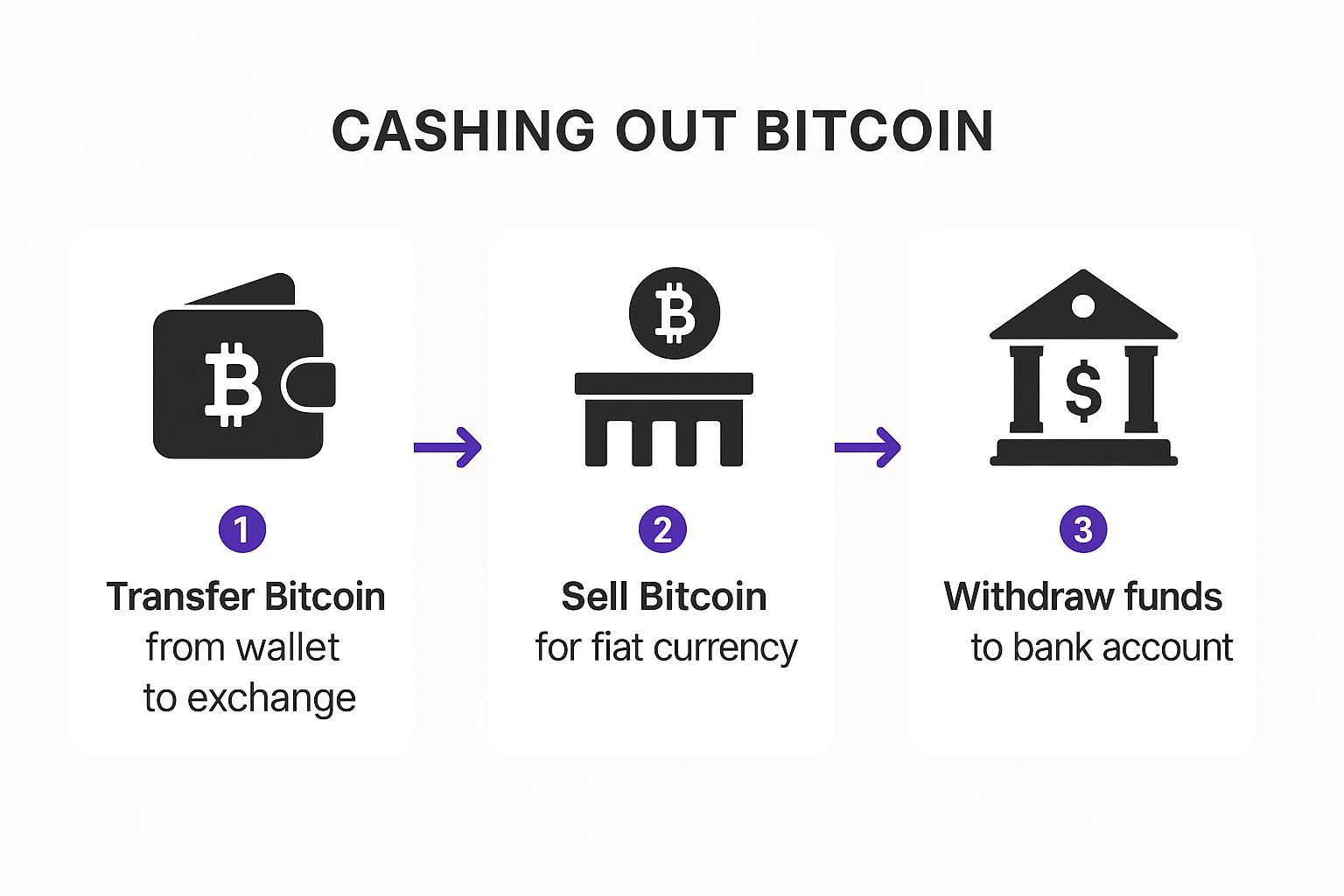

So, you’re ready to cash out your Bitcoin. The actual process is simpler than you might think. It boils down to three key stages: moving your BTC from your personal wallet to an exchange like vTrader, selling it for a fiat currency like U.S. dollars, and then sending those funds straight to your bank account.

This guide will walk you through that entire journey on the vTrader platform, making sure every step is clear and secure.

Your Roadmap to Cashing Out Bitcoin on vTrader

Turning your Bitcoin into cash you can spend is a huge milestone for any crypto investor. It can feel like a big deal, but when you break it down, the process is pretty straightforward. Using a trusted, commission-free platform like vTrader not only makes the transaction easier but also gives you peace of mind that your money is handled safely from beginning to end.

Before we get into the nitty-gritty, let's look at the big picture. Think of this as your flight plan before takeoff—you need to know the route before you start. Understanding each stage, from setting up your account to seeing the money in your bank, helps you move forward with confidence and sidestep any potential issues.

