Welcome to your definitive guide for maximizing passive income in the digital asset space. The world of crypto staking offers a powerful way to make your assets work for you, but navigating the options to find the best returns can be overwhelming. High yields often come with unique risks and specific requirements, making it crucial to look beyond just the advertised numbers.

This article cuts through the noise. We are providing a curated list of platforms and protocols where you can find some of the highest APY crypto staking opportunities available today. Forget sifting through endless forums and complex whitepapers; we’ve compiled the essential details you need to make an informed decision.

For each option on our list, we will break down the key information:

- The specific platform or protocol.

- The token you can stake and its potential APY.

- Critical details like lock-up periods and risk factors.

- Actionable insights with direct links and screenshots to get you started.

Our goal is to equip you with the knowledge to confidently identify and engage with top-tier staking opportunities, turning your portfolio's potential into tangible profit. We will also introduce powerful tools like the vTrader Crypto Staking Calculator to help you accurately forecast potential earnings and make data-driven decisions.

1. Crypto Staking Calculator: Maximize Your Rewards Today | vTrader

For investors aiming to secure the highest APY crypto staking returns, a strategic approach is paramount. The Crypto Staking Calculator by vTrader stands out not merely as a platform, but as a sophisticated planning tool designed to demystify and maximize your passive income potential. This resource empowers you to move beyond guesswork and model your staking outcomes with precision, making it an indispensable first stop for both new and experienced stakers.

The calculator's primary strength lies in its highly customizable and dynamic interface. Users can input specific variables that directly impact their earnings, including the principal investment amount, the precise APY of a given asset, any associated network or platform fees, the staking duration, and the compounding frequency. This level of detail allows for a far more accurate projection of potential returns compared to generic estimators. Before you even commit capital, you can simulate various scenarios to identify the most lucrative opportunities.

Why vTrader Excels for High-Yield Staking

What elevates the vTrader calculator is its seamless integration into a comprehensive, commission-free trading ecosystem. This creates a powerful workflow where you can research, model, and execute your staking strategy all within one secure environment. The platform is backed by a regulated infrastructure, providing the peace of mind necessary when dealing with digital assets.

Key features that contribute to its premier status include:

- Precise Modeling: The ability to factor in fees and compounding intervals gives you a realistic financial forecast. This is a critical component, as a fundamental grasp of understanding how to calculate return on investment is the foundation of any successful staking venture.

- Integrated Ecosystem: Transition effortlessly from calculating potential earnings to trading or staking assets on the vTrader platform. This eliminates the friction and potential security risks of moving assets between different services.

- Educational Support: vTrader is committed to user education. If you're new to the concepts of yield farming or liquid staking, the platform provides extensive guides and resources to help you build a strong knowledge base. You can explore these educational materials at the vTrader Academy to deepen your understanding.

- Universal Accessibility: The tool is fully functional across both desktop and mobile devices, allowing you to plan and adjust your strategies on the go, supported by real-time market data and 24/7 customer support.

Ultimately, while the calculator itself doesn't generate yield, it provides the strategic foresight needed to confidently pursue the highest APY crypto staking opportunities available in the market. By enabling data-driven decisions, it positions you to optimize your portfolio for maximum growth.

Visit the Crypto Staking Calculator by vTrader to start modeling your potential earnings.

2. Coinbase

Coinbase offers one of the most accessible entry points into the world of crypto staking, especially for users based in the United States. As a publicly-traded and heavily regulated exchange, it removes many of the technical barriers associated with earning staking rewards. Users can buy, sell, and stake various proof-of-stake cryptocurrencies directly within a single, user-friendly interface, making it an excellent platform for those seeking simplicity and security.

The platform stands out by managing all the complex backend operations, such as running validator nodes, so users don't need any technical expertise. This convenience is a key reason why it's a top choice for beginners looking for high APY crypto staking opportunities without the steep learning curve. Coinbase provides clear, estimated reward rates for each eligible asset and handles the distribution of rewards directly to your account.

Key Features and User Experience

Coinbase's strength lies in its seamless integration and straightforward design. The staking process is intuitive: simply hold an eligible asset in your Coinbase wallet, and you can opt-in to staking with a few clicks.

- Broad Asset Support: Stake popular assets like Ethereum (ETH), Solana (SOL), Cardano (ADA), Tezos (XTZ), and more.

