So, you want to learn how to trade cryptocurrency. It’s not just about picking a coin and hoping for the best. To do it right, you need to get a handle on the fundamentals: choosing a solid exchange, figuring out how to read the market, knowing which order types to use, and—most importantly—managing your risk.

The journey starts with setting up your account, then moves into basic analysis, and finally to placing smart trades that protect your capital. Think of this guide as your roadmap to get started on the right foot.

Starting Your Crypto Trading Journey

Jumping into the world of digital assets can feel like a lot all at once, but it doesn't have to be. The secret is building a solid foundation of practical knowledge instead of getting bogged down in complex jargon. This is your orientation—we’re here to help you get the right tools and mindset before you ever click "buy" or "sell."

Our goal is simple: build your confidence by walking you through a structured approach. Using vTrader as our playground, we'll cover all the essentials, from locking down your account to making sense of market movements. This method will help you dodge the common pitfalls that trip up so many beginners who rush in without a plan.

Adopting a Trader's Mindset

Before you even think about placing an order, you need to get your head in the game. Successful trading isn’t about hitting the jackpot on a single moonshot. It’s a discipline built on smart decisions and a commitment to always be learning.

Here are a few core principles every trader lives by:

- Patience is your best friend: The market has its own rhythm, with ups and downs. Don't get suckered into chasing quick gains or panic-selling when prices dip.

- Never stop learning: The crypto space evolves at lightning speed. You have to dedicate time to understanding new projects, tech, and trading strategies to stay sharp.

- Risk management is everything: Your number one job is to protect your capital. We'll dig into specific techniques for this later on.

Trading is a marathon, not a sprint. The goal isn’t to win one trade; it’s to stay in the game and remain profitable over the long haul by making calculated, informed decisions.

Understanding the Market Opportunity

Why is everyone so eager to learn how to trade crypto? Just look at the explosive growth. The global crypto market was valued at around USD 5.7 billion in 2024 and is on track to more than double to USD 11.7 billion by 2030.

This incredible expansion shows just how much investor interest is pouring into the space, making it a great time to build your trading skills and participate in this dynamic market.

This guide is your roadmap. For those who want to go even deeper, vTrader has an incredible library of educational content. I highly recommend checking out the resources in the vTrader Academy (https://www.vtrader.io/en-us/academy) to build on what you learn here. By pairing this practical guide with more in-depth knowledge, you’ll be in a much stronger position to start your trading journey with real confidence.

Securing Your vTrader Account Like a Pro

Alright, this is where things get serious. If you want to learn how to trade cryptocurrency, you have to start with a rock-solid foundation. A secure account isn't just a "nice-to-have"—it's the absolute bedrock of your trading journey.

Ignoring these next steps is like leaving the keys in your brand-new car with the engine running. Let’s make sure your account is a fortress from day one.

Lock It Down with Two-Factor Authentication

Your first line of defense is a strong password, but that’s just table stakes. The single most important security upgrade you can make is enabling Two-Factor Authentication (2FA).

Think of 2FA as a digital deadbolt on your account. Even if a thief somehow gets your password, they can't get past the second lock without your phone or physical key. This one move drastically cuts down your risk.

vTrader gives you a couple of great options here:

- Authenticator Apps: Tools like Google Authenticator are the go-to for most traders. The app generates a new six-digit code on your phone every 30 seconds. You’ll need this code, plus your password, to log in.

- Hardware Keys: For the ultimate peace of mind, a physical device like a YubiKey is unmatched. You plug it into a USB port and tap it to approve a login, making it virtually impossible for someone to access your account remotely.

For anyone starting out, an authenticator app hits the sweet spot between ironclad security and everyday convenience. Do this the moment your account is created.

Your security is your responsibility. In the world of digital assets, there's often no "undo" button. Taking 10 minutes to properly set up 2FA is the single best investment you can make in protecting your future portfolio.

