Think of Ether staking rewards as your payment for helping keep the Ethereum network secure and running. It's a lot like earning interest in a high-yield savings account. But instead of a bank, you're putting your ETH to work supporting a global, decentralized network—and getting paid for it.

By locking up your ETH, you're not just holding; you're actively participating in validating transactions and making the whole system more robust.

Understanding the Core of Ether Staking

At its heart, staking is the engine behind Ethereum's Proof-of-Stake (PoS) consensus model. This system is a major upgrade from the old, power-hungry Proof-of-Work (PoW) model that relied on massive amounts of computational power for "mining." PoS is a much greener and more efficient way to keep the blockchain's integrity intact.

Instead of miners racing to solve complex math problems, PoS randomly selects participants—called validators—to propose and confirm new blocks of transactions. To even be considered, you have to "stake" a certain amount of Ether as collateral.

This stake acts like a security deposit. It’s your promise to the network that you'll play by the rules. If you do your job right, you earn rewards. If you act maliciously or even just go offline for too long, you risk losing a chunk of your staked ETH in a process known as "slashing."

Why Your Participation Matters

Your role as a staker is absolutely critical to the health of the Ethereum network. When you stake your ETH, you’re doing more than just trying to grow your holdings. You're actively boosting the network’s security and decentralization.

Every new staker makes it exponentially harder and more expensive for a bad actor to attack or manipulate the blockchain.

By staking, you turn a passive asset into a productive one. You’re not just holding a coin; you’re supporting the very infrastructure of the network you believe in, all while earning rewards for your commitment.

This is what decentralized finance is all about. It perfectly aligns the financial incentives of token holders with the overall health of the network. The more widely distributed the stakers are, the stronger and more resilient the entire ecosystem becomes. Before jumping in, it's always a good idea to get a handle on the price and market dynamics of the native token Ether.

Key Factors Influencing Your Staking Rewards

To really get a feel for how your rewards are calculated, it helps to understand the moving parts. This table breaks down the primary components that determine how much you can earn from staking Ether.

| Component | How It Affects Your Rewards | Why It Matters |

|---|---|---|

| Validator | An active participant who has staked ETH to help secure the network. Validators process transactions and create new blocks. | Being a validator is how you directly earn rewards. Your performance dictates your profitability. |

| Proof-of-Stake (PoS) | The system that selects validators based on the amount of ETH they have staked. The more ETH staked network-wide, the lower the individual reward rate. | This mechanism ensures rewards are distributed fairly but also adjusts based on overall network participation. |

| Slashing | A penalty where a validator forfeits a portion of their staked ETH for dishonest behavior or extended downtime. | This is the "stick" to the "carrot" of rewards, ensuring validators act in the network's best interest. |

| Decentralization | The distribution of control across many participants. Staking encourages this by allowing anyone to participate. | A more decentralized network is more secure and censorship-resistant, which protects the long-term value of your stake. |

In short, these concepts work together to create a balanced system where participation is rewarded, and bad behavior is punished, all while strengthening the entire Ethereum ecosystem.

How Your Staking Rewards Are Calculated

To really get a feel for staking, you need to know where the ether staking rewards actually come from. They don't just appear out of thin air; they're generated from two different sources that are both critical for keeping the Ethereum network humming.

It helps to think of these as two distinct income streams that flow together to create your total earnings.

First, you have the most reliable source: the consensus layer. This is where the Ethereum protocol itself issues brand new ETH to validators. It’s a direct payment for the hard work of securing the network and the core economic engine that keeps everyone honest and their machines running.

The second source is the execution layer. This is where all the action happens—people sending tokens, interacting with DeFi apps, and minting NFTs. As a validator, you earn a cut of the transaction fees, or "tips," that users pay to get their transactions processed and added to a block.

