In an ever-evolving cryptocurrency landscape, Ethereum stands out as a beacon of innovation and potential profitability. As of today, September 11, 2025, Ethereum’s journey continues to pique the interest of investors and enthusiasts alike. Recently, Sygnum, a renowned digital asset bank, shed light on the key factors propelling Ethereum’s price to greater heights. According to their insights, three main catalysts are steering Ethereum’s valuation upwards: robust fundamental developments, a looming supply shock, and burgeoning institutional demand.

Fundamental Developments: The Backbone of Ethereum’s Growth

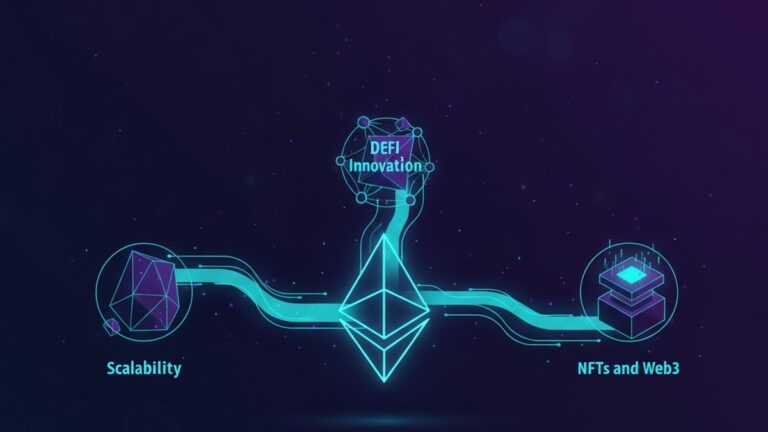

Ethereum’s value proposition has always been its ability to evolve and adapt, thanks to continuous fundamental developments. Over the years, Ethereum’s blockchain has undergone significant upgrades, with Ethereum 2.0 being the most notable. This upgrade, which began its phased rollout in December 2020, aims to enhance the network’s scalability, security, and sustainability. By transitioning from a proof-of-work to a proof-of-stake consensus mechanism, Ethereum 2.0 reduces energy consumption, making it a more eco-friendly choice in a world increasingly conscious of carbon footprints.

Moreover, Ethereum’s role in powering decentralized applications (dApps) and smart contracts remains unparalleled. Innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs) continue to thrive on Ethereum’s blockchain, attracting developers and users worldwide. This continuous innovation not only solidifies Ethereum’s position as a leader in the crypto space but also drives its demand and, consequently, its price.

Supply Shock: A Catalyst for Price Surge

In the realm of cryptocurrency, the concept of a supply shock can significantly influence asset prices. For Ethereum, this phenomenon is partly driven by the EIP-1559 upgrade, implemented in August 2021. This Ethereum Improvement Proposal introduced a base fee mechanism that burns a portion of the transaction fees, effectively reducing the overall supply of Ether (ETH). As a result, the deflationary aspect of EIP-1559 has created a scarcity effect, contributing to upward price pressure.

The ongoing transition to Ethereum 2.0 further exacerbates this supply shock. With the staking of ETH required to participate in the new proof-of-stake network, a substantial amount of Ethereum is effectively locked up, unavailable for trading. This reduction in circulating supply, combined with the burning of transaction fees, creates a favorable environment for price appreciation.

Institutional Demand: The New Wave of Interest

Institutional interest in Ethereum has been growing steadily, marking a significant shift in the cryptocurrency market. As traditional financial institutions become more comfortable with digital assets, Ethereum has emerged as a preferred choice, thanks to its robust network and diverse use cases. Investment giants and tech-forward firms are increasingly integrating Ethereum into their portfolios, recognizing its potential for long-term growth.

This surge in institutional demand is fueled by several factors. Firstly, Ethereum’s unique position as a platform for DeFi and NFTs offers investors exposure to two of the most dynamic sectors in the crypto industry. Secondly, the network’s commitment to sustainability through Ethereum 2.0 aligns with the growing emphasis on environmentally responsible investing. Finally, Ethereum’s proven track record of innovation and resilience instills confidence in institutional investors seeking both stability and growth.

Balancing Optimism with Caution

While the catalysts identified by Sygnum paint a promising picture for Ethereum, it’s crucial to consider potential challenges. The crypto market is inherently volatile, and factors such as regulatory developments, technological hurdles, and market sentiment can influence prices. Investors must remain vigilant, keeping an eye on both external and internal factors that could impact Ethereum’s trajectory.

Regulatory scrutiny, for instance, remains a critical concern. As governments worldwide grapple with how to regulate digital currencies, any adverse regulatory changes could affect Ethereum’s adoption and price. Moreover, technological challenges, such as network congestion and security vulnerabilities, could pose risks to Ethereum’s continued success.

The Road Ahead

As Ethereum continues its ascent, driven by strong fundamentals, a supply shock, and increased institutional interest, the future looks bright. However, the path forward is not without its obstacles. Investors and enthusiasts should stay informed, embracing both the opportunities and challenges that come with Ethereum’s dynamic ecosystem.

In conclusion, Ethereum’s story is one of innovation, resilience, and growth. As we stand on the cusp of a new era in digital finance, Ethereum’s role as a pioneer and leader in the crypto space is more evident than ever. Whether you’re a seasoned investor or a curious onlooker, one thing is clear: Ethereum is a force to be reckoned with in the world of digital assets.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.