You've probably heard the old saying, "don't put all your eggs in one basket." That’s diversification in a nutshell. But for investors, it’s about more than just common sense—it's your first line of defense against the market's wild swings.

The whole point is to spread your money across different types of investments—stocks, bonds, maybe even some crypto—that don't all move in the same direction at the same time. This is how you reduce risk without kneecapping your growth potential. A smartly diversified portfolio is built to deliver smoother, more consistent returns, protecting you from a major blow if one part of your portfolio takes a hit.

Why Portfolio Diversification Is Your Best Defense

In today's markets, real diversification goes way beyond just mixing a few stocks and bonds. It’s about building a financial fortress that can stand strong no matter what the economy throws at it. The goal is to own a mix of assets that react differently to the same market news.

This is critical because what’s hot one year can be ice-cold the next. A portfolio loaded up on tech stocks might have looked brilliant during a bull run, but it would have gotten crushed during a market correction. By adding assets with low correlation—meaning they don't move in lockstep—you create a buffer. When one investment zigs, another zags, helping to keep your overall portfolio stable.

The Problem with Old-School Models

For decades, the 60/40 portfolio (60% stocks, 40% bonds) was the undisputed champion of balanced investing. The idea was simple and, for a long time, effective: when stocks tanked, "safe" bonds would usually rally and soften the blow.

But times have changed. Economic curveballs like high inflation and aggressive interest rate hikes have thrown that old playbook out the window. Suddenly, we're seeing scenarios where both stocks and bonds fall together, leaving investors with nowhere to hide.

The numbers don't lie. In 2022, the S&P 500 Index plunged by -18.11%. That classic 60/40 portfolio didn't fare much better, dropping -15.79%. But a more modern, broadly diversified portfolio that included other asset classes only fell by -11.80%. That's a powerful demonstration of resilience when it matters most.

A truly diversified portfolio isn’t just a mix of stocks and bonds; it's a carefully constructed blend of non-correlated assets designed to perform across different economic seasons. Its strength lies in its ability to limit downside risk while capturing upside potential from various sources.

Core Ideas You Need to Know

Before we dive into building your portfolio, let's get a few key concepts straight. These are the foundational principles that will guide every decision you make. Getting a handle on these ideas is non-negotiable for success.

A great way to stay sharp is by keeping up with professional market analysis, like the kind you'll find on the vTrader news hub. Staying informed helps you connect these concepts to what's happening in the real world.

To help you get started, here's a quick rundown of the fundamental building blocks of diversification.

At-a-Glance Guide to Key Diversification Concepts

| Concept | What It Means for Your Portfolio | Simple Example |

|---|---|---|

| Asset Allocation | This is your master plan—how you divide your money among different categories like stocks, bonds, real estate, and crypto. It’s the single biggest factor determining your long-term results. | Deciding to put 50% of your money in stocks, 30% in bonds, 10% in real estate, and 10% in crypto. |

| Risk Tolerance | This is your personal gut-check. It’s about how much of a rollercoaster ride you can stomach without panic-selling. It shapes how aggressive or conservative your allocation will be. | An investor with high risk tolerance might allocate 80% to stocks, while a conservative one might only allocate 30%. |

| Correlation | This measures how two investments move in relation to each other. The magic happens when you combine assets with low or negative correlation, as they balance each other out. | When the stock market (Asset A) drops, gold (Asset B) often rises. These two assets have a negative correlation. |

With these core ideas in mind, you're ready to start putting together a portfolio that's built not just to grow, but to last.

Defining Your Personal Investment Blueprint

Before you even think about buying a single stock or crypto coin, you need a map. A well-diversified portfolio isn’t just a random basket of assets; it’s a plan built specifically for you. Without that blueprint, you're just navigating the markets blindfolded.

This is the part where you get brutally honest about your money, your timeline, and your personality. The answers you come up with here will be the foundation for every investment decision you make down the road.

Clarifying Your Investment Goals and Timeline

First things first: what are you actually investing for? A vague goal like "making more money" won't cut it. You need concrete, time-bound objectives that give your portfolio a real purpose. The longer you have, the more risk you can generally afford to take.

