Setting up your first crypto wallet is a huge step—it’s the moment you take real ownership of your digital assets. Think of it less like an app and more like your own personal digital vault. It gives you direct control over your crypto, all secured by a unique set of cryptographic keys that belong only to you.

Why Your Crypto Wallet Is More Than Just an App

Before we jump into the setup, it’s really important to get what a crypto wallet actually is. It’s not like a bank account. It’s much more like a personal safe you hold the only key to. When you create a crypto wallet, you're actually generating a unique pair of cryptographic keys that serve as your credentials on the blockchain.

This is where you'll hear the terms public keys and private keys thrown around.

- Your Public Key: This is what generates your wallet address—think of it like your bank account number. You can share this freely with anyone who wants to send you crypto. It’s public and totally safe to hand out.

- Your Private Key: This is the big one. It's like your ATM PIN or the physical key to your vault. It proves you own the crypto and gives you the power to send it. You should never share this with anyone, for any reason.

The golden rule of crypto is to guard your private key with your life. Anyone who gets their hands on it has total control over your funds. This idea of self-custody is what decentralized finance is all about.

Understanding Your Role in a Growing Market

By learning to manage your own wallet, you’re getting in on the ground floor of a massive financial shift. The global crypto wallet market was pegged at around USD 12.59 billion in 2024 and is on a trajectory to blow past USD 100 billion by 2033. That explosive growth shows just how quickly crypto is becoming a serious asset class. If you're curious, you can dig into the full crypto wallet market report for all the details.

Getting these core concepts down isn't just a technical exercise; it's about building confidence. True ownership starts with understanding the tools you're using. If you want to firm up your knowledge before moving on, the resources at the vTrader Academy are a great place to get more context on crypto fundamentals. Nailing these ideas now will make choosing and securing your first wallet a much smoother ride.

Choosing the Right Type of Crypto Wallet for You

Picking the right crypto wallet is easily one of the most critical decisions you'll make in your crypto journey. This isn't a one-size-fits-all situation; the best choice really comes down to your personal goals. Are you planning to be an active trader, jumping in and out of positions? Or are you in it for the long haul, planning to "hodl" your assets? Figuring that out is your first move.

Think of it like deciding between a debit card and a safe deposit box. Your debit card is fantastic for daily spending—it’s convenient and always on hand. The safe deposit box, on the other hand, is where you lock away your most valuable assets for serious security. Crypto wallets operate on a very similar principle, splitting into two main camps: hot wallets and cold wallets.