Getting Through the KYC Process

Once you’re secure, you'll run into the Know Your Customer (KYC) process. This is a standard identity check required on regulated platforms like vTrader. You'll be asked to submit a government-issued ID and maybe a quick selfie to prove you're really you.

It might feel like a bit of a chore, but KYC is there to protect everyone by preventing fraud and keeping bad actors off the platform. The key to a smooth verification is just providing clear, well-lit photos of your documents. If you hit a snag, the vTrader FAQ section has plenty of guides to help you out.

Funding Your Trading Account

Now for the exciting part: funding your account. With your account created, secured, and verified, it’s time to add some capital. You have a few ways to do this, and each has its own trade-offs between speed, cost, and convenience.

Choosing the right deposit method really depends on your immediate goal. Are you looking to get in the game instantly, or are you moving a larger sum where minimizing fees is the top priority?

Here’s a quick breakdown of what to expect with each option on vTrader.

Account Funding Methods on vTrader Compared

| Funding Method | Processing Speed | Typical Fee | Best For |

|---|---|---|---|

| Bank Transfer (ACH) | 3-5 Business Days | Often Free | Larger deposits where speed isn't critical. |

| Debit Card | Instant | 2-4% | Quick, small deposits to start trading immediately. |

| Crypto Deposit | Minutes | Network Fee Only | Transferring existing assets from another wallet. |

For most first-timers, a debit card is the simplest and fastest route. The slightly higher fee is often worth it for the ability to jump into the market right away. As you get more comfortable, you might find that bank transfers for larger amounts or direct crypto deposits make more sense financially.

Navigating the vTrader Platform with Confidence

Opening a trading platform for the first time can feel like stepping into a spaceship's cockpit—a dashboard filled with blinking numbers, complex charts, and scrolling data. The vTrader interface is built to be powerful, but you only need to get a handle on a few key areas to start making smart decisions. Let's walk through the essential components you'll be looking at every day.

Your journey to learn how to trade cryptocurrency effectively really starts with knowing your tools. Take some time to get familiar with the main sections of the dashboard: the watchlist for keeping an eye on assets, the charting tools for your analysis, the order book showing live buy and sell action, and your portfolio summary. This is your command center.

Reading the Language of the Market

Before you even think about placing a trade, you have to understand what the market is trying to tell you. This doesn't take a finance degree; it just starts with learning to read the story that price charts tell. At its core, basic market analysis is about spotting patterns and trends to get a feel for where prices might head next.

The most fundamental tool here is the candlestick chart. Each "candle" represents a set time period (like one hour or one day) and shows you four critical pieces of information:

- Open: The price at the beginning of the period.

- Close: The price at the end of the period.

- High: The highest price the asset hit during that period.

- Low: The lowest price the asset hit during that period.

A green candle usually means the price closed higher than it opened (a bullish sign), while a red candle means it closed lower (a bearish sign). Just by watching these patterns form, you can get a gut feeling for the market's momentum.