Let's break it down by real-life milestones:

- Short-Term (1-3 years): Think saving for a down payment on a house or a new car. The last thing you want is a big loss right before you need the cash, so capital preservation is the name of the game here.

- Mid-Term (4-10 years): This could be for funding a kid's college education or launching a business. You can handle some market bumps along the way but still need a balanced strategy.

- Long-Term (10+ years): Retirement is the classic example. With decades ahead of you, you have plenty of time to ride out market downturns, which opens the door for a more aggressive, growth-oriented approach.

A 25-year-old socking away money for retirement in 40 years can weather market storms much differently than a 55-year-old who needs that money in 10. Your timeline is everything.

Gauging Your True Risk Tolerance

Risk tolerance isn't just a score on a quiz. It’s about how you’d really feel if your portfolio suddenly dropped 20% in a month. Would you panic and sell everything? Or would you see it as a buying opportunity? Your gut reaction is what separates theory from reality.

An honest assessment of your risk tolerance is your best defense against emotional decision-making. It stops you from panic-selling during a downturn or chasing hype during a bull market.

Think about both your ability and your willingness to take risks. A young professional with a stable job has a high ability to take risks. But if they're naturally cautious, their willingness might be low. You need to find the sweet spot where both align.

Here are the common investor profiles:

- Conservative Investor: Puts capital preservation above all else. They prefer lower-risk assets like government bonds and blue-chip stocks. Perfect for short-term goals or folks nearing retirement.

- Moderate Investor: Wants a healthy balance between growth and safety. They’re comfortable with a mix of stocks and bonds, accepting some volatility for the chance at better returns. This fits most people with mid-to-long-term goals.

- Aggressive Investor: Is all about maximum growth and doesn’t flinch at major market swings. Their portfolio is heavily weighted in stocks, international markets, and maybe even alternative assets like crypto. This is for investors with long time horizons and nerves of steel.

Creating Your Investment Policy Statement

Once you've nailed down your goals and risk profile, it's time to put it in writing with an Investment Policy Statement (IPS). It sounds official, but it can be a simple one-page document that acts as your financial North Star.

Your IPS should clearly spell out:

- Your Goals: List those specific, time-bound objectives.

- Your Risk Tolerance: State if you're conservative, moderate, or aggressive.

- Your Target Asset Allocation: Define the percentage breakdown (e.g., 60% stocks, 30% bonds, 10% crypto).

- Your Rebalancing Rules: Decide how often you'll review and adjust your portfolio (e.g., once a year).

This document is your secret weapon for staying disciplined when the markets get chaotic. As you build out your plan, check out the resources at https://www.vtrader.io/en-us/academy for deeper insights into market fundamentals. It’s also smart to explore various proven wealth-building strategies to make sure your approach is solid. Your IPS is the crucial link between your personal finances and your investing actions.

Building Your Portfolio with Core Asset Classes

Alright, you've got your personal investment blueprint. Now it’s time for the fun part: picking the materials to actually build your portfolio. Think of asset classes like different types of building materials—some provide strength and stability, others create soaring growth potential. Any solid structure needs a smart mix of both.

The goal isn't just to grab a random assortment of investments and hope for the best. The real strategy behind diversifying a portfolio is choosing assets that zig when others zag. You want things that react differently to economic shifts, so when one part of your portfolio is having a tough time, another part is likely holding its own or even thriving.

Stocks: The Growth Engine

For most investors, stocks—also called equities—are the primary engine for long-term growth. When you buy a stock, you're buying a tiny piece of a company, giving you a claim on its future success. It's no secret that historically, stocks have delivered the highest returns over long horizons.

But "stocks" is a massive, sprawling category. Real diversification means you have to dig deeper.

- Domestic Stocks: These are shares in companies based in your home country. They can be anything from huge, stable "blue-chip" corporations to smaller, faster-growing businesses.

- International Stocks: In today's global economy, investing outside your home country isn't just a good idea—it's essential. This move gives you a slice of economic growth happening all over the world and helps insulate your portfolio from purely local downturns.

