When you hear "zero-fee crypto exchange," it's easy to think you've found a way to trade for free. But as any experienced trader knows, there's no such thing as a free lunch, especially in the world of finance.

So, what does it really mean?

A zero-fee cryptocurrency exchange is a platform that gets rid of direct trading commissions. That’s it. You aren't paying that typical percentage or flat fee every single time you buy or sell a digital asset, which can be a game-changer for active traders.

Think of it like an online retailer offering "free shipping." You know the cost of getting that package to your door is factored in somewhere, likely in the price of the item itself. Zero-fee exchanges operate on a similar principle. They have smart business models that shift the costs away from direct transaction fees to other, less obvious areas.

This approach has been incredibly popular, and it's easy to see why. Lowering the barrier to entry has brought a flood of new users into the crypto space.

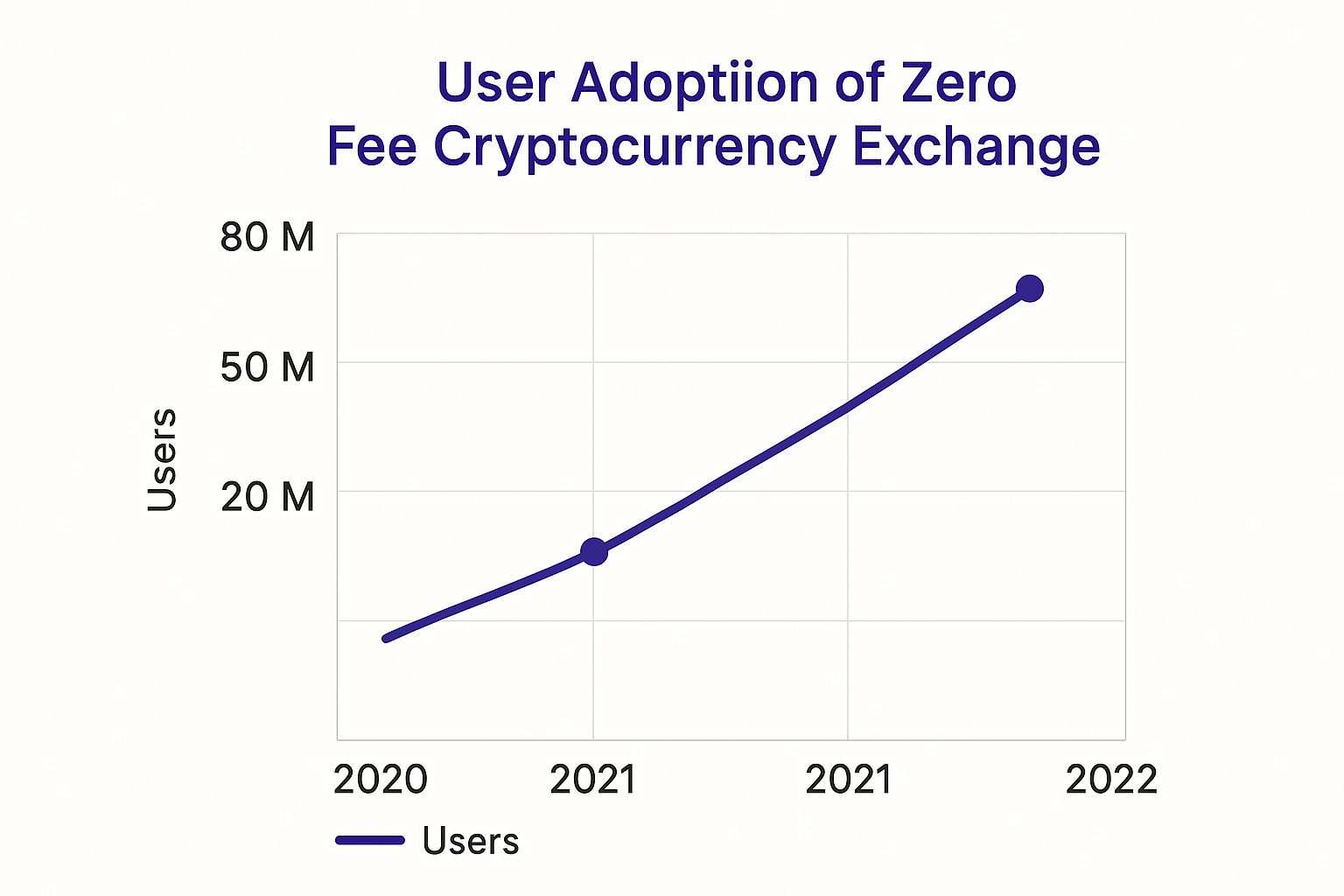

The data speaks for itself. We saw a staggering 300% jump in user adoption for these models between 2020 and 2022 alone. Clearly, the appeal of keeping more of your own money is a powerful motivator.