The Pizza Analogy for Reward Distribution

Let's break it down with an analogy. Imagine the total reward pool for any given day is a giant pizza. The size of that pizza is determined by how much is happening on the network and the base issuance rate. Every validator who is online and doing their job correctly gets a slice.

But here’s the catch: the number of slices is always changing. As more validators join the network, that same pizza has to be cut into more and more pieces. So, while the network gets stronger and more secure, the size of your individual slice—your reward—shrinks a bit.

This is a really important dynamic. It keeps the rewards attractive enough to bring in new stakers but prevents the rate from getting so high that it becomes unsustainable.

The core principle is a delicate balance: the more ETH staked, the more secure the network becomes. But this also means the individual Annual Percentage Yield (APY) for each staker will dip. It’s an inverse relationship that helps keep the network healthy.

To get a true sense of whether staking ETH is profitable for you, it's a good idea to understand concepts like how to calculate Return on Investment (ROI). Getting a handle on this helps you see the bigger financial picture beyond just the day-to-day rewards.

Core Duties That Drive Your Earnings

Your rewards aren't just handed to you; they're directly tied to how well your validator performs. Nail your duties, and you’ll earn the maximum possible yield. It really boils down to two main jobs:

- Attestations: This is your validator's bread and butter. An attestation is basically a vote that confirms a new block is valid. Performing these correctly and on time accounts for the majority of your staking income.

- Proposals: Every so often, your validator gets chosen to propose an entirely new block of transactions. This is a much bigger deal and comes with a bigger reward, as you get to collect all the priority fees from the transactions in that block.

At the end of the day, consistent uptime and accurate attestations are the foundation of steady ether staking rewards. If you miss these duties, you miss out on rewards. In more serious cases, like being offline for too long or acting maliciously, you can even face penalties.

Understanding the Fluctuating APY

The Annual Percentage Yield (APY) for staking ETH is anything but static. It's a living number that shifts based on the total amount of ETH being staked and the overall activity on the network.

Historically, the annualized rewards for direct staking have hovered in the 4-6% range, but this number is always in flux. This APY is a combination of consensus layer issuance, those execution layer tips, and even something called Maximum Extractable Value (MEV). For a deep dive into the current rates and how they're broken down, resources like CF Benchmarks offer a great look under the hood.

Choosing Your Path to Staking Ether

So, you’ve decided to stake your Ether. That’s the easy part. The big question now is how you’re going to do it. There's no one-size-fits-all answer for earning ether staking rewards; the right path for you hinges on your technical chops, how much ETH you’re holding, and your overall comfort with risk.

Think of it like investing in real estate. You could go all-in, buy a property, and manage it yourself to maximize your returns (and your workload). Or, you could take a more hands-off approach and put your money into a real estate fund. Staking offers a similar spectrum of choices, and each comes with its own set of pros and cons.

Let's break down the four main routes you can take on your staking adventure.

Solo Staking: The Gold Standard

Solo staking is the purest way to participate in securing the Ethereum network. It means you're running your own validator node from a dedicated computer that’s online 24/7. This approach offers the biggest potential rewards because you get to keep everything you earn—no middlemen, no fees.

But this path isn't for the faint of heart. It has the highest barrier to entry, demanding a 32 ETH deposit just to get started. You also need the technical skills to set up and maintain the validator software yourself. You are 100% responsible for your node's performance and security, and any slip-ups could result in penalties, a process known as "slashing."

Staking as a Service: A Guided Approach

If the idea of running your own node sounds like a headache, Staking-as-a-Service (SaaS) providers offer a fantastic middle ground. You still need the 32 ETH, but you get to offload all the technical heavy lifting to a team of experts.

With this model, you keep control of your funds while the provider manages the hardware, software, and uptime. For their trouble, they'll take a small slice of your staking rewards. It's a great option for anyone who has the capital but would rather skip the complexities of being a full-time node operator.

