Ever heard the phrase "make your money work for you"? That's the core idea behind passive crypto income. It’s all about earning more crypto with the assets you already own, without having to actively trade or stare at charts all day. Think of it like getting interest from a savings account or dividends from stocks, but for the digital age. This strategy is a game-changer for growing your portfolio automatically.

What Is Passive Crypto Income

At its heart, passive crypto income means putting your crypto to work. Instead of just letting your coins and tokens sit idle in a wallet, you're plugging them into the crypto ecosystem in ways that reward you for participating. You're turning your static investments into dynamic, income-producing assets.

A great way to picture it is like being a digital landlord. You own the property (your crypto), and you can "rent it out" to the network or other users. For doing so, you collect regular payments—not in cash, but in more crypto. It’s a hugely popular approach because it lets you compound your holdings without the stress of trying to time the market.

Why It Matters for Your Portfolio

Building a passive income stream is a cornerstone of smart investing, and it's just as crucial in the crypto world. It provides a way to build wealth steadily, helping to smooth out the wild swings of market volatility. You're no longer just betting on price appreciation, which can be a total rollercoaster; you're creating a consistent flow of rewards.

This strategy brings some serious advantages to the table:

- Compounding Growth: The rewards you pocket can be put right back to work, generating even more income. Over time, this creates a powerful snowball effect.

- Reduced Emotional Trading: When you’re earning automatically, you're far less likely to panic-sell or FOMO-buy based on short-term price drama.

- Portfolio Diversification: It adds another layer of returns to your strategy, going beyond the simple "buy and hold" approach.

The goal is simple: make your crypto work as hard as you do. By putting your assets to use within blockchain networks, you unlock new avenues for financial growth that don't require you to be glued to a trading screen.

If you're looking to dive deeper into the nuts and bolts of how these strategies work, check out the educational resources over at the https://www.vtrader.io/en-us/academy.

Comparing Top Passive Income Methods

Not all roads to passive crypto income are paved the same way. Different strategies come with a unique mix of potential rewards, required know-how, and, of course, inherent risks. Figuring out these differences is the first step to picking a method that actually fits your financial goals and what you’re comfortable with.

Let's walk through the three most common approaches: Staking, Lending, and Yield Farming. Think of them as different levels of a game, each with its own set of rules and prizes.

Crypto Passive Income Methods At A Glance

To give you a quick snapshot, here’s how these three popular methods stack up against each other. Each one caters to a different type of crypto holder, from the set-it-and-forget-it investor to the more hands-on DeFi enthusiast.

| Method | How It Works | Difficulty Level | Potential Return | Key Risk |

|---|---|---|---|---|

| Staking | Lock up your crypto to help secure a blockchain network and earn rewards. | Low | Low to Moderate | Slashing penalties, lock-up periods. |

| Lending | Loan your assets to borrowers through a platform and earn interest. | Low to Moderate | Moderate | Platform risk, borrower default. |

| Yield Farming | Provide liquidity to DeFi protocols and earn fees and token rewards. | High | High | Impermanent loss, smart contract bugs. |

As you can see, the path you choose really depends on how much risk you're willing to take on for a shot at higher returns.

Staking: Simple and Secure

For most people dipping their toes into passive income, staking is the go-to starting point. The idea is refreshingly simple: you "lock up" your crypto to help run and secure a Proof-of-Stake (PoS) blockchain. For pitching in, the network thanks you by paying you rewards in that same crypto.

It’s a lot like putting your money in a high-yield savings account. The bank uses your cash to operate, and you get paid interest. Here, the network uses your crypto to stay secure, and you get staking rewards. It's popular because it's fairly low-risk and the returns are predictable. If you want to get into the nitty-gritty, you can learn more about the specifics of staking with vTrader.

Lending: A Helping Hand for Steady Interest

Crypto lending is exactly what it sounds like. You loan out your digital assets to other people or institutions through a platform, and they pay interest on that loan. You, as the lender, get a cut of that interest.

This approach offers a nice, steady return, especially if you’re lending out stablecoins that aren’t bouncing all over the place in price. It’s a great middle-of-the-road option that usually pays better than staking but doesn't throw you into the deep end of DeFi.