How Do These Exchanges Actually Make Money?

If they aren't charging for trades, how do they keep the lights on? This is the crucial question every trader should ask. Platforms like vTrader build a sustainable business by being upfront about how they operate while still offering fantastic value.

Here's a look at the common revenue streams:

- The Spread: This is the most common method. It's the small difference between the buying price (the "ask") and the selling price (the "bid"). Exchanges can build a tiny margin into this spread, earning a fraction of a cent on every trade.

- Withdrawal Fees: While you can often deposit funds for free, you’ll likely run into a fee when you want to move your crypto off the exchange and into a personal wallet.

- Premium Tiers: Many platforms offer optional paid subscriptions. These unlock advanced features like sophisticated trading bots, in-depth analytics, or higher API limits.

- Other Financial Services: Exchanges are becoming financial hubs. They also earn revenue from services like crypto lending, staking programs, and providing liquidity for other projects.

To make this crystal clear, let's break down where you'll find costs and where you'll find savings.

Breaking Down the Zero Fee Trading Model

This table reveals how zero fee exchanges structure their costs, highlighting what's typically free versus where you might find other charges.

| Fee Type | What Is Often Free | Where Costs Can Hide |

|---|---|---|

| Trading Commissions | Spot trading (buying/selling assets) is often 100% commission-free. | Some platforms may still charge commissions on futures, options, or margin trading. |

| The Spread | N/A | The difference between the buy and sell price contains a small, built-in margin for the exchange. |

| Deposits & Withdrawals | Crypto and fiat deposits are usually free. | Withdrawing crypto to an external wallet almost always incurs a network or platform fee. |

| Platform Features | Basic charting tools, order types, and account access are free. | Advanced analytics, automated trading bots, and API access may require a premium subscription. |

Ultimately, this model is about giving traders more control and flexibility.

By eliminating direct commissions, zero-fee platforms lower the barrier to entry for new investors and enable high-frequency traders to execute strategies that would otherwise be unprofitable.

This isn't just a gimmick; it's a fundamental shift in the industry. The global crypto exchange market was valued at $48.41 billion in 2025 and is projected to skyrocket to $122.63 billion by 2032. This incredible growth is driven by spot trading, which makes up over 61% of the market and is the perfect fit for the zero-fee model.

By understanding exactly how these exchanges work, you can evaluate their true cost and make smarter decisions. You can see a full breakdown of how vTrader operates by checking out our official fees page.

How Zero-Fee Exchanges Actually Make Money

When you hear "zero-fee," it's natural to be a bit skeptical. If an exchange isn't taking a cut from your trades, how are they keeping the lights on? It's the most important question to ask, and the answer shows how clever these platforms really are. They aren't charities; they’ve just found different, often less obvious, ways to make money.

The most common method is profiting from the spread. You can think of the spread as a tiny, built-in commission that you never see on a receipt. It's simply the difference between the price you can buy a crypto for (the ask price) and the price you can sell it for (the bid price).

For instance, an exchange might offer to sell you Bitcoin for $60,005 but only offer to buy it from another trader for $60,000. That $5 gap is the spread. The exchange pockets that difference on every single transaction, and when you're dealing with millions of trades a day, those small amounts add up fast.

Beyond the Bid-Ask Spread

Relying solely on the spread can be risky, so smart exchanges build multiple income streams to create a more stable business. This approach allows them to keep trading free while still having the cash to invest in better security, new features, and customer support.

Here are a few other ways they generate revenue:

- Withdrawal Fees: While trading on the platform might be free, moving your crypto out to a private wallet usually isn't. The exchange will charge a small fee that covers the blockchain's network cost (the "gas fee") and often includes a little extra for themselves.

- Network Fees: Every transaction on a blockchain requires a fee to pay the network validators. Exchanges typically pass this cost on to you, sometimes with a small service charge tacked on for facilitating the transaction.

