Turning your crypto into fiat is just a fancy way of saying you’re converting digital assets like Bitcoin or Ethereum back into government-issued money, such as US Dollars or Euros. Think of it as "cashing out."

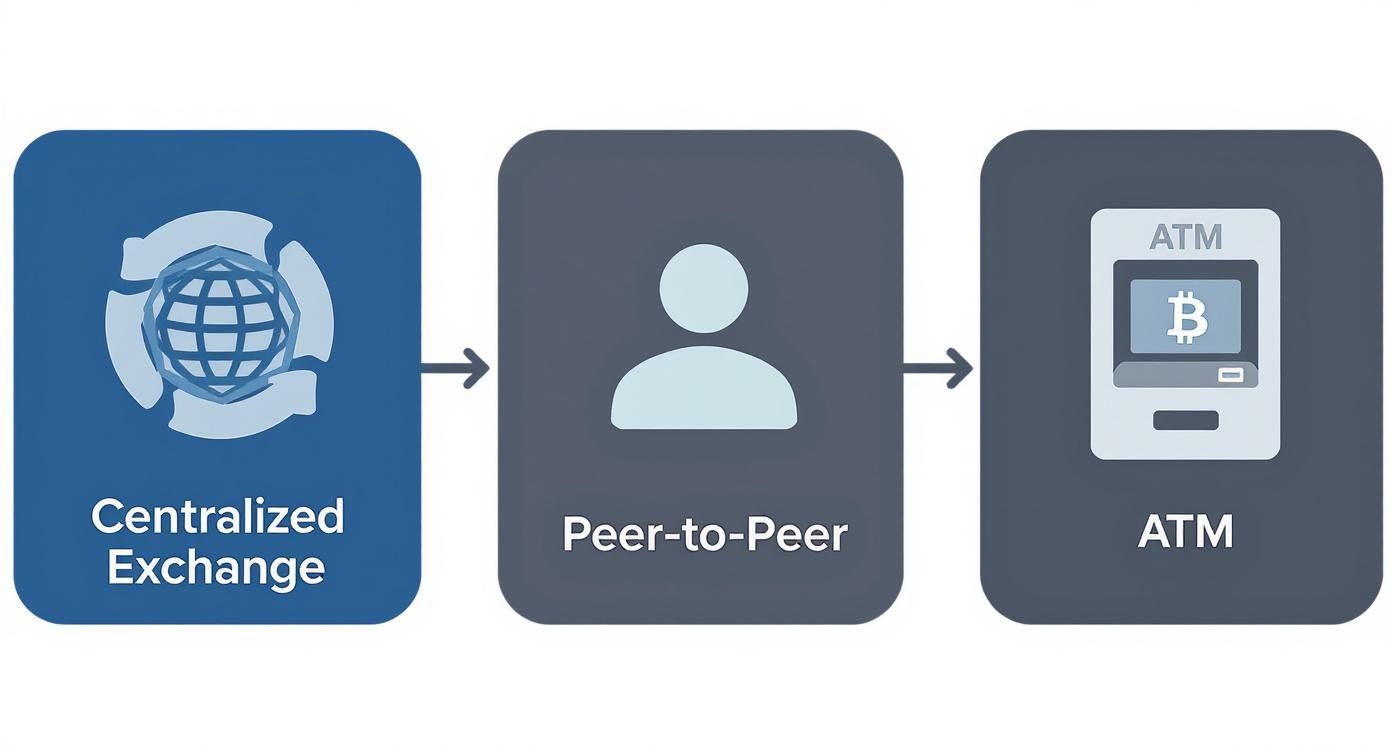

Most people do this through one of three main avenues: a centralized crypto exchange, a peer-to-peer (P2P) platform, or a specialized crypto ATM. Each has its own trade-offs when it comes to speed, fees, and overall convenience.

