If you’ve spent any time in the crypto space, you’ve probably heard the term FUD thrown around. It’s an acronym that stands for Fear, Uncertainty, and Doubt, and it’s one of the most powerful forces that can move markets.

Think of it as a strategic whisper campaign designed to rattle investors and tank an asset's price.

Decoding FUD In Crypto And What It Means For You

At its heart, FUD is the engine driving many of crypto's most dramatic price swings. It preys on basic human psychology, flipping market sentiment from bullish optimism to pure panic, sometimes in just a few hours. This can be intentional—bad actors spreading rumors to manipulate prices for their own gain—or it can happen accidentally when complex news is misunderstood and amplified.

Crypto is the perfect breeding ground for FUD. Its natural volatility, combined with the lightning speed of social media, means a single unverified tweet or a sensationalized headline can spark a massive chain reaction of panic selling. This often happens even if the original "news" was completely false or wildly exaggerated.

To really get a handle on FUD, it helps to first understand what makes crypto different from traditional money. This definitive guide to fiat currency vs cryptocurrency is a great place to start.

The Three Pillars Of Crypto FUD

FUD isn't just a random feeling; it’s a specific cocktail of emotions designed to cloud your judgment. Breaking it down helps you spot it in the wild before it can influence your decisions.

Each component—Fear, Uncertainty, and Doubt—targets a specific emotional trigger to push investors into making irrational moves. Here's a quick look at how they work together.

The Three Pillars Of Crypto FUD

| Component | Description | Investor Reaction |

|---|---|---|

| Fear | Spreading alarming, worst-case scenarios about a project or the market. | Triggers immediate panic selling to cut potential losses. |

| Uncertainty | Introducing vague doubts about a project's future, tech, or team. | Creates hesitation and erodes long-term confidence. |

| Doubt | Questioning the fundamental value or legitimacy of a crypto, often without proof. | Encourages investors to dump their holdings and question their own research. |

This trio is so effective because it bypasses logic and hits you right in the gut. When combined, these emotions can convince even seasoned investors to sell at the worst possible time.

The crypto market is still young and finding its footing, which makes it especially vulnerable to these kinds of manipulation tactics. Building your knowledge is the best defense. You can sharpen your skills and learn to trade with a clearer head in our vTrader Academy.

The Hidden History Of FUD From Boardrooms To Blockchain

Believe it or not, FUD was a weapon in corporate arsenals long before Satoshi Nakamoto even wrote the Bitcoin whitepaper. The tactic of spreading Fear, Uncertainty, and Doubt isn't a crypto-native phenomenon; it’s a time-tested strategy used by industry giants to squash competition and seize control of the narrative.

This whole approach became infamous in the world of big tech. While the term has roots stretching back to the 1920s, it really took off in the 1970s. It was the go-to playbook for established behemoths like IBM, who would sow skepticism about competitors' products to slow them down. You can dig deeper into how these old-school strategies found a new home in crypto on Changelly.com.

From Corporate Strategy To Crypto Tactic

In the corporate world, FUD was a slow burn. A company might drop hints about a future product release that would supposedly make a competitor's brand-new tech obsolete. This would cause potential customers to hesitate and delay their purchases. It was subtle, but effective.

The psychological game is identical to what we see in crypto today. The goal has always been to manipulate perception, kill momentum, and influence decision-making by painting a competitor as a massive risk. The only real difference is the terrifying speed and scale at which it all happens now.

