While many associate cryptocurrency purely with active trading and price speculation, a more strategic approach involves making your digital assets generate returns on their own. Instead of letting your portfolio sit idle, you can leverage it to create consistent revenue streams. This guide moves beyond the charts and focuses on eight powerful methods for earning passive income from cryptocurrency. We will explore practical, actionable strategies that can turn your holdings into a productive, self-sustaining financial engine.

To truly unlock your crypto's earning potential through strategies like staking and liquidity providing, it's essential to grasp the underlying principles of the ecosystem. Understanding how these mechanisms operate within the broader framework is the first step toward building a successful passive income strategy. For a foundational overview, see this guide on Decentralized Finance (DeFi) explained.

From staking and yield farming to lending and affiliate programs, we will break down each method into simple, understandable steps. You will learn not just what these strategies are, but how to implement them effectively, using platforms like vTrader to simplify the process. Our goal is to equip you with the knowledge to build sustainable wealth and maximize your crypto's potential long after the initial investment. Let's dive into how you can put your digital assets to work.

1. Cryptocurrency Staking

Cryptocurrency staking offers a straightforward way to generate passive income from cryptocurrency by participating directly in the security and operations of a blockchain network. Instead of letting your digital assets sit idle, staking involves locking them up in a crypto wallet to support a Proof-of-Stake (PoS) network. In return for your contribution, which helps validate transactions and secure the blockchain, the network rewards you with additional coins.

This process is similar to earning interest in a traditional savings account. The more coins you stake and the longer you commit them, the greater your potential rewards. Major PoS networks like Ethereum, Cardano, and Solana rely on stakers to maintain their integrity, making this a fundamental and widely accessible income-generating activity. Platforms like vTrader simplify this process, allowing users to stake their assets directly from their accounts with just a few clicks.

How to Get Started with Staking

Getting started is relatively simple. First, you need to acquire a PoS cryptocurrency, such as ETH, ADA, or SOL. Next, you choose a staking method. You can either stake directly through a personal wallet, which gives you more control, or use a staking-as-a-service provider on an exchange, which is often more user-friendly.

- Choose a Reputable Validator: Validators are responsible for running the nodes that process transactions. Research their uptime, commission fees, and overall reputation before delegating your coins.

- Consider Liquid Staking: Services like Lido Finance issue a tokenized version of your staked assets, allowing you to use them in other DeFi applications while still earning staking rewards. This provides liquidity for assets that would otherwise be locked.

- Diversify Your Stake: To minimize risk, avoid putting all your assets with a single validator. Spreading your stake across multiple validators can protect you if one goes offline or underperforms.