Yield Farming: The High-Risk, High-Reward Frontier

Now we get to the wild side. Yield farming is easily the most complex and potentially the most profitable of the bunch. It typically involves depositing a pair of assets into a "liquidity pool" on a decentralized finance (DeFi) protocol. In exchange, you earn a piece of the trading fees from that pool, plus extra rewards in the form of other tokens.

Think of a yield farmer as a savvy investor who is constantly hunting for the best returns, moving their money between different high-yield products to maximize their gains. The payouts can be huge, but so are the risks—we're talking about things like smart contract bugs and the dreaded "impermanent loss."

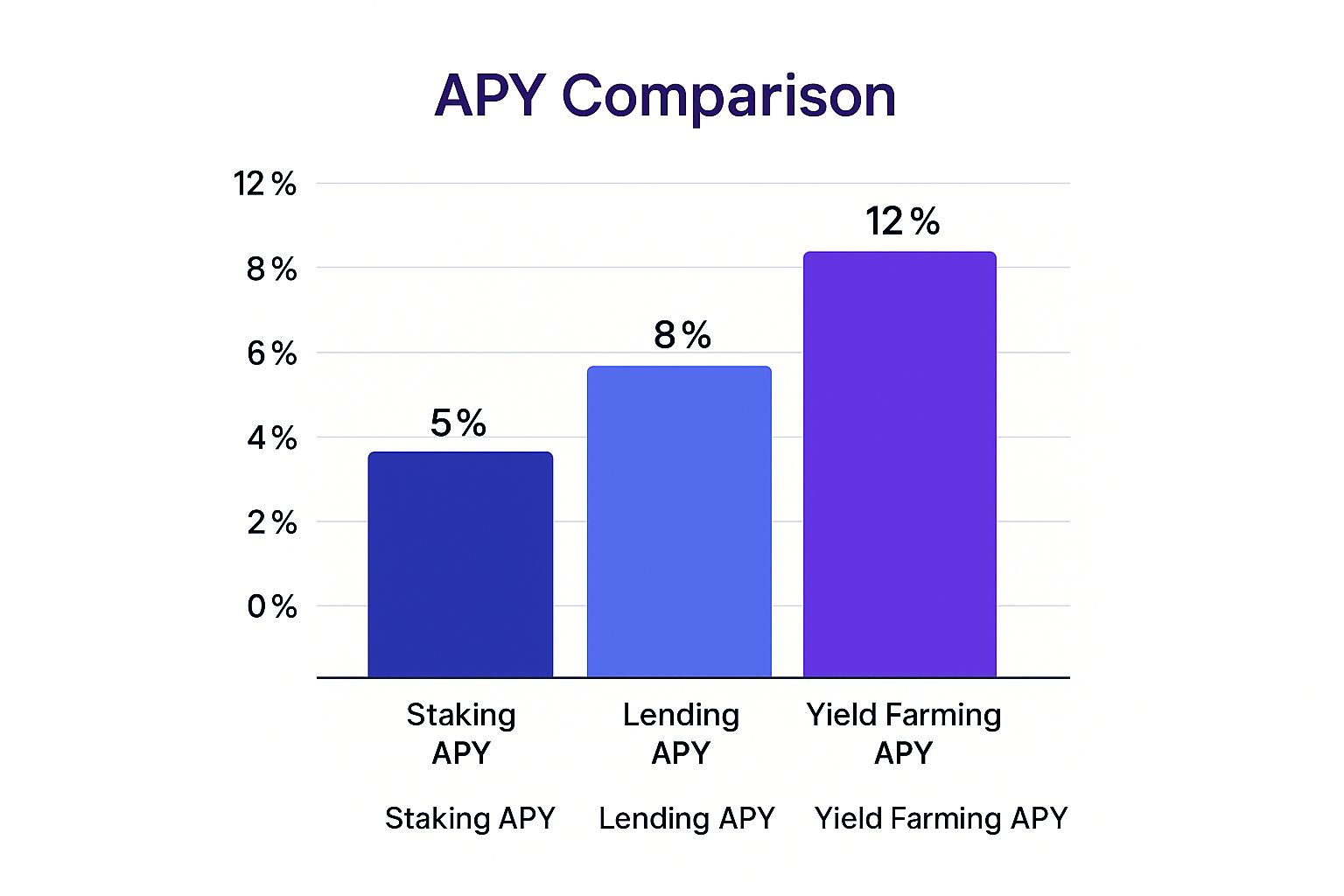

The chart below gives you a general idea of the kind of annual percentage yield (APY) you might see from each strategy.

