Table of Contents

XRP Fundamentals (For Price Prediction)

What fundamentals drive XRP price?

XRP fundamentals that drive long-term price include adoption and utility demand, market access and regulatory clarity, liquidity depth, and supply/tokenomics dynamics. Stronger fundamentals raise the probability of bullish scenarios, while weak adoption or access lowers it.

Fundamentals influence XRP’s long-term price through adoption, market access, liquidity, and supply dynamics. This hub focuses on measurable fundamental drivers—not technical analysis or short-term price movements. For technical structure and levels, see the XRP technical analysis hub. For the complete forecasting framework, see the XRP price prediction methodology.

Fundamental Driver Dashboard:

- Utility & Use-Cases: Payment/settlement adoption, ODL volume, institutional usage

- Adoption Signals: Active addresses, transaction volume, partnership integrations

- Market Access: Regulatory clarity, exchange listings, custody solutions, ETF products

- Tokenomics: Circulating supply, escrow dynamics, distribution patterns

- Liquidity Depth: Order book depth, spreads, market structure quality

Apply fundamentals to forecasts: XRP 2026 forecast | XRP 2030 forecast | XRP price targets

Last updated: January 14, 2026

What Are ‘Fundamentals’ for XRP?

In traditional finance, fundamentals refer to earnings, revenue, and cash flow. For XRP, fundamentals are the underlying factors that create sustained demand and determine long-term valuation potential. These are measurable attributes, not narratives.

Utility and Demand Drivers

XRP’s primary utility narratives center on:

- Cross-border payments: Using XRP as a bridge asset for international settlement

- On-Demand Liquidity (ODL): Ripple’s product using XRP for instant liquidity in corridors

- XRPL ecosystem: DeFi applications, NFTs, and other use-cases building on the network

Market Access and Regulatory Regime

Market access determines who can buy, hold, and trade XRP:

- Regulatory clarity: The August 2025 SEC settlement removed major legal uncertainty

- Exchange access: Broader listing support expands the buyer pool

- Investment products: ETF approvals (November 2025) opened institutional access channels

For regulatory and legal impact details, see the SEC lawsuit impact hub and XRP ETF impact hub.

Supply / Tokenomics Constraints

XRP’s supply dynamics include a 100 billion maximum supply, with approximately 57.5 billion in circulation and the remainder in escrow. Supply constraints affect valuation math but don’t guarantee price outcomes—demand and liquidity matter more.

Core XRP Fundamental Drivers (Entity–Attribute–Value Map)

| Driver | Attribute | Measurable Signal | Direction | Horizon |

| Utility | Payment/settlement usage | ODL volume, corridor growth | ↑ = Bullish | 2026-2030 |

| Adoption | User/integration growth | Active addresses, partnerships | ↑ = Bullish | 2026-2030 |

| Ecosystem | XRPL development | dApp activity, developer count | ↑ = Bullish | 2030+ |

| Market Access | Institutional availability | ETF AUM, custody solutions | ↑ = Bullish | 2026 |

| Liquidity | Market depth/quality | Spreads, order book depth | ↑ = Bullish | All |

| Tokenomics | Supply dynamics | Circulation rate, escrow releases | Context | 2030+ |

Utility and Use-Cases (Payments, Settlement, Liquidity)

XRP’s utility thesis rests on being faster and cheaper than traditional settlement:

- 3-5 second settlement vs days for traditional rails

- Fraction-of-a-cent transaction costs

- Bridge asset for illiquid currency pairs

The key metric is sustained usage growth, not announcements. Look for measurable ODL volume trends and corridor expansion.

Adoption Signals (Users, Volume, Integrations)

- Active addresses: Growth in unique addresses using the network

- Transaction volume: Network transaction count and value over time

- Partnership integrations: Look for evidence of actual usage, not just announcements

Ecosystem Development (XRPL Apps, Activity)

The XRPL ecosystem includes DeFi protocols, NFT marketplaces, and developer tools. Ecosystem growth matters most for long-term horizons (2030+) where network effects compound. Near-term (2026), focus on payment/settlement utility.

Market Access and Venues (Institutional Access, Custody, Products)

Market access expansion is a 2026 priority driver:

- ETF products: US spot ETFs launched November 2025; $1.6B+ cumulative inflows by January 2026

- Custody solutions: Institutional-grade custody enables larger allocations

- Exchange listings: Broader venue support increases liquidity and access

Liquidity Depth and Market Structure

Liquidity depth determines how easily large positions can be established or exited. Deeper liquidity supports higher valuations and reduces volatility. Exchange-held XRP is down 57% since early 2025, indicating structural tightening. For detailed liquidity analysis, see the XRP sentiment and liquidity hub.

Tokenomics and Supply Dynamics (What Actually Matters)

XRP tokenomics are frequently discussed but often misunderstood. Supply matters for valuation math, but price outcomes depend on demand and liquidity.