Why Cashing Out Crypto Matters

Knowing how to cash out your crypto is a non-negotiable skill for any serious investor. It’s the final, crucial step that transforms digital profits on a screen into actual money you can spend, save, or reinvest in other assets. Without a solid off-ramping plan, your crypto gains are stuck in the digital world.

This isn't just a simple transaction; it's about building a reliable bridge between two completely different financial systems. Getting it right means you can react to market swings, lock in profits during a bull run, or just pull out your capital whenever you need it.

The gap between digital and traditional finance is still massive, which makes having a trusted conversion method essential. We explore these differences more in our article on cryptocurrency vs. fiat currency.

What This Guide Will Cover

Think of this guide as your complete roadmap for the entire crypto-to-fiat journey. We’ll walk through everything you need to know to make smart decisions and ensure your conversions are smooth, secure, and fully compliant.

Here’s a look at what we’ll break down:

- Choosing Your Platform: We'll compare the good, the bad, and the ugly of centralized exchanges, P2P marketplaces, crypto ATMs, and even Over-the-Counter (OTC) desks for the big players.

- The Withdrawal Process: A practical, step-by-step look at how it actually works—from passing KYC checks to connecting your bank and initiating the transfer.

- Fees and Wait Times: An honest breakdown of the costs you'll face (trading, network, and withdrawal fees) and how to keep them as low as possible.

- Security and Taxes: Must-know best practices for keeping your funds safe during the process and a clear look at your tax obligations when you cash out.

To give you an idea of the scale we're talking about, consider this:

The total value of fiat flowing into major centralized exchanges has already blown past $2.4 trillion, with the U.S. dollar leading the charge. This isn't a niche market anymore; it's a sign of crypto becoming a real part of the mainstream financial system. You can dig into more data on global adoption from the experts at Chainalysis.

By the time you're done with this guide, you’ll have the know-how to pick the right method for your situation and handle the entire process with confidence.

Choosing Your Crypto to Fiat Exchange Platform

Picking the right platform is probably the single most important decision you'll make when cashing out your crypto. This goes way beyond just hunting for the lowest fees. It’s about finding a service whose security, speed, and overall vibe match what you actually need. The platform you choose will directly shape how smoothly—and cheaply—you can turn your digital assets into cash in your bank account.

You’ve got four main roads to take, and each one is built for a different kind of journey. We'll walk through the big players: Centralized Exchanges (CEXs), Peer-to-Peer (P2P) marketplaces, Bitcoin ATMs, and Over-the-Counter (OTC) desks. Knowing which one to use and when is the key to a hassle-free conversion.

Centralized Exchanges: The Go-To for Most Users

There’s a reason why centralized exchanges like Coinbase, Kraken, or our own vTrader are the default on-ramp and off-ramp for millions. They offer a clean, familiar experience that feels a lot like your online banking portal or brokerage account. If you’re just getting started, a CEX holds your hand through the process.

These platforms act as a trusted middleman, using a central order book to match buyers and sellers. This model creates deep liquidity, which is just a fancy way of saying you can nearly always sell your crypto instantly at a fair market price. Plus, their reputation and regulatory compliance (like being registered with FinCEN in the US) add a serious layer of security and trust. If you need a reliable, no-fuss way to convert typical amounts of crypto, a CEX is almost always your best bet.

Want to explore more options? Check out our breakdown of the 12 best cryptocurrency exchanges for beginners.

The demand for reliable off-ramps is exploding. The global volume of crypto-to-fiat payments has shot up, with some platforms settling nearly $30 million in a single month. This trend, largely driven by stablecoins like USDC and USDT, shows just how much people are relying on these services to bridge the gap between digital and traditional finance.

Peer-to-Peer Marketplaces: For Flexibility and Control

Peer-to-Peer (P2P) platforms such as Paxful or Binance P2P flip the script. Instead of trading with the exchange, you’re dealing directly with another person. The platform just plays referee, holding the crypto in escrow until the fiat payment is confirmed.