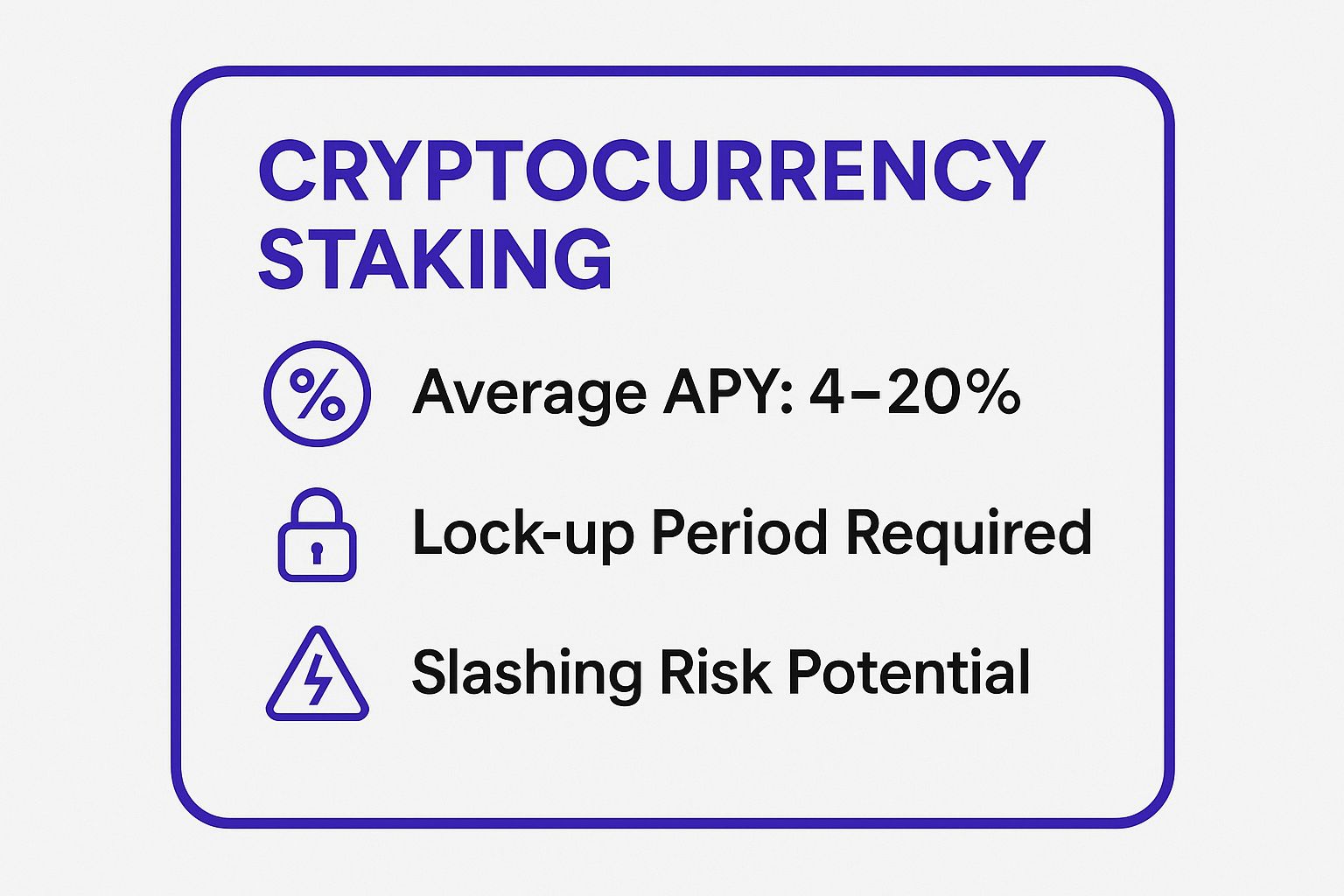

The following summary box highlights the key data points to consider before you begin staking.

As the infographic shows, while the potential returns are attractive, it's crucial to be aware of lock-up periods and the risk of slashing, where you can lose a portion of your stake if your chosen validator acts maliciously. To explore a secure and simplified way to begin, you can learn more about staking on vTrader and see how its integrated tools can help you manage these factors effectively.

2. Liquidity Providing (Yield Farming)

Liquidity providing, often called yield farming, is another powerful method for generating passive income from cryptocurrency. This strategy involves depositing a pair of crypto assets into a liquidity pool on a decentralized exchange (DEX). These pools are the backbone of DEXs, enabling users to trade tokens without a traditional order book. In return for providing the necessary liquidity, you earn a share of the trading fees generated by that pool, often supplemented by additional token rewards from the platform.

This process is essential for the functionality of the decentralized finance (DeFi) ecosystem. By becoming a liquidity provider (LP), you help facilitate seamless token swaps while your deposited assets work for you. Yields can be substantial, especially in newer or more volatile pools, with popular platforms like Uniswap, PancakeSwap, and Curve Finance offering a wide array of opportunities.

How to Get Started with Yield Farming

Getting started with yield farming requires a bit more active management than staking but can offer higher returns. First, you'll need two different crypto assets to deposit as a pair. Next, you connect your wallet to a DEX and add your tokens to a chosen liquidity pool.

- Start with Stablecoin Pairs: To minimize the risk of impermanent loss (where the value of your deposited assets diverges from what it would be if you simply held them), consider starting with pairs like USDC/USDT. These pairs have minimal price fluctuation.

