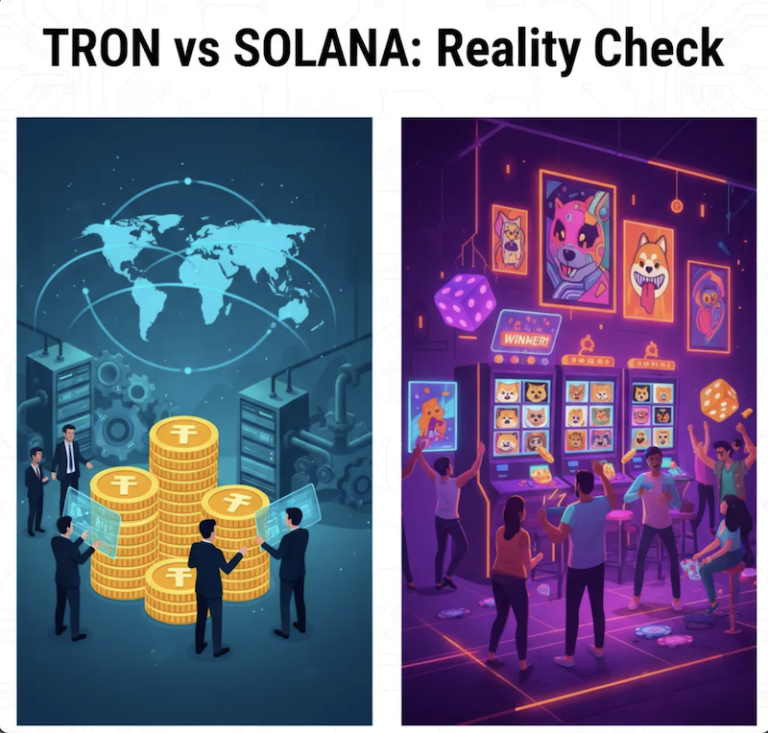

Everyone’s bullish on Solana. I get it. The memes are fun, the ecosystem looks shiny, and the tech bros love it. Here’s the thing nobody wants to talk about: TRON is quietly eating Solana’s lunch, and it’s not even trying that hard.

The Numbers Are Wild

Solana circulates $2 billion in USDT, which is really impressive. TRON processes $81 billion in USDT. That’s 51% of all Tether in existence. That’s not a small difference. That’s TRON having 20x more stablecoin value locked up.

When people actually need to move money, real money, not some memecoin that might not exist tomorrow, they use TRON. Not Solana. The numbers don’t lie. Billions and billions of dollars sitting on TRON because that’s where people actually trust their money to move reliably and cheaply.

On Solana, 65% of activity is DEX trading. Only 10% is real payments.

60% of TRON’s USDT volume sits on cross-border payments. Actual remittances. People sending money home to their families.

TRON’s been quietly dominating this space while everyone’s been distracted by the latest dog coin on Solana. The data’s right there. Anyone can look it up. That’s not an accident. That’s not temporary. That’s the market telling you where real value transfer happens.

Where Stablecoins Actually Go

Here’s what the Silicon Valley types miss: When you’re running a business in Argentina, you don’t care about your theoretical TPS. You care that TRON costs a penny to send money and it actually works.

Kripton just onboarded 2,000 Argentine merchants to TRON. Not Solana. TRON. People are sending money home to their families. Businesses are paying suppliers across borders. This is the critical yet often overlooked, classified as “boring” stuff that actually keeps the global economy running.

Solana’s high transaction speed and near-zero cost make it ideal for high-frequency trading, arbitrage, and speculative activity, which is reflected in Jupiter and other DEX’s massive trading volumes. Actual payments to actual merchants for actual goods and services? Maybe 10% if you’re being generous. That’s not a payment network. That’s a casino with a payment feature bolted on as an afterthought.

TRON shows that businesses and freelancers are moving thousands of dollars at a time. Real economic activity. Someone getting paid for actual work. Someone buying actual inventory. On Solana it’s either massive whale trades worth millions or tiny memecoin buys worth $50. There’s no middle. There’s no actual economy. It’s either degens gambling or whales manipulating markets.

The Geographic Split

TRON owns emerging markets and this is something Silicon Valley can’t quite understand. I’m talking about Latin America, Africa, Southeast Asia. The places where crypto actually matters for survival, not just speculation. They’re all using TRON for actual payments. For example, TRON blockchain emerges as critical fintech infrastructure in emerging markets, enabling 39% of UQUID’s 2025 e-commerce transactions with low-cost, high-speed payments.

Latin America accounts for 45% of payment volume through platforms like UQUID. Africa? 35%. These aren’t venture-backed startups burning through cash. These are real businesses that need payments to work. Even Xapo Bank launched USDT deposits on TRON this year. You know why? Because their customers don’t want to pay variable fees. They want predictable, cheap transfers that just work.