The Cash Out Journey Visualized

This image shows the basic flow of turning your crypto into cash. It's a clear path that vTrader has made incredibly smooth.

As you can see, it's a logical sequence: from your wallet, through the exchange, and landing right in your bank account.

To give you an even clearer idea of what to expect, this table outlines the entire process.

vTrader Bitcoin Cash Out Process Overview

| Stage | Estimated Time | What You Need |

|---|---|---|

| Account Setup & Verification | 15-30 minutes | A valid ID and proof of address. |

| Deposit Bitcoin to vTrader | 10-60 minutes (depends on network) | Your vTrader BTC deposit address. |

| Sell Bitcoin for Fiat | A few seconds | A decision on your sell price (market or limit). |

| Withdraw Fiat to Bank | 1-3 business days | Linked and verified bank account details. |

This overview simplifies the journey, showing that in just a few steps, you can successfully convert your digital assets into cash.

Understanding the Scale of Bitcoin Transactions

The need to cash out is part of a massive global machine. The sheer volume of daily Bitcoin transactions is staggering and shows just how many people are moving their assets every single day.

As of late September 2025, the Bitcoin network was handling around 569,683 transactions in a 24-hour period. That breaks down to almost 24,000 transactions every hour. While this is down a bit from its peak of over 687,000 daily transactions in 2024, it still highlights the incredible global demand for Bitcoin liquidity. This constant flow is exactly why having a reliable and simple way to cash out is so essential.

For anyone who wants to get a deeper understanding of market trends and dynamics, the resources at the vTrader Academy are a great place to start.

Setting Up Your vTrader Account for Safe Withdrawals

Before you even think about turning that Bitcoin into cash, you need to lock down your account. Seriously. Jumping straight to the withdrawal process without laying a solid security foundation is asking for trouble. Taking just a few minutes now will save you a world of headaches later, ensuring your funds are safe and sound when it's time to cash out.

When you first create your vTrader account, the process feels simple, but slow down when you get to the password. This isn’t the place to recycle the same one you use for everything else. Create something long, complex, and completely unique to vTrader—mix it up with uppercase letters, lowercase, numbers, and symbols.

Double-Lock Your Account with Two-Factor Authentication

A strong password is a great start, but two-factor authentication (2FA) is your non-negotiable next step. Think of it as a deadbolt on your digital vault. Even if a bad actor somehow gets your password, they can't get in without that second code from your phone.

Setting up 2FA on vTrader is a breeze and massively boosts your security. Most people use an authenticator app like Google Authenticator or Authy. It adds maybe five seconds to your login time but throws up a huge wall against anyone trying to get unauthorized access.

"Enabling 2FA is no longer just a 'best practice'; it's a fundamental requirement for anyone serious about protecting their crypto assets. The slight inconvenience of entering a code is a tiny price to pay for peace of mind."

Getting Through the KYC Verification Maze

With your basic security locked in, it's time to tackle the Know Your Customer (KYC) process. This is a standard regulatory step for any legitimate crypto exchange, and it's there to prevent things like fraud and money laundering. It’s what allows vTrader to operate above board, which is a good thing for all of us.

You’ll need to have a couple of documents ready for this part:

- A government-issued photo ID: Your driver's license, passport, or national ID card will do the trick. Just make sure the picture is crystal clear and every word is legible.

- Proof of your address: A recent utility bill or a bank statement works perfectly here. The name and address must be an exact match to what you entered when you signed up.

Here’s a look at what the identity verification step typically looks like on a crypto platform. It's all about confirming you are who you say you are.

This process adds another layer of trust and security, not just for you, but for the entire platform.

Linking Your Bank Account: The Final Step

The last piece of the setup puzzle is linking the bank account where you want your money to go. This is the finish line, so precision is everything. Double- and triple-check your account and routing numbers before you hit submit. A single typo can cause major withdrawal delays or even bounce the transaction back.

While you're at it, getting familiar with the platform's rules is always a smart move. For a general overview, it’s helpful understanding platform terms that govern these types of services. For the specifics on vTrader, you can find everything you need to know in the official vTrader terms and conditions. A quick read-through now ensures you know what to expect later.

How to Execute Your Bitcoin Sale on vTrader

You’ve made it through the setup and security checks, and now you’re at the heart of the action. This is where your Bitcoin becomes cash. Getting your bearings on a trading screen for the first time can feel like stepping into a cockpit, but it’s really all about giving you control over how you sell.

The big question you need to answer is how you want to sell. Your answer will determine the type of order you place, and each one comes with its own strategy. Nailing this choice is the key to turning your crypto into cash on your terms.

Choosing Your Selling Strategy: Market vs. Limit Orders

The two main ways to offload your Bitcoin are with market orders and limit orders. They might sound technical, but the difference is simple: one is about speed, the other is about price.

