So, is staking crypto safe? The short answer is that it's a spectrum. Like any investment, it's neither perfectly safe nor a guaranteed disaster.

The reality is that your level of safety comes down to a few key things: the cryptocurrency you choose, the staking method you use, and how seriously you take your own security.

A Balanced View on Staking Safety

Crypto staking is an incredible way to earn passive income on your digital assets, but you have to go into it with your eyes wide open. You need to understand the trade-offs.

Think of it like being a landlord. You collect rent every month (your staking rewards), but you're also exposed to risks. You might get an unreliable tenant (a malicious validator), deal with unexpected plumbing issues (a smart contract bug), or watch the neighborhood's property values drop (crypto market volatility).

The goal isn't to find a "no-risk" staking option—because one simply doesn't exist. Instead, the smart move is to learn how to spot the risks, measure them, and manage them effectively.

Before you lock up your funds, you have to weigh the potential rewards against the real dangers. Our complete guide to crypto staking services dives deeper into how different platforms work.

To give you a clear, high-level overview, we've put together a quick comparison of the pros and cons.

Crypto Staking Risks vs Rewards at a Glance

This table breaks down the fundamental trade-offs in staking, giving you an at-a-glance look at what you stand to gain versus what you could potentially lose.

| Potential Risk | Description | Potential Reward |

|---|---|---|

| Market Volatility | The value of your staked crypto—and the rewards you earn—can plummet during market downturns. | Passive Income |

| Slashing Penalties | Your stake can be partially forfeited if your chosen validator acts maliciously or has too much downtime. | Network Security |

| Smart Contract Bugs | Exploitable flaws in the staking protocol's code could lead to a complete loss of your funds. | Capital Appreciation |

| Lockup Periods | Your assets are often illiquid for a set time, meaning you can't sell even if the market crashes. | Governance Rights |

This is just the starting point. Understanding these core dynamics is the first step toward making smarter, safer staking decisions.

How Crypto Staking Actually Secures Networks

To really get a handle on the question "is staking crypto safe," we first have to understand what it’s actually doing. Staking isn't just some magic money machine; it’s the engine that keeps many modern blockchains secure and honest. It's the core of a system called Proof-of-Stake (PoS).

Think of a blockchain as a community-run bank where the members make all the big decisions. In a PoS network, your staked coins are like your shares in that bank. By "locking up" your crypto, you earn the right to help run the show—specifically, by validating new transactions and adding them to the official ledger.

This isn't just volunteer work. For helping keep the ledger accurate and secure, the network rewards you with more crypto. This reward system gives everyone with skin in the game a financial reason to play by the rules and act in the network's best interest.

The Key Roles in Network Security

When it comes to staking, you can play one of two main roles. Each comes with a different level of responsibility and technical know-how, and knowing the difference helps you see where you fit in.

- Validators: These are the real heavy-lifters, the active bookkeepers of the blockchain. They run powerful computers (nodes) 24/7 that are constantly proposing and confirming new blocks of transactions. To even get this job, you have to lock up a serious amount of the network's crypto—think of it as a huge security deposit.

- Delegators: Let's be honest, not everyone has the cash or the technical chops to run a validator node. That’s where delegators come in. They're token holders who "delegate" their coins to a validator they trust. In doing so, they beef up the network’s security without dealing with any of the complex tech and, in return, get a cut of the validator's rewards.

Staking creates a powerful economic disincentive against cheating. Validators have their own money on the line, and if they try to approve a fake transaction, they can lose their entire stake. This process, called "slashing," makes attacking the network a very expensive and stupid idea.

How Your Stake Creates a Shield

Every single coin that gets staked—whether it's from a massive validator or a small-time delegator—adds another layer to the network's armor. The more value that's locked in, the harder and more expensive it becomes for anyone to mess with the system.

An attacker would need to get their hands on an insane amount of crypto, often more than 51% of all staked coins, just to have a chance at causing problems.