Want to know why? Because when you’re running a business in Buenos Aires and inflation is eating your profits, you don’t care about theoretical TPS. You don’t care about how many validators there are. You don’t care about the latest technical innovation. You care that when you need to pay your supplier in Shanghai, the payment goes through, it costs pennies, and it works every single time. This is what TRON brings to the table. Emerging economies have no interest in high bank or gas fees and wires that take days to go through.

Tether Picks Sides

Tether and TRON launched that T3 Financial Crime Unit together. That’s real. They’re freezing illicit funds together. They’re working with law enforcement together. This isn’t just a partnership. This is Tether prioritizing TRON. This initiative is critical as it is leading the charge to combat illicit activities on the blockchain. Tether actually works with TRON. They are building infrastructure together.

The Legal Situation

Justin Sun had SEC issues. Yeah, we all know that. The SEC came after him like they came after everyone else in crypto. Then he donated to Trump. Smart move. Then he partnered with Trump’s son to launch his Special Purpose Acquisition Company (Ticker: TRON on the Nasdaq) . The legal risk that was the dark cloud hanging over TRON? It’s gone, via an act of political mastery executed by Justin Sun.

Meanwhile, I’ve seen reports about government entities building on TRON. Real nation-states choosing TRON for their digital currency infrastructure. The Commonwealth of Dominica recently appointed the TRON protocol as its designated national blockchain infrastructure. TRON was recently selected by the U.S. Commerce Department to publish GDP Data on the blockchain.

Regulatory clarity is coming. The partnerships are already here. While everyone’s worried about which chain the SEC might go after next, TRON’s already solved that problem. They played the game. They won. Move on.

Solana’s Casino Problem

I’m not anti-Solana. It does what it does well. High-speed trading,and memecoins. If you want to trade the latest dog coin at lightning speed, Solana’s your chain. Of the 100 million crypto tokens in existence, 85 million of them are on Solana. Solana may be great for adoption. Its a good marketing engine for the asset class. I’m not denying that.

The issue is that’s ALL it does. Most stablecoin activity on Solana is just trading. People swapping one token for another, hoping to catch a pump.

TRON is actually transacting payments and solving real world issues. People are buying things, getting paid for work, and generating real economic activity.

Where’s that real world utility?

The Infrastructure Reality

TRON just cut fees by like 60%. The network still works fine. No drama, no crisis, just lower fees because they wanted to stick to their ethos and ensure that fees were manageable for their users. In fact, TRON still is leading all Layer-1 blockchains in network fees over the past 90 days. That’s what happens when your network actually works efficiently. You can make changes without everything falling apart. You can improve things without causing chaos.

And guess what? That fee reduction they were so worried about losing revenue over? No longer even a valid concern since we just saw a huge spike in increased user activity fortified by community buzz and innovative solutions to common trading painpoints.

While everyone’s been obsessing over Solana’s meme coins, Tron quietly locked down real integrations with companies that matter and DApps that people actually use. The DeFi play? That’s where it gets interesting. They’re not trying to reinvent the wheel – just basic lending, borrowing, yield farming – but here’s the thing: it works and people trust it with real money. You can see it in the numbers. Capital doesn’t lie. When institutional money starts flowing into your DeFi protocols, you know you’ve built something beyond just another crypto casino. That revenue spike isn’t from speculation; it’s from actual utility. And yeah, while everyone’s debating which L1 is fastest, Tron’s just sitting there processing billions in stablecoin transactions because they focused on what users actually need instead of what sounds cool on Twitter.

The Case for Solana

TRON dominates current USDT remittance volume, especially in Latin America and Africa. It’s cheap, reliable, and already integrated into the tools people use. But Solana isn’t standing still. A few things worth noting:

- USDC volume on Solana recently passed Ethereum

- Stripe is using Solana for global USDC payouts

- Visa and Circle are actively building on Solana

- Solana has a partnership with Worldpay, which serves over one million merchants globally

- Solana Pay exists.

- Solana also launched a phone called Seekr, which has a shot at decentralizing the App and Play store.

- Solana signed a partnership with Shopify, the massive e-Commerce platform

TRON owns the “it just works” lane today. Solana seems focused on building the rails for where payments are going; especially with regulated fintechs. TRON and Solana are making different plays, with the payback period on different timelines.

My Take

Keep your SOL. The next memecoin cycle could be huge. Maybe pump.fun and Moonshot Money creates the next thousand millionaires. Maybe the NFT market comes roaring back. Maybe Solana captures all that value. It’s possible. I’m not saying sell everything and buy TRON.

What I do know is TRON already won the payments game. While everyone’s watching pump.fun, TRON’s moving trillions in actual volume. Real businesses use TRON. Real payments happen on TRON. The boring stuff that actually matters. The stuff that doesn’t make headlines but keeps the global economy functioning.

Five years from now, which matters more? The network processing remittances globally or the one processing meme coins in Brooklyn? The network handling payroll for millions of workers or the one handling the latest animal-themed gambling token? You tell me. Because from where I’m sitting, it’s not even a close call.