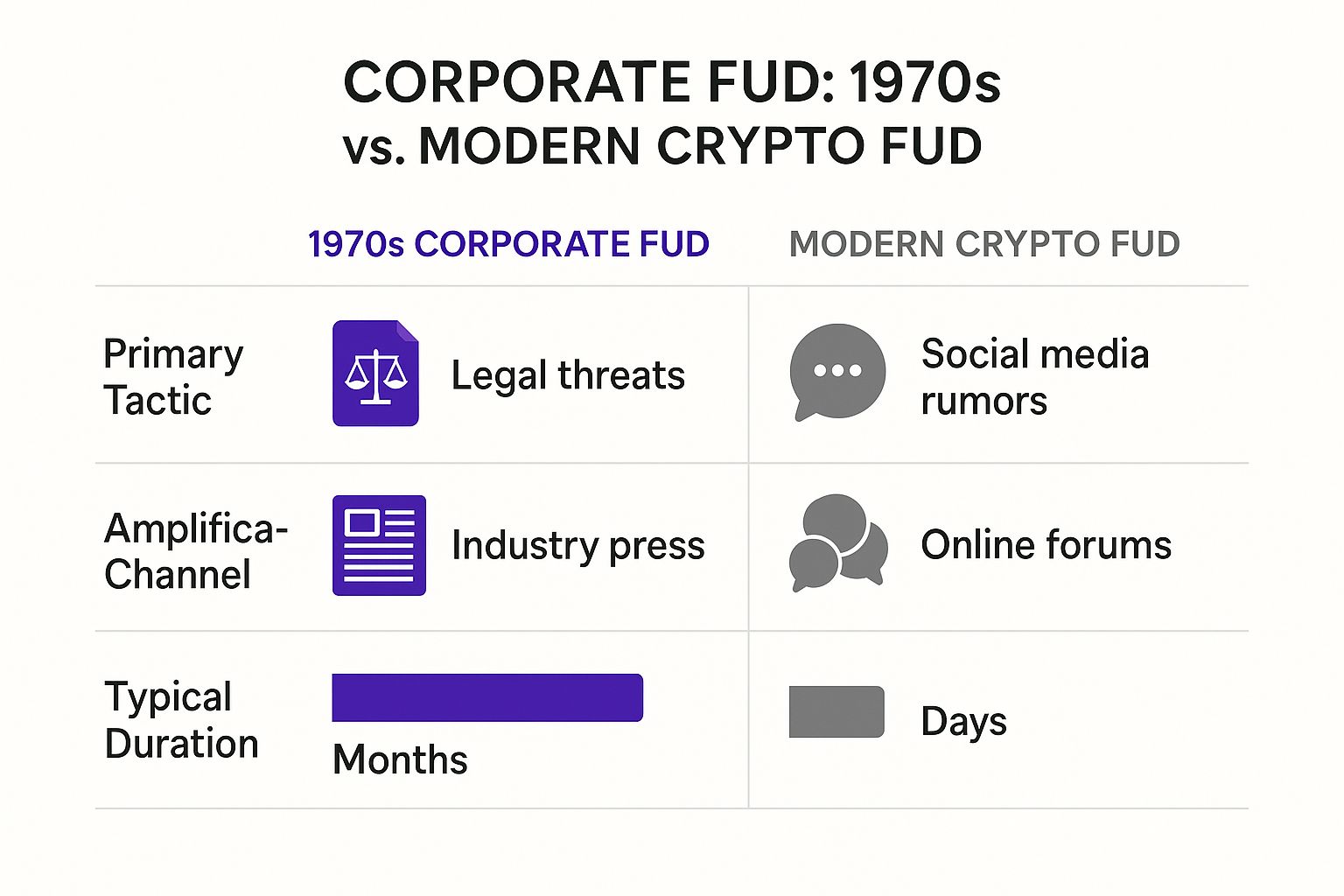

The infographic below really nails how this classic corporate tactic has been supercharged for the crypto markets.

As you can see, the core strategy hasn't changed a bit. But the tools have evolved dramatically, making FUD campaigns faster and more widespread than ever before.

The Great Amplification

What once took months to whisper through industry magazines can now go viral in minutes on platforms like X (formerly Twitter) and Telegram. This massive amplification has morphed FUD from a targeted corporate jab into a market-moving tidal wave that anyone with an internet connection can unleash.

Key Takeaway: Understanding that FUD is a deliberate, historical manipulation tactic—not just random market jitters—is the first step toward building immunity. It’s an old playbook being run in a new, lightning-fast arena.

By recognizing its origins, you can start to see FUD for what it is: often a calculated attack, not a genuine sign of a project's weakness. This historical context is absolutely crucial for separating real red flags from strategically planted doubt.