This collective "buy-in" creates a decentralized shield that protects every transaction on the network. When you stake, you're directly contributing to that shield. For a deeper dive into this and other core crypto concepts, the guides at the vTrader academy are a great place to start. Now that we've covered how it works, let's look at the risks.

The Primary Risks You Must Understand

While staking helps secure a blockchain, it’s not free money. To really answer the question, "is staking crypto safe," you have to look the risks squarely in the eye. Understanding these five primary dangers is the first step toward building a staking strategy that can actually last.

Think of it like investing in a new restaurant. You wouldn’t just show up and hand over your cash. You'd want to know about the chef, the location, the competition, and the local economy. Staking is no different; you have to do your homework.

Slashing: The Penalty for Bad Behavior

The most direct threat to your staked crypto is slashing. This is an automated penalty the network slaps on a validator for messing up. That could mean doing something fraudulent, like double-signing a transaction, or something as simple as having their server go offline for too long.

If your validator gets slashed, a piece of their staked crypto—and by extension, a piece of your delegated funds—is burned forever. It’s the network’s way of keeping everyone honest and online.

For example, on the Tezos network, several validators were caught double-signing blocks. The people who had delegated their tokens to them saw a chunk of their investment disappear overnight. This is why choosing a top-tier validator isn’t just a recommendation; it’s essential.

Smart Contract Vulnerabilities

A lot of staking protocols, especially in the DeFi and liquid staking world, run on smart contracts. Think of these as complex bits of code that automatically handle all the staking and reward payouts.

The problem is, if there’s a single bug or flaw in that code, a hacker can exploit it and drain every last token locked inside.

A well-known DeFi platform lost around $200 million in staked crypto after an attacker found a weak spot in its smart contract. Once those funds are gone, they're almost always gone for good.

Validator and Platform Risk

Your safety also hangs on the people and platforms you trust. A validator might not be a scammer, but they could just be incompetent. Maybe they're running old, insecure hardware that constantly crashes, tanking your rewards and putting you at risk of getting slashed.

Even worse, a centralized exchange or staking pool could get hacked, mismanage user funds, or get shut down by regulators. You're handing them your crypto and trusting them to keep it safe. That’s a huge layer of risk you need to be comfortable with. Part of this is digging into the details, like understanding the fee structures and operational details of any platform you consider.

Market Volatility: The Unseen Factor

Even if you pick the perfect validator and the code is flawless, your investment is still at the mercy of the crypto market's wild price swings. The tokens you stake and the rewards you earn can plummet in value during a bear market.

Imagine you're earning a great 10% APY. But then, the token's price crashes by 50%. You're earning more tokens, sure, but the dollar value of your entire investment has been nearly cut in half. This happens all the time and can wipe out your staking gains in a hurry.

Liquidity Risk: The Inability to Sell

Finally, you have to deal with lock-up periods. Many staking protocols make you lock your tokens for a set amount of time, known as an unbonding period. This can be a few days or even several weeks.

During this time, your crypto is totally illiquid. You can't sell it. You can't move it. You can't do anything but watch, even if the market is in a freefall. We’ve seen "Flash Crash" events where some coins lose over 30% of their value in a matter of hours. Being stuck on the sidelines while that happens is a massive risk. With about 12% of all crypto assets now staked, more and more investors are waking up to these realities.

Comparing Different Ways to Stake Your Crypto

Staking isn't a one-size-fits-all game. The path you take completely changes your potential rewards, how much work you have to put in, and most importantly, your overall safety. Picking the right approach is all about matching it to your tech skills and how much risk you’re comfortable with.

Let’s walk through the four main ways people stake their crypto, each with its own trade-offs. This should help you figure out which one clicks with your investment goals.

H3: Running a Validator Node

This is the most direct, hands-on way to get involved. By running your own validator node, you become a core part of the blockchain's security, directly processing transactions and creating new blocks.