A good, transparent exchange will be upfront about all non-trading costs. You should always be able to easily find out what you’ll be charged for moving assets or interacting with different blockchains.

Premium Services and Financial Products

This is where the real money is often made. Many exchanges have evolved from simple trading platforms into full-blown financial ecosystems, offering a suite of products that go way beyond basic buying and selling.

These premium offerings usually fall into two main camps:

- Subscription Models: The most powerful tools are often kept behind a paywall. If you want access to things like advanced AI trading bots, in-depth market analytics, or higher-speed data feeds for automated trading, you'll likely need a premium subscription.

- Financial Products: Exchanges are also starting to act a lot like digital banks. They offer services like crypto lending, where they earn interest on assets they loan out. They also facilitate staking, where they take a small commission from the rewards you earn for helping secure a blockchain network. You can see exactly how crypto staking generates returns to get a better sense of how this works.

By weaving together these different income sources—spreads, withdrawal fees, premium tools, and financial services—a "zero-fee" exchange creates a surprisingly robust business model that works for both the company and its traders.

The Strategic Advantages of Trading Commission-Free

Choosing a zero-fee crypto exchange is more than a simple cost-cutting move. It's a strategic decision that fundamentally alters how you can engage with the market. For some trading styles, the absence of commissions is the single factor that separates a winning strategy from a losing one.

Take a high-frequency trader or a scalper, for instance. These traders live in the margins, executing dozens or even hundreds of trades a day to profit from tiny price fluctuations. If every single one of those trades had a 0.2% fee tacked on, the costs would pile up so fast it would be almost impossible to turn a profit.

Removing those fees makes these high-volume strategies possible. Traders can jump in and out of positions to catch the smallest gains, knowing that commissions won't eat away at their earnings. It’s like being a fisherman who can cast their net as many times as they like without having to pay a toll for every cast.

Lowering the Barrier for New Traders

For anyone just dipping their toes into the crypto world, trading fees can feel like a tax on learning. Each small, experimental trade or portfolio tweak slowly eats away at your starting capital. This creates a kind of pressure to only make "perfect" moves, which often leads to not making any moves at all.

A zero-fee environment completely removes that pressure. It becomes a true sandbox for learning, where you can:

- Experiment Freely: Buy tiny amounts of different coins just to see how they move and feel.

- Practice Dollar-Cost Averaging: Make small, regular investments without watching fees chip away at your returns over time.

- Learn Without Penalty: Concentrate on honing your strategy instead of constantly doing the math on trading costs.

This freedom helps new traders build real-world skills and confidence much faster. For those ready to go deeper, the vTrader Academy provides structured lessons to help you master crypto trading fundamentals and get up to speed.

The psychological impact is immense. When you remove the mental baggage of calculating fees for every action, you free up cognitive resources to focus on what truly matters: market analysis and strategic decision-making.

Ultimately, trading without commissions encourages a more active and nimble approach to managing your portfolio. You're far more likely to rebalance your holdings, lock in small wins, or cut your losses early when you know the action itself is free. In the volatile world of crypto, that kind of agility is a massive advantage.

Navigating the Hidden Costs and Potential Risks

Any experienced trader knows that the best-looking deals often come with a catch. While a zero-fee crypto exchange can be a huge advantage, it's smart to look beyond the homepage headlines and understand the potential downsides. If you don't, you might find that "free" trading costs you more than a simple, upfront commission.

The most common hidden cost is the wider spread. Remember the spread? It's the small gap between the buy (ask) price and the sell (bid) price. Some zero-fee platforms make their money by widening this gap. This means you end up paying a little more every time you buy and getting a little less every time you sell. On a single trade, it might seem trivial, but over dozens or hundreds of trades, it really adds up.

Another thing to watch out for is withdrawal fees. An exchange might let you trade for free all day long, but then hit you with a hefty fee when you try to move your crypto to your own wallet. These fees can make small transfers pointless and essentially lock your funds on the platform unless you’re moving a significant amount.

Liquidity and Slippage Concerns

Beyond the direct costs, you have to think about the operational side of things, especially with newer or smaller exchanges. Poor liquidity—meaning a low volume of active buyers and sellers—is a massive red flag. When an exchange has thin liquidity, it can lead to a really frustrating problem called slippage.