A market order is your express lane to cash. You're basically telling vTrader to sell your Bitcoin right now, for whatever the best current price is. This is the perfect move if you need your money fast and you’re not trying to squeeze every last cent out of the trade.

A limit order, on the other hand, puts you firmly in the driver's seat on price. You get to name your price (your "limit"), and the trade will only go through if the market climbs to meet it. This is the strategic play if you have a specific target price in mind and you’re not in a rush.

Let's say Bitcoin is trading at $60,000, but you have a hunch it might pop to $60,250. You can set a limit order at that price. Your BTC won’t sell until a buyer agrees to your price, making sure you don't leave money on the table.

Understanding the Trading Interface and Fees

When you pull up the vTrader trading screen, you’ll be greeted with a lot of data. Don't get intimidated. The only parts you really need to focus on are the order book—which is a live feed of all the buy and sell orders happening—and the form where you’ll actually place your own order.

Here’s the breakdown of what to do:

- Order Type: Choose "Market" for speed or "Limit" for price control.

- Amount: Punch in how much Bitcoin you want to sell. You can usually pick a percentage of your total holdings, like 25% or 50%, to make it easy.

- Price (for Limit Orders): If you're placing a limit order, this is where you enter the minimum price you're willing to accept for your BTC.

One of the best things about vTrader is its commission-free trading. This isn't a small detail; it means you're not going to get hit with surprise fees that eat into your profits. The price you sell at is the cash you get. That kind of transparency is a huge plus, especially when so many other exchanges find ways to take a cut.

Finalizing Your Trade Execution

Okay, you've set your order type and amount. Before you pull the trigger, give everything one last look. If you're using a limit order, check that price again. A simple typo—a misplaced decimal—can turn a great trade into a painful mistake.

Once you’re confident, hit the "Sell BTC" button.

- If you went with a market order, it's over in a flash. The trade will execute almost instantly, and you’ll see the cash pop up in your fiat balance.

- If you placed a limit order, it will show up under your "Open Orders." It’ll just hang out there until the market hits your target price, then it will execute on its own.

With the sale executed, you've officially converted your Bitcoin into cash right inside your vTrader account. You’re on the home stretch now, with just one step left: getting that money into your bank.

Navigating Price Volatility When You Sell

Knowing how to sell your Bitcoin is only half the battle. The real trick is knowing when. The crypto market is infamous for its wild price swings, and that volatility is the single biggest thing that will affect how much cash you actually get in your bank account. Trust me, making a strategic decision beats a knee-jerk reaction to a price spike every single time.

To really get a handle on this, you have to look at Bitcoin's history. It’s a story of incredible peaks and gut-wrenching valleys. These cycles aren't random; they're driven by big-picture stuff like macroeconomic trends, regulatory chatter, and general market mood. Watching these patterns helps you get ahead of the market instead of just being swept along by it.

Take a look back. Since it kicked off in 2009, Bitcoin has gone through several massive cycles that have completely changed the game for cashing out. At the start of 2019, for example, Bitcoin was sitting around $4,000. Fast forward to mid-2025, and it exploded to nearly $119,000—that’s an unbelievable 2,970% jump.

Selling 1 BTC back in 2019 would have landed you $4,000. That same coin in 2025? Almost $119,000. The difference is staggering. I always recommend people explore historical data to really feel out these trends for themselves.

Developing Your Personal Cash Out Strategy

A solid plan is your best defense against making emotional, and often costly, mistakes. Don't let FOMO (fear of missing out) or panic selling call the shots. Instead, you need to build a strategy that’s all about your personal financial goals.

First things first: what does success look like for you? Are you trying to skim a certain amount of profit off the top? Or are you cashing out to buy a car or make a down payment on a house? Your goals are what set your price targets.

A well-defined exit strategy is the difference between locking in gains and watching them disappear. Decide on your profit targets and stop-loss points before you even think about selling. This removes emotion from the equation when the market gets chaotic.

Let's break that down into some real, practical steps:

- Set Clear Profit Targets: Decide, right now, at what price you'll sell a piece of your holdings. For instance, you could commit to selling 25% of your Bitcoin if the price hits a specific milestone you've set.

- Use Stop-Loss Points: Think of a stop-loss as your safety net. It’s an order you place to automatically sell your Bitcoin if it falls to a certain price, protecting your gains from a sudden market crash.

- Monitor Key Trends: Keep an eye on market news and basic technical indicators. You don't need to become a day trader, but understanding major support and resistance levels gives you crucial context for your decisions.

When you create a plan like this, you stop being a reactive gambler and start acting like a strategic investor. This approach ensures your decision to cash out bitcoins lines up with your long-term goals, not just the market's mood of the day.

Completing the Withdrawal to Your Bank Account

Alright, you've sold your Bitcoin and the cash is sitting pretty in your vTrader fiat balance. This is the final, and let's be honest, most satisfying step: getting that money into your bank account.