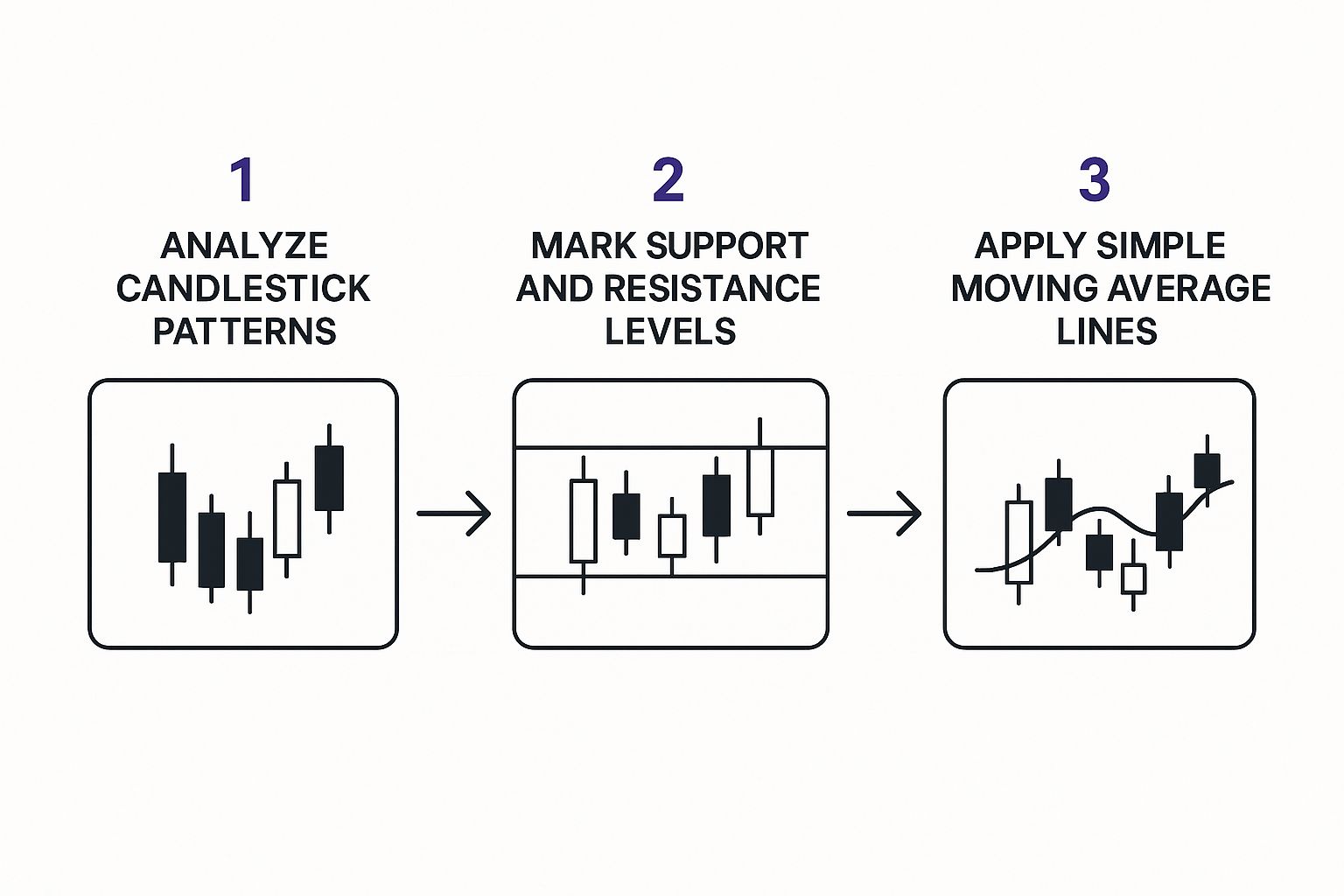

This simple workflow gives you a structured way to look at a chart, moving from the immediate price action to the bigger market trends.

Identifying Key Price Levels

Looking past individual candles, you'll want to start identifying support and resistance levels. These are just horizontal price zones where an asset has historically had a tough time breaking through.

- Support is a price level where a downtrend often stalls out because of a concentration of buying interest. Think of it as a floor that the price struggles to fall through.

- Resistance is the exact opposite—a price ceiling where an uptrend tends to run out of steam due to selling pressure. The price just can't seem to punch above it.

Marking these levels on your vTrader chart is as easy as drawing horizontal lines where you see the price repeatedly reverse. These zones are powerful because they give you logical areas to consider entering trades or setting your stop-loss orders.

Don't overcomplicate it. As a beginner, your goal isn't to find dozens of obscure patterns. It's to spot the most obvious support and resistance zones that everyone else can see, because that’s where collective market psychology often kicks in.

Using Simple Indicators for Clarity

Finally, let's add one simple but incredibly effective tool: the Moving Average (MA). A moving average smooths out all the choppy price data into a single, easy-to-read line, making it much easier to see the overall trend. For instance, a 50-day Simple Moving Average (SMA) simply shows you the average closing price over the last 50 days.

