Imagine your crypto working for you, 24/7, even while you sleep. That’s the big idea behind crypto passive income. Instead of just holding your digital assets and hoping the price goes up, you put them to work generating even more crypto.

It's less like frantic day trading and more like earning interest in a high-yield savings account, only with the power of blockchain technology behind it.

Understanding Crypto Passive Income

So, what exactly is passive income in the crypto world? Simply put, it's a way to use your existing holdings to generate more crypto with minimal day-to-day effort. You aren't trying to time the market or profit from price swings. Instead, you're helping blockchain networks and DeFi protocols run smoothly.

These systems need capital to operate—whether it's for securing the network, enabling trades, or funding loans. By providing your assets, you become a crucial part of that ecosystem. In return for your contribution, the network rewards you. It’s a win-win.

How It Works Without the Jargon

Let's cut through the noise. Forget the complex charts and technical terms for a second.

Think of it this way: if you own a valuable tool, you could let it collect dust in your garage, or you could rent it out to someone who needs it and earn money. Crypto passive income is just the digital version of that. You're "renting" out your assets to the network.

The key takeaway is that you are not just a holder; you become an active participant in the digital economy. Your crypto stops being a static asset and transforms into a productive one, generating a steady stream of rewards over time.

This strategy completely changes the game from the classic "buy and hold" (or HODL) approach. While HODLing relies entirely on price appreciation, passive income adds another revenue stream. This can seriously compound your growth in a bull market and help soften the blow when prices dip.

The most common ways to do this fall into a few main buckets:

- Staking: You lock up your coins to help secure a blockchain network. Think of it like a fixed-term deposit that pays you interest for your commitment.

- Lending: You loan your crypto out to borrowers through a platform and earn interest, much like a bank does.

- Providing Liquidity: You deposit a pair of tokens into a decentralized exchange, helping others trade them. In return, you get a cut of the trading fees.

Each of these methods has a different risk-and-reward profile. To give you a better sense of how they compare, here's a quick overview.

Crypto Passive Income Methods at a Glance

This table breaks down the most popular strategies, giving you a clear look at what you might earn and the risks involved.

| Method | Typical APY Range | Complexity Level | Primary Risk |

|---|---|---|---|

| Staking | 3% – 20% | Low | Slashing, Lock-up Periods |

| Lending | 2% – 15% | Low | Default, Smart Contract Bugs |

| Liquidity Providing | 10% – 100%+ | Medium | Impermanent Loss |

| Yield Farming | 20% – 500%+ | High | Smart Contract Hacks, Volatility |

As you can see, higher potential returns usually come with higher complexity and risk. We'll dig deeper into each of these to help you figure out which one might be the right fit for you.

Exploring Top Passive Income Strategies

Diving into crypto passive income is a bit like planning a vacation. You have popular, well-trodden paths and more adventurous, off-the-beaten-track options. Each strategy comes with its own mix of potential rewards, risks, and the amount of effort you need to put in.

Let's skip the dense technical jargon and break down the most common strategies with simple, clear analogies. By the end, you'll have a solid feel for how each method works, making it much easier to pick the one that fits your goals.

Staking Rewards For Securing The Network

Think of staking as putting your crypto into a high-yield savings account. You lock up your coins to help secure a blockchain network and validate transactions. In return for that commitment, the network pays you rewards, usually in the same cryptocurrency you staked. Simple as that.

This is the core engine behind blockchains that use a Proof-of-Stake (PoS) system. When you stake, you’re not just a bystander; you're actively helping the network run smoothly and stay secure. It’s one of the most direct ways to earn, as your assets are doing real work.

By staking, you shift from being a passive holder to an active network participant. Your assets aren't just collecting dust—they're performing a vital function and earning you rewards for it. For a deeper dive into the mechanics, check out our guide on how crypto staking works.

Crypto Lending: Become The Bank

If staking is like a savings account, crypto lending is like being the bank. You lend out your digital assets to borrowers through a lending platform. Those borrowers pay interest on the loan, and you get a cut of the profits, creating a steady income stream.