We’ve seen the value of a global approach play out time and again. Just look at 2025. While US tech stocks were hitting some serious headwinds, markets outside the US showed impressive resilience. The iShares MSCI EAFE ETF, which tracks developed markets outside the US and Canada, jumped about 10% in the first half of the year, even with all the global economic jitters. It’s a perfect example of why you can't afford to ignore the rest of the world.

To help you visualize how these assets fit together, here’s a quick breakdown of their typical characteristics and what role they play in a balanced portfolio.

Asset Class Characteristics and Role in a Portfolio

| Asset Class | Typical Risk Level | Primary Role in Diversification |

|---|---|---|

| Stocks | High | Drives long-term growth and capital appreciation. |

| Bonds | Low to Medium | Provides stability, income, and a buffer during stock market volatility. |

| Real Estate (REITs) | Medium to High | Offers inflation protection and potential income. |

| Commodities (Gold) | Varies | Acts as a safe-haven asset and hedge against economic uncertainty. |

As you can see, each asset class brings something unique to the table. Relying on just one is like trying to build a house with only one type of material—it’s just not going to be very strong.

Bonds: The Stabilizers for Income and Safety

If stocks are the engine, then bonds are the brakes and suspension. You're essentially lending money to a government or a corporation, and in return, they pay you regular interest. Their main job is to provide stability and a predictable income stream, acting as a crucial shock absorber when the stock market gets rocky.

And just like stocks, bonds aren't a monolith. They come in several flavors:

- Government Bonds: Issued by national governments, these are widely considered the safest bonds you can buy. The returns are lower, but they provide an essential anchor of stability during economic storms.

- Corporate Bonds: Companies issue these to raise money. They carry a bit more risk than government bonds but offer higher interest payments to compensate.

- Municipal Bonds: These come from state and local governments. A big plus is that their interest is often tax-free, which is a huge benefit for high-income earners.

A classic rookie mistake is assuming all bonds are the same. If your portfolio is stuffed with high-risk "junk" bonds, you won't get that stability you're looking for. The trick is to blend different types to match your own risk tolerance and income goals.

And don't forget to look beyond your own borders. Many savvy investors explore opportunities for foreign yield, which adds another layer of global diversification to the income-focused side of their portfolio.

Real Assets: The Inflation Shield

Real assets are tangible things with intrinsic value, like real estate and commodities. Their superpower is performing well when inflation kicks in, since their prices tend to rise right along with the cost of living. This makes them an incredible tool for protecting your purchasing power over the long haul.

A super practical way to get real estate exposure without the headache of being a landlord is through Real Estate Investment Trusts (REITs). These are companies that own and operate income-generating properties. You can buy shares in a REIT just like a stock, instantly giving you a piece of a diverse real estate portfolio.

Commodities like gold and oil also have a special place. Gold, in particular, is the classic "safe-haven" asset. When economic uncertainty hits and investors get nervous, they often pile into gold, making it a valuable counterweight when stocks and bonds might be struggling. Each of these core classes plays a distinct, vital role in creating a resilient financial structure.

Using Alternatives to Enhance Your Portfolio

Once you’ve built a solid base with stocks, bonds, and real estate, it’s time to look at investments that march to the beat of their own drum. These are known as alternative investments, and their real value lies in their low correlation with traditional markets. Simply put, when stocks zig, these assets often zag.

Think of them as specialist players on your team. You won't build your entire strategy around them, but adding a small, strategic allocation can make your whole portfolio more durable. This is especially true when economic uncertainty rattles the usual suspects in the market.

Looking Beyond Stocks and Bonds

The world of alternatives is huge, but a few key areas are now within reach for everyday investors. Commodities like gold have been a classic safe-haven play for centuries. More recently, digital assets have emerged, bringing a completely different type of growth potential to the table.

The goal isn't to chase hype. It's about strategically adding pieces that don't move in lockstep with everything else you own. Let's dig into how to do it right.

- Commodities: We're talking about raw materials like gold, silver, and oil. Gold, in particular, tends to perform well when inflation spikes or fear takes over the market, as investors seek its perceived stability.

- Digital Assets: This is crypto territory, dominated by names like Bitcoin and Ethereum. They're known for being volatile, but they offer growth potential that's completely separate from things like corporate earnings reports or interest rate decisions.