If the current price is trading above its 50-day SMA, it suggests a general uptrend is in play. If it's trading below, it points to a downtrend. It’s a clean way to cut through the day-to-day noise and see the bigger picture.

Understanding market volume is also huge, as it confirms the strength behind these moves. For example, the crypto market's total trading volume hit a staggering $9.72 trillion in a single month in 2025, a surge of 7.58% that shows the immense liquidity driving these price changes.

When you're trading assets like Ethereum, external factors can also play a big role. High network congestion, for instance, can lead to painful transaction fees. It's always a good idea to check real-time network data, and you can do that right on vTrader's ETH Gas Tracker. This little trick helps you time your trades for when network fees are lower, saving you real money on every transaction. You can find that tool here: https://www.vtrader.io/en-us/eth-gas-tracker.

Placing Your First Trades Using Smart Order Types

Alright, you've got your bearings on the vTrader dashboard and have a handle on basic analysis. Now it's time for the rubber to meet the road. This is the moment where theory becomes action.

Executing your first trade is a huge milestone, but doing it with a clear plan is what separates a casual speculator from a disciplined trader. It's about more than just hitting that big green "Buy" button and hoping for the best.

To really get the hang of trading crypto, you need to understand the tools you have for getting in and out of the market. We call these "order types," and each one serves a very different strategic purpose. Let's dig into the three you'll be using most.

Market Orders for Speed and Simplicity

The most direct way to jump into the market is with a Market Order. It's simple: you're telling vTrader to buy or sell an asset immediately at whatever the best available price is right now. It is, without a doubt, the fastest way to open a position.

Let's say Bitcoin is hovering around $70,000. You've got a feeling it's about to pop and you want in now. A market order gets you in instantly, filling your order with whatever sellers are offering at that exact moment.

But that speed comes with a small catch. In a chaotic market, the price you actually get—what we call the "fill price"—might be a tiny bit different from the price you saw when you clicked the button. This is called slippage. It’s usually not a big deal for a liquid asset like Bitcoin, but it’s something you should know about.

Limit Orders for Price Control

What if you're not in a rush and have a specific price in your sights? That's where a Limit Order becomes your best friend. A limit order lets you set the exact price you're willing to buy or sell at. Your order just sits there and will only execute if the market hits your price—or better.

Let’s go back to our Bitcoin example. You like BTC, but you think $70,000 is a little steep. You decide you’re only buying if it dips back down to $69,500. By setting a buy limit order at $69,500, you guarantee you won't pay a penny more. You're in complete control of your entry.

A limit order is your primary tool for disciplined trading. It forces you to define your entry and exit points ahead of time, removing the emotion of chasing a rising price or panic-selling into a dip.

This control is huge, but there's a flip side: your order might never get filled. If Bitcoin never drops back to your price and just keeps climbing, you'll be left watching from the sidelines. It’s the classic trade-off between guaranteeing the trade (Market Order) and guaranteeing the price (Limit Order).

Using Stop-Loss Orders to Protect Your Capital

This one is non-negotiable. The most critical order for managing your risk is the Stop-Loss Order. Think of it as your automated safety net. It's a preset order that automatically sells your position if the price falls to a specific level, capping your potential losses.

So, you got your Bitcoin at $69,500. The very next thing you should do is place a stop-loss order at, say, $68,000. If the market suddenly turns against you, your order triggers and sells your position, preventing a small loss from turning into a disaster. This is the foundation of responsible trading. Keeping an eye on trading costs is also vital; you can check out the full fee structure on vTrader to plan everything out.

A common strategy involves trading against stablecoins. These are essential tools, giving you a stable asset to move into during volatile times. By 2025, their total market cap shot past $230 billion, with USDT and USDC making up over 90% of that value. Since they are pegged to fiat currencies, they let you lock in profits or sit on the sidelines without cashing out to traditional money.

