Ripple case reached a settlement in August 2025. Ripple paid a civil penalty; the SEC did not appeal the court’s ruling that programmatic XRP sales to retail investors were not securities transactions. XRP’s legal status in the US has improved, supporting expanded exchange access and institutional product development. This page provides scenario-based analysis of how ongoing regulatory developments affect XRP price forecasts.

Last Updated: January 14, 2026 | See Update Log below

Legal Scenario Impact Summary:

- Positive clarity: Access expands, risk premiums compress, bull scenario probability rises

- Uncertainty/limbo: Range-bound risk, wider forecast bands, base scenario maintained

- Negative shock: Access contracts, risk premiums rise, bear scenario probability increases

For the complete forecasting framework, see the XRP price prediction methodology. For all price drivers, see the XRP catalysts hub.

Disclaimer: This page provides informational content only and does not constitute legal advice. Legal classifications depend on jurisdiction and specific facts. Consult qualified legal counsel for advice on specific situations.

What Is the XRP SEC Lawsuit? (Entity Definitions)

The SEC v. Ripple Labs case was a landmark legal action filed in December 2020. The SEC alleged that Ripple and certain executives conducted an unregistered securities offering through sales of XRP. The case produced significant rulings about when and how XRP sales constituted securities transactions.

SEC (Agency) – Role and Claims (High-Level)

- SEC: US Securities and Exchange Commission, the federal agency that regulates securities markets

- Original claim: Ripple sold XRP as an unregistered security

- Outcome: Court ruled institutional sales were securities; programmatic retail sales were not

Ripple (Company) vs XRP (Asset) vs XRPL (Network)

Entity Disambiguation (Important):

- Ripple Labs: A private technology company that develops payment solutions using XRP. The defendant in the SEC case.

- XRP: The native digital asset of the XRP Ledger. XRP exists independently of Ripple and can be held, transferred, and traded by anyone.

- XRPL: The XRP Ledger, a decentralized blockchain network. XRPL operates through federated consensus and is not controlled by Ripple.

Why Legal Status Moves XRP Price (Mechanism)

| Legal Event Type | Market Access Effect | Liquidity Effect | Scenario Shift |

| Favorable ruling/settlement | Access expands (listings, custody) | Liquidity deepens | Bull bias |

| Regulatory clarity | Institutional products enabled | Spreads tighten | Bull scenario |

| Prolonged uncertainty | Access unchanged/restricted | Liquidity constrained | Range-bound |

| Adverse ruling/action | Access contracts (delistings) | Liquidity thins | Bear scenario |

| New regulatory threat | Risk premium rises | Volatility spikes | Bear pressure |

Market Access (Exchange Listings, Custody, Products)

Legal clarity affects whether exchanges can list XRP, custodians can hold it, and asset managers can create products. During the lawsuit, several US exchanges delisted XRP. After the favorable ruling and settlement, many relisted. Expanded access means more participants can buy and sell, which affects demand and liquidity.

Liquidity and Spreads (Participation Constraints)

When access is restricted, fewer market makers and participants operate, which can thin liquidity and widen spreads. When access expands, more participants enter, which can deepen order books and tighten spreads. Liquidity conditions affect how easily large orders can be filled and how volatile price movements become.

Risk Premium and Narrative Volatility

Legal uncertainty raises the risk premium investors require. Headlines can cause rapid repricing as market participants reassess access and regulatory risk. This creates narrative volatility—price moves driven by perception changes rather than fundamental changes. For fundamental drivers, see the XRP fundamentals hub.

Headline Risk Box: Legal headlines can widen short-term forecast ranges and shift scenario probabilities quickly. That’s why tomorrow and next-week forecasts treat legal events as scenario switches rather than predictable trend inputs.

Legal/Regulatory Scenarios and Price Impact (Scenario Switch Model)

Positive Clarity Scenario (Access Expands)

If regulatory clarity continues to improve:

- Exchange access expands; more platforms list XRP

- Institutional products (ETFs, custody) become more viable

- Risk premiums compress; sentiment improves

- Bull scenario probability increases across horizons

Uncertainty/Limbo Scenario (Range-Bound Risk)

If new regulatory uncertainties emerge:

- Access unchanged or expansion slows

- Liquidity constrained; spreads stable or widen

- Base scenario maintained with wider forecast bands

Negative Shock Scenario (Access Contracts)

If a negative regulatory development occurs:

- Access contracts; exchanges may delist or restrict

- Liquidity thins; volatility spikes

- Bear scenario probability increases; key support levels become critical

Evidence-Based Indicators to Watch (Signals, Not Predictions)

Listing/Venue Access Changes (Observable)

- Exchange listing announcements or delistings

- Trading pair additions or removals

- Geographic access expansions or restrictions

Institutional Product Chatter (Observable)

- ETF filings and regulatory progress

- Custody solution announcements

- Asset manager product launches

For ETF-specific analysis, see the XRP ETF impact hub.