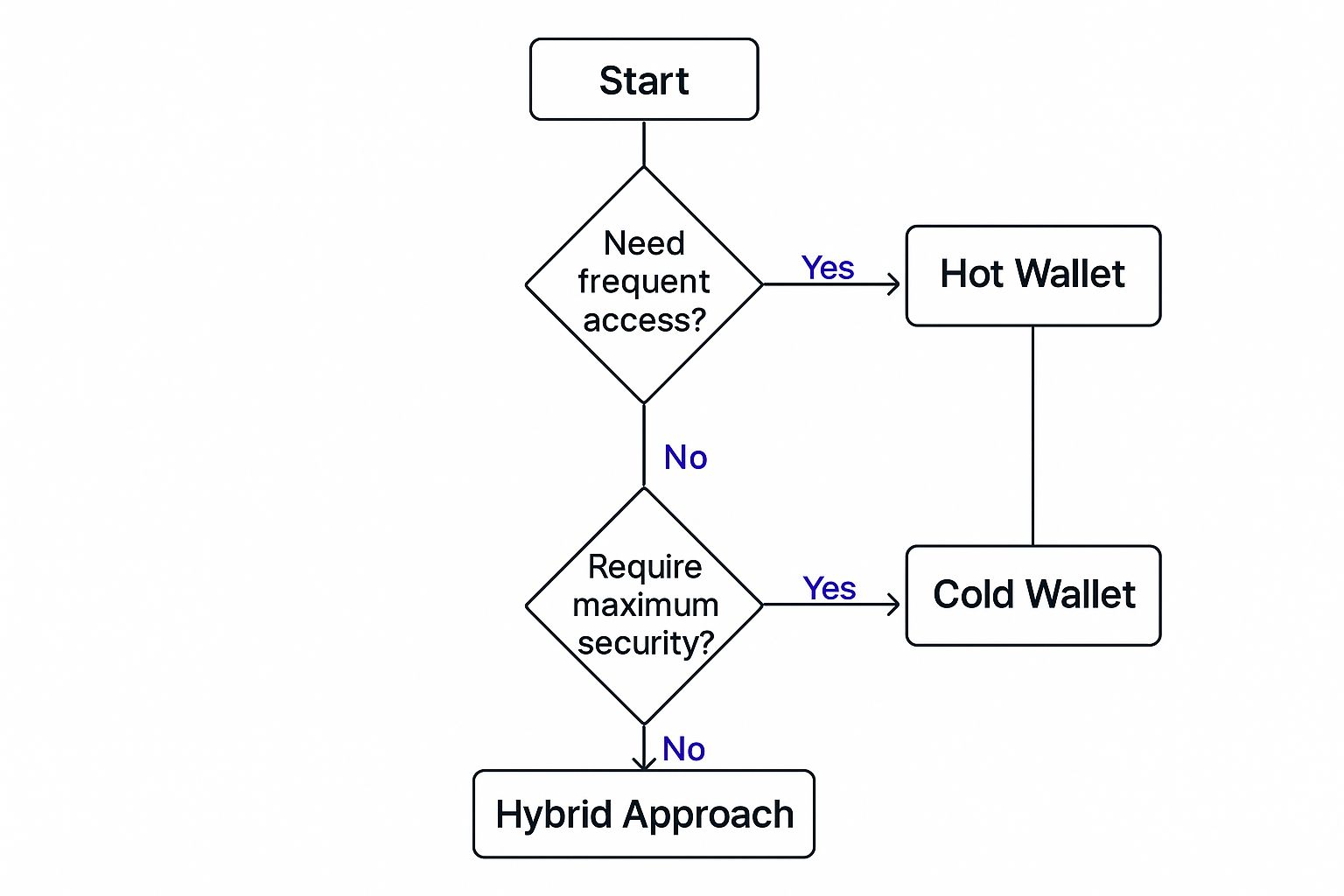

This simple decision tree can help you picture which path makes the most sense for you.

As you can see, it all boils down to how often you need to access your funds versus how much security you're comfortable with.

Hot Wallets: Your Digital Debit Card

Hot wallets are essentially software that stays connected to the internet. We're talking mobile apps, desktop programs, and even browser extensions. Their biggest selling point? Convenience. If you're a frequent trader, a DeFi enthusiast, or just someone who needs to make quick transactions, a hot wallet is your best friend.

But that constant internet connection is a double-edged sword. It leaves the wallet more exposed to online threats like hacking and malware. Just like you wouldn't walk around with your entire life savings in your physical wallet, you shouldn't keep a huge crypto stash in a hot wallet long-term. They're built for smaller, "spending" amounts.

Cold Wallets: Your Personal Vault

Cold wallets, often called hardware wallets, are physical devices that keep your private keys completely offline. These gadgets, which usually look like a USB drive, create an "air gap" from the internet. To sign off on any transaction, you have to physically connect the device to a computer and manually approve it. This provides a much, much higher level of security against remote attacks.

If you’re a long-term investor or you're holding a significant amount of crypto, a cold wallet isn't just a good idea—it's essential. It acts as your personal vault. The only trade-off is a bit of inconvenience, since you’ll always need the physical device on hand to access your funds.

The choice between hot and cold storage boils down to a classic trade-off: convenience versus security. Many serious investors end up using both—a hot wallet for day-to-day activity and a cold wallet for their core holdings.

The market stats back this up. Hot wallets dominate the scene, making up about 78% of all crypto wallets simply because they're so easy to use. In contrast, cold wallets represent around 22% of the market, but hardware wallet sales are projected to jump by 31% in 2025 as more investors get serious about protecting their assets from cyber theft. You can dig into more wallet adoption statistics to see these trends for yourself.

To make this crystal clear, here’s a side-by-side look.

Hot Wallet vs Cold Wallet Comparison

| Feature | Hot Wallet (Software) | Cold Wallet (Hardware) |

|---|---|---|

| Connectivity | Always online | Primarily offline |

| Security Level | Good, but vulnerable to online threats | Excellent, isolated from online attacks |

| Convenience | High, funds are instantly accessible | Lower, requires physical device access |

| Best For | Frequent trading, daily transactions, small amounts | Long-term holding, large amounts, maximum security |

| Examples | MetaMask, Trust Wallet, Exodus | Ledger, Trezor |

At the end of the day, understanding these core differences is what will empower you to pick a wallet that truly fits your investment strategy and gives you peace of mind.

Setting Up Your First Software Wallet

Alright, let's get our hands dirty and actually create a crypto wallet. We'll start with a software wallet since it's the most common entry point for anyone new to crypto. For this walkthrough, we’re going to use MetaMask, one of the most popular and widely supported wallets out there.