- Low Minimums: You can start staking with as little as $1, making it accessible to investors of all sizes.

- Liquid Staking: For Ethereum, Coinbase offers cbETH (Coinbase Wrapped Staked ETH), a liquid staking token. This allows you to retain liquidity and use your staked assets in the DeFi ecosystem while still earning rewards.

- Transparency: The platform clearly displays the estimated net APY after its commission, along with the network's current staking ratio.

Pros and Cons

While Coinbase excels in usability, it's important to weigh its advantages against its drawbacks. The platform charges a commission on staking rewards, which means the APY you receive will be lower than what you might earn by staking directly on-chain. Additionally, unstaking periods are dictated by the underlying blockchain protocol and can sometimes involve waiting periods.

| Pros | Cons |

|---|---|

| High Security & Regulation | APYs are lower due to platform fees |

| Extremely User-Friendly | Unstaking can involve long wait times |

| Low Staking Minimums | Not your keys, not your coins |

| Liquid Staking with cbETH | Centralized point of failure |

For those new to the space, the trade-off between a slightly lower APY and the platform’s high level of convenience and security is often worthwhile. If you are interested in a more in-depth comparison, you can explore the Coinbase FAQ section for additional details on their services.

Website: https://www.coinbase.com

3. Kraken

Kraken is one of the longest-standing and most respected cryptocurrency exchanges, offering a robust and secure platform for both trading and staking. It provides a reliable avenue for users, including those in the U.S., to engage with some of the highest APY crypto staking opportunities. The platform distinguishes itself with flexible and "bonded" staking options, allowing users to choose between liquidity and potentially higher reward rates on a wide array of digital assets.

This dual-option system makes Kraken an attractive choice for various investor strategies. Whether you prioritize having immediate access to your funds or are willing to lock them up for a fixed term to maximize yields, Kraken accommodates your needs. The platform manages the technical complexities of staking, such as operating validator nodes, providing a straightforward buy-and-stake process for users of all experience levels.

Key Features and User Experience

Kraken’s interface is clean and functional, making it easy to navigate the staking process. Users can view indicative APY ranges for each asset and receive reward payouts weekly, which allows for consistent compounding of returns.

- Flexible & Bonded Staking: Choose "Flexible" staking to unstake at any time or select "Bonded" staking for specific terms to earn higher yields on assets like Polkadot (DOT).

- Wide Asset Selection: Stake a diverse range of assets, including popular options like Ethereum (ETH), Solana (SOL), and Cardano (ADA), alongside higher-yield ecosystem tokens like Cosmos (ATOM).

- Regular Payouts: Staking rewards are typically distributed weekly, allowing your earnings to grow steadily.

- Transparent Rates: The platform clearly displays the estimated reward rates for each staking option, helping you make informed decisions.

Pros and Cons

Kraken’s primary strength is its choice-driven staking model, which caters to different risk appetites and liquidity needs. However, users must be aware of potential geographic restrictions and the commission fees that affect net earnings.

| Pros | Cons |

|---|---|

| Flexible vs. Bonded staking options | Commissions apply, reducing net rewards |

| Wide staking menu with high-yield assets | Geographic restrictions may limit availability |

| Long-standing, reputable exchange | Bonded staking involves lock-up periods |

| Weekly reward payouts | Staking services can change based on regulation |

For investors looking for a secure platform that offers more control over their staking strategy, Kraken presents a compelling balance of flexibility, security, and access to rewarding assets.

Website: https://www.kraken.com

4. Lido

Lido has established itself as the dominant force in the decentralized liquid staking space, particularly for Ethereum. It allows users to stake their ETH without locking up capital, addressing a major pain point of traditional staking. By depositing ETH, users receive stETH, a tokenized version of their staked asset that automatically accrues rewards. This model provides liquidity and unlocks the potential for some of the highest APY crypto staking strategies by allowing stETH to be used across the DeFi ecosystem.

The platform operates as a decentralized autonomous organization (DAO), giving it a non-custodial and more transparent structure compared to centralized exchanges. Lido pools user funds and stakes them with a curated set of professional node operators, diversifying risk and optimizing performance. This approach abstracts away the technical complexities of running a validator node, making ETH staking accessible to anyone while maintaining the principles of decentralization.