This direct-거래 model unlocks a huge range of payment methods you won’t find on most CEXs. You can find buyers willing to settle up with a bank transfer, PayPal, gift cards, or even cash in person. That flexibility makes P2P a fantastic option if you're in a region with spotty banking access or just prefer non-traditional payment methods. But with great flexibility comes great responsibility—you have to do your own due diligence on trading partners to avoid scams.

Bitcoin ATMs and OTC Desks: Niche Solutions

Bitcoin ATMs are exactly what they sound like: cash machines for your crypto. You scan a QR code, send crypto from your wallet, and out comes physical cash. It's hands-down the fastest way to get bills in your hand, but that convenience comes at a premium. Fees often range from 7% to over 20%, making these best for small, urgent withdrawals when cost isn't your primary concern.

At the other end of the scale are Over-the-Counter (OTC) desks. These are white-glove services for high-net-worth individuals or institutions moving serious volume—think $100,000 or more. An OTC desk gives you a private, personalized experience, negotiating a fixed price for your entire block trade away from the public eye.

Key Takeaway: Using an OTC desk prevents slippage—the price drop that can happen when a massive sell order hits a public exchange. It guarantees you get the price you're quoted without crashing the market.

Ultimately, the right platform is a personal choice based on what matters most to you: cost, speed, convenience, or privacy. To make it easier, here’s a side-by-side look at how they stack up.

Detailed Feature Showdown: Conversion Platforms

Here’s a practical comparison of the four main methods for cashing out your crypto. We’ve focused on the details that really matter—like what you’ll pay, how much you can move, and who it’s best for.

| Method | Average Fee Range | Typical Withdrawal Limit | Security Model | Best For |

|---|---|---|---|---|

| Centralized Exchange (CEX) | 0.1% – 1.5% | $10k – $1M+ daily (tiered) | Custodial, highly regulated | Beginners, frequent traders, and standard transactions |

| Peer-to-Peer (P2P) | 0% – 5% (set by seller) | Varies by user and method | Escrow-based, user diligence required | Users needing payment flexibility or in underbanked regions |

| Bitcoin ATM | 7% – 20%+ | Low (e.g., ~$1k – $9k per day) | Non-custodial, physical security | Small, urgent cash withdrawals where fees are a secondary concern |

| Over-the-Counter (OTC) | Negotiable (spread-based) | Very high ($100k+ per trade) | Direct, personalized service | High-volume traders executing large block trades |

This table should give you a clear starting point. A CEX is the workhorse for most people, but P2P, ATMs, and OTC desks all have their place depending on your specific situation.

Your Crypto to Fiat Withdrawal Workflow

So, you’re ready to turn your digital assets into cash in the bank. Excellent. Getting from crypto to fiat on a centralized exchange is the most beaten path for a reason—it's structured, regulated, and generally the most straightforward route. Think of it as the main highway for cashing out.

We'll walk through the entire journey, from proving you are who you say you are, to the moment the funds actually land in your bank account. Knowing what to expect at each stage takes the anxiety out of the process, letting you manage your money with confidence.

The goal here is simple: make your crypto-to-fiat conversion feel like a routine, predictable transaction.

As you can see, the centralized exchange offers the most direct line to a traditional bank, which is exactly why we're digging into its specific workflow.

Completing Your Identity Verification

Before you can withdraw a single dollar, you have to get through Know Your Customer (KYC). This is a non-negotiable step for any legit exchange. It’s a regulatory hurdle designed to clamp down on fraud and money laundering—basically the digital version of a bank asking for your driver's license to open an account.

You'll almost always need to provide:

- A government-issued photo ID (your passport or driver's license works best).

- Proof of where you live (a recent utility bill or bank statement).

- A quick "selfie" to prove your face matches the one on your ID.

Yes, it can feel a bit intrusive, but this is a critical security measure that protects everyone involved. A fast, smooth KYC process is often the first sign you're on a well-oiled platform. On vTrader, for instance, this is mostly automated and can be done in just a few minutes, getting you cleared for trading and withdrawing without a long wait.