Liquid Staking Pools: Maximum Flexibility

What if you don't have 32 ETH lying around, or you want the freedom to access your funds? This is where liquid staking pools like Lido or Rocket Pool have become wildly popular. These platforms let you pool your ETH with thousands of other users, so there’s no minimum deposit.

When you stake your ETH, you get a liquid staking token (like stETH) in return. This token represents your staked ETH and automatically collects rewards, but here’s the cool part: you can trade it or use it in other DeFi apps. This method gives you incredible accessibility and flexibility, though the rewards are slightly smaller due to service fees and the smart contract risks involved.

The core trade-off with staking pools is simple: you exchange a small portion of your rewards and direct control for convenience, liquidity, and a much lower barrier to entry.

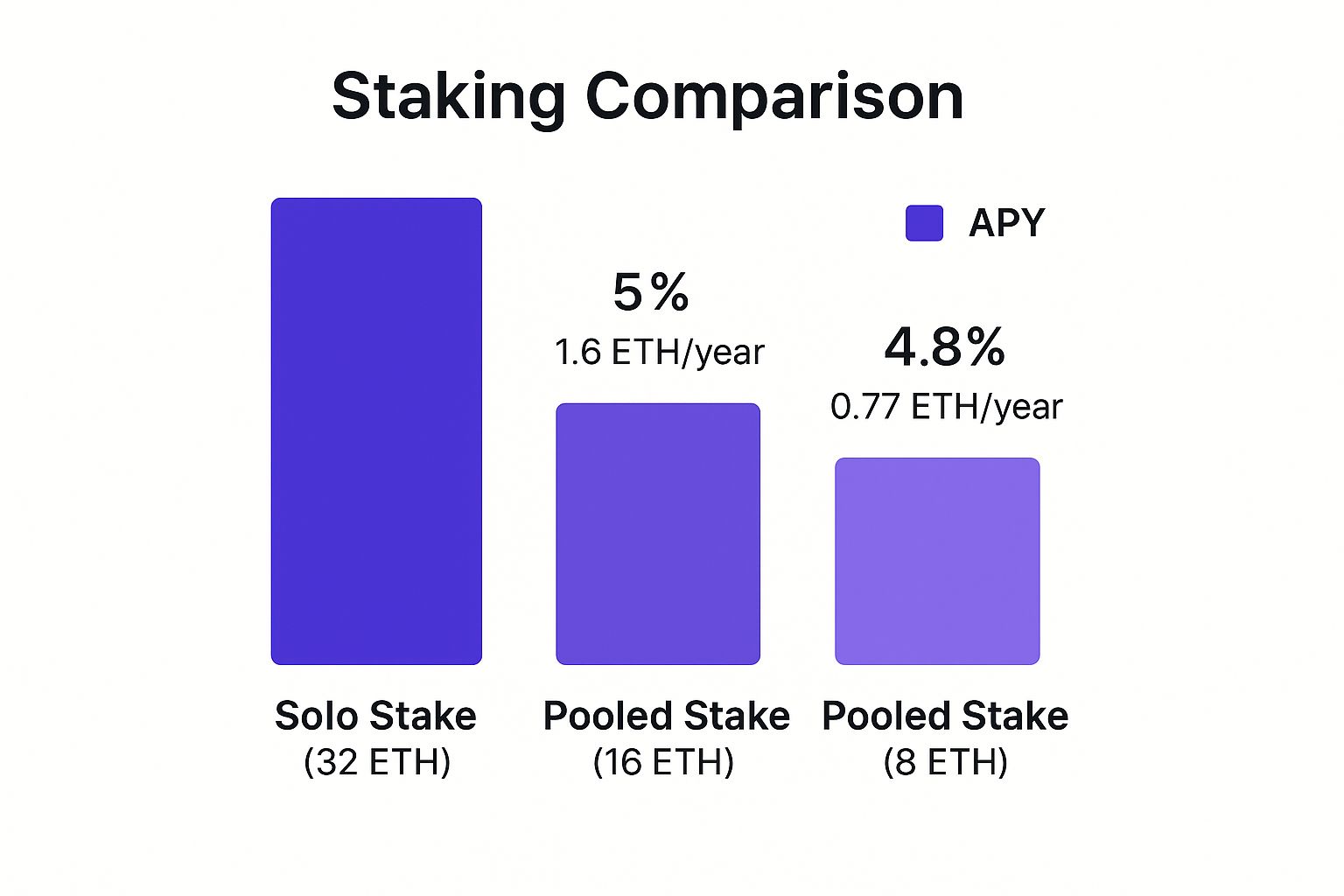

This chart gives you a quick visual on how reward potential can shift based on the amount of ETH you decide to stake.

As you can see, while solo staking boasts the highest percentage yield, pooled staking can still deliver very competitive returns, especially for those with less capital to commit.

Centralized Exchanges: The Easiest On-Ramp

For sheer, unadulterated simplicity, nothing beats staking directly through a centralized exchange like vTrader. The process is usually just a couple of clicks from your account dashboard, with the exchange handling every technical detail behind the scenes.

This makes it the perfect on-ramp for beginners. But it’s crucial to know what you’re trading for that convenience:

- Custody: The exchange holds your ETH, which introduces counterparty risk.

- Fees: Exchanges often take a bigger cut of the rewards compared to other methods.

- Centralization: Over-reliance on exchanges can work against Ethereum’s core principle of decentralization.

A Practical Comparison of Ethereum Staking Methods

To help you decide, here’s a side-by-side breakdown of your options. Use this to find the best fit for your resources, technical skills, and risk tolerance.

| Staking Method | Required ETH | Technical Complexity | Control Over Rewards | Key Risks |

|---|---|---|---|---|

| Solo Staking | 32 ETH | High | Full Control | Technical failures, slashing penalties, hardware costs |

| Staking-as-a-Service | 32 ETH | Low | High (minus provider fee) | Provider reliability, third-party performance |