Slippage is what happens when your trade goes through at a different price than what you saw on the screen. It’s most common when you’re placing a large order or when the market is going wild. If there aren't enough orders on the books to fill yours at your target price, the system will fill it at the next best available price—which can be a lot worse for you.

A truly great zero-fee cryptocurrency exchange understands this balance. It must offer not just low costs but also deep liquidity, ensuring your savings from commissions aren't eaten away by bad trade execution.

Other Potential Pitfalls

You should always be on the lookout for other creative ways platforms might pass costs on to you. Here are a few more to keep on your radar:

- High Network Fees: Some exchanges will pass on the blockchain's native network fees (like gas fees on Ethereum) but add a significant markup for themselves. You can always cross-reference what you're being charged by using an Ethereum gas tracker to see the network's real-time costs.

- Limited Asset Selection: Be careful of the bait-and-switch. A platform might offer zero-fee trading on big names like Bitcoin and Ethereum but charge standard (or even high) fees on all the less common altcoins you want to trade.

- Poor Customer Support: When something goes wrong with a trade or a withdrawal, responsive customer support is priceless. A platform that's cutting corners on its support team can end up costing you a lot of time, money, and stress.

The global crypto exchange market is absolutely exploding. It's projected to grow from $14.29 billion in 2021 to over $29.37 billion by 2025 as platforms fiercely compete for your business. By knowing where the hidden costs are buried, you can make sure you’re choosing an exchange that offers genuine value, not just slick marketing.

So, Why Is vTrader a Smarter Zero-Fee Platform?

Knowing the theory behind a zero-fee crypto exchange is one thing; seeing it done right is something else entirely. Lots of platforms will dangle the "zero-fee" carrot as a marketing gimmick, but a truly smart exchange like vTrader builds its entire experience on a foundation of transparency, security, and real, tangible value.

It's not just about what you don't pay. It’s about what you get in return for your trust.

The first piece of the puzzle is a totally transparent fee structure. With vTrader, there are simply no surprises. While spot trading is genuinely commission-free, any potential non-trading costs, like withdrawal fees, are laid out in plain English. This kind of honesty means you’ll never get that sinking feeling of discovering a hidden charge eating into your profits.

Competitive Spreads and Rock-Solid Security

Next up is the spread. vTrader tackles the hidden cost problem head-on by maintaining tight, competitive spreads. This is a big deal because it means you're getting a fair market price on every single transaction. The savings you get from commission-free trading are actually real, not just silently siphoned away by an inflated gap between the buy and sell price—a sneaky trick some other platforms pull.

But honestly, none of that matters without security. vTrader proves that offering zero-fee trading doesn't mean you have to cut corners on protecting user assets.

The platform relies on a multi-layered security strategy that just makes sense:

- Cold Storage: The vast majority of user funds are kept offline, far away from the reach of online threats.

- Multi-Factor Authentication (MFA): This adds that crucial second lock to your account, making sure only you can get in.

- Regular Security Audits: vTrader brings in independent third-party experts to poke and prod its systems, verifying that all security protocols are airtight and current.

This deep-seated commitment to security is fundamental to the platform. To get a better sense of the principles that guide our approach, you can read about vTrader's mission and core values on our official site.

It's About More Than Just Free Trades

At the end of the day, the best platforms get that value is about much more than just fees. A zero-fee crypto exchange still has to compete on its features, tools, and overall user experience. This is where vTrader really stands out, offering a full suite of advanced tools that give both new and seasoned traders the power to make smarter decisions.

This is a key differentiator in a very crowded market. Just look at a major player like Binance, which, as of April 2025, held a commanding 38.0% share of the total spot trading volume. Its dominance proves that deep liquidity and a rich feature set are what truly attract and keep users. It shows that a zero-fee model isn’t just a gimmick; it’s a competitive starting point that has to be backed up by other powerful services. You can dig deeper into these crypto exchange market dynamics in this detailed report.

vTrader’s intuitive dashboard puts all the tools you need for effective trading right at your fingertips.

The interface neatly integrates real-time charting, order book depth, and technical indicators into one clean, easy-to-read view. This design ensures you can analyze market movements and execute trades quickly and efficiently, all without feeling overwhelmed. It just creates a much better trading environment.

Your Checklist for Choosing the Right Exchange

Now that you've got the lay of the land, you’re ready to evaluate any zero-fee crypto exchange like a seasoned pro. Picking the right platform goes way beyond just chasing the lowest cost; it’s about finding the best overall value for your trading style.