Here’s how it usually goes down:

- You Deposit: You add your crypto to a lending platform.

- Borrowers Take Loans: Others borrow your assets, putting up their own crypto as collateral.

- You Earn Interest: The platform collects interest from the borrowers and passes most of it on to you.

This is a really popular strategy for stablecoins—crypto pegged to assets like the U.S. dollar. Since their value is stable, they offer more predictable returns, making them a go-to for many passive income investors.

Yield Farming And Providing Liquidity

Ready to get a bit more advanced? Let’s talk about yield farming and liquidity providing. Imagine you own a currency exchange booth at an airport. To serve travelers, you need to keep a supply of both dollars and euros on hand. For providing this service, you earn a small fee on every swap.

Decentralized exchanges (DEXs) work the same way. They need pools of paired assets (like ETH and USDC) so people can trade between them. As a liquidity provider, you deposit an equal value of two different tokens into a pool. In return, you earn a share of the trading fees every time someone uses it.

Yield farming takes this concept and cranks it up a notch. It’s the practice of moving your assets between different pools and platforms, constantly chasing the best returns. While it can be highly profitable, it comes with greater risks like impermanent loss, where the value of your deposited tokens can drop compared to if you had just held them.

The entire crypto passive income market has grown into a serious part of the financial world. By 2025, the market matured significantly, with over $150 billion locked in various decentralized finance (DeFi) protocols. For more stable strategies, investors can typically find Annual Percentage Yields (APYs) between 3% and 8%. For instance, staking Bitcoin might get you around 2-4% APY, while lending stablecoins often delivers a more appealing 4-8% APY thanks to their lower volatility.

Comparing Yields, Risks, and Liquidity

When you're exploring crypto passive income, it's easy to get fixated on the highest Annual Percentage Yield (APY). But chasing a triple-digit APY without understanding the fine print is a recipe for disaster. Real, sustainable success comes from balancing three key things: the potential yield, the risks you're taking on, and how easily you can get your money back (liquidity).

Not all passive income streams are created equal. Far from it. A conservative play, like lending out stablecoins, might net you a respectable 4% to 8% APY. On the other hand, an aggressive yield farming position could dangle a 100%+ APY in front of you. That huge difference in returns is directly tied to the underlying risk—think smart contract bugs, wild market swings, or the dreaded impermanent loss.