The whole process is simple, but as with anything involving money, the details matter. Paying attention now ensures your funds land where they should without any frustrating delays.

Getting the transfer started is a breeze. From your main vTrader dashboard, just head over to the "Withdraw" area and pick the currency you're holding (like USD). You'll see the bank account you linked when you first set up your profile. All you have to do is punch in the amount you want to send and confirm it—usually with a quick 2FA code for security.

Understanding Timelines and Limits

This is where a little patience comes in. While selling your Bitcoin felt almost instant, bank transfers still play by old-school rules.

- Standard Processing Times: You should expect most withdrawals to process within 1-3 business days. Remember, that's business days, so weekends and holidays don't count. If you need the cash by a certain date, plan ahead.

- Withdrawal Limits: Like any regulated platform, vTrader has withdrawal limits in place for your security. These are usually set on a daily and monthly basis and can change depending on your verification level. It's always a good idea to check your current limits before starting a big transfer.

The banking system just doesn't move at the speed of crypto. Seeing a "pending" status for a day or two is totally normal and no reason to worry. Your money is just making its way through the traditional financial system.

Navigating Fees and Troubleshooting Issues

One of the great things about vTrader is the commission-free trading, but it’s always smart to know about any withdrawal fees. While vTrader keeps its costs low, your own bank might have some fees on their end. For the full picture, you can always review the official vTrader fee schedule.

What if you hit a snag? If a withdrawal takes longer than expected or gets rejected, don't panic. More often than not, it's something simple.

The most common culprits are a mismatch between the name on your vTrader account and your bank account, or a typo in your bank details. First things first, double-check that every piece of information is an exact match. If you've checked everything and the problem persists, vTrader’s 24/7 customer support is your best bet for getting it sorted out quickly. By following these pointers, you can confidently and successfully cash out bitcoins.

Considering Alternatives Like Bitcoin Cash

While our main focus here is on cashing out bitcoins, it's always a good idea to keep an eye on the broader crypto market. A perfect case in point is Bitcoin Cash (BCH), which famously forked from Bitcoin back in 2017. Though they share a family name, their journeys, especially when it comes to price, couldn't be more different.

Bitcoin Cash was engineered to be a faster, cheaper version of Bitcoin, making it a favorite for some who want to make small, quick payments. But that speed comes with a hefty price: a serious trade-off in stability and market depth. If your goal is to convert a significant amount of crypto back to cash, this is a massive factor. BTC simply has far deeper liquidity, letting you sell larger positions without sending the price into a nosedive.

Volatility and Cashing Out BCH

The price history of BCH is a wild ride compared to its older sibling. Timing your exit is absolutely critical, as the coin has a history of incredible monthly pumps followed by long, painful dumps.

This volatility has defined the experience of cashing out Bitcoin Cash. After launching at over $1,000 in August 2017, it came crashing down to just $81 by December 2018. More recently, on August 31, 2025, it was trading around $553.53, but not without the kind of daily price swings that scream instability when compared to Bitcoin. You can dig into the numbers yourself and check out its historical data on CoinMarketCap.

The takeaway here is pretty clear: while you might save a little on transaction fees, the risk of the asset’s value cratering just as you hit "sell" is dramatically higher with BCH. It's a classic risk-versus-reward scenario.

At the end of the day, this is why most serious investors and traders stick with BTC when it’s time to cash out larger sums. Its established market and relatively greater stability offer a much more predictable outcome. If you're curious, you can track real-time Bitcoin Cash prices on vTrader and see this volatility play out for yourself.

Common Questions About Cashing Out Bitcoins

Whenever you get ready to cash out bitcoins, a few questions inevitably pop up. Thinking through things like timing, taxes, and security ahead of time is the key to making the whole process feel straightforward and predictable.

One of the biggest hurdles for many is figuring out the tax situation. In most places, including the United States, turning your Bitcoin back into dollars is considered a taxable event. This means if you've made a profit since you first got your coins, you could owe capital gains tax. It's always smart to have a quick chat with a tax professional to be sure.

Another thing people always ask about is speed. While selling your Bitcoin on vTrader is pretty much instant, getting the money into your bank account usually takes 1-3 business days. This isn't a crypto delay; it's just the old-school banking system doing its thing.

The single most important thing to remember is security. Always, and I mean always, double-check withdrawal addresses and make sure you're using two-factor authentication (2FA). It's your best defense for protecting your funds from start to finish.

If you have more specific questions about how the platform works, the best place to look is the vTrader FAQ section. It's packed with detailed answers on everything from getting your account verified to withdrawal limits.

Ready to cash out your Bitcoin with zero trading fees? Join vTrader today and experience a secure, commission-free platform designed to maximize your returns. Get started with vTrader now.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.