The explosion in user-friendly wallets has been incredible to watch. MetaMask is a prime example, reporting around 30 million monthly active users (MAUs) in 2025. That's a massive jump from just over 10 million back in 2021, a surge largely thanks to features that make the whole experience much smoother for everyone.

Choosing Your Official Download Source

First thing's first—security starts before you even click "install." You must, without exception, download your wallet directly from the official source. This means going straight to the official website (like metamask.io) or the official app store for your phone (Apple App Store or Google Play Store).

Seriously, don't click on ads or random links you find online. Scammers are clever and build convincing fake websites and apps designed to do one thing: steal your info and your funds. Sticking to the official source is your first and most important line of defense.

Here's what the official MetaMask website looks like. Notice how clean it is, pointing you directly to the verified downloads.

The clear layout is designed to guide you straight to the secure download for your browser or mobile device, cutting out any guesswork.

The Most Important Step: Your Secret Recovery Phrase

Once the wallet is installed, you'll be prompted to create a new one. During this process, the wallet will generate what’s called a Secret Recovery Phrase (you might also see it called a seed phrase). It's typically a list of 12 or 24 simple words.

This phrase is the master key to everything. It's the only way to get your wallet back if you forget your password, your phone gets stolen, or your computer dies.

Your Secret Recovery Phrase is everything. If someone gets it, they get your crypto. If you lose it, your crypto is gone forever. There's no customer service hotline to call or "Forgot Password" link to click. You are your own bank.

These are the non-negotiable rules for handling this phrase:

- Write it down. On paper. With a pen. Make sure you get the words in the correct order.

- Never, ever store it digitally. No screenshots, no text files, no password managers, no cloud drives. Just don't.

- Keep it somewhere safe and offline. Think of a fireproof safe at home or a safe deposit box at a bank. Some people even stamp their words onto a metal plate to make it indestructible.

- Make a couple of copies. Store them in different, equally secure physical locations.

Once you’re set up, you'll eventually need to send a transaction or interact with an app. Part of that means dealing with network fees, or "gas." To avoid surprises and failed transactions on Ethereum, it’s a good habit to check a live ETH gas tracker to see what the current costs look like. This tiny step can save you a lot of headache and money.

Upgrading Your Security with a Hardware Wallet

When you get serious about protecting your crypto, creating a wallet that lives completely offline is the ultimate security upgrade. This is where hardware wallets, also known as cold wallets, come in. They are physical devices built to do one thing exceptionally well: keep your private keys isolated from the internet and safe from online threats.

I like to think of a software wallet as your everyday billfold—it's great for convenience, but you wouldn't keep your life savings in it. A hardware wallet, like a Ledger or Trezor, is more like a fortified vault. Your private keys are generated and stored on the device itself and never touch your computer or the web. This creates an "air gap" that hackers simply can't cross remotely.

The Unboxing and Setup Experience

Setting up a hardware wallet is a very deliberate and secure process by design. The moment you unbox a new device, your first move is to connect it to your computer and verify its authenticity through the manufacturer’s official software. This is a crucial check to make sure the device hasn't been tampered with on its way to you.

From there, the device itself walks you through generating a brand new set of private keys. It will then show your 24-word recovery phrase right on its small, trusted screen.

This is the most critical moment of the entire setup. You absolutely must write this phrase down on the physical recovery sheets they provide and store them somewhere incredibly secure. This phrase is the only backup for your funds if something goes wrong.

To make sure you've done it right, the device will quiz you, asking you to re-enter a few of the words to confirm they're recorded correctly. It's a methodical process, but it ensures you’re prepared for anything.

What If You Lose the Device?

It’s a common fear, but this is where the genius of the recovery phrase system shines. If your hardware wallet gets lost, stolen, or just stops working, your crypto is not gone. Your assets actually live on the blockchain, and that recovery phrase is the master key to get to them.

You can simply:

- Purchase a new hardware wallet (from any compatible brand).

- Choose the "restore from recovery phrase" option during its setup.

- Carefully enter your original 24 words.

And just like that, your new device regains full control of all your assets. This is exactly why protecting your recovery phrase is even more important than protecting the device itself. Treat those words like gold bars—store them in a fireproof safe or another secure location, completely separate from your hardware wallet.

Once you have your assets buttoned up and secure, you might want to put them to work. For long-term holders, exploring ways to earn passive income is a logical next step. If that sounds interesting, our guide on crypto staking strategies explains how you can use your secured assets to generate rewards right from your vTrader account.