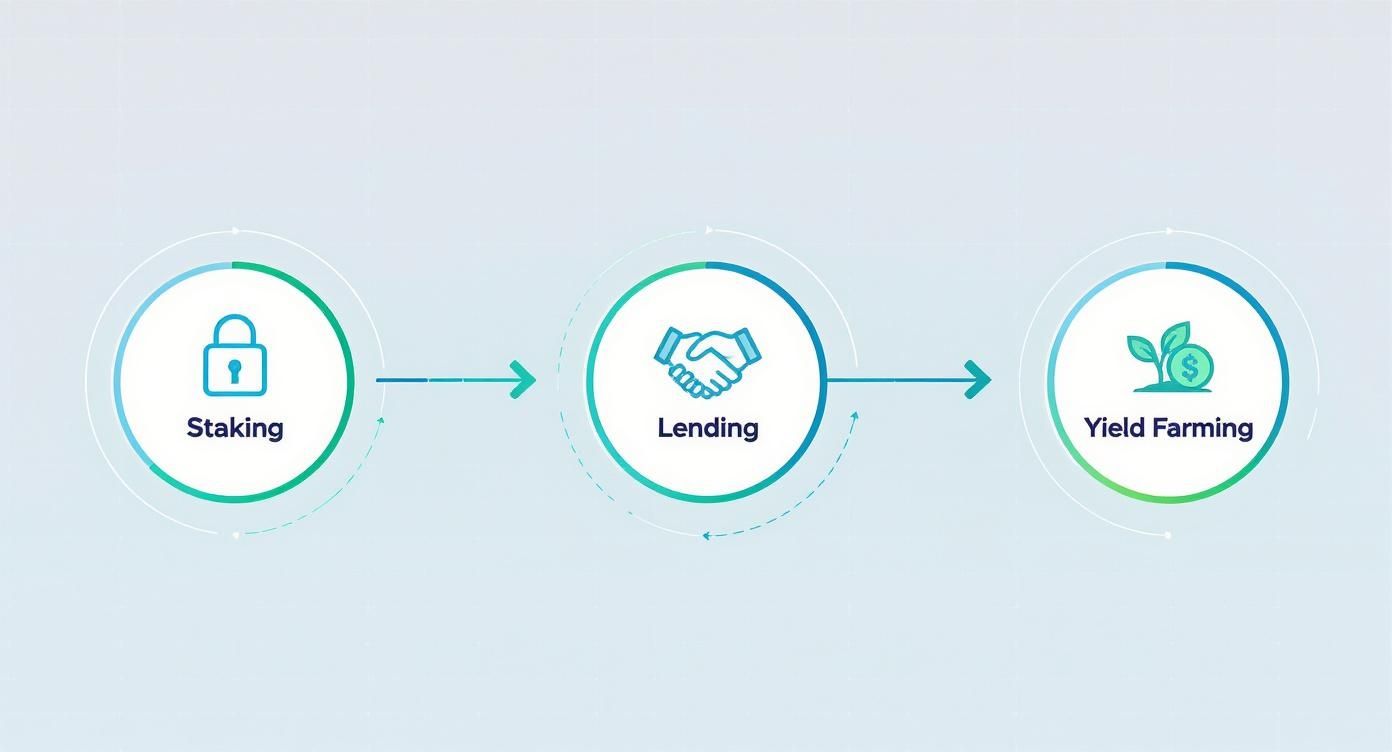

This visual gives you a good sense of how these strategies build on each other, moving from simpler, lower-risk methods to more complex ones.

As you can see, staking forms the foundation. From there, you can move into lending, and then into the more advanced world of yield farming.

Understanding The Risk Spectrum

On one end of the scale, you have lower-risk activities like staking a major cryptocurrency such as Ethereum (ETH). When you stake ETH, you’re helping to secure one of the world's most battle-tested blockchains. The risks aren't zero, but they are relatively low.

On the flip side, yield farming often means you're interacting with brand-new protocols that haven't been audited nearly as much. Those insane yields are there for a reason: to attract money fast. But this can expose your funds to exploits or simple coding mistakes that could drain the entire pool.

The golden rule here is simple: Higher yields are almost always compensation for higher risk. The real goal isn't just to chase the biggest number, but to find a strategy that fits your personal risk tolerance.

Understanding this dynamic is non-negotiable for building a solid passive income portfolio. Before you put a single dollar to work, you need to know exactly where your strategy sits on this spectrum. For a deeper look at the safety measures involved, check out our guide on whether crypto staking is a safe investment strategy.

The Importance Of Liquidity

The next piece of the puzzle is liquidity—how quickly can you turn your crypto back into cash without taking a major price hit? Some methods require you to lock up your funds for a set period, which makes them illiquid. It's a critical trade-off to consider.

- High Liquidity: Lending stablecoins on a platform with flexible terms usually lets you pull your money out whenever you want.

- Medium Liquidity: Staking often comes with an "unbonding" period. This means your funds might be locked for a few days or weeks after you decide to unstake.

- Low Liquidity: Some staking protocols or yield farms demand you lock your assets for months—or even years—to earn the top-tier rewards.

That lock-up period is a big deal. Sure, it might secure you a better APY, but it also means you're stuck on the sidelines if the market takes a nosedive. You have to be completely comfortable with the idea of not touching those funds for the entire lock-up duration.

A Comparative Look At Strategies

To make the right call, you need to see how yield, risk, and liquidity stack up across the board. Every method is built for a different kind of investor, from the cautious beginner to the DeFi power user.