Pro Tip: Grab your smartphone and take sharp, well-lit photos of your documents. The number one reason for KYC delays is blurry images or glare. Make sure all four corners are in the shot and every word is crystal clear.

Linking and Securing Your Bank Account

Once your identity is confirmed, it's time to connect your bank account. This is the financial bridge your money will cross. Most exchanges use services like Plaid to let you log into your online banking securely, or they'll have you manually punch in your account and routing numbers.

Security is everything here. Before you link anything, make sure you have Two-Factor Authentication (2FA) activated on your exchange account. It’s a simple step that provides a massive layer of protection. If you want to see how this works in reverse, our guide on how to buy crypto with a bank account has some extra tips on keeping these connections locked down.

And please, double-check every single digit you enter. A tiny typo in an account number is a recipe for failed transfers and a massive headache trying to figure out where your money went.

Selling Your Crypto for Fiat Currency

With all the prep work done, it's time for the main event: selling your crypto. This is more than just clicking a button; a little bit of strategy can save you real money.

First, decide what you're selling. If you're holding a few different assets, it’s usually best to sell something with high liquidity, like Bitcoin (BTC) or Ethereum (ETH). Coins with lots of trading activity tend to have tighter spreads—the gap between the buy and sell price—which means less money is lost in the transaction itself.

Next, you’ll place a sell order. You have two basic choices:

- Market Order: Sells your crypto instantly at the best price available right now. It's fast and guaranteed to execute, but you get whatever the market gives you.

- Limit Order: Lets you set the exact price you want to sell at. Your order will only go through if the market hits your price. You have more control, but there's no guarantee it will sell.

For a quick and easy conversion, a market order is usually fine. But if you're dealing with a large amount or the market is going wild, a limit order can protect you from a sudden price crash while you're trying to sell.

Initiating the Fiat Withdrawal

After the sale, you'll see the fiat currency (like USD or EUR) sitting in your exchange wallet. The final move is getting it to your bank account. Here, you'll choose how you want the money sent, and your options will depend on where you live and the exchange you’re using.

Common withdrawal methods include:

- ACH Transfer (US): This is the standard electronic bank transfer. It’s usually free but takes 1-3 business days to show up.

- Wire Transfer (Global): The faster option. Wires often arrive the same day but expect to pay a fee, typically $25-$35.

- SEPA Transfer (Europe): The go-to for Euro withdrawals. It's quick (usually within a business day) and very low-cost.

It's a classic trade-off: speed versus cost. If you're not in a rush, ACH is the smart, economical choice. If you need the cash now, paying the wire fee might be worth it. Pick your method, confirm the amount, punch in your 2FA code to authorize it, and your money is on its way.

Navigating Fees, Timelines, and Withdrawal Limits

Making a profitable trade is one thing, but getting that cash into your bank account without any nasty surprises is another game entirely. It’s where many people get tripped up. The path from a successful sell order to usable fiat is often littered with unexpected fees, confusing delays, and strict platform limits.

Getting a handle on these variables before you cash out is the secret to a smooth conversion. A little bit of planning ensures those hard-won profits don't get chipped away by costs you never saw coming.

Decoding the Fee Structure

When you turn your crypto into fiat, you’ll run into a few different kinds of fees. They’re not always spelled out clearly, so it’s crucial to know what you’re looking for.

- Network Fees: These aren't paid to the exchange but to the miners or validators who process your crypto deposit on the blockchain. They can swing wildly depending on network congestion. Trying to send Ethereum during peak hours, for example, will cost you a lot more in gas fees than doing it overnight.

- Trading Fees: This is the exchange's cut for executing your sell order. Most use a maker-taker model. A "maker" order (like a limit order) adds liquidity to the market, so you get a lower fee. A "taker" order (like a market order) removes liquidity, so the fee is a bit higher.