Key Features and User Experience

Lido’s user experience is streamlined and focused entirely on its liquid staking protocol. The interface is clean, showing real-time statistics like total assets staked, current APY, and the number of stakers.

- Liquid Staking: Receive stETH tokens (or wstETH for DeFi compatibility) that represent your staked ETH and its accrued rewards, which can be traded or used as collateral.

- DeFi Integration: stETH is widely integrated across over 100 DeFi protocols, allowing users to lend, borrow, and provide liquidity to earn additional yield on top of their staking rewards.

- Non-Custodial: Users retain full control over their assets. You stake directly from your own wallet, such as MetaMask, without ever giving up custody of your private keys.

- No Minimums: Unlike running a solo validator node which requires 32 ETH, Lido has no minimum staking amount, opening the door for investors of all sizes.

Pros and Cons

Lido's primary advantage is the powerful combination of staking rewards and liquidity. However, this model introduces unique risks tied to smart contracts and market dynamics. For those interested in its governance structure, you can learn more about the Lido DAO token and its role in the ecosystem.

| Pros | Cons |

|---|---|

| Maintains asset liquidity via stETH | Focus on ETH limits asset diversification |

| Competitive ETH staking APY | Smart contract and protocol risks |

| Widespread DeFi integration | Potential de-peg risk of stETH in stress events |

| Highly decentralized & non-custodial | Rewards subject to a 10% platform fee |

Lido is an ideal choice for users who want to maximize their capital efficiency. By earning staking rewards and simultaneously deploying their liquid stETH tokens in other DeFi protocols, users can compound their returns and achieve some of the highest yields available.

Website: https://lido.fi

5. Rocket Pool

Rocket Pool offers a highly decentralized and permissionless approach to Ethereum liquid staking, setting it apart from more centralized alternatives. It empowers users to stake ETH without needing the full 32 ETH required for a solo validator, making it a key player for those seeking the highest APY crypto staking returns while prioritizing network health. The protocol allows users to stake as little as 0.01 ETH in exchange for rETH, a liquid staking token that accrues value as staking rewards are earned.

The platform is designed to be non-custodial and governed by its community, which resonates with users who are deeply committed to the core principles of decentralization. Unlike centralized exchanges, Rocket Pool is managed by a network of independent node operators, which reduces single points of failure. This structure not only enhances security but also allows advanced users to run their own nodes with just 8 ETH (through a "minipool"), earning a higher commission and RPL token rewards.

Key Features and User Experience

Rocket Pool requires a Web3 wallet like MetaMask to interact with its decentralized application (dApp). While this involves a steeper learning curve than a centralized exchange, it provides full custody over your assets.

- Decentralized Liquid Staking: Swap ETH for rETH, which represents your staked ETH plus accrued rewards. The rETH token can be used across the DeFi ecosystem to generate additional yield.

- Low Staking Minimum: The entry point is just 0.01 ETH, making it accessible to nearly everyone.

- Permissionless Node Operation: Advanced users can run their own "minipool" with 8 ETH, contributing to network decentralization and earning extra rewards from commissions and RPL incentives.

- Non-Custodial: Users maintain full control over their private keys and assets throughout the staking process.

Pros and Cons

Rocket Pool's greatest strength is its unwavering commitment to decentralization, but its ETH-only focus and DeFi-native interface may not suit all investors. The reliance on a Web3 wallet means users are responsible for their own security.

| Pros | Cons |

|---|---|

| Strong Decentralization Focus | ETH-only focus restricts asset choice |

| Low 0.01 ETH Staking Minimum | Requires Web3 wallet and DeFi literacy |

| Non-Custodial Control of Assets | Smart contract risk is inherent to the protocol |

| Option for Higher APY via Node Operation | Variable APY based on network conditions |

For users comfortable with DeFi protocols, Rocket Pool presents a compelling, secure, and decentralized method for earning ETH staking rewards. If you are interested in exploring similar opportunities, you can learn more about staking on vtrader.io to compare different platforms and approaches.

Website: https://rocketpool.net

6. ether.fi

ether.fi is a premier liquid restaking protocol on Ethereum, offering a sophisticated way to earn yield that goes beyond traditional staking. It allows users to stake their ETH and in return receive a liquid restaking token (eETH), which simultaneously accumulates standard Ethereum staking rewards and additional yield from EigenLayer restaking. This dual-source yield model makes it a powerful contender for those searching for the highest APY crypto staking opportunities.