The table below breaks it all down, giving you a clear visual of the trade-offs involved. Use it to figure out which strategy aligns best with your goals.

Risk and Reward Comparison of Passive Income Strategies

This table offers a side-by-side comparison of the most common crypto passive income methods, helping you weigh the potential returns against the inherent risks and liquidity constraints.

| Strategy | Potential APY | Key Risks | Liquidity | Best For |

|---|---|---|---|---|

| Staking (ETH, ADA) | 3% – 7% | Slashing, Lock-up Periods | Medium to Low | Long-term holders seeking stable returns on established assets. |

| Lending (Stablecoins) | 4% – 10% | Platform insolvency, Counterparty Risk | High (with flexible terms) | Risk-averse investors wanting predictable, dollar-based returns. |

| Liquidity Providing | 10% – 50%+ | Impermanent Loss, Smart Contract Bugs | High (but with caveats) | Investors comfortable with market volatility and DeFi mechanics. |

| Yield Farming | 20% – 200%+ | Smart Contract Hacks, Protocol Failure | Variable | Experienced users with a high risk tolerance chasing maximum yields. |

Ultimately, there's no single "best" strategy—only the one that's right for you. By carefully considering these factors, you can build a passive income plan that helps you grow your crypto portfolio without taking on more risk than you can handle.

Your Step-by-Step Guide to Getting Started

Theory is great, but it’s time to put your money to work. This section is your roadmap from just holding crypto to actively earning with it. We’ll walk through setting up your account, funding it, and firing up your first passive income stream on a platform built for it, like vTrader.

It’s a lot more straightforward than you might think. Let's get you set up and earning.

Step 1: Choose and Secure Your Platform

Your first move is your most important: picking a reputable platform. For anyone just starting, a centralized exchange like vTrader is the perfect blend of user-friendliness, security, and easy access to earning features like one-click staking.

Look for platforms that are registered with financial authorities—like FinCEN in the U.S.—as this adds a serious layer of regulatory oversight and accountability.

Once you’ve made your choice, you'll go through the sign-up process. Expect to complete a Know Your Customer (KYC) check, which usually means submitting a government-issued ID and a selfie. It's a standard security step that protects you and the platform from fraud.

Pro Tip: Enable Two-Factor Authentication (2FA) the moment your account is open. This is non-negotiable. It requires a code from your phone to log in, making it dramatically harder for anyone to get unauthorized access.

Step 2: Fund Your Account and Buy Crypto

Account secured? Great. Now it’s time to fund it. Most platforms let you connect a bank account for an ACH transfer or use a debit card for instant buys. Debit cards are quick, but keep an eye on the fees, as they can be a bit higher.

For your first purchase, stick with something established. Here are two solid starting points:

- A Major Staking Asset: Ethereum (ETH) is a go-to choice. It powers a massive ecosystem and offers dependable staking rewards.

- A Stablecoin: A coin like USDC or USDT is pegged to the U.S. dollar. This makes it a low-volatility anchor for your portfolio, perfect for earning steady interest in savings or lending programs.

While the exchange wallet is fine for getting started, your next skill to learn is setting up a dedicated wallet for long-term security. Our guide on how to set up a secure Bitcoin wallet is a great place to start.

The growth of yield generation shows crypto is maturing from its wild-west days into a more predictable financial sector. As of 2025, centralized platforms are the dominant choice for their simplicity, offering typical APYs between 4% to 8% on major assets and stablecoins. While they do have counterparty risk, the user experience has made earning passive income more accessible than ever.

Step 3: Activate Your First Passive Income Stream

This is the fun part—putting your crypto to work. We'll use vTrader’s one-click staking as an example, since the process is almost identical on most top-tier platforms.

The vTrader app makes getting started incredibly simple, letting you go from sign-up to earning in just a few minutes.

Here's how easy it is:

- Navigate to the 'Earn' or 'Staking' Section: Log in to your vTrader account and look for the rewards section. It’s usually front and center on the dashboard.