As you can tell, the potential returns climb right alongside the complexity and risk involved.

Ultimately, picking the right method is a personal call. Someone might be happy earning over 5% annually on a stablecoin like USDC through a platform like Coinbase—it's a simple, straightforward way to start. A more adventurous user might dive into yield farming to chase those higher APYs. Your journey into passive crypto income should always line up with your personal risk tolerance and how much time you want to spend managing your assets.

How DeFi Protocols Power Your Earnings

Ever wonder what’s actually happening behind the scenes when you earn passive crypto income? The magic ingredient is almost always Decentralized Finance, or DeFi.

Think of DeFi protocols as community-run banks built entirely on the blockchain. They cut out the traditional middlemen—the loan officers, the corporate overhead—creating a far more direct and transparent system for everyone.

Platforms like Aave and Compound run on automated "smart contracts" that handle all the lending, borrowing, and trading. This lets you lend your crypto directly to other users and start racking up interest almost instantly. By eliminating the middleman, these protocols can pass the savings on to you, often resulting in much better returns than you'd ever see from a traditional bank.

The Role of Liquidity Pools

At the very heart of most DeFi protocols, you'll find something called liquidity pools. It’s a bit different from how old-school banks work.

Instead of matching one lender with one borrower, DeFi users pool their assets together into a massive digital fund. This collective pot provides the "liquidity" that makes instant trades and loans possible on the platform.

When you add your crypto to one of these pools, you officially become a liquidity provider. For contributing your funds and helping the platform run smoothly, you get a slice of the fees generated by all the activity in that pool. It’s a foundational concept that really drives the entire DeFi machine.

DeFi essentially replaces the traditional bank teller and loan officer with code. This shift not only increases efficiency but also hands more power—and more of the profits—back to the users who provide the capital.

The growth here has been nothing short of explosive. It's estimated that by 2025, over $150 billion will be locked in various DeFi protocols. That staggering figure opens up massive opportunities for passive income through methods like staking and lending.

Gauging a Protocol's Health with TVL

So, how can you tell which DeFi protocol is solid and which one is smoke and mirrors? One of the most telling metrics to keep an eye on is the Total Value Locked (TVL).

This number represents the total amount of crypto assets that users have deposited—or "locked"—into a specific protocol.

A high TVL is generally a great sign. It signals strong community trust, deep liquidity, and a healthy, active platform. You can think of it as a quick gauge of the protocol's market share and overall health. Before you even think about committing your funds, checking the TVL is a crucial first step.

Big-name platforms like Aave consistently maintain a high TVL, which is a strong indicator of their stability. You can dive deeper into how pioneering protocols like Aave work to really get a feel for how these systems operate.

Getting Started with Cloud Mining

Not too long ago, crypto mining was a game reserved for the big players—those with the cash for high-end hardware and the technical skills to keep it all running. Cloud mining has completely flipped the script, opening up a direct route to earning passive crypto income without you ever having to touch a piece of equipment.

The idea behind it is surprisingly straightforward. Instead of buying, setting up, and wrestling with your own powerful mining rigs, you rent computing power—what’s known in the industry as hash rate—from a massive, established data center. Think of it like leasing a car. You get to drive it wherever you want, but you don't have to worry about the oil changes, tire rotations, or surprise repair bills.

This model blows the doors wide open for just about anyone. It slashes the steep upfront costs and saves you from the headache of soaring electricity bills, excess heat, and the constant hum of machinery. You just pick a contract, pay the fee, and watch your share of the mining profits roll into your wallet.