- Monitor Pool Performance: Yields can change quickly. Regularly check the Annual Percentage Rate (APR) of your pools and be prepared to move your assets to more profitable opportunities. Yield aggregator platforms can help automate this process.

- Be Mindful of Gas Fees: Transactions on blockchains like Ethereum can be expensive. Consider using Layer 2 solutions or alternative chains like Binance Smart Chain or Polygon to reduce transaction costs and maximize your profits.

While the potential for high returns is a major draw, it's crucial to understand the associated risks, particularly impermanent loss. To build a solid foundation of knowledge, you can explore the vTrader Academy to learn more about the fundamentals of yield farming before committing your capital.

3. Cryptocurrency Lending

Cryptocurrency lending provides another powerful avenue to generate passive income from cryptocurrency by acting as a digital bank. Instead of leaving your assets dormant in a wallet, you can lend them to borrowers through specialized platforms and earn interest on them. The process is facilitated by either centralized finance (CeFi) platforms or decentralized finance (DeFi) protocols, which connect lenders with borrowers and automate interest payments.

This model functions much like a high-yield savings account, where your crypto assets work for you. By lending out stablecoins like USDT or major cryptocurrencies like Bitcoin and Ethereum, you receive regular interest payments, often at much higher rates than traditional finance offers. Platforms like BlockFi and Celsius Network popularized this model, while decentralized protocols like Aave and Compound Finance brought it on-chain, offering greater transparency and control through smart contracts.

How to Get Started with Lending

Beginning your lending journey involves choosing a platform that aligns with your risk tolerance and goals. You'll need to deposit your chosen crypto onto the platform, which will then pool it with other lenders' funds to offer loans. The interest you earn is paid out from the interest paid by the borrowers.

- Research Platform Security: Before lending, thoroughly investigate the platform's security measures, insurance coverage for user funds, and historical track record. Centralized platforms often offer insurance but require you to give up custody of your keys.

- Diversify Across Platforms: To mitigate counterparty risk, consider spreading your assets across multiple lending platforms. This ensures that if one platform faces issues, your entire lending portfolio isn't compromised.

- Start with Reputable Platforms: For beginners, starting with well-established and regulated platforms is a safer approach. These services typically have more robust security and clearer terms of service. DeFi protocols offer more control but demand a deeper understanding of smart contract risks.

The following summary box highlights the key data points to consider before you begin lending.

As the infographic illustrates, crypto lending offers attractive APYs, but it's essential to understand the associated risks, such as platform insolvency or smart contract vulnerabilities. To ensure you maximize your returns, it's also important to understand the fee structure of any platform you use. You can learn more about vTrader's fee structure to see how its transparent approach can help you keep more of your earnings.

4. Cryptocurrency Dividends and Airdrops

Cryptocurrency dividends and airdrops provide an exciting way to earn passive income from cryptocurrency simply by holding specific digital assets. Unlike active trading, this method involves receiving free tokens directly into your wallet. Dividends are regular distributions paid to holders of certain coins, similar to stock dividends, while airdrops are typically one-time events where projects distribute new tokens to build a community or reward early supporters.

This strategy allows you to accumulate a diverse portfolio of digital assets over time with minimal effort. For instance, some blockchains generate a secondary token as a reward for holding the primary one, like VeChain (VET) generating VeThor (VTHO). Major airdrops, such as those from Uniswap or Arbitrum, have historically distributed thousands of dollars worth of tokens to eligible users, rewarding them for their participation in the ecosystem.

How to Get Started with Dividends and Airdrops

To position yourself for these opportunities, the key is holding the right assets in the right places and staying informed. You must be proactive in identifying projects that offer dividends or are likely to conduct airdrops.

- Hold Dividend-Yielding Tokens: Acquire and hold cryptocurrencies known for paying dividends, such as NEO (which generates GAS) or VeChain. Ensure they are stored in a wallet that supports the reward generation process.

- Participate in New Ecosystems: Engage with emerging DeFi protocols, testnets, or new blockchain networks. Early users are often the primary recipients of airdrops designed to decentralize governance.