Smart Habits for Everyday Wallet Management

Getting your first crypto wallet set up is a huge first step, but the work doesn't stop there. Think of it less like a one-and-done task and more like an ongoing practice. Building smart, consistent habits is what truly protects your assets in the long run and gives you the confidence to navigate the crypto world.

The single most important habit? Treat every single transaction with extreme caution. Before you even think about hitting "send," you need to triple-check the recipient's wallet address. One wrong character can launch your funds into a black hole, and there's no "undo" button. I've seen it happen. My personal method is to copy and paste the address, then visually confirm the first four and last four characters. It takes five seconds and can save you from a catastrophic mistake.

Diversify Your Digital Vaults

You wouldn't keep your life savings in cash under your mattress, right? The same logic applies to crypto. Spreading your assets across different wallets isn't just a good idea—it's a core security strategy. The key is to assign different wallets specific jobs based on how you use them.

- Hot Wallet (Software): This is your daily driver, your "spending cash." Keep a small, manageable amount here for active trading on platforms like vTrader, interacting with DeFi apps, or making quick payments.

- Cold Wallet (Hardware): Treat this as your high-security savings vault. It's where the bulk of your long-term holdings should live, completely disconnected from online threats.

This separation of funds is your financial firewall. If your hot wallet is ever compromised, the damage is contained. The attacker gets away with your pocket money, not your life savings. As you move funds between wallets, be mindful of network costs; you can explore vTrader's fee structure for a clear breakdown to avoid any surprise charges on your trades and transfers.

The goal is to make security a reflex, not an afterthought. Your habits are your best defense against both sophisticated hacks and simple human error.

Stay Alert and Aware

The crypto space is exciting, but it also has its share of bad actors. A classic trap is the unsolicited airdrop, where mystery tokens suddenly appear in your wallet out of nowhere. Your first instinct might be to sell them, but don't. Interacting with these tokens—trying to swap or transfer them—can trigger malicious smart contracts designed to drain your entire wallet. The rule is simple: if you don't recognize it, ignore it.

Finally, nail down the basics. Use a strong, unique password for your wallet software, and if you're on a mobile device, enable biometric security like a fingerprint or Face ID. These simple, everyday habits are the foundation of a secure crypto journey. They're what elevate you from just owning crypto to being a responsible guardian of your own digital wealth.

Common Questions About Creating a Crypto Wallet

Diving into the world of crypto wallets for the first time usually brings up a few big questions. Getting those sorted out is the fastest way to feel confident managing your own digital assets. Let's walk through some of the most common things people ask.

The first panic-inducing thought for many is about hardware wallets: what happens if you actually lose the device? It’s a terrifying prospect, but the reality is surprisingly reassuring. Your crypto is not physically stored on the device—it lives on the blockchain. The wallet is just an incredibly secure key.

As long as you have that secret recovery phrase (the 12 or 24 words you wrote down and stored safely), your funds are completely fine. You can just buy a new device, even one from a competing brand, punch in your original phrase, and restore full access to all your assets. It’s that simple.

Wallet Capabilities and Security

Another frequent question revolves around versatility. Can you really keep all your different cryptocurrencies in one place? For the most part, yes. Most modern wallets, both software and hardware, are multi-currency by design, built to hold everything from Bitcoin and Ethereum to thousands of other tokens.

When you’re picking a wallet, just do a quick check on its list of supported coins and networks. You want to make sure it covers the assets you plan to hold. For example, MetaMask is the go-to for Ethereum and EVM-compatible networks, while wallets like Trust Wallet or Exodus cast a much wider net across different blockchains.

Here's the most critical distinction to get right: the difference between your public wallet address and your private key. Think of it like your email. The public address is like your email address—you can share it freely to receive funds. Your private key is the password. Never, ever share it with anyone.

Finally, what's the deal with mobile crypto wallets? How safe are they, really? They are generally quite secure for managing smaller, everyday amounts of crypto. But because your phone is always online, they are "hot wallets," which inherently makes them more exposed to risks than an offline hardware wallet.

If you're using a mobile wallet, you can beef up security by:

- Using a strong passcode and biometric locks (Face ID, fingerprint) on your phone.

- Only downloading official wallet apps from the Apple App Store or Google Play.

- Never, under any circumstances, taking a screenshot of your recovery phrase.

For any amount of crypto you'd be upset to lose, moving it to a hardware wallet is always the smartest play. If you run into more specific issues as you get set up, you can dive into a comprehensive list of FAQs to find detailed answers on security, transactions, and more.

Ready to put your knowledge into action with zero trading fees? vTrader offers a secure, commission-free platform to buy, sell, and manage your crypto portfolio. Get started with vTrader today and claim your $10 sign-up bonus.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.