Think of it as being your own bank.

- Rewards: You have the highest earning potential because you keep 100% of the rewards. There’s no middleman taking a cut.

- Risks: This path also carries the most risk. You’re on the hook for everything—the technical setup, keeping it online 24/7, and securing it from attacks. One mistake can trigger slashing penalties, causing you to lose a chunk of your staked crypto. This is for the tech-savvy and requires a serious upfront investment.

H3: Delegated Staking

If the idea of running your own server makes you sweat, delegated staking is a fantastic alternative. You simply "delegate" your coins to a professional validator who handles all the complicated stuff for you. In exchange, they take a small commission from your earnings.

The good news is you never give up your private keys, which keeps your funds more secure. The catch? Your earnings depend entirely on the performance and integrity of the validator you pick. Choose poorly, and you could see lower rewards or even lose money if they get slashed.

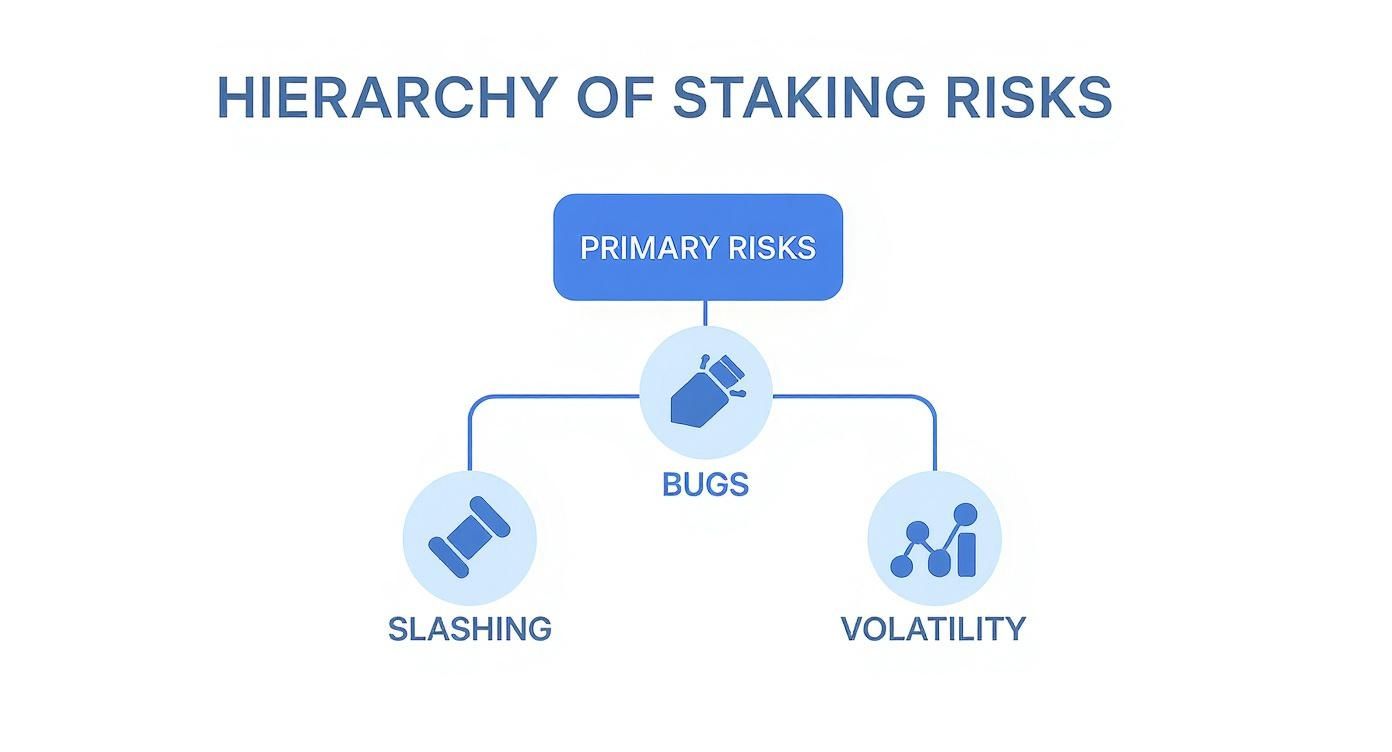

The infographic below shows the main risks you'll face with almost any staking method, including delegation.