Benefits and Major Risks

The number one draw for cloud mining is its sheer simplicity. It dramatically lowers the barrier to entry, letting you jump in and help secure major networks while earning rewards. But where there’s simplicity, there are also serious risks you need to keep your eyes on.

The cloud mining scene has, unfortunately, been a magnet for scams over the years. This makes it absolutely critical to only work with reputable providers who have a solid, verifiable track record. If a platform is promising you the moon with returns that sound too good to be true and isn’t transparent about their operations, it’s a massive red flag.

At its heart, cloud mining takes something incredibly complex and makes it accessible. Renting remote computing power lets you earn mining rewards without a huge initial investment or deep technical knowledge, but doing your homework is non-negotiable to sidestep the scams.

You also have to dig into the contract terms. Pay close attention to the fee structure, how long the contract lasts, and the fine print about what happens if the price of the crypto you’re mining takes a nosedive. Some contracts can quickly become unprofitable in a bear market, potentially leaving you in the red. You can get a better sense of how the price of assets like Bitcoin influences mining profitability on our platform.

Evaluating If It Is Right for You

So, is cloud mining a good fit? It all comes down to weighing the convenience against the potential pitfalls. It can be a smart move, but only if you find a provider you trust and you’re crystal clear on every detail of the agreement you’re signing.

Take platforms like IOTA Miner, for instance. They offer a way for users to earn ETH rewards without shelling out for pricey hardware. When the market conditions are right, some users have reported earning a steady daily income of 1.97 ETH, which shows you the kind of potential we’re talking about when things line up. Discover more about these cloud mining trends.

In the end, success in cloud mining isn't about luck; it's about meticulous research and a sober understanding of the risks you’re taking on.

Understanding The Risks of Passive Crypto Income

While the dream of earning crypto while you sleep is incredibly appealing, it's a world you need to enter with your eyes wide open. High returns and high risks often go hand-in-hand, and knowing what you're up against is the first step to making smart moves. This isn't about being scared of risk—it's about learning to manage it.

One of the biggest boogeymen in this space is smart contract risk. Think of the DeFi protocols that run lending and yield farming as complex machines built entirely of code. If a hacker finds just one tiny flaw or bug in that code, they can potentially drain the entire protocol. We’ve seen it happen time and again; even big, reputable platforms aren't immune to a clever exploit.

Navigating Market and Protocol Dangers

Beyond the code itself, you're also dealing with the wild west of crypto markets. These risks are less about a hacker breaking in and more about the financial forces that can turn your gains into losses.

- Impermanent Loss: This is a tricky one unique to yield farming. It’s a situation where you could have made more money by simply holding your tokens instead of providing them as liquidity. During big price swings, the value of your deposited assets can actually fall below what they would have been worth just sitting in your wallet.

- Market Volatility: No surprises here. The crypto market can swing violently. A sudden crash in the price of the asset you’re staking or lending can easily erase all the passive income you've worked to accumulate.

- Regulatory Uncertainty: Governments around the globe are still trying to figure out the rules for crypto. An unexpected new law or a sudden ban could instantly change the game for certain passive income strategies or even entire platforms.

The promise of passive earnings is powerful, but it's built on a foundation of complex technology and volatile markets. Your best defense is a deep understanding of what can go wrong before you commit your capital.

Then there's platform risk. Whether you're using a centralized exchange or a decentralized protocol, the platform itself can be a point of failure. If it goes bankrupt, gets into legal trouble, or is just poorly managed, your funds could be trapped or lost forever.

This is why doing your homework on any platform is non-negotiable. Always read the fine print. For example, taking the time to understand a platform's rules and who is responsible for what, as laid out in the vTrader terms and conditions, is a crucial step. Building a solid passive income strategy is all about balancing that exciting potential with a healthy dose of respect for the risks involved.

Alright, theory is great, but let's be honest—the real fun starts when you actually put your crypto to work. This is where we get practical. We’re going to walk you through exactly how to start generating that passive crypto income right here on vTrader. Think of this as your hands-on guide to turning what you've learned into actual earnings.

Getting up and running is designed to be painless. First things first, you'll need to create and lock down your account, then get it funded with the assets you want to put on the payroll.