- Select Your Asset: You’ll see a list of coins eligible for staking. Find the one you just bought, like Ethereum (ETH), and select it.

- Enter the Amount: Decide how much you want to stake. You don’t have to lock up your whole bag—start with a small amount to get a feel for it.

- Review and Confirm: The platform will show you the estimated APY and any lock-up terms. Read this carefully. When you're ready, just hit 'Stake' or 'Confirm.'

And that’s it. Your crypto is now officially staked and earning rewards. You can track everything right from your dashboard and watch your portfolio grow on its own.

Managing Security and Tax Obligations

Earning crypto passive income is fantastic, but it’s not just about watching the rewards roll in. As your portfolio gets bigger, so do your responsibilities. You have to get serious about security and taxes, because ignoring either can turn those hard-earned gains into a major headache.

Think of it this way: this isn't just about collecting rewards, it's about building a sustainable strategy. Nailing these two areas from the start ensures your journey is profitable, compliant, and stress-free for the long haul.

Fortifying Your Digital Assets

In crypto, you're in charge. You are your own bank. That freedom is powerful, but it means you're solely responsible for protecting your assets from thieves and scammers. The first rule you need to burn into your memory is "not your keys, not your coins." This simple phrase gets at the core difference between leaving assets on an exchange versus holding them in a wallet you control.

For any serious, long-term holding, a hardware wallet is the gold standard. It's a physical device that keeps your private keys completely offline, making it virtually impossible for online hackers to get to them. It’s like having a personal vault for your digital money.

Beyond that, you absolutely must follow these security basics:

- Activate Two-Factor Authentication (2FA): Always use an app like Google Authenticator to add a second layer of defense to your accounts. Don't rely on SMS-based 2FA—it's surprisingly vulnerable to SIM-swap attacks.

- Beware of Phishing Scams: Get paranoid about suspicious links. Never, ever enter your seed phrase anywhere except on your actual hardware wallet device. Scammers are experts at creating fake websites and emails that look real, all to trick you into giving up your keys.

Navigating Your Tax Responsibilities

Crypto might feel like a separate world, but it doesn't exist in a tax-free bubble. Governments are catching up fast and setting clear rules, and you don’t want to be on the wrong side of the law.

A huge misconception is that you only owe taxes when you cash out to dollars or euros. The reality is that most tax authorities treat rewards from staking, lending, and yield farming as ordinary income, taxable the moment you receive them.

That means you’re on the hook for taxes based on the fair market value of the crypto when it landed in your wallet. For example, if you get a staking reward worth $100 in ETH, that $100 is considered taxable income for that year.

Keeping meticulous records of every single transaction—every reward, swap, and sale—is non-negotiable. This gets messy fast, especially if you’re active in DeFi.

To stay sane, using specialized crypto tax software is the way to go. These tools connect to your exchanges and wallets, automatically track your activity, and generate the reports you need for filing. To get a better handle on this, check out our complete guide on how to calculate your crypto taxes.

Ultimately, nothing beats professional advice. Find a qualified tax professional who actually understands digital assets. They can help you navigate the specific rules in your country and make sure you’re fully compliant without overpaying.

A Beginner Roadmap to Building Your Portfolio

Turning the idea of crypto passive income into actual returns starts with a clear plan. Let's walk through a few sample portfolios to make this concrete, moving from super conservative strategies to more balanced ones to help you set realistic expectations.

A cautious investor might begin with a $1,000 portfolio dedicated entirely to stablecoin lending. Earning a realistic 5% APY, this simple setup could generate about $50 in passive income over a year. It's a fantastic, low-risk way to learn the ropes without worrying about market swings.

For a more balanced approach, consider a $2,500 portfolio. You could put $1,500 into staking a major asset like Ethereum (ETH) at 4% APY and the remaining $1,000 into a stablecoin savings product earning 6% APY. This mix would generate around $120 a year, combining steady income with the potential for your ETH to grow in value.