How FUD Triggers Real Market Crashes

Fear, Uncertainty, and Doubt aren't just feelings—they're potent forces that can drain real value straight from your portfolio. It often starts with a single negative headline or a perfectly timed rumor. That first domino falls, sparking a chain reaction of panic selling that can quickly snowball into a full-blown market crash.

The whole thing usually kicks off when a piece of bad news, whether true, exaggerated, or completely fabricated, hits social media or a major news outlet. Retail investors, seeing the smoke, immediately assume there's a fire and start selling to cut their losses. This initial sell-off nudges the price down, which then trips the automated stop-loss orders set by other traders, piling on even more sell pressure.

This wave of selling can trigger cascading liquidations, especially in leveraged markets where traders borrow to amplify their bets. As prices tumble, these leveraged positions are automatically closed out by exchanges, creating massive sell orders that flood the market and send prices into a nosedive.

The Role Of Whales And Influencers

It’s not just the little guys panicking, either. Huge investors, known as "whales," can use FUD as a weapon. By spreading or amplifying negative stories, they can deliberately tank the price of an asset.

Why? This manufactured dip is their golden ticket to scoop up more coins or tokens at a massive discount from everyone who’s panic-selling. Once they’ve loaded their bags, the FUD campaign mysteriously quiets down, and the market starts to find its feet again.

"A market crash triggered by FUD is a masterclass in wealth transfer. It moves assets from the hands of the fearful and impatient to the portfolios of the patient and strategic."

Even off-the-cuff remarks from big names can send markets reeling. Remember when JPMorgan's CEO Jamie Dimon famously called Bitcoin a “fraud” back in the day? It sent ripples of uncertainty through the market, even though his own company later dove headfirst into blockchain tech. You can dig deeper into how powerful players can pull the strings by learning more about unmasking crypto market manipulation on Certik.com.

Connecting FUD To The Price Charts

Once you understand how a FUD-driven crash works, you start to see market dips differently. Instead of just reacting with your gut when you see red on the charts, you can begin to question the story behind the drop. Is this a genuine technical problem, or is it just a coordinated campaign designed to shake out the "weak hands"?

Being able to spot these patterns is a vital skill. Another piece of the puzzle is understanding what's happening on-chain, and our real-time ETH Gas Tracker offers a great window into network activity during these wild swings. By connecting the dots between the news and the price action, you learn to see FUD not as a random disaster, but as a predictable—if chaotic—market force. That’s the key to staying rational when everyone else is losing their cool.

Fud Vs Legitimate Concern A Comparison

It’s one thing to spot FUD, but it’s just as important to recognize genuine red flags. This table breaks down the key differences to help you tell baseless fear-mongering from issues that demand your attention.

| Characteristic | Typical FUD | Legitimate Concern |

|---|---|---|

| Source | Anonymous accounts, unverified rumors, or influencers with a clear agenda. | Reputable security firms, official team announcements, or verified data. |

| Evidence | Vague claims, emotional language, and a lack of verifiable proof. | Specific, data-backed evidence, code exploits, or on-chain analysis. |

| Motivation | Often designed to manipulate prices for personal gain. | Aims to inform the community of real risks, vulnerabilities, or problems. |

| Call to Action | "Sell now before it goes to zero!" or other urgent, panicked commands. | "Be aware of this security risk," or "The team is addressing this bug." |

| Resolution | Fades away once the market moves on or the manipulator's goal is met. | Addressed by the project team with clear updates, fixes, or explanations. |

Ultimately, learning to distinguish between the two comes down to critical thinking. Always question the source, demand evidence, and consider the messenger's potential motives before making a move.

Famous Crypto FUD Events And What We Learned

To really get a feel for what FUD in crypto is, you have to see it in the wild. Theory is one thing, but watching a single, flimsy narrative send a multi-billion dollar market into a nosedive? That’s a lesson you don’t forget.

These moments from crypto history are more than just stories; they’re a playbook of FUD tactics that get recycled time and time again. By breaking them down, you can learn to spot the red flags of a FUD campaign—from the initial spark to its wildfire spread on social media and the inevitable blood-red candles on the charts. This knowledge is your best armor against making panicked, emotional trades.