Circulating Supply vs Escrow Concepts

| Supply Category | Amount | Relevance |

| Maximum Supply | 100 billion XRP | Hard cap; used for long-term market cap calculations |

| Circulating Supply | ~57.5 billion XRP | Currently tradeable; primary basis for current market cap |

| Escrow Holdings | ~40+ billion XRP | Released monthly (up to 1B); unused returns to escrow |

Supply Releases and Perception vs Price Impact

Monthly escrow releases (up to 1 billion XRP) generate headlines but actual market impact depends on:

- How much is actually used vs returned to escrow

- Market absorption capacity (liquidity depth)

- Overall demand conditions at the time of release

Distribution Narratives and What to Measure

Rather than reacting to supply headlines, track net market impact: exchange balance changes, OTC flow estimates, and whether releases are absorbed without price disruption. Consistent absorption during releases is fundamentally positive.

Ripple vs XRP vs XRPL (Entity Disambiguation)

Clear entity disambiguation is essential for accurate analysis. These three entities are related but distinct:

Disambiguation Box:

Ripple (Company) Attributes

- Entity type: Private technology company

- Products: RippleNet, On-Demand Liquidity (ODL), RLUSD stablecoin

- XRP relationship: Largest holder; uses XRP in ODL; influences ecosystem development

Related: Ripple’s path to banking license could propel XRP to $50

XRP (Asset) Attributes

- Entity type: Native digital asset of the XRP Ledger

- Function: Bridge currency, transaction fees, network utility

- Independence: Exists independently of Ripple; network would continue without Ripple

XRPL (Network) Attributes

- Entity type: Decentralized blockchain network

- Consensus: Federated consensus protocol (not proof-of-work or proof-of-stake)

- Features: Built-in DEX, token issuance, smart contract capabilities (Hooks)

Why Disambiguation Matters for Search and Trust

Many news articles conflate Ripple company news with XRP asset performance. Clear entity separation helps readers distinguish between company events and factors that actually affect token fundamentals. Ripple news matters when it affects adoption, access, or ecosystem development—not automatically.

Valuation & Feasibility (Constraints That Remove Hype)

Feasibility Check: Before believing any price target, check the implied market cap and liquidity requirements. See the XRP price targets hub for detailed feasibility analysis of $5, $10, $100, and $1,000 targets.

Market Cap Math and Implied Valuation Checks

| Price | Market Cap (57.5B circ) | Market Cap (100B max) | Comparison |

| $5 | ~$287 billion | ~$500 billion | Near ETH market cap |

| $10 | ~$575 billion | ~$1 trillion | Near BTC market cap |

| $100 | ~$5.7 trillion | ~$10 trillion | > All crypto combined |

Velocity / Utility-Style Reasoning (Conceptual, Not Over-Precise)

Some valuation frameworks consider how much XRP must be held to facilitate payment volumes (velocity models). These are conceptually useful but shouldn’t be treated as precise calculators. The key insight: sustained utility demand creates price support, but speculative demand dominates near-term.

Why Some Targets Need Unrealistic Assumptions

Targets like $100+ require XRP to become one of the largest assets in global finance, exceeding the current total crypto market cap. This doesn’t mean impossible, but it requires assumptions about adoption scale and time horizons that go far beyond current conditions. Always check the math before accepting target claims.

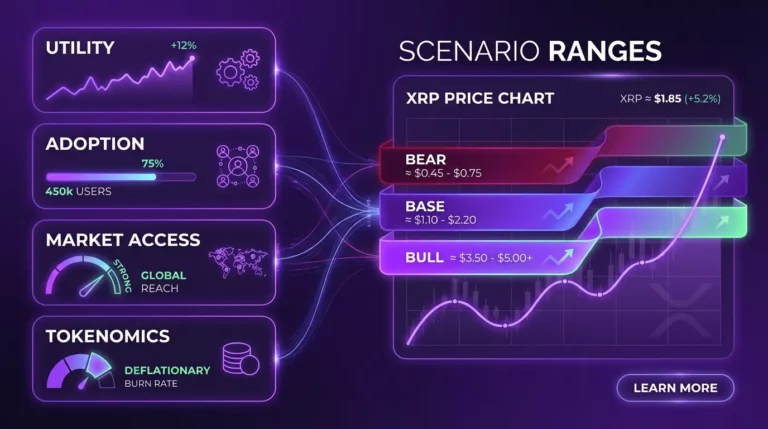

Fundamentals → Forecast Scenarios (How Fundamentals Map to 2026 and 2030)

Fundamentals feed directly into scenario probabilities. Here’s how each scenario relates to fundamental conditions:

Base Scenario Fundamentals (Most Likely Conditions)

- Adoption continues at current trajectory (gradual, not explosive)

- Market access remains stable (ETF flows steady, no new restrictions)