- Private Equity & Venture Capital: This used to be a playground for the super-rich, involving investments in private companies. Now, specialized ETFs and funds are opening the doors for more people, offering a shot at the next wave of innovation.

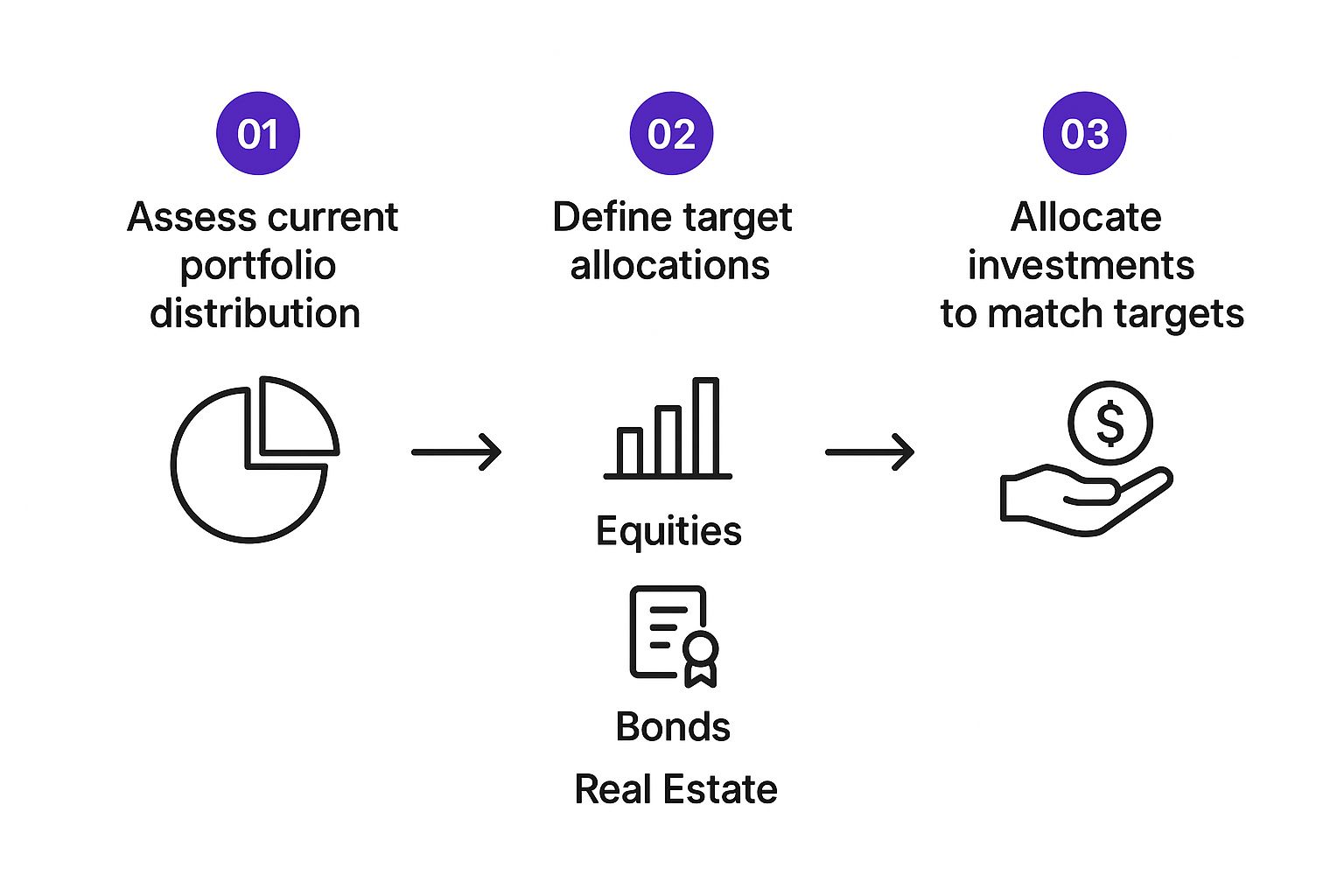

This infographic lays out the basic game plan for adding new asset classes to your portfolio.