| Liquid Staking Pools | No Minimum | Very Low | Lower (fees & pool structure) | Smart contract vulnerabilities, token de-pegging |

| Centralized Exchange | Very Low Minimum | None | Lowest (highest fees) | Exchange insolvency, regulatory risks, custody risk |

Each path offers a unique balance of reward, risk, and responsibility. The key is to pick the one that aligns with your personal goals.

For those looking to get a deeper grasp on these concepts, a structured learning environment can make all the difference. You can learn more about crypto fundamentals at vTrader Academy, which is packed with guides on a huge range of topics to get you up to speed.

Navigating the Risks and Benefits of Staking

The idea of earning ether staking rewards is definitely exciting, but it’s smart to go in with your eyes wide open. While the potential for passive income is a huge draw, staking isn't a "set it and forget it" path to riches. It’s all about weighing the very real benefits against the potential downsides to see if it truly fits your financial game plan.

The most obvious win, of course, is the reward itself. You’re putting your ETH to work, generating a yield that can often leave traditional savings accounts in the dust. But the perks go way beyond just your personal balance.

When you stake your Ether, you’re doing more than just earning. You become an active participant in securing and decentralizing the entire Ethereum network. Think of each staker as a single thread in a massive, interwoven safety net—the more threads, the stronger and more attack-resistant the whole system becomes. This is the heart and soul of decentralized finance in action.

The Upside of Staking Ether

Beyond the numbers flashing on a screen, the benefits of staking are both practical and philosophical. You’re not just an investor; you’re gaining a real stake in the future of a technology you believe in.

Let’s break down the main advantages:

- Consistent Reward Generation: Staking offers a predictable way to grow your ETH holdings. Unlike the rollercoaster of trading, which depends on perfect timing, staking rewards trickle in as long as your validator is doing its job.

- Strengthening Network Security: Your staked ETH is basically collateral. It makes bad behavior incredibly costly for would-be attackers, making the network exponentially safer for everyone. The more ETH is staked, the more secure Ethereum gets.