While delegating makes life easier, it doesn't shield you from fundamental risks like slashing or a sudden market crash.

H3: Staking on a Centralized Exchange

For pure convenience, nothing beats staking on a centralized exchange (CEX). It’s usually as easy as clicking a button in their app. The exchange takes care of all the technical details, making it the most beginner-friendly option out there.

But that convenience comes at a price: counterparty risk. You are trusting the exchange with your money. If the platform gets hacked, goes bankrupt, or freezes withdrawals, your assets could be gone for good. Exchanges also tend to offer lower reward rates compared to doing it yourself.

H3: Liquid Staking

A more modern approach, liquid staking, was designed specifically to solve the problem of locked-up funds. When you stake through a liquid staking protocol, you get a tradable token—a liquid staking derivative (LSD)—that represents your staked coins.

This means your capital is no longer stuck. You can sell, lend, or use your LSD token in other DeFi apps, all while still earning those staking rewards.

This flexibility is a game-changer, but it introduces a new vulnerability: smart contract risk. Your funds are essentially held by the protocol's code, and if there's a bug or exploit, hackers could drain it. The booming Ethereum staking ecosystem is a perfect example of where liquid staking is really taking off.

The incredible growth in Ethereum staking, with over 52% of its supply now locked up, signals massive investor confidence. Yet, with around 38% of retail investors using staking pools, as reported by Coinlaw.io, the related counterparty and technical risks are a major consideration for anyone asking, "Is staking crypto safe?"

To make this all a bit clearer, here's a quick comparison of the different methods.

Comparison of Crypto Staking Methods

| Staking Method | Best For | Key Risks | Typical Reward Level |

|---|---|---|---|

| Running a Validator | Technical experts with significant capital | Slashing, operational costs, downtime | Highest |

| Delegated Staking | Users seeking balance between control and ease | Validator performance, slashing | High |

| Centralized Exchange | Beginners prioritizing convenience | Counterparty risk, lower rewards | Low to Medium |

| Liquid Staking | DeFi users who want to stay liquid | Smart contract bugs, LSD price risk | Medium to High |

Ultimately, the right method depends on your personal risk tolerance and how hands-on you want to be.

Actionable Steps to Make Your Staking Safer

Knowing the risks is one thing, but actively defending against them is what really matters. You need a game plan.

Think of it like setting up a security system for your house. No setup is 100% foolproof, but adding the right layers of defense makes you a much tougher target for trouble. These practical steps can seriously lower your risk and let you stake with more confidence.

Carefully Vet Your Validators

Choosing a validator is probably the biggest decision you'll make when you delegate your crypto. Don't just sort by the lowest fees and pick the first one you see—that's often a red flag. A solid validator is your first and best defense against slashing and missed rewards.

Before you commit any funds, do a little digging on these key stats:

- Uptime: You want to see a nearly perfect record here, ideally 99% or higher. If a validator is constantly offline, you’re losing out on rewards and raising your risk of being slashed.

- Commission Rate: Super-low fees look tempting, but a rate that seems too good to be true might mean the validator is skimping on security or hardware. A fair commission keeps them motivated to do a good job.

- Community Standing: See what people are saying about them on X (formerly Twitter) or Discord. A validator with a strong, transparent history and an active community presence is almost always a safer choice.

Diversify Your Stake

You've heard it a million times: don't put all your eggs in one basket. That advice is just as true for staking. Even the most reliable validator can have a bad day or run into a technical glitch.