Liquidity Metrics (Depth/Spreads) After Headlines

- Order book depth changes

- Bid-ask spread movements

- Volatility and volume responses to legal news

Timeline Snapshot (Structured, Not Exhaustive)

| Date | Event |

| Dec 2020 | SEC files lawsuit against Ripple Labs |

| Jan 2021 | Major US exchanges delist or suspend XRP trading |

| Jul 2023 | Court rules programmatic retail sales were not securities transactions |

| Aug 2025 | SEC and Ripple reach settlement; case effectively concludes |

| Post-settlement | US exchanges begin relisting XRP; institutional access expands |

How We Update Forecasts After Legal News (Method Excerpt)

What Triggers an Update (Rule-Based)

- Material legal ruling or settlement

- Observable market access change (listing/delisting)

- Significant liquidity or volatility shift after headline

- New regulatory action or guidance affecting XRP

What Does Not Trigger an Update (Noise)

- Unconfirmed rumors or speculation

- Social media commentary without official sources

- Minor procedural filings without market impact

How This Connects to Forecast Horizons (Navigation)

Tomorrow / Next Week (Headline Risk)

Legal news can move XRP quickly. Short-horizon forecasts treat legal events as scenario switches—widening ranges and updating confirmation/invalidation conditions. See XRP price prediction tomorrow and XRP price prediction next week for tactical applications.

2026 / 2030 (Probability Bands Shift)

Legal outcomes can shift scenario probabilities for annual forecasts. Clearer access conditions support bullish pathways; prolonged uncertainty supports wider, range-bound base cases. See XRP 2026 forecast and XRP 2030 forecast.

Targets Pages (Feasibility Constraints)

High targets ($10, $100) require sustained access and deep liquidity. Legal risk affects feasibility by changing participation constraints. Use the XRP price targets hub for constraint-based feasibility checks and the XRP AI modeling hub for AI limitations with exogenous shocks.

Main hub: XRP price prediction | Technical context: XRP technical analysis hub

Common Misconceptions About the XRP Lawsuit (Debunk)

| Misconception | Reality |

| XRP is a security | Court ruled programmatic retail sales were NOT securities; classification depends on context |

| The lawsuit made XRP worthless | XRP continued trading throughout; price recovered after favorable ruling |

| Ripple winning = instant moon | Legal clarity helps access/liquidity but sustained impact requires flows and adoption |

| The case is still ongoing | Settlement reached August 2025; no appeal. New regulatory actions possible but case concluded |

| Ripple = XRP | Ripple is a company; XRP is an independent digital asset on a decentralized ledger |

Frequently Asked Questions

Is XRP still in a lawsuit with the SEC?

The SEC v. Ripple case reached a settlement in August 2025. This hub summarizes the current status with a date and links to the latest VTrader news coverage. Because legal posture can change, the page shows a ‘Last updated’ timestamp and an update log for transparency.

Is XRP considered a security?

Legal classifications depend on jurisdiction and specific facts. The court ruled that programmatic sales of XRP to retail investors were not securities transactions. This page explains the concept at a high level and focuses on observable market effects (access, liquidity, risk premiums) rather than making speculative legal claims.

How does regulatory clarity affect XRP price?

Clarity can expand market access (listings, custody, institutional products) and reduce risk premiums, which can improve liquidity and demand. Uncertainty tends to widen ranges and increase volatility risk.

Can SEC news move XRP price in a single day?

Yes. Legal headlines can create sudden volatility, liquidity shifts, and rapid repricing. That’s why short-horizon forecasts (tomorrow/next week) should treat legal events as scenario switches rather than predictable trend inputs.

What should traders watch after a major legal headline?

Watch market access signals and liquidity response: spreads, depth, volatility, and whether price holds/breaks key levels. If the market re-prices risk, scenario probabilities change—use confirmation/invalidation rules rather than emotions.

How do exchange listings relate to the lawsuit impact?

Listings and custody access affect participation and liquidity. If access expands after clarity, liquidity can deepen; if access contracts, spreads can widen and volatility can increase. The mechanism is access → liquidity → price behavior.

How does the lawsuit affect XRP’s 2026 forecast?

Legal outcomes can shift the probability bands for 2026 scenarios. Clearer access conditions can support bullish pathways; prolonged uncertainty often supports a wider, more range-bound base case until evidence changes.

How does legal risk affect long-term targets like $10 or $100?

High targets require sustained access and deep liquidity. Legal risk can raise required returns and reduce participation, making extreme targets less feasible without major adoption and broad market access improvements.

How often is this XRP lawsuit impact page updated?

Update it whenever there’s a material legal development or a clear change in market access/liquidity conditions. Use a short update log to record changes without publishing duplicate evergreen pages.

Where can I find the latest XRP legal news on VTrader?

Use VTrader’s News section and follow the internal links on this hub to the most recent legal coverage posts. Those time-stamped posts should also link back here for evergreen context.

Update Log

| Date | What Changed |

| Jan 14, 2026 | Initial SEC lawsuit hub published. Status: Settlement reached August 2025. Scenario framework and mechanism analysis established. |

| — | Future legal updates will be logged here |

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.