- Energy Efficiency: By taking part in the Proof-of-Stake system, you’re supporting a far more environmentally friendly way of reaching consensus compared to old-school Proof-of-Work mining.

The sheer growth in participation shows just how much people believe in this. Recent data shows that over 33.8 million ETH is currently staked, which is about 27.57% of the total supply. This massive commitment is upheld by more than one million active validators, a figure that exploded after withdrawals were enabled. You can discover more insights about Ethereum staking statistics on Datawallet.

Understanding the Potential Risks

No investment comes without risk, and staking is no different. You absolutely have to get familiar with the potential hazards before you lock up your assets. The specific risks can change depending on how you stake, but some are universal.

The risk everyone talks about is slashing. This is a penalty built into the network where a portion of your staked ETH is permanently destroyed. It’s reserved for serious misbehavior, like your validator going offline for too long or trying to cheat the system by double-signing transactions. It's rare, but the financial sting is real.

Staking requires a long-term perspective. The risks involved, from market fluctuations to technical penalties, mean you should only stake capital you are comfortable locking up and potentially exposing to volatility.

Beyond direct penalties, here are other risks to keep on your radar:

- Market Risk: The price of ETH can swing wildly. The dollar value of both your staked assets and your rewards can drop hard during a market downturn.

- Smart Contract Risk: If you’re using a liquid staking pool or another decentralized service, you’re placing your trust in their code. A bug or exploit in a smart contract could mean your funds are gone in an instant.

- Liquidity Risk: Your ETH is locked up while you’re staking. Even though withdrawals are possible now, there's still an entry and exit queue. You can’t get your funds back instantly if you need them.

Finally, if you use an exchange or service provider, you’ll likely run into fees that eat into your net rewards. Always get a clear picture of the full fee structure, as it can make a big difference to your bottom line. You can see a clear breakdown of potential costs by checking out our detailed fee schedule at vTrader.

How to Start Staking Ether on vTrader

Alright, let's move from theory to practice—this is where the fun begins. Talking about ether staking rewards is one thing, but actually earning them is the exciting part. While some of the concepts can feel a bit abstract, platforms like vTrader are built to cut through the complexity.

This hands-on guide will walk you through the exact process, step by step. We're going to turn your digital assets into a genuine source of passive income. The best part? It's surprisingly intuitive, even if you're just dipping your toes into the crypto world. With just a few clicks, you can put your Ether to work securing the network and watch the rewards start to stack up.

Your Step-by-Step Guide

The whole point of staking on vTrader is to let you skip the technical headaches. You don't have to worry about running your own validator node or tinkering with confusing software. We handle all of that on the back end so you can focus on what matters: growing your portfolio.

Here’s the breakdown of how simple it is:

-

Log In to Your vTrader Account: First things first, get into your vTrader account. If you don't have one yet, signing up is quick and painless. Just make sure your account is funded with the Ether you plan on staking.

-

Head to the Staking Dashboard: Once you're in, look for the "Staking" section in the main menu. Think of this as your command center for all things staking—you'll see which assets are available, their current APY, and any positions you already have.

-

Pick Ethereum (ETH) From the List: On the dashboard, you’ll find a list of all the cryptocurrencies you can stake. Find Ethereum (ETH) and give it a click. This will take you to a page with all the specifics, including the estimated annual reward rate.

-

Enter How Much You Want to Stake: Now it's time to decide how much ETH you want to commit. You can type in a specific amount or just use the handy percentage buttons. Quick tip: only stake an amount you’re comfortable having locked up for a while.

-

Review and Confirm: This is the final check. The platform will give you a clear summary of the transaction, showing the amount of ETH you're staking and the terms. If everything looks good, hit confirm, and you're officially staking.

We designed the vTrader interface to be crystal clear. You'll always see your staked amount, total rewards earned, and the current APY at a glance. No digging through complicated menus.