As the visual shows, it’s a disciplined process: figure out where you are, decide where you want to be, and then strategically move your capital to hit that new target.

Gold: The Classic Safe Haven

When the markets get rough, gold has a long and storied history of being a stabilizing force. Its value isn't tied to the fortunes of a single company or government, giving it a unique role as a store of value.

We’ve seen this play out recently. By early June 2025, gold was up about 30%, a rally fueled by central bank buying and investors scrambling for a safe harbor from market volatility. That performance was a huge help for portfolios that were getting hammered by weaker domestic stocks.

Remember, gold isn’t a growth engine. Its job is to be an anchor in a storm. For most people, a small allocation of 3% to 5% is plenty to get that defensive benefit without weighing down your long-term returns.

The Role of Digital Assets and Crypto

You can't have a serious discussion about diversification today without talking about crypto. Assets like Bitcoin and Ethereum exist completely outside the traditional financial system, and that's exactly what makes them such powerful diversifiers.

Of course, that independence comes with wild price swings. The volatility can be intense, which is why your position size is everything. A small, calculated bet lets you tap into the massive upside potential without risking your entire nest egg. Think of it as a high-octane satellite orbiting your stable core portfolio.

On vTrader, many investors start with a modest 1% to 2% of their total portfolio in crypto. This lets them get in on the action while keeping the potential damage from a downturn under control. And if you're looking to put those assets to work, you can learn more about crypto staking to earn rewards on your holdings.

Accessing Other Alternatives

Beyond gold and crypto, the alternative universe keeps expanding. Private equity—investing in companies that aren’t on the stock market—was once an exclusive club. Today, certain ETFs and funds offer a ticket in, giving you a piece of high-growth, early-stage companies.

These investments are typically less liquid and carry higher risks, but the potential rewards can be significant. Just like with crypto, moderation is key. These should be a small, specialized slice of your portfolio, not the main dish.

Keeping Your Portfolio on Track with Rebalancing

So you’ve built a diversified portfolio. That’s a massive first step, but the work isn’t over. Think of your mix of assets as a living, breathing thing. Market movements are constantly trying to pull it out of shape, and that's where the discipline of rebalancing comes in. It’s the essential maintenance that keeps your strategy locked in on your goals.

Let's say you started with a classic 60/40 portfolio—60% stocks and 40% bonds. After a killer year for the stock market, those equities might now represent 70% of your holdings. Just like that, your portfolio is carrying more risk than you signed up for. This slow, unintentional shift is called portfolio drift, and rebalancing is how you fix it.

Why You Need to Rebalance (and When)

At its core, rebalancing forces you to stick to the golden rule of investing: buy low and sell high. It's a structured way to skim profits from your top performers and redirect that cash into assets that are lagging. This simple action prevents you from getting dangerously overexposed to one hot sector right before it cools off.

So, how do you know when it’s time to make a move? Most investors stick to one of two popular methods.

- Calendar-Based Rebalancing: This is the easiest approach by far. You just pick a date on the calendar—quarterly, semi-annually, or annually—and on that day, you adjust everything back to your target allocations. For most people with a long-term view, once a year is plenty.

- Threshold-Based Rebalancing: Instead of watching the calendar, you watch your percentages. You set a specific drift tolerance, like a 5% threshold. If your 50% stock allocation creeps up to 55%, that’s your signal to trim it back down.

A lot of savvy investors actually blend these two. They might check their portfolio on an annual basis but only make trades if an asset has drifted past their preset threshold. This is a great way to stay disciplined without racking up unnecessary trading fees.