To protect yourself from a single point of failure, diversify your stake.

Instead of sending all your coins to one validator, split them up between three to five different, high-quality operators. That way, if one of them goes offline or gets slashed, the hit to your total bag is much smaller. The same logic applies to platforms—spreading your crypto across a few different exchanges or protocols reduces your counterparty risk.

"A proactive security mindset is essential. The data shows that while many investors are worried about platform safety, the vast majority are already taking personal security steps like using 2FA and strong passwords. This highlights a crucial point: your safety starts with your own actions."

This cautious attitude is pretty common. A recent survey showed that 50% of crypto owners hold back from investing more because of security fears, with 19% strongly agreeing that it's a major barrier. But here's the good news: 95% of them are already using at least one security measure, which shows that people are taking active steps to manage their risk. You can dig into the specifics of how investors are handling their security in the full survey from Kraken.

Use a Hardware Wallet

If you're staking directly from your own wallet or using a non-custodial platform, keeping your private keys safe is everything. A hardware wallet (often called a "cold wallet") is a device that stores your keys completely offline. That makes them basically immune to online attacks like malware or phishing scams.

When you use a hardware wallet for staking, no transaction can be signed without you physically confirming it on the device. It creates a physical firewall between your assets and anyone trying to steal them online, giving you the final say. When you ask, "is staking crypto safe," a big part of the answer depends on your own setup, and a hardware wallet is a non-negotiable cornerstone of good security.

Frequently Asked Questions About Staking Safety

Even after you've got a good handle on the risks, a few specific questions always seem to pop up. Let's tackle them head-on, so you can walk away with the clarity you need to decide if staking is a good fit for you.

Answering these common concerns helps fill in the final pieces of the puzzle when you're sizing up staking for your own portfolio.

Can You Lose All Your Money from Staking?

It's not the most likely scenario, but yes—a complete loss is possible. This isn't usually just from a nasty market downturn, although a 95% price crash can sure feel like one. The real risk of losing it all comes from a catastrophic failure on the technical side.

The two main culprits to watch out for are:

- Severe Slashing Events: In very rare cases, a validator might do something seriously wrong on the network. This can trigger a massive slashing penalty that could wipe out a huge chunk of the funds you've staked.

- Smart Contract Exploits: This is arguably the bigger and more common threat. If the staking protocol you're using has a critical bug in its code, a hacker could drain all the funds locked in that contract. When that happens, stakers are left with nothing.

Is Staking Safer Than Day Trading?

Pitting staking against day trading is like comparing a landlord to a house flipper. They're both in the real estate game, but their risk profiles are worlds apart. Day trading is an intense, high-stress activity where you're constantly exposed to extreme market swings. A few bad trades, and you could be wiped out in minutes.

Staking, on the other hand, is a more hands-off strategy with an entirely different set of dangers.

The risks in staking are slower-burning and more technical. You’re worried about validator uptime, smart contract code, and lockup periods, not split-second price movements. For most people with a long-term mindset, staking is generally considered less risky than the high-stakes gamble of day trading.

How Are Staking Rewards Taxed?

This is a huge one, and the answer is often complicated and changes depending on where you live. In many places, like the United States, staking rewards are typically treated as income the moment they hit your wallet. The value is based on the token's market price on the day you receive them.

Then, if you decide to sell those reward tokens later, you might also owe capital gains tax on any profit you made since they were issued to you.

Crypto tax laws are still a moving target and can be incredibly confusing. It's highly recommended to consult with a qualified tax professional in your area. They can give you personalized advice for your situation, helping you stay compliant and avoid any nasty surprises come tax season. For more general questions about our platform, feel free to check out our detailed vTrader FAQ section.

Ready to explore staking with zero trading fees? vTrader offers a secure and user-friendly platform to grow your crypto portfolio. Start staking today and maximize your returns.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.