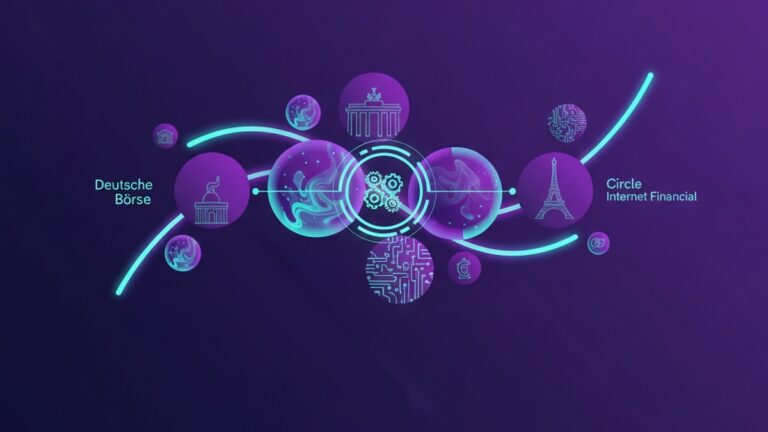

Deutsche Börse Group, Europe’s leading exchange operator, is taking a significant step towards integrating stablecoins into its market infrastructure. This initiative, in collaboration with Circle Internet Financial, aims to make the euro more relevant in the rapidly expanding realm of digital finance. The partnership is set to introduce Circle’s euro- and dollar-backed tokens under the European Union’s new cryptocurrency regulations.

A Strategic Alliance

The collaboration between Deutsche Börse and Circle is more than just a business venture; it’s a strategic move to position the euro as a key player in the digital currency space. Deutsche Börse, with its extensive experience in market operations, provides a robust platform for Circle’s stablecoins, which are known for their stability and reliability. This partnership is expected to enhance the liquidity and accessibility of digital assets in Europe, making it easier for businesses and individuals to engage in digital transactions.

Circle, the issuer of popular stablecoins such as USDC (U.S. Dollar Coin) and EUROC (Euro Coin), brings its expertise in blockchain technology and digital currencies to the table. By leveraging Circle’s advanced technology, Deutsche Börse aims to integrate stablecoins seamlessly into its existing market infrastructure. This integration is anticipated to streamline transactions and reduce the volatility often associated with cryptocurrencies.

Navigating the Regulatory Landscape

The introduction of Circle’s stablecoins into Deutsche Börse’s ecosystem comes at a time when the European Union is tightening its grip on cryptocurrency regulations. The EU’s new crypto rulebook, which seeks to provide a clear legal framework for digital assets, is designed to protect consumers and foster innovation within the industry. By aligning with these regulations, Deutsche Börse and Circle are not only ensuring compliance but also paving the way for broader adoption of stablecoins in Europe.

This regulatory alignment is crucial for the success of the initiative. It provides a level of assurance to investors and businesses that the stablecoins are secure and compliant with EU laws. Furthermore, it demonstrates a commitment to transparency and accountability, which are essential in building trust in digital finance.

The Euro’s Digital Transformation

At the heart of this partnership is the ambition to elevate the euro’s status in the digital world. While the U.S. dollar has long dominated the cryptocurrency market, the introduction of euro-backed stablecoins could shift the balance. Deutsche Börse and Circle’s initiative is seen as a step towards promoting the euro as a viable alternative to the dollar in digital transactions.

The use of euro-backed stablecoins could have a wide-ranging impact on the European economy. For businesses, it offers a new avenue for cross-border transactions without the need to convert to and from different currencies. For consumers, it provides a stable and secure means of engaging in digital transactions. Moreover, it could stimulate innovation in the fintech sector, as companies explore new applications for stablecoins.

Balancing Opportunities and Challenges

While the partnership between Deutsche Börse and Circle presents numerous opportunities, it’s not without challenges. One of the primary concerns is the potential impact on traditional banking systems. As stablecoins become more integrated into the financial ecosystem, they could disrupt existing banking models by offering a more efficient and cost-effective alternative for transactions.

Additionally, the success of this initiative hinges on the widespread acceptance of stablecoins among businesses and consumers. Despite the benefits, some may be hesitant to adopt digital currencies due to concerns about security and volatility. Deutsche Börse and Circle will need to address these concerns through education and outreach to ensure the successful integration of stablecoins into the market.

Looking Ahead

As Deutsche Börse and Circle embark on this ambitious project, the eyes of the financial world are watching closely. The partnership represents a significant step towards mainstreaming stablecoins in Europe and could set a precedent for other regions to follow. If successful, it could transform the European digital finance landscape and reinforce the euro’s position in the global economy.

The collaboration also highlights the evolving nature of the cryptocurrency industry. As regulatory frameworks become more defined and stablecoins gain traction, we can expect to see more traditional financial institutions exploring partnerships with digital currency companies. This trend could lead to a more integrated and inclusive financial system, where digital and traditional finance coexist harmoniously.

In conclusion, Deutsche Börse and Circle’s partnership is a bold move towards expanding the use of stablecoins in Europe. By aligning with EU regulations and leveraging each other’s strengths, they are well-positioned to drive the euro’s digital transformation. While challenges remain, the potential benefits for businesses, consumers, and the broader economy make this initiative one to watch. As the digital finance landscape continues to evolve, partnerships like this will play a crucial role in shaping the future of money.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.