Setting Up and Funding Your Account

It all starts with a solid, secure foundation. Just follow these quick steps to get your account ready for action.

- Create Your vTrader Account: Head over to our sign-up page. You'll just need a secure email and a strong, unique password you haven't used anywhere else.

- Enable Two-Factor Authentication (2FA): This isn't optional; it's essential for keeping your funds safe. We highly recommend using an authenticator app for the best possible security.

- Deposit Your Crypto: Now, it's time to bring in your assets. You can transfer crypto like Ethereum (ETH) or a stablecoin like USDT directly from another exchange or an external wallet into your new vTrader wallet.

Once your account is funded, you're officially ready to start exploring the earning opportunities waiting for you.

Finding and Committing to a Strategy

We've made it simple to find staking and lending options that fit what you're looking for. Your vTrader dashboard lays everything out clearly, showing you the available assets, their estimated annual percentage yields (APY), and any lock-up periods involved.

Take a look at the vTrader dashboard below to see how easy it is to scope out different staking options.

As you can see, comparing potential returns is a breeze. You can see everything you need at a glance to make a smart, quick decision.

Spotted an opportunity you like? The rest is just a few clicks. Select the asset, punch in the amount you want to commit, and give the terms a quick review. Once you confirm, your assets are officially working for you, and you can watch your earnings grow right from your dashboard.

The best way to start is to start small. Begin with an amount you're comfortable with, something that lines up with your personal risk tolerance. As you get the hang of it, you can always scale up and even branch out into other strategies to diversify your passive crypto income.

By following these straightforward steps, you can confidently make the jump from just holding crypto to actively earning with it. Getting your hands dirty is really the best way to see your digital asset portfolio grow over time.

Frequently Asked Questions

Jumping into the world of passive crypto income can bring up a lot of questions. It's a smart move to get some clarity before you start. Here are some of the most common things people ask, broken down into simple, no-nonsense answers.

Can Beginners Actually Earn Passive Crypto Income?

You bet. You don't need to be a coding genius or a financial guru to get started.

Methods like staking and lending on a straightforward platform are perfect entry points for newcomers. In many cases, staking is as simple as clicking a button to lock up your crypto. Once you do, you start earning rewards for helping to keep the network secure. It's an easy first step into making your assets work for you.

Is Passive Crypto Income Really "Passive"?

That's a great question, and the answer is: it depends on the strategy you choose.

Some methods, like staking and lending, are very much a "set it and forget it" kind of deal. You make your initial deposit, and the rewards start rolling in with very little ongoing effort. On the flip side, more complex strategies like yield farming are a different beast entirely. They demand constant attention—you'll be hunting for the best returns, shifting your funds between different protocols, and keeping a close eye on the market. Think of it as the difference between owning a rental property (mostly passive) and actively day-trading stocks (very active).

The term may be "passive," but the most profitable journeys always start with active learning. Your best first move is always to understand the risks, the platforms, and the crypto you're getting into.

What's The Safest Way To Get Started?

If safety is your number one priority, your best bet is often staking well-known Proof-of-Stake (PoS) cryptocurrencies. Think of the big players like Ethereum or Cardano. Staking them on a trusted, secure platform is widely considered the lowest-risk way to dip your toes in the water.

Another solid option is lending out stablecoins. Because their value is tied to a real-world currency like the US dollar, you're protected from the wild price swings that can hit other crypto assets. It’s a calmer, more predictable way to earn.

How Does The Tax Man View Passive Crypto Income?

Navigating crypto taxes can be tricky, as the rules are still catching up and vary wildly from one country to another.

Generally speaking, any rewards you get from staking, lending, or mining are considered ordinary income. This means you'll likely be taxed at your standard income tax rate, based on the market value of the crypto at the moment you received it. Keeping meticulous records of every transaction and earning is non-negotiable. It's always a good idea to chat with a tax professional who knows the crypto space to make sure you're playing by the rules in your jurisdiction.

Ready to stop just holding crypto and start putting it to work? Join vTrader today to explore zero-fee trading and powerful staking tools designed to grow your portfolio.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.