To cut through the marketing noise, ask yourself these five critical questions. They'll help you see what really matters.

Is the Exchange Secure and Regulated?

This is the big one. If the platform isn't secure, nothing else matters. Your funds are only as safe as the exchange holding them, so start digging.

Do they have a clear security policy? Look for non-negotiables like proof of reserves, multi-factor authentication, and a solid track record of independent security audits. Regulation adds another layer of protection, so check if they're compliant with major financial authorities.

Are All Fees Genuinely Transparent?

A good exchange won't make you hunt for its fee schedule. You should be able to find a straightforward, comprehensive list of all non-trading costs without breaking a sweat.

This means being upfront about everything: withdrawal fees, network fees, and any other charges for specific services. If that information feels like it's buried in the fine print, that's a huge red flag.

How Competitive Are the Spreads?

Since the spread is how these exchanges make their money, it can vary wildly from one platform to another. The best way to gauge this is to do a live comparison.

Pull up the buy and sell prices for the same crypto on a few different exchanges at the same time. Crucially, watch how those spreads behave during market craziness. Some exchanges widen them dramatically when things get volatile, which can chew up your profits fast.

Choosing a zero-fee crypto exchange with tight, consistent spreads is crucial. A platform that widens its spread during market volatility can quickly erase any savings you gained from avoiding commissions.

Does It Offer Sufficient Liquidity?

Liquidity is just a fancy word for how easily you can buy or sell without moving the price. An exchange with high trading volume has deep liquidity, and that’s what protects you from slippage—that maddening moment when your order fills at a worse price than you expected.

Take a look at the 24-hour trading volume for the coins you're interested in. You need to know the platform is robust enough to handle your orders without any nasty surprises.

How Good Is the Actual Trading Experience?

Finally, think about the user experience. A clunky, confusing, or slow interface isn't just annoying; it can lead to expensive mistakes.

The platform should feel intuitive. It needs to offer the tools you'll actually use, whether you’re just placing simple market orders or you need advanced charting features to map out your strategy.

Got Questions About Zero-Fee Exchanges? We've Got Answers.

Even after you understand how these exchanges make money, it's natural to have a few lingering questions. Let's tackle some of the most common ones head-on so you can trade with total peace of mind.

Are Zero-Fee Exchanges Actually Safe?

This is probably the biggest question on everyone's mind, and the answer has very little to do with fees. A platform's security is all about its infrastructure and operational discipline, not its pricing model. The best exchanges demonstrate their commitment to safety through tangible actions.

Here’s what really matters:

- Regulatory Standing: Is the exchange playing by the rules? Look for registration with financial bodies like FinCEN.

- Proof of Reserves: Can they prove they hold customer assets 1-to-1? This should be verified through regular, independent audits.

- Security Tech: Are they using best practices like keeping the vast majority of funds in offline cold storage and requiring multi-factor authentication for users?

An exchange's dedication to these principles is what makes it safe, regardless of whether it charges a commission on trades.

What's the Real "Catch" with Commission-Free Trading?

Fair question. Usually, the "catch" is that the costs are simply moved somewhere less obvious than a trading fee. You really need to dig into two specific areas before you commit to a platform.

First, look closely at the bid-ask spread. A wide spread can quietly eat into your profits, often costing you more than a small commission would, especially if you trade frequently. Second, scrutinize the withdrawal fees. Some platforms let you trade for free but then charge a fortune to move your crypto elsewhere, essentially locking you in. Always read the fine print on their fee schedule.

Can I Actually Make Large Trades on These Platforms?

Yes, you can, but there's a huge "if" attached. You must check the exchange's liquidity and the depth of its order book. An exchange with thin volume simply can't handle a large order without causing major slippage—that’s when your trade fills at a much worse price than you expected.

When you're moving serious capital, the potential cost of slippage on a low-liquidity exchange can dwarf any savings you get from zero fees. A deep, active order book is absolutely essential.

Before you execute a big trade, always look at the 24-hour volume for that specific trading pair. Make sure the market is deep enough to absorb your order without the price moving against you.

Ready to trade with clarity and confidence? vTrader combines genuine zero-fee trading with transparent costs, robust security, and deep liquidity. Start building your portfolio today and experience a smarter way to trade.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.