- Stay Informed on Announcements: Follow crypto news outlets and project announcements on social media to learn about upcoming airdrops and their eligibility criteria. Being aware of snapshot dates and required actions is crucial.

While dividends provide a predictable income stream, airdrops can be more sporadic yet potentially more lucrative. Both methods reward long-term holders and active community members. To stay updated on the latest events and potential airdrop opportunities, you can explore the latest crypto news and updates on vTrader and ensure you never miss a chance to grow your portfolio.

5. Cryptocurrency Masternodes

Running a masternode is an advanced method for generating passive income from cryptocurrency that involves providing critical infrastructure to a blockchain network. Masternodes are full-node servers that perform specialized functions beyond simple transaction validation, such as facilitating instant transactions, participating in governance votes, or enabling private transactions. In return for the high level of service and financial commitment required, masternode operators receive a significant share of the network's block rewards.

This process is more demanding than staking, as it requires a substantial upfront collateral investment in the network's native cryptocurrency, which must remain locked. For example, the Dash network, which pioneered the masternode concept, requires operators to lock up 1,000 DASH. Other projects like PIVX have similar high-collateral requirements. This high barrier to entry ensures operators are heavily invested in the network's success and incentivizes them to maintain reliable service.

How to Get Started with Masternodes

Setting up a masternode is a technical undertaking but can be highly rewarding. First, you must acquire the required collateral for your chosen cryptocurrency. Next, you need to set up a dedicated server or Virtual Private Server (VPS) that meets the network's specifications and can run 24/7 without interruption.

- Calculate Your ROI: Before investing, carefully calculate the potential return on investment. Factor in the cost of the collateral, server hosting fees, and the volatility of the reward-paying cryptocurrency.

- Use Masternode Hosting Services: If you lack the technical expertise to configure and maintain a server, services like Allnodes or ZCore can manage the technical side for a fee, simplifying the process significantly.

- Consider Shared Masternodes: For those who cannot afford the full collateral, some platforms offer shared masternode services. This allows you to pool your funds with others to meet the minimum requirement and receive a proportional share of the rewards, lowering the entry barrier.

While platforms like vTrader focus on more accessible options like staking, understanding masternodes provides deeper insight into the various ways you can contribute to and earn from blockchain networks. The high collateral and technical requirements make this a strategy best suited for experienced investors with a strong belief in a project's long-term potential.

6. Crypto Savings Accounts

Crypto savings accounts provide a familiar and accessible method for generating passive income from cryptocurrency, functioning much like traditional bank savings accounts. Instead of leaving digital assets dormant, you can deposit them into these accounts to earn interest. Platforms offering these services typically pool user funds and lend them to institutional borrowers or deploy them in other yield-generating activities, sharing the profits with depositors in the form of an annual percentage yield (APY).

This approach is ideal for those seeking a straightforward, hands-off way to grow their crypto holdings. By simply depositing your assets, you begin earning interest, which often compounds over time. Major platforms like Nexo and Crypto.com have popularized this model by offering competitive rates on a wide range of cryptocurrencies, making it a simple entry point for earning passive rewards without needing deep technical knowledge.

How to Get Started with Crypto Savings Accounts

Getting started is typically a simple process. First, you need to select a reputable platform that offers crypto savings accounts and open an account. After completing any required identity verification, you can deposit your chosen cryptocurrency and start earning interest almost immediately.

- Compare Rates and Terms: Different platforms offer varying interest rates, lock-up periods, and withdrawal policies. Research and compare options like Nexo or Crypto.com to find one that aligns with your financial goals and risk tolerance.

- Verify Platform Security: Since you are entrusting a third party with your funds, it's crucial to assess their security measures. Look for platforms with robust security protocols, cold storage solutions, and insurance coverage for deposited assets.

- Start Small to Test: Before committing a large amount, consider depositing a smaller sum to test the platform’s functionality, interest payment schedule, and withdrawal process. This helps build confidence and familiarity with the service.