The platform stands out by natively restaking the ETH deposited, meaning users earn compounded rewards from both consensus layer validation and EigenLayer's economic security services from day one. Unlike centralized exchanges, ether.fi is a decentralized protocol, giving users full control over their assets via a Web3 wallet. This approach caters to more experienced DeFi users who are comfortable managing their own keys and interacting directly with smart contracts.

Key Features and User Experience

ether.fi provides a streamlined interface for a complex process, focusing on maximizing yield while maintaining liquidity. The protocol’s design is centered around its liquid token, eETH, which can be used across the DeFi ecosystem.

- Native Restaking: Your staked ETH automatically earns both standard staking rewards and EigenLayer points and rewards, creating a blended, higher APY.

- Liquid Token (eETH): Receive eETH, a token that represents your staked ETH plus rewards. This token can be traded or used in other DeFi protocols to earn even more yield.

- Decentralized Control: Users maintain full custody of their assets and keys, a core principle of DeFi that contrasts with centralized staking providers.

- Liquid Vaults: The platform offers optional "Liquid Vaults" that deploy assets into specific DeFi strategies to generate incremental yield on top of the base restaking rewards.

Pros and Cons

ether.fi’s innovative model presents a compelling yield opportunity, but it also introduces unique risks associated with its multi-layered approach. The potential for higher returns is balanced against the complexities of depending on multiple protocols.

| Pros | Cons |

|---|---|

| Potential for higher APY through blended rewards | Added smart contract risk from multiple protocol layers |

| Liquid token (eETH) maintains DeFi composability | Requires a Web3 wallet and DeFi knowledge |

| Rapidly growing ecosystem and DeFi integrations | Not a centralized exchange; less beginner-friendly |

| Full custody of your own assets | Restaking is a newer concept with evolving risks |

For DeFi users aiming to maximize their Ethereum yields, ether.fi offers one of the most direct and efficient paths to engage with the emerging restaking narrative. If you want to dive deeper into the token that powers this ecosystem, you can learn more about Ethereum's role in DeFi and its staking mechanisms.