The Role of Stablecoins in Passive Income

Stablecoins are the bedrock for many passive income strategies, and for good reason. Their high liquidity and huge volume in transactions make them incredibly reliable. Just how huge? Adjusted stablecoin transactions on Ethereum and Tron alone hit a staggering $772 billion in September 2025.

With a total supply topping $300 billion in 2025, stablecoins are the engine behind robust lending and yield products that consistently offer returns in the 4-8% APY range. You can dig deeper into these trends in the latest state of crypto report from a16zcrypto.com.

Your First Three Months: A Simple Roadmap

Getting started can feel like a lot, but breaking it down into small, manageable steps makes all the difference. Here’s a simple 90-day plan to get your crypto passive income portfolio off the ground.

The goal isn’t to become a DeFi expert overnight. It's about taking small, consistent actions to build your knowledge and your portfolio step by step.

Here’s a clear path to get you going:

Month 1: Education and First Steps

- Learn the Basics: Spend some time really understanding the core concepts of staking and lending. Don't just skim—get comfortable with them.

- Open an Account: Sign up on a trusted platform like vTrader and get your identity verified.

- Make Your First Purchase: Buy a small amount of a stablecoin (like USDC) and a major staking asset (like ETH).

- Start Small: Test the waters by activating a simple staking or savings feature with just a fraction of your funds. See how it works firsthand.

Month 2: Monitor and Expand

- Track Your Earnings: Get into the habit of checking your rewards. Using a good crypto portfolio tracker app is a great way to see all your progress in one place.

- Explore a Second Stream: If you started with staking, now’s the time to try a stablecoin savings product, or vice versa. This is your first step toward diversification.

Month 3: Review and Refine

- Assess Your Performance: Take a look at what you’ve earned and, more importantly, how you feel about the risks involved.

- Adjust Your Strategy: Based on your experience, you can decide whether you're ready to increase your allocation or maybe explore another low-risk strategy.

Frequently Asked Questions

Jumping into crypto passive income naturally brings up a few questions. We've gathered the most common ones from beginners to give you clear, straight-ahead answers on safety, startup costs, and what's realistically possible.

Is Earning Crypto Passive Income Safe for Beginners?

The short answer is: it depends entirely on what you do and where you do it. Sticking to proven, lower-risk strategies is the smartest way to start.

Things like staking major cryptocurrencies (think Ethereum) or lending stablecoins on a well-known, regulated platform are about as safe as it gets in this space. These methods are transparent and have been around long enough to build trust.

On the other hand, the crypto world has its wild side. Chasing super-high yields with things like yield farming on brand-new protocols is where the real danger lies. You're exposed to risks like smart contract bugs or impermanent loss, which can wipe out your funds fast.

The best approach is to start small on a platform you trust. Get a feel for how everything works before you even think about putting in serious money. And the golden rule always applies: Never invest more than you can afford to lose.

How Much Money Do I Need to Get Started?

You definitely don't need a fortune to get started. Most platforms let you begin with as little as $10 or $20. The goal isn't to get rich overnight; it's to learn the ropes with an amount you're completely comfortable with.

Starting small lets you walk through the entire process—from buying your first crypto to clicking the button to stake it—without the pressure of risking a lot of capital. Once you see how it works and start earning your first rewards, you can decide if you want to add more.

Can I Actually Live Off Crypto Passive Income?

While it’s possible, it’s an extremely difficult goal that shouldn't be your starting point. To generate enough income to live on, you'd need a very large portfolio—likely in the six or even seven figures—plus a rock-solid understanding of the markets and risk management.

For the vast majority of people, crypto passive income is a way to supplement what you already earn and make your portfolio grow faster. Think of it as a powerful booster for your long-term wealth, not a replacement for your day job.

Ready to put your crypto to work? Start your passive income journey with vTrader and benefit from zero-fee trading, one-click staking, and a secure, user-friendly platform. Sign up today and get started.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.