The Never-Ending Story: China Bans Bitcoin

If there's a hall of fame for FUD, the "China bans Bitcoin" story is a first-ballot entry. This headline, in one form or another, has been rattling cages and crashing markets since at least 2013.

It almost always starts the same way: a vague memo from some obscure Chinese regulatory body, or maybe a poorly translated news clip. Before you know it, social media algorithms are pushing the most terrifying interpretations to the top of everyone's feed. Within hours, the market is bleeding out as panicked investors dump their bags.

So, what’s the takeaway here?

- Nuance is the first casualty of FUD. The real story is never as simple as "China bans Bitcoin." In reality, the crackdowns have usually targeted financial institutions or mining operations, not a blanket ban on citizens owning BTC.

- History rhymes. For crypto veterans, this FUD cycle is so predictable it's become an inside joke. For many seasoned traders, another China "ban" isn't a signal to panic-sell; it's a potential buying opportunity.

The Mt. Gox Collapse: A Cautionary Tale

The implosion of the Mt. Gox exchange back in 2014 wasn't FUD—it was a real, catastrophic disaster. But the event has been weaponized ever since to spread FUD about the fundamental security of Bitcoin and other exchanges.

At its peak, Mt. Gox was handling over 70% of all Bitcoin transactions. When it went belly-up after losing hundreds of thousands of Bitcoin, the initial narrative blamed a supposed flaw in the Bitcoin protocol itself. This was a powerful story because it attacked the very foundation of crypto's value. The FUD screamed that Bitcoin was broken and your money wasn't safe.

The real lesson from Mt. Gox is learning to separate the protocol from the platforms built on it. The Bitcoin network was never hacked; a centralized, horribly-managed exchange was. That's a crucial distinction for understanding and managing your risk.

The Environmental Impact Debate

More recently, a massive FUD campaign has been built around Bitcoin's energy consumption. In 2021, the narrative exploded with sensational headlines claiming Bitcoin mining used more power than entire countries, painting it as an environmental menace. This story gained huge traction and was a major factor in a significant market crash.

While Bitcoin's energy use is a valid topic, the FUD is almost always stripped of crucial context. These stories conveniently ignore the rapidly growing use of renewable energy in mining, the colossal energy footprint of the legacy financial system, and the constant push for greater efficiency.

To cut through the noise, it's essential to get your information from reliable sources that present the full picture. For the latest unbiased reporting, check out the vTrader News section.

These events all teach the same core lesson: FUD works by latching onto a kernel of truth, blowing it out of proportion, and triggering an emotional response. By learning from the past, you can build the mental fortitude to navigate the market with a calm, analytical approach.

Your Toolkit For Navigating A FUD-Filled Market

When a FUD storm hits, navigating the crypto market can feel like trying to sail through a hurricane. Your gut screams "sell," but a little voice of reason is probably whispering to hang on. This is your playbook for turning up the volume on that voice and making calls based on cool-headed strategy, not raw fear.

The name of the game is to stop being a victim of market gossip and start acting like a proactive analyst. It all begins with building a mental filter to separate the signal from the deafening noise, giving you the confidence to trust your own judgment when things get heated.

Adopt A Critical Mindset

The first—and most powerful—tool in your kit is healthy skepticism. When you see a dramatic headline or a panicked tweet, your first instinct should be to question everything. Don't just react. Take a breath and run through this quick mental checklist.

- Who is the source? Are they a verified expert or a well-known news outlet? Or is it just some anonymous account with a cartoon profile pic? Anonymous sources are almost always red flags.

- What's their angle? Does this person or group have something to gain if the price tanks? Big players and rival projects often have a direct financial incentive to spread a little FUD.

- Is there any actual proof? A real concern will have verifiable on-chain data, code updates, or official statements to back it up. FUD, on the other hand, usually just leans on vague claims and emotional language.

This simple three-step process forces your analytical brain to take the wheel, shoving those emotional reactions into the back seat. It’s like checking for smoke before you run out of the building just because a fire alarm went off.