Understanding Common Crypto Order Types

To help you get started, here's a quick rundown of the essential order types. Think of this as your cheat sheet for making smarter trading decisions from day one.

| Order Type | Primary Function | Best Use Case |

|---|---|---|

| Market Order | Executes a trade immediately at the best available market price. | When speed is your top priority and you need to get into or out of a position right away. |

| Limit Order | Executes a trade only at a specific price or better. | When you have a target entry or exit price and are willing to wait for the market to reach it. |

| Stop-Loss Order | Automatically triggers a market sell order if the price drops to a specific level. | To protect your capital and limit potential losses on every single trade you make. |

Mastering these three orders will dramatically improve your control over your trading, helping you move from simply reacting to the market to proactively managing your strategy.

A Practical Walkthrough on vTrader

Let's tie this all together with a real-world scenario. You want to buy 0.01 BTC using USDT, a popular stablecoin. Here’s a smart way to approach it on the platform:

- Analysis: You've looked at the chart and identified a solid support level for BTC at $69,000. You believe it's a strong entry point.

- Entry Plan: Instead of buying at market, you set a Buy Limit Order for 0.01 BTC right at $69,000 USDT. Now you wait for the price to come to you.

- Risk Management: The moment your limit order fills, you immediately place a Stop-Loss Order at $67,500. This clearly defines your maximum acceptable loss on the trade.

- Profit Target: At the same time, you can set a Take-Profit Limit Order (which is just a sell limit order) at $72,000. This automatically locks in your gains if the trade goes your way.

By using these smart orders, you’ve built a complete trading plan with a defined entry, an exit for loss, and an exit for profit. That's how you trade with intention.

Building Your Crypto Risk Management Plan

Landing one massive, lottery-ticket win isn't the key to long-term success in crypto. Not even close. The real secret weapon of traders who stick around is a disciplined, almost boring, commitment to risk management. It's about surviving the inevitable losses.

Without a solid plan, the market's notorious volatility will chew right through your capital. This is where we build your financial armor—a set of non-negotiable rules that protect your account so you can stay in the game long enough to find your edge.

The Foundation: The 1% Rule

Let's kick things off with the most powerful rule in trading: the 1% rule. The idea is deceptively simple but incredibly effective. It means you should never, ever risk more than 1% of your total trading capital on any single trade.

If you're working with a $2,000 account, your maximum potential loss on one position is just $20. It sounds tiny, right? But this single guideline is what separates professional traders from gamblers. It ensures that a string of bad trades—and trust me, every trader has them—won't knock you out of the market.

A trader following the 1% rule could take ten straight losses and still have 90% of their starting capital ready to go. This provides an incredible psychological and financial buffer, allowing you to make calm, rational decisions instead of panicking.

This rule forces you to put capital preservation first and profits second. It’s the absolute bedrock of a sustainable trading career.

Calculating Your Position Size

Following the 1% rule doesn't mean you can only trade with $20. It means your potential loss is capped at $20. This is where position sizing becomes your best friend. It’s the art of adjusting how much crypto you buy based on where you place your protective stop-loss order.

The formula is straightforward:

Position Size = (Total Capital x Risk Percentage) / (Entry Price – Stop-Loss Price)

Let's walk through a real-world scenario. You're eyeing a long position on Bitcoin and your analysis points to a good entry.

- Your Total Capital: $2,000

- Your Risk (1%): $20

- Your Entry Price: $65,000

- Your Stop-Loss Price: $64,500 (this is a $500 difference per BTC)

Now, plug those numbers into the formula: Position Size = $20 / $500 = 0.04 BTC. Simple. You can buy up to 0.04 BTC knowing that if you get stopped out, your loss is capped at exactly $20. If you're trading a more volatile asset and need a wider stop-loss, the formula automatically shrinks your position size to keep that dollar risk constant. It’s a critical calculation you must do before every single trade.

