Let me be crystal clear about something: Apple hasn’t announced jack about stablecoin integration. Neither has Google, Airbnb, or X. What we have are “preliminary talks” according to Fortune’s sources. In corporate speak, that means someone had coffee with someone else and maybe exchanged business cards.

This isn’t happening yet. Let me repeat that. This. Isn’t. Happening. Yet.

What we’re talking about is the massive opportunity sitting right in front of Big Tech’s face. A $27 trillion payment rail that already exists, already works, costs a fraction of traditional payments, settles instantly, operates 24/7, and somehow these companies are just now having “preliminary discussions” about maybe possibly considering it. It’s like watching someone discover fire in 2025.

Here’s my hot take: The fact that this isn’t already happening is insane. The infrastructure exists. The regulatory framework is clarifying. Circle just IPO’d and doubled on day one. Stablecoins processed more volume than Visa and Mastercard combined last year. Yet Apple’s still “exploring” this? They should’ve been all over this two years ago.

Let me walk you through why this opportunity is massive, why it’s inevitable, and why the fact it hasn’t happened yet tells you everything about how slow Big Tech moves when banks are involved.

The Opportunity That’s Just Sitting There

Every day, Visa and Mastercard extract 2-3% from virtually every transaction in America. That’s $145 billion annually in processing fees alone. Not revenue from goods sold. Just fees. Rent on the payment rails.

Stablecoins could do the same thing for 1.5% or less. On efficient chains, we’re talking 0.1%. The infrastructure already handles $27 trillion in annual volume. It works. It’s proven. It’s just missing one thing: consumer adoption.

Enter Apple Pay. Or Google Pay. Or any payment app that normal humans actually use.

The opportunity is stupidly obvious. Take the payment rail that already works better and cheaper, plug it into the payment apps people already use, cut out the middlemen taking their 3% tax on everything. Simple, right?

Wrong. Because this isn’t actually happening. It’s just talks. Preliminary ones at that.

Why This Should Already Exist

Circle already announced Apple Pay support back in 2022. That was for businesses accepting USDC through Apple Pay. The reverse integration, letting consumers spend stablecoins through Apple Pay, should’ve been the immediate next step. Instead, we’re here in 2025 with “preliminary discussions.”

You know what’s not preliminary? The $27.6 trillion that moved through stablecoins last year. The fact that sending money internationally through banks still takes 3-5 days and costs $45. The reality that Venmo charges 1.75% for instant transfers of your own money.

The technology works. USDC maintains its dollar peg. Transactions settle in seconds. The rails handle more volume than traditional payment networks. So why are we still talking about “early conversations”?

The Real Reason This Isn’t Happening (Yet)

Banks. It’s always banks.

Apple Card runs through Goldman Sachs. Google Pay connects to traditional bank accounts. These companies have deep, profitable relationships with the existing financial system. Relationships that generate billions in interchange fees, data, and cross-selling opportunities.

Integrating stablecoins doesn’t just disrupt Visa and Mastercard. It disrupts the banks behind every card in your Apple Wallet. You think Jamie Dimon’s happy about Apple potentially routing payments around JPMorgan’s rails? You think Bank of America wants to lose that sweet, sweet interchange revenue?

This is why we’re seeing “preliminary talks” instead of product launches. Big Tech is trying to figure out how to capture this opportunity without burning their banking relationships. Good luck with that balancing act.

What Apple Should Actually Do (But Won’t)

Here’s what Apple should do tomorrow: Announce native USDC support in Apple Pay. Let users add their Circle account like they add a credit card. Enable tap-to-pay with stablecoins at any merchant that accepts Apple Pay. The merchant still gets dollars, Apple handles the conversion in the background. Users save on fees, merchants get instant settlement, Apple takes a small cut. Everyone wins except Visa.

They won’t do this. Not tomorrow, not next month, probably not even next year.

Instead, they’ll continue these “preliminary discussions.” They’ll form committees. They’ll study the regulatory landscape. They’ll wait for someone else to go first. Meanwhile, stablecoins will process another $30 trillion while Apple debates whether disrupting payment rails is worth the angry phone calls from bank CEOs.

The Integration Path Nobody’s Talking About

When this does happen (not if, when), it won’t be a big announcement. Apple won’t stand on stage talking about revolutionizing payments. They’ll quietly add a “Add Digital Dollar Account” option in Apple Pay settings. Maybe they’ll mention it in passing at WWDC. “Oh, by the way, you can now add USDC to Apple Pay. Moving on.”

The integration already exists in limited form. Circle’s making it work for businesses. The technical lift to make it work for consumers is trivial. This is a business decision, not a technical challenge.

What’s more likely? Apple waits for regulatory clarity from the GENIUS Act. They watch Circle’s stock price. They see if the Trump administration actually follows through on crypto-friendly policies. Then, maybe, if the stars align and the banks aren’t too angry, they’ll flip the switch.

Why The Delay Actually Matters

Every day Apple doesn’t do this, that’s another day of 2-3% fees on trillions in transactions. Another day of three-day settlement times. Another day of “sorry, international transfers take 5-7 business days.”