- Fiat Withdrawal Fees: This is the charge for sending cash from the exchange to your bank. A standard ACH transfer might be free, but a faster wire transfer can easily set you back $25 or more.

These costs add up fast. For a deeper dive, check out our complete guide on understanding crypto trading fees.

Timelines: Speed Versus Cost

So you’ve hit "withdraw"—how long until you see the money? This almost always comes down to a classic tradeoff: speed vs. cost.

A standard bank transfer, like ACH in the US or SEPA in Europe, is usually your cheapest option—sometimes it's even free. The catch? You'll need to be patient. Expect to wait 1-3 business days for the funds to actually clear and land in your account.

If you need your cash now, a wire transfer is the way to go. It’s more expensive, but the money often arrives the same business day. For urgent situations, that extra fee can be well worth it.

The demand for these reliable on-ramps and off-ramps is fueling massive growth. The crypto payment gateway market, which powers these conversions, was recently valued at $1.685 million and is expected to grow at 13.6% annually for the next ten years. You can read more on this trend in this detailed market analysis.

Managing Withdrawal Limits and Bank Relations

Every regulated exchange has withdrawal limits. These caps are directly tied to your verification level—the more KYC information you provide, the more you can withdraw daily or monthly. If you're planning to cash out a significant amount, get fully verified well ahead of time.

Finally, don't be shocked if a large transfer from a crypto exchange triggers an alert at your bank. Banks are legally obligated to monitor for suspicious activity, and a sudden deposit from a crypto platform often fits the bill.

If your transaction gets flagged, don't panic. The bank might put a temporary hold on the funds and call you to confirm the source. Just be ready to explain where the money came from. A good pro-tip is to call your bank's fraud department before you make a large withdrawal. Giving them a heads-up can help pre-clear the transfer and save you a lot of hassle.

Security and Tax Essentials for Cashing Out

The moment you decide to turn your crypto back into cash is a big deal. It’s not just another transaction; it’s a critical point where your security and financial compliance are on the line. Getting these two things right means you keep your profits safe and stay on the right side of the law, saving yourself a world of trouble later on.

Let's walk through the practices that separate a smooth cash-out from a potential nightmare. Think of these as your digital armor and financial playbook for the final leg of your investment journey.

Fortifying Your Account Against Threats

Security isn't just a feature—it's everything. The process of cashing out is a magnet for scammers and hackers who know you're moving real-world value. Your best line of defense starts with enabling robust two-factor authentication (2FA). Ditch the less-secure SMS codes and use an authenticator app like Google Authenticator. It's a simple switch that makes a huge difference.

Another powerful security layer to use is whitelisting withdrawal addresses. Most good exchanges have this feature, which lets you create a pre-approved list of bank accounts that can receive your money. If a hacker somehow gets into your account, they can’t just drain your funds to their own account—it hasn't been whitelisted, and adding a new one usually involves a mandatory waiting period.

This is also the time to be extra paranoid about phishing scams. You’ll see fake emails pretending to be from your exchange, creating panic about a "problem" with your withdrawal and urging you to click a link. These links lead to convincing but fake login pages built to steal your credentials. We break down exactly how to spot these in our guide on how to protect against phishing attacks.

Key Takeaway: Always go directly to the exchange’s website by typing the address yourself. Never, ever click on links in emails that create a sense of urgency about your money.

Understanding Your Tax Obligations

Now for the part everyone loves to ignore: taxes. In most places, including Australia, cashing out your crypto is a taxable event. When you sell crypto for fiat currency, you're "disposing" of an asset, which triggers either a capital gain or a loss.

It boils down to this:

- If you sell crypto for more than you paid for it, that’s a capital gain, and you owe tax on the profit.

- If you sell it for less, you have a capital loss, which can often be used to offset other gains and reduce your overall tax bill.

Meticulous record-keeping is your best friend here. If your records are clear and comprehensive, you can report everything accurately without breaking a sweat come tax season.

