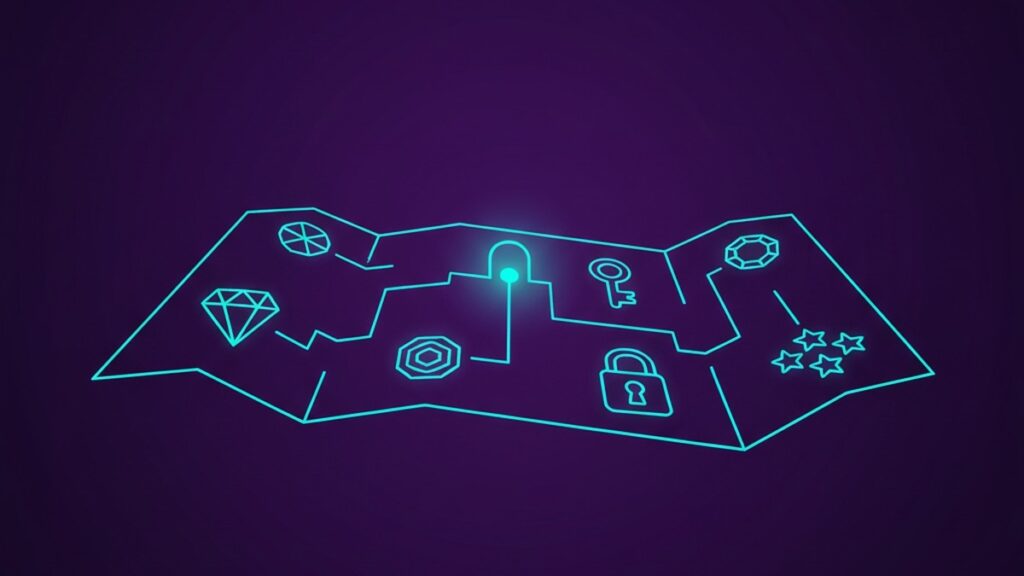

Spotting early cryptocurrency gems has become a treasure hunt in 2025, with the digital landscape brimming with opportunities and pitfalls. As the crypto ecosystem continues to expand, investors are eager to discover the next big thing before it hits the mainstream. However, separating the genuine prospects from potential “exit liquidity traps” requires a keen eye and a strategic approach. Here’s a guide to navigating the crypto jungle and uncovering potential gems with five crucial checks: builders, usage, liquidity, token design, and security.

The Architects Behind the Code

In the world of cryptocurrencies, the people behind the project—the builders—are often the most telling indicators of potential success. Projects led by experienced developers and visionary leaders tend to inspire more confidence. For instance, examining the team behind Ethereum or Polkadot reveals a track record of innovation and achievement. When assessing a new crypto project, delve into the team’s background. Do they have a history of successful projects? Are they transparent and communicative with their community? Builders who are in it for the long haul are more likely to steer their projects towards genuine growth rather than short-lived hype.

Real-World Application

Usage is another critical factor in identifying early crypto gems. A project with a clear, practical application stands a better chance of success. In 2025, the crypto market is saturated with coins and tokens, but only a handful offer real-world solutions. Consider the rise of Chainlink, which emerged as a leader by providing decentralized oracles that connect blockchain technology with real-world data. Similarly, when evaluating a new project, investors should assess whether the token serves a genuine purpose beyond speculation. Is there a demand for the technology? Are businesses or users actively integrating it into their operations? The answers to these questions can separate viable projects from mere vaporware.

Navigating Liquidity

Liquidity is the lifeblood of any financial asset, and cryptocurrencies are no exception. A project’s liquidity reflects its ability to facilitate transactions without significantly affecting its price. Low liquidity can be a red flag, indicating potential manipulation or difficulty in cashing out investments. In contrast, projects with healthy liquidity often signal strong investor interest and market confidence. For example, Uniswap’s decentralized exchange model has become a blueprint for liquidity in the DeFi space. Investors should look for projects with active trading volumes and presence on reputable exchanges. This not only ensures ease of buying and selling but also reduces the risk of becoming a victim of “exit liquidity traps,” where early investors are left holding the bag as insiders sell off their holdings.

The Blueprint of Token Design

The design of a token can significantly impact its success and longevity. A well-crafted tokenomics model considers factors like supply, distribution, and utility. In 2025, projects that incorporate deflationary mechanisms or utility-based incentives often attract more attention. Take, for instance, Binance Coin’s (BNB) success, partly due to its token burn strategy, which reduces supply over time. Investors should examine a project’s whitepaper to understand its tokenomics. Are there mechanisms in place to encourage holding and usage? Is the distribution fair, or is it skewed towards insiders? A robust token design can prevent excessive volatility and align the interests of developers, users, and investors.

Security: The Foundation of Trust

Last but not least, security is paramount in the crypto world. With the rise in cyber threats, a project’s commitment to security can make or break its future. In 2025, blockchain’s inherent security features are complemented by additional measures like smart contract audits and bug bounty programs. Projects that prioritize security not only protect their investors but also build trust within the community. Consider Ethereum’s transition to Ethereum 2.0, which emphasized increased scalability and security. Investors should look for projects that have undergone third-party audits and have a track record of timely security updates. In an environment where hacks and exploits are common, a proactive approach to security can safeguard investments and instill confidence.

Balancing Risk and Reward

While these five checks—builders, usage, liquidity, token design, and security—provide a solid framework for identifying early crypto gems, it’s crucial to remember that the crypto market is inherently volatile. Even projects that tick all the boxes can face sudden downturns due to market sentiment or regulatory changes. Diversification remains a key strategy, allowing investors to spread risk across different projects and sectors.

Additionally, staying informed and engaged with the crypto community can offer insights and early warnings about upcoming trends or potential red flags. Platforms like Twitter, Reddit, and dedicated crypto forums serve as valuable resources for real-time information and discussions.

In conclusion, discovering early crypto gems in 2025 is a blend of art and science, requiring thorough research, sound judgment, and a bit of intuition. By focusing on the fundamentals and maintaining a balanced perspective, investors can navigate the complexities of the crypto market and potentially uncover the next big opportunity. As always, it’s essential to approach each investment with caution, recognizing both the immense potential and the inherent risks of the rapidly evolving digital frontier.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.