Website: https://ether.fi

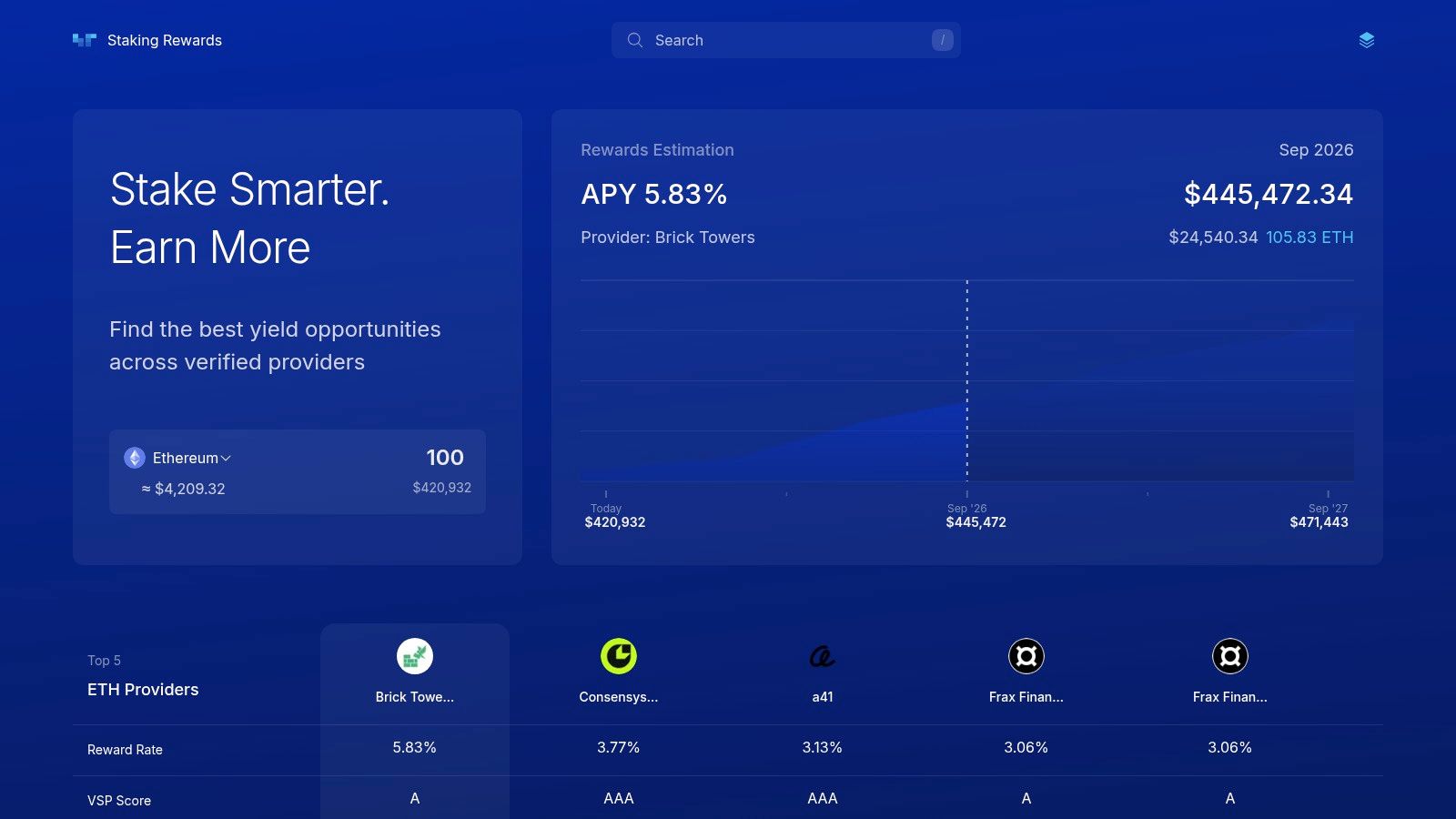

7. Staking Rewards

Staking Rewards serves as a comprehensive data aggregator and discovery engine rather than a direct staking provider. It is an indispensable tool for anyone looking to find the highest APY crypto staking opportunities across the entire ecosystem. The platform gathers, analyzes, and presents staking data from countless assets, networks, and providers, offering a centralized hub to compare potential returns and make informed decisions without bias.

The platform’s core value lies in its neutrality and breadth of information. Instead of locking users into a single exchange or wallet, it empowers them with the knowledge to choose the best option based on their risk tolerance and desired yield. It provides detailed metrics, calculators, and verified provider profiles, helping users navigate the complex landscape of staking rewards, from major exchanges to decentralized protocols.

Key Features and User Experience

Staking Rewards is designed for research and comparison, offering powerful tools to filter and sort through numerous staking options. The user experience is data-driven, prioritizing clarity and ease of access to critical information.

- Comprehensive Database: Access detailed data on hundreds of crypto assets and providers, with leaderboards showcasing top-performing staking opportunities.

- Yield Comparison: Easily compare estimated APYs, factoring in variables like inflation and provider fees, to understand your potential net return.

- Staking Calculator: Model your potential earnings over time with a sophisticated calculator that helps you project rewards based on your investment amount and staking duration.

- Provider Verification: The platform features profiles for various staking providers, including their Total Value Locked (TVL) and other key metrics, to help you assess their credibility.

Pros and Cons

As an analytics tool, Staking Rewards offers unparalleled market insight but doesn't handle the staking process itself. This means users must perform their own due diligence on the external platforms they are directed to.

| Pros | Cons |

|---|---|

| Neutral, comprehensive comparison tool | Data can sometimes lag behind real-time rates |

| Vast database of assets and providers | Staking occurs on external, third-party sites |

| Powerful calculators and filtering tools | Requires users to verify information on the final platform |

| Direct links to official staking pages | Primarily a directory and analytics tool |

For investors dedicated to finding the absolute highest APY crypto staking yields, Staking Rewards is the essential first step. It provides the map, but you still have to navigate the journey to the final destination yourself.