A pre-planned investment thesis is your single best defense against emotional trading. If you know why you invested in a project in the first place, a wave of baseless FUD is far less likely to shake your conviction.

Practical Strategies To Neutralize FUD

Beyond just thinking critically, you need some solid actions you can take to stay grounded when the market gets wild. These techniques will help you keep your perspective when everyone else is losing theirs.

-

Zoom Out on the Charts: That scary red candle on the hourly chart can look terrifying. But before you panic, zoom out to the daily, weekly, or even the monthly view. This simple move gives you some much-needed long-term perspective and often shows that the so-called "crash" is just a small dip in a much bigger uptrend.

-

Cross-Reference Your Information: Never, ever trust a single source. If one website is screaming about catastrophic news, check with several other independent and reputable outlets. If nobody else is confirming the story, you're probably just looking at a targeted FUD campaign.

-

Understand Your Costs: High trading fees can make panic-selling even more painful, especially when you have to buy back in later. Knowing your platform's fee structure is critical. For instance, understanding a model like vTrader’s commission-free model can directly influence your strategy by removing the cost barrier to making a move.

-

Have an Exit Strategy: Decide on your selling conditions before the FUD hits. Maybe it's a specific price target or a fundamental change in the project's development. This plan, made with a clear head, will be your anchor in a sea of panic.

Common Questions About Crypto FUD Answered

To really wrap our heads around what FUD in crypto is, let's dive into some of the questions that pop up most often. Getting these straight will sharpen your understanding of this powerful market force and clear up any confusion.

Is All Negative News About Crypto Considered FUD

Not even close. And knowing the difference is one of the most important skills you can develop as a trader. Legitimate criticism is actually essential for a healthy market to function. The real distinction comes down to intent and evidence.

Genuine concerns are always backed by something solid. We're talking about a documented security vulnerability in a protocol's code, a detailed analysis of a project's flawed tokenomics, or an official regulatory crackdown from a government agency. These are specific, data-driven points that you should be paying attention to.

FUD, on the other hand, is all about stoking emotion and confusion. It leans heavily on anonymous sources, over-the-top language, and vague, sweeping claims. The goal isn't to inform you; it's to make you panic. Always ask yourself: "Can this be verified, or is it just trying to scare me into selling?"

How Does Social Media Make FUD Worse

Social media is basically rocket fuel for FUD. It takes a small spark of misinformation and turns it into a raging inferno, amplifying its reach and impact at an incredible speed. The very design of these platforms creates a perfect storm for FUD to spread.

Here’s a quick rundown of how it happens:

- Speed and Reach: A misleading tweet or post can go viral in minutes, hitting millions of screens around the world before anyone even has a chance to check the facts.

- Algorithmic Bias: Social media algorithms are built to promote engagement. FUD is a goldmine for engagement—it sparks angry replies, frantic shares, and emotional reactions. So, the algorithm naturally pushes it right to the top of your feed.

- Echo Chambers: The same algorithms trap us in bubbles where fear just bounces around and gets louder. Dissenting opinions or factual corrections get filtered out, making the negative feeling seem like the only reality.

On top of that, you have coordinated campaigns using armies of bots and fake accounts to create the illusion of a massive panic. This can make a completely manufactured FUD narrative look far more credible than it really is.

Can Positive News Also Be A Form Of Market Manipulation

Yes, absolutely. This is the other side of the same coin. The opposite of FUD is what we call "FOMO" (Fear Of Missing Out), and it can be just as manipulative. Instead of spreading fear to drive the price down, bad actors use wild hype and misleadingly positive news to whip up a buying frenzy.

This is the classic playbook for a "pump and dump" scheme. A shady project might pay a bunch of influencers to shill their token, announce fake partnerships, or lie about their tech progress to get the price soaring. As soon as unsuspecting retail investors pile in, the manipulators dump their massive bags, crashing the price and leaving everyone else holding worthless tokens.

You have to be just as skeptical of over-the-top hype as you are of scary rumors. For more answers to common crypto questions, feel free to explore our detailed vTrader FAQ section. A smart trader looks for steady, evidence-based growth, not emotional rollercoasters.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.