What Happens Next?

Once you confirm, your ETH is officially on the job. You can pop back into the staking dashboard anytime to see your earnings, which accumulate in real time.

Behind the scenes, vTrader’s system pools your funds with other users. This is what allows everyone to get in on the action without needing the hefty 32 ETH required to run a solo validator node.

By staking with vTrader, you're tapping into institutional-grade security and professional validator management. Our team is on it 24/7, ensuring top performance and uptime to maximize your reward potential and minimize risks like slashing.

It's a straightforward and secure way to do your part for the Ethereum network and get rewarded for it. To see all the assets you can stake and check out the specific terms for each one, feel free to explore the full vTrader staking platform whenever you're ready.

Common Questions About Ether Staking Rewards

Let’s wrap things up by tackling a few of the questions that always seem to come up when people start thinking about earning ether staking rewards. Getting straight answers to these is the best way to feel confident before you jump in.

The whole staking world can feel a bit tangled at first, but once you pull on the right threads, the core concepts are surprisingly simple. Here’s what you really need to know.

How Often Are Rewards Paid Out?

This is a big one. Everyone wants to know when they'll see their rewards—daily, weekly, monthly?

The short answer is that the Ethereum network itself is doling out rewards almost constantly. To get technical, the network crunches the numbers and calculates rewards at the end of every "epoch," which is a fancy word for a time slot that lasts about 6.4 minutes.

But how often that money actually hits your wallet is a different story. It really comes down to how you’re staking.

- Solo Stakers: Get their execution layer tips right away, but the consensus layer rewards are batched and paid out periodically.

- Pools and Exchanges: These guys usually set their own schedules. Some pay out daily, others weekly, and some just let the rewards pile up in your account automatically.

Can You Lose Your Staked Ether?

Yes, it’s possible, but don't panic—it’s not something that happens by accident. The main risk is a penalty called slashing. This is the network's way of punishing validators for serious misbehavior, like trying to cheat the system or just going offline for way too long.

You could also lose funds if a staking pool’s smart contract has a vulnerability that gets exploited by a hacker. And, of course, there’s always market risk. The price of Ether can go down, which means the dollar value of your staked ETH would drop, too.

The whole point of slashing is to make being a bad actor incredibly expensive. It gives every validator a massive financial reason to play by the rules and keep the network secure.

Staking vs Liquid Staking

So what’s the real difference here? The clue is right in the name: liquidity.

When you do traditional staking, your ETH is locked up. It’s committed to the network and you can’t touch it.

Liquid staking changes the game. You deposit your ETH into a protocol, and in return, you get a special token (like stETH) that acts as a receipt for your staked ETH. This new token keeps earning rewards for you, but the brilliant part is that you can trade it or use it in other DeFi apps. You get the rewards and keep your capital flexible.

We've put together a quick rundown of the most common questions our users ask.

Frequently Asked Questions

| Question | Answer |

|---|---|

| How much can I earn staking ETH? | The Annual Percentage Rate (APR) for staking ETH fluctuates based on network participation but typically ranges from 3% to 5%. |

| Is there a minimum amount to stake? | Solo staking requires 32 ETH. However, staking pools and platforms like vTrader allow you to stake with much smaller amounts. |

| Are my staking rewards taxed? | Yes, in most jurisdictions, staking rewards are considered income and are subject to income tax. It's best to consult a tax professional. |

| How long is my ETH locked when staking? | The lock-up period varies. With traditional staking, there's an exit queue. With liquid staking, you can often exit instantly by trading your liquid staking token. |

Hopefully, that clears a few things up! For an even deeper dive, feel free to check out the complete FAQ page on vTrader anytime.

Ready to put your knowledge into action? With vTrader, you can start staking your Ether in just a few clicks, with no hidden fees. Put your assets to work and begin earning rewards today by visiting https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.