A Practical Rebalancing Scenario

Let's put this into practice. Imagine you started the year with a $100,000 portfolio broken down like this:

- 50% Domestic Stocks ($50,000)

- 20% International Stocks ($20,000)

- 20% Bonds ($20,000)

- 10% Alternatives (like Crypto) ($10,000)

Fast forward a year. The market did its thing. Your domestic stocks took off, and crypto had a solid run. Your portfolio is now worth $115,000, but your allocations are all out of whack:

- Domestic Stocks: $63,000 (54.8%)

- International Stocks: $21,000 (18.2%)

- Bonds: $20,000 (17.4%)

- Alternatives (Crypto): $11,000 (9.6%)

Your domestic stock position has drifted nearly 5% over its target, leaving your bonds and international stocks underweight. To rebalance, you’d sell $5,500 of your domestic stocks. You'd then use that money to buy $2,300 in international stocks and $2,050 in bonds, snapping everything back to your original targets.

Rebalancing feels weird at first. Selling your winners goes against every instinct. But this disciplined process is what stops one hot asset from growing so big that its inevitable downturn could wreck your entire portfolio.

This routine ensures you're systematically locking in gains and putting that money to work where assets are cheaper. Of course, every trade can have costs. It's always smart to understand the transaction fees on platforms like vTrader before you start rebalancing to make sure your strategy stays cost-effective. Ultimately, this is the proactive work that keeps your portfolio doing its job—protecting and growing your wealth for the long haul.

Common Questions About Portfolio Diversification

Even with a solid plan, it's natural for questions to pop up while you're figuring out how to diversify your investments. Let's tackle some of the most common ones I hear from investors to help clear the air and get you moving forward with confidence.

How Many Stocks Should I Own for Good Diversification?

There's no single magic number, but the old rule of thumb suggests holding between 20 to 30 individual stocks from a mix of different industries. The idea is to reduce what's called "company-specific risk"—where one company having a terrible quarter doesn't tank your entire portfolio.

But let's be realistic. For most people, that's a lot of homework. A much simpler, and frankly more effective, approach is using broad-market index funds or ETFs. Think about it: a single S&P 500 ETF instantly gives you a piece of 500 of the biggest companies in the U.S. Trying to replicate that by hand-picking stocks is nearly impossible.

Is It Possible to Be Too Diversified?

Absolutely. There’s a point where diversification stops helping and starts hurting, a concept known as "diworsification." This is what happens when you own so many different things that your best-performing assets have their gains totally diluted by everything else.

Over-diversifying often leads to just plain average returns, all while making your portfolio a nightmare to manage. The real goal is strategic diversification—owning a smart mix of assets that don't all move in the same direction. A well-built portfolio with 10-15 carefully chosen ETFs across different asset classes will almost always beat one with 50 random ones.

The point of diversification isn't to own everything. It's to own the right combination of things that create balance and resilience, ensuring your winners have a meaningful impact while your losers don't cause catastrophic damage.

How Does My Age Affect My Diversification Strategy?

Your age is probably the single biggest factor because it determines your investment time horizon. A 25-year-old has decades to bounce back from a market crash, so they can afford to aim for higher growth by taking on more risk.

- Younger Investors (20s-30s): Portfolios for this group are usually heavy on growth assets like stocks, often making up 80-90% of the mix. Time is on their side to ride out the market’s ups and downs.

- Older Investors (Nearing Retirement): As you get closer to retirement, the game changes. Protecting the money you've saved becomes the top priority. This means shifting to a more conservative portfolio with more bonds, maybe 40-50% in stocks.

Your strategy needs to evolve with you. As the years go by, you'll want to gradually shift from an aggressive growth stance to one that locks in and protects what you’ve built.

What Are the Easiest Ways to Start Diversifying Today?

For anyone just jumping in, the most direct route is through "all-in-one" funds like target-date funds or balanced ETFs. These are practically built for instant, hands-off diversification.

A target-date fund is brilliant in its simplicity—it automatically gets more conservative as you get closer to your target retirement date. An asset allocation ETF just holds a fixed mix of stocks and bonds (like 60/40 or 80/20) in one ticker. Both are fantastic starting points if you want a diversified strategy right now without the headache of managing it all yourself.

If you have more specific questions about our platform or investment options, you can always check out the vTrader FAQ page for more detailed answers.

Ready to build a stronger, more resilient portfolio? vTrader offers commission-free trading on Bitcoin, Ethereum, and over 30 altcoins, giving you the tools to diversify your assets without the fees. Sign up today and get a $10 bonus to start your journey.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.