7. Cryptocurrency Index Funds and ETFs

Cryptocurrency index funds and ETFs offer a diversified, hands-off approach to generating passive income from cryptocurrency. Instead of researching and managing individual assets, you can invest in a single fund that holds a curated basket of digital currencies. These funds track specific market indices, such as the top 10 cryptocurrencies by market cap, and distribute gains or dividends to investors, providing a streamlined way to gain broad market exposure.

This method is ideal for investors who prefer a traditional investment vehicle or want to avoid the complexities of direct token ownership and self-custody. Products like the Grayscale Bitcoin Trust (GBTC) or the tokenized DeFi Pulse Index (DPI) allow you to benefit from the growth of the crypto sector without needing to manage multiple wallets or private keys. The income is generated through the appreciation of the underlying assets, which is then reflected in the fund's share price or through direct distributions.

How to Get Started with Index Funds and ETFs

Investing in these products often mirrors traditional stock market investing. For exchange-traded funds (ETFs) and trusts, you typically need a brokerage account. For tokenized index funds, you’ll need a crypto wallet and access to a decentralized exchange.

- Compare Expense Ratios: Funds charge an annual fee for management, known as the expense ratio. Compare these fees across different providers, as lower ratios mean more of the returns stay in your pocket.

- Understand the Index Methodology: Each fund tracks a different index. Research how the index is constructed, what assets it includes, and how often it is rebalanced to ensure it aligns with your investment goals.

- Monitor Premium or Discount: For products like GBTC, the share price can trade at a premium or discount to the net asset value (NAV) of the underlying crypto. Be aware of this dynamic, as it can significantly impact your returns.

The following summary box highlights the key data points to consider before you begin investing in crypto funds.

As shown in the infographic, while diversification is a major benefit, it is crucial to understand the management fees and potential for tracking errors. Platforms like vTrader offer access to a wide range of assets, allowing you to build your own diversified portfolio as an alternative to pre-packaged funds. You can explore the asset selection on vTrader to start creating a personalized investment strategy.

8. Crypto Affiliate and Referral Programs

Crypto affiliate and referral programs offer a powerful way to generate passive income from cryptocurrency by leveraging your network and influence. Many exchanges, platforms, and services reward you for bringing in new customers, turning your recommendations into a consistent revenue stream. Participants typically earn commissions from the trading fees of their referrals, receive a one-time bonus, or benefit from ongoing revenue-sharing models.

This method transforms your social reach into a tangible asset. By sharing unique referral links on blogs, social media, or with friends, you can build a network of users whose activity generates income for you over time. Unlike active trading, this income can grow exponentially as your referred user base expands. Platforms like vTrader have structured affiliate programs that reward community builders, allowing you to earn by introducing others to a reliable trading environment.

How to Get Started with Affiliate Programs

Getting started is accessible to anyone with an online presence or a community. The key is to build trust and provide genuine value, rather than just sharing links. First, identify platforms with strong reputations and attractive programs, such as those offered by major exchanges or hardware wallet providers like Ledger and Trezor.

- Provide Genuine Value and Education: Create helpful content like tutorials, reviews, or market analysis that naturally integrates your affiliate links. This builds trust and encourages users to sign up through you.

- Build Trust Through Transparency: Always disclose that you are using affiliate links. Honesty is crucial for maintaining credibility with your audience and is often a requirement of the program.

- Track and Optimize Your Strategies: Use analytics to see which links perform best and double down on successful strategies. Understanding your audience helps you tailor your recommendations for better results.

For those looking to dive deeper into the broader concepts of affiliate marketing, beyond just the crypto space, you can explore resources on general affiliate marketing principles to refine your approach. This method is ideal for content creators, influencers, and community leaders who can authentically recommend products and services they trust. To see how a competitive program works, you can explore the vTrader affiliate program and discover its commission structures and partner benefits.