More importantly, it’s another day for someone else to get there first. Maybe not Google or X, they’re all equally slow. Think bigger. What happens when WeChat or Alipay adds stablecoin support? What happens when some startup nobody’s heard of builds the killer app that makes spending stablecoins as easy as Apple Pay?

The window for Big Tech to own this transition is open now. It won’t stay open forever.

The Regulatory Cover They’re Waiting For

The GENIUS Act is moving through Congress. Trump’s explicitly pro-crypto. The SEC’s backing off enforcement actions. Circle just went public without the world ending. The regulatory green lights are flashing.

Yet we’re still in “preliminary talks.”

This tells you everything about how Big Tech approaches financial services. They don’t innovate. They wait for permission. They wait for someone else to take the regulatory arrows. Then they swoop in with better UX and distribution.

Facebook tried to innovate with Libra. Dead. Killed by regulators before it launched. That’s the lesson every Big Tech company learned: Don’t be first in financial services. Be second with better distribution.

What Actually Happens Next

Here’s my prediction: Nothing happens in 2025. These “preliminary talks” continue through the year. Maybe we get an announcement in Q4 about a “pilot program” starting in 2026.

The real catalyst won’t be Apple or Google. It’ll be when a major merchant, someone like Amazon or Walmart, starts accepting stablecoins directly. Not through payment processors, not through conversion, just straight USDC for goods. That’s when Big Tech panics and suddenly these “preliminary talks” become “urgent product roadmaps.”

Or maybe Circle pulls a power move. They’ve got Apple Pay integration for businesses. What if they flip it without Apple’s permission? Let users spend USDC through virtual cards that work with Apple Pay. Technically possible. Regulatory nightmare. Exactly the kind of move that forces Apple’s hand.

The Revolution That’s Taking Forever

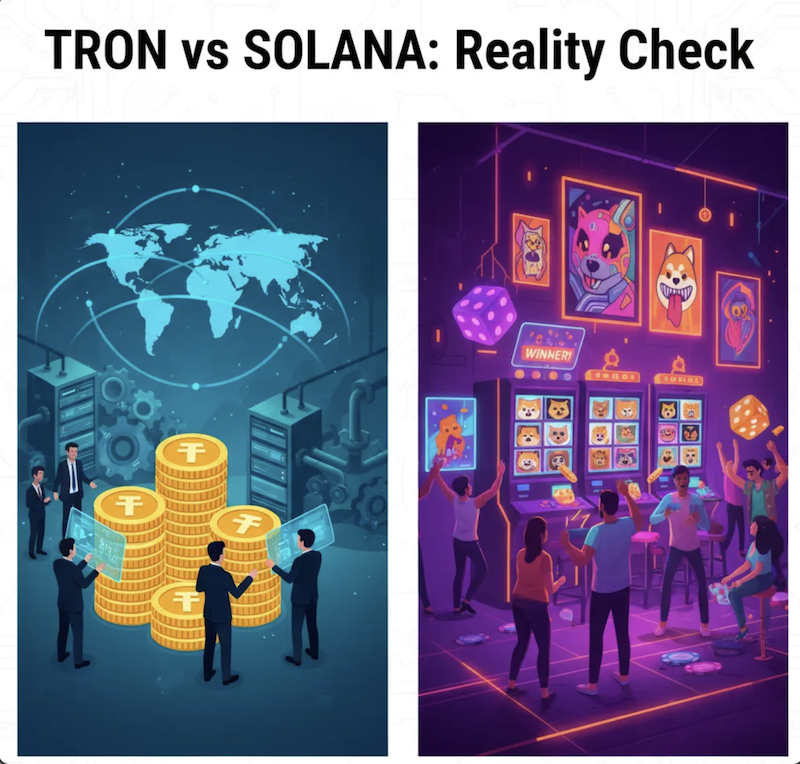

The killer app for crypto was always payments. Not DeFi yields. Not NFTs. Not whatever new token launched this week. Just boring, simple payments that work better than the current system.

Stablecoins are that better system. They exist. They work. They’re processing trillions in volume. They just need consumer distribution.

Apple Pay is that distribution. A billion iPhones worldwide. Tap to pay everywhere. The perfect marriage of better infrastructure and massive distribution.

The fact that this marriage hasn’t happened yet? That tells you everything about how slowly money moves. Not the transactions. The industry itself. The negotiations, the politics, the protection of existing revenue streams.

This integration is inevitable. The economics are too compelling, the user experience too superior, the opportunity too massive. The only question is whether Big Tech captures this opportunity or watches someone else do it first.

Based on these “preliminary talks,” I’m betting on someone else. Big Tech doesn’t disrupt payments. They optimize them after someone else takes the risk.

The $27 trillion opportunity is just sitting there. Waiting. While Apple has another meeting about maybe having a meeting about possibly considering actually doing something.

That’s not disruption. That’s just tech being tech. Slow, careful, and perpetually six months away from changing everything.