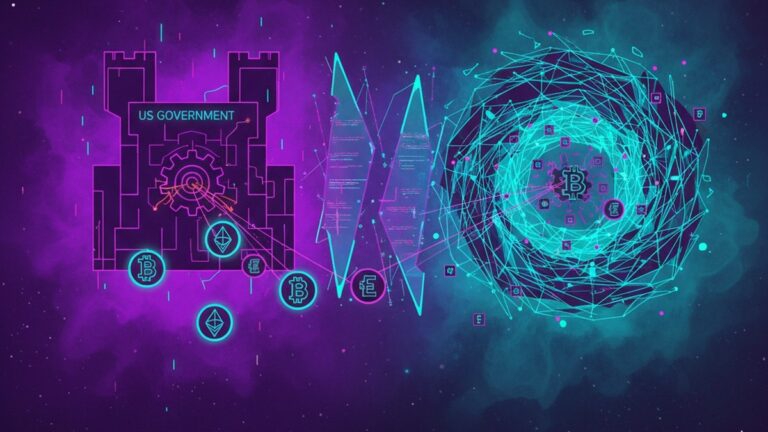

Amid the ongoing government shutdown, U.S. lawmakers are caught in a heated debate over the taxation of cryptocurrencies. With the shutdown entering its third week, the crypto tax policy has emerged as a crucial issue that could significantly impact both the burgeoning digital currency market and the broader economy.

The Current State of Affairs

Cryptocurrencies have been a topic of intense discussion in Congress, and recent developments have only intensified these conversations. The current tax policy treats cryptocurrencies like property, meaning every transaction, no matter how small, is a taxable event. This policy, critics argue, stifles the everyday use of digital currencies by imposing significant tax reporting burdens on users and businesses alike.

As the Senate grapples with these issues, some lawmakers are advocating for a shift in policy that would exempt small transactions from taxation altogether. This move, they argue, could spur wider adoption of cryptocurrencies in daily transactions, similar to how cash is used today.

Proponents of Tax Exemptions

Supporters of tax exemptions for cryptocurrencies argue that the current system is outdated and incompatible with the fast-paced world of digital currencies. Senator Cynthia Lummis, a vocal advocate for crypto-friendly policies, stated that “we’re missing out on a huge opportunity to integrate digital currencies into our everyday lives.” Lummis and her allies believe that by easing the tax burdens on small transactions, the government could foster innovation and bolster the U.S.’s standing as a leader in the tech industry.

These lawmakers are pushing for legislation that would exempt transactions below a certain threshold, suggesting figures between $200 and $600. Such a change, they argue, would mirror the de minimis tax exemptions already in place for foreign currency transactions, thus leveling the playing field for cryptocurrencies.

Opposing Views

On the other side of the aisle, some lawmakers are wary of granting special tax exemptions to cryptocurrencies. Senator Elizabeth Warren has been outspoken in her concerns that such exemptions could lead to increased tax evasion and money laundering. “We need to ensure that our tax system is fair and that everyone pays their fair share,” Warren emphasized, highlighting the potential risks of creating loopholes that could be exploited by bad actors.

Critics also point out that exempting crypto transactions from taxes could lead to significant revenue losses for the government, which is already grappling with budgetary constraints amid the shutdown. They argue that any changes to the tax code should be carefully considered and balanced against the need for fiscal responsibility.

Industry Stakeholders Weigh In

The cryptocurrency industry itself is closely watching these developments. Many businesses and investors are hopeful that a more favorable tax policy could lead to increased adoption and investment in digital assets. However, they also recognize the importance of regulation in ensuring the market’s stability and credibility.

Leading crypto exchanges and blockchain companies have voiced support for reasonable tax exemptions, noting that the current system is cumbersome and discourages innovation. “We need a tax policy that understands the unique nature of digital assets,” said a spokesperson for a major crypto exchange. “By creating an environment that encourages growth, the U.S. can maintain its competitive edge in the global market.”

The Path Forward

As the debate continues, it’s clear that finding a balance between encouraging innovation and ensuring regulatory compliance is no easy task. Lawmakers are under pressure to address the issue swiftly, given the potential implications for the U.S. economy and the crypto industry.

Some experts suggest that a phased approach could be the most effective way forward, gradually introducing exemptions while monitoring their impact on both the market and government revenues. This approach could allow lawmakers to make data-driven decisions and adjust policies as needed.

In the meantime, the government shutdown and the broader political climate add layers of complexity to the discussion. With many government functions halted, the pressure is on for Congress to find solutions that not only address immediate concerns but also lay the groundwork for future growth and innovation in the digital economy.

Conclusion

As U.S. lawmakers continue to grapple with the intricacies of crypto tax policy, the stakes couldn’t be higher. The outcome of these debates will likely shape the future of cryptocurrencies in the U.S., influencing everything from how they’re used in everyday transactions to their role in the global economy. Whether Congress can reach a consensus remains to be seen, but one thing is certain: the conversation around cryptocurrencies and taxation is far from over.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.