- Supply releases absorbed without disruption

- Macro environment neutral to slightly supportive

Bull Scenario Fundamentals (What Must Be True)

- Adoption accelerates (major financial institution deployments, ODL volume growth)

- Market access expands (additional ETF products, international approvals)

- Regulatory tailwinds (favorable legislation, banking license progress)

- Macro risk-on with strong crypto inflows

Bear Scenario Fundamentals (What Fails)

- Adoption stalls or competitors gain ground

- Market access contracts (ETF outflows, venue restrictions)

- Regulatory setbacks or new legal challenges

- Macro risk-off with crypto outflows

What Fundamentals Can’t Predict (Limits)

Short-Term Volatility and Reflexivity

Fundamentals don’t explain day-to-day or week-to-week price moves. Short-term volatility is driven by market structure, sentiment, and positioning. Use fundamentals for year-horizon frameworks; use technical analysis and sentiment for shorter horizons.

Exogenous Shocks (Regulatory Surprises)

Unexpected regulatory actions, geopolitical events, or market structure failures can override fundamental trends. This is why forecasts use scenarios with invalidation conditions rather than single-point predictions.

Related: XRP catalysts hub (event-driven changes) | ChatGPT, Grok, and Claude weigh in on XRP rally

How to Use This Fundamentals Hub (Navigation)

Year Hubs (2026 / 2030)

Fundamentals provide the driver framework for year forecasts. See XRP 2026 forecast for nearer-term scenarios emphasizing market access and adoption catalysts. See XRP 2030 forecast for long-term scenarios emphasizing sustained adoption and ecosystem maturation.

Catalyst Hub (Event-Driven Changes)

Catalysts modify fundamental conditions. When an ETF is approved, a partnership is announced, or regulations change, fundamentals shift. The XRP catalysts hub tracks events that change fundamental drivers.

Methodology Hub (How We Publish Updates)

For the complete forecasting framework—how fundamentals combine with technical analysis, sentiment, and catalysts—see the XRP price prediction methodology. For AI-assisted analysis, see the XRP AI modeling hub.

Main hub: XRP price prediction

Frequently Asked Questions

What makes XRP valuable fundamentally?

Fundamental value is driven by sustained demand (utility and adoption), market access (regulatory clarity and venue support), and liquidity depth. Supply dynamics matter, but long-term outcomes depend more on whether use-cases scale and participation expands.

Does XRP have real utility or is it mainly speculative?

XRP has utility narratives tied to payments and liquidity, but market pricing also reflects speculation and risk appetite. Fundamentals analysis focuses on measurable adoption and access signals rather than opinions about narratives.

How does Ripple’s business affect XRP price?

Ripple’s actions can influence perception, partnerships, and ecosystem development, but XRP’s price ultimately reflects market demand, liquidity, and access conditions. Clear entity disambiguation helps avoid attributing company events to token price without evidence.

How does XRP token supply and escrow influence price?

Supply headlines can affect sentiment, but price impact depends on net demand and market liquidity. A good fundamentals view distinguishes circulating supply, escrow mechanics, and actual market absorption capacity.

What adoption metrics matter most for XRP?

Look for measurable usage signals: growth in active addresses/activity (where relevant), transaction volumes, integration announcements with measurable usage, and evidence of sustained demand rather than one-off headlines.

Do partnerships increase XRP price long-term?

Partnerships matter when they translate into sustained usage and liquidity. Fundamentals analysis separates ‘announcement’ from ‘measurable adoption’ and updates scenarios only when usage signals appear.

How do regulations and legal outcomes affect XRP fundamentals?

Regulatory clarity can expand market access, reduce risk premiums, and increase participation. Negative outcomes can restrict venues and limit liquidity. Legal/regulatory is a fundamentals driver because it shapes access and demand conditions.

Can fundamentals explain short-term XRP price moves?

Not reliably. Short-term moves are dominated by market structure, liquidity, and sentiment. Fundamentals influence long-term scenario probabilities and provide a framework for year-horizon forecasts, not day-to-day volatility.

How do you value XRP compared to other crypto assets?

Use constraint-based comparisons: market cap math, liquidity depth, adoption signals, and regulatory regime. The goal is not a single ‘fair value’ but scenario pathways and what must be true for higher valuations.

What fundamentals would support XRP reaching $10 or $100?

High targets require a combination of strong adoption growth, broad market access, deep liquidity, and a supportive macro regime. Feasibility checks (implied market cap and liquidity constraints) are essential before treating targets as realistic.

How do fundamentals differ between the 2026 and 2030 forecasts?

2026 focuses on nearer-term catalysts and measurable adoption/access changes. 2030 relies more on sustained multi-year adoption, regulatory regime stability, and market structure maturation. Fundamentals hubs provide the shared driver framework for both horizons.

Last updated: January 14, 2026

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.