Website: https://www.stakingrewards.com

Top 7 Crypto Staking APY Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Crypto Staking Calculator (vTrader) | Low – web/mobile tool, integration needed | Minimal – user inputs data, uses platform data | Accurate personalized staking reward estimates | Beginners & experienced users modeling staking rewards | Customizable inputs, seamless platform integration, secure & real-time data |

| Coinbase | Low – user-friendly exchange interface | Moderate – account with USD, KYC needed | Steady staking rewards with managed validator operations | Simple staking with fiat onramps for US users | Strong compliance, low minimums, clear reward info |

| Kraken | Medium – requires account, US state eligibility | Moderate – account setup, KYC | Flexible or bonded staking yields | Users seeking higher APYs with liquidity options | Wide asset menu, flexible vs bonded staking |

| Lido | Medium – uses non-custodial liquid staking | Low – ETH required, DeFi interactions | ETH staking rewards plus liquidity and DeFi utility | ETH holders wanting liquid staking and DeFi integration | Leading ETH liquid staking, large TVL, extensive DeFi use |

| Rocket Pool | Medium – requires Web3 wallet & DeFi knowledge | Low – minimum 0.01 ETH staking | ETH staking with rETH tokens earning yield & liquidity | Advanced users seeking decentralization & higher control | Strong decentralization, permissionless nodes, yield over time |

| ether.fi | High – involves Web3, multiple protocols | Low – ETH plus interaction with layering protocols | Enhanced ETH + restaking rewards with incremental yields | Users targeting higher blended yields via restaking | Combines ETH staking with restaking, liquid vaults |

| Staking Rewards | Low – aggregator website | Minimal – web access only | Discover highest-yield staking opportunities | Researching, comparing staking options cross-chain | Comprehensive, neutral comparisons, direct staking links |

Staking Strategically: Your Next Steps to Higher Yields

Navigating the world of crypto staking can feel like searching for treasure without a map, but you are now equipped with a detailed guide to the most promising destinations. We have explored a diverse landscape of opportunities, from the straightforward, all-in-one solutions offered by centralized exchanges like Coinbase and Kraken to the more complex, yet potentially more rewarding, realm of decentralized liquid staking with protocols such as Lido, Rocket Pool, and ether.fi. Each platform presents a unique combination of yield potential, risk, and user experience.

The core takeaway is that the "best" option is subjective; it hinges entirely on your personal strategy, risk tolerance, and technical expertise. A beginner might prioritize the security and simplicity of a major exchange, while a seasoned DeFi user may be more comfortable with the on-chain mechanics of a liquid staking derivative to maximize capital efficiency. The key is to align your choice with your long-term financial goals.

Key Considerations Before You Stake

Before deploying your capital, it is crucial to move beyond the advertised APY and evaluate the underlying mechanics of any staking opportunity. High yields are attractive, but they often correlate with higher risk, whether from market volatility, smart contract vulnerabilities, or protocol instability. Your due diligence should be your first line of defense.

To truly stake with confidence, especially in decentralized environments, understanding the integrity of the underlying code is paramount. For those looking to stake strategically and mitigate risks, a crucial step involves understanding how smart contract security audits ensure the integrity of staking platforms. These independent assessments verify that a protocol is secure and functions as intended, providing a vital layer of protection for your assets.

Your Actionable Staking Checklist

As you prepare to put your crypto to work, use this checklist to guide your final decision-making process:

- Define Your Risk Profile: Are you comfortable with the potential for smart contract failure in exchange for higher yields, or do you prefer the custodial security of a centralized platform?

- Assess Lock-up Periods: Determine if you need liquidity. If so, protocols offering liquid staking tokens (LSTs) might be more suitable than options with fixed lock-up terms.

- Calculate Net Yield: Factor in all potential fees, including platform commissions, validator fees, and network transaction costs, to understand your true potential return.

- Diversify Your Portfolio: Avoid concentrating all your assets in a single staking pool or on one platform. Spreading your crypto across different protocols can help mitigate risk.

Ultimately, achieving the highest APY crypto staking rewards is not a sprint; it's a marathon of continuous research, strategic planning, and careful risk management. By leveraging powerful tools like the vTrader Crypto Staking Calculator and committing to ongoing education, you can transform your digital assets from idle holdings into a dynamic source of passive income.

Ready to put your knowledge into action and build your staking portfolio? vTrader offers a secure, commission-free trading environment to acquire the assets you need, while our integrated Staking Calculator helps you forecast potential earnings with precision. Start your journey toward higher yields today with a platform designed for strategic investors. Sign up for vTrader and take control of your crypto's earning potential.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.