Passive Income Crypto Methods Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements 🔄 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐⚡ |

|---|---|---|---|---|---|

| Cryptocurrency Staking | Low – moderate | Moderate (holding & lock-up tokens) | Stable returns (4-20% APY) | Passive income, network security | No expensive hardware, stable rewards ⭐, low maintenance ⚡ |

| Liquidity Providing (Yield Farming) | Moderate to high | High (capital + active management) | High yields (20-100%+ APY) | High-risk high-reward DeFi strategies | Immediate liquidity, multiple income streams ⚡⭐ |

| Cryptocurrency Lending | Low to moderate | Moderate (lending capital) | Predictable interest (3-15% APY) | Passive income with moderate risk | Flexible terms, passive returns ⭐ |

| Cryptocurrency Dividends & Airdrops | Low | Low (just hold tokens) | Variable & unpredictable | Long-term holders seeking passive rewards | Fully passive, no lock-ups, potential surprise rewards ⭐ |

| Cryptocurrency Masternodes | High | High (large collateral + server) | High returns (10-50% APY) | Technical users with capital for infrastructure | Network governance, high reward potential ⭐ |

| Crypto Savings Accounts | Low | Low to moderate | Moderate returns (varies) | Beginner-friendly passive income | User-friendly, some insured, no technical skill needed ⭐⚡ |

| Cryptocurrency Index Funds & ETFs | Low | Low to moderate (investment capital) | Diversified returns with fees | Diversified crypto exposure without direct management | Reduced risk, professional management ⭐ |

| Crypto Affiliate & Referral | Low to moderate | Low (time, audience/network) | Variable, scalable passive income | Content creators, marketers | No capital needed, high scalability potential ⭐⚡ |

Start Your Passive Crypto Journey Today

The path to generating passive income from cryptocurrency is no longer reserved for seasoned developers or institutional investors. As we've explored, the landscape has evolved dramatically, offering a diverse toolkit of strategies tailored to various goals, risk tolerances, and levels of technical expertise. From the straightforward, set-and-forget nature of crypto savings accounts and staking to the more hands-on, potentially higher-reward strategies like yield farming and running masternodes, the opportunities are abundant.

The journey begins not with a massive investment, but with a commitment to education and a clear strategy. We've demystified eight powerful methods, showing that whether you're locking up assets to secure a network or providing liquidity to a decentralized exchange, you are actively participating in the growth and stability of the digital economy. This participation is what generates your returns, transforming static assets into dynamic, income-producing tools.

Key Takeaways for Building Your Crypto Income Stream

Recapping our exploration, the core principles for success remain consistent across all methods:

- Diversification is Essential: Spreading your capital across different strategies, such as combining staking, lending, and an affiliate program, mitigates risk. Over-reliance on a single protocol or asset can expose you to unnecessary volatility.

- Understand the Risk-Reward Spectrum: Higher Annual Percentage Yields (APYs) almost always correlate with higher risks, such as smart contract vulnerabilities or impermanent loss in yield farming. Balance your portfolio with both conservative and aggressive approaches.

- Due Diligence is Non-Negotiable: Before committing funds, thoroughly research the project's team, technology, security audits, and community engagement. A strong foundation is the best indicator of long-term viability.

- Leverage User-Friendly Platforms: The complexity of DeFi can be a significant barrier. Using integrated platforms that simplify processes like staking or accessing lending protocols can dramatically lower the learning curve and enhance security.

Your Actionable Next Steps

Embarking on your passive income journey requires a deliberate, step-by-step approach. Start by assessing your personal financial situation and identifying which of the discussed strategies aligns best with your goals. If you're new, begin with lower-risk options like staking stablecoins or joining a reputable crypto savings program.

As you gain confidence, you can gradually explore more complex avenues like providing liquidity to a well-established pair or investigating a masternode project. The most important step is the first one. By choosing one strategy and starting small, you build practical experience and create a foundation for a robust and diversified portfolio of passive income from cryptocurrency. The digital frontier is waiting for you to stake your claim.

Ready to put these strategies into action on a secure, commission-free platform? vTrader offers integrated tools for staking, lending, and a rewarding affiliate program, making it the perfect place to start or expand your crypto passive income journey. Explore your options and begin building your portfolio today at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.