For a deeper dive into potential price levels, you can check out tools like this guide on BTC price prediction.

Taming Your Trading Psychology

Even with the best rules in place, your biggest opponent is often the person in the mirror. The crypto market is an emotional rollercoaster, and two feelings in particular are absolute account killers for new traders: fear and greed.

- FOMO (Fear Of Missing Out): We’ve all felt it. That burning impulse to jump on a coin that’s already pumping. Chasing green candles is a proven recipe for buying the top right before a painful correction.

- Panic Selling: The flip side. This is when you dump your assets in a panic as the market dips, often locking in a loss right before a major recovery.

So how do you fight back against these powerful emotions? You create a trading plan before you even think about clicking the "buy" button, and you stick to it religiously.

Your plan can be a simple checklist that defines your entire strategy:

- Entry Trigger: What specific market condition (like the price bouncing off a key support level) tells you it's time to get in?

- Profit Target: At what price will you take profits? This stops greed from turning a great trade into a losing one.

- Stop-Loss: Where is your non-negotiable exit point if the trade goes against you? This is your line in the sand.

Writing this down takes the emotion and guesswork out of the equation. When the market gets chaotic, you don’t have to think—you just execute the plan you made when you were calm and logical. This discipline is the final piece of the puzzle, turning you from a reactor into a planner.

Common Questions About Learning to Trade Crypto

Even with the best-laid plans, jumping into the crypto trading ring is going to stir up some questions. It's just part of the process as you move from theory to seeing how this all plays out in the real world. Let’s cut through the noise and tackle some of the biggest concerns new traders have.

How Much Money Do I Need to Start Trading?

Let's clear this up right away: there's no magic number, and it’s a lot less than you probably think. Many platforms, including vTrader, will let you open an account with as little as $10 or $20. The amount isn't what's important—your mindset is.

Think of your first $100 not as an investment, but as tuition. You’re paying to learn. This is the money you’ll use to get a feel for the platform, experience the gut-check of real market swings, and inevitably make those first few mistakes without blowing up your financial life. Your first goal is to learn, not to get rich.

Treat your first deposit like you're buying a ticket to a hands-on workshop. Once you've actually built a consistent strategy and have a firm grip on managing risk, then you can think about putting more capital to work. Never, ever trade with money you need for rent, bills, or other essentials.

What Is the Single Most Common Beginner Mistake?

It's not even close: letting your emotions run the show. This almost always rears its ugly head as "revenge trading." You take a loss, and an overwhelming urge kicks in to jump right back into the market and "win it back."

This is a surefire way to make bigger, dumber trades with zero risk management. The same goes for FOMO-ing into a coin that’s already pumping or panic-selling when the market takes a routine dip. These knee-jerk reactions are the quickest path to an empty account.

Good trading is boring. It’s about having a plan and sticking to it with discipline, no matter what your gut is screaming at you. Honoring your strategy—especially your stop-loss orders—is the only real defense against your own worst emotional instincts.

Should I Focus on Just a Few Cryptocurrencies?

When you’re just starting? Absolutely, one hundred percent yes. Your best bet is to stick with one or two major, high-volume cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

There are a few solid reasons for this:

- Tons of Data: These coins have years of price history, which makes learning technical analysis much more reliable and insightful.

- Less Wild Swings: They're still volatile, but they aren't as prone to the insane pumps and dumps you see in tiny "altcoins."

- Endless Resources: You’ll find a massive community, countless articles, and non-stop analysis on BTC and ETH, which is gold for a new trader.

Trying to keep up with a dozen different coins is a recipe for disaster. You'll spread yourself too thin and never truly understand the personality of any single asset. By zoning in on BTC or ETH, you can actually learn the fundamentals of price action and market psychology in a more predictable environment. Master one, then think about branching out.

Ready to apply what you've learned? With vTrader, you get a commission-free platform designed to help you succeed, complete with advanced tools, real-time data, and a full learning academy. Start your journey with confidence and a $10 sign-up bonus today at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.