Essential Record Keeping for Compliance

To figure out what you owe, you need to track a few key details for every single transaction you make. Trust me, trying to reconstruct this information months or even years down the road is a headache you don't want.

Get into the habit of logging this information right away:

- Date of Acquisition: When did you first buy the crypto?

- Acquisition Cost: How much did you pay for it, including fees?

- Date of Sale: When did you convert it back to cash?

- Sale Proceeds: How much fiat did you get for it?

- Associated Fees: What did you pay in exchange or withdrawal fees?

Crypto tax software like Koinly or CoinTracker can be a lifesaver, automating most of this by importing data straight from your exchange accounts. These tools can save you countless hours and generate the exact reports you need. And if you’re looking to minimize what you owe, you can explore effective strategies to reduce Capital Gains Tax. While the resource focuses on Australia, the core principles of smart tax planning apply almost everywhere.

Answering Your Crypto to Fiat Questions

Even with the best roadmap, you’re bound to have questions when it’s time to turn your crypto back into cash. This is where we tackle the common hang-ups and practical concerns that pop up right when you’re about to make a move.

Think of this as your quick-reference guide for those final, crucial steps.

Can I Convert Crypto to Cash Without a Bank Account?

You can, but your options get narrow and usually a lot more expensive. The most common routes are Bitcoin ATMs or a Peer-to-Peer (P2P) marketplace.

Bitcoin ATMs are pretty direct: you send crypto to the ATM's wallet, and it spits out physical cash. That convenience comes at a steep price, though—fees can easily climb past 15-20%. They’re really only practical for small, urgent withdrawals.

P2P platforms connect you with local buyers who are willing to pay you directly in cash. While it’s more flexible, it also demands way more caution on your part. If you go this route, always, always meet in a secure, public place to handle the exchange.

How Long Does It Take for Money to Reach My Bank?

The wait time almost entirely boils down to your chosen withdrawal method and how fast your bank processes incoming funds. It's a classic trade-off between speed and cost.

Here's a general idea of what to expect:

- ACH Transfers (US): This is the standard, most common method. It typically takes 1-3 business days to clear and is often free, which is why most people use it.

- Wire Transfers (Global): If you need the money now, a wire transfer is your best bet. Funds usually land the same business day, but you'll pay a premium for that speed, often between $25 and $35.

- SEPA Transfers (Europe): For those in Europe, SEPA is the go-to. It's the regional equivalent of an ACH, known for being both fast and cheap, with withdrawals usually finishing within a single business day.

What Happens if I Send Crypto to the Wrong Address?

This is the one that keeps people up at night. Because blockchains are decentralized and irreversible, sending your crypto to the wrong address almost always means it’s gone for good. There’s no "customer service" or central bank to call to reverse the transaction.

This is hands-down the biggest risk in any crypto transaction. Always double-check, or even triple-check, every single character of the destination address before you hit send. For larger amounts, sending a tiny test transaction first is a cheap and incredibly wise safety measure.

Are There Limits on How Much Crypto I Can Convert?

Yes, just about every centralized exchange has limits on how much cash you can withdraw. These aren't random numbers; they’re tied directly to your account’s verification level, which you'll often see referred to as Know Your Customer (KYC) tiers.

A brand-new account with basic verification will have very low daily and monthly withdrawal caps. To get those limits raised, you’ll need to provide more personal details, like a government-issued ID and a proof of address document.

For really big conversions, say over $100,000, the standard exchange withdrawal process probably won't cut it. In those situations, the best practice is to use a dedicated Over-the-Counter (OTC) desk. They are set up to handle large trades in a single transaction without sending ripples through the market price.

Ready to convert your cryptocurrency to fiat with zero trading fees and a secure, user-friendly platform? Join vTrader today and experience seamless withdrawals, instant purchases, and 24/7 support. Start cashing out with confidence at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.